Professional Documents

Culture Documents

Report Body

Report Body

Uploaded by

Sadia HijolOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report Body

Report Body

Uploaded by

Sadia HijolCopyright:

Available Formats

4.

0 Introduction

Modern banking system was introduced into the Muslim countries at a time when they were politically and economically at low ebb, in the late 19th century. The main banks in the home countries of the imperial powers established local branches in the capitals of the subject countries and they catered mainly to the import export requirements of the foreign businesses. The banks were generally confined to the capital cities and the local population remained largely untouched by the banking system. The local trading community avoided the foreign banks both for nationalistic as well as religious reasons. However, as time went on it became difficult to engage in trade and other activities without making use of commercial banks. Even then many confined their involvement to transaction activities such as current accounts and money transfers. Borrowing from the banks and depositing their savings with the bank were strictly avoided in order to keep away from dealing in interest which is prohibited by religion. With the passage of time, however, and other socio-economic forces demanding more involvement in national economic and financial activities, avoiding the interaction with the banks became impossible. Local banks were established on the same lines as the interest-based foreign banks for want of another system and they began to expand within the country bringing the banking system to more local people. As countries became independent the need to engage in banking activities became unavoidable and urgent. Governments, businesses and individuals began to transact business with the banks, with or without liking it. This state of affairs drew the attention and concern of Muslim intellectuals. The story of interest-free or Islamic banking begins here. In the following paragraphs we will trace this story to date and examine how far and how successfully their concerns have been addressed.

Genesis of Islamic Banking in Bangladesh

Bangladesh is the third largest Muslim country in the world with around 135 million populations of which 90 percent are Muslim. The hope and aspiration of the people to run banking system on the basis of Islamic principle came into reality after the OIC recommendation at its Foreign Ministers meeting in 1978 at Senegal to develop a separate banking system of their own. After 5 years of that declaration, in 1983, Bangladesh established its first Islamic bank. At present, out of 49 banks in Bangladesh, 7 fully fledged Islamic Banks and 19 Islamic Banking branches of 9 conventional banks are working in the private sector on the basis of Islamic Shariah. Islamic banks in Bangladesh since their inception have been gaining popularity in spite of some problems in their operation.

Islamic Banking Branches in Conventional Banks

An important development in Islamic banking in the last few years has been the entry of some conventional banks in the market and their use of Islamic modes of financing through their Islamic branches, windows, or units. It necessitates and encourages the mobilized_ion of Islamic banking, which includes some of the giants in the banking and finance industry. Bangladesh was not indifferent to this turning move. Presently, 9 conventional banks have opened 19 Islamic banking branches alongside their interestbased branches. These conventional

15

banks should focus on the safeguards that ensure the Islamic nature of these branches such as separation and compliance with Shariah. Separation of Islamic banking branches includes separation of capital, accounts, staff employed and office. However, the most important thing is compliance with Shariah. There should be strong Shariah supervisory boards in order to prepare the model agreement, to approve the structure of every new operation, and lay down the basic guidelines for each and every mode of financing.

4.1 Current practices of Islamic Banks in Bangladesh

Generally speaking, all interest-free banks agree on the basic principles. However, individual banks differ in their application. These differences are due to several reasons including the laws of the country, objectives of the different banks, individual banks circumstances and experiences, the need to interact with other interest-based banks, etc. In the following paragraphs, we will describe the salient features common to all banks.

4.2 Accounts in Islamic Banks 4.2.1 Deposit accounts

All the Islamic banks have three kinds of deposit accounts: current, savings and investment.

4.2.1.1 Current accounts

Current or demand deposit accounts are virtually the same as in all conventional banks. Deposit is guaranteed.

4.2.1.2 Savings accounts

Savings deposit accounts operate in different ways. In some banks, the depositors allow the banks to use their money but they obtain a guarantee of getting the full amount back from the bank. Banks adopt several methods of inducing their clients to deposit with them, but no profit is promised. In others, savings accounts are treated as investment accounts but with less stringent conditions as to withdrawals and minimum balance. Capital is not guaranteed but the banks take care to invest money from such accounts in relatively risk-free short-term projects. As such lower profit rates are expected and that too only on a portion of the average minimum balance on the ground that a high level of reserves needs to be kept at all times to meet withdrawal demands.

4.2.1.3 Investment account

Investment deposits are accepted for a fixed or unlimited period of time and the investors agree in advance to share the profit (or loss) in a given proportion with the bank. Capital is not guaranteed.

4.2.2 Modes of financing

16

Banks adopt several modes of acquiring assets or financing projects. But they can be broadly categorised into three areas: investment, trade and lending.

4.2.2.1 Investment financing

This is done in three main ways: a) Musharaka where a bank may join another entity to set up a joint venture, both parties participating in the various aspects of the project in varying degrees. Profit and loss are shared in a pre-arranged fashion. This is not very different from the joint venture concept. The venture is an independent legal entity and the bank may withdraw gradually after an initial period. b) Mudarabha where the bank contributes the finance and the client provides the expertise, management and labour. Profits are shared by both the partners in a pre-arranged proportion, but when a loss occurs the total loss is borne by the bank. c) Financing on the basis of an estimated rate of return. Under this scheme, the bank estimates the expected rate of return on the specific project it is asked to finance and provides financing on the understanding that at least that rate is payable to the bank. (Perhaps this rate is negotiable.) If the project ends up in a profit more than the estimated rate the excess goes to the client. If the profit is less than the estimate the bank will accept the lower rate. In case a loss is suffered the bank will take a share in it.

4.2.2.2 Trade financing

This is also done in several ways. The main ones are: a) Mark-up where the bank buys an item for a client and the client agrees to repay the bank the price and an agreed profit later on. b) Leasing where the bank buys an item for a client and leases it to him for an agreed period and at the end of that period the lessee pays the balance on the price agreed at the beginning an becomes the owner of the item. c) Hire-purchase where the bank buys an item for the client and hires it to him for an agreed rent and period, and at the end of that period the client automatically becomes the owner of the item. d) Sell-and-buy-back where a client sells one of his properties to the bank for an agreed price payable now on condition that he will buy the property back after certain time for an agreed price. e) Letters of credit where the bank guarantees the import of an item using its own funds for a client, on the basis of sharing the profit from the sale of this item or on a mark-up basis.

4.2.2.3 Lending

Main forms of Lending are: a) Loans with a service charge where the bank lends money without interest but they cover their expenses by levying a service charge. This charge may be subject to a maximum set by the authorities. b) No-cost loans where each bank is expected to set aside a part of their funds to grant no-cost loans to needy persons such as small farmers, entrepreneurs, producers, etc. and to needy consumers. c) Overdrafts also are to be provided, subject to a certain maximum, free of charge.

4.2.3 Services

Other banking services such as money transfers, bill collections, trade in foreign currencies at spot rate etc. where the banks own money is not involved are provided on a commission or charges basis.

17

4.2.4 Shortcomings in current practices

In the previous section we listed the current practices under three categories: deposits, modes of financing (or acquiring assets) and services. There seems to be no problems as far as banking services are concerned. Islamic banks are able to provide nearly all the services that are available in the conventional banks. The only exception seems to be in the case of letters of credit where there is a possibility for interest involvement. However some solutions have been found for this problem -- mainly by having excess liquidity with the foreign bank. On the deposit side, judging by the volume of deposits both in the countries where both systems are available and in countries where law prohibits any dealing in interest, the non-payment of interest on deposit accounts seems to be no serious problem. Customers still seem to deposit their money with interest-free banks. The main problem, both for the banks and for the customers, seems to be in the area of financing. Bank lending is still practised but that is limited to either no-cost loans (mainly consumer loans) including overdrafts, or loans with service charges only. Both these types of loans bring no income to the banks and therefore naturally they are not that keen to engage in this activity much. That leaves us with investment financing and trade financing. Islamic banks are expected to engage in these activities only on a profit and loss sharing (PLS) basis. This is where the banks main income is to come from and this is also from where the investment account holders are expected to derive their profits from. And the latter is supposed to be the incentive for people to deposit their money with the Islamic banks. And it is precisely in this PLS scheme that the main problems of the Islamic banks lie. Therefore we will look at this system more carefully in the following section.

4.2.5 Investment under PLS scheme

The idea of participatory financing introduced by the Islamic banking movement is a unique and positive contribution to modern banking. However, as we saw earlier, by making the PLS mode of financing the main (often almost the only) mode of financing the Islamic banks have run into several difficulties. If, as suggested in the previous section, the Islamic banks would provide all the conventional financing through lending from their deposit accounts (current and savings), it will leave their hands free to engage in this responsible form of financing innovatively, using the funds in their investment accounts. They could then engage in genuine Mudaraba financing. Being partners in an enterprise they will have access to its accounts, and the problems associated with the non-availability of accounts will not arise. Commenting on Mudaraba financing, The Economist says: some people in the West have begun to find the idea attractive. It gives the provider of money a strong incentive to be sure he is doing something sensible with it. What a pity the Wests banks did not have that incentive in so many of their lending decisions in the 1970s and 1980s. It also emphasises the sharing of responsibility, by all the users of money. That helps to make the freemarket system more open; you might say more democratic.

4.3 Problems in implementing the PLS scheme

18

Several writers have attempted to show, with varying degrees of success, that Islamic Banking based on the concept of profit and loss sharing (PLS) is theoretically superior to conventional banking from different angles. However from the practical point of view things do not seem that rosy. Our concern here is this latter aspect. In the over half-a-decade of full-scale experience in implementing the PLS scheme the problems have begun to show up. If one goes by the experience of Pakistan as portrayed in the papers presented at the conference held in Islamabad in 1992, the situation is very serious and no satisfactory remedy seems to emerge. 13 In the following paragraphs we will try to set down some of the major difficulties.

4.3.1 Financing

There are four main areas where the Islamic banks find it difficult to finance under the PLS scheme: a) participating in long-term low-yield projects, b) financing the small businessman, c) granting non-participating loans to running businesses, and d) financing government borrowing. Let us examine them in turn.

4.3.1.1 Long-term projects

Table 1 shows the term structure of investment by 20 Islamic Banks in 1988. It is clear that less than 10 percent of the total assets goes into medium- and long-term investment. Admittedly, the banks are unable or unwilling to participate in long-term projects. This is a very unsatisfactory situation. Table 1 Term Structure of Investment by 20 Islamic Banks, 1988 Type of Investment Amount* % of Total Short-term 4,909.8 68.4 Social lending 64.2 0.9 Real-estate investment 1,498.2 20.9 Medium- and long-term investment 707.7 9.8 Source: Aggregate balance sheets prepared by the International Association of Islamic Banks, Bahrain, 1988. Quoted in: Ausaf Ahmed (1994). * Unit of currency not given. The main reason of course is the need to participate in the enterprise on a PLS basis which involves time consuming complicated assessment procedures and negotiations, requiring expertise and experience. The banks do not seem to have developed the latter and they seem to be averse to the former. There are no commonly accepted criteria for project evaluation based on PLS partnerships. Each single case has to be treated separately with utmost care and each has to be assessed and negotiated on its own merits. Other obvious reasons are: a) such investments tie up capital for very long periods, unlike in conventional banking where the capital is recovered in regular instalments almost right from the beginning, and the uncertainty and risk are that much higher, b) the longer the maturity of the project the longer it takes to realise the returns and the banks therefore cannot pay a return to their depositors as quick as the conventional banks can. Thus it is no wonder that the banks are averse to such investments.

4.3.1.2 Small businesses

19

Small scale businesses form a major part of a countrys productive sector. Besides, they form a greater number of the banks clientele. Yet it seems difficult to provide them with the necessary financing under the PLS scheme, even though there is excess liquidity in the banks. The observations of Iqbal and Mirakhor are revealing: Given the comprehensive criteria to be followed in granting loans and monitoring their use by banks, small-scale enterprises have, in general encountered greater difficulties in obtaining financing than their large-scale counterparts in the Islamic Republic of Iran. This has been particularly relevant for the construction and service sectors, which have large share in the gross domestic product (GDP). The service sector is made up of many small producers for whom the banking sector has not been able to provide sufficient financing. Many of these small producers, whom traditionally were able to obtain interest-based credit facilities on the basis of collateral, are now finding it difficult to raise funds for their operations.

4.3.1.3 Running businesses

Running businesses frequently need short-term capital as well as working capital and ready cash for miscellaneous on-the-spot purchases and sundry expenses. This is the daily reality in the business world. Very little thought seems to have been given to this important aspect of the business worlds requirement. The PLS scheme is not geared to cater to this need. Even if there is complete trust and exchange of information between the bank and the business it is nearly impossible or prohibitively costly to estimate the contribution of such short-term financing on the return of a given business. Neither is the much used mark-up system suitable in this case. It looks unlikely to be able to arrive at general rules to cover all the different situations. Added to these are the delays involved in authorizing emergency loans. One staff member of the Bank of Industry and Mines of Iran has commented: Often the clients need to have quick access to fresh funds for the immediate needs to prevent possible delays in the projects implementation schedule. According to the set regulations, it is not possible to bridge-finance such requirements and any grant of financial assistance must be made on the basis of the projects appraisal to determine type and terms and conditions of the scheme of financing. The enormity of the damage or hindrance caused by the inability to provide financing to this sector will become clear if we realize that running businesses and enterprises are the mainstay of the countrys very economic survival.

4.3.1.4 Government borrowing

In all countries the Government accounts for a major component of the demand for credit -both short-term and long-term. Unlike business loans these borrowings are not always for investment purposes, nor for investment in productive enterprises. Even when invested in productive enterprises they are generally of a longer-term type and of low yield. This latter only multiplies the difficulties in estimating a rate of return on these loans if they are granted under the PLS scheme. In Iran it has been decreed that financial transactions between and among the elements of the public sector, including Bank Markazi [the central bank] and commercial banks that are wholly nationalized, can take place on the basis of a fixed rate of return; such a fixed

20

rate is not viewed as interest. Therefore the Government can borrow from the nationalized banking system without violating the Law. While the last claim may be subject to question, there is another serious consequence: Continued borrowing on a fixed rate basis by the Government would inevitably index bank charges to this rate than to the actual profits of borrowing entities.

4.4 Deposit Mobilization and Fund Utilization by the Islamic Banks in Bangladesh

The major part of the operational financial resources of Islamic banks is derived from different types of deposits mobilized on the principles of Al-Wadia (safe custodianship) and Al Mudaraba (trust financing). Utilization of fund under the framework of Islamic banking has opened a multifarious way for making loan (the term loan in conventional banking is called "Investment" in the Islamic banking system) conforming to Islamic Shariah. Since Islamic banks can not lend on interest, they have devised different types of interest-free financing devices.

4.5 Performance of the Islamic Banking System

The growth of Islamic banking in Bangladesh is progressing day by day. The remarkable shift signal of high acceptance of the interest-free banking by the public in general. The erosion of the conventional banks and their branches into Islamic lines gives Islamic banking industry continued to show strong growth in 2005 in tandem with the growth in the economy, as reflected in the increased market share of the Islamic banking industry in terms of assets, financing, and deposits of the total banking system. The Islamic banks in Bangladesh started from a very limited resource base. But with the passage of time, they have shown strong performance in respect of mobilization of deposits. Total deposits of the Islamic banks and Islamic banking branches of the conventional banks stood at Taka 188557.4 million in September, 2005. This was 27.6% of the deposits of all private banks and 12.9% of the deposits of the total banking system. Total investment of the Islamic banks and the Islamic banking branches of the conventional banks stood at Taka 184547.2 million at the end of September, 2005. This was 31.4% of all private banks and 15.1% of the total banking system of the country. The Statutory Liquidity Requirement (SLR) for the Islamic banks is fixed at 10% since the inception of the first Islamic Bank in 1983. This remains unchanged till date while SLR for the traditional commercial banks has been changed many times, which presently is fixed at 18%. It is evident from Table 1 that almost all of the Islamic banks have been facing excess liquidity problem while only one bank, the Oriental Bank Limited, is maintaining liquidity position below the required level. However, the excess liquidity of the Islamic banks and Islamic banking branches of conventional banks as of September 2005 was to the tune of Taka 7742.4 million (18.5% of private banks and 7.9% of all banks), which originated mainly due to the non-responsiveness of good borrowers for credit demand and the absence of adequate interest-free financial instruments in the country.

21

Islamic banks and the Islamic banking branches of the conventional banks have created enough employment opportunities in the banking sector by providing a good number of jobs to the people. The total persons employed in the Islamic banking system were 8220 as on September, 2005. This was 25.2% of the private sector banks' total employment and 7.6% of all banks. The total number of branches of the Islamic banks, including the Islamic banking branches of the conventional banks, in the country stood at 308 in September, 2005, of which 236 were urban and 72 were rural. The number of Islamic bank branches was 19.6% of all private banks and 4.9% of the banking system of the country. Table 02: Comparative Position of the Islamic Banking Sector September, 2005 (In million Taka) Group of Deposit Investment Excess Man Banks Liquid power Assets 1 2 3 4 5 Islamic 188557.4 184547.2 7742.4 8220 Banking Sector All Private 682240.4 587575.2 41863.1 32576 Banks: 1/ (27.6) (31.4) (18.5) (25.2) All Banks 1463163.6 Total: 2/ 1220912.2 98126 108451

No. of Branches 6 308

1573 (19.6) 6336

Notes: 1/ Figures in the parentheses indicate share of percentage of the Islamic banking sector to the all private banks. 2/ Figures in the parentheses indicate share of percentage of the Islamic banking sector to all banks. Sources: Banking Regulation and Policy Department, Statistics Department and Central Accounts Departments of all Islamic banks and conventional banks having the Islamic banking branches. The distribution of investment by mode as presented in Table 2, shows that Islamic banks' investment is mainly concentrated in the mark-up and rental-based modes of financing, which occupied 74.6% of total investments (Bai-Murabaha, Bai-Muajjal and Ijarah). Investments under the PLS modes accounted for only 1.38% (both in Mudaraba and Musharaka). This demonstrates a complete bias towards mark-up based financing followed by the Islamic banks in Bangladesh. Table 03: Modewise Investment of Islamic Banks, September 2005 Mode of Investment %

22

Bai Murabaha Bai Muajjal Ijara Bai Istisnaa Bai Salam Musharaka Mudaraba Others Total

28.00 21.82 24.74 14.51 0.43 1.35 0.03 9.02 100.00

An analysis of the deposits and investments distributed by the size of accounts of the Islamic banks also depicts a bias towards the big projects or clients. The distributive efficiency of the Islamic banks has been impaired due to the concentration of assets in the hands of a few investment clients.

4.6 CAMEL Rating

The risk-weighted capital ratio and core capital ratio were maintained by the Islamic banks at prescribed level. Out of 7 Islamic banks, 4 banks maintained the capital ratio above the level while 3 maintained at lower level. This is due mainly to the shortfall of maintaining provision for loan loss. The ratio of non-performing loans (NPLs) to total loans of Islamic banks shows an improving trend, except for just one individual bank. Moreover, the asset quality of the Islamic banks has also improved. Some of them were able to remain below the accepted level on NPL, while some others were well above the level. An analysis of expenditure-income ratio indicates that the operating efficiency of the Islamic banks remained at satisfactory level excepting one bank which is designated as problem bank. Earnings as measured by return on assets (ROA) and return on equity (ROE) vary largely within the Islamic banks. ROA of 4 Islamic banks showed a better performance while 2 performed below the accepted level. As regards ROE, 4 Islamic banks showed a strong performance while the other 3 were unable to sustain the previous level. An analysis of the Net Profit Margin (NPM) of the Islamic banks showed a positive trend but at lowers than the accepted level.

4.7 Islamic Financial Instruments in the Market

In Bangladesh, financial resource mobilization through issuance of Islamic financial instruments is at a nascent stage. No Islamic bank or financial institution has issued any Islamic financial instruments like bonds, debentures, or mutual funds in the primary or secondary market for mobilizing financial resources. They are fully dependent on the deposit funds. Bangladesh Government has introduced a Mudaraba Bond named Bangladesh Government Islamic Investment Bond (Islamic Bond) in October, 2004 with a view to mitigating the longfelt need for a Shariah-based monetary instrument which can be used as an approved security for the purpose of maintaining the SLR as well as providing an outlet for investment or

23

procurement of funds by the Islamic banks. This bond is also open for investment by the private individuals, companies or corporations.

4.8 Difference between conventional and Islamic banks:

One must refrain from making a direct comparison between Islamic banking and conventional banking (apple to apple comparison). This is because they are extremely different in many ways. The key difference is that Islamic Banking is based on Shariah foundation. Thus, all dealing, transaction, business approach, product feature, investment focus, responsibility are derived from the Shariah law, which lead to the significant difference in many part of the operations with as of the conventional The foundation of Islamic bank is based on the Islamic faith and must stay within the limits of Islamic Law or the Shariah in all of its actions and deeds. The original meaning of the Arabic word Shariah is the way to the source of life and is now used to refer to legal system in keeping with the code of behaviour called for by the Holly Quran (Koran). Amongst the governing principles of an Islamic bank are : * The absence of interest-based (riba) transactions; * The avoidance of economic activities involving oppression (zulm) * The avoidance of economic activities involving speculation (gharar); * The introduction of an Islamic tax, zakat; * The discouragement of the production of goods and services which contradict the Islamic value (haram) On the other hand, conventional banking is essentially based on the debtor-creditor relationship between the depositors and the bank on one hand, and between the borrowers and the bank on the other. Interest is considered to be the price of credit, reflecting the opportunity cost of money. Islamic law considers a loan to be given or taken, free of charge, to meet any contingency. Thus in Islamic Banking, the creditor should not take advantage of the borrower. When money is lent out on the basis of interest, more often it leads to some kind of in justice. The first Islamic principle underlying for such kind of transactions is deal not unjustly, and ye shall not be dealt with unjustly [2:279] which explain why commercial banking in an Islamic framework is not based on the debtor-creditor relationship. The other principle pertaining to financial transactions in Islam is that there should not be any reward without taking a risk. This principle is applicable to both labor and capital. As no payment is allowed for labor, unless it is applied to work, there is no reward for capital unless it is exposed to business risk. Thus, financial intermediation in an Islamic framework has been developed on the basis of the above-mentioned principles. Consequently financial relationships in Islam have been participatory in nature.

24

Lastly, for the interest of the readers, the unique features of the conventional banking and Islamic banking are shown in terms of a box diagram as shown below:-

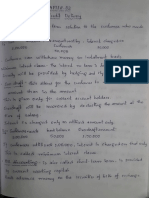

Conventional Banks 1. The functions and operating modes of conventional banks are based on fully manmade principles. 2. The investor is assured of a predetermined rate of interest. 3. It aims at maximizing profit without any restriction. 4. It does not deal with Zakat.

Islamic Banks 1. The functions and operating modes of Islamic banks are based on the principles of Islamic Shariah. 2. In contrast, it promotes risk sharing between provider of capital (investor) and the user of funds (entrepreneur). 3. It also aims at maximizing profit but subject to Shariah restrictions. 4. In the modern Islamic banking system, it has become one of the service-oriented functions of the Islamic banks to be a Zakat Collection Centre and they also pay out their Zakat. 5. Participation in partnership business is the fundamental function of the Islamic banks. So we have to understand our customers business very well. 6. The Islamic banks have no provision to charge any extra money from the defaulters. Only small amount of compensation and these proceeds is given to charity. Rebates are give for early settlement at the Banks discretion. 7. It gives due importance to the public interest. Its ultimate aim is to ensure growth with equity. 8. For the Islamic banks, it must be based on a Shariah approved underlying transaction. 9. Since it shares profit and loss, the Islamic banks pay greater attention to developing project appraisal and evaluations.

5. Lending money and getting it back with compounding interest is the fundamental function of the conventional banks. 6. It can charge additional money (penalty and compounded interest) in case of defaulters.

7. Very often it results in the banks own interest becoming prominent. It makes no effort to ensure growth with equity. 8. For interest-based commercial banks, borrowing from the money market is relatively easier. 9. Since income from the advances is fixed, it gives little importance to developing expertise in project appraisal and evaluations. 10. The conventional banks give greater emphasis on credit-worthiness of the clients.

10. The Islamic banks, on the other hand, give greater emphasis on the viability of the projects. 11. The status of a conventional bank, in 11. The status of Islamic bank in relation to relation to its clients, is that of creditor and its clients is that of partners, investors and

25

debtors. trader, buyer and seller. 12. A conventional bank has to guarantee all 12. Islamic bank can only guarantee deposits its deposits. for deposit account, which is based on the principle of al-wadiah, thus the depositors are guaranteed repayment of their funds, however if the account is based on the mudarabah concept, client have to share in a loss position..

4.9 Classification Under some criterion: 4.9.1 Criteria for Comparison 4.9.1.1 Profitability

The rate of return is considered the main incentive for making an investment decision. Depositors in commercial banks receive a fixed interest rate for their deposit funds. In Islamic banks, investment depositors have the privilege to receive a share in the profits reaped by the bank, from both investments and operations. Recent experience has shown that such gains may be greater than the fixed rate of interest given by the traditional commercial banks. For example the distributed profit by Faisal Islamic Bank in Sudan for the year 1980 was 16 percent to investors and 20 percent to shareholders (Faisal Islamic Bank, p.12). These rates of return are higher than the average rate of return obtained on deposits with traditional banks.

4.9.1.2 Liquidity

A commercial bank is expected to be reasonably liquid in order to meet unexpected withdrawal on deposits. The investment nature of Islamic bank and the profit-sharing mechanism it uses, led some critics to doubt its ability in this regard. Under normal circumstances, however, customer with drawings does not exceed 10/15 percent of total deposits, at any one time (AlNajjar, p.133). Moreover, the Islamic bank, like any other commercial bank, holds a portion of its deposits as required reserve in the central bank. In addition, it may invest in equities and shares. Because of the popularity of placement in Islamic banks and the self imposed restrictions on investments in the international money and capital markets, some of these institutions face the problem of excess liquidity, not the contrary.

4.9.1.3 Accounts Protection

In addition to a reasonable rate of return, depositors are to be assured of the safety of their deposits. An Islamic bank, as any other commercial bank, is structured to provide protection for deposits placed in current and saving accounts. With regard to investment accounts, Islamic banks are very selective with respect to both return and safety. Through diversification and carefully chosen assets, the investment risk is reduced and higher returns are attained. In

26

addition, some Islamic banks keep a special reserve, composed of 20% of the annual profits to meet any unexpected loss (KuwaitFinance House, p.18).

4.9.1.4 Investment Services and Motivations to Invest

Islamic banking encourages the average income earner and small investor to invest their small savings. Investors are motivated by the services and special treatment they receive, as well as by the human desire toward ownership, high rewards and the satisfaction of being part of a recognizable project. Entrepreneurs on the other hand, are also encouraged to be venture partners since they are not obligated to pay a fixed rate of interest. On the other hand entrepreneurs do not welcome interference by banks in their affairs or limitation on their freedom of action.

4.9.1.5 Banking Services

Islamic banking should be able to offer as many services as any commercial bank. These services include use of checks, purchase and sale of foreign currencies and securities, and provision of letters of credit and so on. However, the degree of complexity in managing some of these services, such as letters of credit, within the framework suggested by Islamic banking practices, may cause some anxiety to beneficiaries. Using the profit-sharing mechanism is not yet fully accepted in this subsector of financial services.

4.9.1.6 Economic Development

One of the main objectives of Islamic banks is to foster serious economic development. As mentioned before, these institutions seek to maximize an overall social-benefit function (AIGammal, p.58). Therefore, they strive to overcome local shortages and difficulties and to move the economy to a higher stage of self-sustained development. Their activities include housing and agricultural projects, imports of necessities, financing the purchase of tools and machines for small entrepreneurs and similar activities. On the other hand, traditional commercial banks seek in their lending policy to ensue first of all a high rate of return irrespective of the wider development aspects of the project.

4.9.1.7 Income Distribution and Social Solidarity

Using interest rate mechanism leads to the accumulation of wealth in a few hands through borrowing money at a low rate of interest and then lending it at a higher rate. The borrower's obligation to pay high interest rate regardless of the outcome of the project would, in some cases, deprive him of a portion of his previously accumulated wealth. In Islamic banking, investment depositors, who are numerous, share with the bank its overall profits, including returns from other services as well. In order to meet their moral objectives, some Islamic banks insist on associating themselves with the establishment of a zakah Fund. It is to collect zakah from the haves and distribute it to the have-nots; that is ,from the lower propensity-to-consume people to the higher ones. In other words, Islamic banks should have a favorable effect on the socio economic solider.

27

4.9.1.8 International Dependency

In present-day world, capital flows between countries and markets in accordance with the level of interest rate. International capital also is attracted by the political and economic stability of the national markets. Hence, the flow of capital has been mostly from less developed countries (LDCs) to the industrialized countries and is denominated in the host countries currencies, a matter which has given rise to unfavorable consequences bearing on the economies of LDCs. First, the economies of the LDCs have become subject to unfavorable changes such as fluctuation of the exchange rates and depletion of the real value of financial resources. Second, the outflow of capital most often strengthens the economies of the receiving-countries and weakens the economies of the transferring countries. Third, the outflow of capital limits the mother countries ability to practice in dependent fiscal and monetary policies. Fourth, LDCs borrow back from the international money and capital markets, but at higher interest rates and with more restrictive conditions. In short, the use of interest rate mechanism by LDCs commercial banks results in relatively restraining their economic development and exacerbating their international dependency. Islamic banks, which have different objectives and a different mechanism, are expected to create a far more independent banking system. Establishment of a complementary chain of local, regional, and international Islamic banks ought to provide a better chance for the attainment of the objectives of the LDCs in general and Islamic countries in particular. The accumulated savings of these countries will be mostly directed to investments within the mother countries and in accordance with the announced policy of the Islamic banks. At present investment in some Islamic countries and LDCs in general is surrounded by a high level of uncertainty, which might in the short- run increase the level of risk for their investments.

4.9.1.9 Stabilization of Prices

A distinct feature of commercial banks is their ability to create money. However, borrowers qualify for the new created money irrespective of their ability to produce real goods and services. In other words, there is no certainty that real goods and services will be produced as a result of the increase in money supply (Siddiqi, p.13). The Islamic banking mechanism, on the other hand, would create money when there is strong feeling that a corresponding increase in the supply of goods and services will mature. If the investment fails to meet its goal, borrowed capital will diminish by the amount of loss (Siddiqi, p.13-17). Therefore, prices would be more stable in an Islamic banking system than otherwise.

28

4.9.1.10 Banking Experience and Staff Requirements

Islamic banks are new institutions. Thus we would expect that they would need some time for their banking experience to mature. In this regard, traditional banks score favorably when compared with their Islamic counterparts. Moreover, the nature of the Islamic bank makes its staff requirements harder than the traditional bank. The type of its activities, the structure of its relation with customers and venture partners require more experienced, and Islamic committed staff. However, Islamic banks are expected to overcome this shortcoming as they grow in experience and size.

4.9.1.11 Local Laws and Legislation

Islamic banking faces a serious challenge within the legal arena. Local laws and procedures have been designed to deal with the traditional banking system. For instance, according to such laws banks are very restricted in their direct investments, and are forbidden to participate in the business of trade and real estate (see SAMA). Therefore, a newly established Islamic Bank has to struggle in demanding changes in the rules of the financial game and to obtain some exemptions. Currently operating Islamic banks have succeeded in gaining certain exemptions from local banking laws.

4.9.1.12 Public Acceptance

One of the fundamental reasons for the failure of traditional banking as an efficient mobilization of financial resources, and a successful intermediary between savers and users of financial funds in the Muslim world is the lack of public acceptance. Muslims consider it as a "sinful" alien institution. Therefore, a banking institution operating within Islamic teachings will be more favored by the public at large and should be able to overcome the psychological barrier from which the traditional bank in the Muslim world usually suffers

5. Conclusions

Islamic banking is a very young concept. Yet it has already been implemented as the only system in two Muslim countries; there are Islamic banks in many Muslim countries, and a few in non-Muslim countries as well. Despite the successful acceptance there are problems. These problems are mainly in the area of financing. With only minor changes in their practices, Islamic banks can get rid of all their cumbersome, burdensome and sometimes doubtful forms of financing and offer a clean and efficient interestfree banking. All the necessary ingredients are already there. The modified system will make use of only two forms of financing -- loans with a service charge and Mudaraba participatory financing -- both of which are fully accepted by all Muslim writers on the subject.

29

Such a system will offer an effective banking system where Islamic banking is obligatory and a powerful alternative to conventional banking where both co-exist. Additionally, such a system will have no problem in obtaining authorisation to operate in non-Muslim countries. Participatory financing is a unique feature of Islamic banking, and can offer responsible financing to socially and economically relevant development projects. This is an additional service Islamic banks offer over and above the traditional services provided by conventional commercial banks.

5.1 Recommendations and Implication

1. Islamic banks can provide efficient banking services to the nation if they are supported with appropriate banking laws, and regulations. This will help them introducing PLS modes of operations, which are very much conducive to economic development. It would be better if Islamic banks had the opportunity to work as a sole system in an economy. That would provide Islamic banking system to fully utilize its potentials. Studies show that Islamic banks cannot operate with its full efficiency level if it operates under a conventional banking framework, their efficiency goes down in a number of dimensions. The deterioration is not because of Islamic banks own mechanical deficiencies. Rather it is the efficiency-blunt operations of the conventional banking system that puts obstructions to efficient operation of Islamic banks. This does not mean that the survival of Islamic banks operating within the conventional banking framework is altogether threatens. Evidences from Bangladesh indicate that Islamic banks can survive even within a conventional banking framework by which over from PLS to trade related modes of financing. 2. Even under the conventional banking framework Islamic banks can operate with certain level of efficiency by applying in a reasonable percentage the PLS modes. The distinguishing features of Islamic banking. This has been possible in some countries of the Muslim world where the management of Islamic banks was cautious about possible impacts of every policy measure. Particularly, the management of these banks was judicious in selecting sectors or areas as major of their operations. Sudan Islamic banks are a typical example in this respect. Islamic banks in Bangladesh have much to learn from the experience of this successful Islamic bank. 3. Having been considered the pro-efficiency character of Islamic banking and its beneficial impacts on the economy, government policy in Bangladesh should be in favor of transforming conventional banking system into Islamic banking. It is reasonable to assume that risks involved in Mushraka or Mudaraba financing are different from those involved in trade-type financing. It follows, there for, that prudential regulations of these transactions should be different.

30

4. Determination of profit and loss in profit/loss sharing arrangement and treatment of costs and reserves in such accounting is a pertinent issue to be addressed with utmost importance and priority. However, Islamic banking is a very critical institution to materialize the economic objectives of Islam. It should however, be noted that it is to the whole of the Islamic framework. Compared to the conventional banks it is very much viable by itself, but the full impact of it can only be realized by supplementing it with corresponding reforms in other spheres of life in general, and in the monetary and fiscal fields in particular. Finally, it may be mentioned that if the Islamic financial system, is to become truly liquid and efficient it must develop more standardized and universally (or at least widely) tradable financial instruments. The development of a secondary financial market for Islamic financial products is crucial if the industry is to achieve true comparison with the conventional system. It must also work hard to develop more transparency in financial reporting and accounting and ideally - a form of Islamic GAAP. Development if the whole sale and especially inter-bank and money markets, will be the key to Islamic finance growing outside its current little sphere of influence, and becoming a truly national invigorating force. 5.2 REFERENCES Ahmed, Ausaf. (1995). The Evolution of Islamic Banking. In Encylopedia of Islamic Banking and Insurance, Institute of Insurance . Institute of Islamic Banking and Insurance, London. Ahmad, Z. (1981): Islamic Banking at the Crossroads, Development and Finance in Islam, p. 155-171, and also in Ahmad, Z Concept and \models of Islamic Banking :An Assessment, Islamabad: International Institute of Islamic Economics, 1984. Islami bank Bangladesh Limited : Central Accounts Department. Al-Baraka Bank Bangladesh Limited : Central Accounts Department Al-Arafah Islami Bank Limited : Central Accounts Department Bangladesh Bank ; Department of Banking Operation and Development. Bangladesh Bank: Department of Banking, Operations and Development. Bangladesh Bank: Banking Regulation and Policy Development. Errico, L and Farahbaksh, M (1998). Islamic Banking : Issues in Prudential Regulations and Supervision, IMF Working Paper No. Wp/9830,March 1998, International Monetary fund, JEL Classification Numbers. E58; G18: P51. Islami Banks Bangladesh Limited :Central Accounts Department Islami Bank Bangladesh Limited: Central Accounts Department. Bangladesh Bank: Banking Regulation and Policy Department Bangladesh bank: Scheduled Banks Statistics, April-June, 1997 issue.

31

Islami Bank Bangladesh Limited (1995) : Memorandum and Articles of Association of Al-Baraka bank Bangladesh Limited. Al-Bakara Bank Bangladesh Limited 91987): Memorandum and Articles of Association of al-Baraka Bank Bangladesh Limited. Al-Arafah Islami Bank Limited (1995): Memorandum and Articles of Association of alArafah islamic Bank Limited. Social Investment Bank Limited (1995): Memorandum and Article of Association of Social Investmen bank Limited. International Journal of Islamic Financial Services Vol. 1 No.3 Prime Bank Limited (1997): Annual Report, 1997, Page 15. Islami bank Bangladesh Limited : Tiaras Councils Reports, 1984-1997. Research Department, Bangladesh Bank (1997): On the Dynamism of Islamic banking in Bangladesh, latter issued to all the Islamic banks and Banks having Islamic banking Branches and Counters on 15th March, 1997 (Letter No. DR/PIED/IEC) 1/97). Islamic Banks Consultative forum (IBCF) 1997: Minutes of the first Meetings of all Islamic Banks and Banks having Islamic Board rook of Islami Bank Bangladesh Limited, Dhaka, Bangladesh. Bangladesh Bank : Minutes of the Discussion Meeting held at Bangladesh \bank with the Chairman and Managing Directors of the Islamic Banks on September 14, 1998. Khan, M.A. (1989): A Survey of Critical |Literature on Interest-Free Banking Journal of Islamic Banking and Finance 96:1), Karachi, Pakistan. Mirakhor, A: Progress and Challenges of Islamic banking, Review of Islamic Economics, vol. 4, No.2, 1997. Ahmed, E.A: Islamic banking: distribution of Profit (Case Study), unpublished Ph.D. Thesis, December 1990, University of Hull, UK. Faisal Islamic Bank, Board of Directors' Report to the Regular Annual Meeting of Shareholders, Sudan: Faisal Islamic Bank, May, 1981. Al-Gammal, Ghareeb, Islamic Banks and Financial Houses, Jeddah: Dar AI-Shurouq, 1978. Al-Hawary, Sayed, "Economic Philosophic Principles of Islamic Banking", International Seminar on Islamic Banking, Geneva, January 19-21, 1981. The International Association of Islamic Banks, Model Islamic Bank: Nb with mathematical model, Bahamas: The Islamic Investment Company Ltd. Kuwait Finance House, Third Annual Report, Kuwait: Kuwait Finance House, 1980. Kuwait Finance House, "Reading in the Balance-Sheets of Several Islamic Banks", Islamic Banks Magazine, Cairo, No.13,1980. Kenaranqui, R., Husseiny, A. A. and Sabri, Z.A, 'A Comprehensive Formal Approach to the Evaluation of Bids for Desalination Plants Using verbal Judgment', Desalination, Amsterdam, vol.33, No.3, June 1980, p.311. Al-Naggar, Ahmed, Principles of the Islamic Economic Theory, the International Association of Islamic Banks, 1980.

32

Reed, Edward W., and Others, Commercial Banking, Englewood Cliff, New Jersey: Prentice- Hall, Inc., 1980. SAMA (Saudi Arabian Monetary Agency), Banking Auditing Codes, Riyadh, Saudi Arabia: Saudi Arabian Monetary Agency, 1966. Siddiqi, Muhammad Nejatullah, Rationale of Islamic Banking, Jeddah, Saudi Arabia: International Centre for Research in Islamic Economics, King Abdulaziz University, 1981. Sofrata, H. and Abdul Fattah, A.F., "An Interactive Multi-Attribute Fuzzy Decision Analysis Package", IASTED International Symposium, San Diego, CA., U.S.A., July21-

33

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Report On Financial Inclusion BhaDocument53 pagesProject Report On Financial Inclusion Bhasuruchiathavale22123477% (13)

- Bancassurance: Products, Training and ProfitDocument11 pagesBancassurance: Products, Training and Profitshrivikram_795320213No ratings yet

- Financial Data Analysis of Ferozsons LaboratoryDocument36 pagesFinancial Data Analysis of Ferozsons Laboratorymartain maxNo ratings yet

- Union Bank PDFDocument61 pagesUnion Bank PDFRakeshNo ratings yet

- Specimen of A Trial Balance: S.No. Particulars L.F. Debit CreditDocument1 pageSpecimen of A Trial Balance: S.No. Particulars L.F. Debit CreditArun SankarNo ratings yet

- UEFA Stadium Design Guidelines PDFDocument160 pagesUEFA Stadium Design Guidelines PDFAbdullah Hasan100% (1)

- Maynilad On The MendDocument20 pagesMaynilad On The MendPoc Politi-ko ChannelNo ratings yet

- Chapter 2 MCQs On House PropertyDocument24 pagesChapter 2 MCQs On House PropertyRam Iyer100% (1)

- Chapter 28 Credit ManagementDocument26 pagesChapter 28 Credit ManagementKapil BansalNo ratings yet

- 2019form RevGIS NonStock UpdateDocument7 pages2019form RevGIS NonStock UpdateJohn Faustorilla100% (3)

- Unit III Capital MarketDocument27 pagesUnit III Capital MarketAbin VargheseNo ratings yet

- Home First Finance CompanyDocument12 pagesHome First Finance CompanyJ BNo ratings yet

- Modes Cvedil de Liuey: HypothecalionDocument6 pagesModes Cvedil de Liuey: Hypothecalionsohail shaikNo ratings yet

- Cash Management: Guide To Trading InternationallyDocument4 pagesCash Management: Guide To Trading InternationallySumanto SharanNo ratings yet

- Digest RR 12-2018Document5 pagesDigest RR 12-2018Jesi CarlosNo ratings yet

- Chapter 16 NotesDocument6 pagesChapter 16 Notesazizsuli49No ratings yet

- FORMULIR PENGADUAN Ke OMBUDSMANDocument4 pagesFORMULIR PENGADUAN Ke OMBUDSMANImam MuamarNo ratings yet

- Macomb Community College - Refund PolicyDocument1 pageMacomb Community College - Refund PolicyspicerjlNo ratings yet

- Breaking of Dawn - Reflection On 5 Years of The NCM 011211Document47 pagesBreaking of Dawn - Reflection On 5 Years of The NCM 011211ProshareNo ratings yet

- Contra Charging AR - APDocument3 pagesContra Charging AR - APb_rakes2005No ratings yet

- 2016 Library BudgetDocument20 pages2016 Library BudgetDarien LibraryNo ratings yet

- ch8 From InvestmentsDocument32 pagesch8 From InvestmentsMitchell GriffinNo ratings yet

- U.S. Bancorp & Capital Trust - Investment BankDocument4 pagesU.S. Bancorp & Capital Trust - Investment BankUS Bancorp Capital TrustNo ratings yet

- 21 Intangible AssetsDocument6 pages21 Intangible AssetsAdrian MallariNo ratings yet

- Analytical Views: FactoringDocument6 pagesAnalytical Views: FactoringingaleharshalNo ratings yet

- Research Proposal: Impact of Micro Finance Institutions On Women Empowerment in Zambia by Mutale Tricia BwalyaDocument19 pagesResearch Proposal: Impact of Micro Finance Institutions On Women Empowerment in Zambia by Mutale Tricia BwalyaUtkarsh MishraNo ratings yet

- Federal Loan ProgramsDocument2 pagesFederal Loan Programsaehsgo2collegeNo ratings yet

- (Colin Barrow) Practical Financial Management A G (BookFi)Document225 pages(Colin Barrow) Practical Financial Management A G (BookFi)RajyaLakshmi100% (2)

- Micro Credit Interventions and Its Effect On Empowerment of Rural WomenDocument7 pagesMicro Credit Interventions and Its Effect On Empowerment of Rural WomendrsajedNo ratings yet

- TVT Severance PlanDocument13 pagesTVT Severance PlanJudge ReinholdNo ratings yet