Professional Documents

Culture Documents

Governor Martin O'Malley's Special Gambling Session FAQ

Governor Martin O'Malley's Special Gambling Session FAQ

Uploaded by

David MoonCopyright:

Available Formats

You might also like

- Market Analysis Marina DevelopmentDocument88 pagesMarket Analysis Marina DevelopmentPn EkanayakaNo ratings yet

- API Report On Gaming LegislationDocument9 pagesAPI Report On Gaming LegislationErica ThomasNo ratings yet

- Legal Overview of The Video Gaming ActDocument5 pagesLegal Overview of The Video Gaming ActsaukvalleynewsNo ratings yet

- A Framework For Gaming in Illinois: O G P QDocument9 pagesA Framework For Gaming in Illinois: O G P QgpandersonNo ratings yet

- DATED: November 14, 2012Document14 pagesDATED: November 14, 2012SGNo ratings yet

- 2012 220riDocument11 pages2012 220rigzumelNo ratings yet

- PPA John Pappas - Submitted Testimony (02/26/2014)Document11 pagesPPA John Pappas - Submitted Testimony (02/26/2014)pokerplayersallianceNo ratings yet

- ANALYZING LATEST AMENDMENTS TO I.T. RULES PERTAINING TO GAMBLING IN INDIA (Revised)Document7 pagesANALYZING LATEST AMENDMENTS TO I.T. RULES PERTAINING TO GAMBLING IN INDIA (Revised)Ujjwal AgrawalNo ratings yet

- 2013 House Notes - Week 1Document4 pages2013 House Notes - Week 1RepNLandryNo ratings yet

- Policy Report - Brendan SmithDocument9 pagesPolicy Report - Brendan SmithBrendanNo ratings yet

- Voter Information Handbook 2012Document30 pagesVoter Information Handbook 2012Chip LeakasNo ratings yet

- Bedford Sub Talking PointsDocument3 pagesBedford Sub Talking PointsCatherine SnowNo ratings yet

- Las Vegas Pols Okay Amended On Line Casino Sports Betting Legislationamxrm PDFDocument3 pagesLas Vegas Pols Okay Amended On Line Casino Sports Betting Legislationamxrm PDFWilderRichmond33No ratings yet

- BettingDocument12 pagesBettingJoe WesshNo ratings yet

- Cbo hr308Document4 pagesCbo hr308paul weichNo ratings yet

- New Laws Effective Aug. 1Document12 pagesNew Laws Effective Aug. 1Patch Minnesota100% (1)

- Internet Gambling: Keys To A Successful Regulatory ClimateDocument38 pagesInternet Gambling: Keys To A Successful Regulatory ClimateSteven TitchNo ratings yet

- PPA Players' Funds Legal GuideDocument23 pagesPPA Players' Funds Legal GuidepokerplayersallianceNo ratings yet

- Week 7 Reg. SessionDocument3 pagesWeek 7 Reg. SessionRepNLandryNo ratings yet

- Understanding The Biggest Market in The WorldDocument5 pagesUnderstanding The Biggest Market in The Worldapi-25890976No ratings yet

- Conditional Veto For A2578Document31 pagesConditional Veto For A2578pokerplayersallianceNo ratings yet

- Cu Profile 36Document10 pagesCu Profile 36Odel KabristanteNo ratings yet

- Cu Profile 234Document10 pagesCu Profile 234Odel KabristanteNo ratings yet

- Writing Sample-Policy Report SB84Document12 pagesWriting Sample-Policy Report SB84BrendanNo ratings yet

- Analysis - CombinedDocument2 pagesAnalysis - CombineddelegatemikeNo ratings yet

- STRICKLANDVLTDocument2 pagesSTRICKLANDVLTmatt100% (2)

- Conference Committee Request Letter FY13Document3 pagesConference Committee Request Letter FY13MIRA CoalitionNo ratings yet

- Cu Profile 63958Document12 pagesCu Profile 63958Odel KabristanteNo ratings yet

- GlobalizationDocument4 pagesGlobalizationMuhammad SulemanNo ratings yet

- Cu Profile 5536Document67 pagesCu Profile 5536Odel KabristanteNo ratings yet

- CO - Practical Guide Online Gaming - 080614Document16 pagesCO - Practical Guide Online Gaming - 080614Khushi AgarwalNo ratings yet

- Cu Profile 66310Document72 pagesCu Profile 66310Odel KabristanteNo ratings yet

- Secure and Fair Enforcement For Mortgage Licensing Act of 2008Document54 pagesSecure and Fair Enforcement For Mortgage Licensing Act of 2008Master ChiefNo ratings yet

- From PASPA To IPL: Appraising The Changing Paradigm of Sports' Gambling Summary/abstract of The ContextDocument2 pagesFrom PASPA To IPL: Appraising The Changing Paradigm of Sports' Gambling Summary/abstract of The ContextDebarun MukherjeeNo ratings yet

- 2012Document3 pages2012maustermuhleNo ratings yet

- 01 - TACIDS Award Letter - 2 PDFDocument14 pages01 - TACIDS Award Letter - 2 PDFali_winstonNo ratings yet

- BillDocument2 pagesBillapi-302902999No ratings yet

- Questions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDocument19 pagesQuestions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDavid MoonNo ratings yet

- UntitledDocument5 pagesUntitledramya raviNo ratings yet

- Cu Profile 75Document10 pagesCu Profile 75Odel KabristanteNo ratings yet

- Cu Profile 66319Document10 pagesCu Profile 66319Odel KabristanteNo ratings yet

- 2015 Progress Texas Constitutional Amendment Ballot GuideDocument4 pages2015 Progress Texas Constitutional Amendment Ballot GuideProgressTX100% (1)

- Cu Profile 80Document14 pagesCu Profile 80Odel KabristanteNo ratings yet

- Report License For Illegal 053119Document9 pagesReport License For Illegal 053119WGRZ-TVNo ratings yet

- E S G C:: Xpanding LOT Aming IN AliforniaDocument24 pagesE S G C:: Xpanding LOT Aming IN AliforniareasonorgNo ratings yet

- Cu Profile 16Document10 pagesCu Profile 16Odel KabristanteNo ratings yet

- Cu Profile 306Document10 pagesCu Profile 306Odel KabristanteNo ratings yet

- Legislative Summary - 2014 County CouncilDocument90 pagesLegislative Summary - 2014 County CouncilAlejandro PuyNo ratings yet

- Strategic Management: Case StudyDocument11 pagesStrategic Management: Case StudySidra KhanNo ratings yet

- Florida Constitutional Amendments 2012Document6 pagesFlorida Constitutional Amendments 2012Peggy W SatterfieldNo ratings yet

- Cu Profile 352Document11 pagesCu Profile 352Odel KabristanteNo ratings yet

- Internet Gambling LawsDocument6 pagesInternet Gambling LawsDan MichalskiNo ratings yet

- Summary of Intrastate Crowdfunding Exemptions - Enacted - FinalDocument11 pagesSummary of Intrastate Crowdfunding Exemptions - Enacted - FinalCrowdfundInsiderNo ratings yet

- Plaintiff,: United States District Court For The District of MassachusettsDocument21 pagesPlaintiff,: United States District Court For The District of Massachusettsapi-84753935No ratings yet

- Gambling AbroadDocument2 pagesGambling AbroadLavkesh BhambhaniNo ratings yet

- Cu Profile 378Document10 pagesCu Profile 378Odel KabristanteNo ratings yet

- View Report PDFDocument15 pagesView Report PDFRecordTrac - City of OaklandNo ratings yet

- Final Exam Business Government and SocietyDocument4 pagesFinal Exam Business Government and SocietyJamar JohnsonNo ratings yet

- Online Gambling World - What You Need to Know About Online GamblingFrom EverandOnline Gambling World - What You Need to Know About Online GamblingNo ratings yet

- Letter From 65 Maryland Lawmakers Urging Rejection of Fracked Gas PipelineDocument1 pageLetter From 65 Maryland Lawmakers Urging Rejection of Fracked Gas PipelineDavid MoonNo ratings yet

- Letter From 60 Maryland Lawmakers Re: I-495 & I-270 WideningDocument4 pagesLetter From 60 Maryland Lawmakers Re: I-495 & I-270 WideningDavid MoonNo ratings yet

- Letter To Governor Hogan From 64 Maryland Lawmakers On Coal PollutionDocument2 pagesLetter To Governor Hogan From 64 Maryland Lawmakers On Coal PollutionDavid MoonNo ratings yet

- Grassroots Democracy Commitment For Maryland GovernorDocument1 pageGrassroots Democracy Commitment For Maryland GovernorDavid Moon100% (1)

- Evan Glass - Supporters List For County Council District 5Document3 pagesEvan Glass - Supporters List For County Council District 5David MoonNo ratings yet

- Letter From Maryland Officials To WMATA On Late Night Service HoursDocument3 pagesLetter From Maryland Officials To WMATA On Late Night Service HoursDavid MoonNo ratings yet

- Letter From Prince George's Lawmakers To Doug GanslerDocument2 pagesLetter From Prince George's Lawmakers To Doug GanslerDavid MoonNo ratings yet

- EVENT FLYER: MD Gubernatorial Debate THU 1/30/14Document1 pageEVENT FLYER: MD Gubernatorial Debate THU 1/30/14David MoonNo ratings yet

- MCEA December 2013 EndorsementsDocument1 pageMCEA December 2013 EndorsementsDavid MoonNo ratings yet

- Doug Gansler 2013 MSEA Survey ResponsesDocument36 pagesDoug Gansler 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Anthony Brown 2013 MSEA Survey ResponsesDocument29 pagesAnthony Brown 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Heather Mizeur 2013 MSEA Survey ResponsesDocument23 pagesHeather Mizeur 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Heather Mizeur 2013 MSEA Survey ResponsesDocument23 pagesHeather Mizeur 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Hispanic Chamber of Commerce Letter Endorsing David Fraser-HidalgoDocument1 pageHispanic Chamber of Commerce Letter Endorsing David Fraser-HidalgoDavid MoonNo ratings yet

- Questions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDocument19 pagesQuestions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDavid MoonNo ratings yet

- Progressive Neighbors: Questions For Maryland Gubernatorial Candidates 2014Document10 pagesProgressive Neighbors: Questions For Maryland Gubernatorial Candidates 2014David MoonNo ratings yet

- (PDF) - Lectrostatique Et - Lectrocin - Tiq... Ition - Moussouni Ayoub - AcademiaDocument252 pages(PDF) - Lectrostatique Et - Lectrocin - Tiq... Ition - Moussouni Ayoub - Academiakoss kossNo ratings yet

- Resources For Pet Owners - Food Banks and BoardingDocument6 pagesResources For Pet Owners - Food Banks and Boarding10News WTSPNo ratings yet

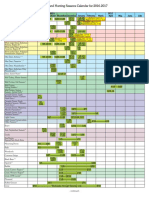

- Marylands' 2017 Hunting Seasons CalendarDocument5 pagesMarylands' 2017 Hunting Seasons CalendarJwestie2007No ratings yet

- Multi-Sports Facility Proposal: Presented ToDocument25 pagesMulti-Sports Facility Proposal: Presented Tohussen seidNo ratings yet

- Maryland Drop Box LocationsDocument5 pagesMaryland Drop Box LocationsChris Berinato100% (1)

- City of Laurel Master Plan Comprehensive AmendmentDocument219 pagesCity of Laurel Master Plan Comprehensive AmendmentAnnieScanlanNo ratings yet

- 3 List of Free Blacks 6-2-9Document126 pages3 List of Free Blacks 6-2-9Laban Selvey BeyNo ratings yet

- 2019-04-25 St. Mary's County TimesDocument32 pages2019-04-25 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

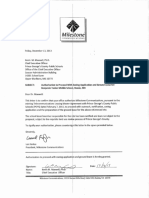

- PGCPS Letters Authorizing Cell Tower Company To Move Forward With Specific PGCPS Schools "Authorization To Proceed Letters On PGCPS Cell Towers"Document11 pagesPGCPS Letters Authorizing Cell Tower Company To Move Forward With Specific PGCPS Schools "Authorization To Proceed Letters On PGCPS Cell Towers"Safe Tech For SchoolsNo ratings yet

- Armed Off-Duty Cop Sends Suspected Carjackers Fleeing As Crime SpiralDocument1 pageArmed Off-Duty Cop Sends Suspected Carjackers Fleeing As Crime Spiraled2870winNo ratings yet

Governor Martin O'Malley's Special Gambling Session FAQ

Governor Martin O'Malley's Special Gambling Session FAQ

Uploaded by

David MoonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Governor Martin O'Malley's Special Gambling Session FAQ

Governor Martin O'Malley's Special Gambling Session FAQ

Uploaded by

David MoonCopyright:

Available Formats

AUGUST 2012 SPECIAL SESSION ON GAMING IN MARYLAND Frequently Asked Questions

Why is this legislation being proposed in a special legislative session? We have an opportunity to create thousands of new construction jobs and as many as 2,000 permanent jobs. By acting now, we also have an opportunity to secure additional revenue for Maryland's public schools over the next two years. It is time to resolve an issue that has consistently been divisive in order to move forward to the other important issues facing the State. The legislation will create predictability in the marketplace, make Marylands gaming program competitive with other states, protect local and city aid being generated at current sites, ensure authorized facilities are capable of being built, and allow the people of Prince George's County to decide at the ballot whether they want a sixth site for the benefit of their county. How soon could there be table games in Maryland? How much revenue will that generate? At what rate will those table games be taxed? If a majority of Maryland voters vote in favor of the question to expand gaming on the November 2012 ballot, the State Lottery and Gaming Control Commission shall immediately begin the regulatory process to authorize table games. It is estimated that Maryland could have table games by early 2013. According to the fiscal analysis provided for the Workgroup to Consider the Expansion of Gaming, table games will likely generate approximately $45-51 million per year in additional revenues to the State. The proposed bill would generate that additional revenue by taxing table games at 20% and dedicating those dollars to the Education Trust Fund. If a sixth facility opens, that distribution adjusts to the benefit of the local jurisdiction in which the facility is located -- with 5% of the proceeds to the jurisdiction and the remaining 15% to the Education Trust Fund. Will there be a new Gaming Commission? Yes. The Workgroup recommended establishing a Gaming Commission, with an expert Executive Director, in order to protect the States interest. The proposed legislation would re-constitute the current State Lottery Agency as the State Lottery and Gaming Control Agency, with a State Lottery and Gaming Control Commission therein. Members would be appointed by the Governor, with the advice and consent of the Senate, and would be required to have substantial experience in a profession relating to fiscal matters or economics. The Commission will also consult with an outside consultant to provide continual analysis of the gaming industry. Specifically, how does the legislation impact Baltimore City and its plans to build a facility? How soon could that move forward? On July 31, 2012, the States Video Lottery Facility Location Commission voted unanimously to approve Caesars Entertainments application to build a $310 million casino near M&T Bank Stadium in Baltimore. That facility is expected to open in the second quarter of 2014. Representatives from that facility have consistently testified in favor of the changes contemplated in this legislation. If a majority of voters approve the expansion of gaming, the Baltimore City facility will have the opportunity to include table games at their facility.

Does the legislation authorize a casino in Prince Georges County? If so, how soon could plans for a casino move forward? The legislation authorizes an additional site in Prince Georges County only if: (1) a majority of Maryland voters vote in favor of the question to expand gaming on the November 2012 ballot; and (2) a majority of voters in Prince Georges County approve the same question. The Commission may not permit the operation of that facility before the earlier of July 1, 2016 or 30 months after the Baltimore City facility is open to the public. Does it allow for a casino located somewhere else besides National Harbor? The legislation does not specify National Harbor but allows for a competitive bidding process, contingent on local zoning approval, thereby affording competition, transparency, local control, and maximum return to State taxpayers Is there a provision minimizing the impact on Baltimore City and Anne Arundel County if a Prince Georges County casino is built? Yes. The bill includes a hold harmless provision to ensure that Baltimore City and Anne Arundel Countys local impact grants are not reduced because of the addition of an additional site. PricewaterhouseCoopers, a gaming consultant to the State, estimated that a new Prince Georges County site will have an impact on facilities in Anne Arundel and Baltimore City. The magnitude of the impact would warrant an increased operator share of 6-10%. In recognition of that fact, if a video lottery facility is licensed in Prince Georges County, the Baltimore City and Anne Arundel County facilities may retain an additional 5% of their video lottery proceeds for marketing, advertising, promotional costs, and/or capital improvements to their facilities. This will help them remain competitive in a new market, and maximize the return for the State. After thoroughly reviewing all relevant data and reporting to the Governor and General Assembly, the State Lottery and Gaming Control Commission, with legislative oversight, may also increase the Baltimore City and Anne Arundel facilities percentage by not more than 5% percent of the video lottery terminal proceeds. It is in the States interest to preserve viable facilities. Importantly, this expansion of sites will generate significant new revenue for the Education Trust Fund. What about the other facilities? The percentage of the video lottery proceeds distributed to other licensees is as follows: Rocky Gap: Current law provides that Rocky Gap will receive 50% of the video lottery proceeds for 10 years and, after 10 years, 43% provided that each year 2.5% of the proceeds is used for capital improvements. Ocean Downs: The legislation provides that, as of July 1, 2013, Ocean Downs will receive a percentage equal to 43% of the video lottery terminal proceeds if the facility has fewer than 1,000 machines and spends at least 2.5% of those proceeds annually on capital improvements. Perryville: Current law provides that the Perryville facility receive 33% of the video lottery terminal proceeds. The legislation also provides that licensees receive an additional 6% of the proceeds if they own or lease the video lottery terminal devices and associated equipment and software. This will generate significant savings for the State and the Education Trust Fund, as the State is currently responsible

for purchasing or leasing the machines at a cost equivalent of 13% of the video lottery terminal revenues. Can Maryland support additional facilities while existing facilities are seeing a decline in revenues? Yes. PricewaterhouseCoopers and the Department of Legislative Services concluded that Maryland can support a 6th facility. The fiscal analysis provided to the Workgroup to Consider the Expansion of Gaming indicated that the addition of a 6th site, along with the other changes provided in the legislation, could generate up to $223 million per year to the State. Will the state continue to lease the video lottery terminals? At some point, will the state turn over responsibility/ownership to the operator? The State will continue to own the video lottery terminals at the Allegany County and Worcester County facilities. After March 31, 2015, the facilities in Anne Arundel and Cecil County will own or lease their own machines. This transfer of ownership is expected to generate tens of millions of dollars in savings to the State, all of which shall be appropriated to the Education Trust Fund. Why ban political donations from gaming entities? The ban would restore confidence that important decisions are being made based on expertise and analysis and without unnecessary distractions. Similar legislation has been introduced in the Maryland General Assembly in previous legislative sessions. Are there provisions regarding minority and women owned businesses? Yes. In current law, there are provisions that require facility operators to meet certain State and local MBE goals. These will continue to apply. In addition, the bill will require an applicant seeking investors to seek out minority equity investors and require the Governors Office of Minority Affairs to assist applicants and potential minority investors with these requirements. The bill will also allow local jurisdictions to apply provisions regarding local minority business participation and local hiring requirements to these projects, to the extent permitted by the Constitution. How do these changes impact Marylands horse racing industry? The bill will provide the same level of funding to the racing industry as is currently expected to be generated by the existing VLT program. This is done by lowering the percentage dedicated to purses, but applying it to 6 sites (with the addition of Prince Georges). Additionally, the Race Track Facility Renewal Fund percentage is reduced, but extended for additional years, to generate a comparable amount of money, while preserving more money for the Education Trust Fund in the near future. Making these changes preserves the money originally dedicated to racing, while generating an additional $20 million a year for the Education Trust Fund.

You might also like

- Market Analysis Marina DevelopmentDocument88 pagesMarket Analysis Marina DevelopmentPn EkanayakaNo ratings yet

- API Report On Gaming LegislationDocument9 pagesAPI Report On Gaming LegislationErica ThomasNo ratings yet

- Legal Overview of The Video Gaming ActDocument5 pagesLegal Overview of The Video Gaming ActsaukvalleynewsNo ratings yet

- A Framework For Gaming in Illinois: O G P QDocument9 pagesA Framework For Gaming in Illinois: O G P QgpandersonNo ratings yet

- DATED: November 14, 2012Document14 pagesDATED: November 14, 2012SGNo ratings yet

- 2012 220riDocument11 pages2012 220rigzumelNo ratings yet

- PPA John Pappas - Submitted Testimony (02/26/2014)Document11 pagesPPA John Pappas - Submitted Testimony (02/26/2014)pokerplayersallianceNo ratings yet

- ANALYZING LATEST AMENDMENTS TO I.T. RULES PERTAINING TO GAMBLING IN INDIA (Revised)Document7 pagesANALYZING LATEST AMENDMENTS TO I.T. RULES PERTAINING TO GAMBLING IN INDIA (Revised)Ujjwal AgrawalNo ratings yet

- 2013 House Notes - Week 1Document4 pages2013 House Notes - Week 1RepNLandryNo ratings yet

- Policy Report - Brendan SmithDocument9 pagesPolicy Report - Brendan SmithBrendanNo ratings yet

- Voter Information Handbook 2012Document30 pagesVoter Information Handbook 2012Chip LeakasNo ratings yet

- Bedford Sub Talking PointsDocument3 pagesBedford Sub Talking PointsCatherine SnowNo ratings yet

- Las Vegas Pols Okay Amended On Line Casino Sports Betting Legislationamxrm PDFDocument3 pagesLas Vegas Pols Okay Amended On Line Casino Sports Betting Legislationamxrm PDFWilderRichmond33No ratings yet

- BettingDocument12 pagesBettingJoe WesshNo ratings yet

- Cbo hr308Document4 pagesCbo hr308paul weichNo ratings yet

- New Laws Effective Aug. 1Document12 pagesNew Laws Effective Aug. 1Patch Minnesota100% (1)

- Internet Gambling: Keys To A Successful Regulatory ClimateDocument38 pagesInternet Gambling: Keys To A Successful Regulatory ClimateSteven TitchNo ratings yet

- PPA Players' Funds Legal GuideDocument23 pagesPPA Players' Funds Legal GuidepokerplayersallianceNo ratings yet

- Week 7 Reg. SessionDocument3 pagesWeek 7 Reg. SessionRepNLandryNo ratings yet

- Understanding The Biggest Market in The WorldDocument5 pagesUnderstanding The Biggest Market in The Worldapi-25890976No ratings yet

- Conditional Veto For A2578Document31 pagesConditional Veto For A2578pokerplayersallianceNo ratings yet

- Cu Profile 36Document10 pagesCu Profile 36Odel KabristanteNo ratings yet

- Cu Profile 234Document10 pagesCu Profile 234Odel KabristanteNo ratings yet

- Writing Sample-Policy Report SB84Document12 pagesWriting Sample-Policy Report SB84BrendanNo ratings yet

- Analysis - CombinedDocument2 pagesAnalysis - CombineddelegatemikeNo ratings yet

- STRICKLANDVLTDocument2 pagesSTRICKLANDVLTmatt100% (2)

- Conference Committee Request Letter FY13Document3 pagesConference Committee Request Letter FY13MIRA CoalitionNo ratings yet

- Cu Profile 63958Document12 pagesCu Profile 63958Odel KabristanteNo ratings yet

- GlobalizationDocument4 pagesGlobalizationMuhammad SulemanNo ratings yet

- Cu Profile 5536Document67 pagesCu Profile 5536Odel KabristanteNo ratings yet

- CO - Practical Guide Online Gaming - 080614Document16 pagesCO - Practical Guide Online Gaming - 080614Khushi AgarwalNo ratings yet

- Cu Profile 66310Document72 pagesCu Profile 66310Odel KabristanteNo ratings yet

- Secure and Fair Enforcement For Mortgage Licensing Act of 2008Document54 pagesSecure and Fair Enforcement For Mortgage Licensing Act of 2008Master ChiefNo ratings yet

- From PASPA To IPL: Appraising The Changing Paradigm of Sports' Gambling Summary/abstract of The ContextDocument2 pagesFrom PASPA To IPL: Appraising The Changing Paradigm of Sports' Gambling Summary/abstract of The ContextDebarun MukherjeeNo ratings yet

- 2012Document3 pages2012maustermuhleNo ratings yet

- 01 - TACIDS Award Letter - 2 PDFDocument14 pages01 - TACIDS Award Letter - 2 PDFali_winstonNo ratings yet

- BillDocument2 pagesBillapi-302902999No ratings yet

- Questions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDocument19 pagesQuestions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDavid MoonNo ratings yet

- UntitledDocument5 pagesUntitledramya raviNo ratings yet

- Cu Profile 75Document10 pagesCu Profile 75Odel KabristanteNo ratings yet

- Cu Profile 66319Document10 pagesCu Profile 66319Odel KabristanteNo ratings yet

- 2015 Progress Texas Constitutional Amendment Ballot GuideDocument4 pages2015 Progress Texas Constitutional Amendment Ballot GuideProgressTX100% (1)

- Cu Profile 80Document14 pagesCu Profile 80Odel KabristanteNo ratings yet

- Report License For Illegal 053119Document9 pagesReport License For Illegal 053119WGRZ-TVNo ratings yet

- E S G C:: Xpanding LOT Aming IN AliforniaDocument24 pagesE S G C:: Xpanding LOT Aming IN AliforniareasonorgNo ratings yet

- Cu Profile 16Document10 pagesCu Profile 16Odel KabristanteNo ratings yet

- Cu Profile 306Document10 pagesCu Profile 306Odel KabristanteNo ratings yet

- Legislative Summary - 2014 County CouncilDocument90 pagesLegislative Summary - 2014 County CouncilAlejandro PuyNo ratings yet

- Strategic Management: Case StudyDocument11 pagesStrategic Management: Case StudySidra KhanNo ratings yet

- Florida Constitutional Amendments 2012Document6 pagesFlorida Constitutional Amendments 2012Peggy W SatterfieldNo ratings yet

- Cu Profile 352Document11 pagesCu Profile 352Odel KabristanteNo ratings yet

- Internet Gambling LawsDocument6 pagesInternet Gambling LawsDan MichalskiNo ratings yet

- Summary of Intrastate Crowdfunding Exemptions - Enacted - FinalDocument11 pagesSummary of Intrastate Crowdfunding Exemptions - Enacted - FinalCrowdfundInsiderNo ratings yet

- Plaintiff,: United States District Court For The District of MassachusettsDocument21 pagesPlaintiff,: United States District Court For The District of Massachusettsapi-84753935No ratings yet

- Gambling AbroadDocument2 pagesGambling AbroadLavkesh BhambhaniNo ratings yet

- Cu Profile 378Document10 pagesCu Profile 378Odel KabristanteNo ratings yet

- View Report PDFDocument15 pagesView Report PDFRecordTrac - City of OaklandNo ratings yet

- Final Exam Business Government and SocietyDocument4 pagesFinal Exam Business Government and SocietyJamar JohnsonNo ratings yet

- Online Gambling World - What You Need to Know About Online GamblingFrom EverandOnline Gambling World - What You Need to Know About Online GamblingNo ratings yet

- Letter From 65 Maryland Lawmakers Urging Rejection of Fracked Gas PipelineDocument1 pageLetter From 65 Maryland Lawmakers Urging Rejection of Fracked Gas PipelineDavid MoonNo ratings yet

- Letter From 60 Maryland Lawmakers Re: I-495 & I-270 WideningDocument4 pagesLetter From 60 Maryland Lawmakers Re: I-495 & I-270 WideningDavid MoonNo ratings yet

- Letter To Governor Hogan From 64 Maryland Lawmakers On Coal PollutionDocument2 pagesLetter To Governor Hogan From 64 Maryland Lawmakers On Coal PollutionDavid MoonNo ratings yet

- Grassroots Democracy Commitment For Maryland GovernorDocument1 pageGrassroots Democracy Commitment For Maryland GovernorDavid Moon100% (1)

- Evan Glass - Supporters List For County Council District 5Document3 pagesEvan Glass - Supporters List For County Council District 5David MoonNo ratings yet

- Letter From Maryland Officials To WMATA On Late Night Service HoursDocument3 pagesLetter From Maryland Officials To WMATA On Late Night Service HoursDavid MoonNo ratings yet

- Letter From Prince George's Lawmakers To Doug GanslerDocument2 pagesLetter From Prince George's Lawmakers To Doug GanslerDavid MoonNo ratings yet

- EVENT FLYER: MD Gubernatorial Debate THU 1/30/14Document1 pageEVENT FLYER: MD Gubernatorial Debate THU 1/30/14David MoonNo ratings yet

- MCEA December 2013 EndorsementsDocument1 pageMCEA December 2013 EndorsementsDavid MoonNo ratings yet

- Doug Gansler 2013 MSEA Survey ResponsesDocument36 pagesDoug Gansler 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Anthony Brown 2013 MSEA Survey ResponsesDocument29 pagesAnthony Brown 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Heather Mizeur 2013 MSEA Survey ResponsesDocument23 pagesHeather Mizeur 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Heather Mizeur 2013 MSEA Survey ResponsesDocument23 pagesHeather Mizeur 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Hispanic Chamber of Commerce Letter Endorsing David Fraser-HidalgoDocument1 pageHispanic Chamber of Commerce Letter Endorsing David Fraser-HidalgoDavid MoonNo ratings yet

- Questions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDocument19 pagesQuestions For Maryland Gubernatorial Candidates 2014: Progressive NeighborsDavid MoonNo ratings yet

- Progressive Neighbors: Questions For Maryland Gubernatorial Candidates 2014Document10 pagesProgressive Neighbors: Questions For Maryland Gubernatorial Candidates 2014David MoonNo ratings yet

- (PDF) - Lectrostatique Et - Lectrocin - Tiq... Ition - Moussouni Ayoub - AcademiaDocument252 pages(PDF) - Lectrostatique Et - Lectrocin - Tiq... Ition - Moussouni Ayoub - Academiakoss kossNo ratings yet

- Resources For Pet Owners - Food Banks and BoardingDocument6 pagesResources For Pet Owners - Food Banks and Boarding10News WTSPNo ratings yet

- Marylands' 2017 Hunting Seasons CalendarDocument5 pagesMarylands' 2017 Hunting Seasons CalendarJwestie2007No ratings yet

- Multi-Sports Facility Proposal: Presented ToDocument25 pagesMulti-Sports Facility Proposal: Presented Tohussen seidNo ratings yet

- Maryland Drop Box LocationsDocument5 pagesMaryland Drop Box LocationsChris Berinato100% (1)

- City of Laurel Master Plan Comprehensive AmendmentDocument219 pagesCity of Laurel Master Plan Comprehensive AmendmentAnnieScanlanNo ratings yet

- 3 List of Free Blacks 6-2-9Document126 pages3 List of Free Blacks 6-2-9Laban Selvey BeyNo ratings yet

- 2019-04-25 St. Mary's County TimesDocument32 pages2019-04-25 St. Mary's County TimesSouthern Maryland OnlineNo ratings yet

- PGCPS Letters Authorizing Cell Tower Company To Move Forward With Specific PGCPS Schools "Authorization To Proceed Letters On PGCPS Cell Towers"Document11 pagesPGCPS Letters Authorizing Cell Tower Company To Move Forward With Specific PGCPS Schools "Authorization To Proceed Letters On PGCPS Cell Towers"Safe Tech For SchoolsNo ratings yet

- Armed Off-Duty Cop Sends Suspected Carjackers Fleeing As Crime SpiralDocument1 pageArmed Off-Duty Cop Sends Suspected Carjackers Fleeing As Crime Spiraled2870winNo ratings yet