Professional Documents

Culture Documents

Measure 80 Financial Impact

Measure 80 Financial Impact

Uploaded by

Statesman JournalCopyright:

Available Formats

You might also like

- A11vo Rexroth Repair Manual DocumentDocument5 pagesA11vo Rexroth Repair Manual DocumentFill Jose80% (5)

- Brewery Business Plan PDFDocument25 pagesBrewery Business Plan PDFZamir Hades100% (2)

- State Medical Marijuana Programs' Financial InformationDocument18 pagesState Medical Marijuana Programs' Financial InformationMPPNo ratings yet

- 7 31 2014 - CannabisFinalReport PDFDocument23 pages7 31 2014 - CannabisFinalReport PDFlighthouseventureNo ratings yet

- Testing Bluetooth HandbookDocument40 pagesTesting Bluetooth HandbookjklasdfjklNo ratings yet

- List of International Electrotechnical Commission Standards - Wikipedia PDFDocument263 pagesList of International Electrotechnical Commission Standards - Wikipedia PDFShivaNo ratings yet

- The Voice of The MountainDocument46 pagesThe Voice of The MountainSG Valdez0% (1)

- Colorado Medical Marijuana Regulatory System Performance AuditDocument102 pagesColorado Medical Marijuana Regulatory System Performance AuditMedicinal ColoradoNo ratings yet

- Regulatory Framework Work Group Meeting Colorado Marijuana Task ForceDocument72 pagesRegulatory Framework Work Group Meeting Colorado Marijuana Task ForceGreenpoint Insurance ColoradoNo ratings yet

- Tennessee Medicaid Claimed Hundreds of Millions of Federal Funds For Certified Public Expenditures That Were Not in Compliance With Federal RequirementsDocument36 pagesTennessee Medicaid Claimed Hundreds of Millions of Federal Funds For Certified Public Expenditures That Were Not in Compliance With Federal RequirementsFOX 17 NewsNo ratings yet

- Center For Economic Justice - Written Comments To TDIDocument13 pagesCenter For Economic Justice - Written Comments To TDITexas WatchNo ratings yet

- Independent Democratic Conference Regulation ReportDocument44 pagesIndependent Democratic Conference Regulation Reportrobertharding22No ratings yet

- 10-23-17 Analysis of CFPB Arbitration RuleDocument18 pages10-23-17 Analysis of CFPB Arbitration RuleHYDROGENENo ratings yet

- Fiscal Note & Local Impact Statement: O L S CDocument3 pagesFiscal Note & Local Impact Statement: O L S CNevin SmithNo ratings yet

- VT-PF Press Release PDFDocument4 pagesVT-PF Press Release PDFTechCrunchNo ratings yet

- Considerations For Entrepreneurs Entering The Recreational Marijuana IndustryDocument15 pagesConsiderations For Entrepreneurs Entering The Recreational Marijuana IndustryRay RodriguezNo ratings yet

- Legalized Marijuana Tax RevenueDocument4 pagesLegalized Marijuana Tax RevenueNick DiMarcoNo ratings yet

- Policy Brief: South Carolina Policy CouncilDocument7 pagesPolicy Brief: South Carolina Policy CouncilSteve CouncilNo ratings yet

- Settlement USDOJ FILING News Release1Document3 pagesSettlement USDOJ FILING News Release1Razmik BoghossianNo ratings yet

- Opioid Settlement Fund Advisory Board ReportDocument652 pagesOpioid Settlement Fund Advisory Board ReportCapitol PressroomNo ratings yet

- Drug Court Discretionary Grant Program: FY 2005 Competitive Grant AnnouncementDocument20 pagesDrug Court Discretionary Grant Program: FY 2005 Competitive Grant AnnouncementlosangelesNo ratings yet

- Drug Court Discretionary Grant Program FY 2007 Competitive Grant AnnouncementDocument10 pagesDrug Court Discretionary Grant Program FY 2007 Competitive Grant Announcementlosangeles100% (5)

- HHS-OIG Texas Medicaid Dental ReportDocument20 pagesHHS-OIG Texas Medicaid Dental ReportDentist The MenaceNo ratings yet

- Rec Marijuana CostsDocument5 pagesRec Marijuana CostsRob PortNo ratings yet

- Ministry of JusticeDocument21 pagesMinistry of JusticerobobriefNo ratings yet

- The Economic Impacts of Marijuana Legalization Final For JournalDocument39 pagesThe Economic Impacts of Marijuana Legalization Final For JournalSegundo AmaralNo ratings yet

- The Budgetary Implications of Marijuana Prohibition - Jeffrey A. MironDocument29 pagesThe Budgetary Implications of Marijuana Prohibition - Jeffrey A. MironEconomic Costs of Texas Drug Prevention PolicyNo ratings yet

- Memo Medical Marijuana Measure 7-13-2016Document4 pagesMemo Medical Marijuana Measure 7-13-2016Rob PortNo ratings yet

- DORA Endorsement LetterDocument6 pagesDORA Endorsement LetterMarijuana MomentNo ratings yet

- Fall 2011: Right To Self-Defense Enacted Into LawDocument4 pagesFall 2011: Right To Self-Defense Enacted Into LawPAHouseGOPNo ratings yet

- Vol 7 Issue 4Document70 pagesVol 7 Issue 4annstpnnk16No ratings yet

- Evans, D., 2013. The Economic Impacts of Marijuana Legalization.Document39 pagesEvans, D., 2013. The Economic Impacts of Marijuana Legalization.maja0205No ratings yet

- Federalregister - Gov/d/2021-01214, and On Govinfo - GovDocument233 pagesFederalregister - Gov/d/2021-01214, and On Govinfo - Govcharlie minatoNo ratings yet

- Federalregister - Gov/d/2021-21009, and On Govinfo - GovDocument233 pagesFederalregister - Gov/d/2021-21009, and On Govinfo - Govcharlie minatoNo ratings yet

- 25 State Laws and Regulation: ObjectivesDocument8 pages25 State Laws and Regulation: ObjectivesMaddy SaddyNo ratings yet

- The Colorado Cannabis Industry: A Tale of Ten CitiesDocument12 pagesThe Colorado Cannabis Industry: A Tale of Ten CitiesJames CampbellNo ratings yet

- Chapter 11 Solutions - Review Questions and ExercisesDocument8 pagesChapter 11 Solutions - Review Questions and Exercisesbip6420No ratings yet

- Caulkins - MarijuanaDocument17 pagesCaulkins - Marijuanaallroy63No ratings yet

- FirstEnergy StatementDocument4 pagesFirstEnergy StatementPatchNo ratings yet

- Price of Prisons - Updated Version - 072512Document28 pagesPrice of Prisons - Updated Version - 072512Hayzeus00No ratings yet

- Price of Prisons Updated Version 021914Document28 pagesPrice of Prisons Updated Version 021914SaraHelmiNo ratings yet

- Program Integrity White PaperDocument8 pagesProgram Integrity White PaperGovtfraudlawyerNo ratings yet

- ff321 0Document4 pagesff321 0Jennifer PeeblesNo ratings yet

- Carl Shapiro Remarks at ABA Antitrust ConferenceDocument35 pagesCarl Shapiro Remarks at ABA Antitrust ConferenceMainJusticeNo ratings yet

- Draft Hiring Incentives To Restore Employment (HIRE)Document4 pagesDraft Hiring Incentives To Restore Employment (HIRE)api-25909546No ratings yet

- Recognize and Report Medicaid FraudDocument2 pagesRecognize and Report Medicaid FraudMike DeWineNo ratings yet

- Medical Marijuana Financial Analysis ReportDocument22 pagesMedical Marijuana Financial Analysis ReportNews-PressNo ratings yet

- House Hearing, 112TH Congress - New Models For Delivering and Paying For Medicare ServicesDocument139 pagesHouse Hearing, 112TH Congress - New Models For Delivering and Paying For Medicare ServicesScribd Government DocsNo ratings yet

- Senate Subcommittee Releases Gao Report On Money Laundering ActivitesDocument4 pagesSenate Subcommittee Releases Gao Report On Money Laundering ActivitestofumasterNo ratings yet

- Selected Operating and Administrative Practices of The Bureau of Narcotic EnforcementDocument32 pagesSelected Operating and Administrative Practices of The Bureau of Narcotic Enforcementcara12345No ratings yet

- Textbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesFrom EverandTextbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesNo ratings yet

- Risk Adjustment Data Validation of Payments Made To Pacificare of California For Calendar Year 2007Document64 pagesRisk Adjustment Data Validation of Payments Made To Pacificare of California For Calendar Year 2007christina_jewettNo ratings yet

- Independence Party 2013 Legislative Agenda 2-15-13Document3 pagesIndependence Party 2013 Legislative Agenda 2-15-13Nick ReismanNo ratings yet

- CONGRESSIONAL BUDGET OFFICE COST ESTIMATE H.R. 2542 Regulatory Flexibility Improvements Act of 2013Document3 pagesCONGRESSIONAL BUDGET OFFICE COST ESTIMATE H.R. 2542 Regulatory Flexibility Improvements Act of 2013nalgrstealthNo ratings yet

- OSC Audit: OFT Procurement PracticesDocument92 pagesOSC Audit: OFT Procurement PracticesCasey SeilerNo ratings yet

- MORE Act MarkupDocument74 pagesMORE Act MarkupMarijuana MomentNo ratings yet

- Consumer Protection Act - SimplifiedDocument4 pagesConsumer Protection Act - SimplifiedyashandwhataboutitNo ratings yet

- Oklahoma 2011LegislativeAccomplishementsDocument8 pagesOklahoma 2011LegislativeAccomplishementsMike SchrimpfNo ratings yet

- Copeland CBA Report Appendix 3-29-13Document40 pagesCopeland CBA Report Appendix 3-29-13James LindonNo ratings yet

- Gao-06-320r (Qui Tam Report) False Claims Act LitigationDocument38 pagesGao-06-320r (Qui Tam Report) False Claims Act LitigationtofumasterNo ratings yet

- Obama Care RolloutDocument18 pagesObama Care Rolloutmyrant2No ratings yet

- SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardFrom EverandSEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardNo ratings yet

- Tax Policy and the Economy: Volume 32From EverandTax Policy and the Economy: Volume 32Robert A. MoffittNo ratings yet

- Nonprofit Law for Colleges and Universities: Essential Questions and Answers for Officers, Directors, and AdvisorsFrom EverandNonprofit Law for Colleges and Universities: Essential Questions and Answers for Officers, Directors, and AdvisorsNo ratings yet

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

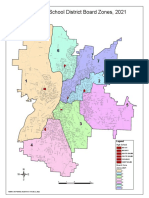

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

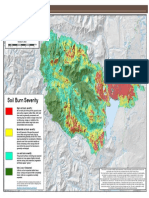

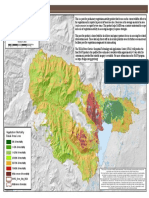

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

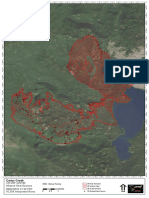

- 2023 Drone Sample MapsDocument6 pages2023 Drone Sample MapsStatesman JournalNo ratings yet

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

- Statement From Marion County Medical Examiner's Office On Heat-Related DeathsDocument1 pageStatement From Marion County Medical Examiner's Office On Heat-Related DeathsStatesman JournalNo ratings yet

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

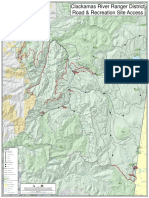

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

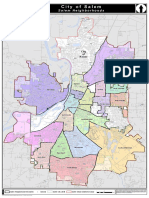

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- Gcab - Personal Electronic Devices and Social Media - StaffDocument2 pagesGcab - Personal Electronic Devices and Social Media - StaffStatesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- Op Ed - Anthony MedinaDocument2 pagesOp Ed - Anthony MedinaStatesman JournalNo ratings yet

- Resource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeDocument3 pagesResource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeStatesman JournalNo ratings yet

- 2021 Ironman 70.3 Oregon Traffic ImpactDocument2 pages2021 Ironman 70.3 Oregon Traffic ImpactStatesman JournalNo ratings yet

- City of Salem Photo Red Light Program 2021 Legislative ReportDocument8 pagesCity of Salem Photo Red Light Program 2021 Legislative ReportStatesman JournalNo ratings yet

- SB Agenda 20210415 EnglishDocument1 pageSB Agenda 20210415 EnglishStatesman JournalNo ratings yet

- Schools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramDocument3 pagesSchools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramStatesman Journal100% (1)

- School Board Zone MapDocument1 pageSchool Board Zone MapStatesman JournalNo ratings yet

- Osu! Keyboard: Step 1: Materials and ExplanationsDocument14 pagesOsu! Keyboard: Step 1: Materials and ExplanationsCata LystNo ratings yet

- Translation Workbench Export andDocument8 pagesTranslation Workbench Export andGaston FalcoNo ratings yet

- Inventory Control NotesDocument11 pagesInventory Control NotesBob34wNo ratings yet

- System Galaxy Quick Guide: Configuration and OperationDocument47 pagesSystem Galaxy Quick Guide: Configuration and OperationTushar ImranNo ratings yet

- Emu8086 TutorialDocument9 pagesEmu8086 Tutoriallordsuggs0% (1)

- CS2354 Advanced Computer ArchitectureDocument14 pagesCS2354 Advanced Computer ArchitectureVanitha VivekNo ratings yet

- Lecture 7 (Two Sample Tests)Document28 pagesLecture 7 (Two Sample Tests)Carlene UgayNo ratings yet

- Mystic Mongolia: Join in Group TourDocument8 pagesMystic Mongolia: Join in Group TourtsmunkhtungalagNo ratings yet

- ASS 7free PDF Reader WebsiteDocument20 pagesASS 7free PDF Reader WebsiteOluyiNo ratings yet

- James Kacouris Sues Facebook, Zuckerberg and Wehner in Class ActionDocument17 pagesJames Kacouris Sues Facebook, Zuckerberg and Wehner in Class ActionJack PurcherNo ratings yet

- Soal Cloze Test Explanation - Global WarmingDocument2 pagesSoal Cloze Test Explanation - Global WarmingPanci SeSbs d'NightflierNo ratings yet

- Understanding DoctorDocument60 pagesUnderstanding DoctorAnonymous 3XM5Fh3G69No ratings yet

- AmulDocument63 pagesAmuljassi7nishadNo ratings yet

- Courier CompanyDocument15,360 pagesCourier CompanyJaveed MohiuddinNo ratings yet

- Melt Pressure Transmitters Ke Series Performance Level C': Output 4... 20maDocument6 pagesMelt Pressure Transmitters Ke Series Performance Level C': Output 4... 20maedgar covarrubiasNo ratings yet

- 4 Single Phase Uncontrolled Full-Wave RectifiersDocument12 pages4 Single Phase Uncontrolled Full-Wave RectifiersLuthfan AzizanNo ratings yet

- NF EN 246 - D18 - 204 2003-General Specifications For Flow Rate RegulatorsDocument19 pagesNF EN 246 - D18 - 204 2003-General Specifications For Flow Rate RegulatorslouisNo ratings yet

- Account Receivable ManagementDocument41 pagesAccount Receivable ManagementUtkarsh Joshi100% (2)

- 7MWTW1715BM 665 MediaDocument10 pages7MWTW1715BM 665 MediaGilberto DomínguezNo ratings yet

- Application New BroadbandDocument2 pagesApplication New BroadbandMithun MuraliNo ratings yet

- Subashnagar Miraj-Malgaon Raod Subashnagar Maharashtra - 416410, India Contact: 9922199978/9850985508Document1 pageSubashnagar Miraj-Malgaon Raod Subashnagar Maharashtra - 416410, India Contact: 9922199978/9850985508stamboli9No ratings yet

- Curriculum Vitae: Tubagus G.PDocument3 pagesCurriculum Vitae: Tubagus G.PTB Gita PriadiNo ratings yet

- LEGO Club Magazine Red Brick MarchpdfDocument47 pagesLEGO Club Magazine Red Brick Marchpdfmartayensid96% (28)

- Emission Control (2uz-Fe)Document15 pagesEmission Control (2uz-Fe)Abbode HoraniNo ratings yet

- CP-420 ManservDocument116 pagesCP-420 Manserve_lab_scribdNo ratings yet

Measure 80 Financial Impact

Measure 80 Financial Impact

Uploaded by

Statesman JournalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Measure 80 Financial Impact

Measure 80 Financial Impact

Uploaded by

Statesman JournalCopyright:

Available Formats

Measure 80 2012 General Election, Estimate of Financial Impact Statement

This measure legalizes the private manufacture, possession and use of cannabis in Oregon. Investigations and prosecutions for related offenses would no longer take place after the effective date of this measure. State and local expenditures and revenues will be impacted by passage of this measure. The measure creates the Oregon Cannabis Commission, appointed by the Governor, to carry out the provisions of the measure. The states Chief Financial Office believes the appointment of the commission will not add noteworthy cost to state expenditures. The cost of operating the Commission may be similar to the cost of operating the existing Oregon Liquor Control Commission, which is about $22 million per year, excluding the variable expenses related to compensating liquor store owners and paying bank card fees. Total additional revenues to state government are indeterminate, but revenues are likely to be sufficient to offset the expenditures of the Commission. The measure requires the Oregon Cannabis Commission to consult with the Board of Pharmacy on various issues and, if practicable, to establish certain rules. As the Commission is not granted rule-making authority, the Board of Pharmacy may be called upon to establish those rules. The Board of Pharmacy estimates the need for one half-time pharmacist, at a cost of approximately $75,000 per year, to carry out these additional duties. State expenditures would be reduced by the amount that the state pays for felony offenders with related convictions in prison and on probation. The savings to the state as a result of the passage of this measure is estimated to be between $1.4 million and $2.4 million a year. The measure prohibits the disclosure of names and addresses of applicants, licensees, and purchasers of cannabis except upon the persons request. The Oregon Judicial Department estimates additional expenditures of between $1.6 million and $3.3 million per year to ensure court case files do not contain such names or addresses prior to allowing them to be viewed by parties to a case, the public, or the media. The amount of the impact for local law enforcement, district attorneys, and the courts is indeterminate.

Impact on Expenditures

Impact on Revenue

Operation of the Commission

May increase $22 million per year

Indeterminate, but likely sufficient to cover expenditures

Board of Pharmacy

Increase $75,000 per year

None

Felony convictions

Decrease of $1.4 - $2.4 million per year None

State Courts

Increase of $1.6 - $3.3 million per year

None

Total Impact to the State:

May increase $22.3 - $23 million per year

Indeterminate, but likely sufficient to cover expenditures

Impact to Local Government:

Indeterminate

Indeterminate

Explanation of Estimate of Financial Impact

The measure replaces the states existing laws relating to cannabis, except those relating to operating a motor vehicle while intoxicated and the Oregon Medical Marijuana Act (OMMA). The OMMA is administered by the Oregon Health Authority, which expects the measures legalization of cannabis to reduce OMMA revenues from application and renewal fees, slightly more than half of which support other public health programs. The magnitude of this reduction in OMMA fee revenues is indeterminate. Under the measure, additional revenues to the state would result from the value of sales of cannabis in excess of expenditures to operate the Oregon Cannabis Commission (OCC). It would also compensate OCC contractors and provide legal defense of the provisions enacted by the measure and of persons prosecuted for acts licensed under the measure. The value of gross sales of

marijuana by the OCC depends on several variables, each of which has a large degree of uncertainty: (1) the amount of cannabis sold per year through OCC stores; and (2) the proportion of those sales that would be at cost for medicinal use and research (provided for in the measures language for ORS 474.045) or at a profit (provided for in the measures language for 474.055). The uncertainty of these variables results in an indeterminate value of additional revenues to the state. The measure outlines the distribution of revenues to a variety of programs, including two new hemp-related state committees. Because the amount of revenue generated is unknown, any related increase of expenditures is also indeterminate. The Judicial Department has identified potential indeterminate financial impacts of the measure on the states court system including: Motions to determine which laws the measure repeals Additional cases in the Court of Appeals to address OCC rulemaking and licensing authority Additional state court time required to resolve unclear or conflicting provisions of the measure Additional cases filed under new misdemeanors and felonies created in the measure Additional cases of DUII offenses, child endangerment, and juvenile dependency Additional court time taken to impose a fine to deprive a defendant of profits. The measure requires the states Attorney General to vigorously defend the provisions of the measure and any person prosecuted for acts licensed under the measure. The Oregon Department of Justice is not able to predict the number and difficulty of such legal defenses and therefore this potential expenditure impact is indeterminate. The Oregon Department of Revenue and Legislative Revenue Office have indicated that the measures impact on personal income tax is indeterminate. The Association of Oregon Counties has indicated that the potential costs and savings of county operations would be indeterminate. Committee Members: Kate Brown, Secretary of State Ted Wheeler, State Treasurer Michael Jordan, Director, Department of Administrative Services James Bucholz, Director, Department of Revenue Debra Guzman, Local Government Representative (The estimate of financial impact and explanation was provided by the above committee pursuant to ORS 250.127.)

You might also like

- A11vo Rexroth Repair Manual DocumentDocument5 pagesA11vo Rexroth Repair Manual DocumentFill Jose80% (5)

- Brewery Business Plan PDFDocument25 pagesBrewery Business Plan PDFZamir Hades100% (2)

- State Medical Marijuana Programs' Financial InformationDocument18 pagesState Medical Marijuana Programs' Financial InformationMPPNo ratings yet

- 7 31 2014 - CannabisFinalReport PDFDocument23 pages7 31 2014 - CannabisFinalReport PDFlighthouseventureNo ratings yet

- Testing Bluetooth HandbookDocument40 pagesTesting Bluetooth HandbookjklasdfjklNo ratings yet

- List of International Electrotechnical Commission Standards - Wikipedia PDFDocument263 pagesList of International Electrotechnical Commission Standards - Wikipedia PDFShivaNo ratings yet

- The Voice of The MountainDocument46 pagesThe Voice of The MountainSG Valdez0% (1)

- Colorado Medical Marijuana Regulatory System Performance AuditDocument102 pagesColorado Medical Marijuana Regulatory System Performance AuditMedicinal ColoradoNo ratings yet

- Regulatory Framework Work Group Meeting Colorado Marijuana Task ForceDocument72 pagesRegulatory Framework Work Group Meeting Colorado Marijuana Task ForceGreenpoint Insurance ColoradoNo ratings yet

- Tennessee Medicaid Claimed Hundreds of Millions of Federal Funds For Certified Public Expenditures That Were Not in Compliance With Federal RequirementsDocument36 pagesTennessee Medicaid Claimed Hundreds of Millions of Federal Funds For Certified Public Expenditures That Were Not in Compliance With Federal RequirementsFOX 17 NewsNo ratings yet

- Center For Economic Justice - Written Comments To TDIDocument13 pagesCenter For Economic Justice - Written Comments To TDITexas WatchNo ratings yet

- Independent Democratic Conference Regulation ReportDocument44 pagesIndependent Democratic Conference Regulation Reportrobertharding22No ratings yet

- 10-23-17 Analysis of CFPB Arbitration RuleDocument18 pages10-23-17 Analysis of CFPB Arbitration RuleHYDROGENENo ratings yet

- Fiscal Note & Local Impact Statement: O L S CDocument3 pagesFiscal Note & Local Impact Statement: O L S CNevin SmithNo ratings yet

- VT-PF Press Release PDFDocument4 pagesVT-PF Press Release PDFTechCrunchNo ratings yet

- Considerations For Entrepreneurs Entering The Recreational Marijuana IndustryDocument15 pagesConsiderations For Entrepreneurs Entering The Recreational Marijuana IndustryRay RodriguezNo ratings yet

- Legalized Marijuana Tax RevenueDocument4 pagesLegalized Marijuana Tax RevenueNick DiMarcoNo ratings yet

- Policy Brief: South Carolina Policy CouncilDocument7 pagesPolicy Brief: South Carolina Policy CouncilSteve CouncilNo ratings yet

- Settlement USDOJ FILING News Release1Document3 pagesSettlement USDOJ FILING News Release1Razmik BoghossianNo ratings yet

- Opioid Settlement Fund Advisory Board ReportDocument652 pagesOpioid Settlement Fund Advisory Board ReportCapitol PressroomNo ratings yet

- Drug Court Discretionary Grant Program: FY 2005 Competitive Grant AnnouncementDocument20 pagesDrug Court Discretionary Grant Program: FY 2005 Competitive Grant AnnouncementlosangelesNo ratings yet

- Drug Court Discretionary Grant Program FY 2007 Competitive Grant AnnouncementDocument10 pagesDrug Court Discretionary Grant Program FY 2007 Competitive Grant Announcementlosangeles100% (5)

- HHS-OIG Texas Medicaid Dental ReportDocument20 pagesHHS-OIG Texas Medicaid Dental ReportDentist The MenaceNo ratings yet

- Rec Marijuana CostsDocument5 pagesRec Marijuana CostsRob PortNo ratings yet

- Ministry of JusticeDocument21 pagesMinistry of JusticerobobriefNo ratings yet

- The Economic Impacts of Marijuana Legalization Final For JournalDocument39 pagesThe Economic Impacts of Marijuana Legalization Final For JournalSegundo AmaralNo ratings yet

- The Budgetary Implications of Marijuana Prohibition - Jeffrey A. MironDocument29 pagesThe Budgetary Implications of Marijuana Prohibition - Jeffrey A. MironEconomic Costs of Texas Drug Prevention PolicyNo ratings yet

- Memo Medical Marijuana Measure 7-13-2016Document4 pagesMemo Medical Marijuana Measure 7-13-2016Rob PortNo ratings yet

- DORA Endorsement LetterDocument6 pagesDORA Endorsement LetterMarijuana MomentNo ratings yet

- Fall 2011: Right To Self-Defense Enacted Into LawDocument4 pagesFall 2011: Right To Self-Defense Enacted Into LawPAHouseGOPNo ratings yet

- Vol 7 Issue 4Document70 pagesVol 7 Issue 4annstpnnk16No ratings yet

- Evans, D., 2013. The Economic Impacts of Marijuana Legalization.Document39 pagesEvans, D., 2013. The Economic Impacts of Marijuana Legalization.maja0205No ratings yet

- Federalregister - Gov/d/2021-01214, and On Govinfo - GovDocument233 pagesFederalregister - Gov/d/2021-01214, and On Govinfo - Govcharlie minatoNo ratings yet

- Federalregister - Gov/d/2021-21009, and On Govinfo - GovDocument233 pagesFederalregister - Gov/d/2021-21009, and On Govinfo - Govcharlie minatoNo ratings yet

- 25 State Laws and Regulation: ObjectivesDocument8 pages25 State Laws and Regulation: ObjectivesMaddy SaddyNo ratings yet

- The Colorado Cannabis Industry: A Tale of Ten CitiesDocument12 pagesThe Colorado Cannabis Industry: A Tale of Ten CitiesJames CampbellNo ratings yet

- Chapter 11 Solutions - Review Questions and ExercisesDocument8 pagesChapter 11 Solutions - Review Questions and Exercisesbip6420No ratings yet

- Caulkins - MarijuanaDocument17 pagesCaulkins - Marijuanaallroy63No ratings yet

- FirstEnergy StatementDocument4 pagesFirstEnergy StatementPatchNo ratings yet

- Price of Prisons - Updated Version - 072512Document28 pagesPrice of Prisons - Updated Version - 072512Hayzeus00No ratings yet

- Price of Prisons Updated Version 021914Document28 pagesPrice of Prisons Updated Version 021914SaraHelmiNo ratings yet

- Program Integrity White PaperDocument8 pagesProgram Integrity White PaperGovtfraudlawyerNo ratings yet

- ff321 0Document4 pagesff321 0Jennifer PeeblesNo ratings yet

- Carl Shapiro Remarks at ABA Antitrust ConferenceDocument35 pagesCarl Shapiro Remarks at ABA Antitrust ConferenceMainJusticeNo ratings yet

- Draft Hiring Incentives To Restore Employment (HIRE)Document4 pagesDraft Hiring Incentives To Restore Employment (HIRE)api-25909546No ratings yet

- Recognize and Report Medicaid FraudDocument2 pagesRecognize and Report Medicaid FraudMike DeWineNo ratings yet

- Medical Marijuana Financial Analysis ReportDocument22 pagesMedical Marijuana Financial Analysis ReportNews-PressNo ratings yet

- House Hearing, 112TH Congress - New Models For Delivering and Paying For Medicare ServicesDocument139 pagesHouse Hearing, 112TH Congress - New Models For Delivering and Paying For Medicare ServicesScribd Government DocsNo ratings yet

- Senate Subcommittee Releases Gao Report On Money Laundering ActivitesDocument4 pagesSenate Subcommittee Releases Gao Report On Money Laundering ActivitestofumasterNo ratings yet

- Selected Operating and Administrative Practices of The Bureau of Narcotic EnforcementDocument32 pagesSelected Operating and Administrative Practices of The Bureau of Narcotic Enforcementcara12345No ratings yet

- Textbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesFrom EverandTextbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesNo ratings yet

- Risk Adjustment Data Validation of Payments Made To Pacificare of California For Calendar Year 2007Document64 pagesRisk Adjustment Data Validation of Payments Made To Pacificare of California For Calendar Year 2007christina_jewettNo ratings yet

- Independence Party 2013 Legislative Agenda 2-15-13Document3 pagesIndependence Party 2013 Legislative Agenda 2-15-13Nick ReismanNo ratings yet

- CONGRESSIONAL BUDGET OFFICE COST ESTIMATE H.R. 2542 Regulatory Flexibility Improvements Act of 2013Document3 pagesCONGRESSIONAL BUDGET OFFICE COST ESTIMATE H.R. 2542 Regulatory Flexibility Improvements Act of 2013nalgrstealthNo ratings yet

- OSC Audit: OFT Procurement PracticesDocument92 pagesOSC Audit: OFT Procurement PracticesCasey SeilerNo ratings yet

- MORE Act MarkupDocument74 pagesMORE Act MarkupMarijuana MomentNo ratings yet

- Consumer Protection Act - SimplifiedDocument4 pagesConsumer Protection Act - SimplifiedyashandwhataboutitNo ratings yet

- Oklahoma 2011LegislativeAccomplishementsDocument8 pagesOklahoma 2011LegislativeAccomplishementsMike SchrimpfNo ratings yet

- Copeland CBA Report Appendix 3-29-13Document40 pagesCopeland CBA Report Appendix 3-29-13James LindonNo ratings yet

- Gao-06-320r (Qui Tam Report) False Claims Act LitigationDocument38 pagesGao-06-320r (Qui Tam Report) False Claims Act LitigationtofumasterNo ratings yet

- Obama Care RolloutDocument18 pagesObama Care Rolloutmyrant2No ratings yet

- SEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardFrom EverandSEC Whistleblower Program: Tips from SEC Whistleblower Attorneys to Maximize an SEC Whistleblower AwardNo ratings yet

- Tax Policy and the Economy: Volume 32From EverandTax Policy and the Economy: Volume 32Robert A. MoffittNo ratings yet

- Nonprofit Law for Colleges and Universities: Essential Questions and Answers for Officers, Directors, and AdvisorsFrom EverandNonprofit Law for Colleges and Universities: Essential Questions and Answers for Officers, Directors, and AdvisorsNo ratings yet

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

- 2023 Drone Sample MapsDocument6 pages2023 Drone Sample MapsStatesman JournalNo ratings yet

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

- Statement From Marion County Medical Examiner's Office On Heat-Related DeathsDocument1 pageStatement From Marion County Medical Examiner's Office On Heat-Related DeathsStatesman JournalNo ratings yet

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- Gcab - Personal Electronic Devices and Social Media - StaffDocument2 pagesGcab - Personal Electronic Devices and Social Media - StaffStatesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- Op Ed - Anthony MedinaDocument2 pagesOp Ed - Anthony MedinaStatesman JournalNo ratings yet

- Resource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeDocument3 pagesResource List For Trauma Responses: Grounding Breathing Exercises To Take You Out of "Fight/Flight" ModeStatesman JournalNo ratings yet

- 2021 Ironman 70.3 Oregon Traffic ImpactDocument2 pages2021 Ironman 70.3 Oregon Traffic ImpactStatesman JournalNo ratings yet

- City of Salem Photo Red Light Program 2021 Legislative ReportDocument8 pagesCity of Salem Photo Red Light Program 2021 Legislative ReportStatesman JournalNo ratings yet

- SB Agenda 20210415 EnglishDocument1 pageSB Agenda 20210415 EnglishStatesman JournalNo ratings yet

- Schools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramDocument3 pagesSchools, Safe Learners (RSSL) Guidance. We Have Established A Statewide Rapid Testing ProgramStatesman Journal100% (1)

- School Board Zone MapDocument1 pageSchool Board Zone MapStatesman JournalNo ratings yet

- Osu! Keyboard: Step 1: Materials and ExplanationsDocument14 pagesOsu! Keyboard: Step 1: Materials and ExplanationsCata LystNo ratings yet

- Translation Workbench Export andDocument8 pagesTranslation Workbench Export andGaston FalcoNo ratings yet

- Inventory Control NotesDocument11 pagesInventory Control NotesBob34wNo ratings yet

- System Galaxy Quick Guide: Configuration and OperationDocument47 pagesSystem Galaxy Quick Guide: Configuration and OperationTushar ImranNo ratings yet

- Emu8086 TutorialDocument9 pagesEmu8086 Tutoriallordsuggs0% (1)

- CS2354 Advanced Computer ArchitectureDocument14 pagesCS2354 Advanced Computer ArchitectureVanitha VivekNo ratings yet

- Lecture 7 (Two Sample Tests)Document28 pagesLecture 7 (Two Sample Tests)Carlene UgayNo ratings yet

- Mystic Mongolia: Join in Group TourDocument8 pagesMystic Mongolia: Join in Group TourtsmunkhtungalagNo ratings yet

- ASS 7free PDF Reader WebsiteDocument20 pagesASS 7free PDF Reader WebsiteOluyiNo ratings yet

- James Kacouris Sues Facebook, Zuckerberg and Wehner in Class ActionDocument17 pagesJames Kacouris Sues Facebook, Zuckerberg and Wehner in Class ActionJack PurcherNo ratings yet

- Soal Cloze Test Explanation - Global WarmingDocument2 pagesSoal Cloze Test Explanation - Global WarmingPanci SeSbs d'NightflierNo ratings yet

- Understanding DoctorDocument60 pagesUnderstanding DoctorAnonymous 3XM5Fh3G69No ratings yet

- AmulDocument63 pagesAmuljassi7nishadNo ratings yet

- Courier CompanyDocument15,360 pagesCourier CompanyJaveed MohiuddinNo ratings yet

- Melt Pressure Transmitters Ke Series Performance Level C': Output 4... 20maDocument6 pagesMelt Pressure Transmitters Ke Series Performance Level C': Output 4... 20maedgar covarrubiasNo ratings yet

- 4 Single Phase Uncontrolled Full-Wave RectifiersDocument12 pages4 Single Phase Uncontrolled Full-Wave RectifiersLuthfan AzizanNo ratings yet

- NF EN 246 - D18 - 204 2003-General Specifications For Flow Rate RegulatorsDocument19 pagesNF EN 246 - D18 - 204 2003-General Specifications For Flow Rate RegulatorslouisNo ratings yet

- Account Receivable ManagementDocument41 pagesAccount Receivable ManagementUtkarsh Joshi100% (2)

- 7MWTW1715BM 665 MediaDocument10 pages7MWTW1715BM 665 MediaGilberto DomínguezNo ratings yet

- Application New BroadbandDocument2 pagesApplication New BroadbandMithun MuraliNo ratings yet

- Subashnagar Miraj-Malgaon Raod Subashnagar Maharashtra - 416410, India Contact: 9922199978/9850985508Document1 pageSubashnagar Miraj-Malgaon Raod Subashnagar Maharashtra - 416410, India Contact: 9922199978/9850985508stamboli9No ratings yet

- Curriculum Vitae: Tubagus G.PDocument3 pagesCurriculum Vitae: Tubagus G.PTB Gita PriadiNo ratings yet

- LEGO Club Magazine Red Brick MarchpdfDocument47 pagesLEGO Club Magazine Red Brick Marchpdfmartayensid96% (28)

- Emission Control (2uz-Fe)Document15 pagesEmission Control (2uz-Fe)Abbode HoraniNo ratings yet

- CP-420 ManservDocument116 pagesCP-420 Manserve_lab_scribdNo ratings yet