Professional Documents

Culture Documents

Depreciation Table MOF

Depreciation Table MOF

Uploaded by

Terra HannaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Table MOF

Depreciation Table MOF

Uploaded by

Terra HannaCopyright:

Available Formats

Depreciation Table

For The Verticl Machine Center

Assumptions:

Acquisition Cost:

Useful Life:

Salvage Value:

Sum-Year's Digits:

$120,000

5 Years

$20,000

15

Lifetime Production Units:

72,000

Annual Production:

14,400

Method:

Straight-Line

Sum of Year's

Double-declining

MACRS

Units of

Depreciation

Digits

Balance

Acquisition Cost:

$120,000

$120,000

$120,000

$120,000

Production

Salvage value Considered:

$20,000

$20,000

$20,000

$0

$20,000

Depreciable Value

$100,000

$100,000

$100,000

$120,000

$100,000

Depreciable

Depreciable

Depreciable

Depreciable

Depreciable

YR 1

value

20.00%

value

33.33%

Value

20%

Value

25%

YR2

20.00%

26.7%

40%

32%

25%

YR3

20.00%

20%

40%

19.20%

25%

YR4

20.00%

13.3%

40%

11.52%

25%

YR5

20.00%

6.7%

40%

11.52%

25%

$120,000

$120,000

$120,000

$120,000

$120,00

20.00%

33.33%

40%

20%

25%

Depreciation Expense:

$20,000

$33,333

$48,000

$24,000

$30,000

Remaining Book Value:

$100,000

$86,667

$72,000

$96,000

$90,000

20.00%

26.7%

40%

32%

25%

Depreciation Expense:

$20,000.00

$26,666.67

$28,800

$38,400

$22,500

Remaining Book Value:

$80,000

$60,000.33

$43,200

$57,600

$67,500

$120,000

Depreciation Factors:

Value

40%

Depreciation Tables:

Acquisition Cost:

Yr1

Depreciation Factor:

Yr2

Depreciation Factor:

Yr3

Depreciation Factor:

40%

19..20%

Depreciation Expense:

$20,000

20.00%

$20,000

20%

$17,280

$23,040.00

$16,875

25%

Remaining Book Value:

$60,000

$40,000.33

$25,920

$34,560

$50,625

Yr4

Depreciation Factor:

20.00%

13.3%

0%

11.52%

25%

Depreciation Expense:

$20,000

$13,333.33

$0

$13,824

$12,656.50

Remaining Book Value:

$40,000

$26,667

$25,920

$20,736

$37,968.50

(can't depreciate any further)

Yr5

Depreciation Factor:

20%

6.7%

0%

11.52%

25%

Depreciation Expense:

$20,000

$6,666.67

$0

$13,824

$9,492.12

Remaining Book Value:

$20,000

$20,000

25,920

$6,912

$28,476.38

Salvage value

Salvage Value

Salvage Value

Salvage Value

Salvage Value

You might also like

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- Case 2Document8 pagesCase 2yuliana100% (1)

- Bilal Hyder I170743 20-SEPDocument10 pagesBilal Hyder I170743 20-SEPUbaid0% (1)

- Chapter 6Document28 pagesChapter 6Faisal Siddiqui0% (1)

- Homework 6.2 and 6.11Document5 pagesHomework 6.2 and 6.11abcNo ratings yet

- Cash Flow Estimation Brigham Case SolutionDocument8 pagesCash Flow Estimation Brigham Case SolutionShahid MehmoodNo ratings yet

- PPE2-sample - Debi Comia PPE2-sample - Debi ComiaDocument16 pagesPPE2-sample - Debi Comia PPE2-sample - Debi ComiaAngelica Pagaduan50% (2)

- CF 11th Edition Chapter 06 Excel Master StudentDocument32 pagesCF 11th Edition Chapter 06 Excel Master StudentAdrian Gonzaga0% (1)

- Case StudyDocument6 pagesCase StudyArun Kenneth100% (1)

- Exer 10 1Document14 pagesExer 10 1AbhishekKumar0% (2)

- Market Analysis Worksheet: (Company Name) (Date)Document5 pagesMarket Analysis Worksheet: (Company Name) (Date)Neha Vrajesh PithwaNo ratings yet

- Market Analysis Worksheet: (Company Name) (Date)Document6 pagesMarket Analysis Worksheet: (Company Name) (Date)iPakistanNo ratings yet

- Market Analysis Worksheet: (Company Name) (Date)Document5 pagesMarket Analysis Worksheet: (Company Name) (Date)Rommel EsperidaNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- C43 Marker Motion Assignment Decision TrackerDocument11 pagesC43 Marker Motion Assignment Decision TrackerDhirajNo ratings yet

- Accounting 202 - A$$IGNMENT # 1Document3 pagesAccounting 202 - A$$IGNMENT # 1mohammadNo ratings yet

- Data Example E: Chapter 8: Applying ExcelDocument12 pagesData Example E: Chapter 8: Applying ExcelBana KhafafNo ratings yet

- C44 Marker Motion Assignment Decision TrackerDocument28 pagesC44 Marker Motion Assignment Decision TrackerDhirajNo ratings yet

- Second SimulationDocument6 pagesSecond SimulationPrashant ChavanNo ratings yet

- Assignment 2-Feb2023Document18 pagesAssignment 2-Feb2023NURUL HANISNo ratings yet

- YP59A ProformaDocument7 pagesYP59A ProformaJonathan FebrianNo ratings yet

- Engineering Economics Final QSDocument6 pagesEngineering Economics Final QSAyugma Acharya0% (1)

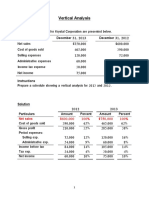

- Vertical Analysis SolutionsDocument5 pagesVertical Analysis SolutionsSamer IsmaelNo ratings yet

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- Tugas 6 J. Erwin R. TambunanDocument2 pagesTugas 6 J. Erwin R. TambunanJAGAR ERWIN RIZNANDO TAMBUNANNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- Capital BudgetingDocument16 pagesCapital Budgetingjamn1979No ratings yet

- ACC 620 WK 3Document21 pagesACC 620 WK 3ToddHurstNo ratings yet

- Hitungan Kuis 6 Bethesda Mining CompanyDocument6 pagesHitungan Kuis 6 Bethesda Mining Companyrica100% (1)

- EE HW3 SolutionDocument5 pagesEE HW3 SolutionLê Trường ThịnhNo ratings yet

- Elite, S.A. de C.V.: Balance GeneralDocument6 pagesElite, S.A. de C.V.: Balance GeneralGuadalupe e ZamoraNo ratings yet

- Flexible Budget Practical Problems & Solutions - Explanation & DiscussionDocument14 pagesFlexible Budget Practical Problems & Solutions - Explanation & DiscussionahmedNo ratings yet

- 326 Chapter 9 - Fundamentals of Capital BudgetingDocument20 pages326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifNo ratings yet

- ABC MedTech ROIDocument27 pagesABC MedTech ROIWei ZhangNo ratings yet

- UntitledDocument15 pagesUntitledemielyn lafortezaNo ratings yet

- Break-Even Visualizer TemplateDocument4 pagesBreak-Even Visualizer TemplateAnnaNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- M11 CHP 09 1 Flex Bud Variances 2011 0524Document47 pagesM11 CHP 09 1 Flex Bud Variances 2011 0524tobeh ibrahimNo ratings yet

- Assignment 30 Ankit A 01Document3 pagesAssignment 30 Ankit A 01Ankit BavishiNo ratings yet

- P.V. Technologies, Inc-Were They Asleep at The Switch - SupplementDocument4 pagesP.V. Technologies, Inc-Were They Asleep at The Switch - SupplementMonika SinghNo ratings yet

- Cash Flow EstimationDocument6 pagesCash Flow EstimationFazul RehmanNo ratings yet

- Forecasting ToolsDocument10 pagesForecasting Toolsapi-26344229No ratings yet

- Economic Engineering - Solution Chapter 9Document19 pagesEconomic Engineering - Solution Chapter 9ScribdTranslationsNo ratings yet

- Answer Key CVP AnalysisDocument9 pagesAnswer Key CVP AnalysisJaybert DumaranNo ratings yet

- Module 19Document45 pagesModule 19ShinNo ratings yet

- Abc - Classic PenDocument14 pagesAbc - Classic PenVinay GoyalNo ratings yet

- Lecture 9Document21 pagesLecture 9Hồng LêNo ratings yet

- Shopping Dollar Revenue SimulationDocument2 pagesShopping Dollar Revenue Simulationtyler4lummisNo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- Lecture 4 SolutionsDocument11 pagesLecture 4 SolutionsHiền NguyễnNo ratings yet

- SpreadsheetDocument5 pagesSpreadsheetNicole Mae TimosaNo ratings yet

- FABMDocument5 pagesFABMAshley Rouge Capati QuirozNo ratings yet

- PICAR, Janine A. - Problems On Financial AnalysisDocument4 pagesPICAR, Janine A. - Problems On Financial AnalysisJanine AriNo ratings yet

- Managerial Accounting Jiambalvo Text Homework: CHP 4,5,6: Estimate of Variable CostDocument3 pagesManagerial Accounting Jiambalvo Text Homework: CHP 4,5,6: Estimate of Variable Costwj68No ratings yet

- SFAD Excel Project Sheet-2Document20 pagesSFAD Excel Project Sheet-2Mansoor ArshadNo ratings yet

- Kanban Change Leadership: Creating a Culture of Continuous ImprovementFrom EverandKanban Change Leadership: Creating a Culture of Continuous ImprovementNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Supply Chain Management and Business Performance: The VASC ModelFrom EverandSupply Chain Management and Business Performance: The VASC ModelNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet