Professional Documents

Culture Documents

Exemptions To Small Scale Industries

Exemptions To Small Scale Industries

Uploaded by

Ravi AroraCopyright:

Available Formats

You might also like

- PalamonDocument6 pagesPalamonRyan Teichmann75% (8)

- Chapter 7 Cost-Volume-Profit AnalysisDocument98 pagesChapter 7 Cost-Volume-Profit AnalysisAlyssa MabalotNo ratings yet

- Mark Minervini Additional NotesDocument3 pagesMark Minervini Additional NotesRoyce Luong100% (10)

- Bureau of Internal RevenueDocument11 pagesBureau of Internal RevenueRomer LesondatoNo ratings yet

- Tax Planning For Setting New BusinessDocument6 pagesTax Planning For Setting New BusinessHardipsinh Yadav56% (9)

- Worksheets LBJ SpecDocument38 pagesWorksheets LBJ SpecGeannineOo100% (3)

- Rev PB SheetDocument10 pagesRev PB SheetPatriqKaruriKimbo100% (1)

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- Maharashtra Value Added Tax ActDocument13 pagesMaharashtra Value Added Tax ActKaran Gandhi0% (1)

- Excise DutyDocument4 pagesExcise DutyDigvijay LakdeNo ratings yet

- Direct TaxDocument13 pagesDirect TaxRajveer Singh SekhonNo ratings yet

- Excise DutyDocument1 pageExcise Dutyniravtrivedi72No ratings yet

- VAT RulesDocument11 pagesVAT RulesamrkiplNo ratings yet

- Scheme For Industrial Development of Jammu & KashmirDocument20 pagesScheme For Industrial Development of Jammu & KashmirShagir AliNo ratings yet

- Central Excise Manual: Chapter-2 Part-I Registration and E.C.C. NumberDocument9 pagesCentral Excise Manual: Chapter-2 Part-I Registration and E.C.C. NumbershivendrakumarNo ratings yet

- Advantages of Incentives and SubsidiesDocument38 pagesAdvantages of Incentives and SubsidiesShashank Jain67% (3)

- Operationalguidelines IippDocument69 pagesOperationalguidelines IippsurichimmaniNo ratings yet

- 20237211773220909CircularNo 02of2023-24Document9 pages20237211773220909CircularNo 02of2023-24bamm-s20-059No ratings yet

- Notification No 8 2002Document6 pagesNotification No 8 2002Dhananjay KulkarniNo ratings yet

- Interpretations Rulings Book - Set IDocument55 pagesInterpretations Rulings Book - Set IAudithya KahawattaNo ratings yet

- Assessable Value: Prof. P. RajendranDocument18 pagesAssessable Value: Prof. P. RajendranProfessor RajendranNo ratings yet

- Aluation of Xcisable Oods: 3.1 Basis of Computing Duty PayableDocument36 pagesAluation of Xcisable Oods: 3.1 Basis of Computing Duty PayableJitendra VernekarNo ratings yet

- Export Promotion and Incentives: International Marketing Marzieh Arianfar Bims-University of Mysore APRIL 2013Document21 pagesExport Promotion and Incentives: International Marketing Marzieh Arianfar Bims-University of Mysore APRIL 2013Jai KeerthiNo ratings yet

- Import ProcedureDocument33 pagesImport Procedureshreyans singhNo ratings yet

- RBI Notice - CAIIB - ABMDocument13 pagesRBI Notice - CAIIB - ABMSATISHNo ratings yet

- The Tax Structure in India Is Divided Into Direct and Indirect TaxesDocument9 pagesThe Tax Structure in India Is Divided Into Direct and Indirect TaxesUjjwal RustagiNo ratings yet

- Valuation of Excisable Goods: 3.1 Basis of Computing Duty PayableDocument38 pagesValuation of Excisable Goods: 3.1 Basis of Computing Duty PayableVaishnaviNo ratings yet

- Role of Cost Audit:: Who Can Be Appointed As Cost AuditorDocument8 pagesRole of Cost Audit:: Who Can Be Appointed As Cost AuditorjaipalmeNo ratings yet

- 09 Ssi PDFDocument20 pages09 Ssi PDFRahul SuhalkaNo ratings yet

- Taxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTDocument5 pagesTaxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTTheEnigmatic AccountantNo ratings yet

- Article On Export Promotion SchemesDocument15 pagesArticle On Export Promotion Schemesjatin ChotaiNo ratings yet

- P 14Document728 pagesP 14Moaaz Ahmed100% (1)

- Taxx Special Economic ZonesDocument4 pagesTaxx Special Economic ZonesAlina RizviNo ratings yet

- How To ImportDocument28 pagesHow To ImportHarinder SinghNo ratings yet

- Sez-Latest Write Up (E/N 17/2011) : Operations Are Free From Tax Burden?Document6 pagesSez-Latest Write Up (E/N 17/2011) : Operations Are Free From Tax Burden?swami_ratanNo ratings yet

- Chapter 12Document32 pagesChapter 12Ram SskNo ratings yet

- The PEZA IssueDocument29 pagesThe PEZA IssueArne TanNo ratings yet

- Income Tax MannualDocument6 pagesIncome Tax MannualMuhammad Ammar KhanNo ratings yet

- IntroductionDocument5 pagesIntroductionsaran91No ratings yet

- Aasnil CHOPRADocument50 pagesAasnil CHOPRAPolite ManNo ratings yet

- Indirect TaxDocument8 pagesIndirect TaxPavan JayaprakashNo ratings yet

- New Business Tax PlanningDocument47 pagesNew Business Tax PlanningashishNo ratings yet

- Export Incentive SchemesDocument7 pagesExport Incentive Schemesnavneet bagriNo ratings yet

- Remaning TopicsDocument7 pagesRemaning TopicsAbhishekNo ratings yet

- Duty Drawback India Presentation 2003Document10 pagesDuty Drawback India Presentation 2003dinkar13375No ratings yet

- Stateschemepunjab 4Document14 pagesStateschemepunjab 4edvikasadNo ratings yet

- How To ImportDocument30 pagesHow To ImportRiyaz ShaikhNo ratings yet

- Be Sem 1 Unit 2 SsiDocument17 pagesBe Sem 1 Unit 2 SsiYash KeshkamatNo ratings yet

- Central Excise Act Notes For Self PreparationDocument29 pagesCentral Excise Act Notes For Self PreparationVivek ReddyNo ratings yet

- Taxation: 8. Special Economic Zone ActDocument6 pagesTaxation: 8. Special Economic Zone ActJustin Robert RoqueNo ratings yet

- Excise Law PDFDocument54 pagesExcise Law PDFJay BudhdhabhattiNo ratings yet

- VAT Guide - Healthcare (2) .Ar - enDocument31 pagesVAT Guide - Healthcare (2) .Ar - enNstrNo ratings yet

- Drawback Section 75.Document4 pagesDrawback Section 75.PRATHAMESH MUNGEKARNo ratings yet

- (H) VISem BCH6.2 GST Week3 AnkitaTomarDocument23 pages(H) VISem BCH6.2 GST Week3 AnkitaTomarRAJBIR SINGH TADANo ratings yet

- Code of Fiscal BenefitsDocument19 pagesCode of Fiscal Benefitsantonior70No ratings yet

- Customs: Notification Nos. Date Tariff Non-Tariff Central Excise Tariff Non-TariffDocument15 pagesCustoms: Notification Nos. Date Tariff Non-Tariff Central Excise Tariff Non-TariffsurampudiprasadNo ratings yet

- Guidance Note On Accounting For State-Level Value Added Tax: F F Y Y I IDocument8 pagesGuidance Note On Accounting For State-Level Value Added Tax: F F Y Y I Idark lord89No ratings yet

- Exemption Under GSTDocument7 pagesExemption Under GSTDebaNo ratings yet

- Nature of Excise DutyDocument16 pagesNature of Excise DutyVinod PatelNo ratings yet

- IMPEX Procedure PDFDocument174 pagesIMPEX Procedure PDFKrishna SinghNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Filing of Service Tax ReturnDocument1 pageFiling of Service Tax ReturnRavi AroraNo ratings yet

- Rates of Service TaxDocument1 pageRates of Service TaxRavi AroraNo ratings yet

- FormsDocument1 pageFormsRavi AroraNo ratings yet

- Astr 1Document1 pageAstr 1Ravi AroraNo ratings yet

- Service Tax Form-3aDocument1 pageService Tax Form-3aRavi AroraNo ratings yet

- Service Tax Form-1Document4 pagesService Tax Form-1Ravi AroraNo ratings yet

- Inkster Judge Misused Funds Says ReportDocument48 pagesInkster Judge Misused Funds Says ReportChannel SevenNo ratings yet

- Profit or Loss, Pre and Post IncorporationDocument22 pagesProfit or Loss, Pre and Post IncorporationApurvaNo ratings yet

- Kier Annual Report 2011Document108 pagesKier Annual Report 2011lippslips_22No ratings yet

- Tax MatrixDocument1 pageTax MatrixJulo R. TaleonNo ratings yet

- Eeca QB PDFDocument6 pagesEeca QB PDFJeevanandam ShanmugaNo ratings yet

- 27 Chap - Module 4 - Pricing StrategiesDocument7 pages27 Chap - Module 4 - Pricing StrategiesraisehellNo ratings yet

- How Tax Reform Changed The Hedging of NQDC PlansDocument3 pagesHow Tax Reform Changed The Hedging of NQDC PlansBen EislerNo ratings yet

- Agency TheoryDocument3 pagesAgency TheoryAvay ShresthaNo ratings yet

- Existing MarketsDocument177 pagesExisting MarketsSanju DurgapalNo ratings yet

- Ebook InventoriesDocument45 pagesEbook InventoriesNadarajanNo ratings yet

- Mba Project ReportDocument15 pagesMba Project ReportPreet GillNo ratings yet

- Com Vs PJ KienerDocument8 pagesCom Vs PJ KienerMabelle ArellanoNo ratings yet

- Company Law and Allied RulesDocument11 pagesCompany Law and Allied RulesFaisalNo ratings yet

- LeverageDocument64 pagesLeverageUsha Padyana100% (1)

- Methods To Initiate VenturesDocument16 pagesMethods To Initiate VenturesRaquel GonzalesNo ratings yet

- Midterm 1 - With Answers PDFDocument7 pagesMidterm 1 - With Answers PDFSamuel BrodriqueNo ratings yet

- NPS - The New Pension SchemeDocument8 pagesNPS - The New Pension SchemeAmit YadavNo ratings yet

- Five Dimensions of Corporate Social RespDocument15 pagesFive Dimensions of Corporate Social RespJavaid NasirNo ratings yet

- 1 X 1 ID Picture, - Address: Bugallon Proper, Ramon, Isabela HLURB Reg. No.Document4 pages1 X 1 ID Picture, - Address: Bugallon Proper, Ramon, Isabela HLURB Reg. No.Maris Joy BartolomeNo ratings yet

- Cases 5: Variable Pay HikeDocument2 pagesCases 5: Variable Pay HikeYASMEEN ALHARBINo ratings yet

- Cost ClassificationDocument9 pagesCost ClassificationPuneet TandonNo ratings yet

- Inventory Org Account DetailsDocument7 pagesInventory Org Account DetailsSyed MustafaNo ratings yet

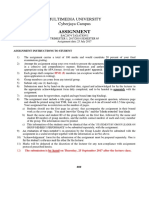

- Assignment: Multimedia University Cyberjaya CampusDocument9 pagesAssignment: Multimedia University Cyberjaya CampusSree Mathi SuntheriNo ratings yet

- Project Chapter 1 EditedDocument18 pagesProject Chapter 1 Editedsamuel debebeNo ratings yet

- Calicut University Bcom SyllabusDocument57 pagesCalicut University Bcom Syllabuslibison1No ratings yet

Exemptions To Small Scale Industries

Exemptions To Small Scale Industries

Uploaded by

Ravi AroraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exemptions To Small Scale Industries

Exemptions To Small Scale Industries

Uploaded by

Ravi AroraCopyright:

Available Formats

The contribution of Small Scale Sector in the industrial growth of the Indian economy and to the Gross Domestic

Product is significant besides the potential for employment generation. The Small Scale Sector has for itself a special dispensation in the Central Excise law in order to make it competitive in the domestic and global market. Central Excise duty concessions have been extended to the units in the small-scale sector based on their turnover so as to facilitate them to graduate by availing these concessions in a graded manner. ELIGIBILITY Manufacturers of specified commodities having clearances not exceeding Rs. 3 crores in the preceding Financial Year are eligible for this exemption. REGISTRATION OF SMALL SCALE COMPANIES Every manufacturer of excisable goods is required (under Rule 9 of Central Excise Rules 2002) to get registered with the Central Excise Department before starting production. SSI units are exempted from registration till their value of clearances reaches the specified limits. (exemption limit 10 lakh rupees) WHO IS COVERED BY THE SSI SCHEME At present, in terms of notification nos. 8/2003-CE and 9/2003-CE, both dated 1st March, 2003, and effective from 1st April, 2003, a general small scale excise duty exemption scheme has been made operational providing slab-rated concessions from excise duty in respect of clearances of specified excisable goods. Under these notifications, all goods specified in the First Schedule to the Central Excise Tariff Act, 1985 are eligible to avail the exemptions/concessions except for those goods which are chargeable to NIL rate of duty or which are exempt from whole of the duty and certain products as given in the Annexure to these notifications. The salient features of these exemption schemes, as contained in the aforesaid notifications are as under:Where the SSI unit does not avail CENVAT Notification No.8/2003-CE, dated 1st March, 2003. For first clearances effective from 1st April of a financial year up to an aggregate value of Rs. 1 Crore, duty is exempted in respect of those SSI units which do not intend to avail CENVAT Credit Where the SSI Unit avails CENVAT Notification No.9/2003-CE, dated 1st March, 2003. The graded scheme of exemption in respect of those SSI units which intend to avail CENVAT is as under:First clearances effective from 1st April of a financial year,up to an aggregate value of Rs.1 crore -

60% of the normal rate of duty Subsequent Clearances at the normal rate of duty The following clearances are excluded from computation of value of clearances :

Clearances of the specified goods which are used as inputs for further manufacture of specified goods within the factory irrespective of the value of clearances. Clearances of excisable goods affixed with the brand name or trade name of another person who is not eligible for availing the exemption under the aforesaid notification.

It may not be noted that wef 1.4.2003, the value of exempted goods will also be taken into consideration for computing the aggregate value. Units availing SSI exemption are permitted to remove specified goods to a place outside the factory for getting any job work done on any specified goods without payment of duty (Notification number 83/94 and 84/94 Central Excise dated 11.4.94 as amended) QUARTERLY RETURN OF PRODUCTION AND CLEARANCE (ER 1) This return is to be filed once in a quarter, before the 20th day of the close of each quarter. A quarterly return of Cenvat Credit taken is also to be filed. VISITS BY OFFICERS No SSI factory should be visited by Central Excise Inspectors except with the specific permission of the Assistant Commissioner and for a specific purpose. WHO TO APPROACH IN CASE OF PROBLEMS FACED In case of any problems faced, the SSI is advised to approach either the jurisdictional Range Supdt., or the Asstt. Commissioner/ Deputy Commissioner of the Division or the Commissioner of Central Excise.

You might also like

- PalamonDocument6 pagesPalamonRyan Teichmann75% (8)

- Chapter 7 Cost-Volume-Profit AnalysisDocument98 pagesChapter 7 Cost-Volume-Profit AnalysisAlyssa MabalotNo ratings yet

- Mark Minervini Additional NotesDocument3 pagesMark Minervini Additional NotesRoyce Luong100% (10)

- Bureau of Internal RevenueDocument11 pagesBureau of Internal RevenueRomer LesondatoNo ratings yet

- Tax Planning For Setting New BusinessDocument6 pagesTax Planning For Setting New BusinessHardipsinh Yadav56% (9)

- Worksheets LBJ SpecDocument38 pagesWorksheets LBJ SpecGeannineOo100% (3)

- Rev PB SheetDocument10 pagesRev PB SheetPatriqKaruriKimbo100% (1)

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- Maharashtra Value Added Tax ActDocument13 pagesMaharashtra Value Added Tax ActKaran Gandhi0% (1)

- Excise DutyDocument4 pagesExcise DutyDigvijay LakdeNo ratings yet

- Direct TaxDocument13 pagesDirect TaxRajveer Singh SekhonNo ratings yet

- Excise DutyDocument1 pageExcise Dutyniravtrivedi72No ratings yet

- VAT RulesDocument11 pagesVAT RulesamrkiplNo ratings yet

- Scheme For Industrial Development of Jammu & KashmirDocument20 pagesScheme For Industrial Development of Jammu & KashmirShagir AliNo ratings yet

- Central Excise Manual: Chapter-2 Part-I Registration and E.C.C. NumberDocument9 pagesCentral Excise Manual: Chapter-2 Part-I Registration and E.C.C. NumbershivendrakumarNo ratings yet

- Advantages of Incentives and SubsidiesDocument38 pagesAdvantages of Incentives and SubsidiesShashank Jain67% (3)

- Operationalguidelines IippDocument69 pagesOperationalguidelines IippsurichimmaniNo ratings yet

- 20237211773220909CircularNo 02of2023-24Document9 pages20237211773220909CircularNo 02of2023-24bamm-s20-059No ratings yet

- Notification No 8 2002Document6 pagesNotification No 8 2002Dhananjay KulkarniNo ratings yet

- Interpretations Rulings Book - Set IDocument55 pagesInterpretations Rulings Book - Set IAudithya KahawattaNo ratings yet

- Assessable Value: Prof. P. RajendranDocument18 pagesAssessable Value: Prof. P. RajendranProfessor RajendranNo ratings yet

- Aluation of Xcisable Oods: 3.1 Basis of Computing Duty PayableDocument36 pagesAluation of Xcisable Oods: 3.1 Basis of Computing Duty PayableJitendra VernekarNo ratings yet

- Export Promotion and Incentives: International Marketing Marzieh Arianfar Bims-University of Mysore APRIL 2013Document21 pagesExport Promotion and Incentives: International Marketing Marzieh Arianfar Bims-University of Mysore APRIL 2013Jai KeerthiNo ratings yet

- Import ProcedureDocument33 pagesImport Procedureshreyans singhNo ratings yet

- RBI Notice - CAIIB - ABMDocument13 pagesRBI Notice - CAIIB - ABMSATISHNo ratings yet

- The Tax Structure in India Is Divided Into Direct and Indirect TaxesDocument9 pagesThe Tax Structure in India Is Divided Into Direct and Indirect TaxesUjjwal RustagiNo ratings yet

- Valuation of Excisable Goods: 3.1 Basis of Computing Duty PayableDocument38 pagesValuation of Excisable Goods: 3.1 Basis of Computing Duty PayableVaishnaviNo ratings yet

- Role of Cost Audit:: Who Can Be Appointed As Cost AuditorDocument8 pagesRole of Cost Audit:: Who Can Be Appointed As Cost AuditorjaipalmeNo ratings yet

- 09 Ssi PDFDocument20 pages09 Ssi PDFRahul SuhalkaNo ratings yet

- Taxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTDocument5 pagesTaxguru - In-Section 10 CGST Act 2017 Composition Levy Under GSTTheEnigmatic AccountantNo ratings yet

- Article On Export Promotion SchemesDocument15 pagesArticle On Export Promotion Schemesjatin ChotaiNo ratings yet

- P 14Document728 pagesP 14Moaaz Ahmed100% (1)

- Taxx Special Economic ZonesDocument4 pagesTaxx Special Economic ZonesAlina RizviNo ratings yet

- How To ImportDocument28 pagesHow To ImportHarinder SinghNo ratings yet

- Sez-Latest Write Up (E/N 17/2011) : Operations Are Free From Tax Burden?Document6 pagesSez-Latest Write Up (E/N 17/2011) : Operations Are Free From Tax Burden?swami_ratanNo ratings yet

- Chapter 12Document32 pagesChapter 12Ram SskNo ratings yet

- The PEZA IssueDocument29 pagesThe PEZA IssueArne TanNo ratings yet

- Income Tax MannualDocument6 pagesIncome Tax MannualMuhammad Ammar KhanNo ratings yet

- IntroductionDocument5 pagesIntroductionsaran91No ratings yet

- Aasnil CHOPRADocument50 pagesAasnil CHOPRAPolite ManNo ratings yet

- Indirect TaxDocument8 pagesIndirect TaxPavan JayaprakashNo ratings yet

- New Business Tax PlanningDocument47 pagesNew Business Tax PlanningashishNo ratings yet

- Export Incentive SchemesDocument7 pagesExport Incentive Schemesnavneet bagriNo ratings yet

- Remaning TopicsDocument7 pagesRemaning TopicsAbhishekNo ratings yet

- Duty Drawback India Presentation 2003Document10 pagesDuty Drawback India Presentation 2003dinkar13375No ratings yet

- Stateschemepunjab 4Document14 pagesStateschemepunjab 4edvikasadNo ratings yet

- How To ImportDocument30 pagesHow To ImportRiyaz ShaikhNo ratings yet

- Be Sem 1 Unit 2 SsiDocument17 pagesBe Sem 1 Unit 2 SsiYash KeshkamatNo ratings yet

- Central Excise Act Notes For Self PreparationDocument29 pagesCentral Excise Act Notes For Self PreparationVivek ReddyNo ratings yet

- Taxation: 8. Special Economic Zone ActDocument6 pagesTaxation: 8. Special Economic Zone ActJustin Robert RoqueNo ratings yet

- Excise Law PDFDocument54 pagesExcise Law PDFJay BudhdhabhattiNo ratings yet

- VAT Guide - Healthcare (2) .Ar - enDocument31 pagesVAT Guide - Healthcare (2) .Ar - enNstrNo ratings yet

- Drawback Section 75.Document4 pagesDrawback Section 75.PRATHAMESH MUNGEKARNo ratings yet

- (H) VISem BCH6.2 GST Week3 AnkitaTomarDocument23 pages(H) VISem BCH6.2 GST Week3 AnkitaTomarRAJBIR SINGH TADANo ratings yet

- Code of Fiscal BenefitsDocument19 pagesCode of Fiscal Benefitsantonior70No ratings yet

- Customs: Notification Nos. Date Tariff Non-Tariff Central Excise Tariff Non-TariffDocument15 pagesCustoms: Notification Nos. Date Tariff Non-Tariff Central Excise Tariff Non-TariffsurampudiprasadNo ratings yet

- Guidance Note On Accounting For State-Level Value Added Tax: F F Y Y I IDocument8 pagesGuidance Note On Accounting For State-Level Value Added Tax: F F Y Y I Idark lord89No ratings yet

- Exemption Under GSTDocument7 pagesExemption Under GSTDebaNo ratings yet

- Nature of Excise DutyDocument16 pagesNature of Excise DutyVinod PatelNo ratings yet

- IMPEX Procedure PDFDocument174 pagesIMPEX Procedure PDFKrishna SinghNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Filing of Service Tax ReturnDocument1 pageFiling of Service Tax ReturnRavi AroraNo ratings yet

- Rates of Service TaxDocument1 pageRates of Service TaxRavi AroraNo ratings yet

- FormsDocument1 pageFormsRavi AroraNo ratings yet

- Astr 1Document1 pageAstr 1Ravi AroraNo ratings yet

- Service Tax Form-3aDocument1 pageService Tax Form-3aRavi AroraNo ratings yet

- Service Tax Form-1Document4 pagesService Tax Form-1Ravi AroraNo ratings yet

- Inkster Judge Misused Funds Says ReportDocument48 pagesInkster Judge Misused Funds Says ReportChannel SevenNo ratings yet

- Profit or Loss, Pre and Post IncorporationDocument22 pagesProfit or Loss, Pre and Post IncorporationApurvaNo ratings yet

- Kier Annual Report 2011Document108 pagesKier Annual Report 2011lippslips_22No ratings yet

- Tax MatrixDocument1 pageTax MatrixJulo R. TaleonNo ratings yet

- Eeca QB PDFDocument6 pagesEeca QB PDFJeevanandam ShanmugaNo ratings yet

- 27 Chap - Module 4 - Pricing StrategiesDocument7 pages27 Chap - Module 4 - Pricing StrategiesraisehellNo ratings yet

- How Tax Reform Changed The Hedging of NQDC PlansDocument3 pagesHow Tax Reform Changed The Hedging of NQDC PlansBen EislerNo ratings yet

- Agency TheoryDocument3 pagesAgency TheoryAvay ShresthaNo ratings yet

- Existing MarketsDocument177 pagesExisting MarketsSanju DurgapalNo ratings yet

- Ebook InventoriesDocument45 pagesEbook InventoriesNadarajanNo ratings yet

- Mba Project ReportDocument15 pagesMba Project ReportPreet GillNo ratings yet

- Com Vs PJ KienerDocument8 pagesCom Vs PJ KienerMabelle ArellanoNo ratings yet

- Company Law and Allied RulesDocument11 pagesCompany Law and Allied RulesFaisalNo ratings yet

- LeverageDocument64 pagesLeverageUsha Padyana100% (1)

- Methods To Initiate VenturesDocument16 pagesMethods To Initiate VenturesRaquel GonzalesNo ratings yet

- Midterm 1 - With Answers PDFDocument7 pagesMidterm 1 - With Answers PDFSamuel BrodriqueNo ratings yet

- NPS - The New Pension SchemeDocument8 pagesNPS - The New Pension SchemeAmit YadavNo ratings yet

- Five Dimensions of Corporate Social RespDocument15 pagesFive Dimensions of Corporate Social RespJavaid NasirNo ratings yet

- 1 X 1 ID Picture, - Address: Bugallon Proper, Ramon, Isabela HLURB Reg. No.Document4 pages1 X 1 ID Picture, - Address: Bugallon Proper, Ramon, Isabela HLURB Reg. No.Maris Joy BartolomeNo ratings yet

- Cases 5: Variable Pay HikeDocument2 pagesCases 5: Variable Pay HikeYASMEEN ALHARBINo ratings yet

- Cost ClassificationDocument9 pagesCost ClassificationPuneet TandonNo ratings yet

- Inventory Org Account DetailsDocument7 pagesInventory Org Account DetailsSyed MustafaNo ratings yet

- Assignment: Multimedia University Cyberjaya CampusDocument9 pagesAssignment: Multimedia University Cyberjaya CampusSree Mathi SuntheriNo ratings yet

- Project Chapter 1 EditedDocument18 pagesProject Chapter 1 Editedsamuel debebeNo ratings yet

- Calicut University Bcom SyllabusDocument57 pagesCalicut University Bcom Syllabuslibison1No ratings yet