Professional Documents

Culture Documents

Money Laundering

Money Laundering

Uploaded by

Komal KhatterOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Money Laundering

Money Laundering

Uploaded by

Komal KhatterCopyright:

Available Formats

Money laundering

From Wikipedia, the free encyclopedia Money laundering is the process of disguising illegal sources of money so that it looks like it came from legal sources. The methods by which money may be laundered are varied and can range in sophistication. Many regulatory and governmental authorities quote estimates each year for the amount of money laundered, either worldwide or within their national economy. In 1996 the International Monetary Fund estimated that two to five percent of the worldwide global economy involved laundered money. However, the FATF, an intergovernmental body set up to combat money laundering, admitted that "overall it is absolutely impossible to produce a reliable estimate of the amount of money laundered and therefore the FATF does not publish any figures in this regard." Academic commentators have likewise been unable to estimate the volume of money with any degree of assurance. Regardless of the difficulty in measurement, the amount of money laundered each year is in the billions (US dollars) and poses a significant policy concern for governments. As a result, governments and international bodies have undertaken efforts to deter, prevent and apprehend money launderers. Financial institutions have likewise undertaken efforts to prevent and detect transactions involving dirty money, both as a result of government requirements and to avoid the reputational risk involved.

What Is Money Laundering? Why Is It So Important To Stop It?

Some Frequently Asked Questions On the Subject. Since 9/11 money laundering has become one of the medias favourite themes. Yet money laundering has been one of the largest global socio-economic problems for many years. However there is still a substantial amount of ignorance and misinformation on this subject. To try and explain the problem, these are the kinds of questions that are usually asked on the washing of dirty money. What is money laundering? The perception that still endures of money laundering is that of a suspicious character turning up at the counter of a bank with a suitcase (probably helpfully labelled Swag) overflowing with used notes. Until recently even more sophisticated analyses of the problem have attempted to reduce the process to a neat three stage technique (placement, layering and integration). It is perhaps only now that it is becoming clear that money laundering is a robust, corrosive, all consuming and dynamic activity that has far reaching consequences and effects. Traditionally money laundering has been viewed (in isolation) as the cleaning of dirty money generated by criminal activity: in the collective mindset these crimes are probably associated with the drugs trade. Of course, money laundering is this, but it is also a

whole lot more. To understand and appreciate the all consuming power and influence of money laundering one needs to go back to the purpose of crime. The vast majority of illegal acts are perpetrated to achieve one thing: money. If money is generated by crime, it is useless unless the original tainted source of funds can be disguised, or preferably obliterated. The money laundering dynamic lies at the corrupt heart of many of the social and economic problems experienced across the globe. Why is this process called "money laundering"? The phrase probably originated in the United States in the 1920s. Criminal gangs were trying to disguise how they got their money so they took over businesses with high cash turnovers such as launderettes and car washes. Then they mingled their dirty money with genuine "clean" cash receipts. Thus whilst the term laundering is associated today with washing criminal funds, the original use of the phrase was because of the actual use of the real laundering business. Where does the dirty money that needs to be laundered come from? Every kind of criminal activity on a global basis. This includes the drugs (illegal narcotics) trade, illegal arms trading, illegal prostitution, corruption, fraud, forgery, armed robberies, blackmail, extortion, arts and antique fraud, smuggling, VAT fraud and trafficking in human beings. What amounts of money are involved? In truth nobody knows how much dirty money is being laundered (or attempted to be laundered) on a global basis. Think of it like this: every criminal act anywhere that involves obtaining money illegally produces funds that need to be laundered. In 1999 the United Nations Development Report estimated that organized criminal syndicates made $1.5 trillion each year. So this is a good base figure to work from but remember this is probably just a start point! Why is money laundering such a global problem? Money laundering is an essential follow on from many criminal activities including such hideous acts as human trafficking, the sex trade, extortion, blackmail: but more crucially once the funds have been cleaned they are reinvested in such activities thus perpetuating the most vicious of circles. Crime can only succeed if the funds generated can be utilized without their true source being known. Moreover, criminal activity continues to expand because the washed funds are then reinvested in the business. Money laundering is the critical tool to enable this. It is a dynamic and robust circular process. Isnt all this stuff about global organized criminal activity a bit of an exaggeration? In fact probably exactly the opposite is true: numerous organized crime groups are active in the UK and on a global basis the successful ones are being run as effectively as normal businesses. Amongst

these groups are Colombian drug cartels, Mexican drug cartels, Russian criminal groups, Japanese Yakuza, the Italian "Mafia", Chinese Triads, Turkish and Kurdish Gangs, West African fraudsters and gangs from the Balkans. As David Blunkett, the UK Home Secretary said in November 2002, "Organized criminals are more organized than we are." Are there any businesses that are particularly susceptible to money laundering? Yes there are so much so that clever launderers have in the past created "dummy" businesses just as a front to launder funds. Traditionally these have been in businesses that have a large cash turnover such as bureau de change, bars, night clubs, fair grounds, car parks and petrol garages. Where is it easiest to identify potential money laundering activity? It is actually getting more and more difficult because criminals are becoming increasingly clever in how they wash dirty money. However there are some basic steps that can be taken to deter money laundering through mainstream locations and facilities. Two essential anti-money laundering procedures are that companies (such as banks and other financial institutions) and professional advisors (such as lawyers and accountants) must firstly know their customer by taking identification and carrying out checks on the customer. Yes, if you are a genuine customer this can be extremely tedious but there is a good reason for doing it. Secondly banks (and professional advisors) should actively look for "red flags" that signify money laundering, such as unusual transactions, large cash payments and movements of funds that have no real logic. There is a but thoughwhilst such "red flags" may identify money laundering there is no guarantee that they will spot terrorist funding, as 9/11 and other terrorist outrages have shown us that the frontline terrorists achieve their aims with very small amounts of money. What about professional advisors such as lawyers and accountants shouldnt they be able to spot money laundering by their clients? Yes but all historical data tell us that these professions have not previously done a very good job. They have generated a very low level of reports of suspected money laundering to the police. This is particularly strange as their core businesses centre on money and detailed knowledge of complex financial systems, products and structures. Why are offshore financial centers always mentioned in relation to money laundering? Offshore financial centers (OFC), offshore jurisdictions, tax havens call them what you will, have always played a vital part in money laundering. However we shouldnt forget that if you are not a UK citizen, London (and the UK as a whole) is an important offshore financial centre. OFCs have in the

past (and still do, to a reduced extent) provided products and services in which the actual account holder is anonymous thus making money laundering and the hiding of assets easier. Is the financing of terrorism the same as money laundering? No but since 9/11 this topic has become strongly linked to money laundering. Traditional ideas of money laundering do not necessarily apply to terrorist financing. The basic premise of criminal money laundering is to wash large amounts of dirty money: however terrorist funding can, and does, operate on a shoestring. That being said terrorist funding can involve large amounts of money. The funding of terrorism generating the funds as opposed to supplying them to front line terrorists involves donations, fake charities, front companies, criminal activities and other supply mechanisms. All of this money has to be washed and "hidden" in the worlds financial systems. However, as with "traditional" money laundering there is mounting evidence that this is being increasingly achieved outside the banking system through such methods as informal exchange systems (such as hawala and hundi), diamond trading and online share trading (to name but three). A further key problem is that because the amounts involved in mounting a terrorist operation are, as we have seen, very small it is not necessarily feasible or possible for banks (or other relevant institutions) to identify terrorist "customers" by analysing their financial transactions. Or to put it in simple terms, a frontline terrorist bank account is more likely to have very small sums of money it, rather than large transfers and transactions. Why is it vitally important to stop money laundering and the financing of terrorism? Money laundering supports and facilitates global criminal and terrorist activity. If we could ever close down the financial flows which underpin these activities we would be able to halt the problem. Criminals and terrorists have no respect whatsoever for laws, regulations, decency or ultimately human life. They will do whatever they need to do to wash the proceeds of their crimes or in the case of terrorists, ensure that funds are available when and where they need them to mount their latest outrage. The history of money laundering by organized criminals is that such groups always surmount any obstacles that are erected in their path, using cutting edge technologies and any new product or facility that can be exploited. Terrorists with strong unwavering ideologies powering them must be expected to do the same. If the money laundering problem is so serious what more can be done to control it, and ultimately stop it?

Clever criminals who are generating substantial sums through their activities realized a long time ago that if you transfer these funds through numerous countries you create a very difficult trail for law enforcement agencies to follow. Money laundering is a worldwide activity but in my opinion criminals have embraced this global economy rather more effectively and quicker than governments and law makers. Countries still think of this problem in national, rather than international terms. Money laundering can only effectively be fought through continuous and effective co-operation through such topics as common laws, sharing of information and co-operation between police forces of relevant countries. Peter Lilley has been described as "a leading expert on money laundering" and is the head of Proximal Consulting, a firm that specializes in global money laundering / fraud prevention and investigation (for further details see www.proximalconsulting.com). He has also written widely on the subject, including his book: "Dirty Dealing: The Untold Truth about Global Money Laundering, International Crime and Terrorism" (Kogan Page)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- E.estate PlanningDocument95 pagesE.estate PlanningRohit KakatiNo ratings yet

- Corporate Finance MG TN DLMDocument470 pagesCorporate Finance MG TN DLManupsorenNo ratings yet

- Project Report On Tariff and Non Tariff FinalDocument17 pagesProject Report On Tariff and Non Tariff FinalKomal Khatter100% (3)

- Project Report On Tariff and Non Tariff FinalDocument17 pagesProject Report On Tariff and Non Tariff FinalKomal Khatter100% (3)

- The Indian Premier LeagueDocument13 pagesThe Indian Premier LeagueKomal KhatterNo ratings yet

- Social Skills SundeepDocument10 pagesSocial Skills SundeepKomal KhatterNo ratings yet

- Prepared By: Komal Mba Ii-A 02112303911Document22 pagesPrepared By: Komal Mba Ii-A 02112303911Komal KhatterNo ratings yet

- Daniel B. Newman, A029 682 240 (BIA March 16, 2015)Document13 pagesDaniel B. Newman, A029 682 240 (BIA March 16, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Unduran vs. Aberasturi PDFDocument38 pagesUnduran vs. Aberasturi PDFJoshua CuentoNo ratings yet

- Article 15Document3 pagesArticle 15Imtiaz AhmadNo ratings yet

- Case Based AssignmentDocument8 pagesCase Based Assignmentpooja0% (1)

- Municipality of Peńablanca: Republic of The Philippines Province of CagayanDocument63 pagesMunicipality of Peńablanca: Republic of The Philippines Province of CagayanLarnie SuyuNo ratings yet

- Gray Manufacturing Company v. ARS Global Guiding Et. Al.Document13 pagesGray Manufacturing Company v. ARS Global Guiding Et. Al.PriorSmartNo ratings yet

- 5 G.R. No. 162416 - de Joya v. MarquezDocument5 pages5 G.R. No. 162416 - de Joya v. MarquezCamille CruzNo ratings yet

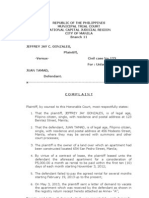

- Complaint Unlawful DetainerDocument4 pagesComplaint Unlawful DetainerPeter CardenasNo ratings yet

- The Evolution of The Republic of China On TaiwanDocument20 pagesThe Evolution of The Republic of China On TaiwanOlivera PopovicNo ratings yet

- TAA Stand For Freedom and DemocracyDocument6 pagesTAA Stand For Freedom and DemocracyRapplerNo ratings yet

- Woodrick V WoodDocument1 pageWoodrick V WoodMissPardisNo ratings yet

- Law of Agency SlideDocument20 pagesLaw of Agency SlidePacific Hunter JohnnyNo ratings yet

- 8 United States District Court: 2 JUY W. WHTEHUST, Principal Deputy County CounselDocument4 pages8 United States District Court: 2 JUY W. WHTEHUST, Principal Deputy County CounselKathleen PerrinNo ratings yet

- Bulletin 112 EI JIG 1530 2nd Edition With AttachmentDocument2 pagesBulletin 112 EI JIG 1530 2nd Edition With AttachmenterwerwerwerwewNo ratings yet

- Civil Procedure ReviewerDocument15 pagesCivil Procedure ReviewerAndrea Ivanne100% (1)

- Comment On Foe Jayme Et AlDocument5 pagesComment On Foe Jayme Et AlRaffy PangilinanNo ratings yet

- Employee Provident Fund (EPF at KWSP) - EPF ACT 1991 (Act 452) - Third ScheduleDocument13 pagesEmployee Provident Fund (EPF at KWSP) - EPF ACT 1991 (Act 452) - Third Scheduleyan100% (14)

- Memorandum of Association Final-2 (1) 07072019Document35 pagesMemorandum of Association Final-2 (1) 07072019romendu bhattacharjeeNo ratings yet

- 4DCA - FELTUSvUSBANK - Lost Note - Fraud Affidavit - Rule 1.190 (A)Document6 pages4DCA - FELTUSvUSBANK - Lost Note - Fraud Affidavit - Rule 1.190 (A)winstons2311No ratings yet

- Special Power of AttorneyDocument5 pagesSpecial Power of AttorneyBen Dover McDuffinsNo ratings yet

- Eusebio Vs CSCDocument2 pagesEusebio Vs CSCApple Gee Libo-onNo ratings yet

- 17 (5) Health InsuranceDocument3 pages17 (5) Health Insuranceashim1No ratings yet

- Forcible Entry CasesDocument22 pagesForcible Entry CasesBeverlyn JamisonNo ratings yet

- Aldi Employment App MASTER 2 16Document2 pagesAldi Employment App MASTER 2 16CybernaughtNo ratings yet

- Agreement: I. I Chundrigar, KarachiDocument6 pagesAgreement: I. I Chundrigar, KarachiirfmanNo ratings yet

- Patents Intellectual PropertyDocument22 pagesPatents Intellectual Propertyteena6506763No ratings yet

- SAP Pocessing ClassesDocument30 pagesSAP Pocessing ClassesAlessandro Lincoln100% (2)

- India and The Rights of Indigenous PeopleDocument277 pagesIndia and The Rights of Indigenous PeopleAfzal MohhamadNo ratings yet

- Counter AffidavitDocument7 pagesCounter AffidavitArvin Labto AtienzaNo ratings yet