Professional Documents

Culture Documents

Balance Sheet

Balance Sheet

Uploaded by

Kashish SrivastavaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet

Balance Sheet

Uploaded by

Kashish SrivastavaCopyright:

Available Formats

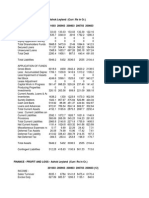

FINANCE - BALANCE SHEET - Suprajit Engineering Ltd (Curr: Rs in Cr.

) As on 01/03/2012

COMPANY/FINANCE/BALANCE SHEET/6045/Suprajit Engg.CmbDetail0CmbCommonsize0

201103 201003 200903 200803 200703 200603 200503 200403 200303 200203 200103 200003 199903 199803 199703

SOURCES OF FUNDS :

Share Capital

12

12

6

6

6

6

6

6

2.89

2.79

2.79

2.79

2.79

2.79

2.79

Reserves Total

85.83 61.49 51.64

43 42.52 33.52 24.14 17.07 13.31

9.63

7.77

6.58

5.51

4.79

4.17

Equity Share Warrants

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Equity Application Money

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Total Shareholders Funds

97.83 73.49 57.64

49 48.52 39.52 30.14 23.07

16.2 12.42 10.56

9.37

8.3

7.58

6.96

Secured Loans

53.93 50.12 45.28

60.6 46.74 21.74 18.14 15.35 10.65

6.64

7.18

7.47

4.66

6.05

4.2

Unsecured Loans

0.75

0.48

4.14

5.18 10.33

7.03

8.13

6.6

5.49

2.58

2.06

0.07

0.22

0.06

0.32

Total Debt

54.68

50.6 49.42 65.78 57.07 28.77 26.27 21.95 16.14

9.22

9.24

7.54

4.88

6.11

4.52

Total Liabilities

APPLICATION OF FUNDS :

Gross Block

Less : Accumulated Depreciation

Less:Impairment of Assets

Net Block

Lease Adjustment

Capital Work in Progress

Producing Properties

Investments

Current Assets, Loans & Advances

Inventories

Sundry Debtors

Cash and Bank

Loans and Advances

Total Current Assets

Less : Current Liabilities and Provisions

Current Liabilities

Provisions

Total Current Liabilities

Net Current Assets

Miscellaneous Expenses not written off

Deferred Tax Assets

Deferred Tax Liability

Net Deferred Tax

Total Assets

Contingent Liabilities

152.51 124.09 107.06 114.78 105.59

68.29

56.41

45.02

32.34

21.64

19.8

16.91

13.18

13.69

11.48

108.31

33.82

0

74.49

0

4.27

0

28.69

85.1

28.96

0

56.14

0

1.91

0

29.24

78.17

24.62

0

53.55

0

0.43

0

23.59

67.63

20.36

0

47.27

0

4.12

0

14.94

45.03

16.92

0

28.11

0

13.58

0

11.36

40.14

14.05

0

26.09

0

0.09

0

1.91

36.39

11.28

0

25.11

0

0

0

5.68

31.57

8.85

0

22.72

0

0

0

5.93

19.81

6.51

0

13.3

0

0

0

10.84

12.7

5.43

0

7.27

0

0.85

0

6.64

12.12

4.55

0

7.57

0

0

0

5.89

11.3

3.72

0

7.58

0

0

0

5.06

10.89

2.93

0

7.96

0

0

0

0.2

9.92

2.22

0

7.7

0

0

0

0.2

7.75

1.54

0

6.21

0

0

0

0.2

24.89

59.94

1.97

8.92

95.72

15.63

43.03

1.04

6.22

65.92

11.59

32.69

0.9

10.97

56.15

10.5

35.44

1.4

20.61

67.95

11.14

29.18

1.95

28.34

70.61

8.83

31.05

5.5

24.12

69.5

7.12

24.1

1

19.25

51.47

4.27

17.08

0.71

13.55

35.61

2.6

9.51

0.56

9.28

21.95

1.24

7.68

0.41

5.28

14.61

1.21

5.47

2

3.67

12.35

0.98

5.4

0.08

2.33

8.79

0.85

3.98

0.68

2.08

7.59

1.18

3.16

0.58

1.9

6.82

1.27

1.96

0.72

1.62

5.57

42.48

4.7

47.18

48.54

0

0.68

4.16

-3.48

21.33

4.15

25.48

40.44

0

0.36

4

-3.64

19.13

4.18

23.31

32.84

0

0.72

4.07

-3.35

15

1.83

16.83

51.12

0

0.47

3.14

-2.67

16.16

2.4

18.56

52.05

0

0.49

0

0.49

9.96

19.56

29.52

39.98

0

0.22

0

0.22

8.21

17.64

25.85

25.62

0

0

0

0

7.76

11.59

19.35

16.26

0.11

0

0

0

5.28

8.72

14

7.95

0.22

0.03

0

0.03

3.01

5.02

8.03

6.58

0.33

0.03

0.06

-0.03

2.7

3.75

6.45

5.9

0.44

0

0

0

2.54

2.53

5.07

3.72

0.55

0

0

0

1.76

1.47

3.23

4.36

0.66

0

0

0

1.12

0.68

1.8

5.02

0.77

0

0

0

0.77

0.61

1.38

4.19

0.88

0

0

0

152.51 124.09 107.06 114.78 105.59

68.29

56.41

45.02

32.34

21.64

19.8

16.91

13.18

13.69

11.48

2.24

0.77

0.79

3.68

0.35

0.48

0.29

5.41

5.41

8.16

7.35

15.02

You might also like

- Ashok LeylandDocument6 pagesAshok Leylandkaaviya6No ratings yet

- Company/Finance/Balance Sheet/5455/Power Grid Corpn Cmbdetail 0 Cmbcommonsize 0Document1 pageCompany/Finance/Balance Sheet/5455/Power Grid Corpn Cmbdetail 0 Cmbcommonsize 0Utkarsh PandeyNo ratings yet

- SAIL Cash Flow ConsolidatedDocument1 pageSAIL Cash Flow ConsolidatedUtkarsh PandeyNo ratings yet

- Z-Score - For Godrej IndustriesDocument6 pagesZ-Score - For Godrej IndustriesHarihar PanigrahiNo ratings yet

- Horizontal Analysis OF: The Andhra Sugars LTDDocument8 pagesHorizontal Analysis OF: The Andhra Sugars LTDDeepest255No ratings yet

- Balance Sheet of ItcDocument1 pageBalance Sheet of ItcabhivermNo ratings yet

- Financial Performance Evaluation of Indian Rare Earths LimitedDocument27 pagesFinancial Performance Evaluation of Indian Rare Earths LimitedNitheesh VsNo ratings yet

- Background: Reliance Communications Limited (Commonly Called RCOM) Is A Major Indian TelecommunicationDocument8 pagesBackground: Reliance Communications Limited (Commonly Called RCOM) Is A Major Indian TelecommunicationChetna SalhotraNo ratings yet

- Company/Finance/Balance Sheet/3711/Medinova Diagno. Cmbdetail 0 Cmbcommonsize 0Document5 pagesCompany/Finance/Balance Sheet/3711/Medinova Diagno. Cmbdetail 0 Cmbcommonsize 0Gunjan NimjeNo ratings yet

- L&T LTDDocument38 pagesL&T LTDRam Krishna KrishNo ratings yet

- FM Asignment RealDocument6 pagesFM Asignment RealPooja TripathiNo ratings yet

- Group10 Cement SectionC ReportDocument3 pagesGroup10 Cement SectionC ReportSayee Prasad KompellaNo ratings yet

- Bs 2009 BergerDocument1 pageBs 2009 BergerSanoj NairNo ratings yet

- Cash Ratio TemplateDocument2 pagesCash Ratio TemplateRadhwen AhmedNo ratings yet

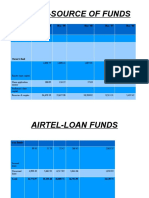

- Airtel-Source of Funds: Balance SheetDocument6 pagesAirtel-Source of Funds: Balance SheetVibhav GuptaNo ratings yet

- AIL Share Holding As of Sep 30, 2010Document1 pageAIL Share Holding As of Sep 30, 2010Prateek DhingraNo ratings yet

- Project On JSW Financial Statement AnalysisDocument24 pagesProject On JSW Financial Statement AnalysisRashmi ShuklaNo ratings yet

- Horizontal Analysis Balance Sheet Profit & Loss Key RatiosDocument18 pagesHorizontal Analysis Balance Sheet Profit & Loss Key Ratiosvinayjain221No ratings yet

- Balance Sheet: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Document3 pagesBalance Sheet: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Rajnish KumarNo ratings yet

- Fin 254 Group Project ExcelDocument12 pagesFin 254 Group Project Excelapi-422062723No ratings yet

- BhartiAndMTN FinancialsDocument10 pagesBhartiAndMTN FinancialsGirish RamachandraNo ratings yet

- Outcome of 184th Board Meeting of Axis Bank Limited Held On 26th April 2018 and 27th April 2018 26.04.2018Document80 pagesOutcome of 184th Board Meeting of Axis Bank Limited Held On 26th April 2018 and 27th April 2018 26.04.2018anvesh anveshNo ratings yet

- Balance SheetDocument1 pageBalance SheetdarshanparikhNo ratings yet

- CompanyDocument19 pagesCompanyMark GrayNo ratings yet

- CiplaDocument5 pagesCiplaSantosh AgarwalNo ratings yet

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNo ratings yet

- Horizontal Analysis of Group Statement of Financial Position For OKA CORPORATION BHDDocument2 pagesHorizontal Analysis of Group Statement of Financial Position For OKA CORPORATION BHDFagbile TomiwaNo ratings yet

- Gujarat Apollo Industries LimitedDocument30 pagesGujarat Apollo Industries LimitedChitsimran NarangNo ratings yet

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarNo ratings yet

- The Central ArecanutDocument3 pagesThe Central Arecanutyathinkantramajal9284No ratings yet

- Particulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsDocument25 pagesParticulars 31-3-2011 31-3-2012 Increase Decrease Current AssetsJithendar ReddyNo ratings yet

- Balance Sheet (In Rs. CR) Reliance IndustriesDocument9 pagesBalance Sheet (In Rs. CR) Reliance IndustrieschhimpayogeshNo ratings yet

- Balance Sheet (In Rs. CR) Reliance IndustriesDocument15 pagesBalance Sheet (In Rs. CR) Reliance IndustriesPranay ChauhanNo ratings yet

- Bajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersDocument16 pagesBajaj Auto LTD Industry:Automobiles - Scooters and 3-WheelersCma Saurabh AroraNo ratings yet

- Pratyaksh Mishra 12209726Document16 pagesPratyaksh Mishra 12209726pratyaksh mishraNo ratings yet

- Aali - Icmd 2010 (A01) PDFDocument2 pagesAali - Icmd 2010 (A01) PDFArdheson Aviv AryaNo ratings yet

- Bajaj Auto FinancialsDocument21 pagesBajaj Auto FinancialsJanendra YadavNo ratings yet

- Influence of Capital Structure On The Performance of The Company-Tata MotorsDocument15 pagesInfluence of Capital Structure On The Performance of The Company-Tata MotorsGiris GovindNo ratings yet

- Hindustan Aeronautics LTD.: BY Gurnoor Singh MBA-2CDocument18 pagesHindustan Aeronautics LTD.: BY Gurnoor Singh MBA-2CHIMANSHU RAWATNo ratings yet

- Cooperative Bank of Surigao Del SurDocument4 pagesCooperative Bank of Surigao Del SurAnonymous iScW9lNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow Statementbalki123No ratings yet

- Accounts Term PaperDocument508 pagesAccounts Term Paperrohit_indiaNo ratings yet

- Capital Structure Analysis of ITC LTDDocument4 pagesCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- Ashok Leyland Annual Report 2012 2013Document108 pagesAshok Leyland Annual Report 2012 2013Rajaram Iyengar0% (1)

- FM - Case Study On Sun Pharma Industries LTD - Group No-02Document14 pagesFM - Case Study On Sun Pharma Industries LTD - Group No-02Ankan MetyaNo ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Balancesheet - MRF LTDDocument4 pagesBalancesheet - MRF LTDAnuNo ratings yet

- Balance Sheet: Sources of FundsDocument1 pageBalance Sheet: Sources of FundsAishwaryaGopalNo ratings yet

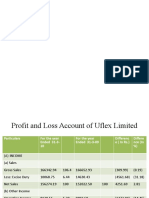

- Friday UFLEXDocument8 pagesFriday UFLEXOnkar TendulkarNo ratings yet

- Previous Years: Tata Motor S - in Rs. Cr.Document28 pagesPrevious Years: Tata Motor S - in Rs. Cr.priya4112No ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDKrishna NimmakuriNo ratings yet

- Financial Statements ofDocument11 pagesFinancial Statements ofConversionApiTestNo ratings yet

- Bharat ElectronicsDocument12 pagesBharat Electronicsnafis20No ratings yet

- Balance SheetDocument1 pageBalance SheetAshutosh KumarNo ratings yet

- Unitech Balance SheetDocument6 pagesUnitech Balance SheetSaurabh SinghNo ratings yet

- In The Previous Class, We Started With Financial Statement AnalysisDocument46 pagesIn The Previous Class, We Started With Financial Statement AnalysisvarunbalutiaNo ratings yet

- Balance Sheet: Schedule Asat31 March 2010 Asat31 March 2009Document2 pagesBalance Sheet: Schedule Asat31 March 2010 Asat31 March 2009Punnya SelvarajNo ratings yet

- Balace SheetDocument1 pageBalace SheetTarun SoniNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Synopsis Demo - Ganpati Group of InstitutionsDocument2 pagesSynopsis Demo - Ganpati Group of InstitutionsKashish SrivastavaNo ratings yet

- 2nd Week Sip DWPDocument3 pages2nd Week Sip DWPKashish SrivastavaNo ratings yet

- Kashish CVDocument2 pagesKashish CVKashish SrivastavaNo ratings yet

- Establishing Strategic Pay Plans: By: Kashish Srivastava Khushbu Bhojwani Lovepreet Arora Malvika GoenkaDocument39 pagesEstablishing Strategic Pay Plans: By: Kashish Srivastava Khushbu Bhojwani Lovepreet Arora Malvika GoenkaKashish SrivastavaNo ratings yet