Professional Documents

Culture Documents

Investment Help Raises Return 7-12

Investment Help Raises Return 7-12

Uploaded by

CLORIS4Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Help Raises Return 7-12

Investment Help Raises Return 7-12

Uploaded by

CLORIS4Copyright:

Available Formats

Investment Help Raises Return

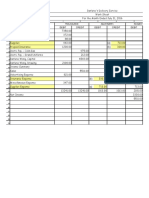

Investment "Help" Raises Return A new report from Aon Hewitt and Financial Engines found that 401(k) plan participants who used investment "help" had annual returns that were nearly three percent higher than those who handled their portfolios on their own. More than 400,000 participants' investment results over the 2006-2010 period were studied. Help in Defined Contribution Plans: 2006 Through 2010 reviewed the impact of professional investment "help," which was defined as online advice, managed accounts and target date funds for the purposes of this study. Not only did those who used help have higher returns, they accomplished that with lower risk. The gap was greatest in 2009, when those not using help experienced poorer investment performance due to investing errors and attempts at market timing at a time when the market was rallying. By the end of 2010, nearly one-third (30 percent) of participants were using help. Automatic enrollment and the availability of a Qualified Default Investment Vehicle (QDIA) likely contributed to this result. Target date funds are more likely to be used by younger participants with smaller account balances, while online advice is more likely to be used by younger participants with larger balances. Those close to retirement are most likely to use managed accounts. Participants aged 50 and older who did not take advantage of help had a wide variety of risk levels; some took on risk above that of the S&P 500 index. They also had the highest incidence of reacting impulsively in the 2008 market downturn by moving out of equities and into cash and bonds, which resulted in poor performance results in 2009. The report is available at http://tinyurl.com/HelpInDCPlans .

Kmotion, Inc., P.O. Box 1456, Tualatin, OR 97062; 877-306-5055; www.kmotion.com 2012 Kmotion, Inc. This newsletter is a publication of Kmotion, Inc., whose role is solely that of publisher. The articles and opinions in this publication are for general information only and are not intended to provide tax or legal advice or recommendations for any particular situation or type of retirement plan. Nothing in this publication should be construed as legal or tax guidance, nor as the sole authority on any regulation, law, or ruling as it applies to a specific plan or situation. Plan sponsors should consult the plans legal counsel or tax advisor for advice regarding plan-specific issues. Tracking #1-039445

Posted By: Patty Loris MBA, CFP.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. LPL Financial, Member FINRA/SIPC

This newsletter was created using Newsletter OnDemand, powered by S&P Capital IQ Financial Communications.

You might also like

- How America Saves - Vanguard Industry Report - July 2011Document92 pagesHow America Saves - Vanguard Industry Report - July 2011schultzdavidNo ratings yet

- Aon Hewitt Presentation FinalDocument21 pagesAon Hewitt Presentation FinalKomal KhushiNo ratings yet

- Fidelity 529 Unique PlanDocument75 pagesFidelity 529 Unique PlanJohn MichalakisNo ratings yet

- BOLD Investor PresentationDocument110 pagesBOLD Investor PresentationSerge Olivier Atchu YudomNo ratings yet

- Abintio Beginner 1Document2 pagesAbintio Beginner 1manjula mishraNo ratings yet

- Performance Summary: Market OutlookDocument2 pagesPerformance Summary: Market OutlookAnonymous Feglbx5No ratings yet

- Global Fund Investor Experience Report 2013Document172 pagesGlobal Fund Investor Experience Report 2013Dan BouchardNo ratings yet

- Where Do Investors Prefer To Find Non Financial InformationDocument4 pagesWhere Do Investors Prefer To Find Non Financial InformationpatishipeteNo ratings yet

- Performance Summary: Market OutlookDocument2 pagesPerformance Summary: Market OutlookAnonymous Feglbx5No ratings yet

- Finance Dissertation SampleDocument8 pagesFinance Dissertation SampleSomeoneToWriteMyPaperForMeEvansville100% (1)

- Dissertation Report of FinanceDocument5 pagesDissertation Report of FinanceCustomWrittenPapersClarksville100% (1)

- ANN PDFDocument48 pagesANN PDFAlejandroMaceoNo ratings yet

- Research Paper On Revenue CollectionDocument8 pagesResearch Paper On Revenue Collectionfyrqkxfq100% (1)

- Kotak ReportDocument9 pagesKotak ReportArjun SriHariNo ratings yet

- On-Line Chapter 3Document16 pagesOn-Line Chapter 3X TriphersNo ratings yet

- PFL Media Release Platform Wrap 312Document2 pagesPFL Media Release Platform Wrap 312Tuan Pham Heyts-YuNo ratings yet

- RGA Investment Advisors Envestnet Slides PDFDocument20 pagesRGA Investment Advisors Envestnet Slides PDFJason Gilbert100% (1)

- Research Paper On InvestmentDocument6 pagesResearch Paper On Investmentiqfjzqulg100% (1)

- The Top 100 Networked VentureDocument4 pagesThe Top 100 Networked VentureJobin GeorgeNo ratings yet

- Wtr2011 Ey FinalDocument70 pagesWtr2011 Ey FinalSBDUserNo ratings yet

- AFP Sales12 Research 1011aDocument3 pagesAFP Sales12 Research 1011aCris CalitinaNo ratings yet

- Corporate Governance and Value Creation - Private Equity StyleDocument9 pagesCorporate Governance and Value Creation - Private Equity StylemokitiNo ratings yet

- Looking For Finance Jobs: Best Entry-Level Positions: Lack of DiversityDocument3 pagesLooking For Finance Jobs: Best Entry-Level Positions: Lack of Diversitysami kamlNo ratings yet

- Chapter Six International Transparency and DisclosureDocument11 pagesChapter Six International Transparency and DisclosuremonikNo ratings yet

- 2011SU Features EcclesSaltzmanDocument7 pages2011SU Features EcclesSaltzmanBrankoNo ratings yet

- Performance Summary: Market OutlookDocument2 pagesPerformance Summary: Market OutlookAnonymous Feglbx5No ratings yet

- Managing The Information Cost of FinancingDocument8 pagesManaging The Information Cost of FinancingkbassignmentNo ratings yet

- Not Regulated Like Mutual FundsDocument3 pagesNot Regulated Like Mutual Fundssaivijay2018No ratings yet

- Tata Aig Life InsuranceDocument18 pagesTata Aig Life Insurancejohnconnor92No ratings yet

- Credit Performance of Private Equity Backed Companies in Great RecessionDocument29 pagesCredit Performance of Private Equity Backed Companies in Great Recessionhttp://besthedgefund.blogspot.comNo ratings yet

- Muhlenkamp 2014 08 28Document17 pagesMuhlenkamp 2014 08 28CanadianValueNo ratings yet

- AI Assignment 2Document8 pagesAI Assignment 2Fareeha SumairNo ratings yet

- Way Points Newsletter 2Q12Document2 pagesWay Points Newsletter 2Q12Anonymous Feglbx5No ratings yet

- Term Paper FinanceDocument5 pagesTerm Paper FinanceBestCustomPapersSingapore100% (2)

- The Journal of Finance - 2023 - DENESDocument71 pagesThe Journal of Finance - 2023 - DENESMary Avila CaroNo ratings yet

- Research Paper On Private EquityDocument8 pagesResearch Paper On Private Equitytutozew1h1g2100% (1)

- Tomorrow's Investor - Final Pension Survey ResultsDocument6 pagesTomorrow's Investor - Final Pension Survey ResultsThe RSANo ratings yet

- Synopsis For ThesisDocument8 pagesSynopsis For ThesismanojlongNo ratings yet

- Research Paper On UlipsDocument7 pagesResearch Paper On Ulipsafeawobfi100% (1)

- Artko Capital 2016 Q4 LetterDocument8 pagesArtko Capital 2016 Q4 LetterSmitty WNo ratings yet

- 2009 Annual MENA PE VC ReportDocument74 pages2009 Annual MENA PE VC ReportMatthew Craig-GreeneNo ratings yet

- Master Limited Partnerships 101:: Understanding MlpsDocument74 pagesMaster Limited Partnerships 101:: Understanding Mlpsstrongchong00No ratings yet

- Fidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Document2 pagesFidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Nais BNo ratings yet

- SR Z Shareholder Activism 2012Document20 pagesSR Z Shareholder Activism 2012BCM PartnersNo ratings yet

- D0803032031 PDFDocument12 pagesD0803032031 PDFAlex NaviliaNo ratings yet

- Zam FAM SavingsDocument4 pagesZam FAM SavingsNaveen SinghNo ratings yet

- Whitepaper Web Final NewDocument16 pagesWhitepaper Web Final NewjantjekutNo ratings yet

- Oh Africa!: Inside This IssueDocument5 pagesOh Africa!: Inside This IssuewhartonfinanceclubNo ratings yet

- Financial Times Top 400 ArticleDocument9 pagesFinancial Times Top 400 ArticlebgeltmakerNo ratings yet

- Task 3Document10 pagesTask 3Mesay AdaneNo ratings yet

- KMPG CB The Pulse of Fintech q2 2016 ReportDocument92 pagesKMPG CB The Pulse of Fintech q2 2016 ReportCrowdfundInsiderNo ratings yet

- 165Document1 page165بيان هيجاويNo ratings yet

- PitchBook US Institutional Investors 2016 PE VC Allocations ReportDocument14 pagesPitchBook US Institutional Investors 2016 PE VC Allocations ReportJoJo GunnellNo ratings yet

- How Sectors Perform Under Republicans vs. Democrats - J.P. Morgan Asset ManagementDocument2 pagesHow Sectors Perform Under Republicans vs. Democrats - J.P. Morgan Asset Managementsophie.j.liangNo ratings yet

- Philippines - Credit Rating: Employment of A Credit Rating by Its BearerDocument5 pagesPhilippines - Credit Rating: Employment of A Credit Rating by Its BearerSonny Boy SajoniaNo ratings yet

- Dissertation Financial AnalysisDocument5 pagesDissertation Financial AnalysisCanSomeoneWriteMyPaperRiverside100% (1)

- Research Spotlight: Taxation and Multinational ActivityDocument7 pagesResearch Spotlight: Taxation and Multinational ActivitySaina ChuhNo ratings yet

- Thesis On Pension FundsDocument6 pagesThesis On Pension Fundsmichellealexanderminneapolis100% (2)

- What To Look For in A Term SheetsDocument23 pagesWhat To Look For in A Term SheetsAnonymous 0hYUyCs3No ratings yet

- Pitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionDocument18 pagesPitchbook & Grant Thornton: Private Equity Exits Report 2011 Mid-Year EditionYA2301No ratings yet

- Market Commentary April 22, 2013Document3 pagesMarket Commentary April 22, 2013CLORIS4No ratings yet

- Market Commentary 1.28.2013Document3 pagesMarket Commentary 1.28.2013CLORIS4No ratings yet

- Market Commentary 2/25/13Document3 pagesMarket Commentary 2/25/13CLORIS4No ratings yet

- Market Commentary1!14!13Document3 pagesMarket Commentary1!14!13CLORIS4No ratings yet

- Market Commentary 3/18/13Document3 pagesMarket Commentary 3/18/13CLORIS4No ratings yet

- Market Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearDocument4 pagesMarket Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearCLORIS4No ratings yet

- Market Commentary 10-08-12Document3 pagesMarket Commentary 10-08-12CLORIS4No ratings yet

- Market Commentary 12-03-12Document3 pagesMarket Commentary 12-03-12CLORIS4No ratings yet

- Market Commentary 12-10-12Document3 pagesMarket Commentary 12-10-12CLORIS4No ratings yet

- Market Commentary 11-26-12Document3 pagesMarket Commentary 11-26-12CLORIS4No ratings yet

- How Will Expenses Change Your RetirementDocument1 pageHow Will Expenses Change Your RetirementCLORIS4No ratings yet

- Market Commentary 11-12-12Document4 pagesMarket Commentary 11-12-12CLORIS4No ratings yet

- Market Commentary 10-22-12Document3 pagesMarket Commentary 10-22-12CLORIS4No ratings yet

- Exit Strategies For EntrepreneursDocument1 pageExit Strategies For EntrepreneursCLORIS4No ratings yet

- Market Commentary 10-29-12Document3 pagesMarket Commentary 10-29-12CLORIS4No ratings yet

- Market Commentary 10-15-12Document3 pagesMarket Commentary 10-15-12CLORIS4No ratings yet

- Market Commentary 9-17-2012Document3 pagesMarket Commentary 9-17-2012CLORIS4No ratings yet

- Marrige and Your FiancesDocument1 pageMarrige and Your FiancesCLORIS4No ratings yet

- Exit Strategies For EntrepreneursDocument1 pageExit Strategies For EntrepreneursCLORIS4No ratings yet

- Payment For Sajadah CMTDocument2 pagesPayment For Sajadah CMTsihdkshfNo ratings yet

- AlDocument2 pagesAlsean gladimirNo ratings yet

- 15.2.7 Packet Tracer - Logging Network Activity (Answers) 15.2.7 Packet Tracer - Logging Network Activity (Answers)Document7 pages15.2.7 Packet Tracer - Logging Network Activity (Answers) 15.2.7 Packet Tracer - Logging Network Activity (Answers)crafNo ratings yet

- Ch-5 Transportation - BBA 2017-20 PDFDocument31 pagesCh-5 Transportation - BBA 2017-20 PDFDisha BhadaniNo ratings yet

- Financial Accounting Assignment: DescriptionDocument4 pagesFinancial Accounting Assignment: DescriptionMujahidNo ratings yet

- 1716524Document4 pages1716524Kamal KhuranaNo ratings yet

- Fin TechDocument32 pagesFin Techkritigupta.may1999No ratings yet

- PM Kisan PDFDocument1 pagePM Kisan PDFSekhar KazaNo ratings yet

- Report On Mobile Database SystemDocument29 pagesReport On Mobile Database SystemDeepak ChoudhuryNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisMohd Salleh AmboNo ratings yet

- CRM Croma Group 4Document15 pagesCRM Croma Group 4yamini kandikattuNo ratings yet

- A Peak Into AxelarDocument12 pagesA Peak Into AxelarShafee LNo ratings yet

- AIS Rep 1,2, 3Document6 pagesAIS Rep 1,2, 3Niia LeonesNo ratings yet

- CP Associates 2021 EnablerDocument15 pagesCP Associates 2021 Enablerprashant pradhan100% (1)

- Xuj JNZ XDFM3 e BJWDocument6 pagesXuj JNZ XDFM3 e BJWNARENDRA PRAVEEN VurukutiNo ratings yet

- Digital Banking: by Navdeep KaurDocument7 pagesDigital Banking: by Navdeep KaurNavdeep Kaur XII-ENo ratings yet

- Tait DMR TN9500 Inter-Network Gateway - SpecificationsDocument4 pagesTait DMR TN9500 Inter-Network Gateway - Specificationsgnosis technologyNo ratings yet

- Chapter 8 WorkingPapers 315F0EBDBB892Document16 pagesChapter 8 WorkingPapers 315F0EBDBB892Lalee ThomasNo ratings yet

- Sample Affidavit of Lost SSS IDDocument2 pagesSample Affidavit of Lost SSS IDJohnLesterDeLeon100% (1)

- Elazar Gilad: Spill Media CMODocument4 pagesElazar Gilad: Spill Media CMOElazar GiladNo ratings yet

- Product Disclosure SheetDocument10 pagesProduct Disclosure SheetIzzudin Nur Syahmie Shahrol AffendiNo ratings yet

- 36304-Cell SelectionDocument46 pages36304-Cell SelectionAhmedNo ratings yet

- Ministry: Dated Is of ForDocument2 pagesMinistry: Dated Is of ForAbhishekNo ratings yet

- Table 6.11: 25 Years Traffic Projection (Section 8)Document27 pagesTable 6.11: 25 Years Traffic Projection (Section 8)Mehran AliNo ratings yet

- Summer Report On H.P. State Cooperative BankDocument61 pagesSummer Report On H.P. State Cooperative BankVIKAS DOGRA71% (7)

- Commercial Mortgage Broker Leads ListDocument102 pagesCommercial Mortgage Broker Leads ListMalik UzairNo ratings yet

- Account Statement For Account:3869000100750616: Branch DetailsDocument4 pagesAccount Statement For Account:3869000100750616: Branch DetailsUddeshya SrivastavaNo ratings yet

- Admission Nursing AssessmentDocument20 pagesAdmission Nursing AssessmentKhaskheli NusratNo ratings yet

- Tourism Product Is A Concept That Is Made Up of Many Components, Such As Tourist Attractions, Provision of Tourism Product Is ADocument2 pagesTourism Product Is A Concept That Is Made Up of Many Components, Such As Tourist Attractions, Provision of Tourism Product Is AVanessa VanessaNo ratings yet