Professional Documents

Culture Documents

1 Section 80C

1 Section 80C

Uploaded by

cssumanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 Section 80C

1 Section 80C

Uploaded by

cssumanCopyright:

Available Formats

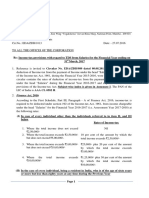

INVESTMENT & INCOME DECLARATION FORM FOR THE FINANCIAL YEAR 2011 - 2012 SECTION-I PERSONAL INFORMATION NAME

OF THE EMPLOYEE ADDRESS

EMPLOYEE CODE LOCATION PAN NO. (MANDATORY) DATE OF JOINING (REQUIRED ONLY IF JOINED ON OR AFTER 1ST APRIL 2011 ) CONTACT NO. E-MAIL ID SECTION-II INVESTMENT PROFILE Sr No. Description 1 SECTION 80C LIC Premium PPF NSCs Interest on NSCs ULIP ELSS Notified Mutual Fund Infrastructure Bonds Principal on Housing Loan (including stamp duty, registration fees & other Expenses incurred for the purpose of transfer of property Child Education Fees - Tuition Fees for full time education to Indian School, University Term Deposit for a fixed period of not less than 5 years with a Scheduled Bank 5 Years Term Deposit under Post Office Term Deposit Rules Deposit in account under the Senior Citizens Savings Scheme Rule 2004 Notified Annuity Plan of LIC or any other Insurer (New Jeevan Dhara, New Jeevan Dhara-I, New Jeevan Akshay, New Jeevan Akshay-I and New Jeevan Akshay-II) CPF/ GPF/ LIC (Salary Saving Scheme) 2 SECTION 80CCC Pension Scheme Investment 3 SECTION 80D Medical/Health Insurance Premium 4 SECTION 80DD Maintenance Including Medical Treatment Of Handicapped Dependent 5 SECTION 80G - Donation to certain funds 6 SECTION 80E - Interest on Education Loan 7 SECTION 80U - Deduction in respect of Disability SECTION-III DECLARATION OF RENT FOR THE PURPOSE OF EXEMPTION U/S 10(13A) 1 2 Rent [Per Month] Location of Property taken on Lease / Rent (HOUSE RENT PAYMENT (Relief provided against sumission Lease agreement, Proof of ownership such as copy of share certificate issued by Co-op Hsg. Society or Copy of Property Tax Bill of Copy of Monthly Society Charges Bill). If Rent Lease Agreement is not available, please attach Rent Self Declaration & Declaration from Landlord. Please Mention No. of Months rent payable during April 200 to March 200 . Montly Rent________ No. of Months ______ Amount (in Rs.)

SECTION-IV DECLARATION FOR THE PURPOSE OF DEDUCTION U/S 24 OF INCOME TAX ACT, 1961 1 Interest on housing loan repaid during the year

SECTION-V (To be filled in only if the employee wishes to furnish any other income (including loss under house property) other than salary income. Form for sending particulars of Income under section 192 (2B) read with 1 Particulars of Income under any head of Income other than Salaries (not being loss under any such head other than the Loss under the head "Income from house property) received in the financial year. (i) Income from house property Amount (In Rs.) (in case of loss, enclose computation thereof) (a) Rent from Property (In case any change is expected during the year please provide info. for the same) (b) House Tax (ii) Income from other sources (a) Dividends (b) Interest (c) Other incomes Aggregate of sub-items (i) to (ii) of item 1 Tax deducted at source (enclose certificate issued under section 203) DECLARATION I,do hereby declare that the aforesaid information is true and correct to the best of my information and belief and I shall indemnify the company against all costs and consequences if any information is later on found to be incorrect.

2 3

(Signature of Employee) Place Date

You might also like

- Rayat Educational & Research TrustDocument2 pagesRayat Educational & Research Trustvijay_2594No ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- Employee DeclarationDocument5 pagesEmployee Declarationloyalbliss14No ratings yet

- Ani Instruments Private Limited: Declaration of Investment Made For The Financial Year 2015 - 16Document7 pagesAni Instruments Private Limited: Declaration of Investment Made For The Financial Year 2015 - 16dileepsiddiNo ratings yet

- Employee DeclarationDocument5 pagesEmployee Declarationloyalbliss14No ratings yet

- Annexure To Income Tax CircularDocument6 pagesAnnexure To Income Tax CircularDipti BhanjaNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Document10 pagesSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevNo ratings yet

- Instructions For Filling Out FORM ITR-2Document8 pagesInstructions For Filling Out FORM ITR-2Ganesh KumarNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Income Tax DepartmentDocument6 pagesIncome Tax DepartmentRajasekar SivaguruvelNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Investment GuidelineDocument3 pagesInvestment GuidelineBuchi YarraNo ratings yet

- LM B K Vatsaraj 23june2010Document61 pagesLM B K Vatsaraj 23june2010Basavaraja C KNo ratings yet

- New IT Declaration FormDocument2 pagesNew IT Declaration FormMahakaal Digital PointNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- Income Tax 2017 Edazdb1013Document50 pagesIncome Tax 2017 Edazdb1013Pradeep PatilNo ratings yet

- FC GPRDocument15 pagesFC GPRAnant MishraNo ratings yet

- AIL-Investment Declaration Form 2013-2014Document2 pagesAIL-Investment Declaration Form 2013-2014G A PATELNo ratings yet

- Ipr MPR of Self-R.mehtaDocument7 pagesIpr MPR of Self-R.mehtasharmarachana066658No ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Form 12BBDocument6 pagesForm 12BBmoin.m.baigNo ratings yet

- Form12BB R539 Proof Submission Form PDFDocument4 pagesForm12BB R539 Proof Submission Form PDFSiva ThotaNo ratings yet

- Know About 30 Changes in New ITR Forms For AY 2022-23-COURTESY TAXMANNDocument23 pagesKnow About 30 Changes in New ITR Forms For AY 2022-23-COURTESY TAXMANNSlyArnieNo ratings yet

- PL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)Document3 pagesPL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)TA ED,SafetyNo ratings yet

- HRA, Chapter VI A - 80CCD, 80C, 80D, Other IncomeDocument9 pagesHRA, Chapter VI A - 80CCD, 80C, 80D, Other Incomefaiyaz432No ratings yet

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyNo ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- Form A SebiDocument17 pagesForm A SebiVibhor BhatiaNo ratings yet

- TAX Saving Investment ProofDocument1 pageTAX Saving Investment ProofAmit ShuklaNo ratings yet

- Withholding Tax Alert: Key Points To NoteDocument3 pagesWithholding Tax Alert: Key Points To NotemusaNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- CAPPFDR270315Document9 pagesCAPPFDR270315tharunsathyaNo ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- Resident Individual Shareholders Valid PanDocument4 pagesResident Individual Shareholders Valid Panharikrishnan176No ratings yet

- Anf 1 Andanf 2 ADocument10 pagesAnf 1 Andanf 2 Atasneem89No ratings yet

- IT Declaration Form April 2023 To March 2024.Document3 pagesIT Declaration Form April 2023 To March 2024.partha.uneesolutionsNo ratings yet

- Guidance Note FY 20-21 - Submitting Investment ProofDocument11 pagesGuidance Note FY 20-21 - Submitting Investment Proofdeepakraj610No ratings yet

- Application Form For CSR Funding From Igl NewDocument5 pagesApplication Form For CSR Funding From Igl NewPrafull ShahaNo ratings yet

- Tax Proof Submission FY 2021-22Document10 pagesTax Proof Submission FY 2021-22cutieedivyaNo ratings yet

- Tax Planning AssignmentDocument10 pagesTax Planning AssignmentJayashree Mohandass100% (1)

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- Election To Be Treated As An Interest Charge DISC: H I Identifying NumberDocument2 pagesElection To Be Treated As An Interest Charge DISC: H I Identifying NumberInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Information Return For Transfers Associated With Certain Personal Benefit ContractsDocument6 pagesInformation Return For Transfers Associated With Certain Personal Benefit ContractsxquangdtNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Instructions For Filling Out FORM ITR-2: Page 1 of 10Document10 pagesInstructions For Filling Out FORM ITR-2: Page 1 of 10mehtakvijayNo ratings yet

- ITR Savings FormatDocument1 pageITR Savings FormatnodalpcrktpsNo ratings yet

- SECTION 2.58. Returns and Payment of Taxes Withheld at SourceDocument5 pagesSECTION 2.58. Returns and Payment of Taxes Withheld at SourceStevenkyNo ratings yet

- 12BB Per Circular 2023-2024Document8 pages12BB Per Circular 2023-2024amer.ms2711No ratings yet

- CSDocument26 pagesCSAnjuElsaNo ratings yet

- OL 4 - BLT Study Text Suppliment 2021 - On New Tax AmmendmentsDocument28 pagesOL 4 - BLT Study Text Suppliment 2021 - On New Tax Ammendmentshte19031No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet