Professional Documents

Culture Documents

Blank 1099 Form

Blank 1099 Form

Uploaded by

Liberia NewsroomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blank 1099 Form

Blank 1099 Form

Uploaded by

Liberia NewsroomCopyright:

Available Formats

CORRECTED (if checked)

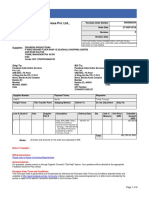

PAYERS name, street address, city, state, ZIP code, and telephone no. 1a Date of sale or exchange OMB No. 1545-0715

1b Date of acquisition

2011

Form

Proceeds From Broker and Barter Exchange Transactions

1099-B

Sales price Sales price less commissions and option premiums

2 Sales price of stocks, bonds, etc.

$

PAYERS federal identification number RECIPIENTS identification number 3 Cost or other basis

Reported to IRS

4 Federal income tax withheld

Copy B $

RECIPIENTS name 5 Wash sale loss disallowed

$

6 If this box is checked, boxes 1b, 3, 5, and 8 may be blank 8 Type of gain or loss Short-term Long-term

For Recipient

This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported.

$

Street address (including apt. no.) 7

City, state, and ZIP code

9 Description

Account number (see instructions)

10 Profit or (loss) realized in 2011 on closed contracts

11 Unrealized profit or (loss) on 14 Bartering open contracts12/31/2010

$

CUSIP number

$

15 If box checked, loss based on amount in box 2 is not allowed

12 Unrealized profit or (loss) on 13 Aggregate profit or (loss) on contracts open contracts12/31/2011

$

Form

$

Department of the Treasury - Internal Revenue Service

1099-B

(keep for your records)

You might also like

- Sheila McCorriston WithdrawalDocument14 pagesSheila McCorriston WithdrawalAnonymous BmFjIMShq9100% (2)

- UntitledDocument4 pagesUntitledkeithNo ratings yet

- Paula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Document2 pagesPaula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Natural Beauty LaserNo ratings yet

- 1099-b Whfit FormDocument6 pages1099-b Whfit FormYarod EL100% (5)

- 5 XVFPSVKDocument1 page5 XVFPSVKIrma AsaroNo ratings yet

- DocumentDocument1 pageDocumentMulletHawkSunshyneBrownNo ratings yet

- 3232 Void Corrected: Form W-2GDocument8 pages3232 Void Corrected: Form W-2GMichael HenryNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMJackson kaylaNo ratings yet

- US Internal Revenue Service: f1099msc - 2002Document7 pagesUS Internal Revenue Service: f1099msc - 2002IRSNo ratings yet

- Quotation: Xin Inventory 2.0 - Invoice Software CodeDocument1 pageQuotation: Xin Inventory 2.0 - Invoice Software CodexincubeNo ratings yet

- US Internal Revenue Service: F1099msa - 1997Document5 pagesUS Internal Revenue Service: F1099msa - 1997IRSNo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- Tax Information Account 943420759Document12 pagesTax Information Account 943420759DavidNo ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- Ve'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?ODocument1 pageVe'H (O5.U H + Q ": Frlitf (TFF Califi ,,'R? Q L (O?OMatthew Robert QuinnNo ratings yet

- 1099 Ssdi 2010Document1 page1099 Ssdi 2010Gary McclainNo ratings yet

- Top of Form Panel 0 4 None 0 0: Legal Name: Social Security NumberDocument2 pagesTop of Form Panel 0 4 None 0 0: Legal Name: Social Security NumberJason RileyNo ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- January 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Document8 pagesJanuary 5, 2022 Mumtaz Makda 1000 Buckshot CT Murphy, TX 75094-3616Mumtaz MakdaNo ratings yet

- ECWANDC Funding - Vendor W9 FormDocument1 pageECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatuspeachyNo ratings yet

- Ron Gilinsky EvictionDocument4 pagesRon Gilinsky EvictionMy-Acts Of-SeditionNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- December 2022Document4 pagesDecember 2022Ejajur RahamanNo ratings yet

- Facebook India Online Services Pvt. LTD., Purchase Order: SupplierDocument9 pagesFacebook India Online Services Pvt. LTD., Purchase Order: SupplierVamsheeNo ratings yet

- f14039 PDFDocument2 pagesf14039 PDFarshdeep singhNo ratings yet

- Craig Hayward - 2021 - 1065 - K1 3Document6 pagesCraig Hayward - 2021 - 1065 - K1 3Craig HaywardNo ratings yet

- Barbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1Document10 pagesBarbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1fiqiNo ratings yet

- 2018 VisitDallas IRS Form 990Document37 pages2018 VisitDallas IRS Form 990George MifflinNo ratings yet

- Rockport Police DepartmentDocument2 pagesRockport Police DepartmentRyan GarzaNo ratings yet

- New York Corporation Tax ReturnDocument4 pagesNew York Corporation Tax Returnbshahn1189No ratings yet

- DOL RDWSU 2020 Form 5500Document205 pagesDOL RDWSU 2020 Form 5500seanredmondNo ratings yet

- CT W4Document2 pagesCT W4Alejandro ArredondoNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusRobert M Hamil.No ratings yet

- DD 0293Document4 pagesDD 0293Kenneth CravensNo ratings yet

- SSF SS 1098T PDFDocument1 pageSSF SS 1098T PDFJoseph FabreNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- NYSE - BX. Dear Unit Holder - PDFDocument9 pagesNYSE - BX. Dear Unit Holder - PDFEugene FrancoNo ratings yet

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyDocument3 pagesForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandNo ratings yet

- US Internal Revenue Service: f1040nr - 2005Document5 pagesUS Internal Revenue Service: f1040nr - 2005IRSNo ratings yet

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Document1 pageCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- Payment Payment: Colorado Individual Income Tax Filing GuideDocument40 pagesPayment Payment: Colorado Individual Income Tax Filing Guidestop recordsNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- F1040es 2020Document12 pagesF1040es 2020Job SchwartzNo ratings yet

- 1099-Div 2021 3350349Document1 page1099-Div 2021 3350349Adam Clifton0% (1)

- GKEDC Form 990 Page 1 For 2013 Through 2019Document7 pagesGKEDC Form 990 Page 1 For 2013 Through 2019Don MooreNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMalahk Ben MikielNo ratings yet

- 2016 Merrill Taxes PDFDocument8 pages2016 Merrill Taxes PDFholymolyNo ratings yet

- Tuition StatementDocument7 pagesTuition StatementAnonymous 9FlDK6YrJNo ratings yet

- SFF IRS Form990 2013Document27 pagesSFF IRS Form990 2013Space Frontier FoundationNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- 8850 Wotc Tax FormDocument2 pages8850 Wotc Tax Formapi-127186411No ratings yet

- Maverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Document19 pagesMaverick Tax Express 941 W Pioneer Pkwy ARLINGTON, TX 76013-6369 817-261-6287Vignesh EswaranNo ratings yet

- Oji 2Document2 pagesOji 2brent_barthanyNo ratings yet

- 2018 NoVo 990Document80 pages2018 NoVo 990Noam Blum100% (1)

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet