Professional Documents

Culture Documents

Property Taxes On Owner-Occupied Housing

Property Taxes On Owner-Occupied Housing

Uploaded by

Tax FoundationCopyright:

Available Formats

You might also like

- Local Income Tax Rates by JurisdictionDocument10 pagesLocal Income Tax Rates by JurisdictionTax Foundation100% (2)

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Fed U.S. Federal Individual Income Tax Rates History, 1862-2013Document68 pagesFed U.S. Federal Individual Income Tax Rates History, 1862-2013Tax Foundation96% (23)

- Federal Income Tax Rates History, Nominal Dollars, 1913-2013Document66 pagesFederal Income Tax Rates History, Nominal Dollars, 1913-2013Tax Foundation100% (1)

- State Corporate Income Tax Rates As of January 1, 2012Document56 pagesState Corporate Income Tax Rates As of January 1, 2012Tax FoundationNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- Proptax 06 10 TaxpaidDocument102 pagesProptax 06 10 TaxpaidTax FoundationNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Proptax10 Taxes PaidDocument27 pagesProptax10 Taxes PaidTax FoundationNo ratings yet

- Mortgage, Rental and Investment SimulatorDocument113 pagesMortgage, Rental and Investment SimulatorSujin RajaNo ratings yet

- Mrs Incidence Report 2011Document2 pagesMrs Incidence Report 2011Melinda JoyceNo ratings yet

- Property Taxes On Owner-Occupied Housing, by State 2008Document10 pagesProperty Taxes On Owner-Occupied Housing, by State 20082391136No ratings yet

- Bend Bend Bend Bend Spring Hill Mac+ T1 iOS T1 Mac+ T2 iOS T2 Mac+ T1Document3 pagesBend Bend Bend Bend Spring Hill Mac+ T1 iOS T1 Mac+ T2 iOS T2 Mac+ T1Ahsan TirmiziNo ratings yet

- Sales Tax Motor Vehicle Sales/Rental Motor FuelsDocument1 pageSales Tax Motor Vehicle Sales/Rental Motor FuelsThe Dallas Morning NewsNo ratings yet

- ABC, Bank: Banks' Statements of Financial PositionDocument24 pagesABC, Bank: Banks' Statements of Financial PositionSpreadsheetZONE100% (1)

- M&O Levy Proposal October 10, 2011Document1 pageM&O Levy Proposal October 10, 2011Debra KolrudNo ratings yet

- Sistema AbcDocument2 pagesSistema AbcaLEJANDROS4No ratings yet

- Bend Bend Bend Bend Spring Hill Cpu T1 iOS T1 Cpu T2 iOS T2 Cpu T1Document3 pagesBend Bend Bend Bend Spring Hill Cpu T1 iOS T1 Cpu T2 iOS T2 Cpu T1Ahsan TirmiziNo ratings yet

- SPX HOA Fees by Unit 2011 3 01 11Document3 pagesSPX HOA Fees by Unit 2011 3 01 11susancurtis02No ratings yet

- KS201 EthnicgroupChangeDocument4 pagesKS201 EthnicgroupChangeAbdisamed AllaaleNo ratings yet

- Ho Jade Result A Dos Conf OptimaDocument6 pagesHo Jade Result A Dos Conf OptimaAndrés GilNo ratings yet

- Caso PrácticoDocument4 pagesCaso PrácticoLuna delgado Kevin LeonardoNo ratings yet

- North Dakota REV-E-NEWS: Message From The DirectorDocument4 pagesNorth Dakota REV-E-NEWS: Message From The DirectorRob PortNo ratings yet

- 1.04 FULL Bitmex Profit and Fees CalculaDocument104 pages1.04 FULL Bitmex Profit and Fees CalculaIlias BenjellounNo ratings yet

- Estudio de Caso Matematicas FinancieraDocument9 pagesEstudio de Caso Matematicas FinancieraCristian MartinezNo ratings yet

- Solar PV Project Cost Calculator: System Inputs Input DescriptionDocument2 pagesSolar PV Project Cost Calculator: System Inputs Input DescriptionVatsal Pancholi0% (1)

- Income SplittingDocument1 pageIncome SplittingNeal JenningsNo ratings yet

- Bitmex Profit and Fees CalculatorDocument95 pagesBitmex Profit and Fees CalculatorArun KumarNo ratings yet

- LD1495 Incidence REPORTDocument3 pagesLD1495 Incidence REPORTMelinda JoyceNo ratings yet

- Wang Jour762 Portfolio AnalysisDocument33 pagesWang Jour762 Portfolio Analysisapi-589827127No ratings yet

- FE Data (Mac)Document9 pagesFE Data (Mac)canenny limNo ratings yet

- RiskDocument6 pagesRisksumon finNo ratings yet

- Colcap Nutresa Fecha VR Rtab VR RtabDocument3 pagesColcap Nutresa Fecha VR Rtab VR RtabAlejandro RojasNo ratings yet

- Menahga ISD821 Estimated Tax Impact Pay 2023Document1 pageMenahga ISD821 Estimated Tax Impact Pay 2023Shannon GeisenNo ratings yet

- MRS Tax Incidence Report 2013Document4 pagesMRS Tax Incidence Report 2013Melinda JoyceNo ratings yet

- Practica Sem 7 - Finanzas CoorpDocument9 pagesPractica Sem 7 - Finanzas Coorpabimm2502No ratings yet

- Cali 5872 1174.4 4981 996.2 - 2196 - 439.2 9823.65 1964.73 3,93,451.86 #Value! CARERRA 83A 42-86 #Value! 0Document23 pagesCali 5872 1174.4 4981 996.2 - 2196 - 439.2 9823.65 1964.73 3,93,451.86 #Value! CARERRA 83A 42-86 #Value! 0julio amayaNo ratings yet

- Olivia's Art Supply Salary ReportDocument2 pagesOlivia's Art Supply Salary ReportGabe BNo ratings yet

- Housing Affordability CalculatorDocument2 pagesHousing Affordability CalculatorB singhNo ratings yet

- 2011 Assessment For Residential PropertiesDocument1 page2011 Assessment For Residential PropertiesmdebonisNo ratings yet

- Sample 1Document1 pageSample 1Elan Silvano SouzaNo ratings yet

- State Individual Income Rates 2000 2011 20110302Document79 pagesState Individual Income Rates 2000 2011 2011030287figmentNo ratings yet

- Obama ClintonDocument10 pagesObama ClintonVishal GhuleNo ratings yet

- Class Size With C4E SpendingDocument2,681 pagesClass Size With C4E SpendingGothamSchools.orgNo ratings yet

- Determinar WaccDocument5 pagesDeterminar WaccLisbeth CarrascoNo ratings yet

- IndicesDocument2 pagesIndicesSofia GrinbergNo ratings yet

- SC MLS One-Sheeter 2010-10Document1 pageSC MLS One-Sheeter 2010-10kwillsonNo ratings yet

- Chapter 12Document17 pagesChapter 12Faisal SiddiquiNo ratings yet

- Alex Sharpe Data V2-Team DylanDocument15 pagesAlex Sharpe Data V2-Team DylanPrajwal KumarNo ratings yet

- Home TestDocument22 pagesHome TestSelina ChenNo ratings yet

- Fin Proj MDDocument5 pagesFin Proj MDKhatab OmerNo ratings yet

- DP04 Selected Housing Characteristics 2006-2010 American Community Survey 5-Year EstimatesDocument4 pagesDP04 Selected Housing Characteristics 2006-2010 American Community Survey 5-Year Estimatesbranthom88No ratings yet

- Budget Variance ReportDocument2 pagesBudget Variance ReportaryanneNo ratings yet

- DIN 472 Circlips AgujerosDocument2 pagesDIN 472 Circlips AgujerosJorgeNo ratings yet

- Utah Housing Numbers (Feb 2023)Document1 pageUtah Housing Numbers (Feb 2023)KUTV 2NewsNo ratings yet

- 2011 Assessment For Commerical PropertiesDocument1 page2011 Assessment For Commerical PropertiesmdebonisNo ratings yet

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- Estimate A BetaDocument9 pagesEstimate A BetaShakhawat HossainNo ratings yet

- Ej 2 HWDocument2 pagesEj 2 HWSofia GrinbergNo ratings yet

- Cuent AsDocument2 pagesCuent AsBrian Adrian Saucedo GómezNo ratings yet

- Utah Proposed Property Tax Increases For 2014Document1 pageUtah Proposed Property Tax Increases For 2014The Salt Lake TribuneNo ratings yet

- Scenario1 Details 0Document3 pagesScenario1 Details 0Karthik RagupathyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

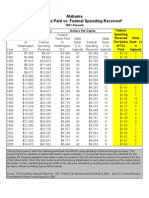

- Federal Taxes Paid Vs Federal Spending Received by States, 1981-2005Document51 pagesFederal Taxes Paid Vs Federal Spending Received by States, 1981-2005Javier Arvelo-Cruz-SantanaNo ratings yet

- North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformDocument84 pagesNorth Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformTax Foundation100% (1)

- Facts and Figures 2014Document55 pagesFacts and Figures 2014Tax FoundationNo ratings yet

- Christmas Cheer Return: Filing StatusDocument2 pagesChristmas Cheer Return: Filing StatusTax FoundationNo ratings yet

- Facts & Figures 2015: How Does Your State Compare?Document55 pagesFacts & Figures 2015: How Does Your State Compare?Tax FoundationNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- Scott Hodge, President Will Mcbride, Chief EconomistDocument20 pagesScott Hodge, President Will Mcbride, Chief EconomistTax FoundationNo ratings yet

- Fiscal Cliff MSA TableDocument11 pagesFiscal Cliff MSA TableTax FoundationNo ratings yet

- State Local Ind Inc Coll 2009Document2 pagesState Local Ind Inc Coll 2009Tax Foundation100% (1)

- Proptax 06 10 TaxpaidDocument102 pagesProptax 06 10 TaxpaidTax FoundationNo ratings yet

- State Local Corp Inc Tax Coll 2009Document2 pagesState Local Corp Inc Tax Coll 2009Tax FoundationNo ratings yet

- Proptax10 Taxes PaidDocument27 pagesProptax10 Taxes PaidTax FoundationNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- Facts and Figures 2012: State Beer Tax RatesDocument2 pagesFacts and Figures 2012: State Beer Tax RatesTax FoundationNo ratings yet

- State Local Corp Inc Tax Coll 2009Document2 pagesState Local Corp Inc Tax Coll 2009Tax FoundationNo ratings yet

Property Taxes On Owner-Occupied Housing

Property Taxes On Owner-Occupied Housing

Uploaded by

Tax FoundationOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Taxes On Owner-Occupied Housing

Property Taxes On Owner-Occupied Housing

Uploaded by

Tax FoundationCopyright:

Available Formats

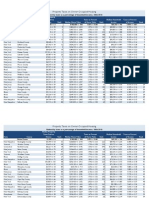

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

New York

Orleans County

$3,072 +/- 116

158

$90,700 +/- 4,071

3.39% +/- 0.20

$56,163 +/- 4,400

5.47% +/- 0.48

58

New York

Wayne County

$3,231 +/- 83

136

$109,600 +/- 2,569

2.95% +/- 0.10

$60,668 +/- 2,355

5.33% +/- 0.25

65

New York

Niagara County

$3,020 +/- 65

162

$102,500 +/- 2,359

2.95% +/- 0.09

$57,698 +/- 1,927

5.23% +/- 0.21

70

New York

Allegany County

$1,969 +/- 72

463

$67,200 +/- 2,017

2.93% +/- 0.14

$48,537 +/- 1,958

4.06% +/- 0.22

225

New York

Monroe County

$3,899 +/- 40

76

$133,500 +/- 1,232

2.92% +/- 0.04

$66,847 +/- 911

5.83% +/- 0.10

50

New York

Cortland County

$2,891 +/- 108

187

$101,500 +/- 5,060

2.85% +/- 0.18

$57,269 +/- 3,241

5.05% +/- 0.34

84

New York

Seneca County

$2,521 +/- 115

275

$91,800 +/- 3,770

2.75% +/- 0.17

$52,362 +/- 2,309

4.81% +/- 0.31

105

New York

Chautauqua County

$2,218 +/- 63

361

$80,800 +/- 2,196

2.75% +/- 0.11

$50,757 +/- 1,547

4.37% +/- 0.18

162

New York

Cattaraugus County

$2,144 +/- 81

380

$78,200 +/- 1,961

2.74% +/- 0.12

$49,375 +/- 1,601

4.34% +/- 0.22

166

New York

Montgomery County

$2,700 +/- 112

234

$98,700 +/- 3,610

2.74% +/- 0.15

10

$53,790 +/- 1,892

5.02% +/- 0.27

85

New York

Genesee County

$2,869 +/- 91

193

$104,900 +/- 3,783

2.73% +/- 0.13

11

$59,992 +/- 1,939

4.78% +/- 0.22

108

New York

Livingston County

$3,150 +/- 130

146

$117,200 +/- 3,563

2.69% +/- 0.14

12

$63,073 +/- 2,907

4.99% +/- 0.31

88

New York

Oswego County

$2,442 +/- 79

295

$91,200 +/- 1,814

2.68% +/- 0.10

13

$55,758 +/- 2,146

4.38% +/- 0.22

161

New York

Wyoming County

$2,621 +/- 83

250

$98,100 +/- 2,464

2.67% +/- 0.11

14

$57,847 +/- 3,720

4.53% +/- 0.32

142

New York

Erie County

$3,204 +/- 35

140

$121,800 +/- 1,167

2.63% +/- 0.04

15

$62,489 +/- 881

5.13% +/- 0.09

78

New York

Steuben County

$2,171 +/- 70

375

$83,800 +/- 1,417

2.59% +/- 0.09

16

$52,992 +/- 1,741

4.10% +/- 0.19

213

New York

Cayuga County

$2,582 +/- 91

261

$99,800 +/- 3,590

2.59% +/- 0.13

17

$56,692 +/- 2,079

4.55% +/- 0.23

135

New York

Chemung County

$2,332 +/- 86

323

$90,200 +/- 2,680

2.59% +/- 0.12

18

$55,322 +/- 2,425

4.22% +/- 0.24

193

New York

Onondaga County

$3,293 +/- 49

133

$129,600 +/- 1,812

2.54% +/- 0.05

19

$67,193 +/- 1,029

4.90% +/- 0.10

99

New Jersey

Camden County

$5,716 +/- 48

24

$226,400 +/- 2,253

2.52% +/- 0.03

20

$77,151 +/- 1,411

7.41% +/- 0.15

12

New York

Herkimer County

$2,162 +/- 103

377

$89,500 +/- 2,640

2.42% +/- 0.14

21

$53,169 +/- 2,470

4.07% +/- 0.27

223

New York

Madison County

$2,786 +/- 111

209

$115,900 +/- 5,253

2.40% +/- 0.15

22

$58,956 +/- 1,913

4.73% +/- 0.24

115

New York

Schenectady County

$3,975 +/- 112

70

$165,500 +/- 2,767

2.40% +/- 0.08

23

$66,411 +/- 1,807

5.99% +/- 0.23

44

New York

Oneida County

$2,553 +/- 54

267

$106,300 +/- 2,337

2.40% +/- 0.07

24

$60,290 +/- 1,647

4.23% +/- 0.15

189

New York

Ontario County

$3,281 +/- 104

134

$136,700 +/- 4,580

2.40% +/- 0.11

25

$65,830 +/- 3,162

4.98% +/- 0.29

91

Illinois

Winnebago County

$3,150 +/- 56

146

$132,200 +/- 1,952

2.38% +/- 0.06

26

$60,335 +/- 1,619

5.22% +/- 0.17

72

New York

Broome County

$2,486 +/- 56

285

$104,700 +/- 2,377

2.37% +/- 0.08

27

$56,688 +/- 1,365

4.39% +/- 0.14

159

Texas

Fort Bend County

$4,162 +/- 86

61

$176,100 +/- 2,883

2.36% +/- 0.06

28

$91,753 +/- 1,536

4.54% +/- 0.12

139

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

Median Home Value

$2,018 +/- 4

New York

Tioga County

Michigan

Wayne County

New York

Chenango County

New York

Tompkins County

$3,919 +/- 178

New Jersey

Gloucester County

Texas

Tarrant County

Illinois

DeKalb County

Illinois

Stephenson County

Illinois

Kendall County

Illinois

Lake County

New York

Texas

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

Rank

$64,519 +/- 62

3.13% +/- 0.01

$59,546 +/- 2,243

4.04% +/- 0.24

232

$2,403 +/- 113

308

$101,700 +/- 4,956

2.36% +/- 0.16

29

$2,511 +/- 16

277

$107,700 +/- 1,025

2.33% +/- 0.03

30

$53,329 +/- 588

4.71% +/- 0.06

118

$2,102 +/- 135

402

$90,200 +/- 3,776

2.33% +/- 0.18

31

$50,218 +/- 2,396

4.19% +/- 0.33

199

74

$169,200 +/- 4,434

2.32% +/- 0.12

32

$70,448 +/- 3,461

5.56% +/- 0.37

56

$5,544 +/- 80

28

$239,700 +/- 2,396

2.31% +/- 0.04

33

$81,702 +/- 1,554

6.79% +/- 0.16

22

$3,141 +/- 36

150

$137,000 +/- 1,026

2.29% +/- 0.03

34

$72,965 +/- 1,051

4.30% +/- 0.08

178

$4,340 +/- 98

55

$189,700 +/- 4,626

2.29% +/- 0.08

35

$69,923 +/- 3,415

6.21% +/- 0.33

36

$2,359 +/- 84

315

$103,300 +/- 4,687

2.28% +/- 0.13

36

$52,698 +/- 2,348

4.48% +/- 0.26

148

$5,585 +/- 134

27

$245,500 +/- 5,997

2.27% +/- 0.08

37

$89,293 +/- 3,312

6.25% +/- 0.28

34

$6,433 +/- 62

16

$284,200 +/- 3,127

2.26% +/- 0.03

38

$91,577 +/- 1,346

7.02% +/- 0.12

17

Fulton County

$2,294 +/- 123

338

$101,600 +/- 6,951

2.26% +/- 0.20

39

$52,796 +/- 3,178

4.35% +/- 0.35

165

Harris County

$3,006 +/- 30

167

$133,700 +/- 733

2.25% +/- 0.03

40

$70,996 +/- 649

4.23% +/- 0.06

190

Wisconsin

Milwaukee County

$3,739 +/- 21

92

$166,400 +/- 912

2.25% +/- 0.02

41

$62,433 +/- 863

5.99% +/- 0.09

43

New Jersey

Salem County

$4,571 +/- 122

44

$204,000 +/- 7,660

2.24% +/- 0.10

42

$71,587 +/- 3,681

6.39% +/- 0.37

30

Illinois

Livingston County

$2,399 +/- 101

309

$107,500 +/- 6,556

2.23% +/- 0.17

43

$58,660 +/- 4,073

4.09% +/- 0.33

216

Texas

Williamson County

$3,806 +/- 55

84

$175,700 +/- 2,553

2.17% +/- 0.04

44

$80,317 +/- 1,402

4.74% +/- 0.11

114

New York

St. Lawrence County

$1,769 +/- 77

573

$81,700 +/- 2,615

2.17% +/- 0.12

45

$52,214 +/- 1,652

3.39% +/- 0.18

420

Texas

Webb County

$2,359 +/- 94

315

$109,000 +/- 3,509

2.16% +/- 0.11

46

$48,073 +/- 2,217

4.91% +/- 0.30

97

Illinois

McHenry County

$5,333 +/- 83

30

$246,800 +/- 2,661

2.16% +/- 0.04

47

$82,851 +/- 1,514

6.44% +/- 0.15

29

Illinois

Kane County

New Hampshire

Cheshire County

New Jersey

$5,292 +/- 86

31

$245,500 +/- 2,989

2.16% +/- 0.04

48

$79,495 +/- 1,480

6.66% +/- 0.16

26

$4,414 +/- 108

51

$204,800 +/- 7,336

2.16% +/- 0.09

49

$65,241 +/- 2,409

6.77% +/- 0.30

23

Essex County

$8,344 +/- 78

$389,100 +/- 3,996

2.14% +/- 0.03

50

$95,309 +/- 1,727

8.75% +/- 0.18

Pennsylvania

Allegheny County

$2,554 +/- 22

266

$119,300 +/- 1,091

2.14% +/- 0.03

51

$62,508 +/- 790

4.09% +/- 0.06

217

Illinois

Will County

$5,099 +/- 60

32

$240,200 +/- 1,942

2.12% +/- 0.03

52

$82,727 +/- 1,504

6.16% +/- 0.13

40

Michigan

Ingham County

$2,766 +/- 49

216

$130,300 +/- 2,823

2.12% +/- 0.06

53

$62,905 +/- 1,603

4.40% +/- 0.14

157

New Jersey

Cumberland County

$3,869 +/- 77

81

$182,800 +/- 3,504

2.12% +/- 0.06

54

$65,021 +/- 2,104

5.95% +/- 0.23

46

New Jersey

Mercer County

$6,481 +/- 97

15

$306,500 +/- 5,833

2.11% +/- 0.05

55

$92,769 +/- 2,310

6.99% +/- 0.20

19

Texas

Dallas County

$2,753 +/- 26

221

$130,200 +/- 1,245

2.11% +/- 0.03

56

$65,111 +/- 771

4.23% +/- 0.06

191

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

Median Home Value

$2,018 +/- 4

$5,740 +/- 69

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

23

$272,000 +/- 3,206

2.11% +/- 0.04

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

57

$86,640 +/- 1,591

6.63% +/- 0.15

Rank

New Jersey

Burlington County

27

New Jersey

Passaic County

$7,863 +/- 100

$373,800 +/- 3,452

2.10% +/- 0.03

58

$84,705 +/- 2,309

9.28% +/- 0.28

New Hampshire

Sullivan County

$3,947 +/- 145

72

$188,900 +/- 9,403

2.09% +/- 0.13

59

$60,378 +/- 3,525

6.54% +/- 0.45

28

Illinois

LaSalle County

$2,731 +/- 85

225

$130,800 +/- 3,775

2.09% +/- 0.09

60

$61,084 +/- 1,487

4.47% +/- 0.18

149

Texas

Collin County

$4,264 +/- 47

56

$204,400 +/- 2,458

2.09% +/- 0.03

61

$100,299 +/- 1,228

4.25% +/- 0.07

185

Texas

Denton County

$3,764 +/- 34

88

$181,900 +/- 2,265

2.07% +/- 0.03

62

$93,980 +/- 1,586

4.01% +/- 0.08

234

New York

Rensselaer County

$3,730 +/- 87

94

$180,800 +/- 4,774

2.06% +/- 0.07

63

$70,618 +/- 3,428

5.28% +/- 0.28

67

Illinois

McLean County

$3,246 +/- 75

135

$157,600 +/- 2,383

2.06% +/- 0.06

64

$75,378 +/- 2,036

4.31% +/- 0.15

177

New York

Franklin County

$1,875 +/- 85

505

$91,200 +/- 3,427

2.06% +/- 0.12

65

$51,282 +/- 2,794

3.66% +/- 0.26

328

Illinois

Peoria County

$2,528 +/- 68

273

$123,100 +/- 2,672

2.05% +/- 0.07

66

$64,379 +/- 1,796

3.93% +/- 0.15

252

New York

Yates County

$2,356 +/- 116

317

$115,000 +/- 6,682

2.05% +/- 0.16

67

$57,500 +/- 2,456

4.10% +/- 0.27

212

Texas

Bexar County

$2,511 +/- 27

277

$122,600 +/- 1,165

2.05% +/- 0.03

68

$61,334 +/- 771

4.09% +/- 0.07

215

Nebraska

Sarpy County

$3,305 +/- 61

132

$161,500 +/- 1,747

2.05% +/- 0.04

69

$80,674 +/- 1,292

4.10% +/- 0.10

214

Texas

Rockwall County

$3,984 +/- 141

69

$194,800 +/- 5,932

2.05% +/- 0.10

70

$84,311 +/- 4,917

4.73% +/- 0.32

116

New Jersey

Warren County

$6,077 +/- 108

20

$299,000 +/- 7,397

2.03% +/- 0.06

71

$86,333 +/- 2,437

7.04% +/- 0.23

16

New Hampshire

Coos County

$2,718 +/- 80

229

$134,100 +/- 6,686

2.03% +/- 0.12

72

$50,540 +/- 3,819

5.38% +/- 0.44

61

Wisconsin

Green County

$3,163 +/- 83

144

$156,100 +/- 4,774

2.03% +/- 0.08

73

$61,457 +/- 1,939

5.15% +/- 0.21

75

Illinois

Champaign County

$2,996 +/- 84

170

$148,000 +/- 3,174

2.02% +/- 0.07

74

$67,261 +/- 1,949

4.45% +/- 0.18

152

Illinois

Boone County

$3,591 +/- 148

105

$178,100 +/- 8,668

2.02% +/- 0.13

75

$68,652 +/- 2,721

5.23% +/- 0.30

71

Illinois

Macon County

$1,867 +/- 54

512

$92,800 +/- 2,597

2.01% +/- 0.08

76

$54,628 +/- 1,838

3.42% +/- 0.15

410

Illinois

Rock Island County

$2,302 +/- 71

334

$114,700 +/- 2,397

2.01% +/- 0.07

77

$56,561 +/- 1,980

4.07% +/- 0.19

221

Texas

Kaufman County

$2,628 +/- 148

245

$131,600 +/- 5,540

2.00% +/- 0.14

78

$70,205 +/- 3,216

3.74% +/- 0.27

306

New Jersey

Union County

$7,714 +/- 106

10

$386,300 +/- 3,715

2.00% +/- 0.03

79

$92,195 +/- 2,102

8.37% +/- 0.22

Illinois

Lee County

$2,257 +/- 119

345

$113,100 +/- 5,685

2.00% +/- 0.15

80

$57,600 +/- 3,147

3.92% +/- 0.30

256

New Jersey

Sussex County

$6,178 +/- 63

19

$309,800 +/- 5,622

1.99% +/- 0.04

81

$90,359 +/- 2,319

6.84% +/- 0.19

21

Illinois

Iroquois County

$2,058 +/- 132

421

$103,200 +/- 5,740

1.99% +/- 0.17

82

$53,107 +/- 2,704

3.88% +/- 0.32

273

New York

Sullivan County

$3,756 +/- 122

89

$188,700 +/- 7,013

1.99% +/- 0.10

83

$59,050 +/- 2,584

6.36% +/- 0.35

31

Illinois

Whiteside County

$1,999 +/- 87

448

$100,500 +/- 3,621

1.99% +/- 0.11

84

$52,551 +/- 2,357

3.80% +/- 0.24

291

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

Median Home Value

$2,018 +/- 4

New York

Washington County

Ohio

Cuyahoga County

Illinois

McDonough County

Texas

El Paso County

New Jersey

Hunterdon County

Illinois

Ogle County

New York

$2,895 +/- 119

185

of Home Value

Median Household Taxes as Percent of

Rank

$187,500 +/- 198

1.08% +/- 0.00

$145,600 +/- 6,754

1.99% +/- 0.12

85

Income

Income

Rank

$64,519 +/- 62

3.13% +/- 0.01

$57,844 +/- 2,019

5.00% +/- 0.27

87

$2,700 +/- 19

234

$135,900 +/- 983

1.99% +/- 0.02

86

$58,485 +/- 895

4.62% +/- 0.08

128

$1,726 +/- 150

594

$87,000 +/- 3,532

1.98% +/- 0.19

87

$47,426 +/- 4,547

3.64% +/- 0.47

336

$2,144 +/- 38

380

$108,300 +/- 1,348

1.98% +/- 0.04

88

$47,223 +/- 1,015

4.54% +/- 0.13

138

$8,582 +/- 154

$433,700 +/- 9,072

1.98% +/- 0.05

89

$115,029 +/- 4,283

7.46% +/- 0.31

11

$3,166 +/- 120

143

$160,000 +/- 4,449

1.98% +/- 0.09

90

$65,964 +/- 3,075

4.80% +/- 0.29

106

Clinton County

$2,398 +/- 156

310

$121,200 +/- 4,512

1.98% +/- 0.15

91

$62,670 +/- 2,762

3.83% +/- 0.30

285

Illinois

Bureau County

$2,041 +/- 109

431

$103,700 +/- 5,515

1.97% +/- 0.15

92

$52,830 +/- 2,412

3.86% +/- 0.27

275

New Hampshire

Merrimack County

$4,806 +/- 75

38

$244,300 +/- 4,131

1.97% +/- 0.05

93

$77,585 +/- 2,528

6.19% +/- 0.22

39

Wisconsin

Kenosha County

$3,569 +/- 42

109

$182,200 +/- 4,024

1.96% +/- 0.05

94

$67,670 +/- 2,223

5.27% +/- 0.18

68

Texas

Montgomery County

$3,180 +/- 85

142

$162,500 +/- 2,728

1.96% +/- 0.06

95

$76,129 +/- 1,523

4.18% +/- 0.14

201

Nebraska

Douglas County

$2,808 +/- 29

200

$143,600 +/- 1,110

1.96% +/- 0.03

96

$68,329 +/- 1,422

4.11% +/- 0.10

210

Wisconsin

Winnebago County

$2,781 +/- 36

211

$142,700 +/- 2,579

1.95% +/- 0.04

97

$63,377 +/- 2,336

4.39% +/- 0.17

158

Illinois

Grundy County

$3,701 +/- 132

99

$190,900 +/- 6,520

1.94% +/- 0.10

98

$72,970 +/- 3,437

5.07% +/- 0.30

83

Wisconsin

Rock County

$2,718 +/- 37

229

$140,300 +/- 2,433

1.94% +/- 0.04

99

$59,494 +/- 1,721

4.57% +/- 0.15

132

New Hampshire

Strafford County

$4,392 +/- 82

53

$227,000 +/- 4,135

1.93% +/- 0.05

100

$71,571 +/- 3,219

6.14% +/- 0.30

41

Illinois

Coles County

$1,778 +/- 81

567

$92,200 +/- 4,536

1.93% +/- 0.13

101

$52,210 +/- 4,996

3.41% +/- 0.36

414

Texas

Galveston County

$2,808 +/- 90

200

$146,300 +/- 3,919

1.92% +/- 0.08

102

$76,385 +/- 3,228

3.68% +/- 0.19

325

Texas

Brazoria County

$2,801 +/- 83

202

$146,000 +/- 3,756

1.92% +/- 0.08

103

$78,851 +/- 2,874

3.55% +/- 0.17

360

Illinois

St. Clair County

$2,433 +/- 65

297

$127,200 +/- 3,671

1.91% +/- 0.08

104

$62,372 +/- 1,924

3.90% +/- 0.16

263

Illinois

Kankakee County

$2,916 +/- 82

179

$152,500 +/- 3,764

1.91% +/- 0.07

105

$63,936 +/- 1,836

4.56% +/- 0.18

134

Nebraska

Adams County

$1,870 +/- 67

511

$97,800 +/- 3,504

1.91% +/- 0.10

106

$60,440 +/- 2,641

3.09% +/- 0.17

530

Texas

Hays County

$3,332 +/- 106

130

$174,300 +/- 4,193

1.91% +/- 0.08

107

$74,192 +/- 2,782

4.49% +/- 0.22

144

Wisconsin

Iowa County

$3,001 +/- 101

168

$157,100 +/- 4,818

1.91% +/- 0.09

108

$62,970 +/- 3,525

4.77% +/- 0.31

110

Wisconsin

La Crosse County

$2,916 +/- 55

179

$152,700 +/- 2,771

1.91% +/- 0.05

109

$63,788 +/- 3,609

4.57% +/- 0.27

131

New York

Orange County

$5,831 +/- 102

22

$306,000 +/- 4,933

1.91% +/- 0.05

110

$87,141 +/- 2,243

6.69% +/- 0.21

25

Illinois

Woodford County

$2,927 +/- 146

177

$153,800 +/- 5,924

1.90% +/- 0.12

111

$72,226 +/- 2,981

4.05% +/- 0.26

227

Michigan

Washtenaw County

$3,898 +/- 54

77

$205,100 +/- 4,198

1.90% +/- 0.05

112

$80,402 +/- 1,728

4.85% +/- 0.12

103

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

Median Home Value

$2,018 +/- 4

New Jersey

Somerset County

Michigan

Oakland County

Illinois

Henry County

Texas

Hidalgo County

$1,440 +/- 37

Texas

Travis County

Michigan

Macomb County

Nebraska

Lancaster County

New York

Nassau County

Illinois

Logan County

New York

Putnam County

Wisconsin

Illinois

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

$7,853 +/- 95

$416,000 +/- 6,991

1.89% +/- 0.04

113

$110,451 +/- 2,946

7.11% +/- 0.21

14

$3,547 +/- 26

113

$188,400 +/- 1,484

1.88% +/- 0.02

114

$78,084 +/- 1,289

4.54% +/- 0.08

137

$2,123 +/- 101

391

$112,900 +/- 5,719

1.88% +/- 0.13

115

$56,260 +/- 3,649

3.77% +/- 0.30

300

774

$76,700 +/- 1,768

1.88% +/- 0.06

116

$38,868 +/- 1,185

3.70% +/- 0.15

318

$4,012 +/- 63

67

$213,800 +/- 2,985

1.88% +/- 0.04

117

$81,153 +/- 1,156

4.94% +/- 0.10

95

$2,735 +/- 18

223

$145,800 +/- 1,633

1.88% +/- 0.02

118

$61,273 +/- 915

4.46% +/- 0.07

150

$2,756 +/- 35

219

$147,200 +/- 2,037

1.87% +/- 0.04

119

$68,970 +/- 1,799

4.00% +/- 0.12

237

$8,968 +/- 42

$479,500 +/- 2,238

1.87% +/- 0.01

120

$105,507 +/- 1,028

8.50% +/- 0.09

$1,803 +/- 108

544

$96,500 +/- 3,390

1.87% +/- 0.13

121

$58,107 +/- 3,257

3.10% +/- 0.25

524

$7,627 +/- 227

11

$408,500 +/- 9,972

1.87% +/- 0.07

122

$98,508 +/- 2,615

7.74% +/- 0.31

Racine County

$3,357 +/- 43

127

$179,900 +/- 3,245

1.87% +/- 0.04

123

$65,387 +/- 1,564

5.13% +/- 0.14

77

Knox County

$1,527 +/- 81

701

$81,900 +/- 2,310

1.86% +/- 0.11

124

$49,870 +/- 2,866

3.06% +/- 0.24

545

Wisconsin

Trempealeau County

$2,487 +/- 59

284

$133,600 +/- 5,036

1.86% +/- 0.08

125

$53,805 +/- 2,888

4.62% +/- 0.27

127

Nebraska

Dawson County

$1,563 +/- 97

679

$84,000 +/- 3,668

1.86% +/- 0.14

126

$51,150 +/- 3,176

3.06% +/- 0.27

547

Wisconsin

Sheboygan County

$2,887 +/- 47

191

$155,600 +/- 3,107

1.86% +/- 0.05

127

$62,181 +/- 1,450

4.64% +/- 0.13

124

Texas

Nueces County

$2,019 +/- 73

441

$108,900 +/- 2,223

1.85% +/- 0.08

128

$57,083 +/- 1,755

3.54% +/- 0.17

366

New York

Rockland County

$8,673 +/- 112

$468,000 +/- 4,687

1.85% +/- 0.03

129

$105,342 +/- 2,525

8.23% +/- 0.22

Illinois

Sangamon County

$2,239 +/- 59

351

$121,000 +/- 2,463

1.85% +/- 0.06

130

$66,965 +/- 1,700

3.34% +/- 0.12

437

Wisconsin

Manitowoc County

$2,348 +/- 50

320

$127,000 +/- 3,892

1.85% +/- 0.07

131

$57,062 +/- 1,788

4.11% +/- 0.16

209

New Jersey

Bergen County

$8,780 +/- 50

$475,200 +/- 3,504

1.85% +/- 0.02

132

$102,269 +/- 1,340

8.59% +/- 0.12

Texas

Bell County

$2,161 +/- 63

378

$117,400 +/- 2,381

1.84% +/- 0.07

133

$63,019 +/- 1,384

3.43% +/- 0.13

406

New Hampshire

Hillsborough County

$4,865 +/- 46

35

$264,300 +/- 2,506

1.84% +/- 0.02

134

$84,845 +/- 1,735

5.73% +/- 0.13

53

Illinois

Tazewell County

Nebraska

Cass County

Pennsylvania

$2,375 +/- 57

313

$129,300 +/- 3,132

1.84% +/- 0.06

135

$62,904 +/- 2,158

3.78% +/- 0.16

297

$2,700 +/- 105

234

$147,000 +/- 6,858

1.84% +/- 0.11

136

$68,872 +/- 3,670

3.92% +/- 0.26

255

Armstrong County

$1,644 +/- 52

636

$89,600 +/- 3,078

1.83% +/- 0.09

137

$49,672 +/- 2,100

3.31% +/- 0.17

450

New Hampshire

Rockingham County

$5,410 +/- 70

29

$294,900 +/- 3,603

1.83% +/- 0.03

138

$87,316 +/- 1,817

6.20% +/- 0.15

37

Wisconsin

Marathon County

$2,622 +/- 34

249

$143,000 +/- 2,495

1.83% +/- 0.04

139

$62,646 +/- 2,143

4.19% +/- 0.15

200

New Jersey

Middlesex County

$6,416 +/- 41

17

$350,000 +/- 2,225

1.83% +/- 0.02

140

$93,389 +/- 1,569

6.87% +/- 0.12

20

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Wisconsin

Dodge County

$2,883 +/- 52

192

$157,900 +/- 2,860

1.83% +/- 0.05

141

$62,054 +/- 1,730

4.65% +/- 0.15

123

North Dakota

Cass County

$2,761 +/- 53

217

$151,300 +/- 3,016

1.82% +/- 0.05

142

$71,756 +/- 2,256

3.85% +/- 0.14

278

Michigan

Genesee County

$1,993 +/- 40

451

$109,400 +/- 1,818

1.82% +/- 0.05

143

$52,885 +/- 1,088

3.77% +/- 0.11

302

Nebraska

Gage County

$1,818 +/- 95

536

$99,800 +/- 6,997

1.82% +/- 0.16

144

$49,820 +/- 1,964

3.65% +/- 0.24

330

Nebraska

Dakota County

$1,747 +/- 168

583

$96,000 +/- 6,082

1.82% +/- 0.21

145

$56,076 +/- 6,389

3.12% +/- 0.46

519

New York

Ulster County

$4,386 +/- 127

54

$241,500 +/- 4,049

1.82% +/- 0.06

146

$69,981 +/- 1,926

6.27% +/- 0.25

33

Illinois

Jackson County

$1,749 +/- 188

582

$96,400 +/- 5,641

1.81% +/- 0.22

147

$51,491 +/- 3,640

3.40% +/- 0.44

416

New York

Suffolk County

$7,411 +/- 53

12

$408,800 +/- 2,713

1.81% +/- 0.02

148

$95,286 +/- 1,097

7.78% +/- 0.11

Wisconsin

Brown County

$2,888 +/- 37

190

$159,700 +/- 1,826

1.81% +/- 0.03

149

$66,776 +/- 1,410

4.32% +/- 0.11

172

Wisconsin

Calumet County

$2,931 +/- 79

176

$162,100 +/- 3,801

1.81% +/- 0.06

150

$68,224 +/- 2,407

4.30% +/- 0.19

180

Illinois

Vermilion County

$1,392 +/- 73

816

$77,000 +/- 3,200

1.81% +/- 0.12

151

$48,192 +/- 2,056

2.89% +/- 0.20

614

Illinois

Fulton County

$1,470 +/- 86

745

$81,500 +/- 3,688

1.80% +/- 0.13

152

$46,880 +/- 1,738

3.14% +/- 0.22

514

Ohio

Montgomery County

$2,146 +/- 41

379

$119,100 +/- 1,491

1.80% +/- 0.04

153

$57,243 +/- 1,118

3.75% +/- 0.10

304

Wisconsin

Dunn County

$2,891 +/- 89

187

$160,600 +/- 3,963

1.80% +/- 0.07

154

$59,048 +/- 2,482

4.90% +/- 0.26

100

Wisconsin

Pierce County

$3,557 +/- 99

110

$197,600 +/- 6,047

1.80% +/- 0.07

155

$71,281 +/- 3,236

4.99% +/- 0.27

89

Wisconsin

Monroe County

$2,383 +/- 76

312

$132,500 +/- 6,821

1.80% +/- 0.11

156

$54,973 +/- 3,921

4.33% +/- 0.34

170

New Jersey

Atlantic County

$4,634 +/- 64

41

$257,700 +/- 4,682

1.80% +/- 0.04

157

$65,005 +/- 2,003

7.13% +/- 0.24

13

Illinois

DuPage County

$5,658 +/- 46

25

$314,700 +/- 2,579

1.80% +/- 0.02

158

$90,276 +/- 1,159

6.27% +/- 0.10

32

Texas

Ellis County

$2,477 +/- 72

288

$138,100 +/- 3,288

1.79% +/- 0.07

159

$72,160 +/- 1,839

3.43% +/- 0.13

404

Wisconsin

Fond du Lac County

$2,618 +/- 35

251

$146,100 +/- 2,875

1.79% +/- 0.04

160

$63,060 +/- 1,743

4.15% +/- 0.13

203

Kansas

Ford County

$1,468 +/- 85

748

$82,000 +/- 5,077

1.79% +/- 0.15

161

$52,626 +/- 2,920

2.79% +/- 0.22

672

Illinois

Madison County

$2,247 +/- 53

349

$126,000 +/- 3,340

1.78% +/- 0.06

162

$61,702 +/- 1,419

3.64% +/- 0.12

334

Texas

Bastrop County

$2,249 +/- 105

347

$126,200 +/- 5,480

1.78% +/- 0.11

163

$61,781 +/- 2,598

3.64% +/- 0.23

335

Wisconsin

Outagamie County

$2,787 +/- 28

208

$156,600 +/- 1,987

1.78% +/- 0.03

164

$65,621 +/- 1,694

4.25% +/- 0.12

187

North Dakota

Grand Forks County

$2,564 +/- 82

263

$144,100 +/- 3,254

1.78% +/- 0.07

165

$68,959 +/- 2,491

3.72% +/- 0.18

313

Texas

Brazos County

$2,600 +/- 79

255

$146,200 +/- 3,993

1.78% +/- 0.07

166

$66,543 +/- 2,721

3.91% +/- 0.20

259

Wisconsin

Dane County

$4,157 +/- 43

62

$233,800 +/- 1,875

1.78% +/- 0.02

167

$81,499 +/- 1,446

5.10% +/- 0.10

81

Connecticut

Hartford County

$4,469 +/- 37

48

$251,400 +/- 2,020

1.78% +/- 0.02

168

$82,118 +/- 957

5.44% +/- 0.08

60

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

Median Home Value

$2,018 +/- 4

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Pennsylvania

Erie County

$2,035 +/- 49

433

$114,600 +/- 2,154

1.78% +/- 0.05

169

$56,144 +/- 1,041

3.62% +/- 0.11

342

Wisconsin

Wood County

$2,110 +/- 61

399

$119,100 +/- 2,499

1.77% +/- 0.06

170

$54,205 +/- 1,637

3.89% +/- 0.16

265

Wisconsin

Juneau County

$2,121 +/- 86

393

$120,100 +/- 4,240

1.77% +/- 0.09

171

$51,238 +/- 2,036

4.14% +/- 0.24

205

Illinois

Clinton County

$2,294 +/- 123

338

$130,000 +/- 6,711

1.76% +/- 0.13

172

$64,703 +/- 3,616

3.55% +/- 0.27

362

Nebraska

Saunders County

$2,406 +/- 86

305

$136,600 +/- 6,353

1.76% +/- 0.10

173

$60,335 +/- 3,867

3.99% +/- 0.29

239

Vermont

Rutland County

$3,113 +/- 102

153

$176,800 +/- 7,095

1.76% +/- 0.09

174

$60,098 +/- 2,603

5.18% +/- 0.28

73

Illinois

Morgan County

$1,648 +/- 89

634

$93,600 +/- 4,824

1.76% +/- 0.13

175

$57,717 +/- 3,934

2.86% +/- 0.25

630

Connecticut

New Haven County

$4,824 +/- 33

37

$274,300 +/- 2,137

1.76% +/- 0.02

176

$81,885 +/- 954

5.89% +/- 0.08

48

Nebraska

Hall County

$1,955 +/- 56

471

$111,200 +/- 3,645

1.76% +/- 0.08

177

$57,629 +/- 2,810

3.39% +/- 0.19

417

New Jersey

Hudson County

$6,625 +/- 102

14

$377,100 +/- 5,881

1.76% +/- 0.04

178

$87,516 +/- 2,828

7.57% +/- 0.27

10

Texas

Cameron County

$1,337 +/- 46

857

$76,200 +/- 1,805

1.75% +/- 0.07

179

$38,884 +/- 1,215

3.44% +/- 0.16

397

New York

Albany County

$3,711 +/- 70

97

$211,600 +/- 4,306

1.75% +/- 0.05

180

$79,370 +/- 1,839

4.68% +/- 0.14

121

Pennsylvania

Berks County

$3,107 +/- 61

155

$177,700 +/- 2,633

1.75% +/- 0.04

181

$65,216 +/- 1,043

4.76% +/- 0.12

112

Wisconsin

Portage County

$2,565 +/- 47

262

$146,800 +/- 3,057

1.75% +/- 0.05

182

$63,290 +/- 2,340

4.05% +/- 0.17

226

Nebraska

Madison County

$1,755 +/- 83

578

$100,500 +/- 5,959

1.75% +/- 0.13

183

$53,169 +/- 2,876

3.30% +/- 0.24

453

Wisconsin

Waupaca County

$2,433 +/- 59

297

$139,600 +/- 4,173

1.74% +/- 0.07

184

$54,522 +/- 2,344

4.46% +/- 0.22

151

Vermont

Windsor County

$3,712 +/- 118

96

$213,500 +/- 10,820

1.74% +/- 0.10

185

$59,922 +/- 2,659

6.19% +/- 0.34

38

Wisconsin

Vernon County

$2,353 +/- 80

318

$135,400 +/- 5,877

1.74% +/- 0.10

186

$49,240 +/- 2,313

4.78% +/- 0.28

109

Kansas

Labette County

$1,088 +/- 82

1079

$62,800 +/- 3,682

1.73% +/- 0.17

187

$45,026 +/- 2,670

2.42% +/- 0.23

861

Wisconsin

Eau Claire County

$2,628 +/- 48

245

$151,700 +/- 3,322

1.73% +/- 0.05

188

$62,353 +/- 2,123

4.21% +/- 0.16

194

Wisconsin

Taylor County

$2,136 +/- 93

385

$123,400 +/- 4,923

1.73% +/- 0.10

189

$49,288 +/- 2,961

4.33% +/- 0.32

171

Michigan

Bay County

$1,796 +/- 37

551

$103,900 +/- 2,737

1.73% +/- 0.06

190

$50,997 +/- 1,469

3.52% +/- 0.12

374

Wisconsin

Clark County

$1,917 +/- 41

487

$110,900 +/- 3,368

1.73% +/- 0.06

191

$47,046 +/- 1,514

4.07% +/- 0.16

220

Michigan

Calhoun County

$1,842 +/- 43

526

$106,600 +/- 2,697

1.73% +/- 0.06

192

$50,704 +/- 1,522

3.63% +/- 0.14

340

Nebraska

Lincoln County

$1,957 +/- 101

469

$113,300 +/- 6,492

1.73% +/- 0.13

193

$61,903 +/- 4,621

3.16% +/- 0.29

496

Texas

Victoria County

$1,773 +/- 112

569

$102,800 +/- 5,250

1.72% +/- 0.14

194

$61,571 +/- 2,116

2.88% +/- 0.21

621

New York

Westchester County

$9,424 +/- 140

$546,900 +/- 6,269

1.72% +/- 0.03

195

$110,211 +/- 1,823

8.55% +/- 0.19

Texas

Caldwell County

$1,834 +/- 275

530

$106,800 +/- 6,307

1.72% +/- 0.28

196

$54,074 +/- 7,619

3.39% +/- 0.70

418

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

Median Home Value

$2,018 +/- 4

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Ohio

Franklin County

$2,688 +/- 23

237

$156,600 +/- 1,160

1.72% +/- 0.02

197

$69,156 +/- 920

3.89% +/- 0.06

268

Pennsylvania

Monroe County

$3,579 +/- 76

107

$208,800 +/- 4,739

1.71% +/- 0.05

198

$62,799 +/- 1,907

5.70% +/- 0.21

55

Wisconsin

Grant County

$2,026 +/- 92

438

$118,200 +/- 3,989

1.71% +/- 0.10

199

$50,723 +/- 2,154

3.99% +/- 0.25

238

North Dakota

Morton County

$1,984 +/- 171

457

$115,800 +/- 9,855

1.71% +/- 0.21

200

$61,025 +/- 4,458

3.25% +/- 0.37

467

Nebraska

Scotts Bluff County

$1,682 +/- 89

615

$98,200 +/- 3,074

1.71% +/- 0.11

201

$52,083 +/- 3,702

3.23% +/- 0.29

477

New Jersey

Morris County

$7,917 +/- 89

$462,600 +/- 4,032

1.71% +/- 0.02

202

$112,395 +/- 2,340

7.04% +/- 0.17

15

Texas

Potter County

$1,401 +/- 58

806

$82,100 +/- 4,126

1.71% +/- 0.11

203

$50,726 +/- 2,133

2.76% +/- 0.16

684

Texas

Cooke County

$1,844 +/- 134

525

$108,200 +/- 13,542

1.70% +/- 0.25

204

$55,202 +/- 3,864

3.34% +/- 0.34

442

New Jersey

Monmouth County

$7,051 +/- 50

13

$413,800 +/- 4,300

1.70% +/- 0.02

205

$100,800 +/- 1,229

7.00% +/- 0.10

18

Ohio

Lucas County

$2,040 +/- 45

432

$119,900 +/- 2,009

1.70% +/- 0.05

206

$55,183 +/- 1,390

3.70% +/- 0.12

321

Wisconsin

Jefferson County

$3,187 +/- 64

141

$187,600 +/- 3,959

1.70% +/- 0.05

207

$64,493 +/- 2,169

4.94% +/- 0.19

96

Vermont

Windham County

$3,552 +/- 105

112

$209,200 +/- 8,237

1.70% +/- 0.08

208

$59,647 +/- 2,588

5.96% +/- 0.31

45

New York

Otsego County

$2,131 +/- 113

387

$126,000 +/- 6,375

1.69% +/- 0.12

209

$52,457 +/- 2,860

4.06% +/- 0.31

224

Vermont

Washington County

$3,485 +/- 106

116

$206,200 +/- 7,116

1.69% +/- 0.08

210

$62,984 +/- 2,834

5.53% +/- 0.30

57

Illinois

Montgomery County

$1,405 +/- 112

801

$83,400 +/- 4,499

1.68% +/- 0.16

211

$49,402 +/- 4,652

2.84% +/- 0.35

639

Texas

San Patricio County

$1,532 +/- 122

697

$91,000 +/- 4,926

1.68% +/- 0.16

212

$59,239 +/- 3,643

2.59% +/- 0.26

778

New York

Lewis County

$1,711 +/- 72

597

$101,700 +/- 5,595

1.68% +/- 0.12

213

$48,486 +/- 3,494

3.53% +/- 0.29

369

Wisconsin

Walworth County

$3,428 +/- 56

120

$204,200 +/- 5,802

1.68% +/- 0.06

214

$66,644 +/- 1,792

5.14% +/- 0.16

76

Texas

Wichita County

$1,488 +/- 60

728

$88,700 +/- 3,074

1.68% +/- 0.09

215

$52,560 +/- 2,110

2.83% +/- 0.16

651

Texas

Lubbock County

$1,784 +/- 57

561

$106,500 +/- 2,652

1.68% +/- 0.07

216

$58,142 +/- 1,482

3.07% +/- 0.13

541

Michigan

Dickinson County

$1,486 +/- 64

730

$88,800 +/- 4,553

1.67% +/- 0.11

217

$47,127 +/- 3,282

3.15% +/- 0.26

501

Wisconsin

Barron County

$2,298 +/- 73

336

$137,600 +/- 3,652

1.67% +/- 0.07

218

$49,517 +/- 1,643

4.64% +/- 0.21

125

Michigan

Kalamazoo County

$2,426 +/- 40

299

$145,300 +/- 2,296

1.67% +/- 0.04

219

$61,091 +/- 1,488

3.97% +/- 0.12

241

Texas

Kleberg County

$1,243 +/- 117

943

$74,500 +/- 6,811

1.67% +/- 0.22

220

$52,009 +/- 5,050

2.39% +/- 0.32

876

Pennsylvania

Greene County

$1,384 +/- 66

823

$83,000 +/- 5,332

1.67% +/- 0.13

221

$50,326 +/- 2,542

2.75% +/- 0.19

690

New Hampshire

Grafton County

$3,580 +/- 115

106

$214,700 +/- 5,690

1.67% +/- 0.07

222

$60,455 +/- 2,679

5.92% +/- 0.32

47

Illinois

Monroe County

$3,349 +/- 135

129

$200,900 +/- 7,394

1.67% +/- 0.09

223

$84,469 +/- 5,492

3.96% +/- 0.30

245

Nebraska

Dodge County

$1,815 +/- 84

538

$109,000 +/- 3,627

1.67% +/- 0.09

224

$52,874 +/- 1,979

3.43% +/- 0.20

403

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Illinois

Shelby County

Kansas

Wyandotte County

Vermont

Orange County

Illinois

Marion County

Pennsylvania

Wisconsin

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

$86,300 +/- 3,372

1.66% +/- 0.14

Median Household Taxes as Percent of

Rank

Income

Income

Rank

$64,519 +/- 62

3.13% +/- 0.01

225

$50,344 +/- 2,833

2.85% +/- 0.27

632

$1,436 +/- 107

777

$1,642 +/- 59

637

$99,000 +/- 2,876

1.66% +/- 0.08

226

$50,179 +/- 1,927

3.27% +/- 0.17

458

$2,998 +/- 109

169

$180,800 +/- 6,834

1.66% +/- 0.09

227

$55,939 +/- 1,778

5.36% +/- 0.26

62

$1,220 +/- 102

963

$73,600 +/- 2,713

1.66% +/- 0.15

228

$46,471 +/- 1,783

2.63% +/- 0.24

750

Beaver County

$1,886 +/- 41

497

$114,000 +/- 2,190

1.65% +/- 0.05

229

$53,921 +/- 1,187

3.50% +/- 0.11

381

Columbia County

$3,011 +/- 87

165

$182,400 +/- 4,819

1.65% +/- 0.06

230

$65,768 +/- 1,747

4.58% +/- 0.18

130

New York

Jefferson County

$2,112 +/- 106

397

$128,000 +/- 5,802

1.65% +/- 0.11

231

$58,562 +/- 2,087

3.61% +/- 0.22

349

Pennsylvania

Delaware County

$3,958 +/- 47

71

$240,100 +/- 2,851

1.65% +/- 0.03

232

$77,779 +/- 1,360

5.09% +/- 0.11

82

Texas

Randall County

$2,214 +/- 72

362

$134,600 +/- 3,420

1.64% +/- 0.07

233

$69,624 +/- 2,806

3.18% +/- 0.16

489

Illinois

Adams County

$1,638 +/- 70

641

$99,900 +/- 3,544

1.64% +/- 0.09

234

$51,981 +/- 2,095

3.15% +/- 0.19

504

Wisconsin

Sauk County

$2,790 +/- 58

207

$170,200 +/- 4,127

1.64% +/- 0.05

235

$61,312 +/- 2,743

4.55% +/- 0.22

136

Connecticut

Tolland County

$4,466 +/- 82

49

$273,100 +/- 3,938

1.64% +/- 0.04

236

$92,032 +/- 2,552

4.85% +/- 0.16

102

Pennsylvania

McKean County

$1,179 +/- 49

1003

$72,100 +/- 3,477

1.64% +/- 0.10

237

$48,141 +/- 2,941

2.45% +/- 0.18

848

Texas

Coryell County

$1,567 +/- 123

675

$96,000 +/- 5,925

1.63% +/- 0.16

238

$57,572 +/- 4,377

2.72% +/- 0.30

706

New York

Dutchess County

$5,073 +/- 109

33

$311,600 +/- 4,982

1.63% +/- 0.04

239

$84,620 +/- 1,891

6.00% +/- 0.19

42

Texas

Johnson County

$1,855 +/- 76

519

$114,200 +/- 3,524

1.62% +/- 0.08

240

$63,366 +/- 2,654

2.93% +/- 0.17

602

Pennsylvania

Warren County

$1,400 +/- 34

807

$86,300 +/- 2,934

1.62% +/- 0.07

241

$48,614 +/- 2,961

2.88% +/- 0.19

620

Vermont

Caledonia County

$2,617 +/- 78

252

$161,400 +/- 4,601

1.62% +/- 0.07

242

$51,264 +/- 2,494

5.10% +/- 0.29

79

Texas

Waller County

$2,068 +/- 311

413

$127,600 +/- 10,264

1.62% +/- 0.28

243

$58,989 +/- 6,803

3.51% +/- 0.66

378

New Hampshire

Belknap County

$3,638 +/- 90

103

$224,900 +/- 6,480

1.62% +/- 0.06

244

$62,781 +/- 2,471

5.79% +/- 0.27

52

Vermont

Addison County

$3,750 +/- 101

91

$232,400 +/- 6,089

1.61% +/- 0.06

245

$65,777 +/- 3,524

5.70% +/- 0.34

54

Wisconsin

Langlade County

$1,768 +/- 76

574

$109,600 +/- 8,940

1.61% +/- 0.15

246

$44,676 +/- 2,485

3.96% +/- 0.28

247

Texas

Parker County

$2,475 +/- 97

289

$153,500 +/- 5,389

1.61% +/- 0.08

247

$70,861 +/- 2,628

3.49% +/- 0.19

383

Vermont

Bennington County

$3,215 +/- 134

139

$199,600 +/- 9,520

1.61% +/- 0.10

248

$58,906 +/- 3,169

5.46% +/- 0.37

59

Nebraska

Washington County

$2,794 +/- 92

205

$173,600 +/- 9,088

1.61% +/- 0.10

249

$70,855 +/- 4,796

3.94% +/- 0.30

248

Iowa

Polk County

$2,471 +/- 28

290

$153,800 +/- 1,914

1.61% +/- 0.03

250

$70,702 +/- 1,296

3.49% +/- 0.08

382

Pennsylvania

Venango County

$1,268 +/- 36

912

$79,000 +/- 2,984

1.61% +/- 0.08

251

$48,203 +/- 2,824

2.63% +/- 0.17

748

New York

Columbia County

$3,731 +/- 133

93

$232,900 +/- 8,114

1.60% +/- 0.08

252

$64,351 +/- 4,638

5.80% +/- 0.47

51

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

372

$136,000 +/- 15,360

1.60% +/- 0.22

Median Household Taxes as Percent of

Rank

Income

Income

Rank

$64,519 +/- 62

3.13% +/- 0.01

253

$63,837 +/- 3,394

3.41% +/- 0.31

411

Texas

Wilson County

$2,178 +/- 159

Wisconsin

Lincoln County

$2,128 +/- 94

388

$133,100 +/- 7,858

1.60% +/- 0.12

254

$57,339 +/- 2,711

3.71% +/- 0.24

316

Kansas

Barton County

$1,169 +/- 93

1014

$73,400 +/- 6,350

1.59% +/- 0.19

255

$51,605 +/- 2,234

2.27% +/- 0.21

949

Kansas

Reno County

$1,420 +/- 59

789

$89,200 +/- 3,510

1.59% +/- 0.09

256

$50,078 +/- 2,754

2.84% +/- 0.20

649

Michigan

Kent County

$2,325 +/- 25

328

$146,100 +/- 1,477

1.59% +/- 0.02

257

$61,120 +/- 933

3.80% +/- 0.07

290

Texas

Wharton County

$1,300 +/- 117

891

$81,700 +/- 6,158

1.59% +/- 0.19

258

$47,616 +/- 3,541

2.73% +/- 0.32

701

New York

Delaware County

$2,046 +/- 119

427

$128,600 +/- 8,741

1.59% +/- 0.14

259

$50,562 +/- 2,295

4.05% +/- 0.30

228

Pennsylvania

Crawford County

$1,619 +/- 61

651

$101,800 +/- 3,457

1.59% +/- 0.08

260

$46,672 +/- 1,843

3.47% +/- 0.19

391

Texas

McLennan County

$1,686 +/- 71

613

$106,100 +/- 2,952

1.59% +/- 0.08

261

$56,370 +/- 1,556

2.99% +/- 0.15

573

Wisconsin

Polk County

$2,682 +/- 51

238

$169,000 +/- 3,236

1.59% +/- 0.04

262

$54,145 +/- 1,863

4.95% +/- 0.19

94

Kansas

Sumner County

$1,393 +/- 82

815

$87,900 +/- 5,275

1.58% +/- 0.13

263

$55,994 +/- 4,248

2.49% +/- 0.24

822

Illinois

Christian County

$1,290 +/- 87

897

$81,500 +/- 3,073

1.58% +/- 0.12

264

$50,196 +/- 3,126

2.57% +/- 0.24

784

Michigan

Saginaw County

$1,696 +/- 27

604

$107,500 +/- 2,686

1.58% +/- 0.05

265

$50,750 +/- 1,149

3.34% +/- 0.09

440

Vermont

Chittenden County

$4,169 +/- 83

60

$264,700 +/- 4,480

1.57% +/- 0.04

266

$78,152 +/- 2,479

5.33% +/- 0.20

64

Ohio

Greene County

$2,502 +/- 63

282

$159,100 +/- 3,002

1.57% +/- 0.05

267

$69,120 +/- 2,659

3.62% +/- 0.17

343

Michigan

Muskegon County

$1,727 +/- 37

593

$109,900 +/- 2,150

1.57% +/- 0.05

268

$49,273 +/- 1,386

3.50% +/- 0.12

379

New York

Schoharie County

$2,303 +/- 146

333

$147,000 +/- 7,366

1.57% +/- 0.13

269

$57,906 +/- 3,394

3.98% +/- 0.34

240

Texas

Jefferson County

$1,450 +/- 48

762

$92,600 +/- 2,087

1.57% +/- 0.06

270

$54,401 +/- 1,831

2.67% +/- 0.13

734

Vermont

Lamoille County

$3,404 +/- 214

124

$217,600 +/- 12,864

1.56% +/- 0.13

271

$63,526 +/- 3,714

5.36% +/- 0.46

63

Texas

Hale County

$1,115 +/- 108

1056

$71,300 +/- 4,450

1.56% +/- 0.18

272

$46,212 +/- 2,853

2.41% +/- 0.28

863

Wisconsin

Shawano County

$1,989 +/- 65

453

$127,200 +/- 5,485

1.56% +/- 0.08

273

$51,574 +/- 1,544

3.86% +/- 0.17

276

Wisconsin

Douglas County

$2,137 +/- 87

384

$136,800 +/- 5,327

1.56% +/- 0.09

274

$56,652 +/- 2,988

3.77% +/- 0.25

301

New Jersey

Ocean County

$4,447 +/- 40

50

$285,800 +/- 2,653

1.56% +/- 0.02

275

$65,908 +/- 1,376

6.75% +/- 0.15

24

Michigan

Midland County

$1,986 +/- 58

455

$127,700 +/- 3,734

1.56% +/- 0.06

276

$58,875 +/- 2,152

3.37% +/- 0.16

426

Texas

Liberty County

$1,245 +/- 72

939

$80,100 +/- 4,801

1.55% +/- 0.13

277

$52,638 +/- 3,242

2.37% +/- 0.20

890

Wisconsin

Jackson County

$1,886 +/- 77

497

$121,600 +/- 4,133

1.55% +/- 0.08

278

$47,529 +/- 1,906

3.97% +/- 0.23

243

Ohio

Hamilton County

$2,316 +/- 29

331

$149,400 +/- 1,747

1.55% +/- 0.03

279

$68,297 +/- 1,242

3.39% +/- 0.07

419

Illinois

Jo Daviess County

$2,224 +/- 161

357

$143,700 +/- 7,962

1.55% +/- 0.14

280

$56,702 +/- 4,073

3.92% +/- 0.40

254

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Ohio

Summit County

$2,199 +/- 32

367

$142,100 +/- 1,657

1.55% +/- 0.03

281

$60,759 +/- 922

3.62% +/- 0.08

344

Ohio

Lake County

$2,455 +/- 33

293

$158,700 +/- 1,835

1.55% +/- 0.03

282

$62,896 +/- 1,469

3.90% +/- 0.11

260

Wisconsin

Kewaunee County

$2,323 +/- 86

329

$150,700 +/- 5,885

1.54% +/- 0.08

283

$59,755 +/- 2,407

3.89% +/- 0.21

267

Illinois

Macoupin County

$1,452 +/- 70

759

$94,300 +/- 4,066

1.54% +/- 0.10

284

$56,722 +/- 3,803

2.56% +/- 0.21

789

Wisconsin

Ozaukee County

$4,002 +/- 102

68

$260,600 +/- 7,321

1.54% +/- 0.06

285

$86,452 +/- 2,916

4.63% +/- 0.20

126

Kansas

Cowley County

$1,214 +/- 77

973

$79,200 +/- 4,267

1.53% +/- 0.13

286

$49,358 +/- 2,779

2.46% +/- 0.21

844

Kansas

Lyon County

$1,396 +/- 65

810

$91,200 +/- 5,377

1.53% +/- 0.11

287

$51,534 +/- 3,306

2.71% +/- 0.21

714

Pennsylvania

Mifflin County

$1,464 +/- 51

749

$95,700 +/- 3,631

1.53% +/- 0.08

288

$45,314 +/- 2,558

3.23% +/- 0.21

476

North Dakota

Stutsman County

$1,459 +/- 134

753

$95,500 +/- 8,059

1.53% +/- 0.19

289

$56,012 +/- 3,515

2.60% +/- 0.29

762

Illinois

Effingham County

$1,618 +/- 112

653

$106,400 +/- 4,517

1.52% +/- 0.12

290

$54,960 +/- 2,758

2.94% +/- 0.25

595

Texas

Willacy County

$736 +/- 131

1407

$48,400 +/- 4,916

1.52% +/- 0.31

291

$27,665 +/- 6,535

2.66% +/- 0.79

738

Iowa

Woodbury County

$1,488 +/- 47

728

$98,000 +/- 2,559

1.52% +/- 0.06

292

$55,303 +/- 2,539

2.69% +/- 0.15

722

Michigan

Eaton County

$2,292 +/- 61

340

$151,000 +/- 3,165

1.52% +/- 0.05

293

$62,547 +/- 2,438

3.66% +/- 0.17

327

Pennsylvania

York County

$2,779 +/- 38

213

$183,200 +/- 1,817

1.52% +/- 0.03

294

$67,241 +/- 1,130

4.13% +/- 0.09

206

Texas

Guadalupe County

$2,301 +/- 99

335

$151,900 +/- 3,540

1.51% +/- 0.07

295

$70,634 +/- 1,948

3.26% +/- 0.17

462

New York

Saratoga County

$3,491 +/- 77

115

$230,500 +/- 3,910

1.51% +/- 0.04

296

$78,879 +/- 2,633

4.43% +/- 0.18

154

Pennsylvania

Northampton County

$3,421 +/- 45

122

$225,900 +/- 3,208

1.51% +/- 0.03

297

$69,758 +/- 1,460

4.90% +/- 0.12

98

Pennsylvania

Schuylkill County

$1,387 +/- 33

822

$91,600 +/- 2,965

1.51% +/- 0.06

298

$49,238 +/- 1,678

2.82% +/- 0.12

661

Wisconsin

Waushara County

$2,108 +/- 84

400

$139,500 +/- 5,818

1.51% +/- 0.09

299

$48,097 +/- 1,893

4.38% +/- 0.25

160

Illinois

Jersey County

$1,787 +/- 117

559

$118,300 +/- 6,307

1.51% +/- 0.13

300

$60,971 +/- 3,046

2.93% +/- 0.24

600

Texas

Navarro County

$1,182 +/- 81

999

$78,300 +/- 4,288

1.51% +/- 0.13

301

$49,345 +/- 4,620

2.40% +/- 0.28

870

Texas

Hunt County

$1,450 +/- 81

762

$96,200 +/- 5,555

1.51% +/- 0.12

302

$53,515 +/- 3,558

2.71% +/- 0.24

713

Nebraska

Platte County

$1,690 +/- 57

607

$112,300 +/- 5,167

1.50% +/- 0.09

303

$55,287 +/- 2,679

3.06% +/- 0.18

546

North Dakota

Burleigh County

$2,414 +/- 45

303

$160,600 +/- 3,200

1.50% +/- 0.04

304

$70,153 +/- 2,993

3.44% +/- 0.16

396

Connecticut

Middlesex County

$4,618 +/- 79

42

$307,500 +/- 6,920

1.50% +/- 0.04

305

$87,873 +/- 2,889

5.26% +/- 0.19

69

Wisconsin

Washington County

$3,525 +/- 46

114

$234,900 +/- 3,275

1.50% +/- 0.03

306

$75,033 +/- 2,695

4.70% +/- 0.18

120

Wisconsin

St. Croix County

$3,352 +/- 59

128

$223,700 +/- 5,008

1.50% +/- 0.04

307

$77,677 +/- 3,021

4.32% +/- 0.18

175

Pennsylvania

Carbon County

$2,166 +/- 80

376

$144,700 +/- 6,410

1.50% +/- 0.09

308

$55,510 +/- 2,797

3.90% +/- 0.24

262

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Pennsylvania

Dauphin County

$2,395 +/- 43

311

$160,000 +/- 2,356

1.50% +/- 0.03

309

$66,352 +/- 1,569

3.61% +/- 0.11

347

Kansas

Seward County

$1,237 +/- 68

951

$82,700 +/- 8,156

1.50% +/- 0.17

310

$49,579 +/- 2,414

2.50% +/- 0.18

816

Pennsylvania

Lawrence County

$1,423 +/- 35

788

$95,300 +/- 3,027

1.49% +/- 0.06

311

$49,164 +/- 1,795

2.89% +/- 0.13

612

Michigan

Van Buren County

$1,850 +/- 57

522

$123,900 +/- 4,312

1.49% +/- 0.07

312

$50,722 +/- 1,958

3.65% +/- 0.18

331

Pennsylvania

Indiana County

$1,529 +/- 60

699

$102,500 +/- 3,661

1.49% +/- 0.08

313

$51,280 +/- 1,764

2.98% +/- 0.16

577

Kansas

Shawnee County

$1,779 +/- 34

566

$119,300 +/- 2,481

1.49% +/- 0.04

314

$62,164 +/- 1,883

2.86% +/- 0.10

626

Wisconsin

Oconto County

$2,198 +/- 64

368

$147,400 +/- 5,457

1.49% +/- 0.07

315

$52,477 +/- 1,942

4.19% +/- 0.20

197

Ohio

Delaware County

Texas

Wise County

Wisconsin

$3,796 +/- 91

86

$255,100 +/- 5,064

1.49% +/- 0.05

316

$100,557 +/- 2,262

3.77% +/- 0.12

298

$1,871 +/- 115

510

$125,800 +/- 8,853

1.49% +/- 0.14

317

$61,440 +/- 4,182

3.05% +/- 0.28

551

Waukesha County

$3,943 +/- 28

73

$265,200 +/- 2,259

1.49% +/- 0.02

318

$87,026 +/- 1,622

4.53% +/- 0.09

143

Kansas

Butler County

$1,845 +/- 80

524

$124,100 +/- 5,279

1.49% +/- 0.09

319

$66,581 +/- 2,950

2.77% +/- 0.17

680

Rhode Island

Kent County

$3,579 +/- 51

107

$240,900 +/- 3,020

1.49% +/- 0.03

320

$71,732 +/- 1,423

4.99% +/- 0.12

90

Pennsylvania

Elk County

$1,396 +/- 48

810

$94,000 +/- 4,930

1.49% +/- 0.09

321

$46,972 +/- 1,547

2.97% +/- 0.14

583

Texas

Val Verde County

$1,254 +/- 158

932

$84,500 +/- 6,608

1.48% +/- 0.22

322

$44,539 +/- 4,392

2.82% +/- 0.45

662

Michigan

Lenawee County

$1,992 +/- 63

452

$134,700 +/- 4,477

1.48% +/- 0.07

323

$55,168 +/- 1,804

3.61% +/- 0.16

345

North Dakota

Ward County

$1,823 +/- 69

534

$123,400 +/- 4,370

1.48% +/- 0.08

324

$61,913 +/- 2,772

2.94% +/- 0.17

594

Michigan

Clinton County

$2,460 +/- 76

292

$167,000 +/- 3,239

1.47% +/- 0.05

325

$64,918 +/- 2,891

3.79% +/- 0.21

296

Wisconsin

Adams County

$1,972 +/- 104

461

$134,100 +/- 6,830

1.47% +/- 0.11

326

$43,066 +/- 2,014

4.58% +/- 0.32

129

Connecticut

Litchfield County

$4,103 +/- 73

64

$279,700 +/- 4,594

1.47% +/- 0.04

327

$80,384 +/- 2,028

5.10% +/- 0.16

80

Michigan

Ottawa County

$2,329 +/- 37

325

$160,000 +/- 1,670

1.46% +/- 0.03

328

$61,384 +/- 1,058

3.79% +/- 0.09

294

Illinois

Cook County

$3,810 +/- 19

83

$262,000 +/- 1,277

1.45% +/- 0.01

329

$71,818 +/- 472

5.31% +/- 0.04

66

South Dakota

Lincoln County

$2,543 +/- 66

270

$174,900 +/- 6,002

1.45% +/- 0.06

330

$76,243 +/- 2,666

3.34% +/- 0.15

443

Texas

Chambers County

$2,105 +/- 202

401

$145,100 +/- 8,495

1.45% +/- 0.16

331

$77,061 +/- 4,819

2.73% +/- 0.31

700

Pennsylvania

Tioga County

$1,637 +/- 80

642

$112,900 +/- 5,586

1.45% +/- 0.10

332

$46,411 +/- 2,810

3.53% +/- 0.27

370

Iowa

Warren County

$2,269 +/- 71

342

$156,500 +/- 5,204

1.45% +/- 0.07

333

$70,999 +/- 3,066

3.20% +/- 0.17

484

Wisconsin

Marinette County

$1,590 +/- 53

663

$109,900 +/- 4,046

1.45% +/- 0.07

334

$46,073 +/- 2,045

3.45% +/- 0.19

394

Michigan

St. Clair County

$2,068 +/- 56

413

$143,000 +/- 3,824

1.45% +/- 0.06

335

$55,411 +/- 1,796

3.73% +/- 0.16

308

Nebraska

Buffalo County

$1,904 +/- 89

491

$131,800 +/- 5,610

1.44% +/- 0.09

336

$59,551 +/- 3,539

3.20% +/- 0.24

483

Property Taxes on Owner-Occupied Housing

Ranked by taxes as a percentage of home value, 2008-2010

Median Property

Taxes Paid on

State

County

United States

Homes

Taxes as Percent

Rank

$2,018 +/- 4

Median Home Value

of Home Value

$187,500 +/- 198

1.08% +/- 0.00

Median Household Taxes as Percent of

Rank

Income

Income

$64,519 +/- 62

3.13% +/- 0.01

Rank

Texas

Grayson County

$1,493 +/- 81

723

$103,400 +/- 4,204

1.44% +/- 0.10

337

$53,486 +/- 2,961

2.79% +/- 0.22

670

Pennsylvania

Mercer County

$1,490 +/- 38

726

$103,200 +/- 3,267

1.44% +/- 0.06

338

$51,172 +/- 1,512

2.91% +/- 0.11

607

Pennsylvania

Lehigh County

$3,020 +/- 64

162

$209,400 +/- 3,476

1.44% +/- 0.04

339

$68,225 +/- 1,662

4.43% +/- 0.14

153

Iowa

Black Hawk County

$1,742 +/- 42

585

$120,800 +/- 2,744

1.44% +/- 0.05

340

$58,538 +/- 1,834

2.98% +/- 0.12

580

Pennsylvania

Clinton County

$1,450 +/- 63

762

$100,700 +/- 4,894

1.44% +/- 0.09

341

$45,578 +/- 1,750

3.18% +/- 0.18

488

Ohio

Wood County

$2,249 +/- 62

347

$156,200 +/- 3,280

1.44% +/- 0.05

342

$66,920 +/- 2,434

3.36% +/- 0.15

429

Vermont

Orleans County

$2,222 +/- 99

358

$154,600 +/- 6,867

1.44% +/- 0.09

343

$44,355 +/- 1,860

5.01% +/- 0.31

86

Pennsylvania

Westmoreland County

Illinois

Perry County

Pennsylvania

$1,877 +/- 31

504

$130,800 +/- 3,081

1.44% +/- 0.04