Professional Documents

Culture Documents

Models

Models

Uploaded by

ashokyerasiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Models

Models

Uploaded by

ashokyerasiCopyright:

Available Formats

Library

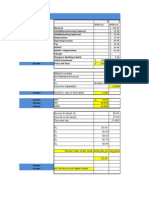

The generalized Black and Scholes option pricing formula

Asset price ( S )

60.00 60.00

Strike price ( X )

65.00 65.00

Time to maturity ( T )

0.2500 0.2500

The Black-Scholes model (French) adjusted for trading day volatility

Asset price ( S )

70.00 70.00

Strike price ( X )

75.00 75.00

Trading time ( t )

0.41 0.41

Calendar time ( T )

0.40 0.40

The Merton's jump diffusion model

Asset price ( S )

45.00 45.00

Strike price ( X )

55.00 55.00

Time to maturity ( T )

0.25 0.25

Jumps per year ( l )

3.00 3.00

American calls on stocks with known dividends

Asset price ( S )

90.00

Strike price ( X )

80.00

Time to dividend payment ( t )

0.25

The Barone-Adesi and Whaley approximation

Asset price ( S )

42.00 42.00

Strike price ( X )

40.00 40.00

Time to maturity ( T )

0.75 0.75

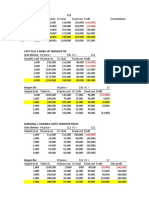

Fixed exchange rate foreign equity options Quantos

Fixed exchange rate ( Ep ) sset price ( S* ) A

1.50 1.50 100.00 100.00

Strike price ( X* )

105.00 105.00

Time to maturity ( T )

0.50 0.50

The Vasicek model for European options on zero coupon bonds

Face value ( F )

104.00 104.00

Strike price ( X )

81.74 81.74

Time to bond maturity ( t )

7.00 7.00

European swaptions in the Black-76 model

Tenor of swap in years ( tCompoundings per year ( m ) Underlying swap rate ( F )Strike price ( X ) 1 )

4.00 4.00 2.00 2.00 7.00% 7.00% 7.50% 7.50%

Executive stock options

Asset price ( S )

65.00 65.00

Strike price ( X )

64.00 64.00

Time to maturity ( T )

2.00 2.00

Forward start options

Asset price ( S )

60.00 60.00

Alpha ( a )

1.10 1.10

Time to maturity ( T )

1.00 1.00

Spread option approximation

Futures 1 ( F1 )

28.00 28.00

Futures 2 ( F2 )

20.00 20.00

Strike price ( X )

7.00 7.00

Time to maturity ( T )

0.2500 0.2500

Page 1

Library

Floating strike lookback options

Asset price ( S )

120.00 120.00

Observed minimum ( Smin ) Observed maximum ( Smax ) Time to maturity ( T )

100.00 100.00 120.00 120.00 0.50 0.50

Time switch options

Asset price ( S )

100.00 100.00

Strike ( X )

110.00 110.00

Accumulated amount ( A )

5.00 5.00

Geometric average rate options (Asian)

Spot price ( S )

80.00 80.00

Average price ( SAV )

80.00 80.00

Strike price ( X )

85.00 85.00

The Turnbull and Wakeman arithmetic average approximation (Asian)

Spot price ( S )

100.00 100.00

Average price ( SAV )

110.00 110.00

Strike price ( X )

95.00 95.00

Levy's arithmetic average approximation (Asian)

Spot price ( S )

100.00 100.00

Average price ( SAV )

110.00 110.00

Strike price ( X )

95.00 95.00

Options on options

Asset price ( S )

500.00 500.00 500.00 500.00

Strike underlying option ( X1 ) Strike option on option ( X2 )

520.00 520.00 520.00 520.00 50.00 50.00 50.00 50.00

Gap options

Asset price ( S )

50.00 50.00

Strike price 1 ( X1 )

50.00 50.00

Strike price 2 ( X2 )

57.00 57.00

Writer extendible options

Asset price ( S )

80.00 80.00

Initial strike price ( X1 )Extended strike price ( X2 )

90.00 90.00 82.00 82.00

Fixed strike lookback options

Asset price ( S )

100.00 100.00

Observed minimum ( Smin ) Observed maximum ( Smax )

100.00 100.00 100.00 100.00

Partial-time floating strike lookback options

Asset price ( S )

90.00 90.00

Observed minimum ( Smin ) Observed maximum ( Smax ) Above/bellow actual extremum ( l )

90.00 90.00 90.00 90.00 1.00 1.00

Partial-time fixed strike lookback options

Asset price ( S ) Strike price ( X ) Time to start of lookback period ( maturity ( T2 ) Time to t1 )

Page 2

Library

100.00 100.00

100.00 100.00

0.50 0.50

1.00 1.00

Cash-or-nothing options

Asset price ( S )

100.00 100.00

Strike price ( X )

80.00 80.00

Cash ( K )

10.00 10.00

Time to maturity ( T )

0.75 0.75

Asset-or-nothing options

Asset price ( S )

70.00 70.00

Strike price ( X )

65.00 65.00

Time to maturity ( T )

0.50 0.50

Risk-free rate ( r )

7.00% 7.00%

Foreign equity options struck in domestic currency

Exchange rate ( E )

1.50 1.50

Asset price ( S* )

100.00 100.00

Strike price ( X )

160.00 160.00

Time to maturity ( T )

0.50 0.50

Equity linked foreign exchange options

Exchange rate ( E )

1.50 1.50

Asset price ( S* )

100.00 100.00

Strike price ( X )

1.52 1.52

Time to maturity ( T )

0.25 0.25

Takeover foreign exchange options

Value of foreign firm ( V )Number of currency units ( B ) rate ( E ) Exchange

200.00 260.00 1.50

Strike price ( X )

1.50

Supershare options

Asset price ( S )

100.00

Lower strike ( XL )

90.00

Upper strike ( XH )

110.00

Time to maturity ( T )

0.25

European option on a stock with cash dividends

Stock price ( S )

100.00 100.00

Strike price ( X )

90.00 90.00

Time to maturity ( T )

0.75 0.75

Risk-free rate ( r )

10.00% 10.00%

Volatility ( s )

Page 3

Library

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

8.00% 8.00% 8.00% 8.00% 30.00% 30.00%

Call Put

c p

Value

2.1334 5.8463

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

8.00% 8.00% 8.00% 8.00% 30.00% 30.00%

Call Put

c p

Value

4.2456 6.8836

Risk-free rate ( r )

10.00% 10.00%

Volatility ( s )

25.00% 25.00%

Percent of total volatility ( g )

40.00% 40.00%

Call Put

c p

Value

0.2417 8.8838

Time to maturityRisk-free rate (Cash dividend ( D ) (T) r)

0.33 6.00% 4.00

Volatility ( s )

30.00%

Value

12.4462

The Bjerksund and Stensland approximation

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

4.00% 4.00% -4.00% -4.00% 35.00% 35.00%

Call Put

c p

Barone-Adesi and Whaley

5.3129 4.3668

Value in domestic currency

Domestic rate ( rForeign rate ( rf ) ) Dividend yield ( q )

8.00% 8.00% 5.00% 5.00% 4.00% 4.00%

Volatility stock ( sS* )currency ( sE ) (Call Put Volatility Correlation r )

20.00% 20.00% 10.00% 10.00% 0.30 0.30 c c

Value

5.3280 5.3280

Time to option expiration ( T ) rMean reversion level ( q ) Interest rate ( ) Speed of mean reversion ( k ) Volatility ( s )

4.00 4.00 9.00% 9.00% 10.00% 10.00% 0.05 0.05 0.03 0.03

Call Put

c p

Option value

3.3219 3.5950

Risk-free rate ( r Time to maturity ( T )rate volatility ( s ) ) Swap

6.00% 6.00% 2.00 2.00 20.00% 20.00%

Call Put

c p

Value

1.7964 % 3.3206 %

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

7.00% 7.00% 4.00% 4.00% 38.00% 38.00%

Jump rate per year ( l )

0.15 0.15

Call Put

c p

Value

11.3754 7.2447

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

8.00% 8.00% 4.00% 4.00% 30.00% 30.00%

Time to forward start ( t )

0.25 0.25

Call Put

c p

Value

4.4064 8.2971

Risk-free rate ( r Volatility futures 1 ( s1 ) futures 2 ( s2 ) orrelation ( r ) ) Volatility C

5.00% 5.00% 29.00% 29.00% 36.00% 36.00% 0.42 0.42

Call Put

c p

Value

2.1670 1.1795

Page 4

Library

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

10.00% 10.00% 4.00% 4.00% 30.00% 30.00%

Call Put

c p

Value

25.3533 19.7245

Time to maturityNumber of time units fulfilled Dtm ) (T) Time interval ( ( )

1.00 1.00 0 0 0.00274 0.00274

Risk-free rate ( r of carry (Volatility ( s ) Cost ) b) Call Put

6.00% 6.00% 6.00% 6.00% 26.00% 26.00% c p

Value

1.3750 3.3338

Original time to maturity ( t )time to maturity ( (T )) Remaining Risk-free rate r

0.25 0.25 0.25 0.25 5.00% 5.00%

Cost of carry ( b ) ( s ) Volatility

8.00% 8.00% 20.00% 20.00%

Call Put

c p

Value

0.4819 4.6922

Time to start of average periodRemaining( time to maturity ( T2 )rate ( r of carry (Volatility ( s ) Original time to maturity T ) (t) Risk-free Cost ) b) Call Put

0.00 0.00 0.75 0.75 0.50 0.50 10.00% 10.00% 5.00% 5.00% 30.00% 30.00% c p

Value

9.1537 0.4266

Original time to maturity ( T time to maturity ( (T2 )) Remaining ) Risk-free rate r

0.75 0.75 0.50 0.50 10.00% 10.00%

Cost of carry ( b ) ( s ) Volatility

5.00% 5.00% 30.00% 30.00%

Call Put

c p

Value

9.1494 0.4231

Time to maturityTime toon optionunderlying option ( T2 ) of carry ( b ) ( s ) option maturity ( t1 ) rate ( r ) Risk-free Cost Volatility

0.25 0.25 0.25 0.25 0.50 0.50 0.50 0.50 8.00% 8.00% 8.00% 8.00% 5.00% 5.00% 5.00% 5.00% 35.00% 35.00% 35.00% 35.00%

Call Put

cc cp pc pp

Value

17.5947 18.7129 21.1965 15.2602

Time to maturityRisk-free rate (Cost of carry ( b ) (T) r)

0.50 0.50 9.00% 9.00% 9.00% 9.00%

Volatility ( s )

20.00% 20.00%

Call Put

c p

Value

-0.0053 4.4866

Initial time to maturity ( t1 )timeRisk-free rateT2r) ) Extended to maturity ( (

0.50 0.50 0.75 0.75 10.00% 10.00%

Cost of carry ( b ) ( s ) Volatility

10.00% 10.00% 30.00% 30.00%

Call Put

c p

Value

6.8238 10.3105

Strike price ( X ) Time to maturity ( T ) Risk-free rate ( r )

105.00 105.00 0.50 0.50 10.00% 10.00%

Cost of carry ( b ) ( s ) Volatility

10.00% 10.00% 20.00% 20.00%

Call Put

c p

Value

9.8905 13.0739

Length lookbackTime to ( t1 ) Risk-free rate ( r ) period maturity ( T2 )

0.25 0.25 1.00 1.00 6.00% 6.00%

Cost of carry ( b ) ( s ) Volatility

6.00% 6.00% 20.00% 20.00%

Call Put

c p

Value

13.3402 7.9153

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

Call Put

Value

Page 5

Library

6.00% 6.00%

6.00% 6.00%

10.00% 10.00%

c p

10.6285 3.6163

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

6.00% 6.00% 0.00% 0.00% 35.00% 35.00%

Call Put

c p

Value

6.8889 2.6710

Cost of carry ( b Volatility ( s ) )

2.00% 2.00% 27.00% 27.00%

Call Put

c p

Value

48.0647 20.2069

Value in domestic currency

Domestic rate ( rDividend yield Volatility stock ( sS* ) Volatility currency ( sE ) r ) ) (q) Correlation (

8.00% 8.00% 5.00% 5.00% 20.00% 20.00% 12.00% 12.00% 0.45 0.45

Call Put

c p

Value

8.3056 15.7354

Value in domestic currency

Domestic rate ( rForeign rate ( rf ) ) Dividend yield ( q )

8.00% 8.00% 5.00% 5.00% 4.00% 4.00%

Volatility stock ( sS* )currency ( sE ) (Call Put Volatility Correlation r )

20.00% 20.00% 12.00% 12.00% -0.40 -0.40 c p

Value

2.9943 4.2089

Time to expiration ( T ) Domestic risk-free raterisk-free rate ( Stock priceExchange(rate volatility ( sE ) Foreign ( r ) rf ) volatility sV Correlation coefficient (Value ) r)

0.50 10.00% 10.00% 40.00% 12.00% 0.40 8.3644

Risk-free rate ( r Cost of carry ( Volatility ( s ) ) b)

10.00% 0.00% 20.00%

Value

0.7389

Volatility ( s )

25.00% 25.00%

Dividend payment 1 toD1 ) Time ( dividend 1 ( t1 ) ividend payment 2 ( D2 )Dividend) paymentto ( D3Call Put ( t3 ) D Time to dividend 2 ( t2 Time 3 dividend 3 )

2.00 2.00 0.25 0.25 2.00 2.00 0.50 0.50 0.00 0.00 0.00 0.00 c p

Page 6

Library

Delta D

0.3725 -0.6275

Elasticity LGamma G Vega

10.4759 -6.4402 0.0420 0.0420 11.3515 11.3515

Theta Q

-8.4282 -3.3311

Rho r

5.0539 -10.8743

Carry

5.5872 -9.4128

Bjerksund and Stensland

5.2704 4.3613

Zero coupon bond value

57.02 57.02

Payer swaption Receiver swaption

Page 7

Library

Call on the minimum Put on the maximum

[1] Call-on-call [2] Call-on-put [3] Put-on-call [4] Put-on-put

Call on the minimum Put on the maximum

Page 8

Library

Option value Stock price minus NPV dividends

15.6465 2.9965 96.1469 96.1469

Page 9

1.Barriers

Standard barrier options

Barrier monitoring ? Asset price ( S ) Strike price ( X ) Barrier ( H ) Cash rebate ( K ) Time to maturity ( T ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Adjusted barrier Value

100.00 100.00 115.00 3.00 0.50 8.00% 4.00% 20.00% 115.00 7.3508

2 [1] Down-and-in call [2] Up-and-in call [3] Down-and-in put [4] Up-and-in put [5] Down-and-out call [6] Up-and-out call [7] Down-and-out put [8] Up-and-out put 1 Continuously Hourly Daily Weekly Monthly

cui cdi cui pdi pui cdo cuo pdo puo 0.0000 0 0.00011416 0.00273973 0.01923077 0.08333333

Partial-time singel asset barrier options

Barrier monitoring ? Asset price ( S ) Strike price ( X ) Barrier ( H ) Time to maturity ( t1 ) Time to maturity ( T2 ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Adjusted barrier Value

105.00 90.00 115.00 0.35 0.50 10.00% 5.00% 20.00% 118.93 0.6394

3 [1] Up-and-out call type A (H>S) [2] Down-and-out call type A (H<S) [3] Up-and-out put type A (H>S) [4] Down-and-out put type A (H<S) [5] Out call type B1 [6] Out put type B1 [7] Up-and-out call type B2 (H>S) [8] Down-and-out call type B2 (H<S) [9] Up-and-out put type B2 (H>S) [10] Down-and-out put type B2 (H<S) 5 Continuously Hourly Daily Weekly Monthly

puoA cuoA cdoA puoA pdoA coB1 poB1 cuoB2 cdoB2 puoB2 pdoB2 0.0833 0 0.0001 0.0027 0.0192 0.0833

Page 10

1.Barriers

Double barrier options

Barrier monitoring ? Asset price ( S ) Strike price ( X ) Lower barrier ( L ) Upper barrier ( U ) Time to maturity ( T ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Upper curvature ( d1 ) Lower curvature ( d2 ) Adjusted lower barrier Adjusted upper barrier Value

100.00 100.00 90.00 105.00 0.25 10.00% 10.00% 25.00% 0.00 0.00 90.00 105.00 0.1179

2 po [1] Call up-and-out-down-and-out co [2] Put up-and-out-down-and-out po [3] Call up-and-in-down-and-in ci [4] Put up-and-in-down-and-in pi 1 0.0000 Continuously 0 Hourly 0.000114 Daily 0.00274 Weekly 0.019231 Monthly 0.083333

Two asset barrier options

Barrier monitoring ? Asset 1 ( S1 ) Asset 2 ( S2 ) Strike price ( X ) Barrier ( H ) Time to maturity ( T ) Risk-free rate ( r ) Carry asset 1 ( b1 ) Carry asset 2 ( b2 ) Volatility asset 1 ( s1 ) Volatility asset 2 ( s2 ) Correlation ( r ) Adjusted barrier Value

100.00 100.00 95.00 90.00 0.50 8.00% 0.00% 0.00% 20.00% 20.00% 0.50 89.45 5.8874

5 cdo [1] Down-and-in call cdi [2] Up-and-in call cui [3] Down-and-in put pdi [4] Up-and-in put pui [5] Down-and-out call cdo [6] Up-and-out call cuo [7] Down-and-out put do p [8] Up-and-out put puo 3 0.0027 Continuously 0 Hourly 0.0001 Daily 0.0027 Weekly 0.0192 Monthly 0.0833

Page 11

2.Barriers

Partial-time two asset barrier options

Barrier monitoring ? Asset 1 ( S1 ) Asset 2 ( S2 ) Strike price ( X ) Barrier ( H ) Barrier lifetime ( t1 ) Time to maturity ( T 2 ) Risk-free rate ( r ) Carry asset 1 ( b1 ) Carry asset 2 ( b2 ) Volatility asset 1 ( s1 ) Volatility asset 2 ( s2 ) Correlation ( r ) Adjusted barrier Value 100.00 100.00 95.00 90.00 0.25 0.50 8.00% 0.00% 0.00% 20.00% 20.00% 0.50 90.00 6.5078 5 [1] Down-and-in call [2] Up-and-in call [3] Down-and-in put [4] Up-and-in put [5] Down-and-out call [6] Up-and-out call [7] Down-and-out put [8] Up-and-out put 1 Continuously Hourly Daily Weekly Monthly cdo cdi cui pdi pui cdo cuo pdo puo 0.0000 0 0.0001 0.0027 0.0192 0.0833

Soft-barrier options

Asset price ( S ) Strike price ( X ) Lover barrier level ( L ) Upper barrier level ( U ) Time to maturity ( T ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Value 100.00 100.00 95.00 85.00 0.50 10.00% 5.00% 30.00% 7.2496 2 [1] Down-and-in call [2] Down-and-out call [3] Up-and-in put [4] Up-and-out put cdo cdi cdo pui puo

Page 12

2.Barriers

Look-barrier options

Barrier monitoring ? Asset price ( S ) Strike price ( X ) Barrier ( H ) Barrier lifetime ( t1 ) Time to maturity ( T 2 ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) 100.00 105.00 110.00 0.50 1.00 10.00% 10.00% 30.00% 1 cuo [1] Up-and-out call (H>S) cuo [2] Up-and-in call (H>S) cui [3] Down-and-out put (H<S) pdo [4] Down-and-in put (H<S) pdi 1 0.0000 Continuously 0 Hourly 0.0001 Daily 0.0027 Weekly 0.0192 Monthly 0.0833

Adjusted barrier Value

110.00 2.0328

Page 13

BinaryBarrier

Binary barrier options

Barrier monitoring ? Asset price ( S ) Strike price ( X ) Barrier ( H ) Cash ( K ) Time to maturity ( T ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Adjusted barrier Value

105.00 102.00 100.00 15.00 0.50 10.00% 10.00% 20.00% 100.00 40.1574

Page 14

BinaryBarrier

11 Binary Barrier Options [1] Down-and-in cash-(at-hit)-or-nothing (S>H) [2] Up-and-in cash-(at-hit)-or-nothing (S<H) [3] Down-and-in asset-(at-hit)-or-nothing (K=H) (S>H) [4] Up-and-in asset-(at-hit)-or-nothing (K=H)(S<H) [5] Down-and-in cash-(at-expiry)-or-nothing (S>H) [6] Up-and-in cash-(at-expiry)-or-nothing (S<H) [7] Down-and-in asset-(at-expiry)-or-nothing (S>H) [8] Up-and-in asset-(at-expiry)-or-nothing (S<H) [9] Down-and-out cash-(at-expiry)-or-nothing (S>H) [10] Up-and-out cash-(at-expiry)-or-nothing (S<H) [11] Down-and-out asset-(at-expiry)-or-nothing (S>H) [12] Up-and-out asset-(at-expiry)-or-nothing (S<H) [13] Down-and-in cash-(at-expiry)-or-nothing call (S>H) [14] Up-and-in cash-(at-expiry)-or-nothing call (S<H) [15] Down-and-in asset-(at-expiry)-or-nothing call (S>H) [16] Up-and-in asset-(at-expiry)-or-nothing call (S<H) [17] Down-and-in cash-(at-expiry)-or-nothing put (S>H) [18] Up-and-in cash-(at-expiry)-or-nothing put (S<H) [19] Down-and-in asset-(at-expiry)-or-nothing put (S>H) [20] Up-and-in asset-(at-expiry)-or-nothing put (S<H) [21] Down-and-out cash-(at-expiry)-or-nothing call (S>H) [22] Up-and-out cash-(at-expiry)-or-nothing call (S<H) [23] Down-and-out asset-(at-expiry)-or-nothing call (S>H) [24] Up-and-out asset-(at-expiry)-or-nothing call (S<H) [25] Down-and-out cash-(at-expiry)-or-nothing put (S>H) [26] Up-and-out cash-(at-expiry)-or-nothing put (S<H) [27] Down-and-out asset-(at-expiry)-or-nothing put (S>H) [28] Up-and-out asset-(at-expiry)-or-nothing put (S<H) 1 Continuously Hourly Daily Weekly Monthly eta

1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 1 -1 0.0000 0 0.0001 0.0027 0.0192 0.0833

1 phi A5 A5 A5 A5 B2+B4 B2+B4 A2+A4 A2+A4 B2-B4 B2-B4 A2-A4 A2-A4 B3 B1 A3 A1 B2-B3+B4 B1-B2+B4 A2-A3+A4 A1-A2+A3 B1-B3 0 A1-A3 0 B1-B2+B3-B4 B2-B4 A1-A2+A3-A4 A2-A4 A5 A5 A5 A5 B2+B4 B2+B4 A2+A4 A2+A4 B2-B4 B2-B4 A2-A4 A2-A4 B1-B2+B4 B2-B3+B4 A1-A2+A4 A2-A3+A4 B1 B3 A1 A3 B2-B4 B1-B2+B3-B4 A2-A4 A1-A2+A3-A4 0 B1-B3 0 A1-A3

-1 1 -1 1 1 -1 1 -1 1 1 1 1 -1 -1 -1 -1 1 1 1 1 -1 -1 -1 -1

Page 15

Exchange

Exchange options on exchange options

Asset 1 ( S1 ) Asset 2 ( S2 ) Quantity of asset 2 ( Q ) Time to maturity ( t1 ) Time to maturity underlying option ( T2 ) Risk-free rate ( r ) Carry asset 1 ( b1 ) Carry asset 2 ( b2 ) Volatility asset 1 ( s1 ) Volatility asset 2 ( s2 ) Correlation ( r ) Value

105.00 100.00 10.00% 0.75 1.00 10.00% 10.00% 10.00% 20.00% 25.00% 0.50 4.3166

2 1 2 3 4

Option to exchange one asset for another Asset 1 ( S1 ) Asset 2 ( S2 ) Quantity of asset 1 ( Q1 ) Quantity of asset 2 ( Q2 ) Time to maturity ( T ) Risk-free rate ( r ) Carry asset 1 ( b1 ) Carry asset 2 ( b2 ) Volatility asset 1 ( s1 ) Volatility asset 2 ( s2 ) Correlation ( r ) European value American value 101.00 104.00 1.000 1.000 0.50 10.00% 2.00% 4.00% 18.00% 12.00% 0.80 1.5260 1.5558

Side 16

Exchange

[1] Option to exchange Q*S2 for the option to exchange S2 for S1 [2] Option to exchange the option to exchange S2 for S1 in return for Q*S 2 [3] Option to exchange Q*S2 for the option to exchange S1 for S2 [4] Option to exchange the option to exchange S1 for S2 in return for Q*S 2

Two asset correlation options

Asset 1 ( S1 ) Asset 2 ( S2 ) Strike price one ( X1 ) Strike price two ( X2 ) Time to maturity ( T ) Risk-free rate ( r ) Carry asset 1 ( b1 ) Carry asset 2 ( b2 ) Volatility asset 1 ( s1 ) Volatility asset 2 ( s2 ) Correlation ( r ) Digital correlation

52.00 65.00 50.00 70.00 0.5000 10.00% 10.00% 10.00% 20.00% 30.00% 0.75 3.9093

p 2 Call Put

Side 17

.ExtremeSpread

Extreme spread options

Asset price ( S ) Observed minimum ( Smin ) Observed maximum ( Smax ) First time period ( t1 ) Time to maturity ( T2 ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Value

100.00 80.00 120.00 0.25 1.00 10.00% 10.00% 30.00% 13.5892

1 [1] Extreme spread call [2] Extreme spread put [3] Reverse extreme spread call [4] Reverse extreme spread put

Page 18

TwoAssetCashOrNothing

Two asset cash-or-nothing options

Asset 1 ( S1 ) Asset 2 ( S2 ) Strike price 1 ( X1 ) Strike price 2 ( X2 ) Cash ( K ) Time to maturity ( T ) Risk-free rate ( r ) Carry asset 1 ( b1 ) Carry asset 2 ( b2 ) Volatility asset 1 ( s1 ) Volatility asset 2 ( s2 ) Correlation ( r ) Value

100.00 100.00 110.00 90.00 10.00 0.5000 10.00% 5.00% 6.00% 20.00% 25.00% 0.50 2.4987

1 [1] Cash-or-nothing call [2] Cash-or-nothing put [3] Cash-or-nothing up-down [4] Cash-or-nothing down-up

Page 19

RiskyAssets

Options on the maximum or the minimum of two risky assets

Asset 1 ( S1 ) Asset 2 ( S2 ) Strike price ( X ) Time to maturity ( T ) Risk-free rate ( r ) Carry asset 1 ( b1 ) Carry asset 2 ( b2 ) Volatility asset 1 ( s1 ) Volatility asset 2 ( s2 ) Correlation ( r ) Value

100.00 105.00 98.00 0.50 5.00% -1.00% -4.00% 11.00% 16.00% 0.63 2.9340

1 [1] Call on the minimum [2] Call on the maximum [3] Put on the minimum [4] Put on the maximum

cmin cmin cmax pmin pmax

Page 20

Chooser

Chooser options

Simple chooser

Asset price ( S ) Strike price ( X ) Chooser time ( t1 ) Time to maturity ( T2 ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Value 50.00 55.00 0.25 0.50 8.00% 8.00% 25.00% 6.6061

Complex chooser

Asset price ( S ) Strike price call ( XC ) Strike price put ( XP ) Chooser time ( t ) Time to maturity call ( TC ) Time to maturity put ( TP ) Risk-free rate ( r ) Cost of carry ( b ) Volatility ( s ) Value 50.00 55.00 48.00 0.25 0.50 0.5833 10.00% 5.00% 35.00% 6.0508

Page 21

MiltersenSchwartz

The Miltersen and Schwartz commodity option model (Gaussian case)

Price of zero coupon bond ( Pt ) Futures price ( FT ) Strike price ( X ) Time to option maturity ( t ) Time to future contract maturity ( T ) Volatility of the spot commodity price ( s S ) Volatility of future convenience yield ( se ) Volatility of the forward interest rate ( s f ) Correlation commodity price and convenience yield ( r Se ) Correlation commodity price and forward rate ( r Sf ) Correlation convenience yield and forward rate ( ref ) Speed of mean reversion convenience yield ( ke ) Speed of mean reversion forward rates ( kf ) Value 0.9753 95.00 95.00 0.50 1.00 0.2660 0.2490 0.0096 0.8050 0.0964 0.1243 1.0450 0.2000 4.7245 c 1 Call Put

Page 22

You might also like

- MRD ProtocolDocument27 pagesMRD ProtocolVarun Marar67% (3)

- GoldWingGL1800 (2020) CompressedDocument316 pagesGoldWingGL1800 (2020) Compressedchan swantananantNo ratings yet

- Chain Conveyors 150508Document16 pagesChain Conveyors 150508MarcNo ratings yet

- Replicating PortfolioDocument2 pagesReplicating PortfolioChanakya CherukumalliNo ratings yet

- 8th Homework MFADocument3 pages8th Homework MFAAhmed RazaNo ratings yet

- Call and Put Vs Strike Call and Put Vs StockDocument27 pagesCall and Put Vs Strike Call and Put Vs StockjatingediaNo ratings yet

- Total Hambatan Setempat (TF) Nilai Perlawanan Konus (QC)Document7 pagesTotal Hambatan Setempat (TF) Nilai Perlawanan Konus (QC)Wecky ChobarNo ratings yet

- Assignment 2Document9 pagesAssignment 2Shreya SingiNo ratings yet

- Project AppraisalDocument34 pagesProject AppraisalWilly Mwangi KiarieNo ratings yet

- Corrected Sampling VariogramDocument177 pagesCorrected Sampling VariogramZhirokh RMNo ratings yet

- SAPMDocument7 pagesSAPMrakeshkakaniNo ratings yet

- Ch7 SFM Illustrations Futures Derivatives 20-07-2021 B503f5fe0a4d486587926d148cDocument41 pagesCh7 SFM Illustrations Futures Derivatives 20-07-2021 B503f5fe0a4d486587926d148cPraveen ReddyNo ratings yet

- Entropy Methods For Financial Derivatives: Marco Avellaneda G63.2936.001 Spring Semester 2009Document42 pagesEntropy Methods For Financial Derivatives: Marco Avellaneda G63.2936.001 Spring Semester 2009Arthur DuxNo ratings yet

- AssignmentDocument6 pagesAssignmentSaransh PatniNo ratings yet

- Asset Allocation Data: Indiff CurveDocument26 pagesAsset Allocation Data: Indiff CurveMariela CNo ratings yet

- Financial ModelingDocument2 pagesFinancial ModelingabrahamrejaNo ratings yet

- P1.Valuation Global Topic DrillDocument19 pagesP1.Valuation Global Topic Drillm1nx1anNo ratings yet

- Option Valuation Audit Sheet: Assumptions Intermediate ComputationsDocument1 pageOption Valuation Audit Sheet: Assumptions Intermediate ComputationslifeeeNo ratings yet

- Solução Da Opção de ExpansãoDocument2 pagesSolução Da Opção de Expansãojgutierrez_castro7724No ratings yet

- Costs of ProductionDocument30 pagesCosts of ProductionANIKNo ratings yet

- Assingnment: Ch#4 (Options Market and Contracts)Document10 pagesAssingnment: Ch#4 (Options Market and Contracts)Mahnoor ShahbazNo ratings yet

- A. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramDocument13 pagesA. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramHaziq Hakimi100% (1)

- Location StrategyDocument26 pagesLocation StrategyCris CalulotNo ratings yet

- 660 Final Assignment M-1Document16 pages660 Final Assignment M-1Maruf ChowdhuryNo ratings yet

- Share Khan Option CalculatorDocument2 pagesShare Khan Option CalculatorquickutNo ratings yet

- Costs of Production: The Short Run and The Long RunDocument7 pagesCosts of Production: The Short Run and The Long Runilias ahmedNo ratings yet

- NPV IrrDocument7 pagesNPV IrrKômâl MübéèñNo ratings yet

- Input Derived: T Cash Flows PVCF PVCF T T (T+1)Document8 pagesInput Derived: T Cash Flows PVCF PVCF T T (T+1)kanak257No ratings yet

- CostsDocument8 pagesCostsTanjil Hasan TajNo ratings yet

- FIN515 W5 ProjectDocument10 pagesFIN515 W5 ProjectCharlson020No ratings yet

- Ejercicio - 19Document23 pagesEjercicio - 19Diego Kadù Desposorio MendezNo ratings yet

- PTK B 3 Halila Titin Hariyanto 02411640000119Document10 pagesPTK B 3 Halila Titin Hariyanto 02411640000119Halila TitinNo ratings yet

- His To GramsDocument15 pagesHis To GramsMaryam HasanNo ratings yet

- CH 01 Bond Pricing - Ready-To-BuildDocument19 pagesCH 01 Bond Pricing - Ready-To-BuildShruti SankarNo ratings yet

- Calculo Flecha TerminadoDocument149 pagesCalculo Flecha TerminadoSebastián ValenciaNo ratings yet

- Analysis of SpotspeeddataDocument4 pagesAnalysis of SpotspeeddatalakshmidileepNo ratings yet

- Analysis of SpotspeeddataDocument4 pagesAnalysis of SpotspeeddatalakshmidileepNo ratings yet

- KPI Formula Mapping - All VendorsDocument18 pagesKPI Formula Mapping - All VendorsJefferson Aboo100% (2)

- V@R - Session 2Document17 pagesV@R - Session 2Kethana SamineniNo ratings yet

- Rate Analyse For Civil Item by Engr Mustafa HaiderDocument38 pagesRate Analyse For Civil Item by Engr Mustafa HaiderAmy LambNo ratings yet

- Tutor 13Document7 pagesTutor 13Kamarulnizam ZainalNo ratings yet

- EconDocument16 pagesEconvivek3790No ratings yet

- Percentage Change in Net Sales % of 2013 Actual Proforma Income Statement Sales 2013 2014 2015Document2 pagesPercentage Change in Net Sales % of 2013 Actual Proforma Income Statement Sales 2013 2014 2015Joshua PelegrinoNo ratings yet

- Chapter Fourteen: Simulation: Problem Summary Problem SolutionsDocument20 pagesChapter Fourteen: Simulation: Problem Summary Problem SolutionsMisha LezhavaNo ratings yet

- 2 - Dimensional TransformationDocument10 pages2 - Dimensional Transformationanon_830732024No ratings yet

- Siemens Electric Motor WorksDocument4 pagesSiemens Electric Motor WorksSangtani PareshNo ratings yet

- Siemens Electric Motor WorksDocument4 pagesSiemens Electric Motor WorksSangtani PareshNo ratings yet

- Quiz 1Document7 pagesQuiz 1qwertyuiopNo ratings yet

- Bond Pricing ToolDocument30 pagesBond Pricing ToolRavi KumarNo ratings yet

- Econ Eportfolio Part 2Document3 pagesEcon Eportfolio Part 2api-252980817No ratings yet

- Option Valuation The Black-Scholes-Merton Option Pricing ModelDocument9 pagesOption Valuation The Black-Scholes-Merton Option Pricing ModelArchit KhareNo ratings yet

- Logitech Case SolutionDocument4 pagesLogitech Case SolutionAhmad AliNo ratings yet

- Chapter 2 Questions and AnswersDocument11 pagesChapter 2 Questions and AnswersNoor TaherNo ratings yet

- Black-Scholes Options Pricing Calculator: Effect of A Change in The Stock PriceDocument7 pagesBlack-Scholes Options Pricing Calculator: Effect of A Change in The Stock PriceVinay KaraguppiNo ratings yet

- Altman Credit Scoring Model UpdateDocument90 pagesAltman Credit Scoring Model UpdateJuan AntonioNo ratings yet

- Ifsa Chapter2 IalDocument3 pagesIfsa Chapter2 IalbingoNo ratings yet

- ACCA F9 Financial Management Complete Text Errata Sheet 210909Document4 pagesACCA F9 Financial Management Complete Text Errata Sheet 210909kcp123No ratings yet

- Single Index ModelDocument7 pagesSingle Index ModelNeelam MadarapuNo ratings yet

- 高量採樣器 - 流量校正Document3 pages高量採樣器 - 流量校正jackjack0402No ratings yet

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskFrom EverandFinancial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskNo ratings yet

- Samuel FrimpongDocument14 pagesSamuel Frimpongdunlut pelemNo ratings yet

- Extra Exercises For Relative ClausesDocument12 pagesExtra Exercises For Relative Clausesfabienne destouesseNo ratings yet

- Love and War by Sandisiwe GxabaDocument694 pagesLove and War by Sandisiwe GxabaReneilwe AshleyNo ratings yet

- Geology of The Moon: Edward M. Murphy Department of Astronomy University of VirginiaDocument51 pagesGeology of The Moon: Edward M. Murphy Department of Astronomy University of Virginiasahithi1999No ratings yet

- Staad Foundation Advanced: Product Data SheetDocument2 pagesStaad Foundation Advanced: Product Data Sheetsofonias bezabehNo ratings yet

- Inflatable Packers and GroutingDocument7 pagesInflatable Packers and GroutingjasonlaiymNo ratings yet

- Cashflow Project CimahiDocument50 pagesCashflow Project CimahiBrandy HarperNo ratings yet

- WLAN EvolutionDocument6 pagesWLAN EvolutionJansen GüntherNo ratings yet

- Lexmark C500 Menus and MessagesDocument15 pagesLexmark C500 Menus and MessagesjcontractorNo ratings yet

- SC 5 L 14 2-Plants and AnimalsDocument28 pagesSC 5 L 14 2-Plants and Animalsapi-263271261No ratings yet

- Wbi12 01 Rms 20240307Document28 pagesWbi12 01 Rms 20240307fathimaifaza2004No ratings yet

- Caolin C. Britex 95 Qpros PDFDocument3 pagesCaolin C. Britex 95 Qpros PDFEduardo Pérez100% (1)

- Toucan DrawingDocument34 pagesToucan Drawingapi-293137787No ratings yet

- A Systemic Review of Functional Near-Infrared Spectroscopy For Stroke: Current Application and Future DirectionsDocument14 pagesA Systemic Review of Functional Near-Infrared Spectroscopy For Stroke: Current Application and Future DirectionsEricNo ratings yet

- Safety Data Sheet: Section 1: Identification of The Substance/Mixture and of The Company/UndertakingDocument10 pagesSafety Data Sheet: Section 1: Identification of The Substance/Mixture and of The Company/UndertakingIsmael Enrique ArciniegasNo ratings yet

- FILE 20210720 230205 Ôn-Tập-TACNDocument9 pagesFILE 20210720 230205 Ôn-Tập-TACNVăn KhánhNo ratings yet

- Panasonic Broadcast AJ-D455 Mechanical ArtsDocument26 pagesPanasonic Broadcast AJ-D455 Mechanical ArtskarkeraNo ratings yet

- Ch06 SlidesDocument73 pagesCh06 SlidesbeelzeburtonNo ratings yet

- ELEC4110 Midterm Exercise 2014 With SolutionDocument12 pagesELEC4110 Midterm Exercise 2014 With SolutionoozgulecNo ratings yet

- Tome of Minor ItemsDocument23 pagesTome of Minor ItemsMorrissMinorNo ratings yet

- Anthropocene102 595 PDFDocument17 pagesAnthropocene102 595 PDFTimothy CaldwellNo ratings yet

- The Book of Astarte and AstarothDocument11 pagesThe Book of Astarte and Astaroth69bjkf9rbpNo ratings yet

- AcuitSign M8&M6&M5&M3 User's Manual 20141215 - CompressedDocument305 pagesAcuitSign M8&M6&M5&M3 User's Manual 20141215 - CompressedElectromedycal EQUIPO MEDICONo ratings yet

- Contoh Format SoalDocument3 pagesContoh Format SoalAinol mardiyahNo ratings yet

- Welding Code, or AWS D1.1, Structural Welding Code-Steel) To The Construction Division, MaterialsDocument10 pagesWelding Code, or AWS D1.1, Structural Welding Code-Steel) To The Construction Division, MaterialsDak KaizNo ratings yet

- Wi SUN Alliance Comparing IoT Networks r1Document6 pagesWi SUN Alliance Comparing IoT Networks r1Roberto AmbrozioNo ratings yet

- Production and Operations ManagementDocument178 pagesProduction and Operations ManagementRavi KumarNo ratings yet