Professional Documents

Culture Documents

Rate Buydown Flyer

Rate Buydown Flyer

Uploaded by

Ken CaianiCopyright:

Available Formats

You might also like

- DCF Modeling Examplye Deal Gallagher MohanDocument16 pagesDCF Modeling Examplye Deal Gallagher Mohansuraj k33% (3)

- 30 Questions: MGT 303 Pricing Money Market Instruments IIDocument28 pages30 Questions: MGT 303 Pricing Money Market Instruments IIFelixNo ratings yet

- Tawarruq Home FinancingDocument9 pagesTawarruq Home Financingnur ameerah100% (1)

- Bank 1 PDFDocument7 pagesBank 1 PDFadam burdNo ratings yet

- Tutorial 6 SolDocument14 pagesTutorial 6 SolAlex C. Guerrero100% (1)

- Sci TronicDocument14 pagesSci TronicFez Research Laboratory100% (19)

- View PDFDocument6 pagesView PDFfabrikfashions171No ratings yet

- Account Statement - Aug 31, 2020Document7 pagesAccount Statement - Aug 31, 2020judyvijayNo ratings yet

- Kev 2Document11 pagesKev 2adam burdNo ratings yet

- Principal June StatementDocument10 pagesPrincipal June Statementsusu ultra menNo ratings yet

- Personal Budget & Net Worth StatementDocument2 pagesPersonal Budget & Net Worth StatementJuhas KuhanasNo ratings yet

- Donald 1Document11 pagesDonald 1adam burdNo ratings yet

- Account Statement - Jun 30, 2021Document8 pagesAccount Statement - Jun 30, 2021Clifton WilsonNo ratings yet

- Agosto 2022Document54 pagesAgosto 2022Alexander BejaranoNo ratings yet

- Exit Counseling: 1,033/year 1,031 2,064Document2 pagesExit Counseling: 1,033/year 1,031 2,064Jacob BurbrinkNo ratings yet

- Rent vs. Buy Calculation: Inflation RateDocument3 pagesRent vs. Buy Calculation: Inflation RateOthman Alaoui Mdaghri BenNo ratings yet

- Sri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - BondsupermartDocument5 pagesSri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - Bondsupermartsaliyarumesh2292No ratings yet

- Only Enter Data Into The Green CellsDocument34 pagesOnly Enter Data Into The Green CellsEthan StoneNo ratings yet

- Asbcalcv33Document1 pageAsbcalcv33st6861fNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Asb CalculatorDocument1 pageAsb CalculatorAbdul RoisNo ratings yet

- Tower 2009AR Dated 31 Mar 2010Document146 pagesTower 2009AR Dated 31 Mar 2010scho0577No ratings yet

- Cootamundra House PricesDocument4 pagesCootamundra House PricesDaisy HuntlyNo ratings yet

- APOD - A Sample of The ReportDocument1 pageAPOD - A Sample of The ReportJames R Kobzeff100% (1)

- Bangladesh Economy and DevelopmentDocument14 pagesBangladesh Economy and DevelopmentNafis Hasan khanNo ratings yet

- 2020-IBG-ARDocument148 pages2020-IBG-ARcathyandre2007No ratings yet

- OM 650 SW 1 10pagesDocument10 pagesOM 650 SW 1 10pagesjuan ospinaNo ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- REALTY WEALTH ADVISORS 2 Story Rockport and Roll 1Document1 pageREALTY WEALTH ADVISORS 2 Story Rockport and Roll 1Oliver ProctorNo ratings yet

- Property Analysis Spreadsheet (Roofstock)Document2 pagesProperty Analysis Spreadsheet (Roofstock)Thameem Ansari NooraniNo ratings yet

- SCI Investor Day 2022Document104 pagesSCI Investor Day 2022Victor CamposNo ratings yet

- Savings Interest Calculator: Savings Plan Inputs Summary of ResultsDocument7 pagesSavings Interest Calculator: Savings Plan Inputs Summary of ResultsmorrisioNo ratings yet

- Solutions To IFM 2020 JanDocument4 pagesSolutions To IFM 2020 Janrahul krishnaNo ratings yet

- Q1 2011 Quarterly EarningsDocument15 pagesQ1 2011 Quarterly EarningsRip Empson100% (1)

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Equity CalclutorDocument89 pagesEquity CalclutorShrinivas ReddyNo ratings yet

- Rental Investment ReportDocument5 pagesRental Investment ReportTuba TunaNo ratings yet

- Loan Payoff CalculatorsDocument11 pagesLoan Payoff CalculatorsBeeipNo ratings yet

- Account Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueDocument22 pagesAccount Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueFerguson TchayaNo ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- Total Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison CalculatorDocument5 pagesTotal Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison Calculatorjohnsmith05046876No ratings yet

- Mcclintock 4356 Mcclintock Street San Diego, Ca 92105: 8 Well Maintained Units in City HeightsDocument5 pagesMcclintock 4356 Mcclintock Street San Diego, Ca 92105: 8 Well Maintained Units in City Heightsassistant_sccNo ratings yet

- ASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Document1 pageASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)johariakNo ratings yet

- Effective Interest Method of Amortization Calculator 1Document33 pagesEffective Interest Method of Amortization Calculator 1Brev PNo ratings yet

- Request AOLDocument10 pagesRequest AOLjyarowNo ratings yet

- Founding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorDocument2 pagesFounding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorArturo Alejandro Rochefort RojasNo ratings yet

- Discount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Document13 pagesDiscount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Futuresow support zone BangladeshNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33Izwan HanafiNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33De'Noorish Elegance EJNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33rads9802No ratings yet

- ASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Document1 pageASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Hidayat FariziNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33mondayz_freaksNo ratings yet

- IAF310 CH 7 SS - DhoDocument24 pagesIAF310 CH 7 SS - Dhonasie.kazemiNo ratings yet

- Deal List 9 30 10Document6 pagesDeal List 9 30 10jhoppenNo ratings yet

- Savings Interest Calculator: Savings Plan Inputs Summary of ResultsDocument7 pagesSavings Interest Calculator: Savings Plan Inputs Summary of ResultsAntoOrmeñoNo ratings yet

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoNo ratings yet

- Insight Insight: Leveraged Loan MarketDocument8 pagesInsight Insight: Leveraged Loan MarketDavid BriggsNo ratings yet

- Benefits AIGDocument3 pagesBenefits AIGsavvy.shopper.mom2No ratings yet

- Account Statement - Mar 31, 2021Document7 pagesAccount Statement - Mar 31, 2021Clifton WilsonNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Payroll Template - Quiz#2Document5 pagesPayroll Template - Quiz#2jericho lleraNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- Guidelines For Foreign Exchange Transactions - Bangladesh BankDocument441 pagesGuidelines For Foreign Exchange Transactions - Bangladesh BankAshiq RayhanNo ratings yet

- Working Capital Financing Policy of HDFC, IDBI, Canara Bank, Indian Overseas Bank and Axis BankDocument17 pagesWorking Capital Financing Policy of HDFC, IDBI, Canara Bank, Indian Overseas Bank and Axis BankjashanNo ratings yet

- GRP 1 Financial-Market-Intro-TypesDocument34 pagesGRP 1 Financial-Market-Intro-TypesXander C. PasionNo ratings yet

- Characteristics of EuroDocument10 pagesCharacteristics of EuroSujith PSNo ratings yet

- 07 Communities Cagayan v. Sps. Arsenio and Angeles NanolDocument1 page07 Communities Cagayan v. Sps. Arsenio and Angeles NanolTelle MarieNo ratings yet

- Jakia, Finance MathsDocument13 pagesJakia, Finance MathsangelNo ratings yet

- Loan Amortization ScheduleDocument30 pagesLoan Amortization ScheduleAnonymous 8iP4hCNo ratings yet

- Pre Cast YardDocument2 pagesPre Cast YardeddieNo ratings yet

- Money Market FinalDocument6 pagesMoney Market FinalPriyanka SharmaNo ratings yet

- Capallocation-65 Country StudyDocument28 pagesCapallocation-65 Country StudyshklyarevskyNo ratings yet

- International Financial Management DR Jyoti AgarwalDocument10 pagesInternational Financial Management DR Jyoti AgarwalRadha Raman PandeyNo ratings yet

- Loan Amortization Schedule1 IBFDocument4 pagesLoan Amortization Schedule1 IBFM Shiraz KhanNo ratings yet

- Compound IntrestDocument5 pagesCompound Intrestvenkata sureshNo ratings yet

- The Future of FinTech Paradigm Shift Small Business Finance Report 2015Document36 pagesThe Future of FinTech Paradigm Shift Small Business Finance Report 2015Jibran100% (3)

- Form GFR 16 - For MDocument2 pagesForm GFR 16 - For MLeo KingNo ratings yet

- IbcmDocument11 pagesIbcmrahulhaldankarNo ratings yet

- Loan Amount 416,000 Loan Amount 416,000: 30 Yr Plan 15yr PlanDocument70 pagesLoan Amount 416,000 Loan Amount 416,000: 30 Yr Plan 15yr PlanClay DriskillNo ratings yet

- Assignment - Loan Amortisation ScheduleDocument12 pagesAssignment - Loan Amortisation Scheduleangie_nimmoNo ratings yet

- Role of Money MarketsDocument3 pagesRole of Money Marketssiddharthjain_90No ratings yet

- PrenticeHall Finance SeriesDocument4 pagesPrenticeHall Finance SeriesYo_amaranthNo ratings yet

- Security and Portfolio Management Answer.Document7 pagesSecurity and Portfolio Management Answer.ttwahirwa100% (3)

- Loan Amortization Schedule: Enter Values Loan SummaryDocument8 pagesLoan Amortization Schedule: Enter Values Loan SummaryoscarwhiskyNo ratings yet

- Structured Notes CmsDocument3 pagesStructured Notes Cmsashu khetanNo ratings yet

- Simple InterestDocument19 pagesSimple InterestJerico E. AlajenioNo ratings yet

- Fixed Price Vs Book Building MethodDocument2 pagesFixed Price Vs Book Building MethodH. M. Akramul HaqueNo ratings yet

- Case+Study+Solution-1+ 1Document14 pagesCase+Study+Solution-1+ 1Muhammad Usama WaqarNo ratings yet

Rate Buydown Flyer

Rate Buydown Flyer

Uploaded by

Ken CaianiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rate Buydown Flyer

Rate Buydown Flyer

Uploaded by

Ken CaianiCopyright:

Available Formats

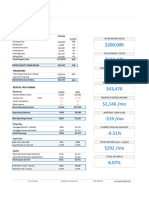

Get Informed. Shop.

Save

With a full shift in power from a seller's market to a buyer's market, both sellers and buyers need to

reevaluate the best approach to a transaction. The examples below illustrate how a simple seller credit

towards the buyer's Interest Rate can produce significant monthly savings for the buyer.

Normal Price Reduction Rate Buydown

Sales Price $552,000 $537,000 $552,000

Down Payment % 20% 20% 20%

Loan Amount $441,600 $429,600 $441,600

Program 7/1 IO Arm 7/1 IO Arm 7/1 IO Arm

Rate 6.625% 6.625% 5.875%

Term IO IO IO

Payment $3,088.00 $3,021.75 $2,812.00

Income to Qualify $7,720.00 $7,554.38 $7,030.00

Monthly Savings $66.25 $276.00

In this example we used 2.125 in points or $15,000 to buy down the in- Ken Caiani

terest rate from 6.625% to 5.875% resulting in a net savings of $276.00 Owner

per month. 303-830-1151

www.informmortgage.com

Also, the points are a t ax deduction in the year the property is purchased ken@informmortgage.com

for the buyer. Please consult your CPA for specific information. Inform Mortgage

1554 S. Downing St.

This example is to show you the power of reducing Rate versus Price. Denver · CO · 80210

Let’s meet and discuss how this strategy can help you finance or sell the

home of your dreams!

State and local laws prohibit discrimination on other bases, which might include sexual orientation, age, marital status, veteran status, income source and others. All such discrimination violates the rules of this site. Ads must not include any discriminatory statement or

EQUAL HOUSING

LENDER

image.

You might also like

- DCF Modeling Examplye Deal Gallagher MohanDocument16 pagesDCF Modeling Examplye Deal Gallagher Mohansuraj k33% (3)

- 30 Questions: MGT 303 Pricing Money Market Instruments IIDocument28 pages30 Questions: MGT 303 Pricing Money Market Instruments IIFelixNo ratings yet

- Tawarruq Home FinancingDocument9 pagesTawarruq Home Financingnur ameerah100% (1)

- Bank 1 PDFDocument7 pagesBank 1 PDFadam burdNo ratings yet

- Tutorial 6 SolDocument14 pagesTutorial 6 SolAlex C. Guerrero100% (1)

- Sci TronicDocument14 pagesSci TronicFez Research Laboratory100% (19)

- View PDFDocument6 pagesView PDFfabrikfashions171No ratings yet

- Account Statement - Aug 31, 2020Document7 pagesAccount Statement - Aug 31, 2020judyvijayNo ratings yet

- Kev 2Document11 pagesKev 2adam burdNo ratings yet

- Principal June StatementDocument10 pagesPrincipal June Statementsusu ultra menNo ratings yet

- Personal Budget & Net Worth StatementDocument2 pagesPersonal Budget & Net Worth StatementJuhas KuhanasNo ratings yet

- Donald 1Document11 pagesDonald 1adam burdNo ratings yet

- Account Statement - Jun 30, 2021Document8 pagesAccount Statement - Jun 30, 2021Clifton WilsonNo ratings yet

- Agosto 2022Document54 pagesAgosto 2022Alexander BejaranoNo ratings yet

- Exit Counseling: 1,033/year 1,031 2,064Document2 pagesExit Counseling: 1,033/year 1,031 2,064Jacob BurbrinkNo ratings yet

- Rent vs. Buy Calculation: Inflation RateDocument3 pagesRent vs. Buy Calculation: Inflation RateOthman Alaoui Mdaghri BenNo ratings yet

- Sri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - BondsupermartDocument5 pagesSri Lanka Gov. Bonds 6.825% 18jul2026 Govt (USD) - Bondsupermartsaliyarumesh2292No ratings yet

- Only Enter Data Into The Green CellsDocument34 pagesOnly Enter Data Into The Green CellsEthan StoneNo ratings yet

- Asbcalcv33Document1 pageAsbcalcv33st6861fNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Asb CalculatorDocument1 pageAsb CalculatorAbdul RoisNo ratings yet

- Tower 2009AR Dated 31 Mar 2010Document146 pagesTower 2009AR Dated 31 Mar 2010scho0577No ratings yet

- Cootamundra House PricesDocument4 pagesCootamundra House PricesDaisy HuntlyNo ratings yet

- APOD - A Sample of The ReportDocument1 pageAPOD - A Sample of The ReportJames R Kobzeff100% (1)

- Bangladesh Economy and DevelopmentDocument14 pagesBangladesh Economy and DevelopmentNafis Hasan khanNo ratings yet

- 2020-IBG-ARDocument148 pages2020-IBG-ARcathyandre2007No ratings yet

- OM 650 SW 1 10pagesDocument10 pagesOM 650 SW 1 10pagesjuan ospinaNo ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- REALTY WEALTH ADVISORS 2 Story Rockport and Roll 1Document1 pageREALTY WEALTH ADVISORS 2 Story Rockport and Roll 1Oliver ProctorNo ratings yet

- Property Analysis Spreadsheet (Roofstock)Document2 pagesProperty Analysis Spreadsheet (Roofstock)Thameem Ansari NooraniNo ratings yet

- SCI Investor Day 2022Document104 pagesSCI Investor Day 2022Victor CamposNo ratings yet

- Savings Interest Calculator: Savings Plan Inputs Summary of ResultsDocument7 pagesSavings Interest Calculator: Savings Plan Inputs Summary of ResultsmorrisioNo ratings yet

- Solutions To IFM 2020 JanDocument4 pagesSolutions To IFM 2020 Janrahul krishnaNo ratings yet

- Q1 2011 Quarterly EarningsDocument15 pagesQ1 2011 Quarterly EarningsRip Empson100% (1)

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Equity CalclutorDocument89 pagesEquity CalclutorShrinivas ReddyNo ratings yet

- Rental Investment ReportDocument5 pagesRental Investment ReportTuba TunaNo ratings yet

- Loan Payoff CalculatorsDocument11 pagesLoan Payoff CalculatorsBeeipNo ratings yet

- Account Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueDocument22 pagesAccount Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueFerguson TchayaNo ratings yet

- 10 YrDocument1 page10 Yrapi-25887578No ratings yet

- Total Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison CalculatorDocument5 pagesTotal Interest Paid $ 181,360.40 Total Interest Paid: Mortgage Comparison Calculatorjohnsmith05046876No ratings yet

- Mcclintock 4356 Mcclintock Street San Diego, Ca 92105: 8 Well Maintained Units in City HeightsDocument5 pagesMcclintock 4356 Mcclintock Street San Diego, Ca 92105: 8 Well Maintained Units in City Heightsassistant_sccNo ratings yet

- ASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Document1 pageASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)johariakNo ratings yet

- Effective Interest Method of Amortization Calculator 1Document33 pagesEffective Interest Method of Amortization Calculator 1Brev PNo ratings yet

- Request AOLDocument10 pagesRequest AOLjyarowNo ratings yet

- Founding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorDocument2 pagesFounding Seed: Total 100% 100 100% 118 $ 95,238 Cumulative Stake Per InvestorArturo Alejandro Rochefort RojasNo ratings yet

- Discount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Document13 pagesDiscount Rate 10% Year Cash Flow 1 $100.00 2 $200.00 3 $300.00 4 $400.00 5 $500.00Futuresow support zone BangladeshNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33Izwan HanafiNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33De'Noorish Elegance EJNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33rads9802No ratings yet

- ASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Document1 pageASB Calculator - Based On Irwan's (HTTP://WWW - Irwan.biz/asb-Calculator-V2/)Hidayat FariziNo ratings yet

- Asbcalcv 33Document1 pageAsbcalcv 33mondayz_freaksNo ratings yet

- IAF310 CH 7 SS - DhoDocument24 pagesIAF310 CH 7 SS - Dhonasie.kazemiNo ratings yet

- Deal List 9 30 10Document6 pagesDeal List 9 30 10jhoppenNo ratings yet

- Savings Interest Calculator: Savings Plan Inputs Summary of ResultsDocument7 pagesSavings Interest Calculator: Savings Plan Inputs Summary of ResultsAntoOrmeñoNo ratings yet

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutDocument1 page3402 N Shadeland Ave Flex Proforma 10-23 Blacked OutJuan bastoNo ratings yet

- Insight Insight: Leveraged Loan MarketDocument8 pagesInsight Insight: Leveraged Loan MarketDavid BriggsNo ratings yet

- Benefits AIGDocument3 pagesBenefits AIGsavvy.shopper.mom2No ratings yet

- Account Statement - Mar 31, 2021Document7 pagesAccount Statement - Mar 31, 2021Clifton WilsonNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Payroll Template - Quiz#2Document5 pagesPayroll Template - Quiz#2jericho lleraNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- Guidelines For Foreign Exchange Transactions - Bangladesh BankDocument441 pagesGuidelines For Foreign Exchange Transactions - Bangladesh BankAshiq RayhanNo ratings yet

- Working Capital Financing Policy of HDFC, IDBI, Canara Bank, Indian Overseas Bank and Axis BankDocument17 pagesWorking Capital Financing Policy of HDFC, IDBI, Canara Bank, Indian Overseas Bank and Axis BankjashanNo ratings yet

- GRP 1 Financial-Market-Intro-TypesDocument34 pagesGRP 1 Financial-Market-Intro-TypesXander C. PasionNo ratings yet

- Characteristics of EuroDocument10 pagesCharacteristics of EuroSujith PSNo ratings yet

- 07 Communities Cagayan v. Sps. Arsenio and Angeles NanolDocument1 page07 Communities Cagayan v. Sps. Arsenio and Angeles NanolTelle MarieNo ratings yet

- Jakia, Finance MathsDocument13 pagesJakia, Finance MathsangelNo ratings yet

- Loan Amortization ScheduleDocument30 pagesLoan Amortization ScheduleAnonymous 8iP4hCNo ratings yet

- Pre Cast YardDocument2 pagesPre Cast YardeddieNo ratings yet

- Money Market FinalDocument6 pagesMoney Market FinalPriyanka SharmaNo ratings yet

- Capallocation-65 Country StudyDocument28 pagesCapallocation-65 Country StudyshklyarevskyNo ratings yet

- International Financial Management DR Jyoti AgarwalDocument10 pagesInternational Financial Management DR Jyoti AgarwalRadha Raman PandeyNo ratings yet

- Loan Amortization Schedule1 IBFDocument4 pagesLoan Amortization Schedule1 IBFM Shiraz KhanNo ratings yet

- Compound IntrestDocument5 pagesCompound Intrestvenkata sureshNo ratings yet

- The Future of FinTech Paradigm Shift Small Business Finance Report 2015Document36 pagesThe Future of FinTech Paradigm Shift Small Business Finance Report 2015Jibran100% (3)

- Form GFR 16 - For MDocument2 pagesForm GFR 16 - For MLeo KingNo ratings yet

- IbcmDocument11 pagesIbcmrahulhaldankarNo ratings yet

- Loan Amount 416,000 Loan Amount 416,000: 30 Yr Plan 15yr PlanDocument70 pagesLoan Amount 416,000 Loan Amount 416,000: 30 Yr Plan 15yr PlanClay DriskillNo ratings yet

- Assignment - Loan Amortisation ScheduleDocument12 pagesAssignment - Loan Amortisation Scheduleangie_nimmoNo ratings yet

- Role of Money MarketsDocument3 pagesRole of Money Marketssiddharthjain_90No ratings yet

- PrenticeHall Finance SeriesDocument4 pagesPrenticeHall Finance SeriesYo_amaranthNo ratings yet

- Security and Portfolio Management Answer.Document7 pagesSecurity and Portfolio Management Answer.ttwahirwa100% (3)

- Loan Amortization Schedule: Enter Values Loan SummaryDocument8 pagesLoan Amortization Schedule: Enter Values Loan SummaryoscarwhiskyNo ratings yet

- Structured Notes CmsDocument3 pagesStructured Notes Cmsashu khetanNo ratings yet

- Simple InterestDocument19 pagesSimple InterestJerico E. AlajenioNo ratings yet

- Fixed Price Vs Book Building MethodDocument2 pagesFixed Price Vs Book Building MethodH. M. Akramul HaqueNo ratings yet

- Case+Study+Solution-1+ 1Document14 pagesCase+Study+Solution-1+ 1Muhammad Usama WaqarNo ratings yet