Professional Documents

Culture Documents

MF0015 Spring Drive Assignment 2012

MF0015 Spring Drive Assignment 2012

Uploaded by

Sudip1101Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MF0015 Spring Drive Assignment 2012

MF0015 Spring Drive Assignment 2012

Uploaded by

Sudip1101Copyright:

Available Formats

Spring / February 2012

Master of Business Administration- MBA Semester 4 MF0015 International Financial Management - 4 Credits (Book ID: B1316) Assignment Set- 1 (60 Marks)

Note: Each Question carries 10 marks. Answer all the questions.

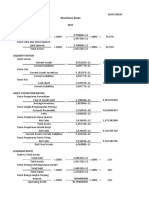

Q1. You are given the following information: Spot EUR/USD : 0.7940/0.8007 Three months swap: 25/35 Calculate three month EUR/USD rate.

Spot USD/GBP: 1.8215/1.8240

Q2. Distinguish between Eurobond and foreign bonds. What are the unique characteristics of Eurobond markets? Q3. What is sub-prime lending? Explain the drivers of sub-prime lending? Explain briefly the different exchange rate regime that is prevalent today.

Q4. Explain (a) Parallel Loans (b) Back to- Back loans Q5. Explain double taxation avoidance agreement in detail Q6. What do you mean by optimum capital structure? What factors affect cost of capital across nations?

Spring / February 2012

Master of Business Administration- MBA Semester 4 MF0015 International Financial Management - 4 Credits (Book ID: B1316) Assignment Set- 2 (60 Marks)

Note: Each Question carries 10 marks. Answer all the questions.

Q1.

Because of its broad global environment, a number of disciplines (geography, history, political science, etc.) are useful to help explain the conduct of International Business. Elucidate with examples.

Q2. What is a credit transaction and a debit transaction? Which are the broad categories of international transactions classified as credits and as debits?

Q3. What is cross rates? Explain the two methods of quotations for exchange rates with examples. Q4. Explain covered and uncovered interest rate arbitrage. Q5. Explain briefly the mechanism of futures trading Q6. Briefly explain the difference between functional currency and reporting currency. Identify the factors that help in selecting an appropriate functional currency that can be used by an organisation.

Spring / February 2012

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- P2P Accounting EntriesDocument4 pagesP2P Accounting EntriesNaren Rayar25% (4)

- RMC 36-99Document3 pagesRMC 36-99Rieland CuevasNo ratings yet

- APSR-17.7Annual Verification CertificateDocument2 pagesAPSR-17.7Annual Verification CertificatekkkothaNo ratings yet

- Medical Check Up BillDocument2 pagesMedical Check Up BillAniketh Pradhan100% (1)

- Kurwitu Ventures LTD Annual Report Financial Statements For The Year Ended 31st Dec 2017 PDFDocument44 pagesKurwitu Ventures LTD Annual Report Financial Statements For The Year Ended 31st Dec 2017 PDFKibet KiptooNo ratings yet

- Ledger - Ms Vizin India PVT LTDDocument3 pagesLedger - Ms Vizin India PVT LTDgaurav narnoliaNo ratings yet

- 09 Republic Vs CA and Cuaycong 65 Scra 186Document9 pages09 Republic Vs CA and Cuaycong 65 Scra 186Ping KyNo ratings yet

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaNo ratings yet

- Business StrategyDocument96 pagesBusiness Strategyaspire5572wxmiNo ratings yet

- Nabintu - Factors Affecting The Performance of Small and Micro EnterprisesDocument76 pagesNabintu - Factors Affecting The Performance of Small and Micro EnterprisesJay Calalang ManatadNo ratings yet

- Electrical Machinery - Make in IndiaDocument3 pagesElectrical Machinery - Make in IndiaBitan GhoshNo ratings yet

- Stock Market ProjectDocument16 pagesStock Market Projectapi-278469995No ratings yet

- Ultiple Choice QuestionsDocument10 pagesUltiple Choice QuestionssakfeeNo ratings yet

- Business Finance Grade 12 Summative Examination 1Document2 pagesBusiness Finance Grade 12 Summative Examination 1Ron MontevirgenNo ratings yet

- SIDBI Sammelan 2023Document1 pageSIDBI Sammelan 2023assmexellenceNo ratings yet

- 201996185131dmi Im 06092019Document92 pages201996185131dmi Im 06092019Aravind KrishNo ratings yet

- International Transfer PricingDocument26 pagesInternational Transfer Pricingmessi1986No ratings yet

- General Quiz: Chiranjeevi and SharmilaDocument68 pagesGeneral Quiz: Chiranjeevi and SharmilaRavi TejaNo ratings yet

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesGianna PeñalosaNo ratings yet

- Firm Betas Versus Divisional Betas: Aswath DamodaranDocument15 pagesFirm Betas Versus Divisional Betas: Aswath DamodaranDuong NhanNo ratings yet

- CH 3 (Qamar Abbas) - Investment and Security Analysis or Portfolio ManagmentDocument18 pagesCH 3 (Qamar Abbas) - Investment and Security Analysis or Portfolio Managmentفہد ملکNo ratings yet

- HW17 Palm 031913Document2 pagesHW17 Palm 031913tli04No ratings yet

- New Cascadia (WA Statute - CL Majority Rule) Old Olympia (CL - Modern Trend)Document19 pagesNew Cascadia (WA Statute - CL Majority Rule) Old Olympia (CL - Modern Trend)Sam AdamsNo ratings yet

- Clubbing of IncomeDocument4 pagesClubbing of Incomeapi-3832224100% (1)

- Global Governance Principles: Influence Connect InformDocument36 pagesGlobal Governance Principles: Influence Connect InformKelton Cyrel RosalesNo ratings yet

- Project On DemonetizationDocument64 pagesProject On DemonetizationGomes Jollison100% (3)

- Revenue Memorandum Circular No. 19-95Document8 pagesRevenue Memorandum Circular No. 19-95Carla GrepoNo ratings yet

- Handout For Clerks of Court PDFDocument49 pagesHandout For Clerks of Court PDFZader Gaze100% (1)

- Master Thesis Mission DriftDocument126 pagesMaster Thesis Mission DriftNgale Ewah Oliver100% (1)

- Book Review: Glen Arnold, The Deals of Warren Buffett: The First $100mDocument2 pagesBook Review: Glen Arnold, The Deals of Warren Buffett: The First $100mAmira KareemNo ratings yet