Professional Documents

Culture Documents

Ratio Analysis

Ratio Analysis

Uploaded by

Alpna PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis

Ratio Analysis

Uploaded by

Alpna PatelCopyright:

Available Formats

Fixed Assets Turnover Ratio =

Net Sales

Fixed Assets The fixed asset turnover measures how effectively the firm uses its plant and eq uipment. Interpretation:Nerolac Paints 2010-11 Average Industry 7.791840888 6.157929481 8.521607

Shalimar Paints 2010-11 Average Industry 11.910151 11.81045925 8.521607 ANALYSIS: The higher the fixed asset turnover ratio the better it is. Nerolac paints ratio has improved, it means that they are using their assets pro ductively. However there is still scope for improvement as its ratio is lower th an industry average. Shalimar paints ratio has marginally improved compared to its average past perfo rmance. This means that they are improving the productive usage of their fixed a ssets. However, the value is higher than the industry average. Also, Shalimar pa ints is using their fixed assets much better than Nerolac paints.

Total Assets Turnover Ratio =

Net sales Total assets

This ratio measures the turnover of all the firm s assets. Interpretation:-

Nerolac Paints 2010-11 Average Industry 1.453630804 1.507314253 1.566000637 Shalimar Paints 2010-11 Average Industry 1.6071892 1.6939706 1.566000637

ANALYSIS: The total asset turnover indicates sales generated per rupee of asset employed i n the company. Nerolac paints ratio is worse than its average past performance and the industry average. This indicates better poor utilization of resources by the company when compared to its previous performance. Sahlimar paints ratio has worse ned as compared to the average past performance but is still above the industry average. Thus, Shalimar Pain s.is generating sufficient volume of business given its total assets investment.

Debt Ratio = Total Liabilities (Current Liabilities + Loan Funds) Total Assets This ratio shows the percentage of funds provided by creditors. Interpretation:Nerolac Paints 2010-11 Average Industry

0.056061902 0.109621874 0.433484669 Shalimar Paints 2010-11 Average Industry 0.78671 0.793283833 0.433484669

ANALYSIS: The debt ratio is significantly higher than the Industry average in Shalimar Pai nts but it is quite lower in the case of Nerolac paints.It is evident from previ ous year s average that Nerolac paints has decreased its debt ratio. Nerolac paints in particular has reduced debt ratio by 5.3 percentage points based on the perfo rmance of 2010-11. Shalimar Paints ratio is worst than industry average by a large distance, that m akes it highly leveraged or debt-ridden. However they have been able to improve it marginally to some extent as compared to the past. Nerolac paints debt ratio is better than Sahlimar paints by around 73 percentage points which makes it easy to raise more debt funds. Long term debt to Total Capitalization Ratio = term debt + shareholder s equity Long term debt Long This ratio measures the extent to which long term debt is used for financing Interpretation:Nerolac Paints 2010-11 Average Industry 0.075711 0.054347 0.063396485 Shalimar Paints

2010-11 Average Industry 0.0035066 0.001144545 0.063396485 ANALYSIS Nerolac Paints ratio is slightly more than the industry average and the current average is higher than the past performance that means the company is using long term debt as a major source of capital. Shalimar Paints on the other hand has a low ratio of 3.5 percent. They are lowly dependable on debt for permanent financing. This will increase credit worthines s of the company. However, their ratio has increased from the past average indic ating greater use of long term debts. Shalimar paints is more credit worthy th an Nerolac paints. Debt Equity Ratio = Total liabilities Shareholder

s equity

It measures debt relative to equity base in the capital structure. Interpretation: Nerolac Paints 2010-11 Average Industry 0.090031621 0.163991127 1.207744172

Shalimar paints 2010-11 Average Industry 3.6853991 3.8521002 1.207744172

ANALYSIS: Lower the ratio, the better it is for the creditors. Nerolac paints ratio is low er than the average past performance as well as industry average.This indicates that their creditors can have a higher amount of security and hence their risk i s lower. Thus the company can generate debt at a lower cost. Shalimar paints ratio is lower than the average past performance. Thus they have re duced their debts in the capital structure thereby enhancing their creditworthin ess.

Fixed Charge coverage = Operating profit + lease payments Interest Expense + lease payments It measures coverage capability more broadly than times interest earned by inclu ding lease payments as a fixed expense. Nerolac paints 2010-11 Average Industry 238.346250916 97.77 79.64653249

Shalimar paints 2010-11 Average Industry 1.3936257 3.06510477 79.64653249

ANALYSIS: Higher the ratio, better it is. Higher ratio means higher coverage for interest and lease payments. In this case, Nerolac paints ratio is extremely high as compared to its past per formance as well as to the industry average. This means the firm has covered its fixed costs very effectively. Shalimar paints ratio is very low. This shows the firms inability to cover its f ixed costs at a reasonable level. Their ratio has worsened over the past. This i ndicates some defect in the revenue generation model of the company, which has c aused tremendously low incomes.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FlashMemory Beta NPVDocument7 pagesFlashMemory Beta NPVShubham Bhatia50% (2)

- Lesson 3 Sales Budget and Schedule of Expected Cash CollectionDocument18 pagesLesson 3 Sales Budget and Schedule of Expected Cash CollectionZybel RosalesNo ratings yet

- Citrus Products Inc - Case Analysis - Final ExamDocument17 pagesCitrus Products Inc - Case Analysis - Final ExamAhmed BeramNo ratings yet

- Akuntansi Keuangan Lanjutan - Baker (10 E)Document1,086 pagesAkuntansi Keuangan Lanjutan - Baker (10 E)Nabila Nur IzzaNo ratings yet

- Summer Internship ProjectDocument31 pagesSummer Internship ProjectAayush PasawalaNo ratings yet

- Portfolio Management Tutorial 3: Prepared By: Ang Win Sun Pong Chong Bin Chin Chen Hong Jashvin Kaur Diong Seng LongDocument10 pagesPortfolio Management Tutorial 3: Prepared By: Ang Win Sun Pong Chong Bin Chin Chen Hong Jashvin Kaur Diong Seng LongchziNo ratings yet

- Ciptadana Sekuritas MAIN Favorable Chicken Prices Lead To Profitable Business UnitDocument7 pagesCiptadana Sekuritas MAIN Favorable Chicken Prices Lead To Profitable Business Unitroy95121No ratings yet

- OYO Portal ReportDocument22 pagesOYO Portal ReportPMNo ratings yet

- The Cost of Trigger Happy InvestingDocument4 pagesThe Cost of Trigger Happy InvestingBrazil offshore jobsNo ratings yet

- DaburDocument31 pagesDaburRavi VarmaNo ratings yet

- Samplex MidtermsDocument10 pagesSamplex Midtermsnichols greenNo ratings yet

- Ashok LeylandDocument37 pagesAshok LeylandBandaru NarendrababuNo ratings yet

- 1 Bond AccountingDocument25 pages1 Bond AccountingAhsan ImranNo ratings yet

- After Tohoku: Do Investors Face Another Lost Decade From Japan?Document14 pagesAfter Tohoku: Do Investors Face Another Lost Decade From Japan?ideafix12No ratings yet

- Profit and Loss Important FactsDocument9 pagesProfit and Loss Important Factsz1y2100% (1)

- Icici Bank Rar 2015Document42 pagesIcici Bank Rar 2015Moneylife Foundation0% (1)

- 2020 CFA Program: Level III ErrataDocument14 pages2020 CFA Program: Level III ErrataJacek KowalskiNo ratings yet

- Aisa - Icmd 2009 (B01)Document4 pagesAisa - Icmd 2009 (B01)IshidaUryuuNo ratings yet

- Physical Fixed Asset SystemDocument2 pagesPhysical Fixed Asset SystemGabriel PatronNo ratings yet

- List of Lease Instruments - A 78 2017Document5 pagesList of Lease Instruments - A 78 2017Maldives Islands100% (2)

- UK Corporate Governance MilestonesDocument5 pagesUK Corporate Governance MilestonesCristina Cimpoes DorofteNo ratings yet

- Schwab One Account AgreementDocument112 pagesSchwab One Account AgreementcadeadmanNo ratings yet

- Lecture 10 FINM2401 CAPM and Cost of CapitalDocument56 pagesLecture 10 FINM2401 CAPM and Cost of CapitalThomasNo ratings yet

- Pilipinas Shell Petroleum CorporationDocument115 pagesPilipinas Shell Petroleum Corporationkiema katsutoNo ratings yet

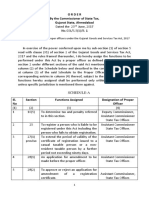

- Order by The Commissioner of State Tax, Gujarat State, AhmedabadDocument10 pagesOrder by The Commissioner of State Tax, Gujarat State, Ahmedabadarpit85No ratings yet

- Shah Latif Coaching Centre PRE-Examination Paper 2019: Principles of CommerceDocument4 pagesShah Latif Coaching Centre PRE-Examination Paper 2019: Principles of CommerceBilal JafryNo ratings yet

- SATU Annual Report 2018Document187 pagesSATU Annual Report 2018sinta nuriaNo ratings yet

- Analisis Capital Asset Pricing Model CAPM SebagaiDocument8 pagesAnalisis Capital Asset Pricing Model CAPM SebagaiWidya RezaNo ratings yet

- Effects of Bonus Share On Market Price of A CompanyDocument23 pagesEffects of Bonus Share On Market Price of A CompanyShoray TandonNo ratings yet