Professional Documents

Culture Documents

Who Is Eligible For TDS?

Who Is Eligible For TDS?

Uploaded by

bvbhinaCopyright:

Available Formats

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementMinisha Gupta100% (19)

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- TDS TCSDocument15 pagesTDS TCSVikas BhadauriyaNo ratings yet

- What Does Scrutiny of Income Mean?Document2 pagesWhat Does Scrutiny of Income Mean?RaghavShanNo ratings yet

- Prerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument62 pagesPrerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- PVT LTD SavingsDocument5 pagesPVT LTD Savingstaxqoof1No ratings yet

- Handbook TDSDocument74 pagesHandbook TDSaditya duttaNo ratings yet

- Tax Avoidance Vs Tax EvasionDocument3 pagesTax Avoidance Vs Tax EvasionWasim Arif HashmiNo ratings yet

- Now in Case of Company or CorporateDocument2 pagesNow in Case of Company or CorporaterajeshkumarrkollamNo ratings yet

- Tax - DefinitionsDocument4 pagesTax - DefinitionsAnshul NemaNo ratings yet

- Tech QuestionsDocument14 pagesTech QuestionsRoshan King MakerNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- InlgesDocument1 pageInlgesBlanca EstelaNo ratings yet

- Business FormalitiesDocument21 pagesBusiness FormalitiesGovindNo ratings yet

- TdsDocument4 pagesTdsshanikaNo ratings yet

- Income Tax Return Filing Doubts Solution Ebook by JagoinvestorDocument13 pagesIncome Tax Return Filing Doubts Solution Ebook by Jagoinvestoranandakumar2810100% (1)

- CTCDocument6 pagesCTCmeg2209No ratings yet

- What Is The Difference Between TDS & TCS & VAT ?: DEFINITION of 'Tax Return'Document1 pageWhat Is The Difference Between TDS & TCS & VAT ?: DEFINITION of 'Tax Return'Ishan SharmaNo ratings yet

- Basic Introduction of TDSDocument32 pagesBasic Introduction of TDSsaurabh.singhNo ratings yet

- How and When TDS Deductions Can Be Avoided - Fin - BankbazaarDocument3 pagesHow and When TDS Deductions Can Be Avoided - Fin - Bankbazaaraamar45No ratings yet

- E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument41 pagesE-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- Tax Planning - Intro NotesDocument7 pagesTax Planning - Intro NotesBest How To StudioNo ratings yet

- Journal Entries of VATDocument4 pagesJournal Entries of VATSureshArigela0% (1)

- Income Tax Basics - A Comprehensive Guide PDFDocument42 pagesIncome Tax Basics - A Comprehensive Guide PDFsrinivasa varmaNo ratings yet

- Does My Business Need A Federal Tax ID Number?Document3 pagesDoes My Business Need A Federal Tax ID Number?Yan AcostaNo ratings yet

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- Tax Planning Assignment: Tax Deducted at SourceDocument4 pagesTax Planning Assignment: Tax Deducted at SourceJinesh NelsonNo ratings yet

- 2 Scheme of Tax CalculationDocument72 pages2 Scheme of Tax CalculationvivekNo ratings yet

- The Easy Guide To: The Goods and Services or Harmonized Sales Tax (GST/HST)Document10 pagesThe Easy Guide To: The Goods and Services or Harmonized Sales Tax (GST/HST)hellkatNo ratings yet

- How 2 Fillforn 280Document6 pagesHow 2 Fillforn 280anon_639359071No ratings yet

- Income Tax Calculator - TaxScoutsDocument1 pageIncome Tax Calculator - TaxScoutsnadine.massabkiNo ratings yet

- Expat's TDS Circulars: Creating Collywobbles in Many StomachsDocument1 pageExpat's TDS Circulars: Creating Collywobbles in Many StomachsMansi BhardwajNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Income From Other SourcesDocument6 pagesIncome From Other Sourcesanusaya1988No ratings yet

- GST in DetailDocument8 pagesGST in DetailVenkatesulu GNo ratings yet

- Enrolled Agent Training in India OverviewDocument9 pagesEnrolled Agent Training in India OverviewAbinashNo ratings yet

- Income Tax FaqDocument11 pagesIncome Tax FaqNasir AhmedNo ratings yet

- Final Notes For StudentsDocument45 pagesFinal Notes For Studentskishenmanocha485No ratings yet

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDocument17 pagesSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNo ratings yet

- ITP - TdsDocument8 pagesITP - TdsSaloni GuptaNo ratings yet

- Why People Avoid Tax in Third World Country Like Bangladesh: Report byDocument5 pagesWhy People Avoid Tax in Third World Country Like Bangladesh: Report bySajid Al NoorNo ratings yet

- Tds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersDocument10 pagesTds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersTaxRaahiNo ratings yet

- 10 Easy Steps To Tax FilingDocument8 pages10 Easy Steps To Tax FilingChandan VirmaniNo ratings yet

- Amongst GST Registered Companies in Malaysia and Abroad: (CITATION Roy19 /L 1033)Document5 pagesAmongst GST Registered Companies in Malaysia and Abroad: (CITATION Roy19 /L 1033)Yasier AimanNo ratings yet

- AFA100 - Journal Entries With Taxes - S - S23Document3 pagesAFA100 - Journal Entries With Taxes - S - S23Morongwa MamoseboNo ratings yet

- UntitledDocument5 pagesUntitledtheright placeNo ratings yet

- A Guide To Payroll Management: Product Customers Pricing Resources LoginDocument11 pagesA Guide To Payroll Management: Product Customers Pricing Resources LoginGeetika apurvaNo ratings yet

- Tds Due DatesDocument1 pageTds Due DatesKrishna Chaitanya DammalapatiNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- Tax Planning and ManagementDocument23 pagesTax Planning and Managementarchana_anuragi100% (1)

- Employer: 1. Introduction To PAYEDocument16 pagesEmployer: 1. Introduction To PAYELindaBakóNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- 39 Tds in TallyDocument50 pages39 Tds in TallytalupurumNo ratings yet

- Record Week 6 - ALKDocument11 pagesRecord Week 6 - ALKLeona Vierman Al-ZuraNo ratings yet

- EconomyDocument86 pagesEconomySridhar HaritasaNo ratings yet

- Salary Vs ConsultantDocument6 pagesSalary Vs Consultant77APACHEMUSICNo ratings yet

- 7 Write Offs Every S Corporation Business Owner Must KnowDocument13 pages7 Write Offs Every S Corporation Business Owner Must KnowJey DeeNo ratings yet

- Data - Sort & Filter-Sort/ Filter/ Advanced Filter Sort FilterDocument2 pagesData - Sort & Filter-Sort/ Filter/ Advanced Filter Sort FilterbvbhinaNo ratings yet

- Ms-Word CutDocument1 pageMs-Word CutbvbhinaNo ratings yet

- MS WordDocument2 pagesMS WordbvbhinaNo ratings yet

- TDS Create in Tally: First StepDocument2 pagesTDS Create in Tally: First StepbvbhinaNo ratings yet

Who Is Eligible For TDS?

Who Is Eligible For TDS?

Uploaded by

bvbhinaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Who Is Eligible For TDS?

Who Is Eligible For TDS?

Uploaded by

bvbhinaCopyright:

Available Formats

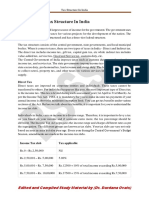

TDS Tax Deduction at Source(TDS) and the rate for some of the TDS.

We all aware that we need to pay the Income Tax for our income. In some cases the employer will be taking care of paying the total tax amount to the government in behalf of all the employees by deducting the tax amount from their salaries. This process is called TDS or Tax Deduction at Source. Taxes are deducted at the time of calculating your income. For example, your are working for a company X. Every money they will be paying you the salary of Rs.350000. If you are looking into your payslip there is a colum name IT which mention the tax amount deducted from your salary. Actully the tax amount is deducted by your company and then pays to the government. Where as if you are not working for any company or doing the professional jobs like Doctor,Charted Accountant(CA),etc. You are liable to pay the tax to the government. Who is eligible for TDS? Not every one can deduct the tax at source. You have to apply for the Tax Deduction Account Number(TAN). TAN or Tax Deduction and Collection Account Number is a 10 digit alpha numeric number required to be obtained by all persons who are responsible for deducting or collecting tax. It is compulsory to quote TAN in TDS/TCS return (including any e-TDS/TCS return), any TDS/TCS payment challan and TDS/TCS certificates.

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementMinisha Gupta100% (19)

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- TDS TCSDocument15 pagesTDS TCSVikas BhadauriyaNo ratings yet

- What Does Scrutiny of Income Mean?Document2 pagesWhat Does Scrutiny of Income Mean?RaghavShanNo ratings yet

- Prerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument62 pagesPrerequisites in E-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- PVT LTD SavingsDocument5 pagesPVT LTD Savingstaxqoof1No ratings yet

- Handbook TDSDocument74 pagesHandbook TDSaditya duttaNo ratings yet

- Tax Avoidance Vs Tax EvasionDocument3 pagesTax Avoidance Vs Tax EvasionWasim Arif HashmiNo ratings yet

- Now in Case of Company or CorporateDocument2 pagesNow in Case of Company or CorporaterajeshkumarrkollamNo ratings yet

- Tax - DefinitionsDocument4 pagesTax - DefinitionsAnshul NemaNo ratings yet

- Tech QuestionsDocument14 pagesTech QuestionsRoshan King MakerNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- InlgesDocument1 pageInlgesBlanca EstelaNo ratings yet

- Business FormalitiesDocument21 pagesBusiness FormalitiesGovindNo ratings yet

- TdsDocument4 pagesTdsshanikaNo ratings yet

- Income Tax Return Filing Doubts Solution Ebook by JagoinvestorDocument13 pagesIncome Tax Return Filing Doubts Solution Ebook by Jagoinvestoranandakumar2810100% (1)

- CTCDocument6 pagesCTCmeg2209No ratings yet

- What Is The Difference Between TDS & TCS & VAT ?: DEFINITION of 'Tax Return'Document1 pageWhat Is The Difference Between TDS & TCS & VAT ?: DEFINITION of 'Tax Return'Ishan SharmaNo ratings yet

- Basic Introduction of TDSDocument32 pagesBasic Introduction of TDSsaurabh.singhNo ratings yet

- How and When TDS Deductions Can Be Avoided - Fin - BankbazaarDocument3 pagesHow and When TDS Deductions Can Be Avoided - Fin - Bankbazaaraamar45No ratings yet

- E-Filing Income Tax Returns: Dr. Kailash KalyaniDocument41 pagesE-Filing Income Tax Returns: Dr. Kailash KalyaniRicha KalyaniNo ratings yet

- Tax Planning - Intro NotesDocument7 pagesTax Planning - Intro NotesBest How To StudioNo ratings yet

- Journal Entries of VATDocument4 pagesJournal Entries of VATSureshArigela0% (1)

- Income Tax Basics - A Comprehensive Guide PDFDocument42 pagesIncome Tax Basics - A Comprehensive Guide PDFsrinivasa varmaNo ratings yet

- Does My Business Need A Federal Tax ID Number?Document3 pagesDoes My Business Need A Federal Tax ID Number?Yan AcostaNo ratings yet

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- Tax Planning Assignment: Tax Deducted at SourceDocument4 pagesTax Planning Assignment: Tax Deducted at SourceJinesh NelsonNo ratings yet

- 2 Scheme of Tax CalculationDocument72 pages2 Scheme of Tax CalculationvivekNo ratings yet

- The Easy Guide To: The Goods and Services or Harmonized Sales Tax (GST/HST)Document10 pagesThe Easy Guide To: The Goods and Services or Harmonized Sales Tax (GST/HST)hellkatNo ratings yet

- How 2 Fillforn 280Document6 pagesHow 2 Fillforn 280anon_639359071No ratings yet

- Income Tax Calculator - TaxScoutsDocument1 pageIncome Tax Calculator - TaxScoutsnadine.massabkiNo ratings yet

- Expat's TDS Circulars: Creating Collywobbles in Many StomachsDocument1 pageExpat's TDS Circulars: Creating Collywobbles in Many StomachsMansi BhardwajNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Income From Other SourcesDocument6 pagesIncome From Other Sourcesanusaya1988No ratings yet

- GST in DetailDocument8 pagesGST in DetailVenkatesulu GNo ratings yet

- Enrolled Agent Training in India OverviewDocument9 pagesEnrolled Agent Training in India OverviewAbinashNo ratings yet

- Income Tax FaqDocument11 pagesIncome Tax FaqNasir AhmedNo ratings yet

- Final Notes For StudentsDocument45 pagesFinal Notes For Studentskishenmanocha485No ratings yet

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDocument17 pagesSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNo ratings yet

- ITP - TdsDocument8 pagesITP - TdsSaloni GuptaNo ratings yet

- Why People Avoid Tax in Third World Country Like Bangladesh: Report byDocument5 pagesWhy People Avoid Tax in Third World Country Like Bangladesh: Report bySajid Al NoorNo ratings yet

- Tds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersDocument10 pagesTds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersTaxRaahiNo ratings yet

- 10 Easy Steps To Tax FilingDocument8 pages10 Easy Steps To Tax FilingChandan VirmaniNo ratings yet

- Amongst GST Registered Companies in Malaysia and Abroad: (CITATION Roy19 /L 1033)Document5 pagesAmongst GST Registered Companies in Malaysia and Abroad: (CITATION Roy19 /L 1033)Yasier AimanNo ratings yet

- AFA100 - Journal Entries With Taxes - S - S23Document3 pagesAFA100 - Journal Entries With Taxes - S - S23Morongwa MamoseboNo ratings yet

- UntitledDocument5 pagesUntitledtheright placeNo ratings yet

- A Guide To Payroll Management: Product Customers Pricing Resources LoginDocument11 pagesA Guide To Payroll Management: Product Customers Pricing Resources LoginGeetika apurvaNo ratings yet

- Tds Due DatesDocument1 pageTds Due DatesKrishna Chaitanya DammalapatiNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- Tax Planning and ManagementDocument23 pagesTax Planning and Managementarchana_anuragi100% (1)

- Employer: 1. Introduction To PAYEDocument16 pagesEmployer: 1. Introduction To PAYELindaBakóNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- 39 Tds in TallyDocument50 pages39 Tds in TallytalupurumNo ratings yet

- Record Week 6 - ALKDocument11 pagesRecord Week 6 - ALKLeona Vierman Al-ZuraNo ratings yet

- EconomyDocument86 pagesEconomySridhar HaritasaNo ratings yet

- Salary Vs ConsultantDocument6 pagesSalary Vs Consultant77APACHEMUSICNo ratings yet

- 7 Write Offs Every S Corporation Business Owner Must KnowDocument13 pages7 Write Offs Every S Corporation Business Owner Must KnowJey DeeNo ratings yet

- Data - Sort & Filter-Sort/ Filter/ Advanced Filter Sort FilterDocument2 pagesData - Sort & Filter-Sort/ Filter/ Advanced Filter Sort FilterbvbhinaNo ratings yet

- Ms-Word CutDocument1 pageMs-Word CutbvbhinaNo ratings yet

- MS WordDocument2 pagesMS WordbvbhinaNo ratings yet

- TDS Create in Tally: First StepDocument2 pagesTDS Create in Tally: First StepbvbhinaNo ratings yet