Professional Documents

Culture Documents

Time Allowed: 1 Hours Attempt All The Questions

Time Allowed: 1 Hours Attempt All The Questions

Uploaded by

mosesmawangaCopyright:

Available Formats

You might also like

- Tutorial QuestionsDocument19 pagesTutorial QuestionsTan Ngoc TranNo ratings yet

- FR QM - Section B PDFDocument74 pagesFR QM - Section B PDFRishi KumaarNo ratings yet

- CE 22 - Engineering EconomyDocument2 pagesCE 22 - Engineering EconomyLenard PunzalNo ratings yet

- Obsolescence 2. Book Value 3. Depreciation 4. Depletion EtcDocument9 pagesObsolescence 2. Book Value 3. Depreciation 4. Depletion EtcKHAN AQSANo ratings yet

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- Economics For Engineers Model QuestionsDocument16 pagesEconomics For Engineers Model QuestionsNaman KumarNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Problem 12-1aDocument8 pagesProblem 12-1aJose Ramon AlemanNo ratings yet

- Study Set 5Document8 pagesStudy Set 5slnyzclrNo ratings yet

- HW 2 Set 1 KeysDocument7 pagesHW 2 Set 1 KeysIan SdfuhNo ratings yet

- MGTS 301 2018 PDFDocument5 pagesMGTS 301 2018 PDFsubash shresthaNo ratings yet

- Finance 3Document10 pagesFinance 3Jesfer Averie ManarangNo ratings yet

- Assignment 2Document2 pagesAssignment 2Parth ShahNo ratings yet

- IAS16 - PPE - ExercisesDocument5 pagesIAS16 - PPE - Exercises21125244No ratings yet

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentyosefNo ratings yet

- 06 Comparing AlternativesDocument17 pages06 Comparing AlternativesReiVanNo ratings yet

- Groups Assignment EcoDocument4 pagesGroups Assignment Ecorobel pop100% (1)

- Chapter 2 Engineering Costs and Cost EstimatingDocument2 pagesChapter 2 Engineering Costs and Cost EstimatingDipanjan BhattacharyaNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- EEE May 12Document7 pagesEEE May 12Kah Wai TeowNo ratings yet

- Engineering Economy Quiz1Document4 pagesEngineering Economy Quiz1Pyron Ed Daniel SamaritaNo ratings yet

- Worksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedDocument10 pagesWorksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedkalNo ratings yet

- Bab 9Document26 pagesBab 9Saravanan MathiNo ratings yet

- MGTS 301 Feb 16, 2014Document10 pagesMGTS 301 Feb 16, 2014subash shrestha100% (1)

- MGTS 301 2014Document8 pagesMGTS 301 2014Utsav PathakNo ratings yet

- Financial Management - Capital BudgetDocument8 pagesFinancial Management - Capital BudgetDr Rushen SinghNo ratings yet

- Answer To DAF GakenkeDocument22 pagesAnswer To DAF GakenkebomujykijaNo ratings yet

- IENG 302 Lecture 08modDocument15 pagesIENG 302 Lecture 08modJohnalbert L. SibullenNo ratings yet

- Engineering Economy HW-5 SpringDocument2 pagesEngineering Economy HW-5 SpringPantatNyanehBurikNo ratings yet

- Replacement Analysis: SolutionDocument10 pagesReplacement Analysis: Solutionthawatchai112225120% (1)

- ISE211 Chapter4SSand5FallDocument37 pagesISE211 Chapter4SSand5FallV GozeNo ratings yet

- POA 2008 ZA + ZB CommentariesDocument28 pagesPOA 2008 ZA + ZB CommentariesEmily TanNo ratings yet

- Economic Exam 2019Document3 pagesEconomic Exam 2019Abuzeid Ahmed AliNo ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- PlantDocument20 pagesPlantfrankizzta0% (3)

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Document7 pagesWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- Worksheet Managerial EconDocument3 pagesWorksheet Managerial EconMihret AssefaNo ratings yet

- 11CH8DHSS2Document4 pages11CH8DHSS2Pranit SonthaliaNo ratings yet

- Decisions Under CertaintyDocument23 pagesDecisions Under CertaintyJom Ancheta Bautista100% (1)

- Accounting: Budgetary Control and Decision MakingDocument53 pagesAccounting: Budgetary Control and Decision MakingCherry YiNo ratings yet

- Spring2022 (July) Exam-Fin Part2Document4 pagesSpring2022 (July) Exam-Fin Part2Ahmed TharwatNo ratings yet

- Process Econ S1 2021 Evaluation of Alternatives Wk14Document16 pagesProcess Econ S1 2021 Evaluation of Alternatives Wk14Farhan MuhamadNo ratings yet

- Quiz 3Document4 pagesQuiz 3gautam_hariharanNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- Chapter 2 - Tutorial - W.R. Economy Management (2017-2018)Document4 pagesChapter 2 - Tutorial - W.R. Economy Management (2017-2018)Pesar BawaniNo ratings yet

- 14-EC-1 - Version Anglaise - Novembre 2014Document6 pages14-EC-1 - Version Anglaise - Novembre 2014LuisAranaNo ratings yet

- Assignment 4Document4 pagesAssignment 4PrashanthRameshNo ratings yet

- Tutorial Sheet 2Document2 pagesTutorial Sheet 2siamesamuel229No ratings yet

- Cash Flow Estimation Problem SetDocument6 pagesCash Flow Estimation Problem SetmehdiNo ratings yet

- Economics SolvingDocument8 pagesEconomics Solvingchoddobesh01No ratings yet

- Examples and ProblemsDocument4 pagesExamples and ProblemsPaul AounNo ratings yet

- Finals Sa1: Depreciation and Depletion: MC TheoryDocument8 pagesFinals Sa1: Depreciation and Depletion: MC TheoryShaina NavaNo ratings yet

- Topic 9Document18 pagesTopic 9SUREINTHARAAN A/L NATHAN / UPMNo ratings yet

- Previous Assignment 2Document2 pagesPrevious Assignment 2marryam nawazNo ratings yet

- Investment Alternative Selection MethodsDocument24 pagesInvestment Alternative Selection MethodsScribdTranslationsNo ratings yet

- Chapter 3 Property Plant and Equipment 2023 8 24 9 48 25Document12 pagesChapter 3 Property Plant and Equipment 2023 8 24 9 48 25vchandy22No ratings yet

- District Cooling in the People's Republic of China: Status and Development PotentialFrom EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNo ratings yet

Time Allowed: 1 Hours Attempt All The Questions

Time Allowed: 1 Hours Attempt All The Questions

Uploaded by

mosesmawangaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Time Allowed: 1 Hours Attempt All The Questions

Time Allowed: 1 Hours Attempt All The Questions

Uploaded by

mosesmawangaCopyright:

Available Formats

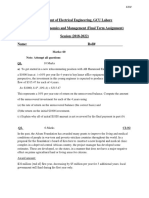

MAKERERE UNIVERSITY DEPARTMENT OF CHEMISTRY BIC II TEST I

COURSE: ICH 2219 DATE: May, 2012 LECTURER: MR. M.MAWANGA/ MR. G.W. MUBIRU

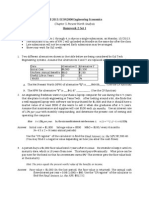

TIME ALLOWED: 1 1 2 HOURS ATTEMPT ALL THE QUESTIONS 1. Explain, with relevant examples, the following economic terms a) Payback period b) Cash flow c) Sales income d) Internal Rate of Return e) Optimal replacement period. 2. a) Explain what you understand by the term Capitalized costs and derive the relevant equations. b) A new storage tank can be purchased and installed for $10,000. This tank would last for 10 years. A worn-out storage tank of capacity equivalent to the new tank is available and it has been proposed to repair the old tank instead of buying a new one. If the tank were repaired, it would have a useful life of 3 years before the same type of repairs would be needed again. Neither tank has any scrap value. Money is worth 9% if compounded annually. If both tanks have equivalent capitalized costs, how much can be spent for repairing the existing tank. 2. Calculate the Net present value of the project of which details are given below. The Project Consideration is being given to a plant which is expected to be replaced by a smaller one in five years time. The required investment is $ 80,000 for equipment (which qualifies for a 30% grant) and $ 40,000 for working capital (which does not). Grants are received and taxes are payable one year after the period they belong. The salvage value receivable in year 6 is expected to be $8,000. Company tax is 30%. Assume straight line depreciation for tax purposes. The gross profit, before taxation or depreciation and discount factors are: Year (n) Gross profit 1/(1 + i)n 1 9,000 0.9091 2 13,000 0.8264 3 21,000 0.7513 4 33,000 0.6830 5 37,000 0.6209 6 0.5645

You might also like

- Tutorial QuestionsDocument19 pagesTutorial QuestionsTan Ngoc TranNo ratings yet

- FR QM - Section B PDFDocument74 pagesFR QM - Section B PDFRishi KumaarNo ratings yet

- CE 22 - Engineering EconomyDocument2 pagesCE 22 - Engineering EconomyLenard PunzalNo ratings yet

- Obsolescence 2. Book Value 3. Depreciation 4. Depletion EtcDocument9 pagesObsolescence 2. Book Value 3. Depreciation 4. Depletion EtcKHAN AQSANo ratings yet

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- Economics For Engineers Model QuestionsDocument16 pagesEconomics For Engineers Model QuestionsNaman KumarNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Problem 12-1aDocument8 pagesProblem 12-1aJose Ramon AlemanNo ratings yet

- Study Set 5Document8 pagesStudy Set 5slnyzclrNo ratings yet

- HW 2 Set 1 KeysDocument7 pagesHW 2 Set 1 KeysIan SdfuhNo ratings yet

- MGTS 301 2018 PDFDocument5 pagesMGTS 301 2018 PDFsubash shresthaNo ratings yet

- Finance 3Document10 pagesFinance 3Jesfer Averie ManarangNo ratings yet

- Assignment 2Document2 pagesAssignment 2Parth ShahNo ratings yet

- IAS16 - PPE - ExercisesDocument5 pagesIAS16 - PPE - Exercises21125244No ratings yet

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentyosefNo ratings yet

- 06 Comparing AlternativesDocument17 pages06 Comparing AlternativesReiVanNo ratings yet

- Groups Assignment EcoDocument4 pagesGroups Assignment Ecorobel pop100% (1)

- Chapter 2 Engineering Costs and Cost EstimatingDocument2 pagesChapter 2 Engineering Costs and Cost EstimatingDipanjan BhattacharyaNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- EEE May 12Document7 pagesEEE May 12Kah Wai TeowNo ratings yet

- Engineering Economy Quiz1Document4 pagesEngineering Economy Quiz1Pyron Ed Daniel SamaritaNo ratings yet

- Worksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedDocument10 pagesWorksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedkalNo ratings yet

- Bab 9Document26 pagesBab 9Saravanan MathiNo ratings yet

- MGTS 301 Feb 16, 2014Document10 pagesMGTS 301 Feb 16, 2014subash shrestha100% (1)

- MGTS 301 2014Document8 pagesMGTS 301 2014Utsav PathakNo ratings yet

- Financial Management - Capital BudgetDocument8 pagesFinancial Management - Capital BudgetDr Rushen SinghNo ratings yet

- Answer To DAF GakenkeDocument22 pagesAnswer To DAF GakenkebomujykijaNo ratings yet

- IENG 302 Lecture 08modDocument15 pagesIENG 302 Lecture 08modJohnalbert L. SibullenNo ratings yet

- Engineering Economy HW-5 SpringDocument2 pagesEngineering Economy HW-5 SpringPantatNyanehBurikNo ratings yet

- Replacement Analysis: SolutionDocument10 pagesReplacement Analysis: Solutionthawatchai112225120% (1)

- ISE211 Chapter4SSand5FallDocument37 pagesISE211 Chapter4SSand5FallV GozeNo ratings yet

- POA 2008 ZA + ZB CommentariesDocument28 pagesPOA 2008 ZA + ZB CommentariesEmily TanNo ratings yet

- Economic Exam 2019Document3 pagesEconomic Exam 2019Abuzeid Ahmed AliNo ratings yet

- Financial Management Assg-1Document6 pagesFinancial Management Assg-1Udhay ShankarNo ratings yet

- PlantDocument20 pagesPlantfrankizzta0% (3)

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Document7 pagesWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- Worksheet Managerial EconDocument3 pagesWorksheet Managerial EconMihret AssefaNo ratings yet

- 11CH8DHSS2Document4 pages11CH8DHSS2Pranit SonthaliaNo ratings yet

- Decisions Under CertaintyDocument23 pagesDecisions Under CertaintyJom Ancheta Bautista100% (1)

- Accounting: Budgetary Control and Decision MakingDocument53 pagesAccounting: Budgetary Control and Decision MakingCherry YiNo ratings yet

- Spring2022 (July) Exam-Fin Part2Document4 pagesSpring2022 (July) Exam-Fin Part2Ahmed TharwatNo ratings yet

- Process Econ S1 2021 Evaluation of Alternatives Wk14Document16 pagesProcess Econ S1 2021 Evaluation of Alternatives Wk14Farhan MuhamadNo ratings yet

- Quiz 3Document4 pagesQuiz 3gautam_hariharanNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- Chapter 2 - Tutorial - W.R. Economy Management (2017-2018)Document4 pagesChapter 2 - Tutorial - W.R. Economy Management (2017-2018)Pesar BawaniNo ratings yet

- 14-EC-1 - Version Anglaise - Novembre 2014Document6 pages14-EC-1 - Version Anglaise - Novembre 2014LuisAranaNo ratings yet

- Assignment 4Document4 pagesAssignment 4PrashanthRameshNo ratings yet

- Tutorial Sheet 2Document2 pagesTutorial Sheet 2siamesamuel229No ratings yet

- Cash Flow Estimation Problem SetDocument6 pagesCash Flow Estimation Problem SetmehdiNo ratings yet

- Economics SolvingDocument8 pagesEconomics Solvingchoddobesh01No ratings yet

- Examples and ProblemsDocument4 pagesExamples and ProblemsPaul AounNo ratings yet

- Finals Sa1: Depreciation and Depletion: MC TheoryDocument8 pagesFinals Sa1: Depreciation and Depletion: MC TheoryShaina NavaNo ratings yet

- Topic 9Document18 pagesTopic 9SUREINTHARAAN A/L NATHAN / UPMNo ratings yet

- Previous Assignment 2Document2 pagesPrevious Assignment 2marryam nawazNo ratings yet

- Investment Alternative Selection MethodsDocument24 pagesInvestment Alternative Selection MethodsScribdTranslationsNo ratings yet

- Chapter 3 Property Plant and Equipment 2023 8 24 9 48 25Document12 pagesChapter 3 Property Plant and Equipment 2023 8 24 9 48 25vchandy22No ratings yet

- District Cooling in the People's Republic of China: Status and Development PotentialFrom EverandDistrict Cooling in the People's Republic of China: Status and Development PotentialNo ratings yet