Professional Documents

Culture Documents

Management-Policy-Irda-Tells-Insurers/444925/ Progress of Banking in India

Management-Policy-Irda-Tells-Insurers/444925/ Progress of Banking in India

Uploaded by

Gaurav SawlaniCopyright:

Available Formats

You might also like

- CAIIB Syllabus - Advanced Bank ManagementDocument19 pagesCAIIB Syllabus - Advanced Bank ManagementAshwin KGNo ratings yet

- Bank Management - Bms - NewDocument2 pagesBank Management - Bms - NewRajendra LamsalNo ratings yet

- 4.36 M.com Banking & FinanceDocument18 pages4.36 M.com Banking & FinancegoodwynjNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Semester: III Finance Specialisation: Recommended BooksDocument12 pagesSemester: III Finance Specialisation: Recommended Booksshivaraj p yNo ratings yet

- Banking & Insurance ManagementDocument2 pagesBanking & Insurance ManagementVishal Mandowara100% (1)

- Credit AnalysisDocument15 pagesCredit Analysisetebark h/michale100% (1)

- Session Plan - Banking - Class of 2022Document6 pagesSession Plan - Banking - Class of 2022ZeusNo ratings yet

- CAIIB Syllabus - Advanced Bank ManagementDocument19 pagesCAIIB Syllabus - Advanced Bank Managementmirhina786No ratings yet

- Mba 410: Commercial Banking Credit Units: 03 Course ObjectivesDocument6 pagesMba 410: Commercial Banking Credit Units: 03 Course ObjectivesakmohideenNo ratings yet

- The Topics Covered Under The Syllabus of Advance Bank Management As Per The CAIIB Syllabus 2020 Are As Given BelowDocument7 pagesThe Topics Covered Under The Syllabus of Advance Bank Management As Per The CAIIB Syllabus 2020 Are As Given BelowCBS CKSBNo ratings yet

- R LearninDocument4 pagesR Learningaurav anandNo ratings yet

- Banking - Theory and Practices 18MBAFM31-1Document88 pagesBanking - Theory and Practices 18MBAFM31-1Nandeep Hêãrtrøbbér50% (2)

- Syllabus For BankingDocument15 pagesSyllabus For BankingAnil NamosheNo ratings yet

- Sem I and II Banking and Finance Syllabus A.Y. 2021 22Document33 pagesSem I and II Banking and Finance Syllabus A.Y. 2021 22Sayyed Muhammad MustafahNo ratings yet

- Banking Theory and PracticeDocument1 pageBanking Theory and Practiceshivarajungeetha4048No ratings yet

- SyllabusDocument8 pagesSyllabusyamumini07100% (1)

- FD 603 Management of Financial Institutions 61017910Document3 pagesFD 603 Management of Financial Institutions 61017910Deepali BansalNo ratings yet

- Credit Risk Management AT Punjab National BankDocument4 pagesCredit Risk Management AT Punjab National BankSahil SethiNo ratings yet

- Syllabus Aug 2022 NHTM 2Document10 pagesSyllabus Aug 2022 NHTM 2Dương Thuỳ TrangNo ratings yet

- SyllabusDocument3 pagesSyllabusAmu AmuthaNo ratings yet

- Credit Management IntroductionDocument1 pageCredit Management IntroductionVanshika Deepak BaharaniNo ratings yet

- Practice Banking SyllabusDocument2 pagesPractice Banking SyllabusSrinivas GowdaNo ratings yet

- Indian Institute of Banking & Finance: CAIIB SyllabusDocument15 pagesIndian Institute of Banking & Finance: CAIIB Syllabusveeresh2907No ratings yet

- Principles and Practices of BankingDocument2 pagesPrinciples and Practices of BankingPuja DuaNo ratings yet

- BMT6134 - Risk-Management-In-Banks - TH - 1.0 - 55 - BMT6134 - 54 AcpDocument2 pagesBMT6134 - Risk-Management-In-Banks - TH - 1.0 - 55 - BMT6134 - 54 AcpchrisNo ratings yet

- CAIIBITDocument27 pagesCAIIBITMLastTryNo ratings yet

- Lecture PlanDocument3 pagesLecture Plandipono6356No ratings yet

- Banking and Finance Subject Code Subjects L T P CDocument10 pagesBanking and Finance Subject Code Subjects L T P Cshanti priyaNo ratings yet

- Credit RiskDocument30 pagesCredit RiskVineeta HNo ratings yet

- Commercial Banking Credit Units: 03 Course ObjectivesDocument2 pagesCommercial Banking Credit Units: 03 Course ObjectivesAman DhawanNo ratings yet

- Banking FinalDocument5 pagesBanking FinalAks MaroNo ratings yet

- Banking Law & Practice OrientationDocument3 pagesBanking Law & Practice OrientationSravan SNo ratings yet

- Credit Risk ManagementDocument92 pagesCredit Risk ManagementVenkatesh NANo ratings yet

- Caiib Exam Syllabus 2021Document4 pagesCaiib Exam Syllabus 2021senthil kumar nNo ratings yet

- Sem VI Paper No. BC 6.1 B Banking and InsuranceDocument3 pagesSem VI Paper No. BC 6.1 B Banking and InsurancekumarsonigulsnNo ratings yet

- Corporate BankingDocument122 pagesCorporate Bankingrohan2788No ratings yet

- 3rd Sem - 1Document31 pages3rd Sem - 1EshanMishraNo ratings yet

- Risk Management in Commercial BanksDocument37 pagesRisk Management in Commercial BanksRavi DepaniNo ratings yet

- Asset and Liability Management in BanksDocument73 pagesAsset and Liability Management in Bankslaser544100% (2)

- Commercial BankingDocument2 pagesCommercial BankingGajendra JaiswalNo ratings yet

- BComHons Sem V Syllabus CBCS 2017Document15 pagesBComHons Sem V Syllabus CBCS 2017Anoushka HarkarNo ratings yet

- Banking and Finance: Bharathiar University: Coimbatore - 641 046Document7 pagesBanking and Finance: Bharathiar University: Coimbatore - 641 046Aswathy S RNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- Asset Liability Management in Banks in India: Doctorate IN Business AdministrationDocument240 pagesAsset Liability Management in Banks in India: Doctorate IN Business AdministrationNIMMANAGANTI RAMAKRISHNANo ratings yet

- Banking and Insurance SyllabusDocument3 pagesBanking and Insurance SyllabusnanakethanNo ratings yet

- Ba8c3banking and Financial InstitutionsDocument1 pageBa8c3banking and Financial InstitutionsAyush ChhabraNo ratings yet

- Canara Bank Accounting SynopsisDocument3 pagesCanara Bank Accounting Synopsiskapil sharmaNo ratings yet

- 3 - Banking Theory and PracticesDocument3 pages3 - Banking Theory and PracticesJunaid MalicNo ratings yet

- Third Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementDocument58 pagesThird Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementsukeshNo ratings yet

- Syllabus 2020-22 FINTECHDocument58 pagesSyllabus 2020-22 FINTECHsukeshNo ratings yet

- A Study of Credit Risk ManagementDocument60 pagesA Study of Credit Risk ManagementPrince Satish Reddy100% (2)

- Sujal Project BlackbookDocument44 pagesSujal Project Blackbooksujal1utekarNo ratings yet

- Leasing-Concept and Development of Leasing, BusinessDocument3 pagesLeasing-Concept and Development of Leasing, BusinessFarooque HereNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- The Practice of Lending: A Guide to Credit Analysis and Credit RiskFrom EverandThe Practice of Lending: A Guide to Credit Analysis and Credit RiskNo ratings yet

- Developing, Validating and Using Internal Ratings: Methodologies and Case StudiesFrom EverandDeveloping, Validating and Using Internal Ratings: Methodologies and Case StudiesNo ratings yet

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskFrom EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskRating: 3.5 out of 5 stars3.5/5 (1)

Management-Policy-Irda-Tells-Insurers/444925/ Progress of Banking in India

Management-Policy-Irda-Tells-Insurers/444925/ Progress of Banking in India

Uploaded by

Gaurav SawlaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management-Policy-Irda-Tells-Insurers/444925/ Progress of Banking in India

Management-Policy-Irda-Tells-Insurers/444925/ Progress of Banking in India

Uploaded by

Gaurav SawlaniCopyright:

Available Formats

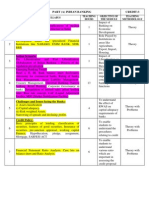

Module Three: Title Contents Risk Management in Banking Marketing and Distributions channels Risk Management, NPA Management,

Asset Liability Management, Managing Credit, Liquidity & Interest rate risk, Managing Risk with loan sales and Securitization T1 Ch 21,22,24 T2 Ch 12,14,15 T3 Ch- 11,12 IGNOU Material in Readings ALM & NPA Based Practical Problems 10 Groups of 3 students each will be made. The groups will be required do a GAP Analysis of the Banks assigned On the Assignment Mentioned above and Current Affair Related to Banking Asset Liability System in Banks RBI Guidelines Asset liability Management in Indian Banking Industry with Special Reference to Interest Rate Risk Management in ICICI Bank, Dr. B Charumathi, World Congress on Engineering, 2008, Vol II An Analysis of Asset Liability Management in Indian Banks, Dash Mihir, Venkatesh, Bhargav BD, SSRN Risk Management in Commercial Banks A Case Study on Public and Private Sector Banks, Arunkumar Rekha, Ninth Capital Market Conference, IICM, 2005 RBI Master Circular - Prudential Norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances IGNOU Asset Liability Management IGNOU Operational Risk Management IGNOU Credit Risk Management A Comparative Study of Non-Performing Assets of Public and Private Sector Banks, Kaur Harpreet, Saddy Kumar Neeraj, IJRCM, Vol No. 2, 2011, pp 82-89 http://www.business-standard.com/india/news/form-asset-liabilitymanagement-policy-irda-tells-insurers/444925/ http://www.rbi.org.in/scripts/AnnualPublications.aspx?head=Trend%20and%20 Progress%20of%20Banking%20in%20India 9 Hours

Text

References Class Activity Assignment Presentation Readings

Web Resources

No. of Sessions

You might also like

- CAIIB Syllabus - Advanced Bank ManagementDocument19 pagesCAIIB Syllabus - Advanced Bank ManagementAshwin KGNo ratings yet

- Bank Management - Bms - NewDocument2 pagesBank Management - Bms - NewRajendra LamsalNo ratings yet

- 4.36 M.com Banking & FinanceDocument18 pages4.36 M.com Banking & FinancegoodwynjNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Semester: III Finance Specialisation: Recommended BooksDocument12 pagesSemester: III Finance Specialisation: Recommended Booksshivaraj p yNo ratings yet

- Banking & Insurance ManagementDocument2 pagesBanking & Insurance ManagementVishal Mandowara100% (1)

- Credit AnalysisDocument15 pagesCredit Analysisetebark h/michale100% (1)

- Session Plan - Banking - Class of 2022Document6 pagesSession Plan - Banking - Class of 2022ZeusNo ratings yet

- CAIIB Syllabus - Advanced Bank ManagementDocument19 pagesCAIIB Syllabus - Advanced Bank Managementmirhina786No ratings yet

- Mba 410: Commercial Banking Credit Units: 03 Course ObjectivesDocument6 pagesMba 410: Commercial Banking Credit Units: 03 Course ObjectivesakmohideenNo ratings yet

- The Topics Covered Under The Syllabus of Advance Bank Management As Per The CAIIB Syllabus 2020 Are As Given BelowDocument7 pagesThe Topics Covered Under The Syllabus of Advance Bank Management As Per The CAIIB Syllabus 2020 Are As Given BelowCBS CKSBNo ratings yet

- R LearninDocument4 pagesR Learningaurav anandNo ratings yet

- Banking - Theory and Practices 18MBAFM31-1Document88 pagesBanking - Theory and Practices 18MBAFM31-1Nandeep Hêãrtrøbbér50% (2)

- Syllabus For BankingDocument15 pagesSyllabus For BankingAnil NamosheNo ratings yet

- Sem I and II Banking and Finance Syllabus A.Y. 2021 22Document33 pagesSem I and II Banking and Finance Syllabus A.Y. 2021 22Sayyed Muhammad MustafahNo ratings yet

- Banking Theory and PracticeDocument1 pageBanking Theory and Practiceshivarajungeetha4048No ratings yet

- SyllabusDocument8 pagesSyllabusyamumini07100% (1)

- FD 603 Management of Financial Institutions 61017910Document3 pagesFD 603 Management of Financial Institutions 61017910Deepali BansalNo ratings yet

- Credit Risk Management AT Punjab National BankDocument4 pagesCredit Risk Management AT Punjab National BankSahil SethiNo ratings yet

- Syllabus Aug 2022 NHTM 2Document10 pagesSyllabus Aug 2022 NHTM 2Dương Thuỳ TrangNo ratings yet

- SyllabusDocument3 pagesSyllabusAmu AmuthaNo ratings yet

- Credit Management IntroductionDocument1 pageCredit Management IntroductionVanshika Deepak BaharaniNo ratings yet

- Practice Banking SyllabusDocument2 pagesPractice Banking SyllabusSrinivas GowdaNo ratings yet

- Indian Institute of Banking & Finance: CAIIB SyllabusDocument15 pagesIndian Institute of Banking & Finance: CAIIB Syllabusveeresh2907No ratings yet

- Principles and Practices of BankingDocument2 pagesPrinciples and Practices of BankingPuja DuaNo ratings yet

- BMT6134 - Risk-Management-In-Banks - TH - 1.0 - 55 - BMT6134 - 54 AcpDocument2 pagesBMT6134 - Risk-Management-In-Banks - TH - 1.0 - 55 - BMT6134 - 54 AcpchrisNo ratings yet

- CAIIBITDocument27 pagesCAIIBITMLastTryNo ratings yet

- Lecture PlanDocument3 pagesLecture Plandipono6356No ratings yet

- Banking and Finance Subject Code Subjects L T P CDocument10 pagesBanking and Finance Subject Code Subjects L T P Cshanti priyaNo ratings yet

- Credit RiskDocument30 pagesCredit RiskVineeta HNo ratings yet

- Commercial Banking Credit Units: 03 Course ObjectivesDocument2 pagesCommercial Banking Credit Units: 03 Course ObjectivesAman DhawanNo ratings yet

- Banking FinalDocument5 pagesBanking FinalAks MaroNo ratings yet

- Banking Law & Practice OrientationDocument3 pagesBanking Law & Practice OrientationSravan SNo ratings yet

- Credit Risk ManagementDocument92 pagesCredit Risk ManagementVenkatesh NANo ratings yet

- Caiib Exam Syllabus 2021Document4 pagesCaiib Exam Syllabus 2021senthil kumar nNo ratings yet

- Sem VI Paper No. BC 6.1 B Banking and InsuranceDocument3 pagesSem VI Paper No. BC 6.1 B Banking and InsurancekumarsonigulsnNo ratings yet

- Corporate BankingDocument122 pagesCorporate Bankingrohan2788No ratings yet

- 3rd Sem - 1Document31 pages3rd Sem - 1EshanMishraNo ratings yet

- Risk Management in Commercial BanksDocument37 pagesRisk Management in Commercial BanksRavi DepaniNo ratings yet

- Asset and Liability Management in BanksDocument73 pagesAsset and Liability Management in Bankslaser544100% (2)

- Commercial BankingDocument2 pagesCommercial BankingGajendra JaiswalNo ratings yet

- BComHons Sem V Syllabus CBCS 2017Document15 pagesBComHons Sem V Syllabus CBCS 2017Anoushka HarkarNo ratings yet

- Banking and Finance: Bharathiar University: Coimbatore - 641 046Document7 pagesBanking and Finance: Bharathiar University: Coimbatore - 641 046Aswathy S RNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- Asset Liability Management in Banks in India: Doctorate IN Business AdministrationDocument240 pagesAsset Liability Management in Banks in India: Doctorate IN Business AdministrationNIMMANAGANTI RAMAKRISHNANo ratings yet

- Banking and Insurance SyllabusDocument3 pagesBanking and Insurance SyllabusnanakethanNo ratings yet

- Ba8c3banking and Financial InstitutionsDocument1 pageBa8c3banking and Financial InstitutionsAyush ChhabraNo ratings yet

- Canara Bank Accounting SynopsisDocument3 pagesCanara Bank Accounting Synopsiskapil sharmaNo ratings yet

- 3 - Banking Theory and PracticesDocument3 pages3 - Banking Theory and PracticesJunaid MalicNo ratings yet

- Third Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementDocument58 pagesThird Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementsukeshNo ratings yet

- Syllabus 2020-22 FINTECHDocument58 pagesSyllabus 2020-22 FINTECHsukeshNo ratings yet

- A Study of Credit Risk ManagementDocument60 pagesA Study of Credit Risk ManagementPrince Satish Reddy100% (2)

- Sujal Project BlackbookDocument44 pagesSujal Project Blackbooksujal1utekarNo ratings yet

- Leasing-Concept and Development of Leasing, BusinessDocument3 pagesLeasing-Concept and Development of Leasing, BusinessFarooque HereNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- The Practice of Lending: A Guide to Credit Analysis and Credit RiskFrom EverandThe Practice of Lending: A Guide to Credit Analysis and Credit RiskNo ratings yet

- Developing, Validating and Using Internal Ratings: Methodologies and Case StudiesFrom EverandDeveloping, Validating and Using Internal Ratings: Methodologies and Case StudiesNo ratings yet

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskFrom EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskRating: 3.5 out of 5 stars3.5/5 (1)