Professional Documents

Culture Documents

The Case of A Summer Project Report

The Case of A Summer Project Report

Uploaded by

vishalanand2206Copyright:

Available Formats

You might also like

- Job Costing Problem 4Document18 pagesJob Costing Problem 4Skynet InfotechNo ratings yet

- A Level Accounting 22 June2015Document16 pagesA Level Accounting 22 June2015Bin SaadunNo ratings yet

- ACT202 ReportDocument9 pagesACT202 Reportrodela1416No ratings yet

- SQB - Chapter 7 QuestionsDocument16 pagesSQB - Chapter 7 QuestionsracsoNo ratings yet

- Paper 1 CA Inter CostingDocument8 pagesPaper 1 CA Inter CostingtchargeipatchNo ratings yet

- Faculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019Document3 pagesFaculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019bananaNo ratings yet

- Engineering Economics RevisionDocument43 pagesEngineering Economics RevisionDanial IzzatNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsSnehalkumar PatelNo ratings yet

- Cost Accounting & FM Test Code - COST-1: IPC - MAY 2017Document5 pagesCost Accounting & FM Test Code - COST-1: IPC - MAY 2017Anonymous elUtuxDNo ratings yet

- COEB442 - Sem - 2 - 2015-2016 RevisionDocument37 pagesCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraNo ratings yet

- PM Q T7Document10 pagesPM Q T7Waqas Siddique SammaNo ratings yet

- Management Accounting Level 3: LCCI International QualificationsDocument17 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- Cold Storage Finance RohitDocument11 pagesCold Storage Finance RohitRohitGuleriaNo ratings yet

- Sample ProposalDocument12 pagesSample ProposalBeky ManNo ratings yet

- 2022 EMAC2624 Test 2 FINALDocument5 pages2022 EMAC2624 Test 2 FINALasandantlumayo77No ratings yet

- Cost Accounting 2013Document3 pagesCost Accounting 2013GuruKPO0% (1)

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- BBA Sem I QPDocument3 pagesBBA Sem I QPyogeshgharpureNo ratings yet

- Midterm Mock Exam (BBA 18 Actual Midterm Exam Paper)Document4 pagesMidterm Mock Exam (BBA 18 Actual Midterm Exam Paper)aryan bhandariNo ratings yet

- Cama PDFDocument15 pagesCama PDFChandrikaprasdNo ratings yet

- Catering & Decorating PDFDocument5 pagesCatering & Decorating PDFSree GeNo ratings yet

- Afin 210 Assignment PDFDocument8 pagesAfin 210 Assignment PDFGeorge MandaNo ratings yet

- Budgeting and Cost ControlDocument7 pagesBudgeting and Cost Controlnags18888No ratings yet

- Cosmatics & StationaryDocument5 pagesCosmatics & Stationarykartik DebnathNo ratings yet

- COSTINGDocument182 pagesCOSTINGjahazi2100% (1)

- Tutorial 7 - Budgeting and Budgetary Control QuestionsDocument3 pagesTutorial 7 - Budgeting and Budgetary Control QuestionsJing ZeNo ratings yet

- Branch AccountsDocument12 pagesBranch AccountsRobert Henson100% (1)

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDocument22 pagesPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsSneha VermaNo ratings yet

- Print TRA - 12Document65 pagesPrint TRA - 12Timothy RogatusNo ratings yet

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- Oil Mill: Nsic Project ProfilesDocument3 pagesOil Mill: Nsic Project ProfilesSachin KharechaNo ratings yet

- Exam Simulator Budgeting PDFDocument8 pagesExam Simulator Budgeting PDFKeila Evelyn Antonio QuirozNo ratings yet

- Project Work of Economics Product: Desiccated Coconut Powder Country: U.A.EDocument31 pagesProject Work of Economics Product: Desiccated Coconut Powder Country: U.A.EMRinal PatiNo ratings yet

- 9706 s16 QP 22 PDFDocument16 pages9706 s16 QP 22 PDFFarrukhsgNo ratings yet

- 9706 Y16 SP 2Document18 pages9706 Y16 SP 2Wi Mae RiNo ratings yet

- D15 Hybrid F5 QPDocument7 pagesD15 Hybrid F5 QPadad9988No ratings yet

- TUTORIAL TOPIC 4 - Cost Estimation, Behaviour and CVP AnalysisDocument10 pagesTUTORIAL TOPIC 4 - Cost Estimation, Behaviour and CVP AnalysisQudwah HasanahNo ratings yet

- Exam OC MAC Period 1 OC104E72.1 October 2012Document5 pagesExam OC MAC Period 1 OC104E72.1 October 2012Azaan KaulNo ratings yet

- BudgetingDocument130 pagesBudgetingRevathi AnandNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument18 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelsagarnitishpirtheeNo ratings yet

- t4 2008 Dec QDocument8 pagest4 2008 Dec QShimera RamoutarNo ratings yet

- FA2 Midterm Test May 2012Document5 pagesFA2 Midterm Test May 2012LimShuLingNo ratings yet

- Financial Statement Analysis of Lucky CementDocument27 pagesFinancial Statement Analysis of Lucky CementRaja UmairNo ratings yet

- Unique Consultancy and Training Center Solution Mannual 2023Document25 pagesUnique Consultancy and Training Center Solution Mannual 2023Firdows SuleymanNo ratings yet

- C. (I), (Ii) and (Iv) OnlyDocument17 pagesC. (I), (Ii) and (Iv) OnlyTrương Đỗ Linh XuânNo ratings yet

- Departmental Acc.Document22 pagesDepartmental Acc.Somsindhu Nag100% (2)

- Cost Sheet - ProblemsDocument3 pagesCost Sheet - Problemssasirekha02758No ratings yet

- PE Exam March 2012Document31 pagesPE Exam March 2012Shahzada Khayyam NisarNo ratings yet

- Cost Accounting Sample Paper 1Document6 pagesCost Accounting Sample Paper 1bhattjishambhuNo ratings yet

- ACC 308 2022 ExamDocument15 pagesACC 308 2022 ExamMonowalehippie MangaNo ratings yet

- 444 and Today AnswerDocument7 pages444 and Today Answerrafiquemaryam41No ratings yet

- 9706 s12 QP 42Document8 pages9706 s12 QP 42Adrian JosephianNo ratings yet

- CPT Question Paper December 2015 With Answer CAknowledgeDocument26 pagesCPT Question Paper December 2015 With Answer CAknowledgerishabh jainNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Automobile Club Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomobile Club Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

The Case of A Summer Project Report

The Case of A Summer Project Report

Uploaded by

vishalanand2206Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Case of A Summer Project Report

The Case of A Summer Project Report

Uploaded by

vishalanand2206Copyright:

Available Formats

The Case of a summer Project Report

6/23/12

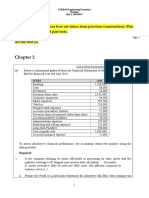

(1) Cost incurred per office per month: ASM salary : 20000 Sales Representatives : 24000 Travel Bills and Rent : 16000 Total for an office : 60000

Total cost incurred for seven offices/month=60000*7=420000. (2)Fixed cost incurred to setting up Distribution Channel : 737000

6/23/12

Selling price of Ghee to distributor= 84.61RS Selling price of SMP to distributor= 78.26 RS Expense/KG of Ghee and SMP

Ghee Central sales Tax Transportation cost State Sales Tax on Landing price C & F agent Second Leg Freight Total SMP 4 3 5.0 0.42 0.75 13.18 2.5 3 4.8 0.42 0.75 11.49

Net margin to the company for Ghee =22-13.18= 8.82. Net margin to the company for SMP =18-11.49= 6.51. 6/23/12

By assuming sales of 4MTS/month

Net Margin/office/month : 4000*8.82+4000*6.51=61346.27 Rs. Cost for each office : 60000 Contribution/office : 1346.27 Total Contribution : 9423.86 Total Fixed Cost : 737000 Time period for breakeven : 737000/9423.86

6/23/12

:78.21 months

You might also like

- Job Costing Problem 4Document18 pagesJob Costing Problem 4Skynet InfotechNo ratings yet

- A Level Accounting 22 June2015Document16 pagesA Level Accounting 22 June2015Bin SaadunNo ratings yet

- ACT202 ReportDocument9 pagesACT202 Reportrodela1416No ratings yet

- SQB - Chapter 7 QuestionsDocument16 pagesSQB - Chapter 7 QuestionsracsoNo ratings yet

- Paper 1 CA Inter CostingDocument8 pagesPaper 1 CA Inter CostingtchargeipatchNo ratings yet

- Faculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019Document3 pagesFaculty of Economics Name: - Andalas University Padang Final Exam Student No.: - SECOND SEMESTER 2018/2019bananaNo ratings yet

- Engineering Economics RevisionDocument43 pagesEngineering Economics RevisionDanial IzzatNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsSnehalkumar PatelNo ratings yet

- Cost Accounting & FM Test Code - COST-1: IPC - MAY 2017Document5 pagesCost Accounting & FM Test Code - COST-1: IPC - MAY 2017Anonymous elUtuxDNo ratings yet

- COEB442 - Sem - 2 - 2015-2016 RevisionDocument37 pagesCOEB442 - Sem - 2 - 2015-2016 RevisionNirmal ChandraNo ratings yet

- PM Q T7Document10 pagesPM Q T7Waqas Siddique SammaNo ratings yet

- Management Accounting Level 3: LCCI International QualificationsDocument17 pagesManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- Cold Storage Finance RohitDocument11 pagesCold Storage Finance RohitRohitGuleriaNo ratings yet

- Sample ProposalDocument12 pagesSample ProposalBeky ManNo ratings yet

- 2022 EMAC2624 Test 2 FINALDocument5 pages2022 EMAC2624 Test 2 FINALasandantlumayo77No ratings yet

- Cost Accounting 2013Document3 pagesCost Accounting 2013GuruKPO0% (1)

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- BBA Sem I QPDocument3 pagesBBA Sem I QPyogeshgharpureNo ratings yet

- Midterm Mock Exam (BBA 18 Actual Midterm Exam Paper)Document4 pagesMidterm Mock Exam (BBA 18 Actual Midterm Exam Paper)aryan bhandariNo ratings yet

- Cama PDFDocument15 pagesCama PDFChandrikaprasdNo ratings yet

- Catering & Decorating PDFDocument5 pagesCatering & Decorating PDFSree GeNo ratings yet

- Afin 210 Assignment PDFDocument8 pagesAfin 210 Assignment PDFGeorge MandaNo ratings yet

- Budgeting and Cost ControlDocument7 pagesBudgeting and Cost Controlnags18888No ratings yet

- Cosmatics & StationaryDocument5 pagesCosmatics & Stationarykartik DebnathNo ratings yet

- COSTINGDocument182 pagesCOSTINGjahazi2100% (1)

- Tutorial 7 - Budgeting and Budgetary Control QuestionsDocument3 pagesTutorial 7 - Budgeting and Budgetary Control QuestionsJing ZeNo ratings yet

- Branch AccountsDocument12 pagesBranch AccountsRobert Henson100% (1)

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDocument22 pagesPaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsSneha VermaNo ratings yet

- Print TRA - 12Document65 pagesPrint TRA - 12Timothy RogatusNo ratings yet

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- Oil Mill: Nsic Project ProfilesDocument3 pagesOil Mill: Nsic Project ProfilesSachin KharechaNo ratings yet

- Exam Simulator Budgeting PDFDocument8 pagesExam Simulator Budgeting PDFKeila Evelyn Antonio QuirozNo ratings yet

- Project Work of Economics Product: Desiccated Coconut Powder Country: U.A.EDocument31 pagesProject Work of Economics Product: Desiccated Coconut Powder Country: U.A.EMRinal PatiNo ratings yet

- 9706 s16 QP 22 PDFDocument16 pages9706 s16 QP 22 PDFFarrukhsgNo ratings yet

- 9706 Y16 SP 2Document18 pages9706 Y16 SP 2Wi Mae RiNo ratings yet

- D15 Hybrid F5 QPDocument7 pagesD15 Hybrid F5 QPadad9988No ratings yet

- TUTORIAL TOPIC 4 - Cost Estimation, Behaviour and CVP AnalysisDocument10 pagesTUTORIAL TOPIC 4 - Cost Estimation, Behaviour and CVP AnalysisQudwah HasanahNo ratings yet

- Exam OC MAC Period 1 OC104E72.1 October 2012Document5 pagesExam OC MAC Period 1 OC104E72.1 October 2012Azaan KaulNo ratings yet

- BudgetingDocument130 pagesBudgetingRevathi AnandNo ratings yet

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument18 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelsagarnitishpirtheeNo ratings yet

- t4 2008 Dec QDocument8 pagest4 2008 Dec QShimera RamoutarNo ratings yet

- FA2 Midterm Test May 2012Document5 pagesFA2 Midterm Test May 2012LimShuLingNo ratings yet

- Financial Statement Analysis of Lucky CementDocument27 pagesFinancial Statement Analysis of Lucky CementRaja UmairNo ratings yet

- Unique Consultancy and Training Center Solution Mannual 2023Document25 pagesUnique Consultancy and Training Center Solution Mannual 2023Firdows SuleymanNo ratings yet

- C. (I), (Ii) and (Iv) OnlyDocument17 pagesC. (I), (Ii) and (Iv) OnlyTrương Đỗ Linh XuânNo ratings yet

- Departmental Acc.Document22 pagesDepartmental Acc.Somsindhu Nag100% (2)

- Cost Sheet - ProblemsDocument3 pagesCost Sheet - Problemssasirekha02758No ratings yet

- PE Exam March 2012Document31 pagesPE Exam March 2012Shahzada Khayyam NisarNo ratings yet

- Cost Accounting Sample Paper 1Document6 pagesCost Accounting Sample Paper 1bhattjishambhuNo ratings yet

- ACC 308 2022 ExamDocument15 pagesACC 308 2022 ExamMonowalehippie MangaNo ratings yet

- 444 and Today AnswerDocument7 pages444 and Today Answerrafiquemaryam41No ratings yet

- 9706 s12 QP 42Document8 pages9706 s12 QP 42Adrian JosephianNo ratings yet

- CPT Question Paper December 2015 With Answer CAknowledgeDocument26 pagesCPT Question Paper December 2015 With Answer CAknowledgerishabh jainNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Automobile Club Revenues World Summary: Market Values & Financials by CountryFrom EverandAutomobile Club Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet