Professional Documents

Culture Documents

M&O Levy Proposal October 10, 2011

M&O Levy Proposal October 10, 2011

Uploaded by

Debra KolrudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M&O Levy Proposal October 10, 2011

M&O Levy Proposal October 10, 2011

Uploaded by

Debra KolrudCopyright:

Available Formats

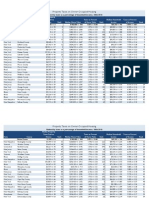

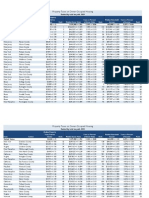

Monroe School District Levy Trends

2006

2007

2008

2009

2010

2011

2012

2012

* -3%** -12.6%

Tax Rates

M&O

$2.39

$1.95

$1.68

$2.16

$2.55

$3.06

$3.36

$3.73

Bonds

$1.25

$1.00

$0.87

$0.95

$1.06

$1.24

$1.45

$1.61

$0.42

$0.48

$0.09

$0.09

$0.10

Capital

Transportation

Tax Rate

Avg Home Value

Levy Amount

$3.64

213,300

8.6

$2.95

$2.55

$3.53

$4.09

$4.39

$4.90

$5.44

259,800 304,100

8.8

297,800

266,300

240,300

233,100

210,000

9.1

12

12.8

13.7

14.6

14.6

Tax

M&O

$509.79

$506.61 $510.89

$643.46

$679.06

$735.32

$783.22

$783.30

Bonds

$266.63

$259.80 $264.57

$283.00

$282.28

$297.97

$338.00

$338.10

$125.12

$127.82

$21.63

$20.98

$21.00

Capital

Transportation

Total Tax

$776.42

$766.41 $775.46 $1,051.58 $1,089.16 $1,054.92 $1,142.20 ######

Average Home Value based on Snohomish County Assessor data

* 2012 Avg Home Value based on District projected -3% devalue

** 2012 Avg Home Value based on Snohomish County Assessor -12.6% devalue

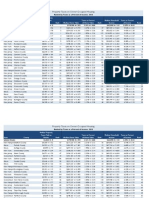

M&O Levy changes since 2006

2006 Average Home Value was $213,300 M&O rate $2.39

2012 Average Home Value will be $210,000 M&O rate $3.73 or 56% increase

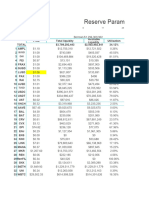

Resolution 10-2011 is for $14.8M for 2013/tax rate $3.40 - $15.1M for 2014/tax rate $3.45

Snohomish County Assessor states a 12.6% decrease value not a 3%

District projected tax rates in Resolution 10-2011 are inaccurate

District projected tax rates are based on 3% devalue versus actually 12.6% devalue

District projected tax rate assumes zero property value change for 2013 & 2014

Report submitted by Director Debra Kolrud October 10, 2011

You might also like

- Addressing ExerciseDocument5 pagesAddressing ExerciseKaranveer Singh GahuniaNo ratings yet

- SC EX 2 Klapore DanveerSinghDocument1 pageSC EX 2 Klapore DanveerSinghDanveer Singh100% (1)

- Seattle Police Report During BLM RiotDocument5 pagesSeattle Police Report During BLM RiotDebra KolrudNo ratings yet

- Neighborhood Watch From Snohomish County SheriffDocument24 pagesNeighborhood Watch From Snohomish County SheriffDebra Kolrud100% (1)

- It's Perfectly NormalDocument1 pageIt's Perfectly NormalDebra KolrudNo ratings yet

- The Mobile Massage StoreDocument2 pagesThe Mobile Massage Storeapi-361715282No ratings yet

- 2013 Snohomish County School District Levy TaxDocument2 pages2013 Snohomish County School District Levy TaxDebra KolrudNo ratings yet

- Clase 1710Document2 pagesClase 1710DIEGO MUÑOZ MOLINANo ratings yet

- Louis Castigliano - 2540128902 - JAWABAN GSLC - Chapter 9 - ForecastDocument24 pagesLouis Castigliano - 2540128902 - JAWABAN GSLC - Chapter 9 - ForecastLouis CastiglianoNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- Single Family HomesDocument1 pageSingle Family Homesapi-26358990No ratings yet

- Lewam AssimentDocument2 pagesLewam Assimentapi-361703056No ratings yet

- Ho Jade Result A Dos Conf OptimaDocument6 pagesHo Jade Result A Dos Conf OptimaAndrés GilNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument66 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Proptax10 Taxes PaidDocument27 pagesProptax10 Taxes PaidTax FoundationNo ratings yet

- LD1495 Incidence REPORTDocument3 pagesLD1495 Incidence REPORTMelinda JoyceNo ratings yet

- Colombia BrasilDocument3 pagesColombia BrasilBryanCamiloChiquizaNo ratings yet

- 2008 Box OfficeDocument1 page2008 Box Officeaaron.a.shaw1819100% (2)

- The Mobile Masses Store: Biweekly Payroll ReportDocument2 pagesThe Mobile Masses Store: Biweekly Payroll Reportapi-361584784No ratings yet

- Tasas Trimestrales 1986 A Dic 2023Document3 pagesTasas Trimestrales 1986 A Dic 2023Verónica Peñalosa GoenagaNo ratings yet

- Data Apbd BpsDocument16 pagesData Apbd BpsHaryonoNo ratings yet

- 2009 NetTaxBefFrz CertifiedDocument2 pages2009 NetTaxBefFrz CertifiedwhundleyNo ratings yet

- Mobile Masses Store PayrollDocument2 pagesMobile Masses Store Payrollapi-361579456No ratings yet

- Minnesota Foster Care Rates 2009Document6 pagesMinnesota Foster Care Rates 2009Beverly TranNo ratings yet

- Trabajo 2Document2 pagesTrabajo 22021 Eco AHUATZIN ALCANTARA MIRANDANo ratings yet

- Microsoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesDocument42 pagesMicrosoft Excel Sheet For Calculating Various Financial Formula by Jack KarnesVikas AcharyaNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- 2009 Forbes 200 Small CompaniesDocument3 pages2009 Forbes 200 Small CompaniesOld School ValueNo ratings yet

- The Mobile Masses Biweekly Payroll ReportDocument1 pageThe Mobile Masses Biweekly Payroll ReportMitch MindanaoNo ratings yet

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- RELE 1318 Real Estate Finance: Input AreaDocument5 pagesRELE 1318 Real Estate Finance: Input AreaPravish KhareNo ratings yet

- Cupp-Patterson School Funding Formula Estimated AidDocument17 pagesCupp-Patterson School Funding Formula Estimated AidAndy ChowNo ratings yet

- SACM Exhibits TemplateDocument11 pagesSACM Exhibits TemplateJustin RuffingNo ratings yet

- Utah Proposed Property Tax Increases For 2014Document1 pageUtah Proposed Property Tax Increases For 2014The Salt Lake TribuneNo ratings yet

- Authorid Income Earned Initial Contract Date Years Under Contract Number of Titles in Print Number of Books Sold Sell PriceDocument7 pagesAuthorid Income Earned Initial Contract Date Years Under Contract Number of Titles in Print Number of Books Sold Sell PricerohitnshenoyNo ratings yet

- Math 1090Document8 pagesMath 1090api-287030709No ratings yet

- Payment Schedule Template 22Document12 pagesPayment Schedule Template 22Raggy TannaNo ratings yet

- Country in Local Currency (LC) in DollarsDocument7 pagesCountry in Local Currency (LC) in Dollarshans gregoryNo ratings yet

- Money & Risk Management Project Financial Kenzie FX " Sukses, Panjang Umur Dan Sehat Selalu "Document4 pagesMoney & Risk Management Project Financial Kenzie FX " Sukses, Panjang Umur Dan Sehat Selalu "me antNo ratings yet

- MRS Tax Incidence Report 2013Document4 pagesMRS Tax Incidence Report 2013Melinda JoyceNo ratings yet

- Eva GlobalDocument7 pagesEva GlobalRodrigo FedaltoNo ratings yet

- Superstore Sales TrainingDocument2,752 pagesSuperstore Sales TrainingKEERTHINo ratings yet

- Auto Loan CalcDocument8 pagesAuto Loan CalcAnonymous Jt3Qr8Yd7No ratings yet

- Facts at A Glance:: InvestmentDocument3 pagesFacts at A Glance:: InvestmentHai V. PhamNo ratings yet

- Interest As Percent of GDPDocument12 pagesInterest As Percent of GDPJohn SarveyNo ratings yet

- May 2012Document5 pagesMay 2012Jared ReimerNo ratings yet

- Chart Top Towns 2019Document11 pagesChart Top Towns 2019Tony PetrosinoNo ratings yet

- Home Loan Comparison1Document2 pagesHome Loan Comparison1krishna_1238No ratings yet

- Mrs Incidence Report 2011Document2 pagesMrs Incidence Report 2011Melinda JoyceNo ratings yet

- Publisher Reports: Ad Performance SummaryDocument3 pagesPublisher Reports: Ad Performance Summaryapi-26710950No ratings yet

- Economic DataWatch Exisiting HomesDocument4 pagesEconomic DataWatch Exisiting HomesandrewbloggerNo ratings yet

- Apply 2-1 Village of Scott Police Department - DONEDocument1 pageApply 2-1 Village of Scott Police Department - DONEgagoodaNo ratings yet

- Cybertrend Superstore Sample-1Document2,940 pagesCybertrend Superstore Sample-1Delvin LeonardNo ratings yet

- BOLT Graham Formula ValuationDocument1 pageBOLT Graham Formula ValuationOld School ValueNo ratings yet

- Aave V2 Dashboard BetaDocument443 pagesAave V2 Dashboard BetaAman GujratiNo ratings yet

- VCF June Improving Margin at Retail - Public VersionDocument23 pagesVCF June Improving Margin at Retail - Public VersionLightship PartnersNo ratings yet

- Total Per Pupil Spending Growth 1988-89 To 2006-07Document2 pagesTotal Per Pupil Spending Growth 1988-89 To 2006-07Education Policy CenterNo ratings yet

- Fundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFDocument31 pagesFundamentals of Corporate Finance Australian 7Th Edition Ross Solutions Manual Full Chapter PDFRussellFischerqxcj100% (13)

- Qa Task 6 Workings Final-1Document49 pagesQa Task 6 Workings Final-1api-238672955No ratings yet

- The Big Mac Index For The Year 2000Document10 pagesThe Big Mac Index For The Year 2000Cherylynne EddyNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Miller V Monroe School District Federal ComplaintDocument46 pagesMiller V Monroe School District Federal ComplaintDebra KolrudNo ratings yet

- Monroe School District FundingDocument2 pagesMonroe School District FundingDebra KolrudNo ratings yet

- Special Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDocument21 pagesSpecial Education Citizen Complaint (Secc) No. 13-72 Procedural HistoryDebra KolrudNo ratings yet

- It's Perfectly NormalDocument2 pagesIt's Perfectly NormalDebra KolrudNo ratings yet

- Washington State Report CardDocument1 pageWashington State Report CardDebra KolrudNo ratings yet

- Monroe School District Facebook GroupDocument22 pagesMonroe School District Facebook GroupDebra KolrudNo ratings yet

- Public School Directors Denied The Ability To Communicate With Their Own District Attorney!!Document4 pagesPublic School Directors Denied The Ability To Communicate With Their Own District Attorney!!Debra KolrudNo ratings yet

- Washington Risk PoolDocument87 pagesWashington Risk PoolDebra KolrudNo ratings yet

- 2013 Snohomish County School District Levy TaxDocument2 pages2013 Snohomish County School District Levy TaxDebra KolrudNo ratings yet

- Monroe School District Superintendent ContractDocument5 pagesMonroe School District Superintendent ContractDebra KolrudNo ratings yet

- Monroe School District End of Course Washington State Report Card For Algebra 1 2012:13Document2 pagesMonroe School District End of Course Washington State Report Card For Algebra 1 2012:13Debra KolrudNo ratings yet

- Office of Superintendent of Public Instruction 2012-13 Table15 Personnel Report On Superintendent SalariesDocument6 pagesOffice of Superintendent of Public Instruction 2012-13 Table15 Personnel Report On Superintendent SalariesDebra KolrudNo ratings yet

- Monroe School District Capital Facilities Plan 2010Document1 pageMonroe School District Capital Facilities Plan 2010Debra KolrudNo ratings yet

- Snohomish County Superform Carlos MartinezDocument3 pagesSnohomish County Superform Carlos MartinezDebra KolrudNo ratings yet