Professional Documents

Culture Documents

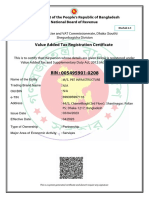

Vat Registration Certificate

Vat Registration Certificate

Uploaded by

Mohit KanoriaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat Registration Certificate

Vat Registration Certificate

Uploaded by

Mohit KanoriaCopyright:

Available Formats

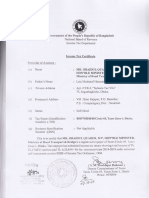

THE WEST BENGAL VALUE ADDED TAX RULES, 2005 FORM 3 (See Rule 6 and Rule 6B)

Certificate Of Registration

Registration Certificate Number Name of the Charge 1 9 6 7 1 0 0 8 3 9 8

SALT LAKE

THIS IS TO CERTIFY THAT

RANVIR JALUKA

engaged in business, whose details are given below, is registered as a dealer under section 24 of the West Bengal Value Added Tax Act, 2003.

1) Name and style of business: 2) Address of principal place of business:

PLANET HOME Room/Flat No-D 107 CITY CENTRE II, NEW TOWN, NOA PARA KOLKATA - 700157

3) Constitution of business: 4) Nature of business: 5) Address of additional place(s) of business:(only one address will be printed)

Unregistered Partnership Retailer,Wholesaler None

6) Registration Certificate is valid from :7) The dealer is liable to pay tax under the WBVAT Act, 2003 with effect from :Place : Date :

KOLKATA 31 October 2011

31 October 2011

09 September 2011

JCCT/CRU

Designation of Registering Authority

This being a dematerialized form of Certificate of Registration no signature of registering authority is required. Note : The above Registration Certificate Number must appear on all the following documents of the dealer - Tax Invoices / Invoices / Cash Memo / Challans / Forwarding Notes etc; - Tax Returns; - Applications and Correspondences with the Commercial Taxes Directorate. It is compulsory for the dealer to keep and display conspicuously the Certificate of Registration at his place of business in terms of provision of the West Bengal Value added Tax Rules, 2005.

You might also like

- Vat Registration CertificateDocument1 pageVat Registration CertificateAnonymous DCnZvu0% (1)

- Habiganj Trade License TemplateDocument1 pageHabiganj Trade License Templatesharifuddin1971kanaighat50% (2)

- Commercial Registration CertificateDocument4 pagesCommercial Registration Certificatejanarthanan desingu raja100% (1)

- Business Registration CertificateDocument1 pageBusiness Registration CertificateGikanga NjugiNo ratings yet

- Balance Certificate of DBBLDocument1 pageBalance Certificate of DBBLBokul100% (1)

- Translate Trade LicenseDocument2 pagesTranslate Trade LicenseMd Touhidul Islam100% (5)

- Updated BIN Certification 2 PDFDocument1 pageUpdated BIN Certification 2 PDFRahat Khan100% (3)

- Rubel Hasan Trade Licence (English)Document1 pageRubel Hasan Trade Licence (English)ianazir.91No ratings yet

- Master Business License.Document1 pageMaster Business License.Ven GeanciaNo ratings yet

- Value Added Tax Registration Certificate: Government of The People's Republic of Bangladesh National Board of RevenueDocument1 pageValue Added Tax Registration Certificate: Government of The People's Republic of Bangladesh National Board of RevenueShuhan Mohammad Ariful Hoque100% (2)

- Corporate InformationDocument7 pagesCorporate InformationmoharifsyaikhubakhrudinNo ratings yet

- BIN Certification 13Document1 pageBIN Certification 13Faruque Uddin100% (2)

- BIN CertificationDocument1 pageBIN Certificationimages experientialNo ratings yet

- Proof of Address Proof NormalDocument2 pagesProof of Address Proof NormalJaknap YednapNo ratings yet

- Erc 2023-2024Document1 pageErc 2023-2024IBRAHIM HOSENNo ratings yet

- VAT - BIN CertificationPDF - 230403 - 145725Document2 pagesVAT - BIN CertificationPDF - 230403 - 145725Md.Tuifiqul Islam BhuiyanNo ratings yet

- Company UKDocument29 pagesCompany UKMuzahir AliNo ratings yet

- Income Tax CertificateDocument1 pageIncome Tax CertificateAL ARAFIN NOMAN SAADNo ratings yet

- New Vat CertificateDocument1 pageNew Vat CertificateMd. Salah UddinNo ratings yet

- TaxPayer Registration CertificateDocument1 pageTaxPayer Registration CertificateAli AhmadNo ratings yet

- NBR Tin Certificate 677293401460Document1 pageNBR Tin Certificate 677293401460Rashedul Islam Pavel100% (2)

- Government of The People's Republic of Bangladesh National Board of RevenueDocument1 pageGovernment of The People's Republic of Bangladesh National Board of RevenueSmart Shop100% (1)

- Vat Registration CertificateDocument1 pageVat Registration Certificateudiptya_papai2007No ratings yet

- BIN Certification 13 PDFDocument1 pageBIN Certification 13 PDFFaruque UddinNo ratings yet

- Vat Reg. CertificateDocument1 pageVat Reg. CertificateMaaz AzadNo ratings yet

- VAT CertificateDocument1 pageVAT CertificateSamrat Khan100% (1)

- Certificate of IncorporationDocument1 pageCertificate of IncorporationVijayKumar LokanadamNo ratings yet

- NBR Tin Certificate 698694223494Document1 pageNBR Tin Certificate 698694223494Azad HossainNo ratings yet

- TIN Certificate M M UDDINDocument1 pageTIN Certificate M M UDDINMezbahNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaFortuna Power TECHNOLOGYNo ratings yet

- VAT CertificateDocument2 pagesVAT CertificatechandhiranNo ratings yet

- Certificate of IncorporationDocument1 pageCertificate of IncorporationsarathNo ratings yet

- Bank Statement 1Document1 pageBank Statement 1Marto NineNo ratings yet

- VAT Registration CertificateDocument1 pageVAT Registration CertificateDelta ServicesNo ratings yet

- Updated TIN PDFDocument1 pageUpdated TIN PDFRahat KhanNo ratings yet

- Government of Tamil Nadu Commercial Taxes DepartmentDocument2 pagesGovernment of Tamil Nadu Commercial Taxes DepartmentcachandhiranNo ratings yet

- Certificate of Incorporation: (Under Act XVIII of 1994)Document1 pageCertificate of Incorporation: (Under Act XVIII of 1994)images experientialNo ratings yet

- Registration Certificate CSTDocument2 pagesRegistration Certificate CSTcachandhiranNo ratings yet

- Obaidul Quader's Income Tax CertificateDocument9 pagesObaidul Quader's Income Tax CertificateNetra NewsNo ratings yet

- BIN CertificationDocument1 pageBIN CertificationAriyan Islam RajNo ratings yet

- GNM-EXPORT LICENCE - Edit - 1626157788133Document1 pageGNM-EXPORT LICENCE - Edit - 1626157788133benard ayomahNo ratings yet

- Government of The People's Republic of Bangladesh National Board of RevenueDocument1 pageGovernment of The People's Republic of Bangladesh National Board of RevenueTasbi Ul Hasan Shaan100% (1)

- Bin-Vat-Mint ApparelsDocument1 pageBin-Vat-Mint ApparelsMd Jahirul Haque Miraj100% (3)

- Tax Certificate 355586559209Document1 pageTax Certificate 355586559209rifatNo ratings yet

- Trade LicenseDocument2 pagesTrade LicenseK M Belal HosseinNo ratings yet

- Value Added Tax Registration Certificate: Government of The People's Republic of Bangladesh National Board of RevenueDocument1 pageValue Added Tax Registration Certificate: Government of The People's Republic of Bangladesh National Board of RevenueWasif HossainNo ratings yet

- Tin Certificate of CatsEyeDocument1 pageTin Certificate of CatsEyePAK PUKNo ratings yet

- Trade License EnglishDocument1 pageTrade License Englishairsyltravel2023No ratings yet

- N4627229 PDFDocument1 pageN4627229 PDFSaddam Idrisi50% (2)

- Certificate of IncorporationDocument1 pageCertificate of IncorporationFLEACART ONLINENo ratings yet

- Value Added Tax Registration Certificate: Government of The People's Republic of Bangladesh National Board of RevenueDocument1 pageValue Added Tax Registration Certificate: Government of The People's Republic of Bangladesh National Board of RevenueSari Yaah0% (1)

- Certificate of IncorporationDocument1 pageCertificate of IncorporationSamrat100% (1)

- Trade LicenseDocument1 pageTrade LicenseAtiqur Rahman Mohon100% (1)

- Tax Certificate BangladeshDocument1 pageTax Certificate BangladeshautheideologistNo ratings yet

- Government of The People's Republic of Bangladesh National Board of RevenueDocument2 pagesGovernment of The People's Republic of Bangladesh National Board of RevenueASIF AL MAHMOOD100% (1)

- Certificate of IncorporationDocument1 pageCertificate of Incorporationajay2726No ratings yet

- Formation DocumentsDocument2 pagesFormation DocumentsKosisochukwuNo ratings yet

- Dutch-Bangla Bank Limited: Itj 1A YDocument1 pageDutch-Bangla Bank Limited: Itj 1A Yimages experientialNo ratings yet

- UntitledDocument19 pagesUntitledJohn Spenn100% (1)

- Form 1: The West Bengal Value Added Tax Rules, 2005Document3 pagesForm 1: The West Bengal Value Added Tax Rules, 2005Amit SenNo ratings yet