Professional Documents

Culture Documents

Costar Pricing Indices Point To Consistent Commercial Real Estate Pricing Growth and Improving Investor Sentiment

Costar Pricing Indices Point To Consistent Commercial Real Estate Pricing Growth and Improving Investor Sentiment

Uploaded by

Gary LoweOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Costar Pricing Indices Point To Consistent Commercial Real Estate Pricing Growth and Improving Investor Sentiment

Costar Pricing Indices Point To Consistent Commercial Real Estate Pricing Growth and Improving Investor Sentiment

Uploaded by

Gary LoweCopyright:

Available Formats

MARCH 2012 CCRSI RELEASE (With data through January 2012)

COSTAR PRICING INDICES POINT TO CONSISTENT COMMERCIAL REAL ESTATE PRICING GROWTH AND IMPROVING INVESTOR SENTIMENT

U.S. COMPOSITE PROPERTY PRICES ADVANCE IN JANUARY ON IMPROVING FUNDAMENTALS, RISING LIQUIDITY AND DECLINING NUMBER OF DISTRESSED SALES

This month's CoStar Commercial Repeat Sale Indices (CCRSI) provides the market's first look at January 2012 commercial real estate pricing. Based on 631 repeat sales in January and more than 100,000 repeat sales since 1996, the CCRSI offers the broadest measure of commercial real estate repeat sales activity. Also, in this release CoStar introduces three new metrics on market liquidity: average sale price-to-asking price ratio, average days on market and the sales withdrawal rate.

January 2012 National Results Highlights

The monthly CCRSI National Composite Index increased by 1.5% in January 2012. The index is now 1.9% above the same period last year, reflecting the ongoing recovery in commercial real estate fundamentals. The National Composite Index has posted gains in eight of the last nine months (since April 2011) with an average monthly increase of 0.8%. This suggests that investor sentiment is improving and pricing growth is gaining consistency. While economic growth is becoming more entrenched, pricing for commercial real estate remains low relative to recent history. The National Composite Index ended January 2012 down 31.9% from its previous peak in August 2007.

COSTAR COMMERCIAL REPEAT-SALE INDICES

MARCH 2012 Release (With Data through January 2012)

The CCRSI National Investment Grade Index increased 3.7% over year-ago levels, bolstered by strong investor interest in coastal markets and core multifamily assets. Liquidity in the commercial real estate markets is improving resulting in more property sales. The number of observed trades over the last 12 months increased by 23% over the prior 12-month period. Importantly for the pricing indices, the number of non-distressed sales observations increased at three times the rate of distressed sales observations over that period. The distress sale percentage of total observed transaction volume fell from 30.1% in January 2011 to 21.1% in January 2012. Rising occupancies have helped stabilize net operating income ( NOI) for property owners across a number of markets, leading to a reduction in the number of forced sales. This trend has been a positive force for commercial real estate pricing. Consistent with the positive pricing trends, the gap between asking and actual sale prices closed by more than 1% over the past year. However, b uyers and sellers still remain far apart based on historical levels. In January 2012, average sale price-to-asking price ratio was still 7.4% lower than the peak of the market in 2007. The average number of days on market (DOM) has grown from a pproximately 250 days in 2007 and remained at a record high of approximately 420 days over the three-month period of November 2011 January 2012, suggesting a high level of inefficiency and friction in the process of matching potential buyers and sellers. This extended sales period intensifies uncertainty and puts downward pressure on asset prices. It also provides insight on why overall price recovery has lagged the recovery in transaction volume. The number of properties withdrawn from the sales market by discouraged sellers is leveling off. In January 2012, the number of properties withdrawn from the market declined 12.7% since the same period last year, another indication of improving investment sentiment.

Monthly CCRSI Results as of 1/31/2012 1 Month Earlier National Composite Index National Investment Grade Index National General Commercial Index

1

1 Quarter Earlier 1.9% 0.4% 1.8%

3

1 Year Earlier 1.9% 3.7% 1.6%

Trough to Current 7.5% 1 18.0% 2 5.6% 3

1.5% -1.7% 2.0%

2

Trough Date: April 2 0 1 1

Tro ugh Date: October 2 0 0 9

Trough Date: April 2011

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

225

U.S. Composite

U.S. Investment Grade

U.S. General Commercial

200

Index Value (2000 4q = 100)

175

150

125

100

75

50 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Monthly Liquidity Indicators as of 1/31/2012 Current Days on Market Sale Price-to-Asking Price Ratio Withdrawal Rate 420 84.7% 41.2%

1 Month Earlier 426 84.3% 42.8%

1 Quarter Earlier 425 83.8% 54.2%

1 Year Earlier 401 83.5% 53.9%

Average days on market and sale price-to-asking price ratio are both calculated based on listings that are closed and confirmed by CoStar research team. Withdrawal rate is the ratio of listings that are withdrawn from the market by the seller relative to all listings for a given month.

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

Days on Market 450

Sale Price-to-Asking Price Ratio (%) 96% 94%

400

92% 90% 88%

350

300

86% 84% 82%

250

200 Aug-07 Oct-07 Oct-08 Oct-09 Oct-10 May-07 Apr-08 Apr-09 Apr-10 Apr-11 Oct-11 Jul-08 Jul-09 Jul-10 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jul-11 Jan-12

80%

Days On Market

Sale Price-to-Asking Price Ratio

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

General Commercial Pair Count 1,400

Investment Grade Pair Count

1,200

1,000 Number of Sale Pairs

800

600

400

200

0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

General Commercial Pair Volume $10 $9 $8 $7 $6 $5 $4 $3 $2 $1 $0 2000 2001 2002 2003 2004 2005

Investment Grade Pair Volume

Billions of Dollars

2006

2007

2008

2009

2010

2011

2012

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

U.S. Investment Grade 40% 35% 30% 25% 20% 15% 10% 5% 0% Jul-08 Jul-09

U.S. General Commercial

Distressed Sale Pairs as a Percentage of Total

Jul-10

Apr-08

Apr-09

Apr-10

Apr-11

Oct-08

Oct-09

Oct-10

Jul-11

Oct-11

Jan-08

Jan-09

Jan-10

Jan-11

About the CoStar Commercial Repeat-Sale Indices

The CoStar Commercial Repeat-Sale Indices (CCRSI) are the most comprehensive and accurate measures of commercial real estate prices in the United States. In addition to the national Composite Index, national Investment Grade Index and national General Commercial Index, which we report monthly, we report quarterly on 30 sub-indices in the CoStar index family. The subindices include breakdowns by property sector (office, industrial, retail, multifamily, hospitality and land), by region of the country (Northeast, South, Midwest, West), by transaction size and quality (general commercial, investment grade), and by market size (composite index of the 10 largest metropolitan areas in the country). The CoStar indices are constructed using a repeat sales methodology, widely considered the most accurate measure of price changes for real estate. This methodology measures the movement in the prices of commercial properties by collecting data on actual transaction prices. When a property is sold more than one time, a sales pair is created. The prices from the first and second sales are then used to calculate price movement for the property. The aggregated price changes from all of the sales pairs are used to create a price index.

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

Jan-12

National Composite CRE Price Index All Properties

National Indices by Property Type Office

Regional Indices

Regional Indices by Property Type Northeast: Office, Multifamily, Industrial, Retail Midwest: Office, Multifamily, Industrial, Retail South: Office, Multifamily, Industrial, Retail West: Office, Multifamily, Industrial, Retail

Top Ten Metro Market Indices by Property Type Office

Northeast

General Commercial

Retail

Midwest

Multifamily

Investment Grade

Industrial

South

Industrial

Multifamily

West

Retail

Hospitality

Land

Largest Office Metro Areas # 1 2 3 4 5 6 7 8 9 10 CBSA New York Los Angeles Washington Chicago Dallas-Fort Worth Boston San Francisco Atlanta Philadelphia Houston

Largest Industrial Metro Areas # 1 2 3 4 5 6 7 8 9 10 CBSA Los Angeles New York Chicago Dallas-Fort Worth Atlanta Detroit Riverside Houston Philadelphia Miami-Fort Lauderdale

Largest Retail Metro Areas # CBSA

Largest Multifamily Metro Areas # CBSA

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

1 2 3 4 5 6 7 8 9 10

New York Los Angeles Chicago Dallas-Fort Worth Miami-Fort Lauderdale Atlanta Houston Philadelphia Washington San Francisco

1 2 3 4 5 6 7 8 9 10

New York Los Angeles Chicago Dallas-Fort Worth Washington Houston Boston Atlanta Seattle Philadelphia

CONTACT:

For more information about CCRSI Indices, including our legal notices and disclaimer, please visit http://www.costar.com/ccrsi.

ABOUT COSTAR GROUP, INC.

CoStar Group (Nasdaq:CSGP) is commercial real estate's leading provider of information and analytic services. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest a most comprehensive database of commercial real estate information. Our nd suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. Headquartered in Washington, DC, CoStar maintains offices throughout the U.S. and in Europe with a staff of approximately 1,500 worldwide, including the industry's largest professional research organization. For more information, visit http://www.costar.com.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations, beliefs, intentions or strategies regarding the future. These statements are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. More information about potential factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to, those stated in CoStar's filings from time to time with the Securities and Exchange Commission, including CoStar's Form 10-K for the year ended December 31, 2011, and CoStar's Form 10-Q for the quarter ended September 30, 2011, under the heading "Risk Factors." In addition to these statements, there can be no assurance that there will continue to be an ongoing recovery in the U.S. commercial real estate market; that investor sentiment is improving and pricing growth is gaining consistency; that liquidity in the commercial real estate markets will continue to improve and to result in more property sales; that investor demand and commercial real estate pricing levels will continue at the levels or with the trends indicated in this release; that the trends represented or implied by the indices will continue; and that the CCRSI will be released on the date and updated on the frequency set forth in the release. All forward-looking statements are based on information a vailable to CoStar on the date hereof, and CoStar assumes no obligation to update such statements, whether as a result of new information, future events or otherwise.

COSTAR COMMERCIAL REPEAT-SALE INDICES MARCH 2012 Release (With Data through January 2012)

You might also like

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Pacific Grove Homes Market Action Report Real Estate Sales For April 2012Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For April 2012Nicole TruszkowskiNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales January 2012Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales January 2012Nicole TruszkowskiNo ratings yet

- Commercial Real Estate Sees Seventh Consecutive Monthly Price Increase in NovemberDocument19 pagesCommercial Real Estate Sees Seventh Consecutive Monthly Price Increase in NovemberMary Beth PriestleyNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For February 2012Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For February 2012Nicole TruszkowskiNo ratings yet

- Monterey Homes Market Action Report Real Estate Sales For March 2012Document3 pagesMonterey Homes Market Action Report Real Estate Sales For March 2012Nicole TruszkowskiNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For August 2012Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For August 2012Nicole TruszkowskiNo ratings yet

- June 2012 Real Estate Market ReportDocument12 pagesJune 2012 Real Estate Market ReportRomeo ManzanillaNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For October 2012Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For October 2012Nicole TruszkowskiNo ratings yet

- Carmel Ca Homes Market Action Report For Real Estate Sales January 2012Document3 pagesCarmel Ca Homes Market Action Report For Real Estate Sales January 2012Nicole TruszkowskiNo ratings yet

- Commercial Real Estate Prices Increase A Modest 1.1% in Fourth Quarter As Property Pricing Levels Off in DecemberDocument13 pagesCommercial Real Estate Prices Increase A Modest 1.1% in Fourth Quarter As Property Pricing Levels Off in DecemberGary LoweNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For July 2012Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For July 2012Nicole TruszkowskiNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For April 2012Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For April 2012Nicole TruszkowskiNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For August 2012Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For August 2012Nicole TruszkowskiNo ratings yet

- Carmel Ca Homes Market Action Report For Real Estate Sales February 2012Document3 pagesCarmel Ca Homes Market Action Report For Real Estate Sales February 2012Nicole TruszkowskiNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For May 2012Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For May 2012Nicole TruszkowskiNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For June 2012Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For June 2012Nicole TruszkowskiNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales June 2012Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales June 2012Nicole TruszkowskiNo ratings yet

- Net Leased Research ReportDocument3 pagesNet Leased Research ReportnetleaseNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For December 2012Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For December 2012Nicole TruszkowskiNo ratings yet

- Salinas Monterey Highway Homes Market Action Report For Real Estate Sales For June 2012Document3 pagesSalinas Monterey Highway Homes Market Action Report For Real Estate Sales For June 2012Nicole TruszkowskiNo ratings yet

- REALTORS® Confidence Index July 2012Document26 pagesREALTORS® Confidence Index July 2012National Association of REALTORS®No ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For July 2012Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For July 2012Nicole TruszkowskiNo ratings yet

- Carmel Ca Homes Market Action Report For Real Estate Sales April 2012Document3 pagesCarmel Ca Homes Market Action Report For Real Estate Sales April 2012Nicole TruszkowskiNo ratings yet

- Carmel Highlands Homes Market Action Report For Real Estate Sales October 2012Document3 pagesCarmel Highlands Homes Market Action Report For Real Estate Sales October 2012Nicole TruszkowskiNo ratings yet

- Centereach, NY November 2012Document3 pagesCentereach, NY November 2012Phillip KingNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For May 2012Document3 pagesPebble Beach Homes Market Action Report Real Estate Sales For May 2012Nicole TruszkowskiNo ratings yet

- Monthly Indicators: February 2013 Quick FactsDocument16 pagesMonthly Indicators: February 2013 Quick FactsJoshua Steven KnodleNo ratings yet

- Carmel Valley Homes Market Action Report For Real Estates Sales January 2012Document3 pagesCarmel Valley Homes Market Action Report For Real Estates Sales January 2012Nicole TruszkowskiNo ratings yet

- Sayville, NY December 2012Document3 pagesSayville, NY December 2012Phillip KingNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For September 2012Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For September 2012Nicole TruszkowskiNo ratings yet

- Salinas Monterey Highway Homes Market Action Report For Real Estate Sales For September 2012Document3 pagesSalinas Monterey Highway Homes Market Action Report For Real Estate Sales For September 2012Nicole TruszkowskiNo ratings yet

- Market Action Report - Rye Jan 2012Document3 pagesMarket Action Report - Rye Jan 2012Adriane DeFeoNo ratings yet

- Eekly Conomic Pdate: Doug Potash PresentsDocument2 pagesEekly Conomic Pdate: Doug Potash PresentsDoug PotashNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For February 2013Document3 pagesPacific Grove Homes Market Action Report Real Estate Sales For February 2013Nicole TruszkowskiNo ratings yet

- East Patchogue, New York December 2012Document3 pagesEast Patchogue, New York December 2012Phillip KingNo ratings yet

- Dec 172012Document2 pagesDec 172012mike1473No ratings yet

- Market Action Report City Bethel April 2012Document3 pagesMarket Action Report City Bethel April 2012szschmidtNo ratings yet

- Eastport, NY December 2012Document3 pagesEastport, NY December 2012Phillip KingNo ratings yet

- Market History Bucks SingleFamilyDocument10 pagesMarket History Bucks SingleFamilyDavid SlaughterNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For June 2012Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For June 2012Nicole TruszkowskiNo ratings yet

- Holtsville, NY January 2013Document3 pagesHoltsville, NY January 2013Phillip KingNo ratings yet

- Carmel Highlands Real Estate Sales Market Report August 2015Document4 pagesCarmel Highlands Real Estate Sales Market Report August 2015Nicole TruszkowskiNo ratings yet

- Current Arizona Real Estate Market Overview - Jan 2013Document10 pagesCurrent Arizona Real Estate Market Overview - Jan 2013Mike KahlNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For April 2012Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For April 2012Nicole TruszkowskiNo ratings yet

- Big Sur Coast Homes Market Action Report Real Estate Sales For July 2012Document3 pagesBig Sur Coast Homes Market Action Report Real Estate Sales For July 2012Nicole TruszkowskiNo ratings yet

- Sayville, NY November 2012Document3 pagesSayville, NY November 2012Phillip KingNo ratings yet

- 15 March 2013 Property Pulse Sales TransactionsDocument1 page15 March 2013 Property Pulse Sales TransactionsBelinda WinkelmanNo ratings yet

- Carmel Valley Homes Market Action Report For Real Estates Sales March 2012Document3 pagesCarmel Valley Homes Market Action Report For Real Estates Sales March 2012Nicole TruszkowskiNo ratings yet

- Carmel Ca Homes Market Action Report For Real Estate Sales October 2012Document3 pagesCarmel Ca Homes Market Action Report For Real Estate Sales October 2012Nicole TruszkowskiNo ratings yet

- Ronkonkoma, NY January 2013Document3 pagesRonkonkoma, NY January 2013Phillip KingNo ratings yet

- Farmingville, NY December 2012Document3 pagesFarmingville, NY December 2012Phillip KingNo ratings yet

- Carmel Valley Homes Market Action Report For Real Estates Sales July 2012Document3 pagesCarmel Valley Homes Market Action Report For Real Estates Sales July 2012Nicole TruszkowskiNo ratings yet

- GBRAR Monthly Indicators 10/2013Document12 pagesGBRAR Monthly Indicators 10/2013Greater Baton Rouge Association of REALTORS® (GBRAR)No ratings yet

- Mastic Beach, NY December 2012Document3 pagesMastic Beach, NY December 2012Phillip KingNo ratings yet

- Carmel Highlands Real Estate Sales Market Report For October 2015Document4 pagesCarmel Highlands Real Estate Sales Market Report For October 2015Nicole TruszkowskiNo ratings yet

- REMAX National Housing Report - July 2012 FinalDocument2 pagesREMAX National Housing Report - July 2012 FinalSheila Newton TeamNo ratings yet

- GBRAR Monthly Indicators 09/2013Document12 pagesGBRAR Monthly Indicators 09/2013Greater Baton Rouge Association of REALTORS® (GBRAR)No ratings yet

- Ronkonkoma, NY December 2012Document3 pagesRonkonkoma, NY December 2012Phillip KingNo ratings yet

- Lessors of Real Estate Revenues World Summary: Market Values & Financials by CountryFrom EverandLessors of Real Estate Revenues World Summary: Market Values & Financials by CountryNo ratings yet

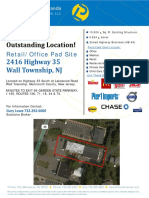

- 2416 Highway 35, Wall Township, NJ Data SheetDocument1 page2416 Highway 35, Wall Township, NJ Data SheetGary LoweNo ratings yet

- 2416 Hwy 35 Wall FlyerDocument1 page2416 Hwy 35 Wall FlyerGary LoweNo ratings yet

- Commercial Real Estate Prices Increase A Modest 1.1% in Fourth Quarter As Property Pricing Levels Off in DecemberDocument13 pagesCommercial Real Estate Prices Increase A Modest 1.1% in Fourth Quarter As Property Pricing Levels Off in DecemberGary LoweNo ratings yet

- Westwind Professional Plaza FlyerDocument1 pageWestwind Professional Plaza FlyerGary LoweNo ratings yet

- 1245 18th Ave FlyerDocument1 page1245 18th Ave FlyerGary LoweNo ratings yet

- Investors Go On Offense: A Special Research ReportDocument3 pagesInvestors Go On Offense: A Special Research ReportGary LoweNo ratings yet

- LPJ Commercial Industrial ListingsDocument1 pageLPJ Commercial Industrial ListingsGary LoweNo ratings yet

- 595 Shrewsbury Ave InformationDocument3 pages595 Shrewsbury Ave InformationGary LoweNo ratings yet