Professional Documents

Culture Documents

NN LMC 120801 Room For Capital Repayment

NN LMC 120801 Room For Capital Repayment

Uploaded by

nonameresearchOriginal Description:

Original Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

NN LMC 120801 Room For Capital Repayment

NN LMC 120801 Room For Capital Repayment

Uploaded by

nonameresearchCopyright:

noname

Investment Research

Company Report

Lafarge Malayan Cement Berhad

Date: 1 August 2012

Room for capital repayment

Even just based on last year DPS of 34 sen, LMC will yield 4.3% at current price of RM8.00. However, we believe LMC true dividend capacity is closer to 45 sen.

Buy

Fair value Previous FV Share price Yield Capital gain Total return Conviction Stock code Market cap RM7.50 N/A RM8.00 +4.3% -6% -2% Average LMC MK RM6,925m

Furthermore, LMC balance sheet has moved from net debt to net cash and we believe there is room for capital management which will either result in higher dividends or capital repayment. Therefore, despite the low yield, we find LMC to be an attractive short term proposition at present. Short term Based on DDM, we derived a fair value of RM7.50 for LMC. We have also assigned an Average conviction rating to LMC. Overall, we have a BUY on LMC.

John LEE

john@nonameresearch.com

nonameresearch.com | 1 August 2012

Room for Capital Management

From net debt to net cash

LMC has been paring down debt. LMC generates close to RM400m in FCF from its operations every year. Out of this, RM250m-RM300m is paid out in dividends leaving LMC with a remainder of RM100m-RM150m. From Figure 1 below, it can be seen that LMC has been using this remaining cash flow to pare down debt. Debt has gradually declined beginning 2007. LMC debt stands at RM108m as end of 2011 compared to RM635m back in 2007 At the same time, cash has gradually increased from RM162m in 2007 to RM352m as at end of 20111 Consequently, LMC balance sheet has moved from a net debt of RM473m in 2007 to net cash of RM244m in 2011

Figure 1: LMC cash and debt 2005-2011

Source: LMC

Balance sheet now net cash. While LMC balance sheet is net cash, it is not strongly net cash yet as RM244m is just under one years net income. However, since LMC has been using its FCF to pare down debt and considering there is little debt left to reduce, there is really only three things LMC could do with that extra cashflow that was previously used to reduce debt. Firstly, LMC could use the cashflow for acquisition or major capex Secondly, LMC could use the cashflow to pay higher dividends since annual dividend of RM250m-RM300m still represents a payout of only 60%-75% of FCF Thirdly, LMC could initiate a capital repayment either by paying out cash from the balance sheet or through additional leverage

We are not aware of any acquisition plan nor major capex requirement. As such, we assign a low probability to such events and prefer to focus on the latter two more likely scenarios.

RM308 as end of 1Q12

nonameresearch.com | 1 August 2012

What is the potential payout?

Scenario A: Potential increase in DPS to 40 sen. LMC has traditionally paid dividends quarterly on the basis of 8 sen for first three quarters and 10 sen for the final quarter for a cumulative 34 sen per year or 90% of net income but 75% of estimated FCF of 45 sen. Assuming that LMC now redirects the extra cashflow to higher dividend payments, more specifically say 90% of FCF, then LMC DPS would increase from the current 34 sen to 40 sen. At 40 sen, LMC dividend yield is 5.1% at current price of RM7.80. Not particularly attractive in the long term (but could be attractive in the current low interest rate environment persists). Scenario B: Potential payout between RM0.20 to RM1.00. If LMC maintains its current 34 sen DPS and goes for capital management initiatives2 instead, then LMC could pay out an extra 20 sen without leveraging up and easily RM1.00 if leverage is used. The extra 20 sen is hardly attractive but the extra RM1.00 is certainly significant enough for a re-rating. In short, under Scenario A, even if LMC were to increase its DPS to 40 sen, the yield is still an unattractive 5.1% as the share price appears to have fully priced in the dividend capacity. Scenario B is more attractive as the potential upside has not been priced in yet. It is important to stress again that management has not guided any higher dividend nor capital management initiatives. That is to be expected as management (not only of LMC but other companies as well) very rarely provides such guidance as it would then be priced in immediately. Therefore, we have evaluated LMC based on its capacity and not its willingness to provide either a higher payout or capital return to shareholders. On this basis, LMC FCF and net cash balance sheet indicate that there is room for higher return to shareholders either through dividend or capital management.

LMC did a capital repayment of 67 sen in 2007

nonameresearch.com | 1 August 2012

Financial Review

Market leader but anemic growth. Despite being the market leader with 40% share of the market, LMC revenue growth has been flat for the last four years. LMC revenue was RM2.5bn both in 2007 and 2011. About 70% of LMC sales is domestic while the rest consists of exports to countries such as Indonesia, Sri Lanka and Bangladesh.

Figure 2: LMC revenue and net income 2007-2011

Source: LMC

Margin normalizing post expiry of tax incentives. Net income has declined to RM317m from high of RM412m in2009 due to expiry of tax incentive. As can be seen below, while GP margin is typically 28%, NI margin has declined to 12% in 2011 as tax rate began to gradually normalize from 7% in 2008 to a more representative 23% in 2011. The lower tax rate in earlier years was due to tax deductions for capex.

Figure 3: LMC gross profit and net income margin

Source: LMC

nonameresearch.com | 1 August 2012

Capacity to increase dividend. As highlighted in the previous section, LMC dividend of circa RM300m represents only a 75% payout of its FCF. Therefore, LMC still has room to increase dividend. A RM300m dividend translates to about 34 sen DPS. At full payout, LMC should be capable of closer to 45 sen DPS.

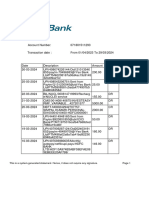

Figure 4: LMC dividend paid 2007-2011

Source: LMC

nonameresearch.com | 1 August 2012

Valuation and Conclusion

Valuation method and key assumption

Based on DDM, we derived a fair value of RM7.50 for LMC. At current price of RM8.00, this represents a potential total return of -2% comprising 4.3% dividend yield and 6% capital loss. LMC should be able to generate circa RM400m or 45 sen in FCF per year even if revenue growth continues to be anemic At our fair value of RM7.50, investor will still receive a dividend yield of at least 4.5% based on last year DPS of 34 sen There is more room for DPS to grow further to 40 sen in the short term There is also room for capital repayment up to RM1.00

Key risks

Higher cement demand. In the last few years, higher headline selling price for cement has been offset by higher rebates by the cement players. In recent years, rebates have widened to more than 35% compared 15%-20% in more normal times. We continue to assume negligible topline growth for LMC. As such, a surge in cement demand or better pricing power could result in potential upside to our fair value. Higher coal price. Coal price currently hovers at USD90/t, approximately 50% lower than the high reached in mid 2008. Higher coal price will result in GP margin compression for LMC (even though the impact appears to be muted in 2008). In our view, compared to historical, the current coal price of USD90/t is actually normal even though it is higher than the pre-07 price of USD60/t. As the USD has depreciated against most currencies by about 20%, the current USD90/t translates to only USD72/t.

Conclusion

Even just based on last year DPS of 34 sen, LMC will yield 4.3% at current price of RM8.00. However, we believe LMC true dividend capacity is closer to 45 sen. Furthermore, LMC balance sheet has moved from net debt to net cash and we believe there is room for capital management which will either result in higher dividends or capital repayment. Therefore, despite the low yield, we find LMC to be an attractive short term proposition at present. Based on DDM, we derived a fair value of RM7.50 for LMC. We have also assigned an Average conviction rating to LMC. Overall, we have a BUY on LMC.

nonameresearch.com | 1 August 2012

Historical Statistics

Revenue and Net Income (FYE-Dec)

3,000 2,531 2,500 2,000 2,483

Dividend Payout (FYE-Dec)

250%

2,553

2,325 200% 150%

226%

2,174

RM m

1,500 100%

113% 91% 69% 62%

1,000

500 288 368 412

293

317

50% 0%

2007 2008

Revenue

2009

Net income

2010

2011

2007

2008

2009

Payout ratio

2010

2011

Net Income Margin (FYE-Dec)

EPS and DPS (FYE-Dec)

90 80 70 60 49 30 30 34 39 37

77

sen

50

43

34

40 30 20 10 -

34

2007

2008

EPS

2009

DPS

2010

2011

Effective Tax Rate (FYE-Dec)

25% 20% 15% 15% 11% 10%

Dividend Paid (FYE-Dec)

23%

7%

8%

5% 0%

2007 2008 2009

Effective tax rate

2010

2011

nonameresearch.com | 1 August 2012 Rating structure The rating structure consists of two main elements; fair value and conviction rating. The fair value reflects the security intrinsic value and is derived based on fundamental analysis. The conviction rating reflects uncertainty associated with the security fair value and is derived based on broad factors such as underlying business risks, contingent events and other variables. Both the fair value and conviction rating are then used to form a view of the security potential total return. A Buy call implies a potential total return of 10% or more, a Sell call implies a potential total loss of 10% or more while all other circumstances result in a Neutral call.

Disclaimer This report is for information purposes only and is prepared from data and sources believed to be correct and reliable at the time of issue. The data and sources have not been independently verified and as such, no representation, express or implied, is made with respect to the accuracy, completeness or reliability of the information or opinions in this report. The information and opinions in this report are not and should not be construed as an offer, recommendation or solicitation to buy or sell any securities referred to herein. Investors are advised to make their own independent evaluation of the information contained in this research report, consider their own individual investment objectives, financial situation and particular needs and consult their own professional and financial advisers as to the legal, business, financial, tax and other aspects before participating in any transaction.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Online Challan For Admission BZU Multan UBL PDFDocument1 pageOnline Challan For Admission BZU Multan UBL PDFsalman63% (8)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SBLC TrainingDocument34 pagesSBLC TrainingLeslie100% (3)

- NN AAPL 130228 The Case Against IPrefsDocument8 pagesNN AAPL 130228 The Case Against IPrefsnonameresearch100% (1)

- NN THEME 121027 The Investment Case For ChinaDocument56 pagesNN THEME 121027 The Investment Case For ChinanonameresearchNo ratings yet

- NN THEME 120918 Malaysian Property Bubble I - The FactsDocument31 pagesNN THEME 120918 Malaysian Property Bubble I - The FactsnonameresearchNo ratings yet

- NN MPR 120730 Deserves More AirtimeDocument8 pagesNN MPR 120730 Deserves More AirtimenonameresearchNo ratings yet

- NN GUIN 120801 Drink Moderately For NowDocument6 pagesNN GUIN 120801 Drink Moderately For NownonameresearchNo ratings yet

- Production Cycle QuizDocument6 pagesProduction Cycle Quizsky wayNo ratings yet

- Biological Assets - NotesDocument1 pageBiological Assets - NotesJessel Ann MontecilloNo ratings yet

- Chart Petterns Ebook EnglishDocument48 pagesChart Petterns Ebook Englishharshmevada81150% (4)

- Mona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementDocument3 pagesMona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementManubhai PatelNo ratings yet

- Less Than Wholly Owned REPORTDocument40 pagesLess Than Wholly Owned REPORTrichelledelgadoNo ratings yet

- 01.financial Statement AnalysisDocument40 pages01.financial Statement Analysismagangajacqueline24No ratings yet

- Chapter 3: Depository Institutions: Activities and CharacteristicsDocument24 pagesChapter 3: Depository Institutions: Activities and Characteristicstjarnob13No ratings yet

- Working Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Document6 pagesWorking Capital Management Work Sheet-Cash Operation Cycle - AR-AP-July 2022Marc WrightNo ratings yet

- Msci Indonesia Index NetDocument3 pagesMsci Indonesia Index NetJuju PoilNo ratings yet

- Flip Pin SpreadsheetDocument1 pageFlip Pin Spreadsheettbecker4No ratings yet

- IdbiDocument3 pagesIdbisanjay.pachauri93No ratings yet

- Stochastic Proportional DividendsDocument21 pagesStochastic Proportional Dividendsmirando93No ratings yet

- Accounting Principles Question Paper, Answers and Examiner's CommentsDocument33 pagesAccounting Principles Question Paper, Answers and Examiner's CommentsFarrukhsgNo ratings yet

- Form 26QB Property Tax Payment Form13Document3 pagesForm 26QB Property Tax Payment Form13JayCharleysNo ratings yet

- Financial Wellbeing Capability UK Adults Poverty Debt Saving Numeracy InfographicDocument1 pageFinancial Wellbeing Capability UK Adults Poverty Debt Saving Numeracy InfographicerioNo ratings yet

- Math108x Document w04GroupAssignmentBudgeting ADocument16 pagesMath108x Document w04GroupAssignmentBudgeting AMatthew MacaballugNo ratings yet

- A Project Report On Loan Procedure of Consumer Durable Product at Bajaj Finserv LendingDocument65 pagesA Project Report On Loan Procedure of Consumer Durable Product at Bajaj Finserv LendingHusna Majid50% (2)

- Basic Accounting QuestionnaireDocument4 pagesBasic Accounting QuestionnaireSamuel FerolinoNo ratings yet

- AUSmall FinancebanklimitedDocument39 pagesAUSmall FinancebanklimitedDIPAN BISWASNo ratings yet

- CrizilDocument11 pagesCrizilSatyabrataNayakNo ratings yet

- Fa I HoecDocument32 pagesFa I HoecBunny SethiNo ratings yet

- Finance (Cash Flow Analysis of MPPTCL)Document49 pagesFinance (Cash Flow Analysis of MPPTCL)Yash KureelNo ratings yet

- Icici Bank Statement Simpal Kumari 01 04 2023 - 29 03 2024Document24 pagesIcici Bank Statement Simpal Kumari 01 04 2023 - 29 03 2024prateek gangwaniNo ratings yet

- Overpaid Bank TellersDocument7 pagesOverpaid Bank TellersMaryam KhushbakhatNo ratings yet

- Account Executive / Sales Resume SampleDocument2 pagesAccount Executive / Sales Resume Sampleresume7.com100% (1)

- 10 Lecture 10Document2 pages10 Lecture 10Ahmad HasnainNo ratings yet

- Aon Risk Maturity Index Report 041813Document28 pagesAon Risk Maturity Index Report 041813Dewa Bumi100% (1)

- Compliance To Barangay Full Disclosure Policy: Annual Quarterly Monthly RemarksDocument1 pageCompliance To Barangay Full Disclosure Policy: Annual Quarterly Monthly RemarksJacjac FamadorNo ratings yet