Professional Documents

Culture Documents

st06 2012

st06 2012

Uploaded by

Hardik PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

st06 2012

st06 2012

Uploaded by

Hardik PatelCopyright:

Available Formats

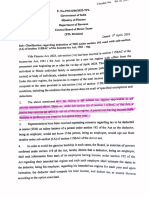

[TO BE PUBLISED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB SECTION (i)] Government of India Ministry

of Finance (Department of Revenue) New Delhi, the 17th March, 2012 Notification No.6/2012 - Service Tax G.S.R. (E). - In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 (32 of 1994) (hereinafter referred to as the Finance Act) and in supersession of the Government of India in the Ministry of Finance (Department of Revenue) notification number 26/2010-Service Tax, dated the 22n d June, 2010, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 532(E), dated the 22n d June, 2010, except as respects things done or omitted to be done before such supersession, the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts the taxable service specified in clause (zzzo) of sub-section (105) of section 65 of the Finance Act, from so much of the service tax leviable thereon under section 66 of the Finance Act, as is in excess of the service tax calculated on a value which is equivalent to forty per cent. of the value of the taxable service by such service provider for providing the said taxable service: Provided that this notification shall not apply in cases where the CENVAT credit of duty on inputs or capital goods, used for providing such taxable service, has been taken under the provisions of the CENVAT Credit Rules, 2004. 2. This notification shall come into force on the 1 st day of April, 2012.

[F. No. 334/1/ 2012 TRU]

(Samar Nanda) Under Secretary to the Government of India

You might also like

- Notification No. 33 of 2012 Service TaxDocument3 pagesNotification No. 33 of 2012 Service TaxAntyoday IndiaNo ratings yet

- 34 Notification No 02 2010 Service TaxDocument1 page34 Notification No 02 2010 Service TaxSatyanarayan PandaNo ratings yet

- in The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)Document9 pagesin The Export of Services Rules, 2005, in Rule 3, in Sub-Rule (1), in Clause (Ii)shreyansghorawatNo ratings yet

- Clean Energy Cess Notn.Document11 pagesClean Energy Cess Notn.Aditya SairamNo ratings yet

- Notfctn 14 Central TaxDocument1 pageNotfctn 14 Central TaxVikas AgrawalNo ratings yet

- Explanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedDocument1 pageExplanation 2.-New Levy or Tax Shall Be Payable On All The Cases Other Than SpecifiedabracadabraNo ratings yet

- Amendments by Finance Act-2014 PDFDocument36 pagesAmendments by Finance Act-2014 PDFvinod240027100% (7)

- Amendment Recruitment Rules 11092023Document3 pagesAmendment Recruitment Rules 110920238793160048ajayNo ratings yet

- Notification No.09/2013 - Service TaxDocument2 pagesNotification No.09/2013 - Service Taxmaahi7No ratings yet

- GST CT 53 2023Document2 pagesGST CT 53 2023raunakyadav009No ratings yet

- st17 2014Document1 pagest17 2014hqpoolkolsouthNo ratings yet

- Amendments in Service TaxDocument15 pagesAmendments in Service TaxShankar NarayananNo ratings yet

- Notf 37 of 2017Document2 pagesNotf 37 of 2017Devdas NairNo ratings yet

- Cus 2212Document1 pageCus 2212patelpratik1972No ratings yet

- Eclerx Services TRLDocument9 pagesEclerx Services TRLChakravarthi B ANo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Notfctn 8 Central Tax English PDFDocument2 pagesNotfctn 8 Central Tax English PDFrgurvareddyNo ratings yet

- GST On Services Exported But Consideration Not ReceivedDocument3 pagesGST On Services Exported But Consideration Not Receivedtharuntraders1987No ratings yet

- Paper 8: Indirect Tax Laws Statutory Update For May 2022 ExaminationDocument25 pagesPaper 8: Indirect Tax Laws Statutory Update For May 2022 Examinationparam.ginniNo ratings yet

- SSTS Special (Procedure) With Holding Rules 2014 - Amended Upto November, 2017 - UPDATEDDocument17 pagesSSTS Special (Procedure) With Holding Rules 2014 - Amended Upto November, 2017 - UPDATEDJalal Anwar BrohiNo ratings yet

- Chapter12 PRADocument6 pagesChapter12 PRAFakhar QureshiNo ratings yet

- Export of Service Rules, 2005Document2 pagesExport of Service Rules, 2005mads70No ratings yet

- CBIC Exempt Supply of Goods and Services From PSU To PSU From Applicability of Provisions Relating To TDS Vide Notification NoDocument1 pageCBIC Exempt Supply of Goods and Services From PSU To PSU From Applicability of Provisions Relating To TDS Vide Notification NoRaja Srinivasa ReddyNo ratings yet

- GSTNTF65Document1 pageGSTNTF65JGVNo ratings yet

- Circular - 111-05-2009-STDocument2 pagesCircular - 111-05-2009-STjayamurli19547922No ratings yet

- Government of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECDocument19 pagesGovernment of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECAhsan RazaNo ratings yet

- Tax Laws Updates For June 2013 ExamsDocument68 pagesTax Laws Updates For June 2013 Examsnisarg_No ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- 01.02.2019 CGST Rules-2017 (Part-A Rules) PDFDocument149 pages01.02.2019 CGST Rules-2017 (Part-A Rules) PDFsridharanNo ratings yet

- Sindh Sales Tax Special Procedure (Withholding) Rules, 2014: Notification No. SRB-3-4/14/2014, Dated 1st July, 2014.Document24 pagesSindh Sales Tax Special Procedure (Withholding) Rules, 2014: Notification No. SRB-3-4/14/2014, Dated 1st July, 2014.Mehak RaniNo ratings yet

- 20 Lakh After 29 March 2018Document1 page20 Lakh After 29 March 2018MCB ACCOUNT BRANCHNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- Press Information Bureau Government of India Ministry of FinanceDocument3 pagesPress Information Bureau Government of India Ministry of Financekumar45caNo ratings yet

- Special Economic Zone (SEZ) Under GST - Taxguru - inDocument3 pagesSpecial Economic Zone (SEZ) Under GST - Taxguru - inAKSHITA SRIVASTAVANo ratings yet

- TLP Supplement GST Dec18 OldSyllabusDocument24 pagesTLP Supplement GST Dec18 OldSyllabusShreya s shettyNo ratings yet

- 13-2012 CessDocument2 pages13-2012 Cesskumar_k_2005No ratings yet

- Amendment Recruitment Rules 24082023Document3 pagesAmendment Recruitment Rules 24082023Dilip BannerjiNo ratings yet

- Customs Tariff Notification No.24/2014 Dated 11th July, 2014Document1 pageCustoms Tariff Notification No.24/2014 Dated 11th July, 2014stephin k jNo ratings yet

- Notification 35and39Document3 pagesNotification 35and39varunnamin1992No ratings yet

- Service Tax-Point of TaxationDocument1 pageService Tax-Point of TaxationNamrata Parakh MarothiNo ratings yet

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsiteNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- Circular No.: Government India Department Revenue Board Direct Division)Document2 pagesCircular No.: Government India Department Revenue Board Direct Division)ashim1No ratings yet

- Charge OF GST: After Studying This Chapter, You Will Be Able ToDocument70 pagesCharge OF GST: After Studying This Chapter, You Will Be Able TooverclockthesunNo ratings yet

- cs13 2013Document1 pagecs13 2013stephin k jNo ratings yet

- Income Tax 7 Lakh CircularDocument3 pagesIncome Tax 7 Lakh CircularMCB ACCOUNT BRANCHNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- 75914bos61400 cp2Document87 pages75914bos61400 cp2Bhanu RawatNo ratings yet

- Ministry of Finance (Department of Revenue) NotificationDocument1 pageMinistry of Finance (Department of Revenue) NotificationKittuNo ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- GST State ActDocument27 pagesGST State ActsolomonNo ratings yet

- Paper-18 Supplementary 180221Document109 pagesPaper-18 Supplementary 180221Srihari SrinivasNo ratings yet

- st01 2017Document1 pagest01 2017Rajula Gurva ReddyNo ratings yet

- What Is Service Tax ?Document15 pagesWhat Is Service Tax ?Nawab SahabNo ratings yet

- cs10 2013Document1 pagecs10 2013stephin k jNo ratings yet

- Page 1 of 2Document2 pagesPage 1 of 2Hr legaladviserNo ratings yet

- Service TAx - Notification-Nos-29-to-37Document6 pagesService TAx - Notification-Nos-29-to-37sd naikNo ratings yet

- Service Tax Exemption in IndiaDocument38 pagesService Tax Exemption in IndiaAnonymous it4wrfEOdNo ratings yet