Professional Documents

Culture Documents

Corp Finance E10.11

Corp Finance E10.11

Uploaded by

Aery JayCopyright:

Available Formats

You might also like

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- Worldwide Paper Company Cash FlowDocument1 pageWorldwide Paper Company Cash FlowEric Silvani100% (4)

- Sampa Video Solution - Harvard Case SolutionDocument10 pagesSampa Video Solution - Harvard Case SolutionkanabaramitNo ratings yet

- Sampa Video Solution Harvard Case SolutionDocument11 pagesSampa Video Solution Harvard Case Solutionhernandezc_jose100% (1)

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- HL Case StudyDocument27 pagesHL Case StudyJorgeNo ratings yet

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- Mercury AthleticDocument17 pagesMercury Athleticgaurav100% (1)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Confidence Cement Ltd. Ratio AnalysisDocument42 pagesConfidence Cement Ltd. Ratio AnalysisShehab Mahmud0% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- 6a02d65b A005 DCF Discounted Cash Flow ModelDocument8 pages6a02d65b A005 DCF Discounted Cash Flow ModelYeshwanth BabuNo ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- Year 0 1 2 3 Income StatementDocument56 pagesYear 0 1 2 3 Income StatementKhawaja Khalid MushtaqNo ratings yet

- Case 25 Gainesboro-Exh8Document1 pageCase 25 Gainesboro-Exh8odie99No ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Dr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Document16 pagesDr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Ankitesh Kumar TiwariNo ratings yet

- Excel Setup and Imp FunctionsDocument27 pagesExcel Setup and Imp FunctionsAfzaal KaimkhaniNo ratings yet

- (Rs MN.) : Case 10.1: Hind Petrochemicals CompanyDocument1 page(Rs MN.) : Case 10.1: Hind Petrochemicals Companylefteris82No ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- FM S 2012 HW5 SolutionDocument49 pagesFM S 2012 HW5 SolutionInzhu SarinzhipNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Maple Leaf Cement Factory LimitedDocument70 pagesMaple Leaf Cement Factory LimitedMubasharNo ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- 2. Excel Setup and Imp Functions (1)Document27 pages2. Excel Setup and Imp Functions (1)Vijay GuptaNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Evaluacion Salud FinancieraDocument17 pagesEvaluacion Salud FinancieraWilliam VicuñaNo ratings yet

- Heritage Doll Company Project EvaluationDocument13 pagesHeritage Doll Company Project EvaluationSabyasachi Sahu100% (1)

- Capital Allowance QuestionsDocument8 pagesCapital Allowance QuestionsTIMOREGH100% (2)

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Oman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Document5 pagesOman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Venkatakrishnan IyerNo ratings yet

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDocument4 pagesJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaNo ratings yet

- Income-: 2010-11 2009-10Document6 pagesIncome-: 2010-11 2009-10superjagdishNo ratings yet

- Lecture #3: Financial Analysis - Example (Celerity Technology)Document4 pagesLecture #3: Financial Analysis - Example (Celerity Technology)Jack JacintoNo ratings yet

- Indian Oil Corporation LTD: Key Financial IndicatorsDocument4 pagesIndian Oil Corporation LTD: Key Financial IndicatorsBrinda PriyadarshiniNo ratings yet

- Bajaj Auto Result UpdatedDocument11 pagesBajaj Auto Result UpdatedAngel BrokingNo ratings yet

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- Performance Highlights: Sales Volume & Growth % Net Sales, Operating EBITDA & Operating EBITDA MarginDocument4 pagesPerformance Highlights: Sales Volume & Growth % Net Sales, Operating EBITDA & Operating EBITDA MarginArijit DasNo ratings yet

- CP All Public Company Limited: 1Q08: Presentation ResultsDocument28 pagesCP All Public Company Limited: 1Q08: Presentation ResultsJakkapong TachawongsuwonNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Indicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Document24 pagesIndicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Ved Prakash GiriNo ratings yet

- CaseDocument11 pagesCasengogiahuy12082002No ratings yet

- Krakatau A - CGAR, BUMN, DupontDocument27 pagesKrakatau A - CGAR, BUMN, DupontJavadNurIslamiNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Metro InpiredDocument16 pagesMetro InpiredOkky Pratama MartadirejaNo ratings yet

- IllustrationforFAQsNLDocument1 pageIllustrationforFAQsNLjsk231193No ratings yet

- Financial Highlights 2011-2012Document1 pageFinancial Highlights 2011-2012cdcrotaerNo ratings yet

- Cairn India Result UpdatedDocument11 pagesCairn India Result UpdatedAngel BrokingNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Submitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BDocument9 pagesSubmitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BtimezitNo ratings yet

- Chapter09 SMDocument14 pagesChapter09 SMkike-armendarizNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- 10 YrsDocument1 page10 YrsDon WolfNo ratings yet

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

Corp Finance E10.11

Corp Finance E10.11

Uploaded by

Aery JayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corp Finance E10.11

Corp Finance E10.11

Uploaded by

Aery JayCopyright:

Available Formats

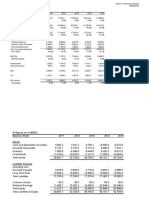

MOHD NAZRI MOHAMAD JAIS (G0820083)

Exercise 10-11 The Henley Corporation

($ Million)

Sales growth rate

Costs/sales

Depreciation/net PPE

Cash/sales

Account receivable/sales

Inventories/sales

Net PPE/sales

Account payable/sales

Accruals/sales

Tax rate

WACC

a) Net sales

Actual

2003

72%

10%

1%

10%

20%

75%

2%

5%

40%

10.5%

Projected

2004

15%

72%

10%

1%

10%

20%

75%

2%

5%

40%

10.5%

2005

10%

72%

10%

1%

10%

20%

75%

2%

5%

40%

10.5%

2006

6%

72%

10%

1%

10%

20%

75%

2%

5%

40%

10.5%

2007

6%

72%

10%

1%

10%

20%

75%

2%

5%

40%

10.5%

Costs

Depreciation

Total operating costs

EBIT

Number of shares (million)

800.00

576.00

60.00

636.00

164.00

10.00

920.00

662.40

69.00

731.40

188.60

1,012.00

728.64

75.90

804.54

207.46

1,072.72

772.36

80.45

852.81

219.91

1,137.08

818.70

85.28

903.98

233.10

Assets

Cash

Marketable securities

Accounts receivable

Inventories

Operating current assets

Net plant and equipment

8.00

20.00

80.00

160.00

248.00

600.00

9.20

10.12

10.73

11.37

92.00

184.00

285.20

690.00

101.20

202.40

313.72

759.00

107.27

214.54

332.54

804.54

113.71

227.42

352.50

852.81

18.40

20.24

21.45

22.74

46.00

64.40

50.60

70.84

53.64

75.09

56.85

79.60

Liabilities and Equity

Accounts payable

Notes payable

Accruals

Operating current liabilities

Long-term bonds

Preferred stocks

16.00

40.00

40.00

56.00

300

15

MOHD NAZRI MOHAMAD JAIS (G0820083)

Exercise 10-11 The Henley Corporation

($ Million)

Calculation of FCF

Net operating working capital

Net Plant

Net operating capital

Investment in operating capital

NOPAT

b) Net Free cash flow

Growth in FCF

Value of Operations

Horizon value

Value of operations

d) MVA

e) Price per share of common equity

c)

Operating profitability

Capital requirements

Expected return on invested capital

Spread (EROIC - WACC)

Actual

2003

192.00

600.00

792.00

98.40

Projected

2004

2005

2006

2007

220.80

690.00

910.80

118.80

113.16

(5.64)

242.88

759.00

1,001.88

91.08

124.48

33.40

692.1%

257.45

804.54

1,061.99

60.11

131.94

71.83

115.1%

272.90

852.81

1,125.71

63.72

139.86

76.14

6.0%

1,793.56

1,869.70

1,329.56

537.56

99.46

12.3%

99.0%

12.4%

1.9%

12.3%

99.0%

12.4%

1.9%

12.3%

99.0%

12.4%

1.9%

12.3%

99.0%

12.4%

1.9%

From the above estimation and calculation, the company has positive MVA, i.e. creating value

for the company.

12.3%

99.0%

12.4%

1.9%

MOHD NAZRI MOHAMAD JAIS (G0820083)

Exercise 14-6: WACC and Optimal Capital Structure

bu

rf

rm

Tax

1.2

5%

6%

40%

Wd

We

D/S

rd

rs

WACC

0.00

0.20

0.40

0.60

0.80

1.00

0.80

0.60

0.40

0.20

0.00

0.25

0.67

1.50

4.00

7%

8%

10%

12%

15%

1.20

1.38

1.68

2.28

4.08

12.20%

13.28%

15.08%

18.68%

29.48%

12.20%

11.58%

11.45%

11.79%

13.10%

The firm's optimal capital structure is at WACC minimal value and in this case

WACC is 11.45% and therefore capital structure is 40% debt ratio.

You might also like

- New Heritage Doll Company Case SolutionDocument42 pagesNew Heritage Doll Company Case SolutionRupesh Sharma100% (6)

- Worldwide Paper Company Cash FlowDocument1 pageWorldwide Paper Company Cash FlowEric Silvani100% (4)

- Sampa Video Solution - Harvard Case SolutionDocument10 pagesSampa Video Solution - Harvard Case SolutionkanabaramitNo ratings yet

- Sampa Video Solution Harvard Case SolutionDocument11 pagesSampa Video Solution Harvard Case Solutionhernandezc_jose100% (1)

- Mercury AthleticDocument13 pagesMercury Athleticarnabpramanik100% (1)

- HL Case StudyDocument27 pagesHL Case StudyJorgeNo ratings yet

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- Mercury AthleticDocument17 pagesMercury Athleticgaurav100% (1)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Confidence Cement Ltd. Ratio AnalysisDocument42 pagesConfidence Cement Ltd. Ratio AnalysisShehab Mahmud0% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- 6a02d65b A005 DCF Discounted Cash Flow ModelDocument8 pages6a02d65b A005 DCF Discounted Cash Flow ModelYeshwanth BabuNo ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- Year 0 1 2 3 Income StatementDocument56 pagesYear 0 1 2 3 Income StatementKhawaja Khalid MushtaqNo ratings yet

- Case 25 Gainesboro-Exh8Document1 pageCase 25 Gainesboro-Exh8odie99No ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Dr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Document16 pagesDr. Smita Sahoo Ankitesh Kumar Tiwari: Submitted To: Submitted By: Roll No:-74Ankitesh Kumar TiwariNo ratings yet

- Excel Setup and Imp FunctionsDocument27 pagesExcel Setup and Imp FunctionsAfzaal KaimkhaniNo ratings yet

- (Rs MN.) : Case 10.1: Hind Petrochemicals CompanyDocument1 page(Rs MN.) : Case 10.1: Hind Petrochemicals Companylefteris82No ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- FM S 2012 HW5 SolutionDocument49 pagesFM S 2012 HW5 SolutionInzhu SarinzhipNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Maple Leaf Cement Factory LimitedDocument70 pagesMaple Leaf Cement Factory LimitedMubasharNo ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- 2. Excel Setup and Imp Functions (1)Document27 pages2. Excel Setup and Imp Functions (1)Vijay GuptaNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- Evaluacion Salud FinancieraDocument17 pagesEvaluacion Salud FinancieraWilliam VicuñaNo ratings yet

- Heritage Doll Company Project EvaluationDocument13 pagesHeritage Doll Company Project EvaluationSabyasachi Sahu100% (1)

- Capital Allowance QuestionsDocument8 pagesCapital Allowance QuestionsTIMOREGH100% (2)

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Oman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Document5 pagesOman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Venkatakrishnan IyerNo ratings yet

- JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDocument4 pagesJK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUYDeepa GuptaNo ratings yet

- Income-: 2010-11 2009-10Document6 pagesIncome-: 2010-11 2009-10superjagdishNo ratings yet

- Lecture #3: Financial Analysis - Example (Celerity Technology)Document4 pagesLecture #3: Financial Analysis - Example (Celerity Technology)Jack JacintoNo ratings yet

- Indian Oil Corporation LTD: Key Financial IndicatorsDocument4 pagesIndian Oil Corporation LTD: Key Financial IndicatorsBrinda PriyadarshiniNo ratings yet

- Bajaj Auto Result UpdatedDocument11 pagesBajaj Auto Result UpdatedAngel BrokingNo ratings yet

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- Performance Highlights: Sales Volume & Growth % Net Sales, Operating EBITDA & Operating EBITDA MarginDocument4 pagesPerformance Highlights: Sales Volume & Growth % Net Sales, Operating EBITDA & Operating EBITDA MarginArijit DasNo ratings yet

- CP All Public Company Limited: 1Q08: Presentation ResultsDocument28 pagesCP All Public Company Limited: 1Q08: Presentation ResultsJakkapong TachawongsuwonNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Indicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Document24 pagesIndicators: Operating Revenue 16,325.90 18,627.00 19,176.10 19,014.00 20,862.00Ved Prakash GiriNo ratings yet

- CaseDocument11 pagesCasengogiahuy12082002No ratings yet

- Krakatau A - CGAR, BUMN, DupontDocument27 pagesKrakatau A - CGAR, BUMN, DupontJavadNurIslamiNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Metro InpiredDocument16 pagesMetro InpiredOkky Pratama MartadirejaNo ratings yet

- IllustrationforFAQsNLDocument1 pageIllustrationforFAQsNLjsk231193No ratings yet

- Financial Highlights 2011-2012Document1 pageFinancial Highlights 2011-2012cdcrotaerNo ratings yet

- Cairn India Result UpdatedDocument11 pagesCairn India Result UpdatedAngel BrokingNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Submitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BDocument9 pagesSubmitted By: Salman Mahboob REGISTRATION NO.: 04151113057 Submitted To: Mr. Wasim Abbas Shaheen Class: Bs (Ba) - 4 Section: BtimezitNo ratings yet

- Chapter09 SMDocument14 pagesChapter09 SMkike-armendarizNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- 10 YrsDocument1 page10 YrsDon WolfNo ratings yet

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet