Professional Documents

Culture Documents

Tax Flyer Levin

Tax Flyer Levin

Uploaded by

Stephen LevinCopyright:

Available Formats

You might also like

- Blank Fillable Social Security Card TemplateDocument3 pagesBlank Fillable Social Security Card TemplateJune MandiNo ratings yet

- Rose Hudson Workbook Case StudyDocument6 pagesRose Hudson Workbook Case StudyMary O'KeeffeNo ratings yet

- LITAC Press RelWill County Low Income Tax Assistance Coalition and The Center For Economic Progress Press ReleaseDocument2 pagesLITAC Press RelWill County Low Income Tax Assistance Coalition and The Center For Economic Progress Press ReleaseJoliet_HeraldNo ratings yet

- LITAC Press Release 2015Document2 pagesLITAC Press Release 2015Joliet_HeraldNo ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- Free Tax Return Preparation: This Service Is Available For Those Who Earn Up To $54,000 Per YearDocument1 pageFree Tax Return Preparation: This Service Is Available For Those Who Earn Up To $54,000 Per YearJoliet_HeraldNo ratings yet

- Tax Preparation 2015 FlyerDocument1 pageTax Preparation 2015 FlyerJoliet_HeraldNo ratings yet

- ISS Taxes SlidesDocument40 pagesISS Taxes SlidesSergey ParsegovNo ratings yet

- Tax Clinic Flyer-EnglishDocument1 pageTax Clinic Flyer-EnglishOffice on Latino Affairs (OLA)No ratings yet

- Child Care Application: Keep For Your Records InstructionsDocument14 pagesChild Care Application: Keep For Your Records InstructionsLaToya CrossNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Form P50 Income Tax PDFDocument2 pagesForm P50 Income Tax PDFemesjotNo ratings yet

- VITA PosterDocument1 pageVITA Posternerak729No ratings yet

- US Internal Revenue Service: F1040esn - 2005Document6 pagesUS Internal Revenue Service: F1040esn - 2005IRSNo ratings yet

- Us W-2 2015 PDFDocument7 pagesUs W-2 2015 PDFkevsNo ratings yet

- Request For Change of Program or Place of Training: Part I - Identification and Personal Information Va Date StampDocument4 pagesRequest For Change of Program or Place of Training: Part I - Identification and Personal Information Va Date StampVictorRosaNo ratings yet

- Income-Driven Repayment Plan Request How To Complete YourDocument13 pagesIncome-Driven Repayment Plan Request How To Complete YourAnonymous 6jR6DuNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- Tax Clinic Flyer-EnglishDocument1 pageTax Clinic Flyer-EnglishOffice on Latino Affairs (OLA)No ratings yet

- 2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovDocument76 pages2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovJason GrohNo ratings yet

- 2011-12 Fafsa Tap Quick GuideDocument2 pages2011-12 Fafsa Tap Quick GuideModou LoNo ratings yet

- Instructions For Forms 1098-E and 1098-T: Future DevelopmentsDocument4 pagesInstructions For Forms 1098-E and 1098-T: Future DevelopmentsArnu Felix CamposNo ratings yet

- Income Driven Repayment FormDocument13 pagesIncome Driven Repayment Formtumi50No ratings yet

- Tax Instructions 2013Document3 pagesTax Instructions 2013Đức Bình NguyễnNo ratings yet

- Manakavoda 2015Document8 pagesManakavoda 2015jc100% (1)

- 2011-2012 Special Circumstance FormDocument4 pages2011-2012 Special Circumstance FormJosh MorfordNo ratings yet

- Individual Taxpayer Identification Number (ITIN)Document47 pagesIndividual Taxpayer Identification Number (ITIN)Victor GonzalezNo ratings yet

- Claim ConfirmationDocument7 pagesClaim Confirmationdebra hillNo ratings yet

- WWW Financialaid Ou EduDocument3 pagesWWW Financialaid Ou EduJoel VandiverNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- 2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFDocument2 pages2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFLISA VOLPENo ratings yet

- Taxes and Payroll in The US: A General Understanding of How Things WorkDocument17 pagesTaxes and Payroll in The US: A General Understanding of How Things WorkbhavnamangalNo ratings yet

- US Internal Revenue Service: p967 - 1997Document5 pagesUS Internal Revenue Service: p967 - 1997IRSNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- Frequently Asked Tax Questions 2015sdaDocument8 pagesFrequently Asked Tax Questions 2015sdaVikram VickyNo ratings yet

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- Liberty Tax HomeworkDocument9 pagesLiberty Tax Homeworkbttvuxilf100% (1)

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846No ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Financial ReviewDocument5 pagesFinancial Reviewmohamedkeynan99No ratings yet

- 2010-2011 Verification Worksheet: Federal Student Aid ProgramsDocument2 pages2010-2011 Verification Worksheet: Federal Student Aid ProgramsGabriel CarranzaNo ratings yet

- td1bc 24eDocument2 pagestd1bc 24eprueba.etoroNo ratings yet

- Facts About EITCDocument2 pagesFacts About EITCSC AppleseedNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- SET (O) Application For Indefinite Leave To Remain in The UK in One of The Categories Listed in This Form and A Biometric Immigration DocumentDocument84 pagesSET (O) Application For Indefinite Leave To Remain in The UK in One of The Categories Listed in This Form and A Biometric Immigration DocumentArsalanNo ratings yet

- Project1 v3 Moge WangDocument2 pagesProject1 v3 Moge Wangapi-282751976No ratings yet

- Itin Aa-Caa Online Pre-ApplicationtrainingDocument88 pagesItin Aa-Caa Online Pre-ApplicationtrainingshahsaagarNo ratings yet

- NI119A - 2021 - Tax DocumentsDocument14 pagesNI119A - 2021 - Tax Documentsvitoriamodena556No ratings yet

- G+ Project - ITIN Application Information SheetDocument1 pageG+ Project - ITIN Application Information SheetFrancisco Adrián Gutiérrez CórdovaNo ratings yet

- 2011 Quebec Tax FormsDocument4 pages2011 Quebec Tax FormsManideep GuptaNo ratings yet

- Beta 1040 EzDocument2 pagesBeta 1040 EzLeonard RosentholNo ratings yet

- Read This First: Estimated Taxes PaidDocument7 pagesRead This First: Estimated Taxes PaidDan HuntingtonNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- Tax HelpDocument1 pageTax HelpJen HanNo ratings yet

- Description: Tags: 0506VerWkshtIndDocument2 pagesDescription: Tags: 0506VerWkshtIndanon-53006No ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- Forward Budgeting: A Paperless and Electronic Household Budget SystemFrom EverandForward Budgeting: A Paperless and Electronic Household Budget SystemNo ratings yet

- 94 Community Newsletter January 2014Document4 pages94 Community Newsletter January 2014Stephen LevinNo ratings yet

- Stephen Levin Calls For Visibility and Safety Improvements On Manhattan Avenue in GreenpointDocument1 pageStephen Levin Calls For Visibility and Safety Improvements On Manhattan Avenue in GreenpointStephen LevinNo ratings yet

- NYC Councilmember Stephen Levin To Introduce Youth Football Safety ActDocument3 pagesNYC Councilmember Stephen Levin To Introduce Youth Football Safety ActStephen LevinNo ratings yet

- Stephen Levin Calls For Traffic Calming Measures On McGuinness BoulevardDocument2 pagesStephen Levin Calls For Traffic Calming Measures On McGuinness BoulevardStephen LevinNo ratings yet

- Report On Co-Packing For Brooklyn Food ManufacturersDocument32 pagesReport On Co-Packing For Brooklyn Food ManufacturersStephen Levin100% (1)

- Elected Officials Request A More Transparent, Impartial, and Inclusive RFP Process at LICHDocument2 pagesElected Officials Request A More Transparent, Impartial, and Inclusive RFP Process at LICHStephen LevinNo ratings yet

- Post StarkDocument1 pagePost StarkStephen LevinNo ratings yet

- VMAs 2013 Community InformationDocument3 pagesVMAs 2013 Community InformationStephen LevinNo ratings yet

- PBNYC Williamsburg FlierDocument1 pagePBNYC Williamsburg FlierStephen LevinNo ratings yet

- Mental Health in Schools Whitepaper FINALDocument3 pagesMental Health in Schools Whitepaper FINALStephen LevinNo ratings yet

- Barclays Center Neighborhood Protection Plan: Mitigation of The Operation of The Arena On Adjacent NeighborhoodsDocument7 pagesBarclays Center Neighborhood Protection Plan: Mitigation of The Operation of The Arena On Adjacent NeighborhoodsStephen LevinNo ratings yet

- IndustrialGrowth 05312012 BKDocument1 pageIndustrialGrowth 05312012 BKStephen LevinNo ratings yet

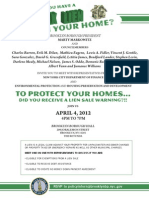

- TaxLien - 2012 Flyer - FINALDocument1 pageTaxLien - 2012 Flyer - FINALStephen LevinNo ratings yet

- Levin 2011 AttendanceDocument3 pagesLevin 2011 AttendanceStephen LevinNo ratings yet

- Arts in Economic Development FlyerDocument1 pageArts in Economic Development FlyerStephen LevinNo ratings yet

- Workshop CB6 (BK)Document1 pageWorkshop CB6 (BK)Stephen LevinNo ratings yet

- Gpebp FlyerDocument1 pageGpebp FlyerStephen LevinNo ratings yet

- Workshop CB2 (BK)Document1 pageWorkshop CB2 (BK)Stephen LevinNo ratings yet

- Property Tax FlyerDocument1 pageProperty Tax FlyerStephen LevinNo ratings yet

- Will'Burg Small BusinessesDocument1 pageWill'Burg Small BusinessesStephen LevinNo ratings yet

- Anti-Semitic JewelryDocument1 pageAnti-Semitic JewelryStephen LevinNo ratings yet

Tax Flyer Levin

Tax Flyer Levin

Uploaded by

Stephen LevinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Flyer Levin

Tax Flyer Levin

Uploaded by

Stephen LevinCopyright:

Available Formats

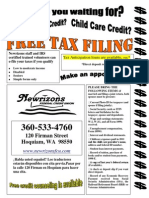

Cabrera Tax Flyer_Tax Prep flyer Levin 3/12/12 3:45 PM Page 1

Council Member Stephen Levin, Food Bank For New York City, and The City University of New York

invite you to

FREE Tax Preparation

Saturday, March 24, 2012

Capital One Bank 356 Fulton Street (2nd floor) Brooklyn, NY 11201

* Qualified people will get their taxes completed for FREE. To qualify you must have the following: If filing jointly with a spouse, both of you must be present with photo IDs. Social Security cards or ITIN (or copies) for you and your spouse if filing jointly and anyone you are claiming on your tax return, or a letter from the Social Security Administration. W-2s for all jobs you held in 2011. Form 1099-G if you received unemployment insurance in 2011. Form 1099-INT if you received interest from a bank account in 2011. Form 1098-T if you paid tuition. Form 1098-E if you paid student loan interest. If you are claiming child care expenses, amount you paid and child care agencys ID or name and Social Security number of the babysitter. Income limits $50,000 with dependents $18,000 without dependents

Sat. 9 am-5 pm

DIRECTIONS: 2/3/4/5 trains to Borough Hall Station.

Food Bank For New York City 212-894-8060 Council Member Stephen Levins office 212-788-7348

foodbanknyc.org/taxhelp

We do not prepare the following returns: Itemized returns; Schedule C (Profit or Loss from Business - except limited Schedule C for child care providers and taxi drivers); Complicated & Advanced Schedule D (Capital Gains and Losses); Schedule E (Rents & Losses); Form SS-5 (request for Social Security Number); Form 2106 (Employee Business Expenses); Form 3903 (Moving Expenses); Form 8606 (Nondeductible IRAs); Form 8615 (Minors investment income).

You might also like

- Blank Fillable Social Security Card TemplateDocument3 pagesBlank Fillable Social Security Card TemplateJune MandiNo ratings yet

- Rose Hudson Workbook Case StudyDocument6 pagesRose Hudson Workbook Case StudyMary O'KeeffeNo ratings yet

- LITAC Press RelWill County Low Income Tax Assistance Coalition and The Center For Economic Progress Press ReleaseDocument2 pagesLITAC Press RelWill County Low Income Tax Assistance Coalition and The Center For Economic Progress Press ReleaseJoliet_HeraldNo ratings yet

- LITAC Press Release 2015Document2 pagesLITAC Press Release 2015Joliet_HeraldNo ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- Free Tax Return Preparation: This Service Is Available For Those Who Earn Up To $54,000 Per YearDocument1 pageFree Tax Return Preparation: This Service Is Available For Those Who Earn Up To $54,000 Per YearJoliet_HeraldNo ratings yet

- Tax Preparation 2015 FlyerDocument1 pageTax Preparation 2015 FlyerJoliet_HeraldNo ratings yet

- ISS Taxes SlidesDocument40 pagesISS Taxes SlidesSergey ParsegovNo ratings yet

- Tax Clinic Flyer-EnglishDocument1 pageTax Clinic Flyer-EnglishOffice on Latino Affairs (OLA)No ratings yet

- Child Care Application: Keep For Your Records InstructionsDocument14 pagesChild Care Application: Keep For Your Records InstructionsLaToya CrossNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Form P50 Income Tax PDFDocument2 pagesForm P50 Income Tax PDFemesjotNo ratings yet

- VITA PosterDocument1 pageVITA Posternerak729No ratings yet

- US Internal Revenue Service: F1040esn - 2005Document6 pagesUS Internal Revenue Service: F1040esn - 2005IRSNo ratings yet

- Us W-2 2015 PDFDocument7 pagesUs W-2 2015 PDFkevsNo ratings yet

- Request For Change of Program or Place of Training: Part I - Identification and Personal Information Va Date StampDocument4 pagesRequest For Change of Program or Place of Training: Part I - Identification and Personal Information Va Date StampVictorRosaNo ratings yet

- Income-Driven Repayment Plan Request How To Complete YourDocument13 pagesIncome-Driven Repayment Plan Request How To Complete YourAnonymous 6jR6DuNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- Tax Clinic Flyer-EnglishDocument1 pageTax Clinic Flyer-EnglishOffice on Latino Affairs (OLA)No ratings yet

- 2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovDocument76 pages2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovJason GrohNo ratings yet

- 2011-12 Fafsa Tap Quick GuideDocument2 pages2011-12 Fafsa Tap Quick GuideModou LoNo ratings yet

- Instructions For Forms 1098-E and 1098-T: Future DevelopmentsDocument4 pagesInstructions For Forms 1098-E and 1098-T: Future DevelopmentsArnu Felix CamposNo ratings yet

- Income Driven Repayment FormDocument13 pagesIncome Driven Repayment Formtumi50No ratings yet

- Tax Instructions 2013Document3 pagesTax Instructions 2013Đức Bình NguyễnNo ratings yet

- Manakavoda 2015Document8 pagesManakavoda 2015jc100% (1)

- 2011-2012 Special Circumstance FormDocument4 pages2011-2012 Special Circumstance FormJosh MorfordNo ratings yet

- Individual Taxpayer Identification Number (ITIN)Document47 pagesIndividual Taxpayer Identification Number (ITIN)Victor GonzalezNo ratings yet

- Claim ConfirmationDocument7 pagesClaim Confirmationdebra hillNo ratings yet

- WWW Financialaid Ou EduDocument3 pagesWWW Financialaid Ou EduJoel VandiverNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- 2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFDocument2 pages2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFLISA VOLPENo ratings yet

- Taxes and Payroll in The US: A General Understanding of How Things WorkDocument17 pagesTaxes and Payroll in The US: A General Understanding of How Things WorkbhavnamangalNo ratings yet

- US Internal Revenue Service: p967 - 1997Document5 pagesUS Internal Revenue Service: p967 - 1997IRSNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- Frequently Asked Tax Questions 2015sdaDocument8 pagesFrequently Asked Tax Questions 2015sdaVikram VickyNo ratings yet

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- Liberty Tax HomeworkDocument9 pagesLiberty Tax Homeworkbttvuxilf100% (1)

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846No ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Financial ReviewDocument5 pagesFinancial Reviewmohamedkeynan99No ratings yet

- 2010-2011 Verification Worksheet: Federal Student Aid ProgramsDocument2 pages2010-2011 Verification Worksheet: Federal Student Aid ProgramsGabriel CarranzaNo ratings yet

- td1bc 24eDocument2 pagestd1bc 24eprueba.etoroNo ratings yet

- Facts About EITCDocument2 pagesFacts About EITCSC AppleseedNo ratings yet

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- SET (O) Application For Indefinite Leave To Remain in The UK in One of The Categories Listed in This Form and A Biometric Immigration DocumentDocument84 pagesSET (O) Application For Indefinite Leave To Remain in The UK in One of The Categories Listed in This Form and A Biometric Immigration DocumentArsalanNo ratings yet

- Project1 v3 Moge WangDocument2 pagesProject1 v3 Moge Wangapi-282751976No ratings yet

- Itin Aa-Caa Online Pre-ApplicationtrainingDocument88 pagesItin Aa-Caa Online Pre-ApplicationtrainingshahsaagarNo ratings yet

- NI119A - 2021 - Tax DocumentsDocument14 pagesNI119A - 2021 - Tax Documentsvitoriamodena556No ratings yet

- G+ Project - ITIN Application Information SheetDocument1 pageG+ Project - ITIN Application Information SheetFrancisco Adrián Gutiérrez CórdovaNo ratings yet

- 2011 Quebec Tax FormsDocument4 pages2011 Quebec Tax FormsManideep GuptaNo ratings yet

- Beta 1040 EzDocument2 pagesBeta 1040 EzLeonard RosentholNo ratings yet

- Read This First: Estimated Taxes PaidDocument7 pagesRead This First: Estimated Taxes PaidDan HuntingtonNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- Tax HelpDocument1 pageTax HelpJen HanNo ratings yet

- Description: Tags: 0506VerWkshtIndDocument2 pagesDescription: Tags: 0506VerWkshtIndanon-53006No ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- Forward Budgeting: A Paperless and Electronic Household Budget SystemFrom EverandForward Budgeting: A Paperless and Electronic Household Budget SystemNo ratings yet

- 94 Community Newsletter January 2014Document4 pages94 Community Newsletter January 2014Stephen LevinNo ratings yet

- Stephen Levin Calls For Visibility and Safety Improvements On Manhattan Avenue in GreenpointDocument1 pageStephen Levin Calls For Visibility and Safety Improvements On Manhattan Avenue in GreenpointStephen LevinNo ratings yet

- NYC Councilmember Stephen Levin To Introduce Youth Football Safety ActDocument3 pagesNYC Councilmember Stephen Levin To Introduce Youth Football Safety ActStephen LevinNo ratings yet

- Stephen Levin Calls For Traffic Calming Measures On McGuinness BoulevardDocument2 pagesStephen Levin Calls For Traffic Calming Measures On McGuinness BoulevardStephen LevinNo ratings yet

- Report On Co-Packing For Brooklyn Food ManufacturersDocument32 pagesReport On Co-Packing For Brooklyn Food ManufacturersStephen Levin100% (1)

- Elected Officials Request A More Transparent, Impartial, and Inclusive RFP Process at LICHDocument2 pagesElected Officials Request A More Transparent, Impartial, and Inclusive RFP Process at LICHStephen LevinNo ratings yet

- Post StarkDocument1 pagePost StarkStephen LevinNo ratings yet

- VMAs 2013 Community InformationDocument3 pagesVMAs 2013 Community InformationStephen LevinNo ratings yet

- PBNYC Williamsburg FlierDocument1 pagePBNYC Williamsburg FlierStephen LevinNo ratings yet

- Mental Health in Schools Whitepaper FINALDocument3 pagesMental Health in Schools Whitepaper FINALStephen LevinNo ratings yet

- Barclays Center Neighborhood Protection Plan: Mitigation of The Operation of The Arena On Adjacent NeighborhoodsDocument7 pagesBarclays Center Neighborhood Protection Plan: Mitigation of The Operation of The Arena On Adjacent NeighborhoodsStephen LevinNo ratings yet

- IndustrialGrowth 05312012 BKDocument1 pageIndustrialGrowth 05312012 BKStephen LevinNo ratings yet

- TaxLien - 2012 Flyer - FINALDocument1 pageTaxLien - 2012 Flyer - FINALStephen LevinNo ratings yet

- Levin 2011 AttendanceDocument3 pagesLevin 2011 AttendanceStephen LevinNo ratings yet

- Arts in Economic Development FlyerDocument1 pageArts in Economic Development FlyerStephen LevinNo ratings yet

- Workshop CB6 (BK)Document1 pageWorkshop CB6 (BK)Stephen LevinNo ratings yet

- Gpebp FlyerDocument1 pageGpebp FlyerStephen LevinNo ratings yet

- Workshop CB2 (BK)Document1 pageWorkshop CB2 (BK)Stephen LevinNo ratings yet

- Property Tax FlyerDocument1 pageProperty Tax FlyerStephen LevinNo ratings yet

- Will'Burg Small BusinessesDocument1 pageWill'Burg Small BusinessesStephen LevinNo ratings yet

- Anti-Semitic JewelryDocument1 pageAnti-Semitic JewelryStephen LevinNo ratings yet