Professional Documents

Culture Documents

Project ON Financial Services: Topic: Factoring in India

Project ON Financial Services: Topic: Factoring in India

Uploaded by

Deepika ChandrasekaranCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Report For Tomato Processing PlantDocument2 pagesProject Report For Tomato Processing PlantRajib Deb100% (2)

- Brio UK Lit Dec 2007Document8 pagesBrio UK Lit Dec 2007Neil HoggNo ratings yet

- BCHEDocument3 pagesBCHERolando AmadNo ratings yet

- Polyhydraminos and OligohydraminosDocument11 pagesPolyhydraminos and OligohydraminosMelissa Catherine ChinNo ratings yet

- Guidance For Plant Engineers StaticelectricityDocument9 pagesGuidance For Plant Engineers Staticelectricityimamers100% (2)

- AR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingDocument168 pagesAR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingYati Nurul HashfiNo ratings yet

- Microsoft Word - Prachi Khanna ResumeDocument1 pageMicrosoft Word - Prachi Khanna Resumeapi-333768733No ratings yet

- Print For ChrysoberylDocument2 pagesPrint For ChrysoberylToh Yang75% (4)

- Parenting Style in Pediatric Dentistry PDFDocument7 pagesParenting Style in Pediatric Dentistry PDFJude Aldo PaulNo ratings yet

- Pressure Vessel Ansys 2Document13 pagesPressure Vessel Ansys 2Bruna Macedo100% (1)

- Y2 Series: Three Phase Cast Iron MotorDocument4 pagesY2 Series: Three Phase Cast Iron MotorMark Christian TorresNo ratings yet

- Work Program For RoadsDocument8 pagesWork Program For RoadsSupun KariyawasamNo ratings yet

- Cicilline 14th Amd Bill TextDocument28 pagesCicilline 14th Amd Bill TextAnonymous GF8PPILW5No ratings yet

- Texto - Banting DietDocument33 pagesTexto - Banting Diettmendes00No ratings yet

- Tourniquet Conversion Drew JSOM Fall 2015 Edition-2Document5 pagesTourniquet Conversion Drew JSOM Fall 2015 Edition-2Oleg ShubinNo ratings yet

- Grade 10 English Achievement TestDocument4 pagesGrade 10 English Achievement TestJelaica Alarilla - GerminoNo ratings yet

- Marcus Deon Smith - Letter To Dept of Justice - Pattern and Practice InvestigationDocument6 pagesMarcus Deon Smith - Letter To Dept of Justice - Pattern and Practice InvestigationHashim WarrenNo ratings yet

- Climate Change Impact at Three Different Scales of Biological Diversity: A Holistic Review of Research Findings From Across The GlobeDocument7 pagesClimate Change Impact at Three Different Scales of Biological Diversity: A Holistic Review of Research Findings From Across The GlobeIJAR JOURNALNo ratings yet

- DEPUTI 4 - Bicara Bumi Mangrove Indonesia Untuk Dunia, Praktik Terbaik Pengelolaan MangroveDocument4 pagesDEPUTI 4 - Bicara Bumi Mangrove Indonesia Untuk Dunia, Praktik Terbaik Pengelolaan MangroveSamuel RahalusNo ratings yet

- General: Technical Data TAD1641GEDocument9 pagesGeneral: Technical Data TAD1641GEBill CastilloNo ratings yet

- Short Procedure Engineering Chemistry SASTRA UniversityDocument13 pagesShort Procedure Engineering Chemistry SASTRA UniversitystarNo ratings yet

- Perbandingan Metode Klamp Dan Lem Terhadap Penyembuhan Luka Pasca Sirkumsisi Pada AnakDocument6 pagesPerbandingan Metode Klamp Dan Lem Terhadap Penyembuhan Luka Pasca Sirkumsisi Pada Anaknanang prasetyoNo ratings yet

- Materials Engg-4Document25 pagesMaterials Engg-4udayrajput253No ratings yet

- SS DM MCH 2020 - 2021 Schedule Nov 6th Update PDFDocument32 pagesSS DM MCH 2020 - 2021 Schedule Nov 6th Update PDFlakshminivas PingaliNo ratings yet

- Worksheet For Chemical BondingDocument2 pagesWorksheet For Chemical Bondingaaradhyajain2106No ratings yet

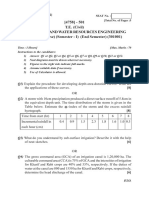

- T.E Question Papers (2012 Pattern) May 2015Document297 pagesT.E Question Papers (2012 Pattern) May 2015Prof. Avinash MahaleNo ratings yet

- Post Incident Damage Assessment ChecklistDocument9 pagesPost Incident Damage Assessment ChecklistFerdinand M. TurbanosNo ratings yet

- The Dancers by Alberto Florentino PDFDocument10 pagesThe Dancers by Alberto Florentino PDFJon Philip GarciaNo ratings yet

- Nursing Care Plan For A Person With Croup Nursing DiagnosisDocument2 pagesNursing Care Plan For A Person With Croup Nursing DiagnosisMonica Rivera100% (1)

- Energy ConservationDocument3 pagesEnergy ConservationakifliaqatNo ratings yet

Project ON Financial Services: Topic: Factoring in India

Project ON Financial Services: Topic: Factoring in India

Uploaded by

Deepika ChandrasekaranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project ON Financial Services: Topic: Factoring in India

Project ON Financial Services: Topic: Factoring in India

Uploaded by

Deepika ChandrasekaranCopyright:

Available Formats

PROJECT ON FINANCIAL SERVICES

TOPIC: FACTORING IN INDIA

Factoring in India:

To you, as a seller/provider of goods and/or services etc, this is a process where a India Factoring pre-pays against your credit invoices/bills that you regularly raise on your established clients. In settlement of this obligation, your clients pay India Factoring on the respective due dates directly. How it works: You deliver goods / services to your client and raise an invoice On an ongoing basis all such invoices of pre-agreed buyer along with supporting trade documents are assigned to India Factoring. India Factoring advances you a pre-payment as early as the next business day on receipt of such documents (subject to being in order) On settlement of the respective invoice by your buyer to India Factoring, the balance amount (if any) is credited to your account Benefits You benefit from predictable cash flows linked directly to performed sales. Readily convert credit receivables to cash, as India Factoring will provide pre-payment immediately. On submission of complete documentation, funding normally by next business day. Quick turnaround times ensure incremental cash flow planning and management. India Factoring can additionally provide credit assessment on customers, new or existing. Free monthly Account Receivable reporting, sales ledger administration and debtor followup. No additional debt created on your balance sheet.

Your "credit line" grows as your business expands. Extremely scalable form of leverage. Possibility of outsourcing your receivables collections process, allowing you to focus on your core business. Variants Apart from this to suit to the intricacies of your business model, certain customized variants are also available: Factoring: Financing alongwith collection and debt administration services provided to client Silent Factoring: Collection is undertaken by the client itself. Bulk Factoring: Collection and debt administration is undertaken by the client. Select Factoring: Structured product factoring for predetermined debtors / invoices Non Recourse Factoring: No recourse to the client on non payment of dues by debtor Maturity Factoring: Financing done to client on the due date Collection Services: Assistance in collection of dues from debtors

Vendor Receivables Factoring

This facility helps provide your vendors with a non-recourse factoring for their sales to yourselves. This product is primarily focused on supporting your business by potentially augmenting your purchase capability as also establishing preferential commercial terms from your vendors/suppliers. This form of factoring however assumes that you have a fair degree of established relationship with your vendors/suppliers and in effect forms a vital part of your overall supply chain management system. How it works: Your vendor sells goods/services to you on preagreed credit terms. The vendor formally assigns the said invoices to India Factoring and submits them along with your acceptance of the assignment and agreement to pay on the due date. India Factoring pays the discounted proceeds to the

vendor on non-recourse basis to them. On the due date India Factoring collects the dues from you. Benefits Your vendor benefits from instant liquidity on account of credit sales to you. Your vendor has no risk on credit sales as this is a non-recourse facility. Upon submission of compliant documentation, funding normally happens the next business day. As in the receivables, India Factoring can provide credit assessment on customers, new or existing Free monthly A/P reporting of all payables No debt is created on your vendors balance sheet. Variants To ensure timely finance to your supply chain, certain customized variants to this are also available : Reverse Factoring: Prepayment on an ongoing basis to pre agreed vendors on delivery of goods Select Reverse Factoring: Prepayments to select pre-determined vendors Reverse Maturity Factoring: Providing payment guarantees to vendors on delivery of goods. Import Factoring: Payment guarantees to correspondents on account of import of goods / services by importers

Forfaiting

Forfaiting is a form of trade finance that involves purchasing of credit instruments such as avalised bills of exchange, letters of credit, promissory note or other freely negotiable instrument on a non recourse basis from you (seller of goods/services). These are normally supported by buyers bank and hence have an implicitly obligor risk which is primarily a bank/financial institution risk. The forfeiter deducts interest (in form of discount) and pays the residual proceeds to you on non-recourse basis

How it works: You ship goods/provide services as per contract and submit necessary documentation to India Factoring/India Factorings Bankers. Trade documents are transmitted to importers bank for acceptance and/or assignment of proceeds to India Factoring. On receipt of such confirmation India Factoring pays discounted proceeds to yourself on a non-recourse basis India Factoring assumes payment risk of the importers Bank. Benefits Forfaiting eliminates risks(Political, transfer and commercial risk) Improves cash flow by providing ready liquidity against transactional documents. Forfaiting allows you to discount Long term debts also.

Advisory Services

Fund Raising: Our experienced team of corporate finance professionals also provides advisory services to assist you in your fund raising activities through debt syndication, private equity placements, mergers & acquisitions and strategic tie ups. Debt Collection:

Our dedicated team of debt recovery specialists can assist in timely follow up with your debtors and facilitate in the collections process thus enabling to you focus on your core business.

Structured Finance

To ensure financially efficient supply chains and sales channels, structured lending programs to meet the ongoing working capital requirements of your suppliers and dealers for their transactions done with you can be customized to suit your level of financial participation in the structure while at the same time ensuring liquidity on your transactions with your vendors / channels.

1. Supply Chain Programs Successful companies realize that managing their supply chains efficiently is a great deal of competitive advantage. Ensuring that your partners have adequate access to steady financing on competitive terms will enable them to meet production schedules set as per the purchase agreements. Under these programs individual limits of your vendors would be set and subsequent invoices raised by them once approved by you would be financed by us. Subsequently depending on the credit period set, the invoices would be collected from you. 2. Dealer financing programs Growing sales through in through dealer / distribution channel would work only if the channel partner has sufficient liquidity to maintain stock to meet increased demand. Through our dealer funding programs, the dealers are individually assessed and separate limits set under which invoices raised by you can be financed upfront.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Report For Tomato Processing PlantDocument2 pagesProject Report For Tomato Processing PlantRajib Deb100% (2)

- Brio UK Lit Dec 2007Document8 pagesBrio UK Lit Dec 2007Neil HoggNo ratings yet

- BCHEDocument3 pagesBCHERolando AmadNo ratings yet

- Polyhydraminos and OligohydraminosDocument11 pagesPolyhydraminos and OligohydraminosMelissa Catherine ChinNo ratings yet

- Guidance For Plant Engineers StaticelectricityDocument9 pagesGuidance For Plant Engineers Staticelectricityimamers100% (2)

- AR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingDocument168 pagesAR 2020 Akasha Wira International TBK Rev 828-06-2021e ReportingYati Nurul HashfiNo ratings yet

- Microsoft Word - Prachi Khanna ResumeDocument1 pageMicrosoft Word - Prachi Khanna Resumeapi-333768733No ratings yet

- Print For ChrysoberylDocument2 pagesPrint For ChrysoberylToh Yang75% (4)

- Parenting Style in Pediatric Dentistry PDFDocument7 pagesParenting Style in Pediatric Dentistry PDFJude Aldo PaulNo ratings yet

- Pressure Vessel Ansys 2Document13 pagesPressure Vessel Ansys 2Bruna Macedo100% (1)

- Y2 Series: Three Phase Cast Iron MotorDocument4 pagesY2 Series: Three Phase Cast Iron MotorMark Christian TorresNo ratings yet

- Work Program For RoadsDocument8 pagesWork Program For RoadsSupun KariyawasamNo ratings yet

- Cicilline 14th Amd Bill TextDocument28 pagesCicilline 14th Amd Bill TextAnonymous GF8PPILW5No ratings yet

- Texto - Banting DietDocument33 pagesTexto - Banting Diettmendes00No ratings yet

- Tourniquet Conversion Drew JSOM Fall 2015 Edition-2Document5 pagesTourniquet Conversion Drew JSOM Fall 2015 Edition-2Oleg ShubinNo ratings yet

- Grade 10 English Achievement TestDocument4 pagesGrade 10 English Achievement TestJelaica Alarilla - GerminoNo ratings yet

- Marcus Deon Smith - Letter To Dept of Justice - Pattern and Practice InvestigationDocument6 pagesMarcus Deon Smith - Letter To Dept of Justice - Pattern and Practice InvestigationHashim WarrenNo ratings yet

- Climate Change Impact at Three Different Scales of Biological Diversity: A Holistic Review of Research Findings From Across The GlobeDocument7 pagesClimate Change Impact at Three Different Scales of Biological Diversity: A Holistic Review of Research Findings From Across The GlobeIJAR JOURNALNo ratings yet

- DEPUTI 4 - Bicara Bumi Mangrove Indonesia Untuk Dunia, Praktik Terbaik Pengelolaan MangroveDocument4 pagesDEPUTI 4 - Bicara Bumi Mangrove Indonesia Untuk Dunia, Praktik Terbaik Pengelolaan MangroveSamuel RahalusNo ratings yet

- General: Technical Data TAD1641GEDocument9 pagesGeneral: Technical Data TAD1641GEBill CastilloNo ratings yet

- Short Procedure Engineering Chemistry SASTRA UniversityDocument13 pagesShort Procedure Engineering Chemistry SASTRA UniversitystarNo ratings yet

- Perbandingan Metode Klamp Dan Lem Terhadap Penyembuhan Luka Pasca Sirkumsisi Pada AnakDocument6 pagesPerbandingan Metode Klamp Dan Lem Terhadap Penyembuhan Luka Pasca Sirkumsisi Pada Anaknanang prasetyoNo ratings yet

- Materials Engg-4Document25 pagesMaterials Engg-4udayrajput253No ratings yet

- SS DM MCH 2020 - 2021 Schedule Nov 6th Update PDFDocument32 pagesSS DM MCH 2020 - 2021 Schedule Nov 6th Update PDFlakshminivas PingaliNo ratings yet

- Worksheet For Chemical BondingDocument2 pagesWorksheet For Chemical Bondingaaradhyajain2106No ratings yet

- T.E Question Papers (2012 Pattern) May 2015Document297 pagesT.E Question Papers (2012 Pattern) May 2015Prof. Avinash MahaleNo ratings yet

- Post Incident Damage Assessment ChecklistDocument9 pagesPost Incident Damage Assessment ChecklistFerdinand M. TurbanosNo ratings yet

- The Dancers by Alberto Florentino PDFDocument10 pagesThe Dancers by Alberto Florentino PDFJon Philip GarciaNo ratings yet

- Nursing Care Plan For A Person With Croup Nursing DiagnosisDocument2 pagesNursing Care Plan For A Person With Croup Nursing DiagnosisMonica Rivera100% (1)

- Energy ConservationDocument3 pagesEnergy ConservationakifliaqatNo ratings yet