Professional Documents

Culture Documents

Moore Tax

Moore Tax

Uploaded by

Ali GuitronOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moore Tax

Moore Tax

Uploaded by

Ali GuitronCopyright:

Available Formats

SURVIVORS'

BENEFIT TAX LIABILITY ACKNOWLEDGEMENT

EXCLUDED (Not Represented By Collective Bargaining AND RANK AND FILE BARGAINING UNIT 06 EMPLOYEES

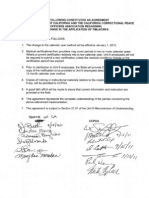

This is an important announcement to all Excluded and Bargaining Unit 06 employees regarding Survivor's Benefit donations. The following information is not to discourage Survivor's Benefit donations but to notify you of a recent taxability concern. Under existing tax laws there may be a tax liability for the donor of Survivor's Benefits. Taxes will be at 25% for Federal and 6% for State. Social Security and Medicare taxes will be deducted if applicable. The Survivor's Benefit allows R06 and Excluded employees to donate leave credits (excluding sick leave) to an eligible employee who dies due to an illness or injury, which was not incurred in the line of duty. Donations of leave credits will only be accepted for 30-days following the approval of the request. These donations are not to exceed the maximum net amount of $50,000.00. The gross amount of the contribution will be included on the Donor's annual statement Form W-2, Wage and Tax Statement. There may also be a possibility of an amended W-2 being issued to the donor once the taxability concern has been addressed.

OAR'!\{ V.(y)oORE

an employee at

C,.DCR::(AljE . mEN

~rY)L)

CQ4.~plledon

_ OS ... ~d~ \

Generous donations were received for the surviving family members. You have donated leave credits towards this benefit. Your signature below acknowledges that you understand and accept the potential taxation liability discussed above. EMPLOYEES WHO HAVE QUESTIONS OR WANT TO RESCIND THEIR ELECTION POTENTIAL TAXATION MUST IMMEDIATELY CONTACT THEIR PERSONNEL OFFICE. PRINTED NAME SIGNATURE DATE DUE TO THE

You might also like

- Lmurillo Benefit LetterDocument2 pagesLmurillo Benefit Letterloretta005No ratings yet

- W 2Document3 pagesW 2lysprr33% (3)

- Rollover FormDocument3 pagesRollover FormJonNo ratings yet

- 1010EZ FillableDocument5 pages1010EZ FillableFilozófus ÖnjelöltNo ratings yet

- Account Eligibility Approved PC Only PDFDocument11 pagesAccount Eligibility Approved PC Only PDFMelv CookNo ratings yet

- Same For Everyone.: WWW - Sba.govDocument4 pagesSame For Everyone.: WWW - Sba.govScott AtkinsonNo ratings yet

- std686 PDFDocument2 pagesstd686 PDFnmkeatonNo ratings yet

- Employee Health Assistance FundDocument6 pagesEmployee Health Assistance Fundkatiejones26No ratings yet

- 2015 Uc Health FaaDocument4 pages2015 Uc Health Faaapi-263913260No ratings yet

- W Epdw Ukmtyw: Employers ContributionsDocument3 pagesW Epdw Ukmtyw: Employers ContributionsslimgialNo ratings yet

- Bacc 403 Tax, Law & Practice 1Document8 pagesBacc 403 Tax, Law & Practice 1ItdarareNo ratings yet

- 2011 Instructions For Schedule SE (Form 1040) Self-Employment TaxDocument5 pages2011 Instructions For Schedule SE (Form 1040) Self-Employment Tax5sfsfdNo ratings yet

- p969 PDFDocument22 pagesp969 PDFstalker1841No ratings yet

- DSS 8605Document2 pagesDSS 8605aspengray85No ratings yet

- Healthcare Reform ActDocument3 pagesHealthcare Reform Actpeterlouisanthony7859No ratings yet

- 2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxDocument6 pages2013 Instructions For Schedule SE (Form 1040) : Self-Employment TaxJames D. SassNo ratings yet

- IRS Publication Form Instructions 8853Document8 pagesIRS Publication Form Instructions 8853Francis Wolfgang UrbanNo ratings yet

- Income TaxationDocument12 pagesIncome TaxationMonica Jarabelo RamintasNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- FAQs For 2020 Peace Corps Evacuees (COVID) Allowances and BenefitsDocument7 pagesFAQs For 2020 Peace Corps Evacuees (COVID) Allowances and BenefitsAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Ir524 PDFDocument2 pagesIr524 PDFTiffany Morris0% (1)

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- Iowa W4Document2 pagesIowa W4ts0m3No ratings yet

- US Individual RegulationDocument3 pagesUS Individual RegulationDarab AkhtarNo ratings yet

- Offer in Compromise: Form 656 BookletDocument28 pagesOffer in Compromise: Form 656 BookletAnonymous JRunUFTMbNo ratings yet

- BHC - Fincl HRDSHP ProgDocument2 pagesBHC - Fincl HRDSHP ProgRobin Catherine HieronymusNo ratings yet

- Qualified Pass-Through Entities Include:: Some Significant Elements of The Tax Cuts and Jobs ActDocument2 pagesQualified Pass-Through Entities Include:: Some Significant Elements of The Tax Cuts and Jobs Actanon_435247981No ratings yet

- 401 (K) Enrollment BookDocument40 pages401 (K) Enrollment BookSwisskelly1No ratings yet

- Essentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1Document49 pagesEssentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1carrie100% (43)

- 5Document10 pages5John C. LewisNo ratings yet

- Pdfs AFTR2016 PDFDocument111 pagesPdfs AFTR2016 PDFpaulgiron275No ratings yet

- Individuals Part 2Document157 pagesIndividuals Part 2Henish N JainNo ratings yet

- Filling For Claim For RefundDocument8 pagesFilling For Claim For RefundsheldonNo ratings yet

- State Tax FormDocument2 pagesState Tax FormRon SchingsNo ratings yet

- IRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSauceDocument4 pagesIRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSaucePanel Rank (panelrank.com)No ratings yet

- Frequently Asked Questions Concerning Retirement and Tax ErrorsDocument2 pagesFrequently Asked Questions Concerning Retirement and Tax ErrorsAbsNo ratings yet

- US Internal Revenue Service: p907 - 2002Document12 pagesUS Internal Revenue Service: p907 - 2002IRSNo ratings yet

- Individual Tax SummaryDocument5 pagesIndividual Tax SummaryMojo CreatorNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- US and Canada Tax ChangesDocument11 pagesUS and Canada Tax ChangesGANYA JOKERNo ratings yet

- Disallowance - 02 03 2022 02-03-2022Document4 pagesDisallowance - 02 03 2022 02-03-2022evitakinsellaNo ratings yet

- Taxation FinalsDocument48 pagesTaxation Finalsaerosmith_julio6627No ratings yet

- IRS Publication Form Instructions 1099 MiscDocument10 pagesIRS Publication Form Instructions 1099 MiscFrancis Wolfgang UrbanNo ratings yet

- Lousianna Tax InstructionDocument17 pagesLousianna Tax Instructionchuckhsu1248No ratings yet

- Article When The IRS Strikes With A LevyDocument6 pagesArticle When The IRS Strikes With A Levyhimself100% (1)

- F1040es 2018Document18 pagesF1040es 2018diversified1No ratings yet

- Saver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasDocument5 pagesSaver'S Tax Credit For Contributions by Individuals To Employer Retirement Plans and IrasIRSNo ratings yet

- Connecticut Resident Income Tax InformationDocument11 pagesConnecticut Resident Income Tax InformationShraddhanand MoreNo ratings yet

- US Internal Revenue Service: p907 - 2001Document12 pagesUS Internal Revenue Service: p907 - 2001IRSNo ratings yet

- Tax Accounting Study GuideDocument4 pagesTax Accounting Study Guides511939No ratings yet

- Servicemembers' Group Life Insurance Election and CertificateDocument4 pagesServicemembers' Group Life Insurance Election and CertificateChad ChriscoNo ratings yet

- University National Bank ("Bank") Refund Transfer Application and AgreementDocument6 pagesUniversity National Bank ("Bank") Refund Transfer Application and AgreementMètrès Rosie-Rose AimableNo ratings yet

- Personal Financial PlanningDocument10 pagesPersonal Financial PlanningTam PhamNo ratings yet

- MW 507Document2 pagesMW 507sosureyNo ratings yet

- VOYA Term Life Certificate 11.20 PDFDocument20 pagesVOYA Term Life Certificate 11.20 PDFDarrick WeatherlyNo ratings yet

- Coronavirus-Related Withdrawal: SECTION 1: What's Included in This KitDocument10 pagesCoronavirus-Related Withdrawal: SECTION 1: What's Included in This KitandryNo ratings yet

- It's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCDocument4 pagesIt's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- SGTPG 1Document1 pageSGTPG 1Ali GuitronNo ratings yet

- New One For OneDocument2 pagesNew One For OneAli GuitronNo ratings yet

- Pico HoursDocument1 pagePico HoursAli GuitronNo ratings yet

- Wave 2 Doc 2Document1 pageWave 2 Doc 2Ali GuitronNo ratings yet

- FMLA AgreementDocument1 pageFMLA AgreementAli GuitronNo ratings yet

- SGTPG 2Document1 pageSGTPG 2Ali GuitronNo ratings yet

- Wave2 1Document1 pageWave2 1Ali GuitronNo ratings yet

- Job Steward (Revo)Document1 pageJob Steward (Revo)Ali GuitronNo ratings yet

- Physical Fitness Take 2Document1 pagePhysical Fitness Take 2Ali GuitronNo ratings yet

- Wave 2 Doc 3Document1 pageWave 2 Doc 3Ali GuitronNo ratings yet

- Wave2 1Document1 pageWave2 1Ali GuitronNo ratings yet

- Wave 2 Doc 1Document1 pageWave 2 Doc 1Ali GuitronNo ratings yet

- Physical Fitness Take 2Document1 pagePhysical Fitness Take 2Ali GuitronNo ratings yet

- Avenal State Prison - Menu ItemsDocument6 pagesAvenal State Prison - Menu ItemsAli GuitronNo ratings yet

- MooreDocument1 pageMooreAli GuitronNo ratings yet

- POFFIIDocument1 pagePOFFIIAli GuitronNo ratings yet

- Addendum AvenalDocument1 pageAddendum AvenalAli GuitronNo ratings yet

- Frank CostaDocument1 pageFrank CostaAli GuitronNo ratings yet