Professional Documents

Culture Documents

Chap 6 Bond Markets

Chap 6 Bond Markets

Uploaded by

Nguyen NgocCopyright:

Available Formats

You might also like

- Creative Thinking Thinking MmunicationDocument334 pagesCreative Thinking Thinking Mmunicationimminseo6No ratings yet

- Grandpas Farm (Possible Worlds Games) - UV6yOlDocument28 pagesGrandpas Farm (Possible Worlds Games) - UV6yOlhjorhrafnNo ratings yet

- Volo's Guide To Monsters - 1Document7 pagesVolo's Guide To Monsters - 1Saz100% (1)

- Chapter 10: Mortgage Markets and DerivativesDocument6 pagesChapter 10: Mortgage Markets and DerivativesRemar22No ratings yet

- Group 9 - PFP - Sec B - Session 3Document22 pagesGroup 9 - PFP - Sec B - Session 3jhawarvibhuti7No ratings yet

- Chapter 9 - Mortgage MarketsDocument12 pagesChapter 9 - Mortgage MarketsLevi Emmanuel Veloso BravoNo ratings yet

- Debt MarketDocument2 pagesDebt MarketShafqat HossainNo ratings yet

- Lecture - Bond MarketDocument6 pagesLecture - Bond MarketAngel GarciaNo ratings yet

- Term Loans and LeasesDocument38 pagesTerm Loans and LeasesPankaj ShahNo ratings yet

- Money Market Instruments: by B.PrabhathDocument13 pagesMoney Market Instruments: by B.PrabhathThwador DarkNo ratings yet

- LN 06 Fixed Income NotesDocument59 pagesLN 06 Fixed Income NoteshersanyNo ratings yet

- Fixed Income Securities - SIGFi - Finance HandbookDocument15 pagesFixed Income Securities - SIGFi - Finance HandbookSneha TatiNo ratings yet

- Bond MarketDocument35 pagesBond MarketBhupendra MoreNo ratings yet

- What Is A Treasury BondDocument12 pagesWhat Is A Treasury Bondmorris yenenehNo ratings yet

- FinQuiz - Smart Summary - Study Session 15 - Reading 52Document5 pagesFinQuiz - Smart Summary - Study Session 15 - Reading 52RafaelNo ratings yet

- Reading 1 NotesDocument6 pagesReading 1 NotesSyed Mujtaba Ali AhsanNo ratings yet

- Lecture Note 01 - IntroductionDocument45 pagesLecture Note 01 - Introductionben tenNo ratings yet

- Chapter 09 PresentationDocument26 pagesChapter 09 PresentationMega_ImranNo ratings yet

- Tradeable Instruments - IIDocument24 pagesTradeable Instruments - IIZenubHusainNo ratings yet

- Bond Market, Bond Valuation and Risk: CH 7, 8 and Some Additional Materials Part ADocument19 pagesBond Market, Bond Valuation and Risk: CH 7, 8 and Some Additional Materials Part AMD AshrafulNo ratings yet

- Fixed-Income NotesDocument3 pagesFixed-Income Notesalexa ubaldoNo ratings yet

- The IB Business of Debt - Fixed IncomeDocument36 pagesThe IB Business of Debt - Fixed IncomeNgọc Phan Thị BíchNo ratings yet

- Bonds: Types, Trading & SettlementDocument52 pagesBonds: Types, Trading & SettlementraviNo ratings yet

- SAPMDocument21 pagesSAPMllNo ratings yet

- Bond MarketDocument22 pagesBond MarketSumonaminur100% (1)

- Bond & Bond ValuationDocument28 pagesBond & Bond ValuationMohin ChowdhuryNo ratings yet

- Investment and Portfolio Management: ACFN 3201Document13 pagesInvestment and Portfolio Management: ACFN 3201Bantamkak FikaduNo ratings yet

- CH 7Document9 pagesCH 7Nowshin NaylaNo ratings yet

- Analysis and Valuation of DebtDocument83 pagesAnalysis and Valuation of Debtupvoteintern06No ratings yet

- Unit 54 - Overview of Bond Sectors & Instruments - 2013Document18 pagesUnit 54 - Overview of Bond Sectors & Instruments - 2013cytishNo ratings yet

- Understanding The Money Market: - Money Market Instruments Are Low Risk, Highly Liquid, and ofDocument12 pagesUnderstanding The Money Market: - Money Market Instruments Are Low Risk, Highly Liquid, and oftapia4yeabuNo ratings yet

- Portfolio Management Module 4Document7 pagesPortfolio Management Module 4Ayush kashyapNo ratings yet

- Corporate Debt Markets The Debt MarketDocument7 pagesCorporate Debt Markets The Debt MarketYashwanth Naik SNo ratings yet

- Mortgage MarketDocument3 pagesMortgage MarketnishioyukihimeNo ratings yet

- Debt MarketDocument20 pagesDebt Marketnishantbali100% (3)

- FGN Bond MarketDocument9 pagesFGN Bond MarketOladipupo Mayowa PaulNo ratings yet

- MortgageDocument6 pagesMortgageMohin ChowdhuryNo ratings yet

- Fixed in Come NotesDocument30 pagesFixed in Come NotesmechedceNo ratings yet

- Ratios in MFDocument23 pagesRatios in MFInvest EasyNo ratings yet

- Lecture 02 PDFDocument1 pageLecture 02 PDFOuadia ElzNo ratings yet

- Section 3: SwapsDocument32 pagesSection 3: Swapsswesam123No ratings yet

- Chapter 12 The Bond MarketDocument42 pagesChapter 12 The Bond MarketJay Ann DomeNo ratings yet

- A BondDocument3 pagesA Bondnusra_t100% (1)

- Financial InstrumentsDocument12 pagesFinancial InstrumentsAkshay Anand100% (1)

- Bond Valuation (Unit Ii Sapm)Document11 pagesBond Valuation (Unit Ii Sapm)advance excelNo ratings yet

- Chapter 3. Bond ValuationDocument31 pagesChapter 3. Bond Valuationmetu07071998No ratings yet

- Chapter Thee Valuation of Financial AssetsDocument143 pagesChapter Thee Valuation of Financial AssetsDejene GurmesaNo ratings yet

- Chapter 09 (Financial Institute and Market)Document33 pagesChapter 09 (Financial Institute and Market)Mega_ImranNo ratings yet

- C. Mortgage Markets and Derivatives 1. Describe What Are Mortgages and Mortgage Market?Document3 pagesC. Mortgage Markets and Derivatives 1. Describe What Are Mortgages and Mortgage Market?Aldrin GerenteNo ratings yet

- Investment AlternativesDocument23 pagesInvestment AlternativesHafiz Muhammad HananNo ratings yet

- CH 2 Investment Alternatives Generic PriciplesDocument34 pagesCH 2 Investment Alternatives Generic PriciplesAbdihamid AliNo ratings yet

- Retail Banking - IcicibankDocument69 pagesRetail Banking - IcicibankKaataRanjithkumarNo ratings yet

- Shuvo FinalDocument3 pagesShuvo FinalNasrin Binta Sorna 1813541630No ratings yet

- Debt FinancingDocument22 pagesDebt Financingdinesh07_1984100% (1)

- Chap 015Document21 pagesChap 015Zaid Osama AldwekNo ratings yet

- Week 2 CH 2Document48 pagesWeek 2 CH 2Noor TaherNo ratings yet

- FinmarDocument4 pagesFinmarLana sereneNo ratings yet

- Lecture 3Document33 pagesLecture 3hafsaNo ratings yet

- Chapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Document11 pagesChapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Seid KassawNo ratings yet

- Investment Alternatives: Charles P. Jones, Investments: Analysis and ManagementDocument33 pagesInvestment Alternatives: Charles P. Jones, Investments: Analysis and ManagementSaeed AwanNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Unlock Real Estate Wealth: A Comprehensive Guide to No-Money Down Investment StrategiesFrom EverandUnlock Real Estate Wealth: A Comprehensive Guide to No-Money Down Investment StrategiesNo ratings yet

- Barangay SinabaanDocument1 pageBarangay SinabaanOmar Dizon IINo ratings yet

- Ancient IndiaDocument9 pagesAncient IndiaAchanger AcherNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument9 pagesCambridge International Advanced Subsidiary and Advanced LevelharpritahingoraniNo ratings yet

- CortinaDocument2 pagesCortinatecnicoeletronico23No ratings yet

- Experiment 6: Method of Mixture ObjectiveDocument3 pagesExperiment 6: Method of Mixture Objectiveshark eyeNo ratings yet

- FILM TREATMENT PE-Revised-11.30.20Document28 pagesFILM TREATMENT PE-Revised-11.30.20ArpoxonNo ratings yet

- Dr. Henry Petroski: Morning Lecture NotesDocument5 pagesDr. Henry Petroski: Morning Lecture Notesapi-299647486No ratings yet

- International Business: Case Study-Report-3 18-02-2022Document5 pagesInternational Business: Case Study-Report-3 18-02-2022swapnil anandNo ratings yet

- Haridwar Cancelled TCKTDocument2 pagesHaridwar Cancelled TCKTRavikumar AppaniNo ratings yet

- Transportation Engineering - I: Introduction To Bridge EngineeringDocument33 pagesTransportation Engineering - I: Introduction To Bridge Engineeringmit rami0% (1)

- Latex ManualDocument160 pagesLatex Manualcd_levyNo ratings yet

- Demonstrating Value With BMC Server Automation (Bladelogic)Document56 pagesDemonstrating Value With BMC Server Automation (Bladelogic)abishekvsNo ratings yet

- Cut 120Document128 pagesCut 120Jimmy MyNo ratings yet

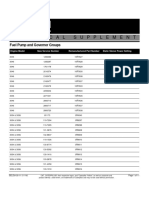

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- Career Theory Model SuperDocument2 pagesCareer Theory Model SuperPrincess ZheminahNo ratings yet

- Document 337737.1Document3 pagesDocument 337737.1elcaso34No ratings yet

- Tugas Inggris M Edi SuryaDocument9 pagesTugas Inggris M Edi SuryaAstaghfirullahNo ratings yet

- Evaluating Tilting Pad - PaperDocument10 pagesEvaluating Tilting Pad - PaperAsit SuyalNo ratings yet

- Crecimiento Bajo en Carbono - Carbon-Disclosure-Project-2011Document80 pagesCrecimiento Bajo en Carbono - Carbon-Disclosure-Project-2011Alan Cereceda EscalonaNo ratings yet

- Welcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesDocument7 pagesWelcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesTapanco BarerraNo ratings yet

- MSDS - Prominent-GlycineDocument6 pagesMSDS - Prominent-GlycineTanawat ChinchaivanichkitNo ratings yet

- Answer Module 1Document3 pagesAnswer Module 1endroNo ratings yet

- Topic 3 SequencesDocument4 pagesTopic 3 SequencesWan Aziah100% (1)

- Dealing With Mental Health Spiritually by Ife AdetonaDocument46 pagesDealing With Mental Health Spiritually by Ife AdetonaIfeNo ratings yet

- Best Astrologer in DelhiDocument5 pagesBest Astrologer in DelhiastrorajkumarNo ratings yet

- Fundamentals of Human Resource Management: Decenzo and RobbinsDocument30 pagesFundamentals of Human Resource Management: Decenzo and RobbinsMalik Naseer AwanNo ratings yet

- Research On Process of Raising Funds Through QipDocument5 pagesResearch On Process of Raising Funds Through QipRachit SharmaNo ratings yet

Chap 6 Bond Markets

Chap 6 Bond Markets

Uploaded by

Nguyen NgocOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 6 Bond Markets

Chap 6 Bond Markets

Uploaded by

Nguyen NgocCopyright:

Available Formats

chap 4

T-bills

t-bills are virtually default risk free and have little interest risk t-bills are auctioned, bids are submitted by gov security dealer, fin & non-fin corporations, and individuals bids can be competitive or noncompetitive competitive bids specify bid price & desired quantity discriminating price: average price of all bidders single price: single lowest price for all bidders noncompetitive bidders get preferential allocation and agree to pay the lowest price of winning competitive bids fed fund rate is target rate in conduct of monetary policy fed fund transactions are short term unsecured loans banks with excess reserves lend fed funds banks with deficient reserves borrow fed funds fed fund are single payment loans use single payment yield

Fed fund

RPs are short term collateralized loans ( typical collateral is US treasury security) CP is the larget money market in term of dollar outstanding

CP is unsecured short term corporate debt - maturity 1 to 127 days sold indirectly through dealer and brokers hold to maturity, no active secondary market yields are quoted discount basis ( like t-bills)

CDs are bearer instruments salable in the secondary market BA is used in international transaction

BA is bearer instruments salable in secondary markets

Chap 6 bond markets

T-notes & bonds

default risk free low returns interest rate risks: longer maturity wider price fluctuations when interest rate changes liquidity risk: older issued t-bond and t-notes trade less frequently than newly issued ones are security issued by state and local gov to fund imbalances between expenditures and receipts to finance capital outlays

municipal bonds

attractive to household investors because interest is exempted from federal and most local income taxes

Chap 7 mortgage

mortgage & characteristics of mortgage collateral: lenders place liens against properties that remain in place until loans are fully paid off

a down payment private mortgage insurance (PMI): is generally required when the loan to value ratio is more than 80% federally insurance mortgages repayment is guaranteed either the federal housing administration or the veterans admnistration amortization schedule distinguish 3 types of mortgage backed security collateralized mortgage obligations (CMOs) are multiclass pass through with multiple bond holder classes or tranches each bond holder class has a different guaranteed coupon mortgage prepayments retire only one tranche at a time mortgage backed bonds (MBBs) allow FIs to raise long term low cost funds without removing mortgages from their balance sheet a group of mortgage asset is pledged as collateral against a MBB issue, but their is no direct link between the cash flows of the mortgages and the cash flows on the MBB

You might also like

- Creative Thinking Thinking MmunicationDocument334 pagesCreative Thinking Thinking Mmunicationimminseo6No ratings yet

- Grandpas Farm (Possible Worlds Games) - UV6yOlDocument28 pagesGrandpas Farm (Possible Worlds Games) - UV6yOlhjorhrafnNo ratings yet

- Volo's Guide To Monsters - 1Document7 pagesVolo's Guide To Monsters - 1Saz100% (1)

- Chapter 10: Mortgage Markets and DerivativesDocument6 pagesChapter 10: Mortgage Markets and DerivativesRemar22No ratings yet

- Group 9 - PFP - Sec B - Session 3Document22 pagesGroup 9 - PFP - Sec B - Session 3jhawarvibhuti7No ratings yet

- Chapter 9 - Mortgage MarketsDocument12 pagesChapter 9 - Mortgage MarketsLevi Emmanuel Veloso BravoNo ratings yet

- Debt MarketDocument2 pagesDebt MarketShafqat HossainNo ratings yet

- Lecture - Bond MarketDocument6 pagesLecture - Bond MarketAngel GarciaNo ratings yet

- Term Loans and LeasesDocument38 pagesTerm Loans and LeasesPankaj ShahNo ratings yet

- Money Market Instruments: by B.PrabhathDocument13 pagesMoney Market Instruments: by B.PrabhathThwador DarkNo ratings yet

- LN 06 Fixed Income NotesDocument59 pagesLN 06 Fixed Income NoteshersanyNo ratings yet

- Fixed Income Securities - SIGFi - Finance HandbookDocument15 pagesFixed Income Securities - SIGFi - Finance HandbookSneha TatiNo ratings yet

- Bond MarketDocument35 pagesBond MarketBhupendra MoreNo ratings yet

- What Is A Treasury BondDocument12 pagesWhat Is A Treasury Bondmorris yenenehNo ratings yet

- FinQuiz - Smart Summary - Study Session 15 - Reading 52Document5 pagesFinQuiz - Smart Summary - Study Session 15 - Reading 52RafaelNo ratings yet

- Reading 1 NotesDocument6 pagesReading 1 NotesSyed Mujtaba Ali AhsanNo ratings yet

- Lecture Note 01 - IntroductionDocument45 pagesLecture Note 01 - Introductionben tenNo ratings yet

- Chapter 09 PresentationDocument26 pagesChapter 09 PresentationMega_ImranNo ratings yet

- Tradeable Instruments - IIDocument24 pagesTradeable Instruments - IIZenubHusainNo ratings yet

- Bond Market, Bond Valuation and Risk: CH 7, 8 and Some Additional Materials Part ADocument19 pagesBond Market, Bond Valuation and Risk: CH 7, 8 and Some Additional Materials Part AMD AshrafulNo ratings yet

- Fixed-Income NotesDocument3 pagesFixed-Income Notesalexa ubaldoNo ratings yet

- The IB Business of Debt - Fixed IncomeDocument36 pagesThe IB Business of Debt - Fixed IncomeNgọc Phan Thị BíchNo ratings yet

- Bonds: Types, Trading & SettlementDocument52 pagesBonds: Types, Trading & SettlementraviNo ratings yet

- SAPMDocument21 pagesSAPMllNo ratings yet

- Bond MarketDocument22 pagesBond MarketSumonaminur100% (1)

- Bond & Bond ValuationDocument28 pagesBond & Bond ValuationMohin ChowdhuryNo ratings yet

- Investment and Portfolio Management: ACFN 3201Document13 pagesInvestment and Portfolio Management: ACFN 3201Bantamkak FikaduNo ratings yet

- CH 7Document9 pagesCH 7Nowshin NaylaNo ratings yet

- Analysis and Valuation of DebtDocument83 pagesAnalysis and Valuation of Debtupvoteintern06No ratings yet

- Unit 54 - Overview of Bond Sectors & Instruments - 2013Document18 pagesUnit 54 - Overview of Bond Sectors & Instruments - 2013cytishNo ratings yet

- Understanding The Money Market: - Money Market Instruments Are Low Risk, Highly Liquid, and ofDocument12 pagesUnderstanding The Money Market: - Money Market Instruments Are Low Risk, Highly Liquid, and oftapia4yeabuNo ratings yet

- Portfolio Management Module 4Document7 pagesPortfolio Management Module 4Ayush kashyapNo ratings yet

- Corporate Debt Markets The Debt MarketDocument7 pagesCorporate Debt Markets The Debt MarketYashwanth Naik SNo ratings yet

- Mortgage MarketDocument3 pagesMortgage MarketnishioyukihimeNo ratings yet

- Debt MarketDocument20 pagesDebt Marketnishantbali100% (3)

- FGN Bond MarketDocument9 pagesFGN Bond MarketOladipupo Mayowa PaulNo ratings yet

- MortgageDocument6 pagesMortgageMohin ChowdhuryNo ratings yet

- Fixed in Come NotesDocument30 pagesFixed in Come NotesmechedceNo ratings yet

- Ratios in MFDocument23 pagesRatios in MFInvest EasyNo ratings yet

- Lecture 02 PDFDocument1 pageLecture 02 PDFOuadia ElzNo ratings yet

- Section 3: SwapsDocument32 pagesSection 3: Swapsswesam123No ratings yet

- Chapter 12 The Bond MarketDocument42 pagesChapter 12 The Bond MarketJay Ann DomeNo ratings yet

- A BondDocument3 pagesA Bondnusra_t100% (1)

- Financial InstrumentsDocument12 pagesFinancial InstrumentsAkshay Anand100% (1)

- Bond Valuation (Unit Ii Sapm)Document11 pagesBond Valuation (Unit Ii Sapm)advance excelNo ratings yet

- Chapter 3. Bond ValuationDocument31 pagesChapter 3. Bond Valuationmetu07071998No ratings yet

- Chapter Thee Valuation of Financial AssetsDocument143 pagesChapter Thee Valuation of Financial AssetsDejene GurmesaNo ratings yet

- Chapter 09 (Financial Institute and Market)Document33 pagesChapter 09 (Financial Institute and Market)Mega_ImranNo ratings yet

- C. Mortgage Markets and Derivatives 1. Describe What Are Mortgages and Mortgage Market?Document3 pagesC. Mortgage Markets and Derivatives 1. Describe What Are Mortgages and Mortgage Market?Aldrin GerenteNo ratings yet

- Investment AlternativesDocument23 pagesInvestment AlternativesHafiz Muhammad HananNo ratings yet

- CH 2 Investment Alternatives Generic PriciplesDocument34 pagesCH 2 Investment Alternatives Generic PriciplesAbdihamid AliNo ratings yet

- Retail Banking - IcicibankDocument69 pagesRetail Banking - IcicibankKaataRanjithkumarNo ratings yet

- Shuvo FinalDocument3 pagesShuvo FinalNasrin Binta Sorna 1813541630No ratings yet

- Debt FinancingDocument22 pagesDebt Financingdinesh07_1984100% (1)

- Chap 015Document21 pagesChap 015Zaid Osama AldwekNo ratings yet

- Week 2 CH 2Document48 pagesWeek 2 CH 2Noor TaherNo ratings yet

- FinmarDocument4 pagesFinmarLana sereneNo ratings yet

- Lecture 3Document33 pagesLecture 3hafsaNo ratings yet

- Chapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Document11 pagesChapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Seid KassawNo ratings yet

- Investment Alternatives: Charles P. Jones, Investments: Analysis and ManagementDocument33 pagesInvestment Alternatives: Charles P. Jones, Investments: Analysis and ManagementSaeed AwanNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Unlock Real Estate Wealth: A Comprehensive Guide to No-Money Down Investment StrategiesFrom EverandUnlock Real Estate Wealth: A Comprehensive Guide to No-Money Down Investment StrategiesNo ratings yet

- Barangay SinabaanDocument1 pageBarangay SinabaanOmar Dizon IINo ratings yet

- Ancient IndiaDocument9 pagesAncient IndiaAchanger AcherNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument9 pagesCambridge International Advanced Subsidiary and Advanced LevelharpritahingoraniNo ratings yet

- CortinaDocument2 pagesCortinatecnicoeletronico23No ratings yet

- Experiment 6: Method of Mixture ObjectiveDocument3 pagesExperiment 6: Method of Mixture Objectiveshark eyeNo ratings yet

- FILM TREATMENT PE-Revised-11.30.20Document28 pagesFILM TREATMENT PE-Revised-11.30.20ArpoxonNo ratings yet

- Dr. Henry Petroski: Morning Lecture NotesDocument5 pagesDr. Henry Petroski: Morning Lecture Notesapi-299647486No ratings yet

- International Business: Case Study-Report-3 18-02-2022Document5 pagesInternational Business: Case Study-Report-3 18-02-2022swapnil anandNo ratings yet

- Haridwar Cancelled TCKTDocument2 pagesHaridwar Cancelled TCKTRavikumar AppaniNo ratings yet

- Transportation Engineering - I: Introduction To Bridge EngineeringDocument33 pagesTransportation Engineering - I: Introduction To Bridge Engineeringmit rami0% (1)

- Latex ManualDocument160 pagesLatex Manualcd_levyNo ratings yet

- Demonstrating Value With BMC Server Automation (Bladelogic)Document56 pagesDemonstrating Value With BMC Server Automation (Bladelogic)abishekvsNo ratings yet

- Cut 120Document128 pagesCut 120Jimmy MyNo ratings yet

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- Career Theory Model SuperDocument2 pagesCareer Theory Model SuperPrincess ZheminahNo ratings yet

- Document 337737.1Document3 pagesDocument 337737.1elcaso34No ratings yet

- Tugas Inggris M Edi SuryaDocument9 pagesTugas Inggris M Edi SuryaAstaghfirullahNo ratings yet

- Evaluating Tilting Pad - PaperDocument10 pagesEvaluating Tilting Pad - PaperAsit SuyalNo ratings yet

- Crecimiento Bajo en Carbono - Carbon-Disclosure-Project-2011Document80 pagesCrecimiento Bajo en Carbono - Carbon-Disclosure-Project-2011Alan Cereceda EscalonaNo ratings yet

- Welcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesDocument7 pagesWelcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesTapanco BarerraNo ratings yet

- MSDS - Prominent-GlycineDocument6 pagesMSDS - Prominent-GlycineTanawat ChinchaivanichkitNo ratings yet

- Answer Module 1Document3 pagesAnswer Module 1endroNo ratings yet

- Topic 3 SequencesDocument4 pagesTopic 3 SequencesWan Aziah100% (1)

- Dealing With Mental Health Spiritually by Ife AdetonaDocument46 pagesDealing With Mental Health Spiritually by Ife AdetonaIfeNo ratings yet

- Best Astrologer in DelhiDocument5 pagesBest Astrologer in DelhiastrorajkumarNo ratings yet

- Fundamentals of Human Resource Management: Decenzo and RobbinsDocument30 pagesFundamentals of Human Resource Management: Decenzo and RobbinsMalik Naseer AwanNo ratings yet

- Research On Process of Raising Funds Through QipDocument5 pagesResearch On Process of Raising Funds Through QipRachit SharmaNo ratings yet