Professional Documents

Culture Documents

Instructions

Instructions

Uploaded by

mail2kandolaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Amazon Company ProfileDocument4 pagesAmazon Company ProfileSruthi Ramakrishnan50% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Globalization - A Basic TextDocument3 pagesGlobalization - A Basic TextJohnny Yang100% (1)

- Equal Hash Code OverrideDocument3 pagesEqual Hash Code Overridemail2kandolaNo ratings yet

- Simple 4. Secure 5. Architectural Neutral 6. Portable 7. Robust 8. Multi-Threaded 9. Interpreted 10. High Performance 11. Distributed 12. DynamicDocument1 pageSimple 4. Secure 5. Architectural Neutral 6. Portable 7. Robust 8. Multi-Threaded 9. Interpreted 10. High Performance 11. Distributed 12. Dynamicmail2kandolaNo ratings yet

- Design Pattern in Simple Example1Document2 pagesDesign Pattern in Simple Example1mail2kandolaNo ratings yet

- Punch LinesDocument1 pagePunch Linesmail2kandolaNo ratings yet

- This Essay: Q.N o Questions 1 AnsDocument9 pagesThis Essay: Q.N o Questions 1 Ansmail2kandolaNo ratings yet

- Benefits of Design PatternsDocument21 pagesBenefits of Design Patternsmail2kandolaNo ratings yet

- Assignment Plastic ProductsDocument10 pagesAssignment Plastic Productsneel_nknNo ratings yet

- QUIZDocument14 pagesQUIZHanny chandraNo ratings yet

- Globalization RiskDocument3 pagesGlobalization RiskSohel Kabir100% (1)

- Answers: Kara Losik Tom Noble Mack Rawhouser Kristin Roork Courtney Skinner Doug VickreyDocument1 pageAnswers: Kara Losik Tom Noble Mack Rawhouser Kristin Roork Courtney Skinner Doug VickreyEditor at Sublette ExaminerNo ratings yet

- MODULE 5 - Econ 221 - Basic MicroeconomicsDocument3 pagesMODULE 5 - Econ 221 - Basic MicroeconomicsNelly GenosasNo ratings yet

- Service Letter: 1.0 Issue - Incorrectly Located Boom Lifting HolesDocument5 pagesService Letter: 1.0 Issue - Incorrectly Located Boom Lifting HolesedwinNo ratings yet

- Jim Martyn V The Port of Anacortes, Airport Sponsor, Charles Mallary, and Ray Niver - Director's DeterminationDocument60 pagesJim Martyn V The Port of Anacortes, Airport Sponsor, Charles Mallary, and Ray Niver - Director's DeterminationNate PistoleNo ratings yet

- Hapag LloydDocument9 pagesHapag LloydzubinpujaraNo ratings yet

- Chapter 8 Theories of Global StratificationDocument5 pagesChapter 8 Theories of Global StratificationmAmei DiwataNo ratings yet

- The Kerala State Cashew Development Corporation LTD, KOLLAM-01. Suo Moto Disclosure Under Sec.4 of Rti Act, 2005Document12 pagesThe Kerala State Cashew Development Corporation LTD, KOLLAM-01. Suo Moto Disclosure Under Sec.4 of Rti Act, 2005BensonNo ratings yet

- Factors Affecting Participation in A Civil Society Network (Nangonet) in Ngara DistrictDocument61 pagesFactors Affecting Participation in A Civil Society Network (Nangonet) in Ngara DistrictRepoa TanzaniaNo ratings yet

- Salary Slip (31837722 February, 2019) PDFDocument1 pageSalary Slip (31837722 February, 2019) PDFUsman AwanNo ratings yet

- Curvas de IndifDocument2 pagesCurvas de IndifJulioMartínezReynosoNo ratings yet

- Practice Test 9Document13 pagesPractice Test 9Yer ChangNo ratings yet

- 2024 Proposed Budget Lehigh CountyDocument494 pages2024 Proposed Budget Lehigh CountyLVNewsdotcomNo ratings yet

- Comparing Countries With Offshore ServicesDocument8 pagesComparing Countries With Offshore ServicesVassilis IliadisNo ratings yet

- HBA INTEREST CALCULATOR ShareDocument1 pageHBA INTEREST CALCULATOR ShareLazy BuoyNo ratings yet

- Tourism Organization Report - NDocument21 pagesTourism Organization Report - NAnnix Tamiao Adaya100% (1)

- Ihs Markit / Bme Germany Manufacturing Pmi®: News ReleaseDocument2 pagesIhs Markit / Bme Germany Manufacturing Pmi®: News ReleaseValter SilveiraNo ratings yet

- Sales Working Paper AUDITDocument3 pagesSales Working Paper AUDITAirille CarlosNo ratings yet

- TSLA Update Letter 2016-4QDocument10 pagesTSLA Update Letter 2016-4QFred LamertNo ratings yet

- Case ReportDocument2 pagesCase ReportJezz VilladiegoNo ratings yet

- 3 - Frank - Chapter03 - Rational Consumer ChoiceDocument40 pages3 - Frank - Chapter03 - Rational Consumer ChoiceNOPPHANUT NGAMVITROJENo ratings yet

- Project: Customer Relationship ManagementDocument65 pagesProject: Customer Relationship ManagementAbhishek GuptaNo ratings yet

- Script - 1Document2 pagesScript - 1SAMNo ratings yet

- The BCG MatrixDocument7 pagesThe BCG Matrixkiran808No ratings yet

- Imprest & Sub ImprestDocument16 pagesImprest & Sub Imprestmiyuru_jNo ratings yet

- Prospects of Islamic Finance in KeralaDocument5 pagesProspects of Islamic Finance in KeralaMuhammed K PalathNo ratings yet

Instructions

Instructions

Uploaded by

mail2kandolaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instructions

Instructions

Uploaded by

mail2kandolaCopyright:

Available Formats

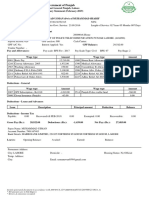

Income Tax 1. Fill the details of Employer (K7:O15) 2. Fill the details of Tax dept. (K17:O19) 3.

Fill the Personal details (K22:O39) 4. Read (Column A2:G69) Fill appropriate INCOME & SAVINGS in (H2:H69)

5. Fill the details of Tax deducted at source. (B72:M83) 6. Fill the details of Tax deducted as interest. (B85:M85) 7. Fill the details of interest payable (H87:H89) 8. Fill the details of Tax Computed for previous years (H91:H154) (if salary received as arrears 'ie (H26:H29) OR (H36:H37) having considerable amount) 9. Observe the TAX at (I2:J2) 10.You can change the name of department (A2:G2) 11.Change the date (H2) if necessary, Change the month begining year (C10) 12.Observe the comments given in certain cells (Move mouse pointer on top of tha t cell) 13.Some Direct entries are required on ITR sheets-( if necessary ) eg. mode of refund required, details of original return if submitting revised ITR, details of special income other than salary, details of Tax Return Preparer, Bank MICR code etc.. 14.Observe the color formatting of cells - means some attention is required Click Click Click Save me - for Store Tax details (Empolyee) Tax - for tax statement (Empolyee to Employer)

Form16 - for Form16 (Empolyer to Employee) - For 10E, Anexure 1& Table A (spliting up arrears to previour (get benefit on tax u/s 89(1))

Click 10E years) Click Click & Close. Best of Luck !

Sahaj - for income tax return (Employee to Income tax Department) Home - come back to Home page

ET Muralimohan

9447186143

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Amazon Company ProfileDocument4 pagesAmazon Company ProfileSruthi Ramakrishnan50% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Globalization - A Basic TextDocument3 pagesGlobalization - A Basic TextJohnny Yang100% (1)

- Equal Hash Code OverrideDocument3 pagesEqual Hash Code Overridemail2kandolaNo ratings yet

- Simple 4. Secure 5. Architectural Neutral 6. Portable 7. Robust 8. Multi-Threaded 9. Interpreted 10. High Performance 11. Distributed 12. DynamicDocument1 pageSimple 4. Secure 5. Architectural Neutral 6. Portable 7. Robust 8. Multi-Threaded 9. Interpreted 10. High Performance 11. Distributed 12. Dynamicmail2kandolaNo ratings yet

- Design Pattern in Simple Example1Document2 pagesDesign Pattern in Simple Example1mail2kandolaNo ratings yet

- Punch LinesDocument1 pagePunch Linesmail2kandolaNo ratings yet

- This Essay: Q.N o Questions 1 AnsDocument9 pagesThis Essay: Q.N o Questions 1 Ansmail2kandolaNo ratings yet

- Benefits of Design PatternsDocument21 pagesBenefits of Design Patternsmail2kandolaNo ratings yet

- Assignment Plastic ProductsDocument10 pagesAssignment Plastic Productsneel_nknNo ratings yet

- QUIZDocument14 pagesQUIZHanny chandraNo ratings yet

- Globalization RiskDocument3 pagesGlobalization RiskSohel Kabir100% (1)

- Answers: Kara Losik Tom Noble Mack Rawhouser Kristin Roork Courtney Skinner Doug VickreyDocument1 pageAnswers: Kara Losik Tom Noble Mack Rawhouser Kristin Roork Courtney Skinner Doug VickreyEditor at Sublette ExaminerNo ratings yet

- MODULE 5 - Econ 221 - Basic MicroeconomicsDocument3 pagesMODULE 5 - Econ 221 - Basic MicroeconomicsNelly GenosasNo ratings yet

- Service Letter: 1.0 Issue - Incorrectly Located Boom Lifting HolesDocument5 pagesService Letter: 1.0 Issue - Incorrectly Located Boom Lifting HolesedwinNo ratings yet

- Jim Martyn V The Port of Anacortes, Airport Sponsor, Charles Mallary, and Ray Niver - Director's DeterminationDocument60 pagesJim Martyn V The Port of Anacortes, Airport Sponsor, Charles Mallary, and Ray Niver - Director's DeterminationNate PistoleNo ratings yet

- Hapag LloydDocument9 pagesHapag LloydzubinpujaraNo ratings yet

- Chapter 8 Theories of Global StratificationDocument5 pagesChapter 8 Theories of Global StratificationmAmei DiwataNo ratings yet

- The Kerala State Cashew Development Corporation LTD, KOLLAM-01. Suo Moto Disclosure Under Sec.4 of Rti Act, 2005Document12 pagesThe Kerala State Cashew Development Corporation LTD, KOLLAM-01. Suo Moto Disclosure Under Sec.4 of Rti Act, 2005BensonNo ratings yet

- Factors Affecting Participation in A Civil Society Network (Nangonet) in Ngara DistrictDocument61 pagesFactors Affecting Participation in A Civil Society Network (Nangonet) in Ngara DistrictRepoa TanzaniaNo ratings yet

- Salary Slip (31837722 February, 2019) PDFDocument1 pageSalary Slip (31837722 February, 2019) PDFUsman AwanNo ratings yet

- Curvas de IndifDocument2 pagesCurvas de IndifJulioMartínezReynosoNo ratings yet

- Practice Test 9Document13 pagesPractice Test 9Yer ChangNo ratings yet

- 2024 Proposed Budget Lehigh CountyDocument494 pages2024 Proposed Budget Lehigh CountyLVNewsdotcomNo ratings yet

- Comparing Countries With Offshore ServicesDocument8 pagesComparing Countries With Offshore ServicesVassilis IliadisNo ratings yet

- HBA INTEREST CALCULATOR ShareDocument1 pageHBA INTEREST CALCULATOR ShareLazy BuoyNo ratings yet

- Tourism Organization Report - NDocument21 pagesTourism Organization Report - NAnnix Tamiao Adaya100% (1)

- Ihs Markit / Bme Germany Manufacturing Pmi®: News ReleaseDocument2 pagesIhs Markit / Bme Germany Manufacturing Pmi®: News ReleaseValter SilveiraNo ratings yet

- Sales Working Paper AUDITDocument3 pagesSales Working Paper AUDITAirille CarlosNo ratings yet

- TSLA Update Letter 2016-4QDocument10 pagesTSLA Update Letter 2016-4QFred LamertNo ratings yet

- Case ReportDocument2 pagesCase ReportJezz VilladiegoNo ratings yet

- 3 - Frank - Chapter03 - Rational Consumer ChoiceDocument40 pages3 - Frank - Chapter03 - Rational Consumer ChoiceNOPPHANUT NGAMVITROJENo ratings yet

- Project: Customer Relationship ManagementDocument65 pagesProject: Customer Relationship ManagementAbhishek GuptaNo ratings yet

- Script - 1Document2 pagesScript - 1SAMNo ratings yet

- The BCG MatrixDocument7 pagesThe BCG Matrixkiran808No ratings yet

- Imprest & Sub ImprestDocument16 pagesImprest & Sub Imprestmiyuru_jNo ratings yet

- Prospects of Islamic Finance in KeralaDocument5 pagesProspects of Islamic Finance in KeralaMuhammed K PalathNo ratings yet