Professional Documents

Culture Documents

Bir Form2550qpp1

Bir Form2550qpp1

Uploaded by

Marilyn P. BorborCopyright:

Available Formats

You might also like

- Solina Menu 2023 RESTODocument16 pagesSolina Menu 2023 RESTOMona Victoria B. PonsaranNo ratings yet

- The Trembling WorldDocument239 pagesThe Trembling Worldxdmhundz999No ratings yet

- 2550 MDocument2 pages2550 MJose Venturina Villacorta100% (3)

- GAA FY2013 (RA 10352) - General ProvisionDocument17 pagesGAA FY2013 (RA 10352) - General Provisionraineydays100% (2)

- Bir Form No. 1702Document6 pagesBir Form No. 1702Mary Monique Llacuna Lagan100% (1)

- Documentary Stamp Tax ReturnDocument6 pagesDocumentary Stamp Tax ReturnSuzette BalucanagNo ratings yet

- New Regular Contractor's LicenseDocument27 pagesNew Regular Contractor's LicenseAdmin BicoreNo ratings yet

- 1701qjuly2008 (ENCS)Document6 pages1701qjuly2008 (ENCS)alvie_budNo ratings yet

- Chaotic Sword GodDocument1,928 pagesChaotic Sword Godxdmhundz999100% (1)

- SPADocument1 pageSPAxdmhundz999No ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- 82255BIR Form 1701Document12 pages82255BIR Form 1701Leowell John G. RapaconNo ratings yet

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDocument1 pageFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezNo ratings yet

- Central Office: ManilaDocument106 pagesCentral Office: ManilaJhon Jezar CalumagNo ratings yet

- Euv 1ST 2011 1701QDocument6 pagesEuv 1ST 2011 1701QAdrian Raymnd EspirituNo ratings yet

- 1701A Annual Income Tax ReturnDocument2 pages1701A Annual Income Tax ReturnJaneth Tamayo NavalesNo ratings yet

- RMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.Document3 pagesRMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.KC AtinonNo ratings yet

- 2-4 Audited Financial StatementsDocument9 pages2-4 Audited Financial StatementsJustine Joyce GabiaNo ratings yet

- Gsis Forms: Type Form DetailsDocument6 pagesGsis Forms: Type Form DetailsJonnel CabuteNo ratings yet

- Dpwh-Dilg JMC 001 07-04-13 & MC 2014-153Document4 pagesDpwh-Dilg JMC 001 07-04-13 & MC 2014-153Arch. Steve Virgil SarabiaNo ratings yet

- Old Form 0605 PDFDocument2 pagesOld Form 0605 PDFeugene badere50% (2)

- Form 2307Document2 pagesForm 2307Dino Garzon OcinoNo ratings yet

- 2023 05 18 Seguiza MC Memorandum of AgreementDocument3 pages2023 05 18 Seguiza MC Memorandum of AgreementNathasia NunezNo ratings yet

- Statement of Single Largest Completed Contract (SLCC) Similar To The ProjectDocument1 pageStatement of Single Largest Completed Contract (SLCC) Similar To The ProjectJonhell Dela Cruz Soriano100% (1)

- Bank Recon FormatDocument1 pageBank Recon FormatAyan VicoNo ratings yet

- SSS R-5 Employer Payment ReturnDocument2 pagesSSS R-5 Employer Payment ReturnJimzon Kristian JimenezNo ratings yet

- Processing and Issuance of Approved ONETT Computation Sheet of Tax Due On Estate With No Other Tax LiabilitiesDocument1 pageProcessing and Issuance of Approved ONETT Computation Sheet of Tax Due On Estate With No Other Tax LiabilitiesJewelyn CioconNo ratings yet

- Form 2306 Witn Computation Electric BillDocument5 pagesForm 2306 Witn Computation Electric BillLean IsidroNo ratings yet

- 03) - Application For Registration and Classification of Contractor For Government Infrastructure ProjectsDocument5 pages03) - Application For Registration and Classification of Contractor For Government Infrastructure ProjectsDyna Endaya100% (2)

- Mulanay ELA 2023-2025Document144 pagesMulanay ELA 2023-2025Ashari CaliNo ratings yet

- Housing and Land Use Regulatory Board: and Urban Development Coordinating CouncilDocument19 pagesHousing and Land Use Regulatory Board: and Urban Development Coordinating CouncilTheaAlbertoNo ratings yet

- COA12 Memo Jan2016Document3 pagesCOA12 Memo Jan2016aliahNo ratings yet

- BIR Form 1701QDocument2 pagesBIR Form 1701QfileksNo ratings yet

- BIR Form 1701-Jan-2018-Encs.-FinalDocument6 pagesBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoNo ratings yet

- PCAB - Allowable Ranges of Contract CostsDocument1 pagePCAB - Allowable Ranges of Contract Costsanon_966209794No ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- 1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsDocument2 pages1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsVince Alvin DaquizNo ratings yet

- PFF285 ApplicationProvidentBenefitsClaim V03Document2 pagesPFF285 ApplicationProvidentBenefitsClaim V03Carlo Beltran Valerio0% (2)

- Coa Circular No. 2023 - 004 - 0001Document3 pagesCoa Circular No. 2023 - 004 - 0001UEP Main Accounting OfficeNo ratings yet

- Lbac Form 2021Document14 pagesLbac Form 2021Zyreen Kate CataquisNo ratings yet

- Affidavit Undertaking CCT CondominiumDocument1 pageAffidavit Undertaking CCT CondominiumRanie Delavente100% (1)

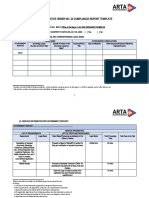

- Citizens Charter Bplo Arta MC 2020-04 Editable TemplateDocument3 pagesCitizens Charter Bplo Arta MC 2020-04 Editable Templateapi-541795421No ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- Application For Forest Landuse AgreementDocument16 pagesApplication For Forest Landuse AgreementMary Joy Moises OrdanezaNo ratings yet

- DO - 003 - S2010 Guidelines in The Acquisition of Motor Vehicles For Use in Construction SupervisionDocument5 pagesDO - 003 - S2010 Guidelines in The Acquisition of Motor Vehicles For Use in Construction SupervisionanbertjonathanNo ratings yet

- EO Inspectorate Team AM2020Document1 pageEO Inspectorate Team AM2020Juan Paolo S. BrosasNo ratings yet

- Republic Act 11964Document10 pagesRepublic Act 11964ArceeNo ratings yet

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Document5 pagesAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Jhanrich MatalaNo ratings yet

- Cash Flow Payment 20KDocument1 pageCash Flow Payment 20KrestyNo ratings yet

- Municipal Ordinance No. 267 S. 2008Document4 pagesMunicipal Ordinance No. 267 S. 2008Randolph QuilingNo ratings yet

- POW-mayabay Hanging BridgeDocument1 pagePOW-mayabay Hanging Bridgesheena gomez100% (1)

- Bautista BTF Elcac Opcen EoDocument2 pagesBautista BTF Elcac Opcen EojomarNo ratings yet

- TouchLink Time Recorder 3 Client ManualDocument11 pagesTouchLink Time Recorder 3 Client ManualJulius SoqNo ratings yet

- 1601e PDFDocument2 pages1601e PDFJanKhyrelFloresNo ratings yet

- RMC 72-2004 PDFDocument9 pagesRMC 72-2004 PDFBobby LockNo ratings yet

- Certificate of Final AcceptanceDocument1 pageCertificate of Final AcceptanceJan Gerona ApostaderoNo ratings yet

- 1st Indorsement PSA CEBU PSO Request For Relief From Accountability PhilSys RC Gaisano Mactan Island MallDocument2 pages1st Indorsement PSA CEBU PSO Request For Relief From Accountability PhilSys RC Gaisano Mactan Island MallJennelyn SantosNo ratings yet

- Order of Survey of Mineral Rights (Mineral Agreement/Financial and Technical Assistance Agreement)Document3 pagesOrder of Survey of Mineral Rights (Mineral Agreement/Financial and Technical Assistance Agreement)regina maximoNo ratings yet

- Order of Payment: Authority To Secure Plans/Bid FormsDocument1 pageOrder of Payment: Authority To Secure Plans/Bid FormsBradNo ratings yet

- Quarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaDocument5 pagesQuarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaJacinto TanNo ratings yet

- NNNDocument4 pagesNNNJemely BagangNo ratings yet

- 2550Mv 2Document7 pages2550Mv 2nelsonNo ratings yet

- Sichsi Vat-March 2010Document7 pagesSichsi Vat-March 2010egettobol10No ratings yet

- World of CultivationDocument1,394 pagesWorld of Cultivationxdmhundz999No ratings yet

- 2return of The Former Hero (Fin)Document306 pages2return of The Former Hero (Fin)xdmhundz999No ratings yet

- 8the Experimental Log of A Crazy Lich (Fin)Document321 pages8the Experimental Log of A Crazy Lich (Fin)xdmhundz999No ratings yet

- Secretary LeoncioDocument3 pagesSecretary Leoncioxdmhundz999No ratings yet

- 9emperor's Domination (Fin)Document879 pages9emperor's Domination (Fin)xdmhundz999No ratings yet

- Galactic Dark NetDocument801 pagesGalactic Dark Netxdmhundz9990% (1)

- 9emperor's Domination (Fin)Document879 pages9emperor's Domination (Fin)xdmhundz999No ratings yet

- 6hokuou Kizoku To Moukinzuma No Yukiguni Karigurashi (Fin)Document281 pages6hokuou Kizoku To Moukinzuma No Yukiguni Karigurashi (Fin)xdmhundz9990% (1)

- 9emperor's Domination (Fin)Document879 pages9emperor's Domination (Fin)xdmhundz999No ratings yet

- Gob TenseiDocument110 pagesGob Tenseixdmhundz999No ratings yet

- 8the Experimental Log of A Crazy Lich (Fin)Document321 pages8the Experimental Log of A Crazy Lich (Fin)xdmhundz999No ratings yet

- 2return of The Former Hero (Fin)Document306 pages2return of The Former Hero (Fin)xdmhundz999No ratings yet

- Punong Barangay Certification (PBC) : (For Barangay Check Disbursement)Document2 pagesPunong Barangay Certification (PBC) : (For Barangay Check Disbursement)xdmhundz999No ratings yet

- FrontDocument2 pagesFrontxdmhundz999No ratings yet

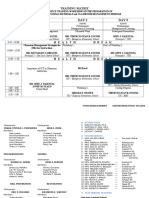

- Time Day 1 Day 2 Day 3: Training MatrixDocument3 pagesTime Day 1 Day 2 Day 3: Training Matrixxdmhundz999No ratings yet

- DO s2016 47 PDFDocument55 pagesDO s2016 47 PDFxdmhundz999No ratings yet

- FILM SHOWING - August 29, 2015: Report On Pa-RaffleDocument2 pagesFILM SHOWING - August 29, 2015: Report On Pa-Rafflexdmhundz999No ratings yet

- 2015 Passers MidwifeDocument26 pages2015 Passers Midwifexdmhundz999No ratings yet

- IBC and BCDocument2 pagesIBC and BCxdmhundz999No ratings yet

Bir Form2550qpp1

Bir Form2550qpp1

Uploaded by

Marilyn P. BorborOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir Form2550qpp1

Bir Form2550qpp1

Uploaded by

Marilyn P. BorborCopyright:

Available Formats

(To be filled up by the BIR)

DLN: PSIC:

Republika ng Pilipinas Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For the Year Ended ( MM / YYYY ) 6 TIN 9 11 Registered Address

Quarterly Value-Added Tax Return

1st 2nd 7 RDO Code 10 12 3rd 3 Return From Period 4th (mm/dd/yy) To 8 Line of Business

BIR Form No.

2550Q

April 2002 (ENCS)

4 Amended Return? Yes 5 No. of sheets attached No Telephone Number Zip Code

Fill in all applicable spaces. Mark all appropriate boxes with an X.

Calendar

Fiscal

2 Quarter

13 Are you availing of tax relief under Special Law or International Tax Treaty? Yes

Part II

If yes, specify No

Computation of Tax

Industries Covered by VAT 14 15 16 17 18 14A 15A 16A 17A 18A

ATC

Sales/Receipts for the Quarter (Exclusive of VAT)

Output Tax Due for the Quarter

14B 15B 16B 17B 18B 19A 20 21 22 Purchases

14C 15C 16C 17C 18C 19B

19 Total Sales/Receipts (Sum of Items 14B to 18B) and Output Tax Due (Sum of Items 14C to 18C) - 10% 20 Zero Rated Sales/Receipts 21 Exempt Sales/Receipts 22 Total Sales/Receipts (Sum of Items 19A, 20 and 21) 23 Less: Input Tax Transitional Input Tax 23A

23B 23C 23D/E

23A 23B 23C

Presumptive Input Tax Input Tax Carried Over from Previous Quarter Domestic Purchases-Capital Goods Domestic Purchases-Services Services rendered by Non-Resident Importations - Capital Goods 23D 23H 23J 23L 23N 23P 23Q Domestic Purchases - Goods other than Capital Goods 23F

23E 23G 23I 23K 23M 23O

23F/G 23H/I 23J/K 23L/M 23N/O

23P

Importations- Goods other than capital goods Purchases Not Qualified for Input Tax

23Q Total Purchases (Sum of Items 23D,23F,23H,23J,23L,23N & 23P)

24 25

Total Available Input Tax (Sum of Items 23A,23B, 23C, 23E, 23G, 23I, 23K,23M & 23O) Less: Deduction from Input Tax 25A Any VAT Refund/ TCC Claimed Excess input tax carrried over to succeeding quarter, if this is an amended return 25B Total (Sum of Items 25A and 25B) 25C

24 25A 25B 25C 26 27 28A 28B 28C 28D 28E 28F 29

26 Net Creditable Input Tax (Item 24 less Item 25C) 27 VAT Payable/(Excess Input Tax) (Item 19B less Item 26) Less: Tax Credits/Payments 28 28A Excess payment in the previous return 28B Monthly VAT Payments - previous two months 28C Creditable Value-Added Tax Withheld (see Schedule I) 28D Advance Payments (see Schedule II) 28E VAT paid in return previously filed, if this is an amended return 28F Total Tax Credits/Payments(Sum of Items 28A to 28E) 29 Tax Payable/(Overpayment) (Item 27 less Item 28F) Add: Penalties Surcharge Interest 30

30A 30B 30C

Compromise

30D

31 Total Amount Payable/(Overpayment)(Sum of Items 29 & 30D) 31 I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. 32

Signature over Printed Name of Taxpayer/ Taxpayer Authorized Representative TIN of Tax Agent (if applicable)

33

Title/Position of Signatory

Tax AgentAcrreditation No. (if applicable)

Part III

Drawee Bank/ Particulars Agency Number 34 Cash/Bank Debit Memo................................................................................ 35 Check 35A 35B 35C 36 Tax Debit 36A 36B Memo .............. 37 Others 37A 37B

37C

Details of Payment Date MM DD YYYY

34 35D 36C 37D

Amount

Stamp of Receiving Office and Date of Receipt

Machine Validation (if filed with an accredited agent bank)/Revenue Official Receipt Details (If not filed with the bank)

You might also like

- Solina Menu 2023 RESTODocument16 pagesSolina Menu 2023 RESTOMona Victoria B. PonsaranNo ratings yet

- The Trembling WorldDocument239 pagesThe Trembling Worldxdmhundz999No ratings yet

- 2550 MDocument2 pages2550 MJose Venturina Villacorta100% (3)

- GAA FY2013 (RA 10352) - General ProvisionDocument17 pagesGAA FY2013 (RA 10352) - General Provisionraineydays100% (2)

- Bir Form No. 1702Document6 pagesBir Form No. 1702Mary Monique Llacuna Lagan100% (1)

- Documentary Stamp Tax ReturnDocument6 pagesDocumentary Stamp Tax ReturnSuzette BalucanagNo ratings yet

- New Regular Contractor's LicenseDocument27 pagesNew Regular Contractor's LicenseAdmin BicoreNo ratings yet

- 1701qjuly2008 (ENCS)Document6 pages1701qjuly2008 (ENCS)alvie_budNo ratings yet

- Chaotic Sword GodDocument1,928 pagesChaotic Sword Godxdmhundz999100% (1)

- SPADocument1 pageSPAxdmhundz999No ratings yet

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- 82255BIR Form 1701Document12 pages82255BIR Form 1701Leowell John G. RapaconNo ratings yet

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDocument1 pageFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezNo ratings yet

- Central Office: ManilaDocument106 pagesCentral Office: ManilaJhon Jezar CalumagNo ratings yet

- Euv 1ST 2011 1701QDocument6 pagesEuv 1ST 2011 1701QAdrian Raymnd EspirituNo ratings yet

- 1701A Annual Income Tax ReturnDocument2 pages1701A Annual Income Tax ReturnJaneth Tamayo NavalesNo ratings yet

- RMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.Document3 pagesRMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.KC AtinonNo ratings yet

- 2-4 Audited Financial StatementsDocument9 pages2-4 Audited Financial StatementsJustine Joyce GabiaNo ratings yet

- Gsis Forms: Type Form DetailsDocument6 pagesGsis Forms: Type Form DetailsJonnel CabuteNo ratings yet

- Dpwh-Dilg JMC 001 07-04-13 & MC 2014-153Document4 pagesDpwh-Dilg JMC 001 07-04-13 & MC 2014-153Arch. Steve Virgil SarabiaNo ratings yet

- Old Form 0605 PDFDocument2 pagesOld Form 0605 PDFeugene badere50% (2)

- Form 2307Document2 pagesForm 2307Dino Garzon OcinoNo ratings yet

- 2023 05 18 Seguiza MC Memorandum of AgreementDocument3 pages2023 05 18 Seguiza MC Memorandum of AgreementNathasia NunezNo ratings yet

- Statement of Single Largest Completed Contract (SLCC) Similar To The ProjectDocument1 pageStatement of Single Largest Completed Contract (SLCC) Similar To The ProjectJonhell Dela Cruz Soriano100% (1)

- Bank Recon FormatDocument1 pageBank Recon FormatAyan VicoNo ratings yet

- SSS R-5 Employer Payment ReturnDocument2 pagesSSS R-5 Employer Payment ReturnJimzon Kristian JimenezNo ratings yet

- Processing and Issuance of Approved ONETT Computation Sheet of Tax Due On Estate With No Other Tax LiabilitiesDocument1 pageProcessing and Issuance of Approved ONETT Computation Sheet of Tax Due On Estate With No Other Tax LiabilitiesJewelyn CioconNo ratings yet

- Form 2306 Witn Computation Electric BillDocument5 pagesForm 2306 Witn Computation Electric BillLean IsidroNo ratings yet

- 03) - Application For Registration and Classification of Contractor For Government Infrastructure ProjectsDocument5 pages03) - Application For Registration and Classification of Contractor For Government Infrastructure ProjectsDyna Endaya100% (2)

- Mulanay ELA 2023-2025Document144 pagesMulanay ELA 2023-2025Ashari CaliNo ratings yet

- Housing and Land Use Regulatory Board: and Urban Development Coordinating CouncilDocument19 pagesHousing and Land Use Regulatory Board: and Urban Development Coordinating CouncilTheaAlbertoNo ratings yet

- COA12 Memo Jan2016Document3 pagesCOA12 Memo Jan2016aliahNo ratings yet

- BIR Form 1701QDocument2 pagesBIR Form 1701QfileksNo ratings yet

- BIR Form 1701-Jan-2018-Encs.-FinalDocument6 pagesBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoNo ratings yet

- PCAB - Allowable Ranges of Contract CostsDocument1 pagePCAB - Allowable Ranges of Contract Costsanon_966209794No ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- 1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsDocument2 pages1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsVince Alvin DaquizNo ratings yet

- PFF285 ApplicationProvidentBenefitsClaim V03Document2 pagesPFF285 ApplicationProvidentBenefitsClaim V03Carlo Beltran Valerio0% (2)

- Coa Circular No. 2023 - 004 - 0001Document3 pagesCoa Circular No. 2023 - 004 - 0001UEP Main Accounting OfficeNo ratings yet

- Lbac Form 2021Document14 pagesLbac Form 2021Zyreen Kate CataquisNo ratings yet

- Affidavit Undertaking CCT CondominiumDocument1 pageAffidavit Undertaking CCT CondominiumRanie Delavente100% (1)

- Citizens Charter Bplo Arta MC 2020-04 Editable TemplateDocument3 pagesCitizens Charter Bplo Arta MC 2020-04 Editable Templateapi-541795421No ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- Application For Forest Landuse AgreementDocument16 pagesApplication For Forest Landuse AgreementMary Joy Moises OrdanezaNo ratings yet

- DO - 003 - S2010 Guidelines in The Acquisition of Motor Vehicles For Use in Construction SupervisionDocument5 pagesDO - 003 - S2010 Guidelines in The Acquisition of Motor Vehicles For Use in Construction SupervisionanbertjonathanNo ratings yet

- EO Inspectorate Team AM2020Document1 pageEO Inspectorate Team AM2020Juan Paolo S. BrosasNo ratings yet

- Republic Act 11964Document10 pagesRepublic Act 11964ArceeNo ratings yet

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Document5 pagesAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 1 I I 0 1 2 I I 0 1 3Jhanrich MatalaNo ratings yet

- Cash Flow Payment 20KDocument1 pageCash Flow Payment 20KrestyNo ratings yet

- Municipal Ordinance No. 267 S. 2008Document4 pagesMunicipal Ordinance No. 267 S. 2008Randolph QuilingNo ratings yet

- POW-mayabay Hanging BridgeDocument1 pagePOW-mayabay Hanging Bridgesheena gomez100% (1)

- Bautista BTF Elcac Opcen EoDocument2 pagesBautista BTF Elcac Opcen EojomarNo ratings yet

- TouchLink Time Recorder 3 Client ManualDocument11 pagesTouchLink Time Recorder 3 Client ManualJulius SoqNo ratings yet

- 1601e PDFDocument2 pages1601e PDFJanKhyrelFloresNo ratings yet

- RMC 72-2004 PDFDocument9 pagesRMC 72-2004 PDFBobby LockNo ratings yet

- Certificate of Final AcceptanceDocument1 pageCertificate of Final AcceptanceJan Gerona ApostaderoNo ratings yet

- 1st Indorsement PSA CEBU PSO Request For Relief From Accountability PhilSys RC Gaisano Mactan Island MallDocument2 pages1st Indorsement PSA CEBU PSO Request For Relief From Accountability PhilSys RC Gaisano Mactan Island MallJennelyn SantosNo ratings yet

- Order of Survey of Mineral Rights (Mineral Agreement/Financial and Technical Assistance Agreement)Document3 pagesOrder of Survey of Mineral Rights (Mineral Agreement/Financial and Technical Assistance Agreement)regina maximoNo ratings yet

- Order of Payment: Authority To Secure Plans/Bid FormsDocument1 pageOrder of Payment: Authority To Secure Plans/Bid FormsBradNo ratings yet

- Quarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaDocument5 pagesQuarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaJacinto TanNo ratings yet

- NNNDocument4 pagesNNNJemely BagangNo ratings yet

- 2550Mv 2Document7 pages2550Mv 2nelsonNo ratings yet

- Sichsi Vat-March 2010Document7 pagesSichsi Vat-March 2010egettobol10No ratings yet

- World of CultivationDocument1,394 pagesWorld of Cultivationxdmhundz999No ratings yet

- 2return of The Former Hero (Fin)Document306 pages2return of The Former Hero (Fin)xdmhundz999No ratings yet

- 8the Experimental Log of A Crazy Lich (Fin)Document321 pages8the Experimental Log of A Crazy Lich (Fin)xdmhundz999No ratings yet

- Secretary LeoncioDocument3 pagesSecretary Leoncioxdmhundz999No ratings yet

- 9emperor's Domination (Fin)Document879 pages9emperor's Domination (Fin)xdmhundz999No ratings yet

- Galactic Dark NetDocument801 pagesGalactic Dark Netxdmhundz9990% (1)

- 9emperor's Domination (Fin)Document879 pages9emperor's Domination (Fin)xdmhundz999No ratings yet

- 6hokuou Kizoku To Moukinzuma No Yukiguni Karigurashi (Fin)Document281 pages6hokuou Kizoku To Moukinzuma No Yukiguni Karigurashi (Fin)xdmhundz9990% (1)

- 9emperor's Domination (Fin)Document879 pages9emperor's Domination (Fin)xdmhundz999No ratings yet

- Gob TenseiDocument110 pagesGob Tenseixdmhundz999No ratings yet

- 8the Experimental Log of A Crazy Lich (Fin)Document321 pages8the Experimental Log of A Crazy Lich (Fin)xdmhundz999No ratings yet

- 2return of The Former Hero (Fin)Document306 pages2return of The Former Hero (Fin)xdmhundz999No ratings yet

- Punong Barangay Certification (PBC) : (For Barangay Check Disbursement)Document2 pagesPunong Barangay Certification (PBC) : (For Barangay Check Disbursement)xdmhundz999No ratings yet

- FrontDocument2 pagesFrontxdmhundz999No ratings yet

- Time Day 1 Day 2 Day 3: Training MatrixDocument3 pagesTime Day 1 Day 2 Day 3: Training Matrixxdmhundz999No ratings yet

- DO s2016 47 PDFDocument55 pagesDO s2016 47 PDFxdmhundz999No ratings yet

- FILM SHOWING - August 29, 2015: Report On Pa-RaffleDocument2 pagesFILM SHOWING - August 29, 2015: Report On Pa-Rafflexdmhundz999No ratings yet

- 2015 Passers MidwifeDocument26 pages2015 Passers Midwifexdmhundz999No ratings yet

- IBC and BCDocument2 pagesIBC and BCxdmhundz999No ratings yet