Professional Documents

Culture Documents

Space Matrix

Space Matrix

Uploaded by

Omar SabryOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Space Matrix

Space Matrix

Uploaded by

Omar SabryCopyright:

Available Formats

Space Martix for Nokia

Financial Position Return on Investment Financial and Operating Leverage Liquidity Working Capital Cash Flows Average 3 2 1 5 2 2.60 Environmental Position Technological Changes Inflation Demand Elsticity Competitor's Price Ranges Barriers to Entery Competitive Pressure Ease of Exit Price Elasticity of Demand Risk Exposure Average Industry Position Growth Potential Profit Potential Financial Stability Resources Availability Ease of Entry Capacity Utilization Average -2 -5 -6 -2 -3 -4 -1 -6 -6 3.89-

Competitive Position Market Share Quality Product Life Cycle Concumer Preference Technological Innovation Sound Supply Chain Average Financial Position Environmental Position Competitive Position Industry Position

-3 -5 -6 -1 -3 -2 3.332.60 3.893.332.83 x 0.50y 1.29-

4 3 6 1 2 1 2.83

Space Matrix

FP

6

Conservative

5 4 3 2 1

Aggressive

CP

654321123-

IP

4-

Defensive

56-

Competitive

EP

Nokia Should Pursue Defensive Strategies

By: Omar Elokda

You might also like

- Strategic Management/ Business Policy: Slides 2 Industry AnalysisDocument41 pagesStrategic Management/ Business Policy: Slides 2 Industry AnalysisballadnaNo ratings yet

- Process Control in Metallurgical Plants: Towards OperationalDocument48 pagesProcess Control in Metallurgical Plants: Towards Operationalquinteroudina50% (2)

- Space Matrix P& GDocument1 pageSpace Matrix P& GSam BaseetNo ratings yet

- Space and Grand Matrix Applied To Courier IndustryDocument8 pagesSpace and Grand Matrix Applied To Courier IndustryMaliha KhanNo ratings yet

- Strategic Position and Action EvaluationDocument2 pagesStrategic Position and Action EvaluationAldo SitumorangNo ratings yet

- Flcs Fault Tolerant DesignsDocument265 pagesFlcs Fault Tolerant DesignsrodericNo ratings yet

- Mohamed 2018 IOP Conf. Ser. Mater. Sci. Eng. 328 012033 PDFDocument11 pagesMohamed 2018 IOP Conf. Ser. Mater. Sci. Eng. 328 012033 PDFTam Jun HuiNo ratings yet

- Shell: Section 3.4 - Petrochemical NanotechnologyDocument16 pagesShell: Section 3.4 - Petrochemical NanotechnologyTej InderNo ratings yet

- Digitizing Oil and Gas ProductionDocument7 pagesDigitizing Oil and Gas ProductionTural100% (1)

- Global Hedge Fund PlatformDocument10 pagesGlobal Hedge Fund PlatformThanasisKakalisNo ratings yet

- Space MatrixDocument6 pagesSpace MatrixguiaNo ratings yet

- Statistical Analysis of Cement IndustryDocument10 pagesStatistical Analysis of Cement IndustryEr Shafique Gajdhar100% (1)

- Offshore SIM Report Content6Document13 pagesOffshore SIM Report Content6David SeowNo ratings yet

- G3 Mine Productivity Undergroun IBS Mine Maintenance Management 1Document53 pagesG3 Mine Productivity Undergroun IBS Mine Maintenance Management 1Christian AraojoNo ratings yet

- COP Advanced Manf TechDocument3 pagesCOP Advanced Manf TechBeema ThangarajanNo ratings yet

- Article Presentation - Supply Chain FlexibilityDocument8 pagesArticle Presentation - Supply Chain FlexibilityIshan KatyalNo ratings yet

- BCG MatrixDocument8 pagesBCG MatrixAsh ZafarNo ratings yet

- COM2014 PAPERID-8565Thwaites ProtectedDocument44 pagesCOM2014 PAPERID-8565Thwaites ProtectedmineralmadnessNo ratings yet

- May 2016 - International PDFDocument104 pagesMay 2016 - International PDFBánh Cuốn Tôm ThịtNo ratings yet

- Artikel 1 MethodologyDocument9 pagesArtikel 1 MethodologyWouter van KranenburgNo ratings yet

- ObsCPMT PDFDocument14 pagesObsCPMT PDFrocaoNo ratings yet

- Acmr Pitch DeckDocument8 pagesAcmr Pitch Deckapi-523877663No ratings yet

- Applied Soft Computing: Chen-Fu Chien, Runliang Dou, Wenhan FuDocument10 pagesApplied Soft Computing: Chen-Fu Chien, Runliang Dou, Wenhan FuCESARPINEDANo ratings yet

- Intro To DMAICDocument40 pagesIntro To DMAICjvanandhNo ratings yet

- MGT 613 Final Term 13 PapersDocument141 pagesMGT 613 Final Term 13 PapersKamran HaiderNo ratings yet

- Study Upstream Oilfield MachineryDocument1 pageStudy Upstream Oilfield MachineryCarlos LoboNo ratings yet

- GPAllied Failure Mechanisms PUBLICDocument2 pagesGPAllied Failure Mechanisms PUBLICnnandhaNo ratings yet

- C6 STMDocument23 pagesC6 STMPratyush BaruaNo ratings yet

- BakerHughes Mining Whitepaper EducationDocument10 pagesBakerHughes Mining Whitepaper EducationCURIBENo ratings yet

- Oscm TeaDocument8 pagesOscm TeaYashaswi ChourasiaNo ratings yet

- Strategic Response To Liberalization: Dr.M.ThenmozhiDocument19 pagesStrategic Response To Liberalization: Dr.M.ThenmozhiDheerajNo ratings yet

- 3 BCM MethodologyDocument59 pages3 BCM Methodologyivans2009100% (1)

- Strategic Response To Liberalization: Dr.M.ThenmozhiDocument19 pagesStrategic Response To Liberalization: Dr.M.ThenmozhijageshwariNo ratings yet

- Cee 1Document14 pagesCee 1Abdullah RamzanNo ratings yet

- 02 02 1Document19 pages02 02 1ashenafi solomonNo ratings yet

- EH&S Management Presentation South AmericaDocument24 pagesEH&S Management Presentation South AmericaNorberto Diaz DuarteNo ratings yet

- ARC White Paper HIMax May09Document16 pagesARC White Paper HIMax May09Andy Kong KingNo ratings yet

- SWOT AnalysisDocument1 pageSWOT AnalysisMohammad Rysul IslamNo ratings yet

- Kratos October 2020Document13 pagesKratos October 2020flateric74@yandex.ruNo ratings yet

- Flexible Supply Chain StrategiesDocument39 pagesFlexible Supply Chain Strategiesn0kkiesNo ratings yet

- Optimal Approaches To Drilling Technology DevelopmentDocument5 pagesOptimal Approaches To Drilling Technology DevelopmentAli HosseiniNo ratings yet

- SMSLandscape CASE2015Document9 pagesSMSLandscape CASE2015Leonardo DanielliNo ratings yet

- Douglas M. Considine, S.D. Ross-Handbook of Applied Insrumentation-McGraw-Hill Book Company (1964)Document9 pagesDouglas M. Considine, S.D. Ross-Handbook of Applied Insrumentation-McGraw-Hill Book Company (1964)Abinash KrNo ratings yet

- Industry C&P Week1 Assignment1Document5 pagesIndustry C&P Week1 Assignment1Sachin MatkarNo ratings yet

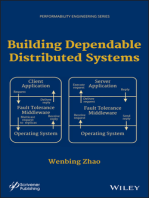

- MOBOOK6474Document517 pagesMOBOOK6474Huy KtđnNo ratings yet

- Control in GrindingDocument4 pagesControl in GrindingalnemangiNo ratings yet

- UTM061001Document56 pagesUTM061001AkoKhalediNo ratings yet

- Remote Operations Centres - Lessons From Other Industries: October 2007Document19 pagesRemote Operations Centres - Lessons From Other Industries: October 2007Commence NkomoNo ratings yet

- The Future of Mining Is Safer Smarter and SustainableDocument14 pagesThe Future of Mining Is Safer Smarter and SustainableAlbertus DickyNo ratings yet

- Safe Rapid Development Through The Application ofDocument23 pagesSafe Rapid Development Through The Application ofFabio OliveiraNo ratings yet

- Event IPMT2010Document12 pagesEvent IPMT2010amitsh20072458No ratings yet

- Technology Planning: Dr. Md. Ariful Islam Associate Professor Dept. of IPEDocument32 pagesTechnology Planning: Dr. Md. Ariful Islam Associate Professor Dept. of IPEDewan HasanNo ratings yet

- Technology For Drilling EfficiencyDocument8 pagesTechnology For Drilling Efficiencysaa6383No ratings yet

- Deloitte Uk Future of Post TradeDocument12 pagesDeloitte Uk Future of Post Tradesushantshewale46No ratings yet

- Albright PortfolioDocument17 pagesAlbright PortfoliosamlundNo ratings yet

- Challenges in Supply Chain Management in Upstream Sector of Oil and Gas IndustryDocument18 pagesChallenges in Supply Chain Management in Upstream Sector of Oil and Gas IndustryHelton DiasNo ratings yet

- Production Automation in The 21st Century:Opportunities For Production Optimization and Remote Unattended OperationsDocument6 pagesProduction Automation in The 21st Century:Opportunities For Production Optimization and Remote Unattended OperationsHajji Assamo PadilNo ratings yet

- CASP+ CompTIA Advanced Security Practitioner Study Guide: Exam CAS-004From EverandCASP+ CompTIA Advanced Security Practitioner Study Guide: Exam CAS-004No ratings yet