Professional Documents

Culture Documents

Book 1

Book 1

Uploaded by

Divya SinghCopyright:

Available Formats

You might also like

- Question 3Document11 pagesQuestion 3asad khatri100% (1)

- Case StudyDocument21 pagesCase StudyAmarinder Singh Sandhu100% (1)

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Class Questions - Cap BudgetingDocument4 pagesClass Questions - Cap BudgetingMANSA MUDGALNo ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingBISHAL ROYNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Capital Budgeting TybmsDocument38 pagesCapital Budgeting TybmsKushNo ratings yet

- Extra OnesDocument2 pagesExtra Onesakshaykumarsingh24072005No ratings yet

- Solved Answers For Payback PeriodDocument9 pagesSolved Answers For Payback Periodwihanga100% (2)

- Exercise 8 (11 Jan 2023)Document2 pagesExercise 8 (11 Jan 2023)Teo ShengNo ratings yet

- Evaluating Single Project: PROBLEM SET: Money-Time RelationshipsDocument4 pagesEvaluating Single Project: PROBLEM SET: Money-Time RelationshipsAnjo Vasquez100% (1)

- MAS Ass1Document4 pagesMAS Ass1Tin BulaoNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- Lbo Case StudyDocument6 pagesLbo Case StudyRishabh MishraNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Chapter 2 - Theory - 2Document46 pagesChapter 2 - Theory - 2Diptish RamtekeNo ratings yet

- SFM CompilerDocument469 pagesSFM CompilerArchana Khapre100% (1)

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- Kiri Industries Report With ValuationDocument6 pagesKiri Industries Report With ValuationDishant ShahNo ratings yet

- Final Exam Financial Management NameDocument6 pagesFinal Exam Financial Management NameInsatiable LifeNo ratings yet

- Capii Financial Management July2015Document14 pagesCapii Financial Management July2015casarokarNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Case 4 Written Report - Third DraftDocument5 pagesCase 4 Written Report - Third DraftMarc MoralesNo ratings yet

- Oinl 14 2 24 PLDocument6 pagesOinl 14 2 24 PLSanjeedeep Mishra , 315No ratings yet

- Capital Budgeting 30032010Document18 pagesCapital Budgeting 30032010kkv_phani_varma5396No ratings yet

- MSL302 Capital Budgeting Decisions Term Paper Report: Submitted byDocument10 pagesMSL302 Capital Budgeting Decisions Term Paper Report: Submitted bychioqueNo ratings yet

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- Corporate Finance I763 UmyMzqnN1hDocument2 pagesCorporate Finance I763 UmyMzqnN1hABHINAV AGRAWALNo ratings yet

- DCF Analysis Assignment 2Document5 pagesDCF Analysis Assignment 2minajadritNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- 208 BDocument10 pages208 BXulian ChanNo ratings yet

- Valuation of Asian PaintsDocument18 pagesValuation of Asian Paintsaravindmenonm0% (3)

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- Problems On Capital BudgetingDocument12 pagesProblems On Capital BudgetingjahidkhanNo ratings yet

- CH 10 FMDocument30 pagesCH 10 FMshubakarNo ratings yet

- ACC314 Practise Paper SolutionsDocument7 pagesACC314 Practise Paper SolutionsRukshani RefaiNo ratings yet

- Problems On Cash FlowsDocument14 pagesProblems On Cash FlowsAbin Jose100% (2)

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- What Is More Valuable - (A) Taka 1,50,000 Per Year For Ever or (B) An Annuity of Taka 2,80,000 For 4 Years? Annual Rate Is 20 PercentDocument24 pagesWhat Is More Valuable - (A) Taka 1,50,000 Per Year For Ever or (B) An Annuity of Taka 2,80,000 For 4 Years? Annual Rate Is 20 Percentafsana zoyaNo ratings yet

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaNo ratings yet

- Capital BudgetingDocument62 pagesCapital BudgetingAshwin AroraNo ratings yet

- CA Inter FM SM RTP May 2024 Castudynotes ComDocument44 pagesCA Inter FM SM RTP May 2024 Castudynotes ComGeo P BNo ratings yet

- Principles of FinanceDocument9 pagesPrinciples of FinanceEdmond YapNo ratings yet

- Gladiolus CultivationDocument7 pagesGladiolus CultivationPraharsh ShahNo ratings yet

- Lecture # 02Document15 pagesLecture # 02bwcs1122No ratings yet

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- 01 Capital-Budgeting Quizzer-1 PDFDocument8 pages01 Capital-Budgeting Quizzer-1 PDFRGems PH100% (1)

- Assignment-4 Full SolutionDocument15 pagesAssignment-4 Full SolutionashishNo ratings yet

- Practise Question Chap 11Document20 pagesPractise Question Chap 11SaadNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- FM TestDocument5 pagesFM TestSamir JainNo ratings yet

- AS Business AnalysisDocument4 pagesAS Business AnalysisLaskar REAZNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

Book 1

Book 1

Uploaded by

Divya SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book 1

Book 1

Uploaded by

Divya SinghCopyright:

Available Formats

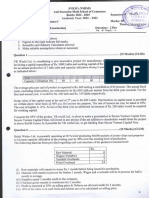

cost of capital

year

0

1

2

3

4

5

calculate

1)

NPV

2)

IRR

18.69%

3)

MIRR

15.97%

Rs. 119,042.88

cash flow

-100000

20000

30000

40000

50000

30000

12%

year

A

0

1

2

3

4

5

6

7

8

9

10

-200000

40000

40000

40000

40000

40000

40000

40000

40000

40000

40000

-300000

40000

40000

40000

40000

40000

30000

30000

20000

20000

20000

-210000

80000

60000

80000

60000

80000

60000

40000

40000

40000

40000

-320000

200000

20000

npv

Rs. 226,008.92

Rs. 194,689.79

Rs. 351,678.35

Rs. 368,647.26

IRR

15%

1%

29%

20%

200000

50000

cost of capital

12%

year

project P

0

1

2

3

4

5

NPV

IRR

project Q

-1000

-1200

-600

-250

2000

4000

-1600

200

400

600

800

100

Rs. 1,813.05

Rs. 1,489.67

12%

your boss wants you to evaluate an investment oppurtunity 4 the org. dis investment opp is in the oil company which is going

in the oil company which is going extract 100 barrel of oil which will decresase by 5% per yr..in the contract all the oil will be sold as 90 d

tract all the oil will be sold as 90 dollars per barrel. in the open market the current price is 40$ per barrel which is expected to increase at

l which is expected to increase at the rate of 12% per annum.evaluate at the rate of 7%

You might also like

- Question 3Document11 pagesQuestion 3asad khatri100% (1)

- Case StudyDocument21 pagesCase StudyAmarinder Singh Sandhu100% (1)

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Class Questions - Cap BudgetingDocument4 pagesClass Questions - Cap BudgetingMANSA MUDGALNo ratings yet

- Capital BudgetingDocument21 pagesCapital BudgetingBISHAL ROYNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Capital Budgeting TybmsDocument38 pagesCapital Budgeting TybmsKushNo ratings yet

- Extra OnesDocument2 pagesExtra Onesakshaykumarsingh24072005No ratings yet

- Solved Answers For Payback PeriodDocument9 pagesSolved Answers For Payback Periodwihanga100% (2)

- Exercise 8 (11 Jan 2023)Document2 pagesExercise 8 (11 Jan 2023)Teo ShengNo ratings yet

- Evaluating Single Project: PROBLEM SET: Money-Time RelationshipsDocument4 pagesEvaluating Single Project: PROBLEM SET: Money-Time RelationshipsAnjo Vasquez100% (1)

- MAS Ass1Document4 pagesMAS Ass1Tin BulaoNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- Lbo Case StudyDocument6 pagesLbo Case StudyRishabh MishraNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Chapter 2 - Theory - 2Document46 pagesChapter 2 - Theory - 2Diptish RamtekeNo ratings yet

- SFM CompilerDocument469 pagesSFM CompilerArchana Khapre100% (1)

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- Kiri Industries Report With ValuationDocument6 pagesKiri Industries Report With ValuationDishant ShahNo ratings yet

- Final Exam Financial Management NameDocument6 pagesFinal Exam Financial Management NameInsatiable LifeNo ratings yet

- Capii Financial Management July2015Document14 pagesCapii Financial Management July2015casarokarNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Case 4 Written Report - Third DraftDocument5 pagesCase 4 Written Report - Third DraftMarc MoralesNo ratings yet

- Oinl 14 2 24 PLDocument6 pagesOinl 14 2 24 PLSanjeedeep Mishra , 315No ratings yet

- Capital Budgeting 30032010Document18 pagesCapital Budgeting 30032010kkv_phani_varma5396No ratings yet

- MSL302 Capital Budgeting Decisions Term Paper Report: Submitted byDocument10 pagesMSL302 Capital Budgeting Decisions Term Paper Report: Submitted bychioqueNo ratings yet

- Capital Budgeting-2Document48 pagesCapital Budgeting-2Adarsh Singh RathoreNo ratings yet

- Corporate Finance I763 UmyMzqnN1hDocument2 pagesCorporate Finance I763 UmyMzqnN1hABHINAV AGRAWALNo ratings yet

- DCF Analysis Assignment 2Document5 pagesDCF Analysis Assignment 2minajadritNo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- 78735bos63031 p6Document44 pages78735bos63031 p6dileepkarumuri93No ratings yet

- 208 BDocument10 pages208 BXulian ChanNo ratings yet

- Valuation of Asian PaintsDocument18 pagesValuation of Asian Paintsaravindmenonm0% (3)

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- Problems On Capital BudgetingDocument12 pagesProblems On Capital BudgetingjahidkhanNo ratings yet

- CH 10 FMDocument30 pagesCH 10 FMshubakarNo ratings yet

- ACC314 Practise Paper SolutionsDocument7 pagesACC314 Practise Paper SolutionsRukshani RefaiNo ratings yet

- Problems On Cash FlowsDocument14 pagesProblems On Cash FlowsAbin Jose100% (2)

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- What Is More Valuable - (A) Taka 1,50,000 Per Year For Ever or (B) An Annuity of Taka 2,80,000 For 4 Years? Annual Rate Is 20 PercentDocument24 pagesWhat Is More Valuable - (A) Taka 1,50,000 Per Year For Ever or (B) An Annuity of Taka 2,80,000 For 4 Years? Annual Rate Is 20 Percentafsana zoyaNo ratings yet

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaNo ratings yet

- Capital BudgetingDocument62 pagesCapital BudgetingAshwin AroraNo ratings yet

- CA Inter FM SM RTP May 2024 Castudynotes ComDocument44 pagesCA Inter FM SM RTP May 2024 Castudynotes ComGeo P BNo ratings yet

- Principles of FinanceDocument9 pagesPrinciples of FinanceEdmond YapNo ratings yet

- Gladiolus CultivationDocument7 pagesGladiolus CultivationPraharsh ShahNo ratings yet

- Lecture # 02Document15 pagesLecture # 02bwcs1122No ratings yet

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- FM IiDocument5 pagesFM IiDarshan GandhiNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- 01 Capital-Budgeting Quizzer-1 PDFDocument8 pages01 Capital-Budgeting Quizzer-1 PDFRGems PH100% (1)

- Assignment-4 Full SolutionDocument15 pagesAssignment-4 Full SolutionashishNo ratings yet

- Practise Question Chap 11Document20 pagesPractise Question Chap 11SaadNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- FM TestDocument5 pagesFM TestSamir JainNo ratings yet

- AS Business AnalysisDocument4 pagesAS Business AnalysisLaskar REAZNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet