Professional Documents

Culture Documents

CDR Statement

CDR Statement

Uploaded by

forbesadminOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CDR Statement

CDR Statement

Uploaded by

forbesadminCopyright:

Available Formats

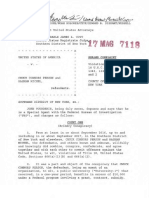

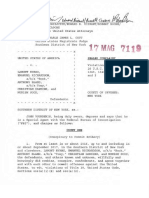

Clayton, Dubilier & Rice Statement Regarding Culligan Derivative Action

Clayton, Dubilier & Rice, LLC (CD&R) acknowledged receipt of a derivative complaint brought on behalf of certain shareholders of Culligan Ltd. who are also Culligan franchise dealers. The complaint seeks relief in connection with a pro rata dividend paid by Culligan to all its shareholders, including approximately $30 million to the franchise dealers, in the spring of 2007. The allegations in the complaint are meritless. The actions by Culligan and its board leading up to the 2007 dividend were entirely fair and proper from a business and legal perspective as confirmed by the independent review undertaken by the Companys outside legal counsel. The plaintiffs received their fair share of the dividend without objection over five years ago and we see no basis for second-guessing Culligans judgment in the context of todays economic environment. With the pending negotiated sale of the business and 100 percent of the Companys first and second lien holders agreeing to the terms of the restructuring by the original solicitation deadline, we strongly believe Culligan is on a positive track both in terms of strengthening its financial profile, as well as executing against its long-term business plan. The Company has a welldiversified business mix with approximately 50% of sales derived from high-margin recurring revenue streams. Culligan also has strong free cash flow characteristics and an attractive and growing commercial and industrial business. As a result of the pending restructuring, no job losses are expected. Since our original investment in 2004, Culligan has undertaken a business transformation aimed at more effectively leveraging its unique market position and improving sales growth, margins and return on capital. As part of this transformation, the Company has undertaken several strategic initiatives to enhance profitability and competitiveness:

(i) (ii) (iii) (iv) (v)

Secured a new royalty-based franchise agreement in North America; Improved North American manufacturing with lower costs and improved quality; Revitalized product portfolio through R&D investments; Rebuilt the North America Commercial & Industrial business; and Streamlined business through non-core asset divestitures and the refranchising of North American company-owned dealers, an important step to make the Company less capital intensive and more profitable.

You might also like

- MLB Pension PlanDocument28 pagesMLB Pension PlanforbesadminNo ratings yet

- Hill Country Snack Foods CoDocument8 pagesHill Country Snack Foods CoANKIT AGARWALNo ratings yet

- Diageo Case Write UpDocument10 pagesDiageo Case Write UpAmandeep AroraNo ratings yet

- America's Best Management Consulting Firms 2016Document9 pagesAmerica's Best Management Consulting Firms 2016forbesadminNo ratings yet

- Blaine Kitchenware CaseDocument4 pagesBlaine Kitchenware Caseskyhannan80% (5)

- Sabya BhaiDocument6 pagesSabya BhaiamanNo ratings yet

- Sealed Air Corporation's Leveraged Recapitalization - RichaDocument3 pagesSealed Air Corporation's Leveraged Recapitalization - Richanishant kumarNo ratings yet

- Astm F1936-10 (2015)Document11 pagesAstm F1936-10 (2015)forbesadmin100% (1)

- Louis Bacon vs. Peter Nygard WritDocument22 pagesLouis Bacon vs. Peter Nygard Writforbesadmin100% (1)

- PR FinanceDocument2 pagesPR FinanceAbdul Rasyid Romadhoni100% (4)

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- San Miguel Corporation:: Reaction PaperDocument3 pagesSan Miguel Corporation:: Reaction PaperMichael Santos0% (1)

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- Case 06 NotesDocument4 pagesCase 06 NotesUmair Mushtaq SyedNo ratings yet

- Case Studies in Working Capital Management and ShortDocument13 pagesCase Studies in Working Capital Management and ShortNguyễn Thế Long100% (1)

- The Wealth HoardersDocument56 pagesThe Wealth Hoardersforbesadmin100% (1)

- Forbes 2016 Best MGMT Consulting FirmsDocument10 pagesForbes 2016 Best MGMT Consulting FirmsforbesadminNo ratings yet

- Affidavit of John Joseph DiPaoloDocument44 pagesAffidavit of John Joseph DiPaoloforbesadminNo ratings yet

- Theranos Letter To JCIDocument3 pagesTheranos Letter To JCIforbesadminNo ratings yet

- CDR StatementDocument1 pageCDR StatementforbesadminNo ratings yet

- Bed Bath & Beyond Inc. Files Voluntary Chapter 11 PetitionsDocument2 pagesBed Bath & Beyond Inc. Files Voluntary Chapter 11 PetitionsSantiago Adolfo OspitalNo ratings yet

- Answers Ans 1Document11 pagesAnswers Ans 1Patrick Panlilio RetuyaNo ratings yet

- Muhammad Elfan Budi Nugroho 29118399 - Midterm TestDocument2 pagesMuhammad Elfan Budi Nugroho 29118399 - Midterm TestKemal Al ZaroNo ratings yet

- Case 32 California - PizzaDocument14 pagesCase 32 California - PizzaPatcharanan Sattayapong100% (1)

- Part 1 Financial Statement Types Presentation Limitation Users - Qs 07 Aug 2021Document17 pagesPart 1 Financial Statement Types Presentation Limitation Users - Qs 07 Aug 2021Le Blanc0% (1)

- G1 6.4 Partnership - Amalgamation and Business PurchaseDocument15 pagesG1 6.4 Partnership - Amalgamation and Business Purchasesridhartks100% (2)

- Cadbury Nigeria PLC 2005Document29 pagesCadbury Nigeria PLC 2005Ada TeachesNo ratings yet

- Bam 2012 q1 LTR To ShareholdersDocument6 pagesBam 2012 q1 LTR To ShareholdersDan-S. ErmicioiNo ratings yet

- Flowserve Corp Case StudyDocument3 pagesFlowserve Corp Case Studytexwan_No ratings yet

- Operational Issues: Corporate Structure of PRIDocument6 pagesOperational Issues: Corporate Structure of PRIRemi AboNo ratings yet

- Press Release - WPG Commences Voluntary Chapter 11 Financial Restructuring (FINAL)Document3 pagesPress Release - WPG Commences Voluntary Chapter 11 Financial Restructuring (FINAL)NBC MontanaNo ratings yet

- Comment On Any Significant Changes in Each Company in Each Assets and LiabilitiesDocument4 pagesComment On Any Significant Changes in Each Company in Each Assets and LiabilitiesNayeem SazzadNo ratings yet

- 3.digested Philippine Bank of Communications vs. Basic Polyprinters and Packaging Corp. GR. No. 187581 October 20 2014Document4 pages3.digested Philippine Bank of Communications vs. Basic Polyprinters and Packaging Corp. GR. No. 187581 October 20 2014Arrianne Obias100% (1)

- Corporate Finance - Hill Country Snack FoodDocument11 pagesCorporate Finance - Hill Country Snack FoodNell MizunoNo ratings yet

- Philippine Bank of CommunicationsDocument3 pagesPhilippine Bank of CommunicationsSol RecuerdoNo ratings yet

- Lecture 10-12 Capital Reconstruction SchemeDocument23 pagesLecture 10-12 Capital Reconstruction SchemeGabriel kortey100% (1)

- Exhibit #41Document52 pagesExhibit #41Jeremy W. GrayNo ratings yet

- GR 187581Document4 pagesGR 187581SabNo ratings yet

- Final AnswerDocument2 pagesFinal Answerronak.asjNo ratings yet

- Ros69749 ch19Document9 pagesRos69749 ch19arzoo26No ratings yet

- FINAL - Q3FY24 Earnings Press Release 2-6-24Document10 pagesFINAL - Q3FY24 Earnings Press Release 2-6-24aiwiki001No ratings yet

- Goodwill and Valuation of GoodwillDocument19 pagesGoodwill and Valuation of GoodwillpranavNo ratings yet

- ILAP - Press Release 16.01.2024Document2 pagesILAP - Press Release 16.01.2024Victor Huaranga CoronadoNo ratings yet

- AICPA Released Questions FAR 2015 DifficultDocument33 pagesAICPA Released Questions FAR 2015 DifficultAZNGUY100% (2)

- Audit Project Kimberly ClarkDocument21 pagesAudit Project Kimberly ClarkmarielapenaNo ratings yet

- 1.0 Executive Summary: 1.1 ObjectivesDocument5 pages1.0 Executive Summary: 1.1 Objectivesethnan lNo ratings yet

- Constellation Brands (STZ) - Anheuser-Busch InBev and Constellation Brands Announce Revised Agreement - 02.14.13Document12 pagesConstellation Brands (STZ) - Anheuser-Busch InBev and Constellation Brands Announce Revised Agreement - 02.14.13jzgordonNo ratings yet

- Merger & Akuisisi TKMKDocument65 pagesMerger & Akuisisi TKMKArieAnggono100% (1)

- 2023 AFRM1 Question BankDocument8 pages2023 AFRM1 Question BankKieu Anh Bui LeNo ratings yet

- CH 01Document16 pagesCH 01Neamul hasan AdnanNo ratings yet

- Fine Organic Industries - R - 17012020Document8 pagesFine Organic Industries - R - 17012020Sameer NaikNo ratings yet

- IfrsDocument12 pagesIfrspapagayo_cNo ratings yet

- Information For Prospective Lenders: Owner Loan ProgramDocument6 pagesInformation For Prospective Lenders: Owner Loan ProgramErick JoseNo ratings yet

- Philippine Bank of Communications vs. Basic Polyprinters and Packaging CorporationDocument2 pagesPhilippine Bank of Communications vs. Basic Polyprinters and Packaging CorporationCharlie BartolomeNo ratings yet

- Acquisition and MergingDocument19 pagesAcquisition and MergingTeerraNo ratings yet

- Report and Accounts 2013Document36 pagesReport and Accounts 2013MdBelaluddinNo ratings yet

- 2021 June Tutorial Set Questions - AuditDocument10 pages2021 June Tutorial Set Questions - AuditakpanyapNo ratings yet

- CH 2 Forms of CRDocument16 pagesCH 2 Forms of CRvince_ezioNo ratings yet

- General Motors Co.'s Recovery Rating ProfileDocument6 pagesGeneral Motors Co.'s Recovery Rating ProfileVladimir BulutNo ratings yet

- The Document Is About Berkshire HathawayDocument4 pagesThe Document Is About Berkshire Hathawayhimanshudhawale18No ratings yet

- Financial Analysis For Eastman KodakDocument4 pagesFinancial Analysis For Eastman KodakJacquelyn AlegriaNo ratings yet

- 2022 Q2 BAM LTR To Shareholders FF BDocument8 pages2022 Q2 BAM LTR To Shareholders FF BDan-S. ErmicioiNo ratings yet

- Project On Fund Costing Synopsis SarikaDocument12 pagesProject On Fund Costing Synopsis SarikassssaruNo ratings yet

- ACCT 3050 Group Assignment S2 2023-2024Document2 pagesACCT 3050 Group Assignment S2 2023-2024Princess DouglasNo ratings yet

- Free Cash Flow: Seeing Through the Accounting Fog Machine to Find Great StocksFrom EverandFree Cash Flow: Seeing Through the Accounting Fog Machine to Find Great StocksRating: 4 out of 5 stars4/5 (1)

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- FPDS-NG - Anduril SocomDocument3 pagesFPDS-NG - Anduril SocomforbesadminNo ratings yet

- Zunum Sues BoeingDocument8 pagesZunum Sues BoeingforbesadminNo ratings yet

- 46 Top Innovative Female CEOs Respond To ForbesDocument3 pages46 Top Innovative Female CEOs Respond To ForbesforbesadminNo ratings yet

- Hempel Vs Cydan Et Al-ComplaintDocument34 pagesHempel Vs Cydan Et Al-Complaintforbesadmin100% (1)

- RobbMandelbaum - Tax ReformDocument1 pageRobbMandelbaum - Tax ReformforbesadminNo ratings yet

- Chao - Asset Inventory-Redacted High ResDocument4 pagesChao - Asset Inventory-Redacted High ResforbesadminNo ratings yet

- Christopher Dorner ComplaintDocument5 pagesChristopher Dorner ComplaintDoug StanglinNo ratings yet

- U.S. v. Chuck Person and Rashan Michel ComplaintDocument32 pagesU.S. v. Chuck Person and Rashan Michel ComplaintAlabama Political ReporterNo ratings yet

- Rules For NonresidentsDocument6 pagesRules For NonresidentsforbesadminNo ratings yet

- US v. Lamont Evans Et Al Complaint 0Document59 pagesUS v. Lamont Evans Et Al Complaint 0WLTXNo ratings yet

- Market Synergy LawsuitDocument37 pagesMarket Synergy LawsuitforbesadminNo ratings yet

- Rhode Island 22016 Real Estate InvestigationDocument89 pagesRhode Island 22016 Real Estate InvestigationforbesadminNo ratings yet

- 107 Super SafetyDocument1 page107 Super SafetyforbesadminNo ratings yet

- 107 Super SafetyDocument1 page107 Super SafetyforbesadminNo ratings yet

- America's Best Management Consulting Firms 2016Document7 pagesAmerica's Best Management Consulting Firms 2016forbesadminNo ratings yet

- Forbes Billionaires Coloring Book 2016Document5 pagesForbes Billionaires Coloring Book 2016forbesadminNo ratings yet

- Apple vs. FBI - DOJ Motion To VacateDocument3 pagesApple vs. FBI - DOJ Motion To VacateCNET NewsNo ratings yet

- Genomic Health ComplaintDocument25 pagesGenomic Health ComplaintforbesadminNo ratings yet

- FY2014 DuPage Clerk Report Showing The Actual Final, Extended Levies With 1% "Loss Tax" For 381 Units of GovernmentDocument82 pagesFY2014 DuPage Clerk Report Showing The Actual Final, Extended Levies With 1% "Loss Tax" For 381 Units of GovernmentforbesadminNo ratings yet

- SpringOwl's Yahoo Presentation 12-13-15Document99 pagesSpringOwl's Yahoo Presentation 12-13-15WSJTech100% (1)

- Filing From UberDocument33 pagesFiling From UberforbesadminNo ratings yet

- Intertech 1, - 2031 Kings Hwy Shreveport, LA 71103 - Phone 646.290.9254Document33 pagesIntertech 1, - 2031 Kings Hwy Shreveport, LA 71103 - Phone 646.290.9254forbesadminNo ratings yet