Professional Documents

Culture Documents

PPFSheet Till DEC2011

PPFSheet Till DEC2011

Uploaded by

mayanknagar2424Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPFSheet Till DEC2011

PPFSheet Till DEC2011

Uploaded by

mayanknagar2424Copyright:

Available Formats

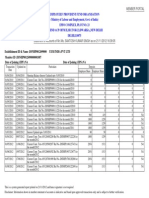

Provisional Provident Fund Statement

SAPIENT CONSULTING EMPLOYEES PROVIDENT FUND TOWER A, BUILDING 2, SECTOR 21 DUNDAHERA, OLD DELHI-GURGAON ROAD GURGAON 122016, HARYANA,INDIA For Financial Year 2011-2012 Employee Details

Payroll ID Emp Name PF Number Date of Joining Year & month :101454 :Mayank Nagar :HR/GGN/30659/1400 :20/06/2011 Employee's Regular Contribution(1) Provident Fund Contribution Employer's Regular Total(1+2) Contribution(2) Employer's Regular Contribution to EPS(3) Remark

Opening balance as on 1st April,2011 July-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Total contribution during the year Total Closing Balance

924.00 2520.00 2520.00 2520.00 2520.00 2520.00 13524.00 13524.00 13524.00

725.00 1979.00 1979.00 1979.00 1979.00 1979.00 10620.00 10620.00 10620.00

1649.00 4499.00 4499.00 4499.00 4499.00 4499.00 24144.00 24144.00 24144.00

199.00 541.00 541.00 541.00 541.00 541.00 2904.00 2904.00 2904.00

Notes: 1. 2. The monthly contributions for a particular month represent the contribution out of payroll for the previous month i.e. Mar,11 contribution will appear against Apr,11. Employers contribution is divided into two parts as P F & EPS. EPS is the contribution towards pension fund/scheme administered by Regional Provident Fund Commissioner (RPFC) . The default contribution towards this scheme is 8.33% of basic salary, subject to maximum of Rs. 541/- per month and the balance amount is termed as P F . e.g. if the basic salary is Rs. 10000/- then deduction towards PF from your salary would be Rs. 1200/- and the same amount is contributed by your employer, out of which Rs. 541/- is deposited as EPS and remaining Rs. 659/- is deposited as PF. Employees Pension Scheme (EPS) Contributions shown on Col. 3 above are deposited with RPFC, Gurgaon.

3.

You might also like

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- Instructions To Use This ProgrammeDocument27 pagesInstructions To Use This ProgrammeSatish HMNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- Wrerwwerwrwwrw SWF WDocument1 pageWrerwwerwrwwrw SWF Wramesh2440No ratings yet

- VFM Systems & Services PVT LTD: For December-2012Document1 pageVFM Systems & Services PVT LTD: For December-2012ramesh2440No ratings yet

- QUA06194 SalarySlipwithTaxDetails9Document1 pageQUA06194 SalarySlipwithTaxDetails9UtsabNo ratings yet

- QUA06184 SalarySlipwithTaxDetails2 PDFDocument1 pageQUA06184 SalarySlipwithTaxDetails2 PDFVivek KumarNo ratings yet

- QUA06184 SalarySlipwithTaxDetails1 PDFDocument1 pageQUA06184 SalarySlipwithTaxDetails1 PDFVivek KumarNo ratings yet

- Form 12-A (Revised) : Ultima Switchgear Ltd. Khasra No.215, Raipur Ind. Area Bhagwanpur, Roorkee, HaridwarDocument2 pagesForm 12-A (Revised) : Ultima Switchgear Ltd. Khasra No.215, Raipur Ind. Area Bhagwanpur, Roorkee, Haridwarvinaysrivastava75No ratings yet

- Ikya Human Capital Solutions PVT LTD: Pay Slip For The MonthDocument1 pageIkya Human Capital Solutions PVT LTD: Pay Slip For The MonthAnkit MishraNo ratings yet

- Loan Account Number: 601770623Document2 pagesLoan Account Number: 601770623dharminderaroraNo ratings yet

- Government: of Andhra PradeshDocument1 pageGovernment: of Andhra Pradeshnmsusarla999No ratings yet

- Aimil LTD.: Pay Slip For The Month of April-12. Delhi BranchDocument1 pageAimil LTD.: Pay Slip For The Month of April-12. Delhi BranchGurpiar SinghNo ratings yet

- TN Mas 00396090000000151Document2 pagesTN Mas 00396090000000151Nila AshokanNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) (Maximum Salary Rs.747170) 0Document1 pageComputation of Total Income Income From Business or Profession (Chapter IV D) (Maximum Salary Rs.747170) 0Jagdish Sharma CANo ratings yet

- PayslipDocument1 pagePayslipSandeep PatilNo ratings yet

- QUA06194 SalarySlipwithTaxDetails PDFDocument1 pageQUA06194 SalarySlipwithTaxDetails PDFUtsabNo ratings yet

- Grrjy00175170000000049 2Document2 pagesGrrjy00175170000000049 2syamjapesya33No ratings yet

- Qua05242 Salaryslip AugustDocument1 pageQua05242 Salaryslip AugustsaurabhNo ratings yet

- Payslip - January'14Document1 pagePayslip - January'14Vijaya ThoratNo ratings yet

- Oct 2011 Pay SlipDocument1 pageOct 2011 Pay SlipSunil TaraniNo ratings yet

- Regular Employee Details: Finance Department, Government of Andhra PradeshDocument2 pagesRegular Employee Details: Finance Department, Government of Andhra PradeshGowri ShankarNo ratings yet

- Delhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012Document1 pageDelhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012tippu09No ratings yet

- India FDI March2012Document10 pagesIndia FDI March2012Sajjad GullNo ratings yet

- QUA06184 SalarySlipwithTaxDetails PDFDocument1 pageQUA06184 SalarySlipwithTaxDetails PDFVivek KumarNo ratings yet

- LetterDocument2 pagesLetterShiv Kiran SademNo ratings yet

- June SalaryDocument1 pageJune SalaryVivek KumarNo ratings yet

- MPR Format (4 Panchayats)Document10 pagesMPR Format (4 Panchayats)rajt_26No ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- MQUA06189 - SalarySlipwithTaxDetails May2015Document1 pageMQUA06189 - SalarySlipwithTaxDetails May2015UtsabNo ratings yet

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110No ratings yet

- QUA06194 SalarySlipwithTaxDetails21 PDFDocument1 pageQUA06194 SalarySlipwithTaxDetails21 PDFUtsabNo ratings yet

- Education Concession SoftwareDocument28 pagesEducation Concession Softwaresrinivasa chary bNo ratings yet

- 1 2 Name of The Company CINDocument16 pages1 2 Name of The Company CINkumar_anil666No ratings yet

- Payslip MarDocument1 pagePayslip MarMaheshKandguleNo ratings yet

- BG B NG 00067030000011672Document3 pagesBG B NG 00067030000011672Shiva Kumar MadigaNo ratings yet

- DSN HP 00126990000001087Document2 pagesDSN HP 00126990000001087Santosh Kumar SinghNo ratings yet

- Salary Slip (30101241 February, 2015) PDFDocument1 pageSalary Slip (30101241 February, 2015) PDFFaheem MirzaNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- ChallanDocument4 pagesChallanggrajeshNo ratings yet

- Budget at A GlanceDocument455 pagesBudget at A Glancesiddhsonu4uNo ratings yet

- QUA06194 SalarySlipwithTaxDetails20 PDFDocument1 pageQUA06194 SalarySlipwithTaxDetails20 PDFUtsabNo ratings yet

- Government of Andhra Pradesh: (Rupees in Thousands)Document2 pagesGovernment of Andhra Pradesh: (Rupees in Thousands)nmsusarla999No ratings yet

- QUA04354 SalarySlipwithTaxDetailsmarchDocument1 pageQUA04354 SalarySlipwithTaxDetailsmarchrajanNo ratings yet

- Salary Slip (30101241 June, 2015) PDFDocument1 pageSalary Slip (30101241 June, 2015) PDFFaheem MirzaNo ratings yet

- Sales 0314Document2 pagesSales 0314sundram joshiNo ratings yet

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- Pay SlipDocument1 pagePay SlipAnonymous QrLiISmpF100% (1)

- Salary Slip (30101241 April, 2015) PDFDocument1 pageSalary Slip (30101241 April, 2015) PDFFaheem MirzaNo ratings yet

- Annual Report 2010-11 EnglishDocument52 pagesAnnual Report 2010-11 EnglishMichael HolcombNo ratings yet

- SasssDocument1 pageSasssAdil SyedNo ratings yet

- Fuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 DaysDocument1 pageFuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 Daysanup_nairNo ratings yet

- QUA06194 SalarySlipwithTaxDetails14Document1 pageQUA06194 SalarySlipwithTaxDetails14UtsabNo ratings yet

- QUA06194 SalarySlipwithTaxDetails2Document1 pageQUA06194 SalarySlipwithTaxDetails2UtsabNo ratings yet

- Pay Slip ModelDocument1 pagePay Slip ModelAryan ShashiNo ratings yet

- KJJJJDocument3 pagesKJJJJvivekbaroleNo ratings yet

- Money Matters: Local Government Finance in the People's Republic of ChinaFrom EverandMoney Matters: Local Government Finance in the People's Republic of ChinaNo ratings yet