Professional Documents

Culture Documents

NSE Circular - Algo2

NSE Circular - Algo2

Uploaded by

prasadpatankar9Copyright:

Available Formats

You might also like

- (KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketDocument27 pages(KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketJay LeeNo ratings yet

- 20005rmo 10-05Document16 pages20005rmo 10-05Cheng OlayvarNo ratings yet

- User Manual For IREPS Reverse AuctionDocument14 pagesUser Manual For IREPS Reverse AuctionVikash Singhi0% (1)

- Automated Crypto Trading BotDocument6 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- ATM User ManualDocument22 pagesATM User ManualPradip KumarNo ratings yet

- User Requirement Specification (URS)Document7 pagesUser Requirement Specification (URS)Yamin JamilNo ratings yet

- The Comprehensive Management Plan For Algorithmic Trading in The KRX Derivatives MarketDocument26 pagesThe Comprehensive Management Plan For Algorithmic Trading in The KRX Derivatives MarketJay LeeNo ratings yet

- Vistex Contracts Overview PDFDocument26 pagesVistex Contracts Overview PDFPrasad KanetkarNo ratings yet

- What Ails Us About High Frequency Trading - Final 2 10-5-09Document4 pagesWhat Ails Us About High Frequency Trading - Final 2 10-5-09prasadpatankar9No ratings yet

- Basel II CheatsheetDocument8 pagesBasel II CheatsheetBhabaniParidaNo ratings yet

- Consultation Paper Algorithmic Trading by Retail Investors: 1. ObjectiveDocument5 pagesConsultation Paper Algorithmic Trading by Retail Investors: 1. Objectivepardeep564No ratings yet

- Algo Trading Activation Ver 1 4Document2 pagesAlgo Trading Activation Ver 1 4sureshbhai3883No ratings yet

- Parts Sale - Electronic OrderingDocument8 pagesParts Sale - Electronic OrderingRajesh SinghNo ratings yet

- Annexure - 1 Functional Requirement Specification - 1Document347 pagesAnnexure - 1 Functional Requirement Specification - 1AdilsonNo ratings yet

- IPL Electronic Trading Training and Information Pack - December 2015 - (Instinet Pacific LTD.)Document70 pagesIPL Electronic Trading Training and Information Pack - December 2015 - (Instinet Pacific LTD.)QuantDev-MNo ratings yet

- Annexure - C (Auditors Qualification)Document3 pagesAnnexure - C (Auditors Qualification)Nilesh JawaleNo ratings yet

- Annexure 1 Functional Requirement Specification - 1 - 1Document1,442 pagesAnnexure 1 Functional Requirement Specification - 1 - 1Khuda BukshNo ratings yet

- MCXDocument32 pagesMCXMANSI POKARNANo ratings yet

- E TenderingDocument10 pagesE TenderingShahin KunhiNo ratings yet

- Chapter 3: Secondary Market (Trading in Shares) : 3.1 National Stock ExchangeDocument7 pagesChapter 3: Secondary Market (Trading in Shares) : 3.1 National Stock ExchangeArjun ChhabriaNo ratings yet

- Custodial Participant Code FAQDocument4 pagesCustodial Participant Code FAQsamir.bandopadhyayNo ratings yet

- NEAT Chapter 1Document6 pagesNEAT Chapter 1Vivek KansalNo ratings yet

- Systemaudit PDocument39 pagesSystemaudit PMANSI POKARNANo ratings yet

- Automated Crypto Trading BotDocument7 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- Cyberia Trader EADocument8 pagesCyberia Trader EAMj ArNo ratings yet

- TCS FS AlgorithmictradingDocument14 pagesTCS FS AlgorithmictradingpercysearchNo ratings yet

- RMC No 68-2015Document4 pagesRMC No 68-2015Pedro Brugada100% (1)

- Karnataka E Mandi DocumentDocument7 pagesKarnataka E Mandi DocumentSaurabh KumarNo ratings yet

- Capital Market (CMDM) Module - NewDocument56 pagesCapital Market (CMDM) Module - NewDeepak OjhaNo ratings yet

- Margin Builder Tool OverviewDocument3 pagesMargin Builder Tool OverviewRedingtonValueNo ratings yet

- Wg2presentation1 062012Document17 pagesWg2presentation1 062012Douglas AshburnNo ratings yet

- Automated Forex TradingDocument7 pagesAutomated Forex Trading1dariusjsbcglobalNo ratings yet

- Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternasDocument8 pagesRepublika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternaslucasNo ratings yet

- SRM ManualDocument127 pagesSRM ManualPrashant VanjariNo ratings yet

- Algorithmic Trading 2023apDocument4 pagesAlgorithmic Trading 2023apAnouar HarourateNo ratings yet

- Algo Trading Ami PartDocument6 pagesAlgo Trading Ami PartamiNo ratings yet

- Chapter 4Document41 pagesChapter 4MubeenNo ratings yet

- Urgent Need of Procurement Management Information System (PMIS) For Improving Public ProcurementsDocument5 pagesUrgent Need of Procurement Management Information System (PMIS) For Improving Public Procurementsprayas09No ratings yet

- MSD57331Document48 pagesMSD57331aaravswastikNo ratings yet

- m4m Mt5 ManualDocument44 pagesm4m Mt5 ManualElsaNo ratings yet

- ORIGINAL - Car Dealership Management SystemDocument80 pagesORIGINAL - Car Dealership Management SystemAbdulrehman FastNUNo ratings yet

- BusinessPlan BinaryTradingDocument11 pagesBusinessPlan BinaryTradinghukaNo ratings yet

- Capital Market Segment Circular No: 038 /2011: July 08, 2011Document13 pagesCapital Market Segment Circular No: 038 /2011: July 08, 2011Ieshan GaurNo ratings yet

- SRS For Auctioning SystemDocument21 pagesSRS For Auctioning SystemSiddu Rajeshwar100% (2)

- Jackpot Trading Contest RulesDocument11 pagesJackpot Trading Contest RulesAfif Nuril AnwarNo ratings yet

- Foreign Trading System ReportDocument45 pagesForeign Trading System Reportabinsha78% (9)

- Treasury OperationsDocument28 pagesTreasury OperationsAbhi Maheshwari100% (1)

- Car MarketsDocument30 pagesCar Marketsdhjxf7prmkNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument5 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- ARB XML-guideDocument22 pagesARB XML-guidepraveenk100% (8)

- Automated Forex Trading Systems With Chatgpt Learn, Improve, and Enjoy Forex Trading With Your Ai Companion (Paul Wealth) (Z-Library)Document66 pagesAutomated Forex Trading Systems With Chatgpt Learn, Improve, and Enjoy Forex Trading With Your Ai Companion (Paul Wealth) (Z-Library)Siju KayNo ratings yet

- SIR-Doorstep Hardware and Software Service SystemDocument10 pagesSIR-Doorstep Hardware and Software Service SystemTaj SNo ratings yet

- Chapter 3 Securities Operations and Risk ManagementDocument88 pagesChapter 3 Securities Operations and Risk ManagementMRIDUL GOEL100% (1)

- Master Card Merchant Admin Guide MR 25Document119 pagesMaster Card Merchant Admin Guide MR 25Ji MeiNo ratings yet

- National Stock Exchange of India LimitedDocument3 pagesNational Stock Exchange of India LimitedKeval ShahNo ratings yet

- Sales and MarketingDocument8 pagesSales and MarketingPatelMounalNo ratings yet

- Algorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesFrom EverandAlgorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- GRIPS Macroeconomics II Fall II Semester, 2016 Problem Set 4Document1 pageGRIPS Macroeconomics II Fall II Semester, 2016 Problem Set 4prasadpatankar9No ratings yet

- GRIPS Macroeconomics II Fall II Semester, 2016 Lecture 3: Keynesian AD Curve (1) : The Money Market and The LM CurveDocument3 pagesGRIPS Macroeconomics II Fall II Semester, 2016 Lecture 3: Keynesian AD Curve (1) : The Money Market and The LM Curveprasadpatankar9No ratings yet

- LectureNote6 GRIPS PDFDocument6 pagesLectureNote6 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote12 GRIPS PDFDocument6 pagesLectureNote12 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote11 GRIPS PDFDocument8 pagesLectureNote11 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote1 GRIPS PDFDocument5 pagesLectureNote1 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote7 GRIPS PDFDocument8 pagesLectureNote7 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote8 GRIPSDocument10 pagesLectureNote8 GRIPSprasadpatankar9No ratings yet

- LectureNote5 GRIPS PDFDocument7 pagesLectureNote5 GRIPS PDFprasadpatankar9No ratings yet

- Man Kiw Chapter 06 Solutions ProblemsDocument9 pagesMan Kiw Chapter 06 Solutions ProblemsJosemariaSaNo ratings yet

- UH131 Spring2012 Hw1ans PDFDocument6 pagesUH131 Spring2012 Hw1ans PDFprasadpatankar9No ratings yet

- The Effect of High-Frequency Trading On Stock Volatility and Price DiscoveryDocument53 pagesThe Effect of High-Frequency Trading On Stock Volatility and Price Discoveryprasadpatankar9No ratings yet

- Bse - AlgoDocument1 pageBse - Algoprasadpatankar9No ratings yet

- Algorithmic Trading Usage Patterns and Their Costs: Executive SummaryDocument17 pagesAlgorithmic Trading Usage Patterns and Their Costs: Executive SummaryYanNo ratings yet

- Session 3A 2 GolubDocument27 pagesSession 3A 2 Golubprasadpatankar9No ratings yet

- Ts Algo SurveyDocument16 pagesTs Algo Surveyprasadpatankar9No ratings yet

- NSEDocument16 pagesNSESajoy P.B.No ratings yet

- NYSE Dealing RulesDocument206 pagesNYSE Dealing Rulesprasadpatankar9No ratings yet

- Hasbrouck SaarDocument57 pagesHasbrouck SaarWoo-seock JungNo ratings yet

- Larry TABB - HFT - Part 1Document18 pagesLarry TABB - HFT - Part 1prasadpatankar9No ratings yet

- IOSCOPD354Document60 pagesIOSCOPD354prasadpatankar9No ratings yet

- Municipality of Guipos: Republic of The Philippines Province of Zamboanga de SurDocument21 pagesMunicipality of Guipos: Republic of The Philippines Province of Zamboanga de SurMelvinson Loui Polenzo SarcaugaNo ratings yet

- 4.3. Obligations of Borrowers: Questions To PonderDocument6 pages4.3. Obligations of Borrowers: Questions To PonderTin CabosNo ratings yet

- Solved Suppose Congress and The President Decide To Increase Government PurchasesDocument1 pageSolved Suppose Congress and The President Decide To Increase Government PurchasesM Bilal SaleemNo ratings yet

- Sample Paperpre Board II Acct 2324-2Document10 pagesSample Paperpre Board II Acct 2324-2kanakchauhan206No ratings yet

- Laptop InvoiceDocument1 pageLaptop InvoicePranjal ThakurNo ratings yet

- NRO Vs NREDocument3 pagesNRO Vs NREsushantNo ratings yet

- Fiber Monthly Statement: This Month's SummaryDocument3 pagesFiber Monthly Statement: This Month's SummaryHimanshuNo ratings yet

- Chap 3 Bonds and Their ValuationDocument42 pagesChap 3 Bonds and Their ValuationShahzad C7No ratings yet

- Materi Lab 8 - Intercompany Profit Transactions - BondsDocument5 pagesMateri Lab 8 - Intercompany Profit Transactions - BondsAlvira FajriNo ratings yet

- Credit MonitoringDocument15 pagesCredit MonitoringSyam Sandeep67% (3)

- Portfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsDocument23 pagesPortfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsHoda El HALABINo ratings yet

- 15-IFRS 15 - SummaryDocument6 pages15-IFRS 15 - SummaryhusseinNo ratings yet

- Somali Sports Fashion Centre: S S F CDocument10 pagesSomali Sports Fashion Centre: S S F CAnonymous U5JZ8NOquNo ratings yet

- Canterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingDocument10 pagesCanterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingSuman GautamNo ratings yet

- Specimen Paper - Maths A&I SL - Answers: November 23, 2021Document2 pagesSpecimen Paper - Maths A&I SL - Answers: November 23, 2021Jaime Molano Moreno0% (1)

- Easy To Pay Centogene": 1. Payment by Bank TransferDocument2 pagesEasy To Pay Centogene": 1. Payment by Bank TransferEh MohamedNo ratings yet

- Termeni Contabili in EnglezaDocument11 pagesTermeni Contabili in EnglezaCrisan AnamariaNo ratings yet

- Financial and Business Risk Management 1 PDFDocument75 pagesFinancial and Business Risk Management 1 PDFrochelleandgelloNo ratings yet

- Audit Prob InvestmentDocument5 pagesAudit Prob InvestmentANGIE BERNAL100% (1)

- You Must Answer Part One You Must Also Answer One Question From Part Two and Two Questions From Part Three Time Limit 3 HoursDocument17 pagesYou Must Answer Part One You Must Also Answer One Question From Part Two and Two Questions From Part Three Time Limit 3 HoursmissmawarlinaNo ratings yet

- RCA 204, Innovation & Entrepreneurship: Unit Iv: (8 HRS)Document12 pagesRCA 204, Innovation & Entrepreneurship: Unit Iv: (8 HRS)Anonymous MhCdtwxQINo ratings yet

- IPeople Inc - SEC Form 17-C Appointment of New Chief Risk Officer - June 1, 2021Document3 pagesIPeople Inc - SEC Form 17-C Appointment of New Chief Risk Officer - June 1, 2021dawijawof awofnafawNo ratings yet

- Thompson-DeWitt Financial Group's New York Advisory Office Jumps Into The Asset-Based Lending ArenaDocument3 pagesThompson-DeWitt Financial Group's New York Advisory Office Jumps Into The Asset-Based Lending ArenaPR.comNo ratings yet

- Narrative ReportDocument79 pagesNarrative ReportJerald Kim VasquezNo ratings yet

- Resource Allocation and Financial Planning: Presented byDocument38 pagesResource Allocation and Financial Planning: Presented byAirish Roperez EsplanaNo ratings yet

- Hyperinflation in Germany, 1914-1923: (This Article Is Excerpted From The Book .)Document10 pagesHyperinflation in Germany, 1914-1923: (This Article Is Excerpted From The Book .)hipsterzNo ratings yet

- A. B. C. D. CompletenessDocument3 pagesA. B. C. D. Completenessedrick LouiseNo ratings yet

- Seminar 1 - QsDocument2 pagesSeminar 1 - QsMaman AbdurrahmanNo ratings yet

- Galgotias University: Bba+Llb (Hons) Section-B Semester-VthDocument11 pagesGalgotias University: Bba+Llb (Hons) Section-B Semester-VthTannu guptaNo ratings yet

NSE Circular - Algo2

NSE Circular - Algo2

Uploaded by

prasadpatankar9Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NSE Circular - Algo2

NSE Circular - Algo2

Uploaded by

prasadpatankar9Copyright:

Available Formats

CAPITAL MARKET SEGMENT Circular No. 025 / 2011 Sub.

: Decision Support Tools / Algorithms for trading through Non-Neat front end

Date: May 17, 2011

Download No.: 17796 Kapil Jaikalyani Prerana Nair Amit Thakkar Hanisha Paryani Neha Lakhani Andrew Pereira

This is in continuation of Circular No. NSE/CMO/31/2008 dated June 09, 2008 and NSE/CMO/039/2009 dated July 22, 2009 pertaining to Decision Support Tools / Algorithms for trading through Non Non-Neat front end. Trading members have represented to the Exchange to smoothen the process an and facilitate the early approval of the Decision Support Tools / Algorithms for trading through Non-Neat front end. Accordingly, to facilitate efficient and speedy approval of Neat the Decision Support Tools / Algorithms, the approval process for the same has been revised. 1. Procedure for granting permission to Trading members The Decision Support Tools / Algorithms applications submitted by the members would ications be categorized as follows for granting of approval.

022-2659 8150 022-2659 8446

a) Approved algorithms through CTCL This procedure will be applicable for granting approval to trading members for Approved Algorithms supplied by vendors (procedure for identification of Approved lgorithms ure Algorithms is provided below).

022-2659 8447

backoffice@nse.co.in

Members desirous of seeking approval for Approved Algorithms shall make an application to the Exchange. The format of the Application is enclosed (Annexure A). On verification of the documents and fulfillment of the conditions as satisfactory and documents meeting SEBI / Exchange minimum requirements, the Exchange shall grant permission to the member for the usage of Approved Algorithms through CTCL. b) Non-approved algorithms through CTCL pproved This procedure will be applicable for granting approval to trading members for Non Nonapproved algorithms. These algorithms may be in-house developed by member or house vendor supplied.

No. of Pages: 8

Members desirous of seeking approval for Non-approved Algorithms shall make an application to the Exchange. The format of the Application is enclosed (Annexure A). The Member shall be required to give demonstration of the automated Risk Management features for each Decision Support Tool / Algorithmic trading product. On verification of the documents and fulfillment of the conditions as satisfactory and meeting SEBI / Exchange minimum requirements, the Exchange shall grant permission to the member for the usage of Non-Approved Algorithms through CTCL. Subsequently, the member shall be required to inform the Exchange in case of any changes to the version number or risk management features of the Decision Support Tool / Algorithmic trading product.

c) DMA algorithms Trading Member / Institutional Client algorithms This procedure will be applicable for granting approval to trading member for DMA algorithms Trading member or institutional client algorithms. These algorithms may be in-house developed by member, vendor supplied or institutional client proprietary algorithms. Members desirous of seeking approval of algorithms through Direct Market Access facility as approved by the Exchange shall make an application to the Exchange. The format of the Application is enclosed (Annexure A). On verification of the documents and fulfillment of the conditions as satisfactory and meeting SEBI / Exchange minimum requirements, the Exchange shall grant permission to the member for the usage of Approved Algorithms through CTCL. 2. Procedure for Identification of Decision Support Tools / Algorithms as Approved Algorithm Vendors offering Decision Support Tools / Algorithmic trading products to trading members and desirous of having their Decision Support Tools / Algorithmic trading products identified as Approved Algorithms shall apply to the Exchange. The format of the Application is enclosed (Annexure B). On fulfillment of the conditions as satisfactory and meeting SEBI / Exchange minimum requirements, the Exchange may identify the vendors Decision Support Tools / Algorithmic trading product as Approved Algorithm. The Exchange may request for any additional information as it deems fit.

3. Additional category of Non- Neat User: Members using Non- Neat Front End have represented to provide a separate user in addition to current categories without a NEAT login facility. The rationale behind this requirement was that such user id is used only for control and validation and not for trading. Hence, Exchange proposes to provide a separate category of Non-Neat user without NEAT login facility along with the current categories of users. Members are requested to note that such category of user shall not be allowed to login/ trade through NEAT/NEAT Plus. Members will be required to build additional back up facilities for exigency. This category of user will not be required to provide any certification as the user does not have trading eligibility by itself. The procedure for requesting such user ids will be provided separately.

4. Risk Managers for Algorithmic Terminals: Pursuant to representation from trading members, it is proposed that, each risk manager shall be allowed to manage multiple algorithms under a single risk management system. Hence it would be considered as single dealer for the compliance purpose. For National Stock Exchange of India Limited

Suprabhat Lala Vice President

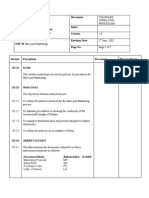

Annexure A Application form for permission for providing Decision Support Tools / Algorithms trading (To be executed on letterhead of the Member) We/I, _________________ having my/our Registered Office/Office at _________ am/are trading member/s of the Capital Market segment / Futures and Options segment / Currency Derivatives segment of the National Stock Exchange of India Limited; hereby apply for the permission of the Exchange for providing Decision Support Tools / Algorithms trading. S No. 1 2 3 Particulars Name of the Trading Member : SEBI Registration number : Registered Office/ Office address : Telephone : Fax No. : Name of the Authorised Signatory and Designation Contact address of the Authorised Signatory : Telephone No. : Fax No. : Approval for Details

4 5

Approved Algorithm through CTCL Non-approved Algorithm through CTCL DMA Algorithms Trading Member or Institutional Client Algorithms Execution Algorithm Arbitrage Algorithm Alpha seeking Algorithm High Frequency Trading Others YES / NO

Type of algorithm

9 10 11

Whether the software providing Decision Support Tools / Algorithms trading is being developed by the member on his own If not, name of software vendor developing Software Strategy Name and Version number Complete address of server routing Algorithm orders to the Exchange

12

13

14.

15

16

trading system. Confirmation letter from the vendor YES / NO supplying the Decision Support Tool / Algorithmic trading product is attached (Applicable only in case of Approved Algorithm through CTCL) Details regarding the vendor who has developed the CTCL / adapter and automated risk management system using which the Decision Support Tools / Algorithmic trading product shall connect to the Exchange Trading system (Applicable only in case of Non-approved Algorithm through CTCL) Details of approved Direct Market Access (DMA) using which the algorithm orders shall be released to the Exchange DMA Application Name : Version number : DMA Approval Date : (Applicable only in case of DMA Algorithms) Trading Member / Institutional client Trading Member / Institutional client Algorithms (Applicable only in case of Algorithms DMA Algorithms) Name of Institutional client (Applicable only in case of DMA Algorithm Institutional client Algorithms)

We confirm and certify that the software for Decision Support Tools / Algorithms trading has undergone tests by us and are satisfied and we undertake to comply with and be bound by the Rules, Bye-laws, Regulations of the Exchange, SEBI, RBI and any other statutory and regulatory body(ies) as may be applicable from time to time. We certify that all the statements are true and correct to the best of our knowledge. We are aware that in case any of the statements are found to be incorrect or false, we are liable for disciplinary action. We understand that the Exchange reserves the right to call for additional information / documents / demonstration related to any Decision Support Tool / Algorithm at any time as it may deem fit. Signed sealed and delivered by the Authorised representative of the MEMBER. Authorised Signatory Name Stamp of the Trading Member

Annexure A1 NOTWITHSTANDING the generality of the above, the software provided complies with the following provisions in particular as directed by SEBI / NSE. S No. 1 Requirement The software provides for routing of orders through electronic / automated risk management systems of the broker to carry out appropriate validations of all risk parameters before released to the Exchange trading system including Individual Order Level: Quantity Limits check Price Range checks Trade price protection checks Order value checks Client Level: Net position v/s available margins RBI violation checks for FII restricted stocks MWPL violation checks Position limit checks Trading limit checks Exposure limit checks at individual client level and at overall level for all clients The system has Provision for generating and maintaining complete Audit Trail. The orders generated by Decision Support Tools / Algorithmic trading products are identified as Algorithm orders while releasing to the Exchange All orders generated by Decision Support Tools / Algorithmic trading products are offered to the market for matching and no cross trades are generated The system has sufficient security features including password protection for the user ID, automatic expiry of passwords as the end of a reasonable duration and reinitialisation of access on entering fresh passwords Whether complied (Yes / No) YES / NO

2 3

YES / NO YES / NO

YES / NO

YES / NO

Annexure B Application form for identification of Decision Support Tools / Algorithms trading as Approved Algorithms (To be executed on letterhead of the Vendor) I / We ______________________________________, an individual / a firm registered under the Indian Partnership Act, 1932 / a Company / Body Corporate incorporated under the Companies Act of 1956/ __________________________ Act, ___, and residing at / having our registered office at _____________________________________________. We are desirous of making available Decision Support Tools/Algorithms to trading members of the Exchange in Capital Markets/ Future & Options Segments/ Currency Derivative Segments for the purpose of Algorithmic Trading; hereby apply for the permission of the Exchange for identification of Decision Support Tools / Algorithms trading as Approved Algorithm S No. 1 2 Particulars Name of the Software Vendor Registered Office/ Office address : Telephone : Fax No. : Name of the Authorised Signatory and Designation Contact address of the Authorised Signatory : Telephone No. : Fax No. : Strategy Name and Version number Type of algorithm Details

3 4

5 6

Whether CTCL / adapter and automated risk management system using which the Decision Support Tools / Algorithmic trading product shall connect to the Exchange Trading system is developed by the vendor on his own 8 If not, name of vendor who has developed CTCL / adapter automated risk management system to which the Decision Support Tools / Algorithmic trading product is integrated Signature of Authorized Signatory of the Vendor Name of the Vendor Date : Place: Stamp/Seal :

Execution Algorithm Arbitrage Algorithm Alpha seeking Algorithm High Frequency Trading Others YES / NO

Annexure B1 NOTWITHSTANDING the generality of the above, the software provided complies with the following provisions in particular as directed by SEBI / NSE. S No. 1 Requirement The software provides for routing of orders through electronic / automated risk management systems of the broker to carry out appropriate validations of all risk parameters before released to the Exchange trading system including Individual Order Level: Quantity Limits check Price Range checks Trade price protection checks Order value checks Client Level: Net position v/s available margins RBI violation checks for FII restricted stocks MWPL violation checks Position limit checks Trading limit checks Exposure limit checks at individual client level and at overall level for all clients The system has Provision for generating and maintaining complete Audit Trail. The orders generated by Decision Support Tools / Algorithmic trading products are identified as Algorithm orders while releasing to the Exchange All orders generated by Decision Support Tools / Algorithmic trading products are offered to the market for matching and no cross trades are generated The system has sufficient security features including password protection for the user ID, automatic expiry of passwords as the end of a reasonable duration and reinitialisation of access on entering fresh passwords Whether complied (Yes / No) YES / NO

2 3

YES / NO YES / NO

YES / NO

YES / NO

You might also like

- (KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketDocument27 pages(KRX) Management+Plan+for+Algorithmic+Trading (1) Algorithmic Trading in The KRX Derivatives MarketJay LeeNo ratings yet

- 20005rmo 10-05Document16 pages20005rmo 10-05Cheng OlayvarNo ratings yet

- User Manual For IREPS Reverse AuctionDocument14 pagesUser Manual For IREPS Reverse AuctionVikash Singhi0% (1)

- Automated Crypto Trading BotDocument6 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- ATM User ManualDocument22 pagesATM User ManualPradip KumarNo ratings yet

- User Requirement Specification (URS)Document7 pagesUser Requirement Specification (URS)Yamin JamilNo ratings yet

- The Comprehensive Management Plan For Algorithmic Trading in The KRX Derivatives MarketDocument26 pagesThe Comprehensive Management Plan For Algorithmic Trading in The KRX Derivatives MarketJay LeeNo ratings yet

- Vistex Contracts Overview PDFDocument26 pagesVistex Contracts Overview PDFPrasad KanetkarNo ratings yet

- What Ails Us About High Frequency Trading - Final 2 10-5-09Document4 pagesWhat Ails Us About High Frequency Trading - Final 2 10-5-09prasadpatankar9No ratings yet

- Basel II CheatsheetDocument8 pagesBasel II CheatsheetBhabaniParidaNo ratings yet

- Consultation Paper Algorithmic Trading by Retail Investors: 1. ObjectiveDocument5 pagesConsultation Paper Algorithmic Trading by Retail Investors: 1. Objectivepardeep564No ratings yet

- Algo Trading Activation Ver 1 4Document2 pagesAlgo Trading Activation Ver 1 4sureshbhai3883No ratings yet

- Parts Sale - Electronic OrderingDocument8 pagesParts Sale - Electronic OrderingRajesh SinghNo ratings yet

- Annexure - 1 Functional Requirement Specification - 1Document347 pagesAnnexure - 1 Functional Requirement Specification - 1AdilsonNo ratings yet

- IPL Electronic Trading Training and Information Pack - December 2015 - (Instinet Pacific LTD.)Document70 pagesIPL Electronic Trading Training and Information Pack - December 2015 - (Instinet Pacific LTD.)QuantDev-MNo ratings yet

- Annexure - C (Auditors Qualification)Document3 pagesAnnexure - C (Auditors Qualification)Nilesh JawaleNo ratings yet

- Annexure 1 Functional Requirement Specification - 1 - 1Document1,442 pagesAnnexure 1 Functional Requirement Specification - 1 - 1Khuda BukshNo ratings yet

- MCXDocument32 pagesMCXMANSI POKARNANo ratings yet

- E TenderingDocument10 pagesE TenderingShahin KunhiNo ratings yet

- Chapter 3: Secondary Market (Trading in Shares) : 3.1 National Stock ExchangeDocument7 pagesChapter 3: Secondary Market (Trading in Shares) : 3.1 National Stock ExchangeArjun ChhabriaNo ratings yet

- Custodial Participant Code FAQDocument4 pagesCustodial Participant Code FAQsamir.bandopadhyayNo ratings yet

- NEAT Chapter 1Document6 pagesNEAT Chapter 1Vivek KansalNo ratings yet

- Systemaudit PDocument39 pagesSystemaudit PMANSI POKARNANo ratings yet

- Automated Crypto Trading BotDocument7 pagesAutomated Crypto Trading BotAutonioNo ratings yet

- Cyberia Trader EADocument8 pagesCyberia Trader EAMj ArNo ratings yet

- TCS FS AlgorithmictradingDocument14 pagesTCS FS AlgorithmictradingpercysearchNo ratings yet

- RMC No 68-2015Document4 pagesRMC No 68-2015Pedro Brugada100% (1)

- Karnataka E Mandi DocumentDocument7 pagesKarnataka E Mandi DocumentSaurabh KumarNo ratings yet

- Capital Market (CMDM) Module - NewDocument56 pagesCapital Market (CMDM) Module - NewDeepak OjhaNo ratings yet

- Margin Builder Tool OverviewDocument3 pagesMargin Builder Tool OverviewRedingtonValueNo ratings yet

- Wg2presentation1 062012Document17 pagesWg2presentation1 062012Douglas AshburnNo ratings yet

- Automated Forex TradingDocument7 pagesAutomated Forex Trading1dariusjsbcglobalNo ratings yet

- Republika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternasDocument8 pagesRepublika NG Pilipinas Kagawaran NG Pananalapi Kawanihan NG Rentas InternaslucasNo ratings yet

- SRM ManualDocument127 pagesSRM ManualPrashant VanjariNo ratings yet

- Algorithmic Trading 2023apDocument4 pagesAlgorithmic Trading 2023apAnouar HarourateNo ratings yet

- Algo Trading Ami PartDocument6 pagesAlgo Trading Ami PartamiNo ratings yet

- Chapter 4Document41 pagesChapter 4MubeenNo ratings yet

- Urgent Need of Procurement Management Information System (PMIS) For Improving Public ProcurementsDocument5 pagesUrgent Need of Procurement Management Information System (PMIS) For Improving Public Procurementsprayas09No ratings yet

- MSD57331Document48 pagesMSD57331aaravswastikNo ratings yet

- m4m Mt5 ManualDocument44 pagesm4m Mt5 ManualElsaNo ratings yet

- ORIGINAL - Car Dealership Management SystemDocument80 pagesORIGINAL - Car Dealership Management SystemAbdulrehman FastNUNo ratings yet

- BusinessPlan BinaryTradingDocument11 pagesBusinessPlan BinaryTradinghukaNo ratings yet

- Capital Market Segment Circular No: 038 /2011: July 08, 2011Document13 pagesCapital Market Segment Circular No: 038 /2011: July 08, 2011Ieshan GaurNo ratings yet

- SRS For Auctioning SystemDocument21 pagesSRS For Auctioning SystemSiddu Rajeshwar100% (2)

- Jackpot Trading Contest RulesDocument11 pagesJackpot Trading Contest RulesAfif Nuril AnwarNo ratings yet

- Foreign Trading System ReportDocument45 pagesForeign Trading System Reportabinsha78% (9)

- Treasury OperationsDocument28 pagesTreasury OperationsAbhi Maheshwari100% (1)

- Car MarketsDocument30 pagesCar Marketsdhjxf7prmkNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument5 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- ARB XML-guideDocument22 pagesARB XML-guidepraveenk100% (8)

- Automated Forex Trading Systems With Chatgpt Learn, Improve, and Enjoy Forex Trading With Your Ai Companion (Paul Wealth) (Z-Library)Document66 pagesAutomated Forex Trading Systems With Chatgpt Learn, Improve, and Enjoy Forex Trading With Your Ai Companion (Paul Wealth) (Z-Library)Siju KayNo ratings yet

- SIR-Doorstep Hardware and Software Service SystemDocument10 pagesSIR-Doorstep Hardware and Software Service SystemTaj SNo ratings yet

- Chapter 3 Securities Operations and Risk ManagementDocument88 pagesChapter 3 Securities Operations and Risk ManagementMRIDUL GOEL100% (1)

- Master Card Merchant Admin Guide MR 25Document119 pagesMaster Card Merchant Admin Guide MR 25Ji MeiNo ratings yet

- National Stock Exchange of India LimitedDocument3 pagesNational Stock Exchange of India LimitedKeval ShahNo ratings yet

- Sales and MarketingDocument8 pagesSales and MarketingPatelMounalNo ratings yet

- Algorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesFrom EverandAlgorithm Trading Strategies- Crypto and Forex - The Advanced Guide For Practical Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- GRIPS Macroeconomics II Fall II Semester, 2016 Problem Set 4Document1 pageGRIPS Macroeconomics II Fall II Semester, 2016 Problem Set 4prasadpatankar9No ratings yet

- GRIPS Macroeconomics II Fall II Semester, 2016 Lecture 3: Keynesian AD Curve (1) : The Money Market and The LM CurveDocument3 pagesGRIPS Macroeconomics II Fall II Semester, 2016 Lecture 3: Keynesian AD Curve (1) : The Money Market and The LM Curveprasadpatankar9No ratings yet

- LectureNote6 GRIPS PDFDocument6 pagesLectureNote6 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote12 GRIPS PDFDocument6 pagesLectureNote12 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote11 GRIPS PDFDocument8 pagesLectureNote11 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote1 GRIPS PDFDocument5 pagesLectureNote1 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote7 GRIPS PDFDocument8 pagesLectureNote7 GRIPS PDFprasadpatankar9No ratings yet

- LectureNote8 GRIPSDocument10 pagesLectureNote8 GRIPSprasadpatankar9No ratings yet

- LectureNote5 GRIPS PDFDocument7 pagesLectureNote5 GRIPS PDFprasadpatankar9No ratings yet

- Man Kiw Chapter 06 Solutions ProblemsDocument9 pagesMan Kiw Chapter 06 Solutions ProblemsJosemariaSaNo ratings yet

- UH131 Spring2012 Hw1ans PDFDocument6 pagesUH131 Spring2012 Hw1ans PDFprasadpatankar9No ratings yet

- The Effect of High-Frequency Trading On Stock Volatility and Price DiscoveryDocument53 pagesThe Effect of High-Frequency Trading On Stock Volatility and Price Discoveryprasadpatankar9No ratings yet

- Bse - AlgoDocument1 pageBse - Algoprasadpatankar9No ratings yet

- Algorithmic Trading Usage Patterns and Their Costs: Executive SummaryDocument17 pagesAlgorithmic Trading Usage Patterns and Their Costs: Executive SummaryYanNo ratings yet

- Session 3A 2 GolubDocument27 pagesSession 3A 2 Golubprasadpatankar9No ratings yet

- Ts Algo SurveyDocument16 pagesTs Algo Surveyprasadpatankar9No ratings yet

- NSEDocument16 pagesNSESajoy P.B.No ratings yet

- NYSE Dealing RulesDocument206 pagesNYSE Dealing Rulesprasadpatankar9No ratings yet

- Hasbrouck SaarDocument57 pagesHasbrouck SaarWoo-seock JungNo ratings yet

- Larry TABB - HFT - Part 1Document18 pagesLarry TABB - HFT - Part 1prasadpatankar9No ratings yet

- IOSCOPD354Document60 pagesIOSCOPD354prasadpatankar9No ratings yet

- Municipality of Guipos: Republic of The Philippines Province of Zamboanga de SurDocument21 pagesMunicipality of Guipos: Republic of The Philippines Province of Zamboanga de SurMelvinson Loui Polenzo SarcaugaNo ratings yet

- 4.3. Obligations of Borrowers: Questions To PonderDocument6 pages4.3. Obligations of Borrowers: Questions To PonderTin CabosNo ratings yet

- Solved Suppose Congress and The President Decide To Increase Government PurchasesDocument1 pageSolved Suppose Congress and The President Decide To Increase Government PurchasesM Bilal SaleemNo ratings yet

- Sample Paperpre Board II Acct 2324-2Document10 pagesSample Paperpre Board II Acct 2324-2kanakchauhan206No ratings yet

- Laptop InvoiceDocument1 pageLaptop InvoicePranjal ThakurNo ratings yet

- NRO Vs NREDocument3 pagesNRO Vs NREsushantNo ratings yet

- Fiber Monthly Statement: This Month's SummaryDocument3 pagesFiber Monthly Statement: This Month's SummaryHimanshuNo ratings yet

- Chap 3 Bonds and Their ValuationDocument42 pagesChap 3 Bonds and Their ValuationShahzad C7No ratings yet

- Materi Lab 8 - Intercompany Profit Transactions - BondsDocument5 pagesMateri Lab 8 - Intercompany Profit Transactions - BondsAlvira FajriNo ratings yet

- Credit MonitoringDocument15 pagesCredit MonitoringSyam Sandeep67% (3)

- Portfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsDocument23 pagesPortfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsHoda El HALABINo ratings yet

- 15-IFRS 15 - SummaryDocument6 pages15-IFRS 15 - SummaryhusseinNo ratings yet

- Somali Sports Fashion Centre: S S F CDocument10 pagesSomali Sports Fashion Centre: S S F CAnonymous U5JZ8NOquNo ratings yet

- Canterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingDocument10 pagesCanterbury Institute of Management (CIM) : ACCT101 Foundations of AccountingSuman GautamNo ratings yet

- Specimen Paper - Maths A&I SL - Answers: November 23, 2021Document2 pagesSpecimen Paper - Maths A&I SL - Answers: November 23, 2021Jaime Molano Moreno0% (1)

- Easy To Pay Centogene": 1. Payment by Bank TransferDocument2 pagesEasy To Pay Centogene": 1. Payment by Bank TransferEh MohamedNo ratings yet

- Termeni Contabili in EnglezaDocument11 pagesTermeni Contabili in EnglezaCrisan AnamariaNo ratings yet

- Financial and Business Risk Management 1 PDFDocument75 pagesFinancial and Business Risk Management 1 PDFrochelleandgelloNo ratings yet

- Audit Prob InvestmentDocument5 pagesAudit Prob InvestmentANGIE BERNAL100% (1)

- You Must Answer Part One You Must Also Answer One Question From Part Two and Two Questions From Part Three Time Limit 3 HoursDocument17 pagesYou Must Answer Part One You Must Also Answer One Question From Part Two and Two Questions From Part Three Time Limit 3 HoursmissmawarlinaNo ratings yet

- RCA 204, Innovation & Entrepreneurship: Unit Iv: (8 HRS)Document12 pagesRCA 204, Innovation & Entrepreneurship: Unit Iv: (8 HRS)Anonymous MhCdtwxQINo ratings yet

- IPeople Inc - SEC Form 17-C Appointment of New Chief Risk Officer - June 1, 2021Document3 pagesIPeople Inc - SEC Form 17-C Appointment of New Chief Risk Officer - June 1, 2021dawijawof awofnafawNo ratings yet

- Thompson-DeWitt Financial Group's New York Advisory Office Jumps Into The Asset-Based Lending ArenaDocument3 pagesThompson-DeWitt Financial Group's New York Advisory Office Jumps Into The Asset-Based Lending ArenaPR.comNo ratings yet

- Narrative ReportDocument79 pagesNarrative ReportJerald Kim VasquezNo ratings yet

- Resource Allocation and Financial Planning: Presented byDocument38 pagesResource Allocation and Financial Planning: Presented byAirish Roperez EsplanaNo ratings yet

- Hyperinflation in Germany, 1914-1923: (This Article Is Excerpted From The Book .)Document10 pagesHyperinflation in Germany, 1914-1923: (This Article Is Excerpted From The Book .)hipsterzNo ratings yet

- A. B. C. D. CompletenessDocument3 pagesA. B. C. D. Completenessedrick LouiseNo ratings yet

- Seminar 1 - QsDocument2 pagesSeminar 1 - QsMaman AbdurrahmanNo ratings yet

- Galgotias University: Bba+Llb (Hons) Section-B Semester-VthDocument11 pagesGalgotias University: Bba+Llb (Hons) Section-B Semester-VthTannu guptaNo ratings yet