Professional Documents

Culture Documents

I'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012

I'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012

Uploaded by

api-162199694Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012

I'll Have Six of One and Half-A-Dozen of The Other, Please.: Glenn Maguire's Asia Sentry Dispatch July 23, 2012

Uploaded by

api-162199694Copyright:

Available Formats

Glenn Maguires Asia Sentry Dispatch

July 23, 2012

Standardised Market Moves (past 24 hours).

Ill have six of one and half-a-dozen of the other, please.

In the absence of any significant data points in Asia this morning, market chatter continued on whether or not China is manipulating the official growth figures (they are, and most probably more significantly than they did in 2008-09) whilst the Japanese Cabinet Office painted the picture of a more widespread global slowdown in their monthly economic report.

Six of one and half a dozen of the other.

There should be absolutely no doubt that the Chinese statistician has historically smoothed the quarterly growth figures, underreporting growth during booms and overstating growth during leaner times. This is broadly understood by most economic observers of the Chinese economy, who rely on a range of secondary or supply side indicators to gauge the true speed of the economy. These include electricity production, commodity stockpiles and freight distribution within the economy. The smoothing of the headline quarterly data was not really the issue. Emerging economies tend to have a greater volatility in their cycle, and this can be exacerbated by poor data collection and sampling. In the case of China, the trend has generally been accurately reported. We suspect that something more sinister is currently at play. Not only is the extent of the China downturn been underplayed in the headline growth figures, it appears that secondary indicators such as electricity production are now also being smoothed to disguise the extent of the actual growth undershoot, which we believe is particularly large, and disguise the increasingly divorced from reality headline growth figures. We have written more extensively about this in our weekly Asia Sentry Report which you can access here. Still, the official rhetoric is already making noises consistent with a bang-on forecast 7.5% year-average growth outturn for 2012. Surprise, surprise!

The 1-day change in an assets price is divided by its 30-day volatility to make changes comparable across asset class.

Monday, July 23, 2012.

Page |1

Sentry Dispatch: The High Frequency Letter of Asia Sentry Advisory.

Song Guoqing, PBoC Advisor, sees growth cooling to 7.4% in Q3. Though markets seem to have interpreted PBoC Advisor Song Guoqings comments that growth may moderate to 7.4% in Q3 as bearish, he has simply extended the H1 slowdown into the second half of the year. If Song is correct, growth only needs to be stronger than 6.9% in Q4 for the economy to hit Beijings 7.5% growth target. There is absolutely no shortage of pundits claiming that the Chinese economy bottomed in Q2 and will be recovering in the second half of 2012. Songs comments directly contradict the consensus benign view of the economy. What is even a bigger slap in the face for the consensus is the evidence that China is clearly massaging (that is the most charitable word we can come up with) the growth figures. If growth were not so desperately weak as it is at the moment, China would have no need to massage its growth numbers. As we outline in our weekly note, we believe the electricity production figures are most probably been massaged as well. There are numerous anecdotal reports of senior executives with access to the power grid data saying that power production was down 10% over the year to June. The official figures for electricity production have been reported as flat. Still, there are some figures the authorities cannot fudge; those of the nations that directly export to China particularly to its processing and assembling hubs that are the engine of its manufacturing sector. Here, we find that Taiwanese and South Korean exports have historically had a nice correlation with Chinese economic activity. The fact that exports from these two economies to China were negative in year-over growth terms in the second quarter suggests that even the electricity output data may have been aberrant in the second quarter. Without a doubt, the GDP and IP figures are very well wide of the mark at this time. Accurate supply side proxies confirm the Chinese economy has flat-lined.

50 150

25

75

0

Electricity Production YoY LHS South Korea Exports to China YoY RHS Taiwan Exports to China YoY RHS

-25 -75 Jun-07 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12

Source: Asia Sentry Advisory and Bloomberg.

Todays Conclusion: We believe the deceleration in the Chinese economy will continue into H2-2012 and consequently forecast a full year- growth rate for 2012 of 7.3%. True growth will be even lower.

Monday, July 23, 2012.

Page |2

Sentry Dispatch: The High Frequency Letter of Asia Sentry Advisory.

Asia Sentry Advisory Pty Ltd Suite 9, Level 40, Northpoint Tower 100 Miller Street, North Sydney, NSW, 2060, Australia. Ph: +61 2 9931 7820 Fx: +61 2 9931 6888 M: +61 401 548 820 www.asiasentry.com gbmaguire@bloomberg.net glenn@asiasentry.com

Asia Sentry Advisory Pty Ltd is a boutique economic consultancy established to meet the growing demands of clients seeking greater exposure to the most dynamic economic region in the post-crisis global economy, Asia. Asia Sentry Advisory marries keen judgment with a rigorous model-based approach and a deeply intuitive understanding of Asia that can only come from on-the-ground experience to deliver market out-performing analysis and forecasts.

How closely are you watching?

Follow us on Twitter, @AsiaSentry Watch us on YouTube. Asia Sentry Advisory See us analyze in real-time on LiveStream, Asia Sentry Advisory

You might also like

- Managerial Economics Applications Strategies and Tactics 14th Edition Mcguigan Solutions ManualDocument26 pagesManagerial Economics Applications Strategies and Tactics 14th Edition Mcguigan Solutions ManualGeraldWalkerajqr100% (59)

- Basic Micro Economics All in Source by Jayson C. LucenaDocument173 pagesBasic Micro Economics All in Source by Jayson C. LucenaJayson Lucena80% (5)

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDocument2 pagesAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694No ratings yet

- Third Point Q3 2012 Investor Letter TPOIDocument11 pagesThird Point Q3 2012 Investor Letter TPOIVALUEWALK LLCNo ratings yet

- SYBFM Equity Market II Session I Ver 1.2Document84 pagesSYBFM Equity Market II Session I Ver 1.211SujeetNo ratings yet

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDocument2 pagesAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694No ratings yet

- Slower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012Document3 pagesSlower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012api-162199694No ratings yet

- A Troika of Disappointment: Asia Sentry DispatchDocument4 pagesA Troika of Disappointment: Asia Sentry Dispatchapi-162199694No ratings yet

- Global Data Watch: Bumpy, A Little Better, and A Lot Less RiskyDocument49 pagesGlobal Data Watch: Bumpy, A Little Better, and A Lot Less RiskyAli Motlagh KabirNo ratings yet

- JPM Global Data Watch Se 2012-09-21 946463Document88 pagesJPM Global Data Watch Se 2012-09-21 946463Siddhartha SinghNo ratings yet

- Data Scan: Japan Q2 GDPDocument2 pagesData Scan: Japan Q2 GDPapi-162199694No ratings yet

- RCSI Presentation - China's Threats: Deflation & Slowing GrowthDocument10 pagesRCSI Presentation - China's Threats: Deflation & Slowing GrowthRCS_CFANo ratings yet

- RCSI Weekly Bull/Bear Recap: Nov. 18-22, 2013Document7 pagesRCSI Weekly Bull/Bear Recap: Nov. 18-22, 2013RCS_CFANo ratings yet

- CIO CMO - The Pressure's On Emerging Market Central BanksDocument9 pagesCIO CMO - The Pressure's On Emerging Market Central BanksRCS_CFANo ratings yet

- CIO CMO - Approving Fiscal BoostersDocument10 pagesCIO CMO - Approving Fiscal BoostersRCS_CFANo ratings yet

- CIO Weekly Letter - Mexico The Global PiñataDocument4 pagesCIO Weekly Letter - Mexico The Global PiñataRCS_CFANo ratings yet

- Global Forecast: UpdateDocument6 pagesGlobal Forecast: Updatebkginting6300No ratings yet

- Economic Insights 25 02 13Document16 pagesEconomic Insights 25 02 13vikashpunglia@rediffmail.comNo ratings yet

- HIM2018Q4NPDocument6 pagesHIM2018Q4NPPuru SaxenaNo ratings yet

- Quarterly Market Review: Second Quarter 2016Document15 pagesQuarterly Market Review: Second Quarter 2016Anonymous Ht0MIJNo ratings yet

- State of Oregon Economic Indicators: May 12 IndexDocument2 pagesState of Oregon Economic Indicators: May 12 IndexStatesman JournalNo ratings yet

- IMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011Document12 pagesIMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011babstar999No ratings yet

- Global Markets Chart Book: High-Grade Bond Yields Plunge To Record LowsDocument12 pagesGlobal Markets Chart Book: High-Grade Bond Yields Plunge To Record LowslosdiabloNo ratings yet

- Quarterly Review and Outlook: Growth Recession Continues Fiscal Policy in NeutralDocument6 pagesQuarterly Review and Outlook: Growth Recession Continues Fiscal Policy in NeutralHonza MynarNo ratings yet

- Ulman Financial Client Letter - 2022 2nd QuarterDocument14 pagesUlman Financial Client Letter - 2022 2nd QuarterClay Ulman, CFP®No ratings yet

- Reserve Bank of India Bulletin August 2011 Volume LXV Number 8Document356 pagesReserve Bank of India Bulletin August 2011 Volume LXV Number 8pt797jNo ratings yet

- Rbi Bulletin October 2013Document140 pagesRbi Bulletin October 2013vijaythealmightyNo ratings yet

- Gic WeeklyDocument12 pagesGic WeeklycampiyyyyoNo ratings yet

- Assignment Experential LearningDocument1 pageAssignment Experential LearningJohn SamuelNo ratings yet

- AnswerSheet4 Intl EconDocument1 pageAnswerSheet4 Intl EconEman AhmedNo ratings yet

- Economic Growth Must Be Re-DirectedDocument2 pagesEconomic Growth Must Be Re-DirectedEd SawyerNo ratings yet

- B W 09032012Document28 pagesB W 09032012Ray Anthony RodriguezNo ratings yet

- How Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaDocument3 pagesHow Common Indian People Take Investment Decisions Exploring Aspects of Behavioral Economics in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Lacy Hunt - Hoisington - Quartely Review Q1 2015Document5 pagesLacy Hunt - Hoisington - Quartely Review Q1 2015TREND_7425No ratings yet

- Reserve Bank of India November Bulletin 2009Document444 pagesReserve Bank of India November Bulletin 2009tonypauljohnNo ratings yet

- 7YrForecasts 813Document1 page7YrForecasts 813CanadianValueNo ratings yet

- What Are 'Narrow' and 'Broad' Money?Document2 pagesWhat Are 'Narrow' and 'Broad' Money?saurabhshineNo ratings yet

- April 1 Weekly Economic UpdateDocument2 pagesApril 1 Weekly Economic UpdateDoug PotashNo ratings yet

- Economic Systems RubricDocument2 pagesEconomic Systems Rubricapi-493862624No ratings yet

- Econs OutlineDocument2 pagesEcons OutlineReesa Corrie DeskerNo ratings yet

- Mizuho EconomicOutlook 17.5.29Document3 pagesMizuho EconomicOutlook 17.5.29abraNo ratings yet

- Hoisington Q4Document6 pagesHoisington Q4ZerohedgeNo ratings yet

- 16.02 RWC GIAA PresentationDocument35 pages16.02 RWC GIAA PresentationGIAANo ratings yet

- Across - The - Curve - in - Rates - and - Structured - Products - and - Across - The - Grade - in - Credit - Products - December 19, 2006 - (Bear, - Stearns - & - Co. - Inc.) PDFDocument60 pagesAcross - The - Curve - in - Rates - and - Structured - Products - and - Across - The - Grade - in - Credit - Products - December 19, 2006 - (Bear, - Stearns - & - Co. - Inc.) PDFQuantDev-MNo ratings yet

- Ebbs & Flows: EM Maiden Funds Outflow in 15 WeeksDocument9 pagesEbbs & Flows: EM Maiden Funds Outflow in 15 WeeksNgọcThủy100% (1)

- Treasury Outlook MarDocument6 pagesTreasury Outlook Marelise_stefanikNo ratings yet

- (US-Africa Summit To Focus On Security, Economics) - (VOA - Voice of America English News)Document1 page(US-Africa Summit To Focus On Security, Economics) - (VOA - Voice of America English News)unokepasavaNo ratings yet

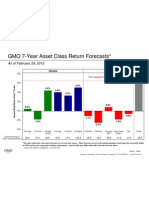

- GMO 7-Year Forecast - Feb '12Document1 pageGMO 7-Year Forecast - Feb '12Douglas RattrayNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- Failure by Design Economic Policy Institute PDFDocument2 pagesFailure by Design Economic Policy Institute PDFEddie0% (1)

- The GIC Weekly Update November 2015Document12 pagesThe GIC Weekly Update November 2015John MathiasNo ratings yet

- Press Release On Islamic Microfinance Is A Good Alternative For The Alleviation of PovertyDocument1 pagePress Release On Islamic Microfinance Is A Good Alternative For The Alleviation of PovertyAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Asia Equity Insights-HSBCDocument10 pagesAsia Equity Insights-HSBCtinylittleworldNo ratings yet

- Economic CollapseDocument2 pagesEconomic CollapseBernardokpeNo ratings yet

- The GIC WeeklyDocument12 pagesThe GIC WeeklyedgarmerchanNo ratings yet

- HSBC - Currency Outlook DecemberDocument46 pagesHSBC - Currency Outlook Decembermgroble3No ratings yet

- Baseeds 15-30Document4 pagesBaseeds 15-30api-276766667No ratings yet

- Economic View - Confronting Income Inequality - NYTimesDocument3 pagesEconomic View - Confronting Income Inequality - NYTimesPhoenixxLogNo ratings yet

- Economy Devt XI Ncert NewDocument3 pagesEconomy Devt XI Ncert NewShweta DixitNo ratings yet

- An Economic Bestiary: Stay Info Rmed To Day and Every DayDocument2 pagesAn Economic Bestiary: Stay Info Rmed To Day and Every DayAriadnaNatyNo ratings yet

- Global Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012Document3 pagesGlobal Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012api-162199694No ratings yet

- Apec Oct2013Document17 pagesApec Oct2013Hungreo411No ratings yet

- Data Scan: China July CPI and PPIDocument2 pagesData Scan: China July CPI and PPIapi-162199694No ratings yet

- Thoughts On RBA Rate CutDocument1 pageThoughts On RBA Rate Cutapi-162199694No ratings yet

- No Asia Inflection Over AugustDocument3 pagesNo Asia Inflection Over Augustapi-162199694No ratings yet

- Taiwanese July Trade Figures Confirm Asia Is Still Weakening, Not StabilizingDocument1 pageTaiwanese July Trade Figures Confirm Asia Is Still Weakening, Not Stabilizingapi-162199694No ratings yet

- Economic Letter Economic Letter: China's Slowdown May Be Worse Than Official Data SuggestDocument4 pagesEconomic Letter Economic Letter: China's Slowdown May Be Worse Than Official Data Suggestapi-162199694No ratings yet

- September Interest Rate Decision: Deleted: DeletedDocument2 pagesSeptember Interest Rate Decision: Deleted: Deletedapi-162199694No ratings yet

- China's New, Prudent Policy RegimeDocument6 pagesChina's New, Prudent Policy Regimeapi-162199694No ratings yet

- Data Scan: Japan Q2 GDPDocument2 pagesData Scan: Japan Q2 GDPapi-162199694No ratings yet

- Data Scan: China July Expenditure DataDocument3 pagesData Scan: China July Expenditure Dataapi-162199694No ratings yet

- Data Scan: China July Trade FiguresDocument2 pagesData Scan: China July Trade Figuresapi-162199694No ratings yet

- Data Scan: Japan June Machinery OrdersDocument2 pagesData Scan: Japan June Machinery Ordersapi-162199694No ratings yet

- The Folly of A Payrolls Relief Rally: Asia Sentry DispatchDocument4 pagesThe Folly of A Payrolls Relief Rally: Asia Sentry Dispatchapi-162199694No ratings yet

- Data Scan: China July CPI and PPIDocument2 pagesData Scan: China July CPI and PPIapi-162199694No ratings yet

- Content But Not Complacent.: Policy PerspectiveDocument5 pagesContent But Not Complacent.: Policy Perspectiveapi-162199694No ratings yet

- Not The Gold, But A Silver Medal PerformanceDocument4 pagesNot The Gold, But A Silver Medal Performanceapi-162199694No ratings yet

- A Troika of Disappointment: Asia Sentry DispatchDocument4 pagesA Troika of Disappointment: Asia Sentry Dispatchapi-162199694No ratings yet

- Pan-Asia Coincident Weakening in Exports and Imports ContinuesDocument3 pagesPan-Asia Coincident Weakening in Exports and Imports Continuesapi-162199694No ratings yet

- Some August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012Document5 pagesSome August Thoughts On Asian Manufacturing: Glenn Maguire's Asia Sentry Dispatch August 01, 2012api-162199694No ratings yet

- I Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For TodayDocument4 pagesI Wish I Had Saved My "Slower, Lower, Weaker" Headline From Last Week For Todayapi-162199694No ratings yet

- Asian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012Document3 pagesAsian Growth Has Inexorably Crawled Back To 2008-09 Levels.: Glenn Maguire's Asia Sentry Dispatch July 26, 2012api-162199694No ratings yet

- Global Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012Document3 pagesGlobal Trade Is Retrenching Sharply. More To Come.: Glenn Maguire's Asia Sentry Dispatch July 24, 2012api-162199694No ratings yet

- Asia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic NewsDocument1 pageAsia Sentry Advisory Data Bytes: Quick Comments On Breaking Economic Newsapi-162199694No ratings yet

- Slower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012Document3 pagesSlower, Lower, Weaker!: Glenn Maguire's Asia Sentry Dispatch July 27, 2012api-162199694No ratings yet

- How Long Can Talk Trump Data?: Glenn Maguire's Asia Sentry Dispatch July 30, 2012Document3 pagesHow Long Can Talk Trump Data?: Glenn Maguire's Asia Sentry Dispatch July 30, 2012api-162199694No ratings yet

- Cfa-Planner Created by MajnuDocument6 pagesCfa-Planner Created by MajnuMohaiminul Islam ShuvraNo ratings yet

- Managerial Economics: Handout in Managerial Economics Ms. Ruby T. Liquigan, LPTDocument2 pagesManagerial Economics: Handout in Managerial Economics Ms. Ruby T. Liquigan, LPTRuby LiquiganNo ratings yet

- Aipost Eng PresentationDocument25 pagesAipost Eng PresentationNurainaa BalqisNo ratings yet

- Cbse SyllabusDocument42 pagesCbse SyllabusChandan MaharanaNo ratings yet

- Theory of Demand and SupplyDocument46 pagesTheory of Demand and SupplyPrajeshChandra PandeyNo ratings yet

- Market StructureDocument69 pagesMarket StructureAnsel Kezin ThomasNo ratings yet

- Chapter-4 Aggregate PlanningDocument22 pagesChapter-4 Aggregate PlanningYonatanNo ratings yet

- RelianceDocument9 pagesRelianceIshpreet SinghNo ratings yet

- Valuation: Source: BSE: 500290 DCF 1st Stage: Next 10 Years Cash Flow ForecastDocument2 pagesValuation: Source: BSE: 500290 DCF 1st Stage: Next 10 Years Cash Flow ForecastAman KhanNo ratings yet

- Wages "Naturally" Tended Towards A Minimum Level Corresponding To The Subsistence Needs of The WorkersDocument2 pagesWages "Naturally" Tended Towards A Minimum Level Corresponding To The Subsistence Needs of The WorkerssmcNo ratings yet

- Key Ans For Assignment 2 CVPDocument11 pagesKey Ans For Assignment 2 CVPNCTNo ratings yet

- Micro Finance ProjectDocument56 pagesMicro Finance Projectraj100% (1)

- Meaning of Environmental EconomicsDocument6 pagesMeaning of Environmental EconomicsNiranjan DebnathNo ratings yet

- Ethical Issues in Food and Agriculture PDFDocument2 pagesEthical Issues in Food and Agriculture PDFKyleNo ratings yet

- Summary of Peltzman - Toward A More General Theory of Regulation - From WikiSDocument4 pagesSummary of Peltzman - Toward A More General Theory of Regulation - From WikiSLavinia MinoiuNo ratings yet

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Solution Practice TestDocument12 pagesSolution Practice TestNgọc KhanhNo ratings yet

- Assignment 3 Financial Markets Tu Huu Phuc s3812120 1Document10 pagesAssignment 3 Financial Markets Tu Huu Phuc s3812120 1Nguyễn TùngNo ratings yet

- Oil Curse and Petro States A Comparative StudieDocument14 pagesOil Curse and Petro States A Comparative StudieGerardo LucasNo ratings yet

- Commercial Banks' Role in The Economic DevelopmentDocument19 pagesCommercial Banks' Role in The Economic Developmentprasanthmct100% (2)

- NATURE, Contribution and Application of Business EconomicsDocument5 pagesNATURE, Contribution and Application of Business EconomicsRishab Jain 2027203No ratings yet

- Robert Kaufman Golden Gate Transit Wage ComparisonsDocument2 pagesRobert Kaufman Golden Gate Transit Wage ComparisonsWill HoustonNo ratings yet

- D - Salvatore Ch14 UneditedDocument46 pagesD - Salvatore Ch14 UneditedLihle Seti100% (1)

- Kaldor Hicks 6592Document6 pagesKaldor Hicks 6592SEDIMAR SUHAILINo ratings yet

- Assignment 1 Business EnvironmentDocument27 pagesAssignment 1 Business EnvironmentBassmah HamidehNo ratings yet

- Profit PlanningDocument32 pagesProfit PlanningSandra LangNo ratings yet

- PS - 2 Econ210Document8 pagesPS - 2 Econ210ŞafakYıldızNo ratings yet

- Fred Halliday (Auth.) - Rethinking International Relations-Macmillan Education UK (1994)Document301 pagesFred Halliday (Auth.) - Rethinking International Relations-Macmillan Education UK (1994)Jenifer Santana80% (5)