Professional Documents

Culture Documents

The European Debt Crisis - A Beginner's Guide

The European Debt Crisis - A Beginner's Guide

Uploaded by

Abhishek SharmaCopyright:

Available Formats

You might also like

- Intercultural Experience Essay Final VersionDocument11 pagesIntercultural Experience Essay Final Versionapi-569419031No ratings yet

- Chapter 7 PRDocument35 pagesChapter 7 PRJulissa AdrianaNo ratings yet

- Reason of Debt CrisisDocument2 pagesReason of Debt CrisisKhan JewelNo ratings yet

- The Lehman Crisis Explained: Just What Is Going On in The United States and How Did The Crisis Come About?Document5 pagesThe Lehman Crisis Explained: Just What Is Going On in The United States and How Did The Crisis Come About?Angela LopezNo ratings yet

- The Europea Debt: Why We Should Care?Document4 pagesThe Europea Debt: Why We Should Care?Qraen UchenNo ratings yet

- B Eichengreen and The EuroDocument2 pagesB Eichengreen and The Euroaluque2004No ratings yet

- What Is The European DebtDocument32 pagesWhat Is The European DebtVaibhav JainNo ratings yet

- Eurozone Debt Crisis: Causes, Timeline, Extent of The Crisis, How It Is Being Addressed and How It'Ll Affect UsDocument15 pagesEurozone Debt Crisis: Causes, Timeline, Extent of The Crisis, How It Is Being Addressed and How It'Ll Affect UsShivani SharmaNo ratings yet

- Behind The Euro CrisisDocument4 pagesBehind The Euro CrisisKostas GeorgioyNo ratings yet

- Eurozone Crisis: Impacts: Prepared ForDocument24 pagesEurozone Crisis: Impacts: Prepared ForAkif AhmedNo ratings yet

- European Meltdown: Still Ahead or Better Outcome PossibleDocument18 pagesEuropean Meltdown: Still Ahead or Better Outcome PossiblepriyakshreyaNo ratings yet

- European UpdateDocument5 pagesEuropean UpdatebienvillecapNo ratings yet

- Compare and Contrast The Eurozone Debt Crisis of The 2000 and The LDC Crisis of 1980s. What Lessons Can Be Learnt From Both CrisisDocument12 pagesCompare and Contrast The Eurozone Debt Crisis of The 2000 and The LDC Crisis of 1980s. What Lessons Can Be Learnt From Both CrisisphlupoNo ratings yet

- Q&A: Greek Debt Crisis: What Went Wrong in Greece?Document7 pagesQ&A: Greek Debt Crisis: What Went Wrong in Greece?starperformerNo ratings yet

- Vinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalDocument4 pagesVinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalFinterestNo ratings yet

- EMS CrisisDocument6 pagesEMS CrisisDivya SharmaNo ratings yet

- Europe On The Rack: Why The Euro Is Breaking The European DreamDocument3 pagesEurope On The Rack: Why The Euro Is Breaking The European DreamGonzalo Prinque AstacioNo ratings yet

- Bob Chapman The Euro Zone and The Crisis of Sovereign Debt 4 2 2012Document4 pagesBob Chapman The Euro Zone and The Crisis of Sovereign Debt 4 2 2012sankaratNo ratings yet

- The European Debt Crisis: HistoryDocument7 pagesThe European Debt Crisis: Historyaquash16scribdNo ratings yet

- 18 Reasons of Financial Collapse in EuropeDocument5 pages18 Reasons of Financial Collapse in EuropeShivam LambaNo ratings yet

- It's Not About Greece AnymoreDocument10 pagesIt's Not About Greece AnymorebowssenNo ratings yet

- Guide To The Eurozone CrisisDocument9 pagesGuide To The Eurozone CrisisLakshmikanth RaoNo ratings yet

- Euro Debt Crises: Written by Shoaib YaqoobDocument4 pagesEuro Debt Crises: Written by Shoaib Yaqoobhamid2k30No ratings yet

- John Mauldin Weekly 10 SeptemberDocument11 pagesJohn Mauldin Weekly 10 Septemberrichardck61No ratings yet

- Case - 04, Can The Eurozone SurviveDocument12 pagesCase - 04, Can The Eurozone SurviveAman SohaniNo ratings yet

- The Impact of Europe Debt Crisis On The World Economy: Assignment of Banking and FinanceDocument16 pagesThe Impact of Europe Debt Crisis On The World Economy: Assignment of Banking and FinanceHồng NhungNo ratings yet

- Bob Chapman The EU Debt Crisis Has Not Been Solved If Europe Financially Implodes 5 11 2011Document4 pagesBob Chapman The EU Debt Crisis Has Not Been Solved If Europe Financially Implodes 5 11 2011sankaratNo ratings yet

- Default and Exit From The Eurozone: A Radical Left Strategy - LapavitsasDocument10 pagesDefault and Exit From The Eurozone: A Radical Left Strategy - Lapavitsasziraffa100% (1)

- George Soros On Soverign CrisesDocument8 pagesGeorge Soros On Soverign Crisesdoshi.dhruvalNo ratings yet

- Financial Crisis 'Will Drive Up Debt Repayments For Poorer Nations'Document2 pagesFinancial Crisis 'Will Drive Up Debt Repayments For Poorer Nations'Simply Debt SolutionsNo ratings yet

- European Sovereign Debt Crisis: PiigsDocument11 pagesEuropean Sovereign Debt Crisis: PiigsBismahqNo ratings yet

- La Euro Crisis. Causas y Sintomas (31-37)Document7 pagesLa Euro Crisis. Causas y Sintomas (31-37)Samara MendozaNo ratings yet

- ECOSOC Topic B: "The Euro Zone Crisis and Its Effects On The Global Markets"Document13 pagesECOSOC Topic B: "The Euro Zone Crisis and Its Effects On The Global Markets"ammaraharifNo ratings yet

- George Soros The Tragedy of The European Union and How To Resolve ItDocument2 pagesGeorge Soros The Tragedy of The European Union and How To Resolve ItBob FisherNo ratings yet

- Greece Financial CrisisDocument4 pagesGreece Financial Crisislubnashaikh266245No ratings yet

- JPF Orphan Currency Lemonde 220508Document2 pagesJPF Orphan Currency Lemonde 220508BruegelNo ratings yet

- Bob Chapman The Demise of The Euro As A World Currency 12 5 10Document3 pagesBob Chapman The Demise of The Euro As A World Currency 12 5 10sankaratNo ratings yet

- The European Debt Crisis: Joseph Foudy Department of Economics Jfoudy@stern - Nyu.eduDocument40 pagesThe European Debt Crisis: Joseph Foudy Department of Economics Jfoudy@stern - Nyu.eduMrJohnGalt09No ratings yet

- Euro Debt-1Document7 pagesEuro Debt-1DHAVAL PATELNo ratings yet

- Global Economy N.130: Agreement On Rescuing The Euro Zone Risks of Financial Contagion Briefs DecipheringDocument5 pagesGlobal Economy N.130: Agreement On Rescuing The Euro Zone Risks of Financial Contagion Briefs Decipheringapi-116406422No ratings yet

- Adam Fisher Soros Hire How To Make Money in A World of RiskDocument6 pagesAdam Fisher Soros Hire How To Make Money in A World of RisktonerangerNo ratings yet

- Why Europe SleptDocument3 pagesWhy Europe SleptBisserNo ratings yet

- Greece's 'Odious' Debt: The Looting of the Hellenic Republic by the Euro, the Political Elite and the Investment CommunityFrom EverandGreece's 'Odious' Debt: The Looting of the Hellenic Republic by the Euro, the Political Elite and the Investment CommunityRating: 4 out of 5 stars4/5 (4)

- Druckversion - Time For Plan B - How The Euro Became Europe's Greatest Threat - SPIEGEL ONLINE - News - InternationalDocument10 pagesDruckversion - Time For Plan B - How The Euro Became Europe's Greatest Threat - SPIEGEL ONLINE - News - InternationaljosephsomersNo ratings yet

- Debt CrisisDocument2 pagesDebt CrisisSantiago SevillaNo ratings yet

- Bob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10Document11 pagesBob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10sankaratNo ratings yet

- Euro Zone Crisis - A Global Problem - The HinduDocument3 pagesEuro Zone Crisis - A Global Problem - The Hindurajupat123No ratings yet

- GRP 7Document19 pagesGRP 7Khushi ShahNo ratings yet

- Bob Chapman Spiralling Public Debt and Economic Stagnation in The European Union 16 4 2011Document3 pagesBob Chapman Spiralling Public Debt and Economic Stagnation in The European Union 16 4 2011sankaratNo ratings yet

- European Economic CrisisDocument7 pagesEuropean Economic CrisisMalik FaysalNo ratings yet

- Special Report On Greece CrisisDocument13 pagesSpecial Report On Greece CrisisAchintya P RNo ratings yet

- Eurozona e CrisiDocument3 pagesEurozona e CrisiPino BacadaNo ratings yet

- Eurozona e CrisiDocument3 pagesEurozona e CrisiPino BacadaNo ratings yet

- European Crisis US BANKDocument6 pagesEuropean Crisis US BANKEKAI CenterNo ratings yet

- Waiting For GODOT, 2012: Vladimir EstragonDocument4 pagesWaiting For GODOT, 2012: Vladimir EstragonAlternative EconomicsNo ratings yet

- Global Ebrief Subject: What The Past Could Mean For Greece, JapanDocument5 pagesGlobal Ebrief Subject: What The Past Could Mean For Greece, Japandwrich27No ratings yet

- Stand or Fall Together: September 15, 2011Document2 pagesStand or Fall Together: September 15, 2011corradopasseraNo ratings yet

- Bill Gross On EuropeDocument3 pagesBill Gross On EuropeBRubin2No ratings yet

- Euro Crisis: England GovernorDocument19 pagesEuro Crisis: England GovernorRohit AnandNo ratings yet

- Where Is The ECB Printing Press?Document7 pagesWhere Is The ECB Printing Press?richardck61No ratings yet

- Currency Articles May 2012Document3 pagesCurrency Articles May 2012iExpatsNo ratings yet

- Mufti ERPDocument8 pagesMufti ERPAbhishek SharmaNo ratings yet

- Tata AceDocument4 pagesTata AceAbhishek SharmaNo ratings yet

- Satyamev Jayate Impact - Maharashtra Medical Council Suspends Licences of 13 DoctorsDocument5 pagesSatyamev Jayate Impact - Maharashtra Medical Council Suspends Licences of 13 DoctorsAbhishek SharmaNo ratings yet

- Seminar Report On Blue EyesDocument23 pagesSeminar Report On Blue EyesRanjeet pratap singh bhadoriya100% (6)

- ColorimetryDocument11 pagesColorimetryAbhishek SharmaNo ratings yet

- Chatterjee - Nationalism As A ProblemDocument18 pagesChatterjee - Nationalism As A Problembubu2222100% (1)

- COMELEC Vs Hon. Thelma CanlasDocument1 pageCOMELEC Vs Hon. Thelma CanlasClint D. LumberioNo ratings yet

- At The Margins of Globalization: Indigenous Peoples and International Economic LawDocument4 pagesAt The Margins of Globalization: Indigenous Peoples and International Economic LawFivtinia OctagusniNo ratings yet

- Tupas Vs OpleDocument10 pagesTupas Vs Oplemcris10150% (2)

- ENGEL v. VITALEDocument6 pagesENGEL v. VITALEAdan_S1No ratings yet

- Origins of The Roman EmpireDocument3 pagesOrigins of The Roman EmpireNaveen KumarNo ratings yet

- KW TaylorA History of The Vietnamese Cambridge CamDocument4 pagesKW TaylorA History of The Vietnamese Cambridge CamShaun MulhollandNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 237, Docket 83-2162Document8 pagesUnited States Court of Appeals, Second Circuit.: No. 237, Docket 83-2162Scribd Government DocsNo ratings yet

- Only The Middle East Can Fix The Middle EastDocument11 pagesOnly The Middle East Can Fix The Middle EastMaryamNo ratings yet

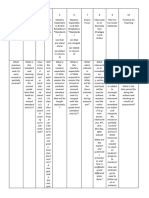

- Detailed Advertisement For Recruitment of MTs Through GATE-2021 Dt. 09.08.2021Document9 pagesDetailed Advertisement For Recruitment of MTs Through GATE-2021 Dt. 09.08.2021Priyadarshan sharmaNo ratings yet

- Ordinance-Ofw Help DeskDocument6 pagesOrdinance-Ofw Help DeskRandell ManjarresNo ratings yet

- SLRPDocument6 pagesSLRPPhoebe DaisogNo ratings yet

- Tashahhud With Sighah Al-KhitabDocument2 pagesTashahhud With Sighah Al-KhitabtakwaniaNo ratings yet

- TourismDocument23 pagesTourismneha18689No ratings yet

- 6026 Krithika JayadasanDocument28 pages6026 Krithika JayadasanMR GODFATHER ZZNo ratings yet

- Cuddy 2009Document33 pagesCuddy 2009datofezNo ratings yet

- Motion and Order To Show Cause On Information in The Nature of Quo WarrantoDocument3 pagesMotion and Order To Show Cause On Information in The Nature of Quo WarrantoBeverly TranNo ratings yet

- Mis 214 2023Document1 pageMis 214 2023Angel Ramas-CaylanNo ratings yet

- OGLES 123 (Jayapal)Document3 pagesOGLES 123 (Jayapal)Michael GinsbergNo ratings yet

- Salient Features of The ConstitutionDocument15 pagesSalient Features of The ConstitutionKeposeyi KezoNo ratings yet

- List of AwardeesDocument2 pagesList of AwardeesHARDI RAHAYU SAPUTRA UmriNo ratings yet

- English PDFDocument8 pagesEnglish PDFvocibotNo ratings yet

- Nowlan - Critical Theory GenderDocument3 pagesNowlan - Critical Theory Gendertechward.siNo ratings yet

- Economic NationalismDocument2 pagesEconomic NationalismMiccah Jade CastilloNo ratings yet

- Jade Bell - Research PaperDocument12 pagesJade Bell - Research Paperapi-458561298100% (1)

- Question Answer Based Notes: Mokshagundam VisvesvarayaDocument1 pageQuestion Answer Based Notes: Mokshagundam VisvesvarayaMRINAL MAZUMDARNo ratings yet

- Piero Sraffa's Political Economy PDFDocument426 pagesPiero Sraffa's Political Economy PDFBlancaLain100% (2)

- Feminist Theoretical Perspectives Pasque Wimmer REV PDFDocument32 pagesFeminist Theoretical Perspectives Pasque Wimmer REV PDFshreshthNo ratings yet

The European Debt Crisis - A Beginner's Guide

The European Debt Crisis - A Beginner's Guide

Uploaded by

Abhishek SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The European Debt Crisis - A Beginner's Guide

The European Debt Crisis - A Beginner's Guide

Uploaded by

Abhishek SharmaCopyright:

Available Formats

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

July 7, 2012

The European Debt Crisis: A Beginner's Guide

The Huffington Post Alexander Eichler First Posted: 12/21/11 05:25 PM ET Updated: 12/27/11 10:19 AM ET The European sovereign debt crisis! It -- wait, come back. This is interesting, we promise. The debt crisis is one of the biggest stories of the year, maybe of the decade. If you're American, how can you tell whether the situation across the pond affects you? Take our quiz to find out: 1) Do you like money? 2) Would you rather have money than not have any money? If you answered "yes" to either of the above, then the Europe situation probably has bearing on your life. Here's a quick explanation of what's happened. (More of a picture person? Scroll down for graphics that help to explain the crisis) WHAT IS THE EUROPEAN DEBT CRISIS? In its most basic form, it's just this: Some countries in Europe have way too much debt, and now they risk not being able to pay it all back. Simple!

Sponsored Links

5 Diet Pills that Work

2012s Top 5 Weight Loss Pills. Updated Consumer Ratings. Free Report. www.DietRatings.org

Get Athena Pheromones

Enjoy more romantic attention w/ Biologist Winnifred Cutler's formulas www.athenainstitute.com

$10,000 Poker Tournament

Play Free Poker. Win Real Cash. No credit cards. No entry fees. www.pureplay.com

Buy a link here

There's more to it than that, of course, but when people talk about the "crisis," what they're worried about is that a big, scary, flashpoint event will happen -- like one or more of the eurozone countries defaulting on its debts -- causing investors to panic and triggering a massive banking shock. The possibility also looms that one or more countries will pull out of the eurozone -- the 17-nation bloc that use the euro currency, which has been around since 1999. Should any of the eurozone nations drop out of this group, it could lead to a rash of bank failures in Europe, and possibly in the United States as well. Under these circumstances, people and businesses who need money might not be able to get any. We'd be looking at depression for Europe and recession for the rest of the world. Some people argue that an orderly, controlled eurozone break-up would be a good thing for certain struggling debtor nations. Still, even this relatively benign scenario carries economic fallout for Europe and maybe beyond. HOW DID THIS HAPPEN?

1 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

The reason everyone is freaking out now is that while some eurozone countries are relatively sound from an economic standpoint, other countries are way over-leveraged, meaning they have too much debt relative to the size of their economies. And the troubles of a few countries could end up affecting everyone, yoked together under one currency for the last decade -even though their economies functioned according to different habits and enjoyed very different degrees of financial health. Portugal, Ireland, Italy, Greece and Spain -- gathered under the unfortunate acronym PIIGS -- are some of the most highly leveraged eurozone countries, and most people think that if a disaster happens, it will start with one of them. Italy's debt is 121 percent the size of its economy. For Ireland, that figure is 109 percent. In Greece, it's 165 percent. The PIIGS took different paths to this scenario. Ireland, for example, underwent a massive real estate bubble, and its banks sustained giant losses. The Irish government wound up rescuing its banks, and now the country is burdened under a huge debt load. Spain, which now has a 22 percent unemployment rate, also experienced a huge housing bubble. The country didn't indulge in excessive borrowing -- rather, it ended up with high deficits because it couldn't collect enough tax revenue to cover its expenses. Greece, on the other hand, not only borrowed beyond its means, but exacerbated the problem with lots of overspending, little economic production to make up the difference, and some creative bookkeeping to prevent eurozone authorities from realizing the true extent of the situation. The deficits weren't piling up everywhere. Countries with strong economies like Germany and France were keeping their output high and their debt at a manageable level. But when 17 nations use the same currency, trouble spreads quickly. Now that the size of the PIIGS' debt has become clear, investors are getting more and more reluctant to buy bonds from European countries, since many of those countries are heavily in debt -- and the ones that aren't in debt look like they might have to assume responsibility for the ones that are. Investors don't want to put their money into bonds if they think they might not eventually get that money back. And governments in Europe have a lot of debt and not much money -- and it's not clear how they're going to correct this. WHOSE FAULT IS IT? Blame often gets cast on the "irresponsible" countries who borrowed too much, taking advantage of the low interest rates available to all euro member nations. However, many argue that it's not right in all cases to blame indebted governments for their own situation, since not every country with high deficits actually engaged in reckless borrowing. Others say the euro currency itself is to blame -- arguing that the idea that a single currency could meet the needs of 17 different economies was inherently flawed. Typically, a country's central bank can adjust a nation's money supply to encourage or inhibit growth as a way of dealing with economic turmoil. However, the nations yoked together under the euro frequently haven't had that option. If Spain and Germany hadn't both spent the last several years on the euro, for example, then they wouldn't have been able to borrow at the same low interest rates -- an interest rate set by the European Central Bank, and one that made more sense for Berlin than for Madrid. Greece might still be shouldering huge debts if not for the euro, but maybe it wouldn't be in a position to take down the rest of Europe with it. And if the PIIGS all still had their own individual currencies, they might be able to export their way out of the mess they're in -- selling goods on the international market until their respective situations were a little less dire. But as it is, they can't. Alternatively, if you like, you could say the interconnectedness of the modern financial industry is to blame. That's certainly a reason default by Italy or a departure of the eurozone by a fed-up Germany -- to name two examples -- could reverberate around the world. FROM THE OLD WORLD TO THE NEW The crisis in Europe could end up affecting the U.S. in some very direct ways. American banks have billions of dollars at risk in European banks. And while that's actually a relatively small fraction of U.S. banks' holdings, the indirect damage could be greater: U.S. business owners could be facing a credit crunch if overseas banks topple. Further, the U.S. stands to suffer huge trade losses if Europe slips into a recession. Fourteen percent of all U.S. exports go to the eurozone, so weak consumption in Europe spells trouble in the States. At the moment, a downturn in Europe is the last thing the U.S. needs. Growth is slow in America, and millions of people aren't working who'd like to be. The U.S. needs to be producing and exporting more, not less, and it's already hard enough for small businesses in the States to get credit from banks. The Great Recession technically ended in 2009, but for a lot of people -- people in poverty, people who can't afford food, people working long hours for low wages -- it feels like things are as bad as ever. A financial emergency in Europe, triggered by some event that sends investors running for cover, could take all of America's problems and make them bigger. WHAT HAPPENS NEXT? This is a fast-moving story, and by the time you read this, circumstances may have already changed. As of this writing, though, all of Europe is basically trying to do damage control. European Union authorities have put together a funding package of 150 billion euro for the International Monetary Fund to disperse to debt-stricken eurozone nations, and many countries are using inventive asset-juggling tricks to get capital into their banks without officially bailing anyone out. Earlier this month, eurozone authorities drew up a tentative proposal to enforce stricter consequences on countries that borrow beyond an agreed-upon limit. The deal would also require eurozone nations to balance their budgets, and aims to bring members of the currency bloc into greater sync from a fiscal standpoint.

2 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

EU leaders will meet again on January 30 to further discuss this deal. In the meantime, European governments are doing all they can to soothe investors -- a task made harder by ominous rumblings from credit rating agencies like Moody's, Fitch and Standard & Poor's, which have all downgraded or threatened to downgrade numerous countries and financial institutions in the eurozone and elsewhere. (You may remember Standard & Poor's from the fun downgrade debacle of this past summer, when that agency lowered the United States' sovereign credit rating one notch and caused markets to spaz out.) At the moment, it's not clear whether any of the curative measures in the works will allow Europe to avoid a major financial downturn. Some onlookers are skeptical that the eurozone nations can reach a workable deal, since the countries have a poor track record of working together on financial matters. And things are likely to remain on a hair trigger even if a deal progresses, since bank-to-bank relationships rely on trust and credibility, and even the perception of a crisis could quickly become self-fulfilling. Meanwhile, as all this is going on, troubled eurozone countries are pledging to cut back government spending to show they can be trusted -- even though this results in financial misery for the people in those countries, and will in all likelihood make it harder for Europe's economy to gain any momentum in the months to come. Is there anything you can do about the situation in Europe? Not really -- except keep an eye on it. Disaster isn't a foregone conclusion at this point, but if things do go south on the Continent, the business climate in America will likely get worse before it gets better. You'll want to be able to see that coming if it does. Below are graphics featuring a country-by-country break down of some of the most important indicators of the crisis : Debt As A Percentage Of GDP The Unemployment Rate Projected Gross Domestic Product

ALSO ON HUFFPOST:

Eurozone crisis live updates:

live blog

Oldest Newest 3:59 AM 12/31/2011 Global Stock Markets Lost 12 Percent Of Value, Or $6.3 Trillion, In 2011 Investors in global stock markets lost $6.3 trillion in wealth in 2011 largely because of fears of a eurozone breakup, according to The Financial Times. The value of global stock markets fell 12 percent to $45.7 trillion. From the FT: The S&P 500 is flat this year while the FTSE 100 has only dropped 5.5 per cent. But the Eurofirst 300 gauge of blue-chip European companies has lost 11 per cent, led by the French and Italian exchanges. The MSCI Emerging Markets index has shed a fifth of its value despite strong growth in China and other emerging markets. Asian equity markets were hit particularly hard with Japans Nikkei index losing 17.3 per cent this year, Hong Kongs Hang Seng index 20 per cent and the Shanghai Composite 22 per cent. --Bonnie Kavoussi Share this: 12:38 AM 12/31/2011 Subsidy Cut Threatens Italy's Newspapers Up to 100 Italian newspapers will be forced to close after the Italian government slashes subsidies to newspapers in the name of shoring up its finances, according to The Financial Times. The subsidy cut amounts to a 69 percent cut in funding for newspapers, according

3 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

to the FT. It was ordered by the government of the previous prime minister, media magnate Silvio Berlusconi, and approved by the new government of Mario Monti. Though the newspaper industry is in decline, some say that these local and sometimes partisan newspapers give voice to stories that the mainstream media ignores, according to the FT. Staffers at the communist daily Liberazione, which has 5,000 readers, are staging an occupation of the newsroom this weekend to prevent the owners from shutting down the paper after its possible last issue is released on Saturday, the FT reports. --Bonnie Kavoussi Share this: 8:58 PM 12/28/2011 Investors Unmoved By Lower Borrowing Costs For Italy Investors were unmoved by the steep fall in Italy's short-term borrowing costs on Wednesday, as Italy's long-term borrowing costs stayed elevated and European stocks fell. The interest rate on Italy's six-month government bonds fell by half to 3.25 percent at an auction on Wednesday: a vote of confidence in Italy's ability to pay off its debts for half a year. But investors remained skeptical about Europe's long-term economic prospects. The DAX in Germany plunged 1.04 percent on Wednesday, the CAC in France fell 0.38 percent, and Italy's FTSE Italia All-Share neither gained nor lost ground. The interest rate on Italy's ten-year government bonds remained unsustainable at 6.80 percent. --Bonnie Kavoussi Share this: 8:38 PM 12/28/2011 EU Admits That Austerity Will Lead To Higher Youth Unemployment The European Commission admitted in a report in mid-December that its medicine for the sovereign debt crisis may be poison for Europe's long-term economic outlook. The report said, according to The Wall Street Journal, that the imminent economic slowdown in Europe, caused in part by a contraction in government spending, will worsen job prospects for young people, and "young people remain the hardest hit by the crisis and its aftermath." The report added that "income shocks may prove permanent." The youth unemployment rate in the European Union is disastrously high at 20 percent, with a high of 48 percent in Spain, according to the WSJ. --Bonnie Kavoussi Share this: 8:35 PM 12/28/2011 European Safe Haven Deposits Reach All-Time High, Again The European sovereign debt crisis is turning into a banking crisis. After breaking a record just a day earlier, the amount of overnight deposits parked at the European Central Bank's overnight deposit facility reached another record high on Tuesday: $591 billion, a 10 percent increase from $538 billion the day before, according to The Wall Street Journal. The deposits attract an interest rate of just 0.25 percent and could translate into a loss for banks, highlighting the rising level of banks' distrust in any risky lending as banks seek to shore up capital to meet new regulatory requirements. --Bonnie Kavoussi Share this: 1:57 AM 12/28/2011 Italy Suffers From Worst Christmas Shopping In Ten Years Italy suffered from the worst Christmas shopping season in ten years, according to the Italian consumer group Codacons, Bloomberg News reported.

4 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

Italians spent $62.75, or 48 euros, less per person during the holidays this year than the average of the past five years, according to Codacons. Shoe and clothing stores suffered the most, with sales in that sector plunging 30 percent compared to previous years, according to Codacons. As the Italian government seeks to rein in its debt by slashing spending and collecting more in taxes, Italians are cutting back in their spending, which will continue to hurt the economy. Italy's latest austerity plan will cost every Italian family about $1,476, or 1,129 euros, according to the Italian consumer group Federconsumatori, Bloomberg News reported. The FTSE Italia All-Share, Italy's main stock index, fell 0.85 percent on Tuesday. --Bonnie Kavoussi Share this: 8:48 PM 12/27/2011 European Safe Haven Deposits Reach All-Time High Banks parked a record high number of deposits in the European Central Bank's overnight deposit facility, which is considered to be a safe haven, according to The Wall Street Journal. Banks deposited $538 billion, or 412 billion euros, overnight at the ECB on Monday, up 19 percent from $453 billion, or 347 billion euros, on the Thursday before Christmas, according to ECB data cited by the WSJ. The high level of overnight deposits reflects the rising level of distrust in inter-bank lending, in conjunction with continued liquidity in the eurozone markets as the ECB lends more to banks, the WSJ noted. --Bonnie Kavoussi Share this: 8:25 PM 12/27/2011 French Unemployment At 12-Year High The number of people without jobs in France reached a 12-year high in November, placing pressure on French President Nicolas Sarkozy's reelection campaign, according to Reuters. France's labor ministry reported that the number of registered jobseekers in France rose to 2.85 million, 1.1 percent more than in October and 5.2 percent more than during the same period last year, according to Reuters. The unemployment rate in France rose in the third quarter to 9.3 percent from 9.1 percent in the second quarter, according to France's national statistics office, Reuters reported. --Bonnie Kavoussi Share this: 8:09 PM 12/27/2011 Post-Christmas Shopping Boosts European Stocks The stock prices of European retailers rose after reports of shoppers flooding stores both in Europe and the United States on Monday, the day after Christmas, according to The Financial Times. The stock price of German retailer Metro rose 1 percent on Tuesday, France's Carrefour rose 0.6 percent, and Swiss watchmakers Swatch and Richemont rose 0.7 percent, according to the FT. The DAX stock index in Germany rose 0.23 percent, while the CAC 40 in France fell just 0.03 percent. --Bonnie Kavoussi Share this: 12:41 AM 12/21/2011 EU Rolls Out Plan To Combat Youth Unemployment In the face of growing youth unemployment across Europe, the European Commission has launched what it calls the Youth Opportunities Initiative, a program aimed at getting more of the continent's young people into the workforce. Per a press release from the European Commission, the program will allocate 4 million euro toward getting young people into employment, education or training within four months of leaving school. At the moment, the EU has a youth unemployment rate of about 21 percent, meaning that 5 million young people are out of work. According to the European Commission, a total of 7.5 million people age 15 to 24 are not employed, attending school or involved in work training. The lack of opportunities for Europe's young people has inspired protests and riots in some countries and mass migrations in others. The problem is expected to grow worse if Europe tips into a recession, or if the EU's many heavily indebted countries impose austerity measures to rein in deficits. -- Alexander Eichler Share this: 11:06 PM 12/20/2011 Cash-Strapped Italy Weighs Sale Of Its Digital Frequencies Italy -- whose debts currently exceed 1.8 trillion euro, or more than 120 percent of the size of its economy -- appears to be considering an auction of six digital frequencies, according to Bloomberg.

5 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

Earlier this week, the Italian government walked back plans to assign the frequencies for free. It now seems to be weighing a proposal to auction the frequencies to the highest bidder. Such a sale could net the government about 2.4 billion euro, according to a professor at University of Rome La Sapienza. "It doesnt make any sense to give away for free scarce resources such as frequencies, especially in light of the financial troubles Italys in, said Dino Bortolotto, head of the telecommunications company Assoprovider, as quoted in Bloomberg. -- Alexander Eichler Share this: 10:12 PM 12/20/2011 European Governments Work Out Some Non-Bailout Ways To Fund Banks Mindful of the stigma associated with bank bailouts, some European governments are using workaround methods to generate quick cash for their countries' financial institutions. Nations including Germany, Italy, Portugal and Spain are moving assets around to help ease the debt burden on their major banks, according to the Wall Street Journal. The hope is that by eschewing any measure that can be characterized as a full-on bailout, the countries can avoid spooking investors with the appearance of vulnerability. One such method, in use in Italy, involves the government selling its unwanted property to banks, then leasing the property back. Banks can bundle the properties as asset-backed securities and use them as collateral to get loans from the European Central Bank. Analysts have warned that these solutions are only a temporary fix and that more comprehensive action will be needed to guarantee the safety of European banks, the WSJ reports. -- Alexander Eichler Share this: 4:52 AM 12/20/2011 Euro Falls Against The Dollar Ahead Of Spanish Debt Auction The euro dipped below the $1.30 mark Monday afternoon as markets closed out a day of disappointing news and developments of uncertain import. At the end of trading Monday, the euro stood at $1.2997, a 0.4 percent decline on the day and close to an 11-month low versus the dollar, according to Bloomberg. There were a number of reasons investors may have been wary during Monday's trading, including a rescue package deal for the International Monetary Fund that fell short of expectations, and tumbles for Asian currencies like the won and the yen as the international community assessed the death of North Korean leader Kim Jong Il. Monday also saw a sell-off for Bank of America stock that left the company trading at just $4.99 at the closing bell. Overall, the Dow ended the day 100 points down. On Tuesday, Spain will auction a series of three- and six-month securities. In the past week, Spain has raised about 11 billions, in debt auctions an unexpectedly good performance aided by falling interest rates. Alexander Eichler Share this: 1:57 AM 12/20/2011 Eurozone Countries Pledge 150 Billion To International Monetary Fund Several nations agreed Monday to provide 150 billion ($195 billion) to the International Monetary Fund, a rescue package that incorporates commitments from eurozone and non-eurozone countries alike, yet may not be far-reaching enough to reassure nervous investors. The 150 billion will consist of contributions from 13 eurozone nations, as well as four countries -- Poland, Denmark, Sweden and the Czech Repoublic -- that are not part of the currency union, Bloomberg reports. Notably absent is the United Kingdom, whose refusal to pledge money to the IMF means that the architects of the deal will fall short of their 200 billion goal. The U.K. will "define its contribution early in the new year," according to a statement from EU finance ministers. Also not participating in the deal are Greece, Ireland and Portugal, three heavily indebted eurozone countries that have received international bailout funds. Alexander Eichler Share this: 12:49 AM 12/20/2011 Unemployment, Low-Paying Jobs Likely To Remain Widespread In Europe, Report Finds With recession looking more and more likely in Europe, the problem of high youth unemployment is unlikely to diminish any time soon, according to a report issued Friday by the European Commission. Europe's economy is widely expected to shrink in the coming months, which bodes ill for the prospect of a labor market recovery. Youth unemployment in the European Union is at 20 percent, according to The Wall Street Journal, and runs significantly higher for some individual countries. In Spain, for example, 48 percent of young people are unemployed. Compounding the problem is the ubiquity of low-paying temporary job contracts in Germany, France, Sweden and other

6 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

countries, according to the WSJ. Many young people are employed under temporary contract arrangements, but these positions offer relatively little chance of moving into a full-time job, and can create a lasting wage gap between temporary and permanent employees. -- Alexander Eichler Share this: 10:57 PM 12/19/2011 Spain's Incoming Prime Minister Offers Details On Economic Reform Mariano Rajoy, who will be sworn in as prime minister of Spain on Wednesday, has lain out some of the measures his government intends to take to address Spain's looming budget deficit. Rajoy told members of Parliament Monday that his government will pass a provisional 2012 budget by the end of December, according to the Financial Times. Under Rajoy's plan, public sector hiring is expected to drop off sharply, and all forms of public spending except pensions will be vulnerable to cuts, the FT reports. The proposed budget aims to reduce Spain's deficit by 16.5 billion, according to BBC News. Spain has an unemployment rate of nearly 23 percent, the highest of any developed economy. Rajoy told Parliament that measures to reform the labor market would be devised by the end of March. Alexander Eichler Share this: 10:28 PM 12/19/2011 Dominique Strauss-Kahn Scolds European Heads Of State Dominique Strauss-Kahn, the former managing director of the International Monetary Fund, had harsh words for eurozone leaders Monday, according to the Financial Times. Speaking at a conference in Beijing, Strauss-Kahn said that European debt crisis was in fact "a growth crisis," and that "[b]ehind the growth crisis is a leadership crisis." Strauss-Kahn cited German Chancellor Angela Merkel and French President Nicolas Sarkozy as two leaders who were not cooperating as effectively as they could, saying he doubted whether they "clearly understand each other." Monday marked Strauss-Kahn's first formal address since being charged with the sexual assault of a hotel housekeeper in May, an accusation that was ultimately dropped. -- Alexander Eichler Share this: 4:32 AM 12/17/2011 U.S. Dollar Usurps Gold's Status As Safe Haven The U.S. dollar -- not gold -- now is the ultimate safe haven. While gold prices fell to their lowest level since September, the U.S. dollar index rose to its highest level since January as investors fled risky investments after the unsuccessful European Union summit last week, according to The Financial Times. "Gold evidently failed to uphold its primary role as a safe haven asset," Ross Norman of Sharps Pixley, a retail bullion brokerage, told the FT. --Bonnie Kavoussi Share this: 3:54 AM 12/17/2011 European Banks Unlikely To Bail Out Struggling European Governments The European Central Bank has given banks a weapon that could serve as a backdoor bailout for troubled European governments: cheap money. But banks are likely to use the money to pay down their own debts rather than save European governments from higher borrowing costs and the threat of default, according to Thomson Reuters' International Financing Review. From the article: Burned by Greek losses, and under the scrutiny of shareholders, banks have slashed their exposure to weaker European sovereigns over recent months. Senior bankers say they will cut further, despite pressure to use newly available, longer-term ECB loans to buy government debt as part of an officially-sanctioned carry trade. "I can't think for a moment why anyone would want to [buy eurozone government debt]," said the head of capital markets at one European bank that is also reducing its exposure to eurozone sovereign bonds. "Everyone is trying to protect capital. It's counterintuitive. It would be digging a deeper hole for yourself." --Bonnie Kavoussi Share this: 3:34 AM 12/17/2011 Moody's Downgrades Belgium's Credit Rating Credit rating firm Moody's Investors Service downgraded Belgium's credit rating two notches on Friday: from Aa1 to Aa3. Moody's attributed the downgrade to the increased risk that the Belgian government took on by bailing out the bank Dexia,

7 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

"increasing medium-term risks to economic growth" due to budget cuts in the eurozone, and higher borrowing costs for eurozone countries such as Belgium. The interest rate on ten-year Belgian government bonds was 4.32 percent as of Friday afternoon. --Bonnie Kavoussi Share this: 3:21 AM 12/17/2011 European Airlines To Slash Costs As Economy Deteriorates The German airline Lufthansa, Europe's largest airline by market value, plans to detail a cost-cutting plan early next year as Europeans turn to cheap airlines and built-in expenses such as the cost of fuel rise, according to The Wall Street Journal. Christoph Franz, Lufthansa's chief executive, said that the company's operating profit this year will be "well below the figure we require in order to secure our company and our jobs in the future," according to the WSJ. Air France also plans to announce cost-cutting measures in mid-January, according to the WSJ. --Bonnie Kavoussi Share this: 2:56 AM 12/17/2011 French Presidential Candidate Promises To Focus On ECB For Rescue If Elected Francois Hollande, the Socialist Party candidate for president of France, said on Friday that if elected, he would seek a eurozone rescue from the only institution that he believes can save Europe, according to The Wall Street Journal: the European Central Bank. Hollande, French President Nicolas Sarkozy's main election opponent, said that the ECB is the only institution with the funding and credibility to be able to provide a full backstop for troubled European governments, according to the WSJ. "Everyone knows that without a powerful intervention by the ECB, it will be impossible to restore calm on markets," he said. Knowing that Germany would resist any change to the treaty preventing the ECB from buying bonds directly from governments, Hollande said that he would like to work within the current legal framework, according to the WSJ. "I would rather have a change in practice than a change in the treaty," he said. --Bonnie Kavoussi Share this: 2:41 AM 12/17/2011 S&P: Traditionally Strong Eurozone Countries May Suffer More Than Others From Recession Standard and Poor's released a report Friday saying that five of Europe's strongest economies may experience an even sharper contraction than other countries. S&P wrote that the eurozone's five "net exporter" countries -- Germany, the Netherlands, Austria, Belgium, and Finland -- will suffer at least as much as other eurozone countries from the imminent European recession, and that they may suffer even more since they are so dependent on external consumer demand. Consumption comprises 73 to 80 percent of those economies, according to S&P. S&P wrote that the Netherlands is the most vulnerable "net exporter" country, followed by the Netherlands. --Bonnie Kavoussi Share this: 2:30 AM 12/17/2011 Irish Economy Shrinks 1.9 Percent Ireland, which implemented austerity measures earlier than other European countries, saw its economy shrink 1.9 percent between July and September, according to figures from Ireland's national statistics office cited by The Financial Times. Ireland thus was the worst-performing economy in the eurozone: a steep turnaround from the previous three months, when the Irish economy performed second best, according to the FT. The Irish economy shrank largely because of a steep decline in corporate investment and consumer demand, the FT wrote. --Bonnie Kavoussi Share this: 2:30 AM 12/17/2011 Euro Weakens After Fitch Ratings Issues Downgrade Warning The euro fell in value on Friday after Fitch Ratings issued a warning that it may downgrade several countries in the eurozone, according to Bloomberg News. Fitch Ratings revised its outlook to negative on Friday on the credit ratings of Spain, Italy, Belgium, Slovenia, Ireland, and Cyprus. After the announcement, the value of the euro fell to $1.3019 at 1:49 p.m. ET, after gaining earlier in the day, according to Bloomberg News. The value of the euro has fallen 2.7 percent this week: the largest such decline since early September. --Bonnie Kavoussi Share this: 1:19 AM 12/17/2011

8 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

German Coalition Party Gives Limited Vote Of Confidence In Merkel German Chancellor Angela Merkel's junior coalition party, the centrist Free Democratic Party (FDP), gave Merkel a limited vote of confidence in her handling of the eurozone crisis. Though the FDP did not reach a quorum in the vote, they backed the decision to create a permanent eurozone bailout fund: the European Stability Mechanism, according to The Wall Street Journal. Nonetheless, the sizable minority in the FDP that is skeptical about the euro probably will prevent Germany from pursuing larger bailout efforts, according to the WSJ. --Bonnie Kavoussi Share this: 9:23 PM 12/16/2011 European Debt Crisis Could Boost Exports The sovereign debt crisis ironically could boost economic growth in Europe through one avenue, however short-term: exports. Investors are selling euros as they lose confidence in the future of the eurozone, which is driving down the value of the euro and making European exports more competitive around the world. The value of the euro has plunged 13 percent since its peak in May to $1.30, which economists say could raise economic growth in the eurozone by at least 0.5 percent as long as the fall in the value of the euro sticks, according to The Wall Street Journal. But the fall in the value of the euro also could keep struggling European countries dependent on exports that no longer will stay competitive over the long term. For example, Portugal's textile industry accounts for 10 percent of the country's exports, according to the WSJ and the head of Portugal's textile association told the WSJ that the weaker euro "will help Portuguese textiles exports, especially for countries outside the European Union." But this is not a sustainable strategy, said Stijn van Nieuwerburgh, associate finance professor at New York University's Stern School of Business. "The future of Portugal does not lie in textiles," van Nieuwerburgh told The Huffington Post, noting that the textile industry in emerging economies has boomed. "It will have to lie in something else -- in R&D [research and development] -- and it's going to have to undergo structural reform, and that's just a very painful and slow process." --Bonnie Kavoussi Share this: 9:01 PM 12/16/2011 France Sneers At United Kingdom, While Entering Recession Two of Europe's strongest economies now seem to be in a competition to see which one will shrink the least. "It is true that the economic situation in Britain is very worrying today and one prefers to be French than British at the moment on the economic level," French finance minister Francois Baroin said on Friday, according to The Financial Times. The French statistics agency Insee recently forecast that the French economy will have shrunk 0.2 percent between October and December of this year, and that it will shrink another 0.1 percent during the first three months of 2012, according to the FT. It also forecast that the unemployment rate in France, which is currently 9.7 percent, would rise to 10 percent by the middle of 2012. The Organization for Economic Cooperation and Development (OECD) forecast in late November that the British economy would fall back into recession during the winter because of government spending cuts and the eurozone crisis, according to The Guardian. --Bonnie Kavoussi Share this: 8:05 PM 12/16/2011 Monti Survives Confidence Vote Mario Monti has survived his first vote of confidence over austerity, Reuters reports (via CNBC). His predecessor, SIlvio Berlusconi, barged his way through more than 50. Markets have not reacted to much today and have been flat, although the CAC-40 has started to drop a bit. The plan, contested by Italy's unions and the opposition Northern League, has been in effect since Monti's government approved it on December 4. But it needed full parliamentary approval within 60 days to remain in force. The upper house, where Monti is a life senator, is expected to approve the package definitively next week, most likely in another confidence vote. Share this: 6:23 PM 12/16/2011 'Hunger For Rigour' Italian Prime Minister Mario Monti has said in a speech that the EU must look for more sustainable, long term solutions to its sovereign debt crisis, and politicians must overlook the short term needs for "rigour" in order to achieve the goal of stability, Reuters reports. Italian Prime Minister Mario Monti said Europe's response to the debt crisis "should be wrapped in a long-term sustainable approach, not just to feed short-term hunger for rigour in some countries."

9 of 10

07-07-2012 16:49

The European Debt Crisis: A Beginner's Guide

http://www.huffingtonpost.com/2011/12/21/european-debt-crisis_n_11...

"To help European construction evolve in a way that unites, not divides, we cannot afford that the crisis in the euro zone brings us ... the risk of conflicts between the virtuous North and an allegedly vicious South," he told a conference in Rome. The speech could be interpreted as a thinly veiled attack on Germany, which has routinely blocked market-friendly approaches, such as European Central Bank (ECB) intervention or discussions of collectively-issued eurobonds. Share this: More

Play

Play

Play

Finding High Ground During the European Debt Crisis

European Debt Crisis Concerns Push Global Equities Lower, Energy...

Euro Falls 1% Vs. Dollar, Risk Aversion Resurfaces as EU Debt...

10 of 10

07-07-2012 16:49

You might also like

- Intercultural Experience Essay Final VersionDocument11 pagesIntercultural Experience Essay Final Versionapi-569419031No ratings yet

- Chapter 7 PRDocument35 pagesChapter 7 PRJulissa AdrianaNo ratings yet

- Reason of Debt CrisisDocument2 pagesReason of Debt CrisisKhan JewelNo ratings yet

- The Lehman Crisis Explained: Just What Is Going On in The United States and How Did The Crisis Come About?Document5 pagesThe Lehman Crisis Explained: Just What Is Going On in The United States and How Did The Crisis Come About?Angela LopezNo ratings yet

- The Europea Debt: Why We Should Care?Document4 pagesThe Europea Debt: Why We Should Care?Qraen UchenNo ratings yet

- B Eichengreen and The EuroDocument2 pagesB Eichengreen and The Euroaluque2004No ratings yet

- What Is The European DebtDocument32 pagesWhat Is The European DebtVaibhav JainNo ratings yet

- Eurozone Debt Crisis: Causes, Timeline, Extent of The Crisis, How It Is Being Addressed and How It'Ll Affect UsDocument15 pagesEurozone Debt Crisis: Causes, Timeline, Extent of The Crisis, How It Is Being Addressed and How It'Ll Affect UsShivani SharmaNo ratings yet

- Behind The Euro CrisisDocument4 pagesBehind The Euro CrisisKostas GeorgioyNo ratings yet

- Eurozone Crisis: Impacts: Prepared ForDocument24 pagesEurozone Crisis: Impacts: Prepared ForAkif AhmedNo ratings yet

- European Meltdown: Still Ahead or Better Outcome PossibleDocument18 pagesEuropean Meltdown: Still Ahead or Better Outcome PossiblepriyakshreyaNo ratings yet

- European UpdateDocument5 pagesEuropean UpdatebienvillecapNo ratings yet

- Compare and Contrast The Eurozone Debt Crisis of The 2000 and The LDC Crisis of 1980s. What Lessons Can Be Learnt From Both CrisisDocument12 pagesCompare and Contrast The Eurozone Debt Crisis of The 2000 and The LDC Crisis of 1980s. What Lessons Can Be Learnt From Both CrisisphlupoNo ratings yet

- Q&A: Greek Debt Crisis: What Went Wrong in Greece?Document7 pagesQ&A: Greek Debt Crisis: What Went Wrong in Greece?starperformerNo ratings yet

- Vinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalDocument4 pagesVinod Gupta School of Management, IIT KHARAGPUR: About Fin-o-MenalFinterestNo ratings yet

- EMS CrisisDocument6 pagesEMS CrisisDivya SharmaNo ratings yet

- Europe On The Rack: Why The Euro Is Breaking The European DreamDocument3 pagesEurope On The Rack: Why The Euro Is Breaking The European DreamGonzalo Prinque AstacioNo ratings yet

- Bob Chapman The Euro Zone and The Crisis of Sovereign Debt 4 2 2012Document4 pagesBob Chapman The Euro Zone and The Crisis of Sovereign Debt 4 2 2012sankaratNo ratings yet

- The European Debt Crisis: HistoryDocument7 pagesThe European Debt Crisis: Historyaquash16scribdNo ratings yet

- 18 Reasons of Financial Collapse in EuropeDocument5 pages18 Reasons of Financial Collapse in EuropeShivam LambaNo ratings yet

- It's Not About Greece AnymoreDocument10 pagesIt's Not About Greece AnymorebowssenNo ratings yet

- Guide To The Eurozone CrisisDocument9 pagesGuide To The Eurozone CrisisLakshmikanth RaoNo ratings yet

- Euro Debt Crises: Written by Shoaib YaqoobDocument4 pagesEuro Debt Crises: Written by Shoaib Yaqoobhamid2k30No ratings yet

- John Mauldin Weekly 10 SeptemberDocument11 pagesJohn Mauldin Weekly 10 Septemberrichardck61No ratings yet

- Case - 04, Can The Eurozone SurviveDocument12 pagesCase - 04, Can The Eurozone SurviveAman SohaniNo ratings yet

- The Impact of Europe Debt Crisis On The World Economy: Assignment of Banking and FinanceDocument16 pagesThe Impact of Europe Debt Crisis On The World Economy: Assignment of Banking and FinanceHồng NhungNo ratings yet

- Bob Chapman The EU Debt Crisis Has Not Been Solved If Europe Financially Implodes 5 11 2011Document4 pagesBob Chapman The EU Debt Crisis Has Not Been Solved If Europe Financially Implodes 5 11 2011sankaratNo ratings yet

- Default and Exit From The Eurozone: A Radical Left Strategy - LapavitsasDocument10 pagesDefault and Exit From The Eurozone: A Radical Left Strategy - Lapavitsasziraffa100% (1)

- George Soros On Soverign CrisesDocument8 pagesGeorge Soros On Soverign Crisesdoshi.dhruvalNo ratings yet

- Financial Crisis 'Will Drive Up Debt Repayments For Poorer Nations'Document2 pagesFinancial Crisis 'Will Drive Up Debt Repayments For Poorer Nations'Simply Debt SolutionsNo ratings yet

- European Sovereign Debt Crisis: PiigsDocument11 pagesEuropean Sovereign Debt Crisis: PiigsBismahqNo ratings yet

- La Euro Crisis. Causas y Sintomas (31-37)Document7 pagesLa Euro Crisis. Causas y Sintomas (31-37)Samara MendozaNo ratings yet

- ECOSOC Topic B: "The Euro Zone Crisis and Its Effects On The Global Markets"Document13 pagesECOSOC Topic B: "The Euro Zone Crisis and Its Effects On The Global Markets"ammaraharifNo ratings yet

- George Soros The Tragedy of The European Union and How To Resolve ItDocument2 pagesGeorge Soros The Tragedy of The European Union and How To Resolve ItBob FisherNo ratings yet

- Greece Financial CrisisDocument4 pagesGreece Financial Crisislubnashaikh266245No ratings yet

- JPF Orphan Currency Lemonde 220508Document2 pagesJPF Orphan Currency Lemonde 220508BruegelNo ratings yet

- Bob Chapman The Demise of The Euro As A World Currency 12 5 10Document3 pagesBob Chapman The Demise of The Euro As A World Currency 12 5 10sankaratNo ratings yet

- The European Debt Crisis: Joseph Foudy Department of Economics Jfoudy@stern - Nyu.eduDocument40 pagesThe European Debt Crisis: Joseph Foudy Department of Economics Jfoudy@stern - Nyu.eduMrJohnGalt09No ratings yet

- Euro Debt-1Document7 pagesEuro Debt-1DHAVAL PATELNo ratings yet

- Global Economy N.130: Agreement On Rescuing The Euro Zone Risks of Financial Contagion Briefs DecipheringDocument5 pagesGlobal Economy N.130: Agreement On Rescuing The Euro Zone Risks of Financial Contagion Briefs Decipheringapi-116406422No ratings yet

- Adam Fisher Soros Hire How To Make Money in A World of RiskDocument6 pagesAdam Fisher Soros Hire How To Make Money in A World of RisktonerangerNo ratings yet

- Why Europe SleptDocument3 pagesWhy Europe SleptBisserNo ratings yet

- Greece's 'Odious' Debt: The Looting of the Hellenic Republic by the Euro, the Political Elite and the Investment CommunityFrom EverandGreece's 'Odious' Debt: The Looting of the Hellenic Republic by the Euro, the Political Elite and the Investment CommunityRating: 4 out of 5 stars4/5 (4)

- Druckversion - Time For Plan B - How The Euro Became Europe's Greatest Threat - SPIEGEL ONLINE - News - InternationalDocument10 pagesDruckversion - Time For Plan B - How The Euro Became Europe's Greatest Threat - SPIEGEL ONLINE - News - InternationaljosephsomersNo ratings yet

- Debt CrisisDocument2 pagesDebt CrisisSantiago SevillaNo ratings yet

- Bob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10Document11 pagesBob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10sankaratNo ratings yet

- Euro Zone Crisis - A Global Problem - The HinduDocument3 pagesEuro Zone Crisis - A Global Problem - The Hindurajupat123No ratings yet

- GRP 7Document19 pagesGRP 7Khushi ShahNo ratings yet

- Bob Chapman Spiralling Public Debt and Economic Stagnation in The European Union 16 4 2011Document3 pagesBob Chapman Spiralling Public Debt and Economic Stagnation in The European Union 16 4 2011sankaratNo ratings yet

- European Economic CrisisDocument7 pagesEuropean Economic CrisisMalik FaysalNo ratings yet

- Special Report On Greece CrisisDocument13 pagesSpecial Report On Greece CrisisAchintya P RNo ratings yet

- Eurozona e CrisiDocument3 pagesEurozona e CrisiPino BacadaNo ratings yet

- Eurozona e CrisiDocument3 pagesEurozona e CrisiPino BacadaNo ratings yet

- European Crisis US BANKDocument6 pagesEuropean Crisis US BANKEKAI CenterNo ratings yet

- Waiting For GODOT, 2012: Vladimir EstragonDocument4 pagesWaiting For GODOT, 2012: Vladimir EstragonAlternative EconomicsNo ratings yet

- Global Ebrief Subject: What The Past Could Mean For Greece, JapanDocument5 pagesGlobal Ebrief Subject: What The Past Could Mean For Greece, Japandwrich27No ratings yet

- Stand or Fall Together: September 15, 2011Document2 pagesStand or Fall Together: September 15, 2011corradopasseraNo ratings yet

- Bill Gross On EuropeDocument3 pagesBill Gross On EuropeBRubin2No ratings yet

- Euro Crisis: England GovernorDocument19 pagesEuro Crisis: England GovernorRohit AnandNo ratings yet

- Where Is The ECB Printing Press?Document7 pagesWhere Is The ECB Printing Press?richardck61No ratings yet

- Currency Articles May 2012Document3 pagesCurrency Articles May 2012iExpatsNo ratings yet

- Mufti ERPDocument8 pagesMufti ERPAbhishek SharmaNo ratings yet

- Tata AceDocument4 pagesTata AceAbhishek SharmaNo ratings yet

- Satyamev Jayate Impact - Maharashtra Medical Council Suspends Licences of 13 DoctorsDocument5 pagesSatyamev Jayate Impact - Maharashtra Medical Council Suspends Licences of 13 DoctorsAbhishek SharmaNo ratings yet

- Seminar Report On Blue EyesDocument23 pagesSeminar Report On Blue EyesRanjeet pratap singh bhadoriya100% (6)

- ColorimetryDocument11 pagesColorimetryAbhishek SharmaNo ratings yet

- Chatterjee - Nationalism As A ProblemDocument18 pagesChatterjee - Nationalism As A Problembubu2222100% (1)

- COMELEC Vs Hon. Thelma CanlasDocument1 pageCOMELEC Vs Hon. Thelma CanlasClint D. LumberioNo ratings yet

- At The Margins of Globalization: Indigenous Peoples and International Economic LawDocument4 pagesAt The Margins of Globalization: Indigenous Peoples and International Economic LawFivtinia OctagusniNo ratings yet

- Tupas Vs OpleDocument10 pagesTupas Vs Oplemcris10150% (2)

- ENGEL v. VITALEDocument6 pagesENGEL v. VITALEAdan_S1No ratings yet

- Origins of The Roman EmpireDocument3 pagesOrigins of The Roman EmpireNaveen KumarNo ratings yet

- KW TaylorA History of The Vietnamese Cambridge CamDocument4 pagesKW TaylorA History of The Vietnamese Cambridge CamShaun MulhollandNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 237, Docket 83-2162Document8 pagesUnited States Court of Appeals, Second Circuit.: No. 237, Docket 83-2162Scribd Government DocsNo ratings yet

- Only The Middle East Can Fix The Middle EastDocument11 pagesOnly The Middle East Can Fix The Middle EastMaryamNo ratings yet

- Detailed Advertisement For Recruitment of MTs Through GATE-2021 Dt. 09.08.2021Document9 pagesDetailed Advertisement For Recruitment of MTs Through GATE-2021 Dt. 09.08.2021Priyadarshan sharmaNo ratings yet

- Ordinance-Ofw Help DeskDocument6 pagesOrdinance-Ofw Help DeskRandell ManjarresNo ratings yet

- SLRPDocument6 pagesSLRPPhoebe DaisogNo ratings yet

- Tashahhud With Sighah Al-KhitabDocument2 pagesTashahhud With Sighah Al-KhitabtakwaniaNo ratings yet

- TourismDocument23 pagesTourismneha18689No ratings yet

- 6026 Krithika JayadasanDocument28 pages6026 Krithika JayadasanMR GODFATHER ZZNo ratings yet

- Cuddy 2009Document33 pagesCuddy 2009datofezNo ratings yet

- Motion and Order To Show Cause On Information in The Nature of Quo WarrantoDocument3 pagesMotion and Order To Show Cause On Information in The Nature of Quo WarrantoBeverly TranNo ratings yet

- Mis 214 2023Document1 pageMis 214 2023Angel Ramas-CaylanNo ratings yet

- OGLES 123 (Jayapal)Document3 pagesOGLES 123 (Jayapal)Michael GinsbergNo ratings yet

- Salient Features of The ConstitutionDocument15 pagesSalient Features of The ConstitutionKeposeyi KezoNo ratings yet

- List of AwardeesDocument2 pagesList of AwardeesHARDI RAHAYU SAPUTRA UmriNo ratings yet

- English PDFDocument8 pagesEnglish PDFvocibotNo ratings yet

- Nowlan - Critical Theory GenderDocument3 pagesNowlan - Critical Theory Gendertechward.siNo ratings yet

- Economic NationalismDocument2 pagesEconomic NationalismMiccah Jade CastilloNo ratings yet

- Jade Bell - Research PaperDocument12 pagesJade Bell - Research Paperapi-458561298100% (1)

- Question Answer Based Notes: Mokshagundam VisvesvarayaDocument1 pageQuestion Answer Based Notes: Mokshagundam VisvesvarayaMRINAL MAZUMDARNo ratings yet

- Piero Sraffa's Political Economy PDFDocument426 pagesPiero Sraffa's Political Economy PDFBlancaLain100% (2)

- Feminist Theoretical Perspectives Pasque Wimmer REV PDFDocument32 pagesFeminist Theoretical Perspectives Pasque Wimmer REV PDFshreshthNo ratings yet