Professional Documents

Culture Documents

Soln 16.1

Soln 16.1

Uploaded by

Vinay SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Soln 16.1

Soln 16.1

Uploaded by

Vinay SinghCopyright:

Available Formats

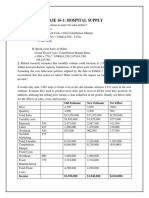

Hospital Supply Case 16-1 Hospital Supply, Inc. 1.

Total fixed costs (TFC) = fixed costs per unit times normal volume =($660 + $770)*3,000 = $4,290,000. Contribution margin per unit = unit price minus unit variable costs = $4,350 - $2,070 = $2,280. Break-even volume: 4,290,000/2,280 = 1,882 units Break-even sales: 4,290,000/((4,350-2,070)/4,350) = $8,185,461 2. I recommend that this should not be taken because lowering prices will red uce the income. Other factors that will affect the decision will be the reductio n of the available capacity and the impact on market share. [pic] 3. I recommend that the contract should not be accepted. Income would be lower if t he contract with the government is accepted by a difference of $617,500. [pic] 4. Minimum price = variable mfg costs + shipping costs + order costs = $1,795 + $410 + $22,000/1,000 = $2,227 5. The manufacturing costs are sunk; therefore, any price in excess of the di fferential costs of selling the hoists will add to income. In this case, those d ifferential costs are apparently the $275 per unit variable marketing costs, sin ce the hoists are to be sold through regular channels; thus the minimum price is $275. 6. [pic] 7. [pic] With this, the maximum payment is $2,950,000. $2,475 should be accepted as the p rice per unit to the contractor. Case 16-3 Bill French 1. Bill French s assumptions:

a. All costs were assumed constant. Fixed costs remain fixed over all op erations mentioned and variable costs remain variable. b. French assumed that the sales price and sales mix remain constant. c. French assumed that the sales break-even point is based on a direct r elationship of sales pattern and production. 2. Break-even analysis: Given: 10% increase in VC, $60,000 increase per month in fixed costs. FC = 3,690,000 VC = $3.23 Break-even in units = 3,690,000/3.23 =...

You might also like

- Hospital Supply Inc. - SolutionsDocument5 pagesHospital Supply Inc. - SolutionsMEERA JOSHY 192743650% (4)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Document34 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 11jasperkennedy089% (28)

- Quiz 16Document7 pagesQuiz 16suranumiNo ratings yet

- Solution Manual - Chapter 3Document10 pagesSolution Manual - Chapter 3psrikanthmbaNo ratings yet

- Answers To Questions: Reflection Paper ON Hospital Supply SummaryDocument2 pagesAnswers To Questions: Reflection Paper ON Hospital Supply SummaryambrosiaeffectNo ratings yet

- Business School - Docx FinalDocument11 pagesBusiness School - Docx FinalMeletios LioulisNo ratings yet

- Hospital SupplyDocument3 pagesHospital SupplyJeanne Madrona100% (1)

- Marginal CostingDocument30 pagesMarginal Costinganon_3722476140% (1)

- Hospital Supply, IncDocument3 pagesHospital Supply, Incmade3875% (4)

- Man Acc 1Document6 pagesMan Acc 1Ange Buenaventura SalazarNo ratings yet

- Geronimo e - Assignment 2Document1 pageGeronimo e - Assignment 2Geronimo EnguitoNo ratings yet

- Case Study MANACODocument39 pagesCase Study MANACOAmorNo ratings yet

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- Cost - Direct Costing, CVP AnalysisDocument7 pagesCost - Direct Costing, CVP AnalysisAriMurdiyantoNo ratings yet

- Bill French - Write Up1Document10 pagesBill French - Write Up1Nina EllyanaNo ratings yet

- BEP AnalysisDocument7 pagesBEP Analysissumaya tasnimNo ratings yet

- Case Study 16-3 Bill FrenchDocument28 pagesCase Study 16-3 Bill FrenchShah 6020% (2)

- CVP, Variable Costing and Absorption CostingDocument7 pagesCVP, Variable Costing and Absorption CostingHannah Vaniza NapolesNo ratings yet

- Day 3Document33 pagesDay 3Leo ApilanNo ratings yet

- Case 16-1 (Alfi & Yessy)Document4 pagesCase 16-1 (Alfi & Yessy)Ana KristianaNo ratings yet

- Agenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingDocument33 pagesAgenda:: A Little More Vocabulary C-V-P Analysis Thursday's Class Group Problem SolvingApoorvNo ratings yet

- Hock CMA P1 2019 (Sections D & E) AnswersDocument9 pagesHock CMA P1 2019 (Sections D & E) AnswersNathan DrakeNo ratings yet

- Answers To QuestionsDocument8 pagesAnswers To QuestionsElie YabroudiNo ratings yet

- Chapter 2: Markets and Instruments: BD BD Ask BidDocument5 pagesChapter 2: Markets and Instruments: BD BD Ask BidSilviu Trebuian100% (1)

- Geronimoe - Assignment 1 & Assignment 2Document1 pageGeronimoe - Assignment 1 & Assignment 2Geronimo EnguitoNo ratings yet

- Seal 6 Esolutions CH 15Document56 pagesSeal 6 Esolutions CH 15Katlego MasibiNo ratings yet

- ESCOPETE Assignment CVPDocument6 pagesESCOPETE Assignment CVPmiljane perdizoNo ratings yet

- Institute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisDocument5 pagesInstitute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisMozid RahmanNo ratings yet

- Decsion Analysis Printing Hock ExamsuccessDocument92 pagesDecsion Analysis Printing Hock ExamsuccessJane Michelle EmanNo ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11Document44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 11kkamjonginnNo ratings yet

- 2-Contribution Margin:: - WithDocument6 pages2-Contribution Margin:: - WithAlyn AlconeraNo ratings yet

- Chapter On CVP 2015 - Acc 2Document16 pagesChapter On CVP 2015 - Acc 2nur aqilah ridzuanNo ratings yet

- Sample Quiz On CVP - SolutionDocument2 pagesSample Quiz On CVP - Solutionmamasita25No ratings yet

- CVP CH One MDocument42 pagesCVP CH One MYonasNo ratings yet

- Absorption CostingDocument33 pagesAbsorption CostingMohit PaswanNo ratings yet

- Latihan UAS Manacc TUTORKU (Answered)Document10 pagesLatihan UAS Manacc TUTORKU (Answered)Della BianchiNo ratings yet

- Q1 AND Q4 (MCQS)Document3 pagesQ1 AND Q4 (MCQS)Maarij KhanNo ratings yet

- CH 03 SolDocument45 pagesCH 03 SolrocketamberNo ratings yet

- Chapter 17Document8 pagesChapter 17rahmiamelianazarNo ratings yet

- Cost BehaviorDocument17 pagesCost BehaviorRona Mae Ocampo ResareNo ratings yet

- COMA Mid Term - 2022-23 V1 - SolutionsDocument6 pagesCOMA Mid Term - 2022-23 V1 - SolutionssurajNo ratings yet

- CMA AK 1 AnswersDocument3 pagesCMA AK 1 Answersshahid yarNo ratings yet

- 2016 GMA711S Exam 2 MemoDocument8 pages2016 GMA711S Exam 2 MemoNolan TitusNo ratings yet

- CH 05Document28 pagesCH 05Rommel CruzNo ratings yet

- RCA Solutions Mod5Document5 pagesRCA Solutions Mod5Danica Austria DimalibotNo ratings yet

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- Implementation / Plan of Action:: Break-Even PointDocument1 pageImplementation / Plan of Action:: Break-Even PointMandeepkaur SandhuNo ratings yet

- Notes CVP 2009, 2017Document13 pagesNotes CVP 2009, 2017Aaron ForbesNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Summary of Austin Frakt & Mike Piper's Microeconomics Made SimpleFrom EverandSummary of Austin Frakt & Mike Piper's Microeconomics Made SimpleNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)