Professional Documents

Culture Documents

Sify Business-Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

Sify Business-Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

Uploaded by

JagannadhamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sify Business-Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

Sify Business-Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

Uploaded by

JagannadhamCopyright:

Available Formats

PTI

Investors in IPOs have lost over Rs 5,000 cr in 2008 so far

Monday, 15 September , 2008, 15:57

Last Updated: Monday, 15 September , 2008, 15:58

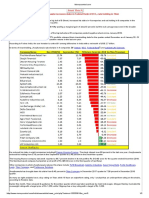

New Delhi: Primary market investors have lost more than Rs 5,000 crore with shares of most of

companies, which came out with initial public issue since January, trading at a discount.

“Out of 34 IPOs issued this calendar year, 26 of them closed below their issue price last week.

These IPOs have raised Rs 16,920 crore but the current value stands at Rs 11,562 crore. So they

are suffering a loss of 31.67 per cent,” said Jagannadham Thunuguntla, Equity Head,

NEXGEN Capitals Limited.

He said five companies which include JSW Energy, RNS Infrastructure, Ybrant Technologies,

Elysium Pharma and Kamayani Patients Care, with the proposed issue of more than Rs 4,000

crore, withdrew their IPOs prior to SEBI approval.

In 2008, 20 companies did not tap the primary market despite approval from SEBI due to

uncertainty in the markets. Shares of eight out of ten companies which got listed on stock

markets during second quarter of the current fiscal (July-September) following the IPO are

trading below the issue price.

According to NSE data, the shares of only Vishal Information Technologies and Austral Coke

and Projects are at 100 per cent and 30 per cent premium respectively, while the equity of

remaining companies are being traded at discount.

The shares of companies (listed during second quarter) which are trading below the issue prices

include Resurgere Mines and Minerals, NuTek India, Birla Cotsyn India, KSK Energy, Lotus

Eye Care, First Winner Industries, Archidply Industries and Sejal Architectural Glass.

You might also like

- Dailyexcelsior - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageDailyexcelsior - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- SifyTamil - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageSifyTamil - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- The Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008Document1 pageThe Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008JagannadhamNo ratings yet

- Business Line - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageBusiness Line - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- Indopia - Sept 16, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008Document1 pageIndopia - Sept 16, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008JagannadhamNo ratings yet

- Money Control - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageMoney Control - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- MyIris - Sept 15, 2008 - IPO Investors Lose Over Rs 50 BN in 2008Document1 pageMyIris - Sept 15, 2008 - IPO Investors Lose Over Rs 50 BN in 2008JagannadhamNo ratings yet

- Congoo - Sept 16,2008 - IPO Investors Lose Over Rs 50 BN in 2008Document1 pageCongoo - Sept 16,2008 - IPO Investors Lose Over Rs 50 BN in 2008JagannadhamNo ratings yet

- Rediff Money - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 in 2008Document1 pageRediff Money - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 in 2008JagannadhamNo ratings yet

- Competition From UPI AppsDocument2 pagesCompetition From UPI AppsAamir MalikNo ratings yet

- India To Offer 68 Blocks in 10th Round of Nelp: BusinessDocument1 pageIndia To Offer 68 Blocks in 10th Round of Nelp: BusinessvinayvpalekarNo ratings yet

- Newswire - Sept 26, 2008 - Study Shows Funds Via QIPs 21 BLN Rupee Since Jan, Down 77% On YrDocument1 pageNewswire - Sept 26, 2008 - Study Shows Funds Via QIPs 21 BLN Rupee Since Jan, Down 77% On YrJagannadhamNo ratings yet

- Reasons For Up N DownDocument5 pagesReasons For Up N DownMukesh Kumar MishraNo ratings yet

- Porinju Veliath Portfolio in Indian MarketDocument2 pagesPorinju Veliath Portfolio in Indian MarketCA Manoj GuptaNo ratings yet

- 15 IPOs Axed at The Last Minute Since January 2011 - The Economic TimesDocument3 pages15 IPOs Axed at The Last Minute Since January 2011 - The Economic TimesSrinivas RaghavanNo ratings yet

- How To Earn Money Today Through Stockmarket by CapitalHeight.Document4 pagesHow To Earn Money Today Through Stockmarket by CapitalHeight.Damini CapitalNo ratings yet

- PSUDocument8 pagesPSUanon_224758276No ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Daily Equity Report 2 February 2015Document4 pagesDaily Equity Report 2 February 2015NehaSharmaNo ratings yet

- Global Strategy & Investment Consulting: Commercial PapersDocument5 pagesGlobal Strategy & Investment Consulting: Commercial PapersBhoomi AhujaNo ratings yet

- Coal India LTDDocument5 pagesCoal India LTDipslogNo ratings yet

- Fundamental June 2011Document4 pagesFundamental June 2011babu_6191No ratings yet

- Rakesh Jhunjhunwala Increases Stake in Federal Bank & NCC, Cuts Holding in TitanDocument2 pagesRakesh Jhunjhunwala Increases Stake in Federal Bank & NCC, Cuts Holding in TitanJayaprakash MuthuvatNo ratings yet

- 10 Largest IPOs in IndiaDocument5 pages10 Largest IPOs in IndiaNeeta Jain MittalNo ratings yet

- Importance of Equity Research in Today's Equity Markets by CapitalHeight.Document4 pagesImportance of Equity Research in Today's Equity Markets by CapitalHeight.Damini CapitalNo ratings yet

- Stock Market Live - Sensex, Nifty Gives Up Morning Gains Banks Surge Nearly 3% But Autos DragDocument15 pagesStock Market Live - Sensex, Nifty Gives Up Morning Gains Banks Surge Nearly 3% But Autos DragRahulNo ratings yet

- National News From India-Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentDocument2 pagesNational News From India-Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentJagannadhamNo ratings yet

- 10 Largest IPOsDocument3 pages10 Largest IPOsrkarora1209No ratings yet

- Indian Investments ReportsDocument4 pagesIndian Investments ReportsPuneet GeraNo ratings yet

- SPEconomics 2nd SeptDocument7 pagesSPEconomics 2nd SeptDhiraj PatilNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- SBI Securities Morning Update - 11-11-2022Document5 pagesSBI Securities Morning Update - 11-11-2022deepaksinghbishtNo ratings yet

- A Presentation By: (Group 7)Document10 pagesA Presentation By: (Group 7)Satish PeriNo ratings yet

- Top 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFDocument9 pagesTop 30 Infrastructure Companies - ConstructionWeekIndiaConstructionWeekIndia PDFMelwin PaulNo ratings yet

- India PE - Oct 13, 2008 - PE Investments Take A BeatingDocument2 pagesIndia PE - Oct 13, 2008 - PE Investments Take A BeatingJagannadhamNo ratings yet

- Tehalka - Nov 2008 - Chronicle of A Death ForetoldDocument3 pagesTehalka - Nov 2008 - Chronicle of A Death ForetoldJagannadhamNo ratings yet

- Bond Market IndiaDocument3 pagesBond Market Indiavaibhav chaurasiaNo ratings yet

- Business News Live and Share Market News by CapitalHeight.Document4 pagesBusiness News Live and Share Market News by CapitalHeight.Damini CapitalNo ratings yet

- 'Interest Rates Are Now Less Meaningful To Equities': Bullish On FMCG On A Restructuring ModeDocument4 pages'Interest Rates Are Now Less Meaningful To Equities': Bullish On FMCG On A Restructuring ModeSmita ShahNo ratings yet

- SBI BondDocument3 pagesSBI BondPrateek JaiswalNo ratings yet

- Top Stories Leader Speak: HCC Approves Lavasa IPO Worth Rs20bnDocument6 pagesTop Stories Leader Speak: HCC Approves Lavasa IPO Worth Rs20bnAkhil AgarwalNo ratings yet

- Etd 2011 12 5 21Document1 pageEtd 2011 12 5 21Nitin GoelNo ratings yet

- Sulekha - Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentDocument2 pagesSulekha - Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentJagannadhamNo ratings yet

- A Technical and Fundamental Analysis of Two Indian StocksDocument7 pagesA Technical and Fundamental Analysis of Two Indian StockselizabethNo ratings yet

- 5 Stocks Are Giving 20% To 40%Document4 pages5 Stocks Are Giving 20% To 40%Gopi KrishnaNo ratings yet

- Govt Sets PSU Selloff Ball Rolling Sidhartha & Surojit Gupta New Delhi TNNDocument6 pagesGovt Sets PSU Selloff Ball Rolling Sidhartha & Surojit Gupta New Delhi TNNSreenivasanVsNo ratings yet

- Market Outlook-VRK100-18072011Document3 pagesMarket Outlook-VRK100-18072011RamaKrishna Vadlamudi, CFANo ratings yet

- The Derrick 20theditionDocument21 pagesThe Derrick 20theditionGagandeep SinghNo ratings yet

- Thaindian - Sept 25, 2008 - Qualified Institutional Placements Value Down 42%Document2 pagesThaindian - Sept 25, 2008 - Qualified Institutional Placements Value Down 42%JagannadhamNo ratings yet

- FII Party On ST Won't Last Long As Worries Remain: HE Conomic ImesDocument1 pageFII Party On ST Won't Last Long As Worries Remain: HE Conomic ImesnikhiljeswaninjNo ratings yet

- Q2Growthat7.4%,With Manufacturingboost: SebigreenlightforexchangeiposDocument1 pageQ2Growthat7.4%,With Manufacturingboost: Sebigreenlightforexchangeiposbosudipta4796No ratings yet

- Pe Firms Manufacturing Funds Ites Industry It Sector Infra FundsDocument2 pagesPe Firms Manufacturing Funds Ites Industry It Sector Infra FundsBhavika JainNo ratings yet

- The India Street Rakesh Jhunjhunwala HoldingsDocument3 pagesThe India Street Rakesh Jhunjhunwala HoldingsmatrixitNo ratings yet

- News & Events 18th May 2020Document1 pageNews & Events 18th May 2020Ravi KiranNo ratings yet

- Assignment Stock Market Operation (Mgt959)Document9 pagesAssignment Stock Market Operation (Mgt959)Rambo VishalNo ratings yet

- Life InsuranceDocument5 pagesLife InsurancechandusapreddyNo ratings yet

- Share Trading Basics by CapitalHeight.Document6 pagesShare Trading Basics by CapitalHeight.Damini CapitalNo ratings yet

- 16 November Empower Bschool-2111Document4 pages16 November Empower Bschool-2111goldbergyNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- The Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008Document1 pageThe Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008JagannadhamNo ratings yet

- The Hindu - Oct 22, 2008 - Indian Equities in Red Again On Global NervousnessDocument2 pagesThe Hindu - Oct 22, 2008 - Indian Equities in Red Again On Global NervousnessJagannadhamNo ratings yet

- The Hindu - Oct 16, 2008 - Cap On Debt-Equity Investment For FIIs GoesDocument1 pageThe Hindu - Oct 16, 2008 - Cap On Debt-Equity Investment For FIIs GoesJagannadhamNo ratings yet

- The Hindu - Oct 13, 2008 - IPOs of 2007 Witness Value Erosion of Over USD 3 BN So FarDocument1 pageThe Hindu - Oct 13, 2008 - IPOs of 2007 Witness Value Erosion of Over USD 3 BN So FarJagannadhamNo ratings yet

- Thaindian - Sept 26, 2008 - Markets End in Red On US Bailout Plan UncertaintyDocument1 pageThaindian - Sept 26, 2008 - Markets End in Red On US Bailout Plan UncertaintyJagannadhamNo ratings yet