Professional Documents

Culture Documents

SifyTamil - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

SifyTamil - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

Uploaded by

JagannadhamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SifyTamil - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

SifyTamil - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So Far

Uploaded by

JagannadhamCopyright:

Available Formats

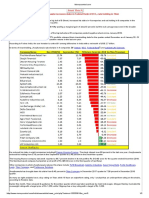

Investors in IPOs have lost over Rs 5,000 cr in 2008 so far

Monday, 15 September , 2008, 15:57

New Delhi: Primary market investors have lost more than Rs 5,000 crore with shares of most of companies, which

came out with initial public issue since January, trading at a discount.

“Out of 34 IPOs issued this calendar year, 26 of them closed below their issue price last week. These IPOs have

raised Rs 16,920 crore but the current value stands at Rs 11,562 crore. So they are suffering a loss of 31.67 per

cent,” said Jagannadham Thunuguntla, Equity Head, NEXGEN Capitals Limited.

He said five companies which include JSW Energy, RNS Infrastructure, Ybrant Technologies, Elysium Pharma and

Kamayani Patients Care, with the proposed issue of more than Rs 4,000 crore, withdrew their IPOs prior to SEBI

approval.

In 2008, 20 companies did not tap the primary market despite approval from SEBI due to uncertainty in the markets.

Shares of eight out of ten companies which got listed on stock markets during second quarter of the current fiscal

(July-September) following the IPO are trading below the issue price.

According to NSE data, the shares of only Vishal Information Technologies and Austral Coke and Projects are at 100

per cent and 30 per cent premium respectively, while the equity of remaining companies are being traded at discount.

The shares of companies (listed during second quarter) which are trading below the issue prices include Resurgere

Mines and Minerals, NuTek India, Birla Cotsyn India, KSK Energy, Lotus Eye Care, First Winner Industries, Archidply

Industries and Sejal Ar chitectural Glass.

You might also like

- Business Line - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageBusiness Line - Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- Sify Business-Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageSify Business-Sept 15, 2008 - Investors in IPOs Have Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- Dailyexcelsior - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageDailyexcelsior - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- The Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008Document1 pageThe Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008JagannadhamNo ratings yet

- Money Control - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarDocument1 pageMoney Control - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008 So FarJagannadhamNo ratings yet

- Indopia - Sept 16, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008Document1 pageIndopia - Sept 16, 2008 - Investors in IPOs Lost Over Rs 5,000 CR in 2008JagannadhamNo ratings yet

- MyIris - Sept 15, 2008 - IPO Investors Lose Over Rs 50 BN in 2008Document1 pageMyIris - Sept 15, 2008 - IPO Investors Lose Over Rs 50 BN in 2008JagannadhamNo ratings yet

- Congoo - Sept 16,2008 - IPO Investors Lose Over Rs 50 BN in 2008Document1 pageCongoo - Sept 16,2008 - IPO Investors Lose Over Rs 50 BN in 2008JagannadhamNo ratings yet

- India To Offer 68 Blocks in 10th Round of Nelp: BusinessDocument1 pageIndia To Offer 68 Blocks in 10th Round of Nelp: BusinessvinayvpalekarNo ratings yet

- Share Trading Basics by CapitalHeight.Document6 pagesShare Trading Basics by CapitalHeight.Damini CapitalNo ratings yet

- Newswire - Sept 26, 2008 - Study Shows Funds Via QIPs 21 BLN Rupee Since Jan, Down 77% On YrDocument1 pageNewswire - Sept 26, 2008 - Study Shows Funds Via QIPs 21 BLN Rupee Since Jan, Down 77% On YrJagannadhamNo ratings yet

- Competition From UPI AppsDocument2 pagesCompetition From UPI AppsAamir MalikNo ratings yet

- Rediff Money - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 in 2008Document1 pageRediff Money - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 in 2008JagannadhamNo ratings yet

- How To Earn Money Today Through Stockmarket by CapitalHeight.Document4 pagesHow To Earn Money Today Through Stockmarket by CapitalHeight.Damini CapitalNo ratings yet

- Reasons For Up N DownDocument5 pagesReasons For Up N DownMukesh Kumar MishraNo ratings yet

- Just Dial Q1 Was An Utter Failure Share Price Dips 3%: Market SynopsisDocument3 pagesJust Dial Q1 Was An Utter Failure Share Price Dips 3%: Market SynopsisSubham MazumdarNo ratings yet

- Life InsuranceDocument5 pagesLife InsurancechandusapreddyNo ratings yet

- Fundamental June 2011Document4 pagesFundamental June 2011babu_6191No ratings yet

- India Opens Stock Market To Foreign InvestorsDocument4 pagesIndia Opens Stock Market To Foreign InvestorsSharad SrivastavaNo ratings yet

- Increasing Non - Performing Assets and Increasing Write Off DebtsDocument3 pagesIncreasing Non - Performing Assets and Increasing Write Off DebtsRohit KhannaNo ratings yet

- Consumer Goods Firms, HUL and Others Post Poor Q2 ResultsDocument2 pagesConsumer Goods Firms, HUL and Others Post Poor Q2 ResultsDynamic LevelsNo ratings yet

- Bond Market IndiaDocument3 pagesBond Market Indiavaibhav chaurasiaNo ratings yet

- Anil BarotDocument18 pagesAnil Barotnayan bhowmickNo ratings yet

- Research Paper On Equity MarketDocument7 pagesResearch Paper On Equity Marketkkxtkqund100% (1)

- Rise in Investment in Equity MarketDocument5 pagesRise in Investment in Equity MarketDynamic LevelsNo ratings yet

- Govt Sets PSU Selloff Ball Rolling Sidhartha & Surojit Gupta New Delhi TNNDocument6 pagesGovt Sets PSU Selloff Ball Rolling Sidhartha & Surojit Gupta New Delhi TNNSreenivasanVsNo ratings yet

- By Denny ThomasDocument2 pagesBy Denny ThomasTarun TandonNo ratings yet

- Rakesh Jhunjhunwala Increases Stake in Federal Bank & NCC, Cuts Holding in TitanDocument2 pagesRakesh Jhunjhunwala Increases Stake in Federal Bank & NCC, Cuts Holding in TitanJayaprakash MuthuvatNo ratings yet

- 35 StocksDocument3 pages35 StocksDynamic LevelsNo ratings yet

- Indian Investments ReportsDocument4 pagesIndian Investments ReportsPuneet GeraNo ratings yet

- PSUDocument8 pagesPSUanon_224758276No ratings yet

- IPO in IndiaDocument15 pagesIPO in IndiaSingh GurpreetNo ratings yet

- Global Strategy & Investment Consulting: Commercial PapersDocument5 pagesGlobal Strategy & Investment Consulting: Commercial PapersBhoomi AhujaNo ratings yet

- The Financial Services Sector in IndiaDocument4 pagesThe Financial Services Sector in IndiaKhyati PatelNo ratings yet

- Private Sector BanksDocument2 pagesPrivate Sector BanksDynamic LevelsNo ratings yet

- Market Mayhem: If You Link Sensex, Nifty Bloodbath To Budget and Economy, You Are Making A Fool of YourselfDocument2 pagesMarket Mayhem: If You Link Sensex, Nifty Bloodbath To Budget and Economy, You Are Making A Fool of YourselfAnkurNo ratings yet

- FINALDocument31 pagesFINALkavi2288No ratings yet

- Journal 1Document2 pagesJournal 1Ehsan KarimNo ratings yet

- Nur Ahmadi Bi RahmaniDocument14 pagesNur Ahmadi Bi RahmaniAndi AbdurahmanNo ratings yet

- gjfmv8n1 04Document6 pagesgjfmv8n1 04Adarsh P RCBSNo ratings yet

- Financial ServicesDocument2 pagesFinancial Serviceskiranks_121No ratings yet

- 'Interest Rates Are Now Less Meaningful To Equities': Bullish On FMCG On A Restructuring ModeDocument4 pages'Interest Rates Are Now Less Meaningful To Equities': Bullish On FMCG On A Restructuring ModeSmita ShahNo ratings yet

- JSTREET Volume 319Document10 pagesJSTREET Volume 319JhaveritradeNo ratings yet

- SBI BondDocument3 pagesSBI BondPrateek JaiswalNo ratings yet

- Recent Trends in Marketing Strategy of Lic of IndiaDocument6 pagesRecent Trends in Marketing Strategy of Lic of IndiaAkhil DasNo ratings yet

- The Derrick 20theditionDocument21 pagesThe Derrick 20theditionGagandeep SinghNo ratings yet

- Porinju Veliath Portfolio in Indian MarketDocument2 pagesPorinju Veliath Portfolio in Indian MarketCA Manoj GuptaNo ratings yet

- A Presentation By: (Group 7)Document10 pagesA Presentation By: (Group 7)Satish PeriNo ratings yet

- SmasHits - Oct 13, 2008 - When Will Mayhem End, Think InvestorsDocument2 pagesSmasHits - Oct 13, 2008 - When Will Mayhem End, Think InvestorsJagannadhamNo ratings yet

- 20 Jun 18 Daily ReportDocument4 pages20 Jun 18 Daily ReportDamini CapitalNo ratings yet

- R. Wadiwala: Morning NotesDocument7 pagesR. Wadiwala: Morning NotesRWadiwala SecNo ratings yet

- Business News Live and Share Market News by CapitalHeight.Document4 pagesBusiness News Live and Share Market News by CapitalHeight.Damini CapitalNo ratings yet

- Birla SunlifeDocument3 pagesBirla SunlifejagannathpressbdkNo ratings yet

- OPOGDocument3 pagesOPOGmohanms.0709No ratings yet

- Bolo Ji - Oct 13, 2008 - When Will Mayhem End, Think InvestorsDocument2 pagesBolo Ji - Oct 13, 2008 - When Will Mayhem End, Think InvestorsJagannadhamNo ratings yet

- Insoc Imes: Gbo Round-UpDocument4 pagesInsoc Imes: Gbo Round-Upricha_kunarNo ratings yet

- Daily Equity Report 2 February 2015Document4 pagesDaily Equity Report 2 February 2015NehaSharmaNo ratings yet

- Pe-Backed Ipos See Record Deals Sizes in Q1 2011Document4 pagesPe-Backed Ipos See Record Deals Sizes in Q1 2011Pushpak Reddy GattupalliNo ratings yet

- A Technical and Fundamental Analysis of Two Indian StocksDocument7 pagesA Technical and Fundamental Analysis of Two Indian StockselizabethNo ratings yet

- The Power of Charts: Using Technical Analysis to Predict Stock Price MovementsFrom EverandThe Power of Charts: Using Technical Analysis to Predict Stock Price MovementsNo ratings yet

- The Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008Document1 pageThe Tribune - Sept 15, 2008 - Investors in IPOs Lost Over Rs 5,000 Crore in 2008JagannadhamNo ratings yet

- The Hindu - Oct 22, 2008 - Indian Equities in Red Again On Global NervousnessDocument2 pagesThe Hindu - Oct 22, 2008 - Indian Equities in Red Again On Global NervousnessJagannadhamNo ratings yet

- The Hindu - Oct 16, 2008 - Cap On Debt-Equity Investment For FIIs GoesDocument1 pageThe Hindu - Oct 16, 2008 - Cap On Debt-Equity Investment For FIIs GoesJagannadhamNo ratings yet

- The Hindu - Oct 13, 2008 - IPOs of 2007 Witness Value Erosion of Over USD 3 BN So FarDocument1 pageThe Hindu - Oct 13, 2008 - IPOs of 2007 Witness Value Erosion of Over USD 3 BN So FarJagannadhamNo ratings yet

- Thaindian - Sept 26, 2008 - Markets End in Red On US Bailout Plan UncertaintyDocument1 pageThaindian - Sept 26, 2008 - Markets End in Red On US Bailout Plan UncertaintyJagannadhamNo ratings yet