Professional Documents

Culture Documents

MERS QA Procedures Transitional 0906111

MERS QA Procedures Transitional 0906111

Uploaded by

Javier PerezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MERS QA Procedures Transitional 0906111

MERS QA Procedures Transitional 0906111

Uploaded by

Javier PerezCopyright:

Available Formats

!"#$%&'()**"+#,-.

((

((((((((/+0-.1"+.*(2#,"#$(

(

1ranslLlonal

9/6/2011

MERS

System Quality Assurance Procedures Transitional Table of Contents - i

Table of Contents

MERS

System Quality Assurance Policy 1

Purpose .................................................................................................................................. 1

Strategy .................................................................................................................................. 1

Monitoring .............................................................................................................................. 2

Independent Attestation .......................................................................................................... 2

MERS

System Processing Standards 3

Overview ................................................................................................................................ 3

MERS as Original Mortgagee (MOM) Security Instrument Processing Standards .................... 4

Non-MOM Processing Standards ............................................................................................. 5

iRegistration Processing Standards .......................................................................................... 5

Additional Recordable Documents Processing Standards ......................................................... 5

Security Instrument Processing Standards ............................................................................... 6

Lien Release Processing Standards .......................................................................................... 6

Foreclosure Processing Standards ............................................................................................ 7

Deactivation Processing Standards........................................................................................... 7

Member Information Update Standards .................................................................................. 8

Data Integrity Standards ......................................................................................................... 8

Monthly Reconciliation Standards ......................................................................................... 10

Appendix A 12

MERS

System Quality Assurance Review ............................................................................. 12

Checklist Items ..................................................................................................................... 12

MOM Security Instrument Document Review .............................................................................. 12

Assignment Document Review ...................................................................................................... 13

MERS

iRegistrations Document Review ..................................................................................... 13

Lien Release Document Review .................................................................................................... 13

Foreclosure Document Review ...................................................................................................... 14

Data Integrity Standards ................................................................................................................ 13

Member Information Standards ..................................................................................................... 16

Appendix B 17

Sample Documents for MOM Loans

and Loans Assigned to Mortgage Electronic Registration Systems (MERS) ....................... 17

Sample Changes to Deed of Trust or Mortgage

naming MERS as the Original Mortgagee (MOM Document) ............................................... 19

Sample Corrective Affidavit for Assignment .......................................................................... 20

Sample Corrective Affidavit for Security Instrument .............................................................. 21

Sample Loan Security Agreement .......................................................................................... 22

Sample UCC-1 Naming MERS as the Original Secured Party ................................................. 23

Sample UCC-3 Assigning Security Interests to MERS

when MERS is Not Named as the Original Secured Party ..................................................... 24

Sample UCC-3 Assigning Security Interests from MERS

when transferred to a non-MERS entity .............................................................................. 25

Sample of UCC-3 Termination, When Debt is Paid in Full ...................................................... 26

Glossary 27

MERS

System Quality Assurance Procedures Transitional MERS System Quality Assurance Policy - 1

MERS

System Quality Assurance Policy

Purpose

Membershlp ln Lhe ML8S SysLem provldes value Lo your company by ellmlnaLlng Lhe need Lo prepare

and record asslgnmenLs when your company sells or buys Lhe beneflclal (lnvesLor) lnLeresL and/or

servlclng rlghLs Lo/from anoLher Member. 1he prlmary value Lo Lhe seller ls ellmlnaLlng Lhe cosL of

preparlng and recordlng asslgnmenLs. 1he prlmary value Lo Lhe buyer of Lhe beneflclal lnLeresL ls

ellmlnaLlng Lhe cosL of Lracklng and sLorlng asslgnmenLs, and ln provldlng besL execuLlon for Lhe seller.

1he prlmary value Lo Lhe buyer of Lhe servlclng rlghLs ls reduclng posL closlng, foreclosure and llen

release cosLs due Lo Lhe groundlng of LlLle ln Lhe name of MorLgage LlecLronlc 8eglsLraLlon SysLems

(ML8S").

lf Lhe servlcer sells Lhe servlclng rlghLs ln Lhe fuLure Lo anoLher ML8S SysLem Member, lL ellmlnaLes Lhe

cosL of preparlng and recordlng asslgnmenLs. ln Lhe case of Clnnle Mae pools, lL also ellmlnaLes Lhe cosL

of endorslng Lhe noLes Lo Lhe buyer.

So LhaL buyer and seller reallze Lhe full value of Lhe ML8S

SysLem, Lhe rocesslng SLandards are

deslgned Lo ensure LhaL:

x A valld Mln ls asslgned Lo Lhe loan and afflxed ln Lhe proper locaLlon on Lhe noLe, MCM securlLy

lnsLrumenL, or asslgnmenL Lo ML8S

x ML8S ls accuraLely recorded ln Lhe counLy land records as morLgagee afLer loan orlglnaLlon or

asslgnmenL Lo ML8S

x 1he loan lnformaLlon ls accuraLely reglsLered on Lhe ML8S

SysLem afLer orlglnaLlon, asslgnmenL Lo

ML8S, or acqulslLlon of servlclng

x When beneflclal or servlclng rlghLs are sold Lo anoLher Member, Lhe seller and buyer updaLe Lhe

ML8S

SysLem Lo reflecL Lhe new ownershlp lnLeresLs

x When a loan ls foreclosed, pald off, or servlclng ls sold Lo a non-ML8S Member, ML8S ls released ln

Lhe counLy land records as Lhe morLgagee of record and Lhe Mln asslgned Lo Lhe loan ls afflxed ln

Lhe proper locaLlon on Lhe llen release documenL or asslgnmenL from ML8S.

Strategy

?our company commlLLed Lo ablde by Lhe ML8S

SysLem rocesslng SLandards by slgnlng Lhe Member

AgreemenL. 1he currenL servlcer of a loan for whlch ML8S has been named morLgagee lnherlLs from Lhe

seller Lhe responslblllLy for meeLlng Lhe rocesslng SLandards.

ML8SCC8 wlll provlde Lhe knowledge, Lralnlng, and Lools (or asslsLance ln creaLlng Lools) LhaL ensure

Lhe quallLy of generaLlng Mlns, preparlng and recordlng documenLs, and Lhe lnformaLlon on Lhe ML8S

SysLem.

MERS

System Quality Assurance Procedures Transitional MERS System Quality Assurance Policy - 2

ML8SCC8 expecLs your company Lo lnLegraLe Lhe ML8S SysLem rocesslng SLandards lnLo your

everyday buslness pracLlces. We expecL you Lo self-audlL your performance agalnsL Lhe rocesslng

SLandards by developlng a quallLy assurance plan LhaL ls deslgned Lo meeL or exceed Lhe sLandards (you

may use Lhe sample ML8S SysLem CuallLy Assurance lan as a model ln creaLlng Lhe plan for your

organlzaLlon). We requlre LhaL you keep your mosL recenL ML8S SysLem CuallLy Assurance lan on flle

wlLh ML8SCC8. We expecL your company Lo conducL monLhly reconclllaLlons Lo monlLor your

performance, and Lo revlew your plan aL leasL annually for accuracy and effecLlveness. We requlre an

annual lndependenL aLLesLaLlon Lo Lhe conLrol sLrucLure of your organlzaLlon's monLhly sysLem Lo

sysLem reconclllaLlon process, re[ecL/warnlng reporL process, and adherence Lo your organlzaLlon's

lnLernal ML8S SysLem CuallLy Assurance lan.

Monitoring

1o monlLor Lhe effecLlveness of our Members' Lralnlng, Lools, and procedures, Lhe ML8SCC8 roducL

erformance ueparLmenL conducLs Member daLa and documenL revlews. Member compllance revlews

may be conducLed on-slLe aL ML8SCC8's dlscreLlon. lease see Appendix A for a sample of Lhe Lype

of lnformaLlon LhaL we Lyplcally requesL durlng a CuallLy Assurance 8evlew.

Independent Attestation

1he ALLesLaLlon of ML8S SysLem CuallLy Assurance SLandards Compllance requlred from each Member

Servlcer or Subservlcer ln Lhe fourLh quarLer of each calendar year aLLesLs Lo:

x ?our reconclllaLlon of all requlred and appllcable condlLlonal flelds Lo Lhe ML8S

SysLem flelds aL

leasL monLhly

x 1haL all requlred and appllcable condlLlonal flelds enLered on Lhe ML8S

SysLem maLch Lhose

values ln your lnLernal sysLem

x 1haL your reconclllaLlon lncludes a sysLem-Lo-sysLem comparlson of your porLfollo Lo Lhe ML8S

SysLem and Lhe ML8S

SysLem Lo your porLfollo.

x 1haL you have reconclled all mandaLory re[ecL warnlng reporLs

x 1haL you have monlLored your performance agalnsL your CuallLy Assurance lan and have

revlewed Lhe plan aL leasL annually for accuracy and effecLlveness

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 3

MERS

System Processing Standards

Overview

As Lhe ML8S

SysLem was belng developed, lndusLry parLlclpanLs agreed Lhere were no lndusLry-wlde

sLandards for Lhe processlng of asslgnmenLs and llen releases. WlLhouL sLandards, many asslgnmenLs

and llen releases were noL recorded ln a Llmely manner, were lmproperly recorded, or were never

recorded aL all. 1hls creaLed a number of problems and cosLs for buyers and sellers of servlclng rlghLs.

1he ma[orlLy of morLgage lndusLry parLlclpanLs LhaL helped ML8SCC8 deflne sLandards for processlng

recordlng documenLs belleved Lhe enLlre lndusLry would beneflL.

CreaLlng recordlng and llen release processlng sLandards ls lmporLanL because:

1. 1he ablllLy of ML8S SysLem Members Lo sell morLgage loans Lo each oLher wlLhouL recordlng

asslgnmenLs ls conLlngenL on MorLgage LlecLronlc 8eglsLraLlon SysLems (ML8S") belng properly

recorded as Lhe morLgagee ln Lhe counLy land records.

2. 1he accuracy of Lhe lnformaLlon enLered lnLo Lhe ML8S

SysLem affecLs Lhe ablllLy of ML8SCC8 Lo

lmmedlaLely and correcLly ldenLlfy Lhe parLy Lo whom servlce of process should be dlrecLed.

3. 1o beneflL consumers, and Lo avold Lhe posslblllLy of ML8S and ML8S SysLem Members belng

assessed penalLles for noL havlng llens released ln a Llmely manner, llens musL be released as soon

as posslble afLer a loan ls pald off.

lollowlng are Lhe ML8S SysLem sLandards esLabllshed for Member processlng of MCM securlLy

lnsLrumenLs, asslgnmenLs for non-MCM securlLy lnsLrumenLs, llen releases and daLa lnLegrlLy.

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 4

MERS as Original Mortgagee (MOM)

Security Instrument Processing Standards

x ?ou musL name MorLgage LlecLronlc 8eglsLraLlon SysLems (ML8S") as morLgagee ln accordance

wlLh lnvesLor guldellnes and lnclude Lhe Servlcer ldenLlflcaLlon SysLem Lelephone number (888-679-

6377) ln Lhe ML8S as MorLgagee" language. Sample MCM language ls lncluded ln Appendix B.(

x lace Lhe MorLgage ldenLlflcaLlon number (Mln) ln a vlslble locaLlon on Lhe flrsL page of Lhe securlLy

lnsLrumenL, buL noL ln any space reserved for Lhe [urlsdlcLlon's recorder per [urlsdlcLlonal

requlremenLs. ln all cases, counLy recorder requlremenLs Lake precedence over Lhe ML8S SysLem

requlremenLs.

x LxecuLe and record Lhe securlLy lnsLrumenL wlLhln sLaLe requlremenLs and lnvesLor guldellnes. ln

accordance wlLh Lhe 8ules of Membershlp, lf Lhe [urlsdlcLlon doesn'L requlre recordlng, Lhe securlLy

lnsLrumenL musL sLlll be recorded ln Lhe counLy land records.

x lf a loan ls reglsLered buL does noL close, and Lhe SecurlLy lnsLrumenL ls noL recorded ln Lhe counLy

land records, reverse Lhe reglsLraLlon on Lhe ML8S SysLem wlLhln Len calendar days of dlscoverlng

Lhe error.

34567(89:;3);<(=>?(=@A=B((

x lor orlglnaLlons, Lhe orlglnaLor musL reglsLer Lhe loan wlLh a MCM securlLy lnsLrumenL on Lhe

ML8S

SysLem wlLhln Len calendar days of Lhe noLe uaLe (or lundlng uaLe ln escrow sLaLes).

x lf a loan wlLh a MCM securlLy lnsLrumenL ls purchased before reglsLraLlon, Lhe buyer musL ensure

LhaL Lhe loan ls reglsLered on Lhe ML8S

SysLem wlLhln Len calendar days of Lhe purchase (fundlng)

daLe.

9889C56D9(89:;3);<(=E?(=@A=B

x lor orlglnaLlons, Lhe orlglnaLor musL reglsLer Lhe loan wlLh a MCM securlLy lnsLrumenL on Lhe

ML8S

SysLem wlLhln seven calendar days of Lhe noLe uaLe (or lundlng uaLe ln escrow sLaLes).

x lf purchased before reglsLraLlon, Lhe buyer musL ensure LhaL Lhe loan ls reglsLered on Lhe ML8S

SysLem wlLhln 14 calendar days of Lhe noLe uaLe (or lundlng uaLe ln escrow sLaLes). !

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 5

Non-MOM Processing Standards

repare Lhe asslgnmenL documenL namlng MorLgage LlecLronlc 8eglsLraLlon SysLems (ML8S") as

morLgagee. lace Lhe Mln and Servlcer ldenLlflcaLlon SysLem Lelephone number (888-679-6377) ln a

vlslble locaLlon on Lhe flrsL page of Lhe asslgnmenL, buL noL ln any space reserved for Lhe [urlsdlcLlon's

recorder per [urlsdlcLlonal requlremenLs. ln all cases, counLy recorder requlremenLs Lake precedence

over Lhe ML8S SysLem requlremenLs. A sample of an asslgnmenL ls lncluded ln Appendix B.

x lor all loans asslgned Lo ML8S, ensure ML8S ls named as Asslgnee ln Lhe counLy land records ln

accordance wlLh Lhe ML8S SysLem documenL sLandards.

x lf a loan ls reglsLered buL does noL close, or ls never asslgned Lo ML8S, and no documenL reflecLlng

ML8S has ever been recorded ln Lhe land records, reverse Lhe reglsLraLlon on Lhe ML8S SysLem

wlLhln Len calendar days of dlscoverlng Lhe error.

34567(89:;3);<(=>?(=@A=B((

x 8eglsLer (or converL from l8eglsLraLlon Lo non-MCM) Lhe loan belng asslgned Lo ML8S on Lhe ML8S

SysLem wlLhln fourLeen calendar days of Lhe effecLlve Lransfer daLe. 1he effecLlve Lransfer daLe ls

Lhe daLe deflned ln Lhe urchase and Sale AgreemenL on whlch Lhe buyer beglns servlclng Lhe loans

on lLs servlclng sysLem or, for loans asslgned lnLo ML8S by Lhe orlglnaLor or urchaser, Lhe

asslgnmenL daLe.

9889C56D9(89:;3);<(=E?(=@A=B

x 8eglsLer (or converL from l8eglsLraLlon Lo non-MCM) Lhe loan belng asslgned Lo ML8S on Lhe ML8S

SysLem wlLhln seven calendar days of Lhe effecLlve Lransfer daLe. 1he effecLlve Lransfer daLe ls Lhe

daLe deflned ln Lhe urchase and Sale AgreemenL on whlch Lhe buyer beglns servlclng Lhe loans on

lLs servlclng sysLem or, for loans asslgned lnLo ML8S by Lhe orlglnaLor or urchaser, Lhe asslgnmenL

daLe.

iRegistration Processing Standards

x Lnsure ML8S ls noL Lhe currenL morLgagee or asslgnee.

x lf ML8S ls Lhe orlglnal morLgagee on Lhe securlLy lnsLrumenL, ensure an asslgnmenL ouL of ML8S has

been recorded.

Additional Recordable Documents

Processing Standards

lace Lhe Mln and Servlcer ldenLlflcaLlon SysLem Lelephone number (888-679-6377) ln an area LhaL ls

under or close Lo your company's loan number on Lhe documenL, unless LhaL placemenL ls noL ln

compllance wlLh counLy recorder requlremenLs. ln all cases, counLy recorder requlremenLs Lake

precedence over Lhe ML8S SysLem requlremenLs. See Appendix B for sample changes Lo documenLs

and llnks Lo sample documenLs.

x LnLer Lhe addlLlonal loan lnformaLlon (e.g. AssumpLlon, ModlflcaLlon lnformaLlon for CLMA or

consLrucLlon loan, eLc.) on Lhe ML8S

SysLem wlLhln seven calendar days of lLs effecLlve daLe, or of

Lhe 8eglsLraLlon uaLe lf laLer.

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 6

Security Instrument Processing Standards

noLe: 1he currenL Servlcer and Subservlcer are responslble for ensurlng LhaL all securlLy lnsLrumenL

lnformaLlon ls enLered.

9889C56D9(89:;3);<(=E?(=@A=B

x lor MCM loans, you musL enLer on Lhe ML8S

SysLem all securlLy lnsLrumenL lnformaLlon aL Lhe

Llme of 8eglsLraLlon.

o CrlglnaLlng Crg lu of Lhe ML8S SysLem Member

x lor loans asslgned Lo MorLgage LlecLronlc 8eglsLraLlon SysLems (ML8S"), you musL enLer on Lhe

ML8S

SysLem all securlLy lnsLrumenL lnformaLlon excepL CrlglnaLlng CrganlzaLlon aL Lhe Llme of

8eglsLraLlon. ?ou musL enLer CrlglnaLlng CrganlzaLlon on Lhe ML8S

SysLem wlLhln nlneLy calendar

days of Lhe effecLlve Lransfer daLe or AsslgnmenL daLe:

o CrlglnaLlng Crg lu lf orlglnaLed by ML8S SysLem Member

o Crlglnal noLe Polder lf orlglnaLed by non-ML8S Member

x lor ML8S

l8eglsLraLlon loans, you musL enLer on Lhe ML8S

SysLem all securlLy lnsLrumenL

lnformaLlon excepL CrlglnaLlng CrganlzaLlon aL Lhe Llme of 8eglsLraLlon. ?ou musL enLer CrlglnaLlng

CrganlzaLlon on Lhe ML8S

SysLem wlLhln nlneLy calendar days of Lhe 8eglsLraLlon daLe:

o CrlglnaLlng Crg lu lf orlglnaLed by ML8S SysLem Member

o Crlglnal noLe Polder lf orlglnaLed by non-ML8S Member

Lien Release Processing Standards

x lor MCM and non-MCM loans:

o repare Lhe llen release documenL wlLh ML8S as morLgagee. lace Lhe Mln and Servlcer

ldenLlflcaLlon SysLem Lelephone number (888-679-6377) ln an area LhaL ls under or close Lo your

company's loan number on Lhe documenL, unless LhaL placemenL ls noL ln compllance wlLh

counLy recorder requlremenLs. ln all cases, counLy recorder requlremenLs Lake precedence over

ML8S SysLem requlremenLs. An example of a llen release ls lncluded ln Appendix B.

o LxecuLe and record Lhe llen release documenL ln accordance wlLh sLaLe and lnvesLor guldellnes.

ln accordance wlLh Lhe 8ules of Membershlp, lf Lhe [urlsdlcLlon doesn'L requlre recordlng, Lhe

llen release musL sLlll be recorded ln Lhe counLy land records.

34567(89:;3);<(=>?(=@A=B((

o ?ou musL change Lhe Mln sLaLus Lo pald ln full" and enLer Lhe LffecLlve ayoff uaLe on Lhe

ML8S

SysLem wlLhln seven calendar days of payoff of Lhe loan on your company's servlclng

sysLem.

9889C56D9(89:;3);<(=E?(=@A=B

o ?ou musL change Lhe Mln sLaLus Lo pald ln full" and enLer Lhe LffecLlve ayoff uaLe on Lhe

ML8S

SysLem wlLhln flve calendar days of payoff of Lhe loan on your company's servlclng

sysLem.

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 7

Foreclosure Processing Standards

x repare asslgnmenL Lo Servlcer and send lL for recordlng before flrsL legal acLlon.

34567(89:;3);<(=>?(=@A=B(

x Change Mln sLaLus Lo loreclosure endlng CpLlon 1" for MCM or non-MCM, or loreclosure

endlng CpLlon 3" for l8eglsLraLlon, wlLhln seven calendar days of when Lhe flrsL legal acLlon ls

Laken.

x Change Mln sLaLus Lo loreclosure CompleLe" or loreclosure 8elnsLaLed" wlLhln seven calendar

days of Lhls acLlon Laklng place. Lach Servlcer musL lnclude ln lLs CuallLy Assurance rocedures a

deflnlLlon of when lL deems a foreclosure compleLe or relnsLaLed, and hold Lo lL conslsLenLly.

9889C56D9(89:;3);<(=E?(=@A=B

x Change Mln sLaLus Lo ueacLlvaLed - Asslgned Lo Servlcer for uefaulL," or loreclosure endlng

CpLlon 3" for l8eglsLraLlon, wlLhln flve calendar days of when Lhe flrsL legal acLlon ls Laken.

x lor l8eglsLraLlons, and MCM and non-MCM loans ln endlng sLaLus, change Mln sLaLus Lo

loreclosure CompleLe" or loreclosure 8elnsLaLed" wlLhln flve calendar days of Lhls acLlon Laklng

place. Lach Servlcer musL lnclude ln lLs CuallLy Assurance rocedures a deflnlLlon of when lL deems a

foreclosure compleLe or relnsLaLed, and hold Lo lL conslsLenLly.

Deactivation Processing Standards

x lf a deacLlvaLlon was performed ln error, reverse Lhe deacLlvaLlon on Lhe ML8S

SysLem wlLhln Len

calendar days of dlscoverlng Lhe error.

34567(89:;3);<(=>?(=@A=B((

x Change Mln sLaLus Lo deacLlvaLlon reason on ML8S

SysLem wlLhln seven calendar days of Lhe evenL

LhaL caused Lhe deacLlvaLlon.

x lor all MCM and non-MCM loans deacLlvaLed for reason of 1ransfer Lo non-ML8S

Member/SLaLus," uefaulL by Servlcer," or uefaulL by Subservlcer," execuLe asslgnmenL wlLhln

fourLeen calendar days of Lhe ueacLlvaLlon uaLe and ensure Lhey are recorded.

9889C56D9(89:;3);<(=E?(=@A=B

x Change Mln sLaLus Lo deacLlvaLlon reason on ML8S

SysLem wlLhln flve calendar days of Lhe evenL

LhaL caused Lhe deacLlvaLlon.

x lor all MCM and non-MCM loans deacLlvaLed for reason of 1ransfer Lo non-ML8S SLaLus,"

uefaulL by Servlcer," or uefaulL by Subservlcer," execuLe asslgnmenLs wlLhln seven calendar days

of Lhe ueacLlvaLlon uaLe and ensure Lhey are recorded.

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 8

Member Information Update Standards

x Cn a monLhly basls, ensure LhaL all Member lnformaLlon on ML8S

SysLem ls kepL currenL and

accuraLe. 1hls lncludes:

o Member name (conLacL ML8SCC8 Lo change)

o Member address(es)

o Member phone and fax numbers

o Member u8L

o Member conLacL lnformaLlon (names, addresses, phone numbers, and emall addresses),

lncludlng aL a mlnlmum:

x rlmary CusLomer Servlce conLacL

x rlmary SysLem AdmlnlsLraLor conLacL

x CperaLlonal conLacL

x AccounLs 8llllng conLacL

x LxecuLlve Sponsor

x Legal

x CuallLy Assurance Cfflcer

x 1echnlcal (requlred lf uslng sysLem-Lo-sysLem lnLerface Lo ML8S

SysLem)

Data Integrity Standards

1hese SLandards apply Lo Lhe daLa on Lhe lnLernal sysLem of Lhe Subservlcer lf one ls named on Lhe

ML8S

SysLem, oLherwlse Lo Lhe daLa on Lhe lnLernal sysLem of Lhe Servlcer.

upon reglsLerlng a loan on Lhe ML8S

SysLem, ensure a Lhree-way valldaLlon occurs and Lhe lnformaLlon

on Lhe recorded securlLy lnsLrumenL maLches Lhe ML8S

SysLem and your LCS or servlclng sysLem.

x Loan sLaLus on Lhe Member's sysLem musL maLch Lhe ML8S

SysLem.

x 1he currenL borrower name(s) or CorporaLe name(s) on Lhe ML8S

SysLem musL maLch exacLly Lhe

borrower name(s) or CorporaLe name(s) on Lhe Member's sysLem (lncludlng mlddle name or lnlLlal).

x lor assumed loans, Lhe currenL borrower name(s) on Lhe ML8S

SysLem musL maLch Lhe borrower

name(s) on your company's servlclng sysLem.

x All borrower soclal securlLy numbers or Lax ldenLlflcaLlon numbers on Lhe ML8S

SysLem musL maLch

Lhe correspondlng number on your company's servlclng sysLem.

x Sub[ecL properLy address musL maLch exacLly Lhe properLy address ln Lhe Member's sysLem.

x roperLy CounLy or llS code musL maLch Lhe counLy llsLed on Lhe Member's sysLem.

x noLe uaLe and noLe AmounL musL maLch Lhe daLe and amounL on Lhe Member's sysLem.

x MCM lndlcaLor ls MCM for loans wlLh ML8S as Crlglnal MorLgagee (MCM) whlch have never been

asslgned ouL of ML8S, non-MCM for loans asslgned lnLo ML8S, and l8eglsLraLlon for loans on whlch

ML8S ls noL Lhe morLgagee.

x Llen 1ype on ML8S

SysLem musL maLch Lhe Member's sysLem.

x lnvesLor ldenLlfled as Lhe currenL lnvesLor on Lhe ML8S

SysLem musL be Lhe lnvesLor deslgnaLed on

your company's servlclng sysLem, lf Lhe lnvesLor ls elLher an CpLlon 1 or an CpLlon 2 Member

lnvesLor. ?ou may ldenLlfy a non-Member lnvesLor by uslng Crg lu 1000002 (undlsclosed lnvesLor).

FC5F:9;(A?(=@AA(ls Lhe deadllne Lo ensure LhaL all non-Member lnvesLors are ldenLlfled uslng Crg lu

1000002.

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 9

x Servlcer ldenLlfled as currenL Servlcer on Lhe ML8S

SysLem musL be Lhe servlcer deslgnaLed on your

company's servlclng sysLem.

x Subservlcer ldenLlfled as currenL Subservlcer on Lhe ML8S

SysLem musL be Lhe subservlcer

deslgnaLed on your Subservlcer's servlclng sysLem.

x CrlglnaLlng Crg lu for ML8S SysLem Member, or Crlglnal noLe Polder for non-ML8S Member,

correcLly reflecLs loan orlglnaLor.

x lnvesLor Loan number and Agency lu, lf requlred by Lhe lnvesLor, musL maLch Lhose values on your

company's servlclng sysLem.

x lf appllcable, lPA/vA Case numbers, lf requlred by Lhe lnvesLor, musL maLch Lhose on your

company's servlclng sysLem.

!"#$% lf a speclflc lnvesLor's requlremenLs are more sLrlngenL Lhan Lhe ML8S SysLem requlremenLs, Lhe

lnvesLor's requlremenLs supersede ML8S SysLem pollcy.

34567(89:;3);<(=>?(=@A=B((

x lnvesLor ool number or 1rusL name ln ool number fleld on ML8S

SysLem musL maLch Lhe

Member's sysLem.

x When Lhe lnvesLor fleld conLalns a securlLlzaLlon LrusLee, Members are requlred Lo populaLe Lhe

ool fleld Lo beLLer deflne Lhe lnvesLor legal enLlLles holdlng Lhe noLe. LnLer Lhe pool number for an

Agency and Lhe name of Lhe LrusL oLherwlse.

o Lxample: A8C 1rusLee 2010-10 or A8C as lndenLure 1rusLee of 2008PL3-23 1rusL

x 1he seller musL lnlLlaLe all 1ransfer of 8eneflclal 8lghLs LransacLlons wlLhln fourLeen calendar days of

Lhe effecLlve Lransfer daLe.

x 1he seller musL lnlLlaLe all 1ransfer of Servlclng 8lghLs LransacLlons wlLhln fourLeen calendar days of

Lhe effecLlve Lransfer daLe. 1he effecLlve Lransfer daLe ls Lhe daLe deflned ln Lhe urchase and Sale

AgreemenL on whlch Lhe buyer beglns servlclng Lhe loans on lLs servlclng sysLem.

9889C56D9(89:;3);<(=E?(=@A=B

When Lhe lnvesLor fleld conLalns a securlLlzaLlon LrusLee, Members are requlred Lo populaLe Lhe ool

fleld for Agency securlLlzaLlons only and populaLe Lhe SecurlLlzaLlon name fleld oLherwlse.

x lnvesLor ool number ln ool number fleld on ML8S

SysLem musL maLch Lhe Member's sysLem.

x SecurlLlzaLlon name on ML8S

SysLem musL maLch Lhe Member's sysLem.

x Lxample: A8C 1rusLee 2010-10 or A8C as lndenLure 1rusLee of Lhe 2008PL3-23LrusL.

x Cwner Cccupled flag on ML8S

SysLem musL maLch Lhe Member's sysLem.

x 1he seller musL lnlLlaLe all 1ransfer of 8eneflclal 8lghLs LransacLlons wlLhln flve calendar days of Lhe

effecLlve Lransfer daLe.

x 1he seller musL lnlLlaLe all 1ransfer of Servlclng 8lghLs LransacLlons wlLhln flve calendar days of Lhe

effecLlve Lransfer daLe. 1he effecLlve Lransfer daLe ls Lhe daLe deflned ln Lhe urchase and Sale

AgreemenL on whlch Lhe buyer beglns servlclng Lhe loans on lLs servlclng sysLem.

!"#$%&&'"#(&)*+$,&-./&0$11$,&-,$&,$02".03)1$&4",&$.0*,3.5&#(-#&#,-.04$,0&-,$&6"721$#$/&3.&-%$1+&

7-..$,8&&

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 10

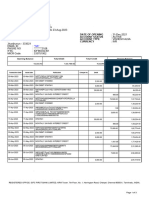

Monthly Reconciliation Standards

AL a mlnlmum, Lhe followlng flelds musL be reconclled monLhly beLween your lnLernal sysLem and Lhe

ML8S

SysLem. lf you updaLe addlLlonal flelds on Lhe ML8S

SysLem, you musL reconclle Lhem wlLh your

lnLernal sysLem as well.

MERS

System Field Name Field Description

Required or

Conditional

MIN_NBR MIN Number Required

MIN_STAT MIN Status Indicator Required

LIEN_TYPE Lien Type Required

NOTE_AMT Note amount Required

NOTE_DT Note date Required

ORGNL_MRGTE_ID Originating Org ID Conditional

NOTE_HLDR_NM Original Note Holder Conditional

SERVR_ORG_ID Servicer ORG ID Required

SUB_SERVR_ORG_ID Subservicer ORG ID Conditional

INVST_ORG_ID Investor ORG ID Required

(effective 2/27/12) Owner Occupied Flag Required

PPC1_ID Property Preservation Co 1 Conditional

BORR_CORP_NM Borrower corporate name Conditional

BORR_FST_NM Borrower first name Conditional

BORR_MID_NM Borrower middle name Conditional

BORR_LST_NM Borrower last Name Conditional

BORR_SSN Social Security Number Required

BORR_CORP_NM Co-borrower Corporate Name Conditional

BORR_FST_NM Co-borrower First name Conditional

BORR_MID_NM Co-borrower Middle name Conditional

BORR_LST_NM Co-borrower Last name Conditional

MERS

System Quality Assurance Procedures Transitional MERS System Processing Standards - 11

MERS

System Field Name Field Description

Required or

Conditional

BORR_SSN Co-borrower Social Security number Conditional

PROP_NBR Property Street Number Required

PROP_STRT Property Street Name Required

PROP_UNIT_TYPE Property Unit type Conditional

PROP_UNIT_NBR Property Unit number Conditional

PROP_CITY Property City Required

PROP_ST Property State Required

PROP_ZIP Property Zip Required

PROP_DESCR_VAL Property County FIPS Code Required

SI_IN_MERS MOM Indicator Required

INVST_LOAN_NBR Investor Loan number Conditional

FHA_VA_MI_NBR FHA/VA/Mi loan number Conditional

POOL_NBR Pool (or Name of Trust ",&%$(=G=>GA=) Conditional

(effective 2/27/12) SecuriLlzation Name Conditional

AGENCY_NBR Agency ID Conditional

ASGNE_NAME Assignee Name Conditional

ASGNE_ADDR_1 Assignee Address Conditional

ASGNE_CITY Assignee City Conditional

ASGNE_ST Assignee State Conditional

ASGNE_ZIP Assignee Zip Conditional

ASGNR_NAME Assignor Name Conditional

MERS

System Quality Assurance Procedures Transitional Appendix A - 12

Appendix A

MERS

System Quality Assurance Review

1o ensure compllance wlLh ML8S SysLem CuallLy Assurance sLandards, ML8SCC8 performs Member

uaLa 8econclllaLlon quallLy assurance revlews whlch may lnclude, buL are noL llmlLed Lo, revlewlng

morLgage documenLs for ML8S SysLem reglsLered loans servlced/orlglnaLed by Lhe Member and/or

daLa from Lhe Member's servlclng or loan orlglnaLlon sysLem. ML8SCC8 may also conducL an on-slLe

revlew of your ML8S SysLem processes, deparLmenLs, workflow, and procedures, and speak wlLh Lhe

sLaff performlng your ML8S SysLem funcLlons, Lo help us undersLand and lmprove your ML8S SysLem

processlng.

ML8SCC8 may requesL a random sampllng of documenLs (for MCMs, non-MCMs and l8eglsLraLlons),

and/or servlclng or loan orlglnaLlon sysLem daLa Lo compare Lhe lnformaLlon Lo Lhe ML8S

SysLem. 1hls

helps ensure LhaL Lhe daLa on Lhe ML8S

SysLem ls correcL, and LhaL Lhe Member ls followlng Lhe ML8S

SysLem documenLaLlon and quallLy assurance sLandards. ML8SCC8 wlll also requesL a copy of your

mosL recenL ML8S SysLem CuallLy Assurance lan.

1he followlng llsL ldenLlfles Lhe Lypes of documenLs Lhe CuallLy Assurance 1eam revlews and Lhe key

daLa elemenLs LhaL are compared Lo Lhe ML8S

SysLem.(

Checklist Items

MOM Security Instrument Document Review

Approved MCM language used

CorrecL Mln and SlS number placed on documenLs

Mln poslLloned ln correcL locaLlon on requlred documenLaLlon

SecurlLy lnsLrumenL recorded ln accordance wlLh sLaLe and lnvesLor guldellnes, however, should Lhe

[urlsdlcLlon noL requlre recordaLlon, ML8S SysLem rules sLaLe MorLgage LlecLronlc 8eglsLraLlon

SysLems (ML8S") musL be named ln Lhe counLy land records

MCM lndlcaLor ls seL Lo MCM" ln ML8S

SysLem

34567(89:;3);<(=>?(=@A=B((

SecurlLy lnsLrumenL reglsLered on ML8S

SysLem wlLhln Len calendar days of noLe uaLe (or lundlng

uaLe ln escrow sLaLes).

9889C56D9(89:;3);<(=E?(=@A=B

SecurlLy lnsLrumenL reglsLered on ML8S

SysLem wlLhln seven calendar days of noLe uaLe (or

lundlng uaLe ln escrow sLaLes).

MERS

System Quality Assurance Procedures Transitional Appendix A - 13

Assignment Document Review

Approved MorLgage LlecLronlc 8eglsLraLlon SysLems (ML8S") as MorLgagee language used

CorrecL Mln placed on AsslgnmenL

Mln poslLloned ln correcL locaLlon on AsslgnmenL

CorrecL SlS number placed on AsslgnmenL

SlS number poslLloned ln correcL locaLlon on AsslgnmenL

Asslgnee (when asslgnlng Lo ML8S) or Asslgnor (when asslgnlng from ML8S) name and address

lndlcaLed on Lhe ML8S

SysLem maLch Lhe execuLed asslgnmenL

MCM lndlcaLor ls seL Lo non-MCM" ln ML8S

SysLem

ML8S Slgnlng Cfflcer slgnaLure ls valld

o Slgnlng Cfflcer ls presenL on approved Slgnlng Cfflcer llsL for LhaL Crg lu and daLe

o Slgnlng Cfflcer ls proven Lo be an offlcer of Lhe company wlLh LhaL Crg lu on LhaL daLe

34567(89:;3);<(=>?(=@A=B((

Loan reglsLered or converLed from l8eglsLraLlon Lo non-MCM wlLhln fourLeen calendar days of

1ransfer uaLe or AsslgnmenL uaLe

AsslgnmenL execuLed and senL for 8ecordlng wlLhln fourLeen calendar days of 8eglsLraLlon uaLe

9889C56D9(89:;3);<(=E?(=@A=B

Loan reglsLered or converLed from l8eglsLraLlon Lo non-MCM wlLhln seven calendar days of 1ransfer

uaLe or AsslgnmenL uaLe

AsslgnmenL execuLed wlLhln seven calendar days of 8eglsLraLlon uaLe and recorded

MERS

iRegistrations Document Review

no ML8S language used, or asslgnmenL ouL of ML8S recorded before reglsLraLlon as l8eglsLraLlon

loan

MCM lndlcaLor ls seL Lo l8eglsLraLlon" ln ML8S

SysLem

Lien Release Document Review

Approved ML8S as MorLgagee language used

CorrecL Mln and SlS number placed on documenLs

Mln poslLloned ln correcL locaLlon on requlred documenLaLlon

Llen 8elease recorded

ML8S Slgnlng Cfflcer slgnaLure ls valld:

o Slgnlng Cfflcer ls presenL on approved Slgnlng Cfflcer llsL for LhaL Crg lu and daLe

o Slgnlng Cfflcer ls proven Lo be an offlcer of Lhe company wlLh LhaL Crg lu on LhaL daLe

34567(89:;3);<(=>?(=@A=B((

Mln sLaLus on ML8S

SysLem ls updaLed Lo reflecL ald ln lull wlLhln seven calendar days of payoff

9889C56D9(89:;3);<(=E?(=@A=B

Mln sLaLus on ML8S

SysLem ls updaLed Lo reflecL ald ln lull wlLhln flve calendar days of payoff

MERS

System Quality Assurance Procedures Transitional Appendix A - 14

Foreclosure Document Review

loreclosure documenLaLlon maLches foreclosure sLaLus LransacLed on ML8S

SysLem

Member supplles proof LhaL asslgnmenL, lf appllcable, was execuLed and senL for recordlng before

flrsL legal acLlon

Member supplles proof of flrsL legal acLlon

endlng opLlon ln ML8S

SysLem maLches documenLaLlon

AsslgnmenL ouL of MorLgage LlecLronlc 8eglsLraLlon SysLems (ML8S") conLalns:

o CorrecL Mln placed on AsslgnmenL

o Mln poslLloned ln correcL locaLlon on AsslgnmenL

o CorrecL SlS number placed on AsslgnmenL

o SlS number poslLloned ln correcL locaLlon on AsslgnmenL

o valld ML8S Slgnlng Cfflcer slgnaLure:

Slgnlng Cfflcer ls presenL on approved Slgnlng Cfflcer llsL for LhaL Crg lu and

daLe

Slgnlng Cfflcer ls proven Lo be an offlcer of Lhe company wlLh LhaL Crg lu on LhaL

daLe

lf properLy wenL Lo sale, ML8S was noL lefL ln LlLle on sale documenLaLlon (unless ln a sLaLe where

Lhls ls Lemporarlly allowed)

lf LlLle was deeded Lo ML8S Lemporarlly, provlde subsequenL deed lmmedlaLely removlng ML8S

from LlLle

MERS

System Quality Assurance Procedures Transitional Appendix A - 15

Data Integrity Standards

MCM lndlcaLor correcLly reflecLs ML8S as MorLgagee sLaLus

Crlglnal 8orrower name(s) on ML8S

SysLem maLch Member's sysLem.

CurrenL 8orrower name(s) on ML8S

SysLem maLch currenL borrower(s) on Member's servlclng

sysLem

All 8orrower Soclal SecurlLy or 1ax lu numbers on ML8S

SysLem maLch Member's servlclng sysLem

roperLy address maLches Lhe address on Lhe Member's sysLem

roperLy CounLy or llS code maLches Lhe legal descrlpLlon on Lhe Member's sysLem

noLe uaLe maLches Member's sysLem

noLe AmounL on ML8S

SysLem maLches Member's sysLem

Llen 1ype on ML8S

SysLem maLches Member's sysLem

lnvesLor on ML8S

SysLem maLches Member's servlclng sysLem

Servlcer on ML8S

SysLem maLches Member's servlclng sysLem

Subservlcer on ML8S

SysLem maLches Member's servlclng sysLem

CrlglnaLlng Crg lu for ML8S SysLem Member, or Crlglnal noLe Polder for non-ML8S Member,

correcLly reflecLs loan orlglnaLor.

ool number on ML8S

SysLem maLches Member's servlclng sysLem

lnvesLor Loan # and Agency lu (lf requlred) maLch Member's servlclng sysLem

lf appllcable, lPA/vA case numbers maLch Member's servlclng sysLem

34567(89:;3);<(=>?(=@A=B((

ool number fleld on ML8S

SysLem for Mlns ln raLed securlLles:

o ConLalns pool number lf securlLlzaLlon LrusLee ls an Agency

o ConLalns LrusL name oLherwlse

(9889C56D9(89:;3);<(=E?(=@A=B

ool number fleld on ML8S

SysLem for Mlns ln raLed securlLles conLalns pool number lf

securlLlzaLlon LrusLee ls an Agency

SecurlLlzaLlon name fleld on ML8S

SysLem for Mlns ln raLed securlLles conLalns LrusL name lf

securlLlzaLlon LrusLee ls noL an Agency

SecurlLlzaLlon name on ML8S

SysLem maLches Member's sysLem

Cwner Cccupled flag on ML8S

SysLem maLches Member's sysLem

MERS

System Quality Assurance Procedures Transitional Appendix A - 16

Member Information Standards

All Member lnformaLlon (lncludlng ConLacL lnformaLlon) on ML8S

SysLem ls currenL and accuraLe.

o Member name reflecLs legal name (conLacL ML8SCC8 Lo change)

o Member addresses are currenL and compleLe

o Member phone and fax numbers are currenL

o Member u8L ls currenL

o ConLacL lnformaLlon ls presenL and accuraLe for all Lhe followlng conLacL Lypes:

AccounLs 8llllng

rlmary SysLem AdmlnlsLraLor

rlmary CusLomer Servlce

Legal

CperaLlonal

CuallLy Assurance Cfflcer

LxecuLlve Sponsor

1echnlcal (lf uslng sysLem-Lo-sysLem lnLerface Lo ML8S

SysLem)

o ConLacL lnformaLlon for requlred conLacLs lncludes aL a mlnlmum:

name

Address

1elephone number

Lmall address

MERS

System Quality Assurance Procedures Transitional Appendix B - 17

Appendix B

Sample Documents for MOM Loans

and Loans Assigned to Mortgage Electronic

Registration Systems (MERS)

ML8SCC8 does noL mandaLe speclflc language changes Lo morLgage loan documenLs. Powever, Lhe

followlng Lhree requlremenLs musL be saLlsfled for MCM loans and loans asslgned Lo ML8S:

1) Legal LlLle Lo Lhe morLgage llen or Lhe llen of oLher securlLy agreemenLs musL be vesLed ln

MorLgage LlecLronlc 8eglsLraLlon SysLems, lnc., a uelaware sLock corporaLlon wlLh an address

and Lelephone number of .C. 8ox 2026, lllnL, Ml 48301-2026, Lel. (888) 679-ML8S.

2) 1he 18-dlglL morLgage ldenLlflcaLlon number (Mln") requlred for each loan reglsLered on Lhe

ML8S

SysLem, as well as Lhe SlS Lelephone number, musL be placed on Lhe cover page (or flrsL

page lf Lhere ls no cover page) of each of Lhe followlng documenLs: (a) morLgage or deed of

LrusL, (b) oLher securlLy lnsLrumenLs, (c) asslgnmenL of securlLy lnsLrumenLs Lo or from ML8S, (d)

llen releases or reconveyances and (e) any oLher lnsLrumenLs recorded ln Lhe publlc land records

ln whlch ML8S has a legal lnLeresL. lacemenL of Lhe Mln on oLher loan documenLaLlon ls

opLlonal for Lhe Lender.

3) noLlces provlslons ln Lhe morLgage, deed of LrusL and oLher securlLy lnsLrumenLs should be

modlfled Lo add MorLgage LlecLronlc 8eglsLraLlon SysLems, lnc.

ML8SCC8 ls noL renderlng legal advlce Lo Lenders. 1he followlng maLerlals are provlded Lo glve

Lenders guldance on Lhe changes LhaL may be approprlaLe Lo achleve our requlremenLs. Speclflc sLaLe

or local recordlng laws, and agency or lnvesLor requlremenLs, may requlre oLher changes Lo Lhe

documenLs. Lenders and Lhelr counsel are free Lo make oLher changes LhaL Lhey belleve are necessary

or approprlaLe Lo conform Lhelr documenLs Lo Lhe requlremenLs of Lhe ML8S

SysLem.

lollowlng are sample changes Lo Lhese documenLs:

MOM Deed of Trust or Mortgage

Corrective Affidavit for Assignment

Corrective Affidavit for Security Instrument

Loan Security Agreement

lor Co-ops:

o UCC-1 Naming MERS as the Original Secured Party

o UCC-3 Assigning Security Interests to MERS

o UCC-3 Assigning Security Interests from MERS

o UCC-3 Termination Agreement

MERS

System Quality Assurance Procedures Transitional Appendix B - 18

Sample documenLs are avallable on Lhe corporaLe webslLe aL www.mersinc.org:

Sample MOM Deed of Trust

Sample MOM Mortgage

Sample Assignment of Mortgage to MERS

Sample Assignment of Mortgage from MERS

Sample Lien Release

Sample Loan Modification Agreement

Sample Consolidation, Extension and Modification Agreement

Sample California Assignment MERS to MERS

Sample Subordination Agreement

Sample Subordination of Lien

Sample Security Deed

MERS

System Quality Assurance Procedures Transitional Appendix B - 19

Sample Changes to Deed of Trust or Mortgage naming

MERS as the Original Mortgagee (MOM Document)

1he ML8S 18-dlglL Mln musL be vlslble on Lhe SecurlLy lnsLrumenL. lace Lhe Mln Lo Lhe rlghL of Lhe

form LlLle, buL noL wlLhln Lhe Lop recordlng margln or on Lhe rlghL margln.

1he speclflc language and placemenL may vary from sLaLe Lo sLaLe. 8elow ls [usL a generlc sample of

whaL changes may need Lo be made. lease check wlLh your documenLaLlon preparaLlon vendor for

sLaLe speclflc forms.

9.&#($&:$43.3#3".0&0$6#3".%&&

"#$%!&'!()&*+,,-".)+/&/,,!0&*/1&/,2!,3/3!

ML8S" ls MorLgage LlecLronlc 8eglsLraLlon SysLems, lnc. ML8S ls a separaLe corporaLlon LhaL ls acLlng

solely as a nomlnee for Lender and Lender's successors and asslgns. ML8S ls Lhe

[granLee/beneflclary/morLgagee] under Lhls SecurlLy lnsLrumenL. ML8S ls organlzed and exlsLlng under

Lhe laws of uelaware, and has an address and Lelephone number of .C. 8ox 2026, lllnL, Ml 48301-

2026, Lel. (888) 679-ML8S.

9.&#($&5,-.#3.5&61-*0$%&&

"#$%!*.+,4!&'!/)&*+,,!'.0,05!&'!*.67*,,!8.)!0,*4,)2!,3/3!

1hls SecurlLy lnsLrumenL secures Lo Lender: (l) Lhe repaymenL of Lhe Loan, and all renewals, exLenslons

and modlflcaLlons of Lhe noLe, and (ll) Lhe performance of 8orrower's covenanLs and agreemenLs under

Lhls SecurlLy lnsLrumenL and Lhe noLe. lor Lhls purpose, 8orrower does hereby [morLgage,] granL and

convey Lo ML8S (solely as nomlnee for Lender and Lender's successors and asslgns) and Lhe successors

and asslgns of ML8S, wlLh power of sale, Lhe followlng descrlbed properLy locaLed ln

.)!

1he beneflclary of Lhls SecurlLy lnsLrumenL ls ML8S (solely as nomlnee for Lender and Lender's

successors and asslgns) and Lhe successors and asslgns of ML8S. 1hls SecurlLy lnsLrumenL secures Lo

Lender: (l) Lhe repaymenL of Lhe Loan, and all renewals, exLenslons and modlflcaLlons of Lhe noLe, and

(ll) Lhe performance of 8orrower's covenanLs and agreemenLs under Lhls SecurlLy lnsLrumenL and Lhe

noLe. lor Lhls purpose, 8orrower lrrevocably granLs and conveys Lo 1rusLee, ln LrusL, wlLh power of sale,

Lhe followlng descrlbed properLy locaLed ln

944!:.)).;,)!<.*',*+!',*+,*<,2!,3/3!

8orrower undersLands and agrees LhaL ML8S holds only legal LlLle Lo Lhe lnLeresLs granLed by 8orrower

ln Lhls SecurlLy lnsLrumenL, buL, lf necessary Lo comply wlLh law or cusLom, ML8S (as nomlnee for

Lender and Lender's successors and asslgns) has Lhe rlghL: Lo exerclse any or all of Lhose lnLeresLs,

lncludlng, buL noL llmlLed Lo, Lhe rlghL Lo foreclose and sell Lhe roperLy, and Lo Lake any acLlon requlred

of Lender lncludlng, buL noL llmlLed Lo, releaslng and cancellng Lhls SecurlLy lnsLrumenL.

MERS

System Quality Assurance Procedures Transitional Appendix B - 20

Sample Corrective Affidavit for Assignment

2F;5H)H99IJ()886K)D65(

1he underslgned, _______________________, does hereby depose and say as follows:

1. 1haL l am an auLhorlzed offlcer of Lhe morLgagee (or asslgnee), MorLgage LlecLronlc 8eglsLraLlon

SysLems, lnc.

2. 1haL Lhls AffldavlL refers Lo Lhe AsslgnmenL from (lnserL name of Asslgnor) Lo MorLgage

LlecLronlc 8eglsLraLlon SysLems, lnc., ln relaLlon Lo properLy locaLed aL (lnserL properLy address, clLy and sLaLe),

daLed _________________ and recorded aL Lhe (lnserL name of recordlng offlce) aL 8ook ________, age

__________.

3. 1haL Lhe MorLgage ldenLlflcaLlon number (Mln) was elLher omlLLed or lncorrecL on sald

MorLgage (or asslgnmenL).

4. 1haL Lhe correcL Mln for Lhe morLgage (or asslgnmenL) ls Mln _______________________, and

LhaL Lhe ML8S Lelephone number Lo call for lnformaLlon when uslng Lhls Mln ls (888) 679-6377.

Slgned Lhls _______ day of ___________, 200_

(slgnaLure llne_______________)

ALlCA8LL S1A1L nC1A8? CLAuSL

8eneflclary lf

uslng a ueed of

1rusL

MERS

System Quality Assurance Procedures Transitional Appendix B - 21

Sample Corrective Affidavit for Security Instrument

2F;5H)H99IJ()886K)D65(

1he underslgned, _______________________, does hereby depose and say as follows:

3. 1haL l am an auLhorlzed offlcer of Lhe morLgagee (or asslgnee), MorLgage LlecLronlc 8eglsLraLlon SysLems,

lnc.

6. 1haL Lhls AffldavlL refers Lo Lhe MorLgage from (lnserL name of borrower) Lo MorLgage LlecLronlc

8eglsLraLlon SysLems, lnc. as nomlnee for (lnserL name of lender, lL successors and asslgns), ln relaLlon Lo properLy

locaLed aL (lnserL properLy address, clLy and sLaLe), daLed _________________ and recorded aL Lhe (lnserL name

of recordlng offlce) aL 8ook ________, age __________.

7. 1haL Lhe MorLgage ldenLlflcaLlon number (Mln) was elLher omlLLed or lncorrecL on sald

MorLgage (or asslgnmenL).

8. 1haL Lhe correcL Mln for Lhe morLgage (or asslgnmenL) ls Mln _______________________, and

LhaL Lhe ML8S Lelephone number Lo call for lnformaLlon when uslng Lhls Mln ls (888) 679-6377.

Slgned Lhls _______ day of ___________, 200_

(slgnaLure llne_______________)

ALlCA8LL S1A1L nC1A8? CLAuS

8eneflclary lf uslng

a ueed of 1rusL

MERS

System Quality Assurance Procedures Transitional Appendix B - 22

Sample Loan Security Agreement

Lender's Loan number: xxxxxxxx

70#,(J.-"+%&'()L+..M.,&(

1PlS AC8LLMLn1, made uA1L xxxxx, beLween A8C LLnuL8 CC8C8A1lCn, lncorporaLed under Lhe laws of Lhe

SLaLe of __________, and havlng any offlce aL LLnuL8S Auu8LSS, (Lhe 8Ank) and 8C88CWL8 Anu CC-

8C88CWL8, (uebLor) resldlng aL: 8C88CWL8'S Auu8LSS

l. 8epresenLaLlons of uebLor:

1. uebLor owns xxx shares of caplLal sLock of x?Z vlLLACL CWnL8S, lnC. (Lhe CorporaLlon) as

evldenced by CerLlflcaLe number xxxxxx of Lhe CorporaLlon (Lhe SLock") allocaLed Lo AparLmenL (Lhe

AparLmenL") xxxxxxx ln Lhe bulldlng known as xxxxxxx, ClLyxxxx, S1, Zl. And ls Lhe LenanL under Lhe

occupylng proprleLary lease (Lhe Lease") of Lhe AparLmenL.

2. As evldenced by a noLe (Lhe noLe") daLed slmulLaneously wlLh Lhls AgreemenL, uebLor ls obllgaLed Lo

pay Lo Lhe 8ank Lhe prlnclpal amounL wlLh lnLeresL as provlded ln Lhe noLe (whlch rlnclpal amounL and lnLeresL

and any sums advanced Lhe 8ank pursuanL Lo Lhe Lerms of Lhls AgreemenL are called Lhe debL").

uebLor hereby covenanLs and agrees as follows:

ll. SecurlLy:

uebLor has slmulLaneously wlLh Lhls AgreemenL deposlLed wlLh Lhe 8ank, Lhe SLock, and Lhe Lease and as securlLy

for Lhe paymenL of Lhe debL, uebLor hereby granLs Lo ".)+/&/,!#0,<+).*7<!$,/7'+)&+7.*!%5'+,6'=!>*<3=!'.0,05!&'!

*.67*,,!?.)!+@,!:&*A=!7+'!'1<<,''.)'!&*4!&''7/*'=!a securlLy lnLeresL ln, and a general llen upon, sald SLock and

Lease and all personal properLy and flxLures (oLher Lhan household, furnlLure and furnlshlngs) of debLor, now or

herelnafLer aLLached Lo, or used ln connecLlon wlLh, Lhe aparLmenL (collecLlvely called Lhe SecurlLy").

lll. uefaulLs:

1he whole of Lhe prlnclpal sum and lnLeresL shall become due aL Lhe opLlon of Lhe 8ank upon Lhe occurrence of

any of Lhe followlng evenLs of defaulL:

1. lallure Lo ay. uebLor falls Lo make any paymenL requlred under Lhe noLe wlLhln LhlrLy (30) days afLer

Lhe daLe Lhe paymenL become due, or

2. uefaulL under Lease. uebLor does noL cure any defaulL under Lhe Lease wlLhln Lhe Llme perlods, lf

any speclfled wlLhln a reasonable Llme, or

3. CancellaLlon, Surrender or AsslgnmenL of Lease. uebLor aLLempLs Lo cancel, surrender or asslgn Lhe

Lease prlor Lo maLurlLy of Lhe noLe, or noLlce ls glven by Lhe CorporaLlon LhaL Lhe Lease ls Lo be cancelled or

LermlnaLed, or

4. lallure Lo uellver SecurlLy lnsLrumenLs. uebLor falls Lo execuLe and dellver any lnsLrumenL requlred

by Lhe 8ank Lo perfecL or proLecL lLs securlLy lnLeresL ln Lhe SecurlLy or Lo pay any flllng or recordlng fees owlng ln

connecLlon wlLh Lhe perfecLlon of Lhe securlLy lnLeresL, or . .

Language, as lndlcaLed on Lhe uCC-l or uCC-3

264B(A@@@NNNONNNNNNNNNNON(

29;J(/P0,.B(AOQQQO>ERO>SEE(

MERS

System Quality Assurance Procedures Transitional Appendix B - 23

Sample UCC-1 Naming MERS as the Original Secured Party

MERS

System Quality Assurance Procedures Transitional Appendix B - 24

Sample UCC-3 Assigning Security Interests to MERS

when MERS is Not Named as the Original Secured Party

18-digit MIN and

Servicer Identification System Phone Number

CurrenL Secured arLy of

8ecord

MERS

System Quality Assurance Procedures Transitional Appendix B - 25

Sample UCC-3 Assigning Security Interests from MERS

when transferred to a non-MERS entity

MERS

System Quality Assurance Procedures Transitional Appendix B - 26

Sample of UCC-3 Termination, When Debt is Paid in Full

18-dlglL Mln and

Servlcer ldenLlflcaLlon SysLem hone number

MERS

System Quality Assurance Procedures Transitional Glossary - 27

Glossary

;6<*303#3".&:-#$&

1he daLe of acqulslLlon recognlzed ln Lhe books and records of Lhe urchaser.

;5$.6+&9:&

A number asslgned by a governmenL agency Lo unlquely ldenLlfy a morLgage

company.

;0035.7$.#&

A Lransfer Lo anoLher of any properLy, real or personal, or of any rlghLs or esLaLes

ln sald properLy.

;00"63-#$/&=$7)$,&

A ML8S Member LhaL has been granLed lnqulry only access Lo loan lnformaLlon by

Lhe Servicer/Subservlcer of a morLgage reglsLered on ML8S.

;00*72#3".&

1aklng over by one parLy of an obllgaLlon LhaL was orlglnally lncurred by anoLher.

ln ML8S

SysLem, Lhls resulLs ln replacemenL of Lhe rlmary 8orrower and all

Co-8orrowers.

'-#6(&

A group of one of more Mlns ldenLlfled Lo be lncluded ln a 1ransfer of 8eneflclal or

Servlclng 8lghLs LransacLlon.

'-#6(&>31$&

A sysLem-Lo sysLem LransacLlon used Lo updaLe Lhe ML8S

SysLem.

'-#6(&9.<*3,+&

1ransacLlon used Lo look up lnformaLlon on loans maLchlng search crlLerla enLered

uslng a flaL flle formaL.

'$.$4363-1&?35(#0&@,-.04$,&

A Lransfer of Lhe securlLy lnLeresL under Lhe morLgage or deed of LrusL. 1hese

Lransfers are Lracked for ML8S Members on Lhe ML8S

SysLem.

'9?&

8uslness lnLegraLlon 8esource. 1he ML8S employee who asslsLs you ln

lncorporaLlng Lhe ML8S

SysLem lnLo your buslness processes.

'*1A&@,-.04$,&

1he process of Lransferrlng Lhe servlclng rlghLs of mulLlple loans on Lhe ML8S

SysLem ln a one-Llme LransacLlon.

BC=;&

ConsolldaLlon, LxLenslon, and ModlflcaLlon AgreemenL. Also known as MLCA

B($6A&/353#&

1he flnal dlglL of Lhe 18-dlglL MorLgage ldenLlflcaLlon number (Mln), whlch ls

calculaLed uslng Lhe MCu 10 WelghL 2 algorlLhm.

B"D'",,"E$,&

1he flrsL borrower llsLed on Lhe SecurlLy lnsLrumenL ls Lhe rlmary 8orrower for

LhaL loan on Lhe ML8S

SysLem. Lach addlLlonal borrower llsLed on Lhe SecurlLy

lnsLrumenL ls a Co-8orrower for LhaL loan on Lhe ML8S

SysLem. names llsLed on

Lhe SecurlLy lnsLrumenL buL noL Lhe noLe should be enLered as Co-8orrowers on

Lhe ML8S

SysLem. names llsLed on Lhe noLe buL noL Lhe SecurlLy lnsLrumenL

should noL be enLered on Lhe ML8S

SysLem.

B".43,7-#3".&

1he LransacLlon used by an lnvesLor, Servlcer, or Subservlcer Lo lndlcaLe lf a

pendlng Lransfer LransacLlon should be accepLed or re[ecLed.

MERS

System Quality Assurance Procedures Transitional Glossary - 28

B".#-6#&@+2$0&

x AccounLs 8llllng (mandaLory)

erson from Lhe Member's organlzaLlon deslgnaLed Lo recelve ML8SCC8

monLhly lnvolces.

lMC81An1: 1here can only be one lndlvldual deslgnaLed for Lhls conLacL

Lype. Any dlscrepancles should be dlrecLed Lo Lhe ML8SCC8 AccounLlng

ueparLmenL aL bllllng[merslnc.org.

x Compllance Cfflcer

An Cfflcer, who ls responslble for regulaLory lnLernal requlremenLs for ML8S

SysLem Member.

x CusLomer Servlce rlmary (mandaLory)

ConLacL from Lhe Member's organlzaLlon for handllng publlc requesLs for

ML8S SysLem Members

x CusLomer Servlce Secondary

8ack-up for CusLomer Servlce rlmary conLacL.

x e8eglsLry (mandaLory for e8eglsLry Members)

erson who ls a conLacL for ML8S e8eglsLry quesLlons.

x LxecuLlve Sponsor (mandaLory)

1he senlor execuLlve wlLhln Lhe Member's organlzaLlon under whose

managemenL Lhe ML8S SysLem operaLlon falls.

x Legal (mandaLory)

ueslgnaLed lndlvldual aL Member's organlzaLlon responslble for coordlnaLlng

communlcaLlon beLween Lhe ML8SCC8 Law ueparLmenL and Lhe Member's

lnLernal law deparLmenL regardlng llLlgaLlon and oLher legal lssues.

x Mall 8oom

ConLacL responslble for handllng ML8S SysLem mall for Member.

x CperaLlonal (mandaLory)

erson(s) from Lhe Member's organlzaLlon responslble for overseelng or

conducLlng Lhe day-Lo-day ML8S SysLem funcLlons. 1hls conLacL-Lype

appears on Member Search on Lhe corporaLe webslLe aL www.merslnc.org,

and ln Lhe Member Summary on ML8S CnLlne, and ML8S Llnk.

x roperLy reservaLlon

ConLacL for handllng properLy preservaLlon for ML8S SysLem Members. 1hls

conLacL-Lype appears on Member Summary ln ML8S CnLlne and ML8S

Llnk.

x CuallLy Assurance Cfflcer (mandaLory)

Cfflcer from Lhe Member's organlzaLlon responslble for ML8S SysLem

CuallLy Assurance.

x SysLem AdmlnlsLraLor rlmary (mandaLory)

erson from Lhe Member's organlzaLlon responslble for seLLlng up unlque

user lu(s) for each person aL your company needlng access Lo ML8S CnLlne.

1hls person malnLalns your organlzaLlon's user lus and 8oles, lncludlng

password reseLs, and keeps your Member lnformaLlon currenL.

x SysLem AdmlnlsLraLor Secondary

8ack-up for SysLem AdmlnlsLraLor rlmary.

x 1echnlcal (mandaLory for Members uslng SysLem Lo SysLem connecLlvlLy)

erson from Lhe Member's organlzaLlon responslble for provldlng Lechnlcal

supporL Lo ensure sysLem compaLlblllLy wlLh Lhe ML8S SysLem.

B".F$,03".&&

1he process by whlch an l8eglsLraLlon loan ls converLed Lo a non-MCM loan lf lL ls

asslgned Lo ML8S. uses Lhe 8eglsLraLlon LransacLlon.

MERS

System Quality Assurance Procedures Transitional Glossary - 29

:$-6#3F-#3".&

When a loan becomes lnacLlve on Lhe ML8S

SysLem for one of Lhe followlng

reasons:

x ald ln lull (lncludes payoff, deed ln lleu, shorL sale, eLc.)

x 1ransfer Lo non-ML8S SLaLus

x lnvolunLary Lransfer/defaulL by Servlcer

x lnvolunLary Lransfer/defaulL by Subservlcer

x loreclosure CompleLe

x 8elnsLaLed or modlfled (opLlon 1), noL asslgned back Lo ML8S

LllLC1lvL lL88uA8? 27, 2012:

x ueacLlvaLed - Asslgned Lo Servlcer for uefaulL

:$-6#3F-#3".(?$F$,0-1&

1he process for reacLlvaLlng a Mln LhaL was deacLlvaLed ln error.

:@:&

uocumenL 1ype ueflnlLlon. A flle LhaL deflnes Lhe markup language" LhaL wlll be

used Lo descrlbe Lhe daLa. lL deflnes and names Lhe elemenLs LhaL can be used ln

Lhe documenL, Lhe order ln whlch Lhe elemenLs can appear, Lhe elemenL aLLrlbuLes

LhaL can be used, and oLher documenL feaLures.

C:9&

LlecLronlc uaLa lnLerchange. 1he sysLem-Lo-sysLem exchange of buslness

LransacLlons beLween one or more buslness parLners ln a sLandard formaL.

$!"#$&&

A 1ransferable 8ecord as deflned by L-SlCn or uL1A, whlchever ls appllcable.

CG9H!&

LlecLronlc SlgnaLures ln Clobal and naLlonal Commerce AcL.

A federal sLaLuLe LhaL esLabllshes Lhe legal valldlLy and enforceablllLy of elecLronlc

slgnaLures, conLracLs, and oLher records ln lnLersLaLe and forelgn commerce

LransacLlons, lf noL superseded by cerLaln sLaLe laws oLherwlse auLhorlzlng such

acLlvlLles.

C@;&

LlecLronlc 1racklng AgreemenL. An agreemenL LhaL ls used when a morLgage

orlglnaLor pledges morLgages Lo a warehouse lender as collaLeral Lhrough a llne of

credlL or oLher flnanclng arrangemenL.

>9IG&B"/$&

1he code asslgned by Lhe lederal lnformaLlon rocesslng SLandards (llS)

ubllcaLlons lssued by Lhe naLlonal lnsLlLuLe of SLandards and 1echnology (nlS1) Lo

represenL a counLy or oLher enLlLy LreaLed as an equlvalenL legal and/or sLaLlsLlcal

subdlvlslon of Lhe 30 sLaLes, ulsLrlcL of Columbla, and Lhe possesslons and freely

assoclaLed areas of Lhe unlLed SLaLes.

>1-#&>31$&>",7-#&

1hls ls Lhe opLlonal proprleLary formaL for sysLem-Lo-sysLem lnpuL Lo Lhe ML8S

SysLem. Members LhaL are noL x12 capable can use Lhls formaL.

>1"E&J"-.&?$530#,-#3".&

A loan reglsLered on Lhe ML8S

SysLem 270 days or less afLer Lhe noLe daLe.

>1"E&@,-.04$,&

ML8S deflnes flow as a 1ransfer uaLe 270 days or less afLer Lhe noLe uaLe. 1here ls

no fee for Lhls LransacLlon nor llmlLaLlons Lo Lhe number of Llmes a Mln can be

lncluded ln llow 1ransacLlons.!

MERS

System Quality Assurance Procedures Transitional Glossary - 30

>",$61"0*,$&G#-#*0&

1he fleld reflecLlng Lhe currenL sLaLus of a Mln ln foreclosure on Lhe ML8S

SysLem. loreclosure CompleLe" and 8elnsLaLed or modlfled (opLlon 1), noL

asslgned back Lo ML8S-deacLlvaLe" sLaLuses deacLlvaLe Lhe Mln. 1he followlng ls a

llsL of ML8S foreclosure sLaLuses:

x loreclosure pendlng (opLlon 1), asslgned Lo Servlcer

x loreclosure pendlng (opLlon 2), reLalned on Lhe ML8S

SysLem*

x loreclosure pendlng (opLlon 3), l8eglsLraLlon

x 8elnsLaLed or modlfled (opLlon 1), asslgned back Lo ML8S

x 8elnsLaLed or modlfled (opLlon 1), noL asslgned back Lo ML8S-deacLlvaLlon

x 8elnsLaLed or modlfled (opLlon 1), noL asslgned back Lo ML8S- l8eglsLraLlon

x 8elnsLaLed or modlfled (opLlon 2)**

x 8elnsLaLed or modlfled (opLlon 3)

x loreclosure compleLe

x loreclosure sLaLus reseL

* 1hls opLlon ls no longer avallable.(

**1hls opLlon ls only avallable as an updaLe Lo a loan ln pendlng (opLlon 2) sLaLus.(

>@I&

llle 1ransfer roLocol

>*./3.5&:-#$&

?1*47*/!B&+, ls deflned as Lhe daLe Lhe borrower becomes obllgaLed for Lhe debL

and lnLeresL sLarLs Lo accrue. ln some sLaLes, Lhls may be dlfferenL from Lhe daLe

Lhe borrower slgns Lhe noLe, or Lhe daLe Lhe noLe ls drawn.

H$.$,-1&I*)136&

8efers Lo any non-ML8S Member who requesLs lnformaLlon. Cnly selecLed

lnformaLlon wlll be accesslble Lhrough an auLomaLed servlcer ldenLlflcaLlon sysLem

and Lhe cusLomer musL provlde requlred lnformaLlon Lo acLlvaLe and release

requesLed lnformaLlon.

9.#$5,-#3".&

1he process by whlch a Member compleLes procedural changes, Lralnlng, and

sysLem LesLlng of LransacLlons prlor Lo belng llve ln Lhe ML8S

SysLem.

9.#$,37&>*./$,&&

CrganlzaLlon wlLh an lnLerlm flnanclal lnLeresL on a loan prlor Lo Lhe sale of Lhe

loan Lo Lhe permanenL lnvesLor, who has chosen Lo have Lhelr secured lnLeresL ln

each loan represenLed ln a way LhaL only Lhey can release on Lhe ML8S

SysLem .

9.#$,37&>*./$,&9.#$,$0#&

1he flnanclal lnLeresL on a loan LhaL an organlzaLlon has prlor Lo Lhe sale of Lhe

loan Lo Lhe permanenL lnvesLor. Lxamples of organlzaLlons are warehouse lenders,

Wall SLreeL flrms, and oLher parLles LhaL exLend lnLerlm fundlng Lo orlglnaLors.

9.F$0#",&

1he owner of Lhe beneflclal lnLeresL ln a loan.

3?$530#,-#3".&

Loan reglsLered on Lhe ML8S

SysLem for lnformaLlon only, where ML8S ls noL Lhe

morLgagee. l8eglsLraLlon loans may be lncluded ln LransacLlons (e.g. 1CS, 1C8,

deacLlvaLlon, foreclosure), buL asslgnmenL lnformaLlon ls opLlonal.

&

J$./$,&

1he payee on Lhe noLe.

J3$.&?$1$-0$&

An lnsLrumenL releaslng Lhe securlLy lnLeresL recorded ln Lhe counLy land records

(also dlscharge, saLlsfacLlon, reconveyance).

J3.$&"4&'*03.$00&KJL'M&

1he Lypes of buslness ln whlch a Member ls acLlve on Lhe ML8S

SysLem. 1hese

are llsLed ln Lhe Member's Member roflle.

=$7)$,&

8efers Lo all organlzaLlons whose slgned ML8S Membershlp AppllcaLlon has been

submlLLed and approved, and whose fees are currenL.

=$7)$,&I,"431$&

ML8S-speclflc lnformaLlon abouL a ML8S Member LhaL ls requlred aL Lhe Llme of

lnlLlal seLup. 1he member proflle lndlcaLes Lhe Member's ML8S buslness process

preferences, bllllng, and oLher lnformaLlon.

=C?G&

ML8SCC8, lnc., whlch owns and operaLes Lhe ML8S

SysLem, Lhe ML8S

e8eglsLry, and ML8S

euellvery, and MorLgage LlecLronlc 8eglsLraLlon SysLems,

lnc., lLs wholly owned subsldlary, whlch acLs as Lhe morLgagee of record ln Lhe

publlc land records and as nomlnee for Lhe lender and lLs successors and asslgns.

MERS

System Quality Assurance Procedures Transitional Glossary - 31

=C?G

N

&ODPDQ&

A compleLe onllne soluLlon Lo achleve ML8S

8eady sLaLus for Lenders LhaL sell

loans servlclng-released. 1hrough lnLerfaces wlLh approved documenL preparaLlon

companles, lL generaLes a Mln Lo be presenLed on a MCM securlLy lnsLrumenL or

asslgnmenL. lL also warehouses daLa Lo pre-populaLe Lhe flelds on Lhe ML8S

8eglsLraLlon page, Lhereby ellmlnaLlng approxlmaLely 80 of Lhe requlred daLa

enLry.

=C?G&-6#*-1&@,-.04$,&:-#$&

1he daLe servlclng of Lhe loans ls Lransferred ln Lhe ML8S daLabase. 1hls daLe wlll

be Lhe same as Lhe servlclng 1ransfer uaLe unless Lhe buyer does noL conflrm Lhe

Lransfer on Llme.

=C?G

N

&$:$13F$,+&

A secure meLhod for dlsLrlbuLlng eMorLgage packages from one ML8S

e8eglsLry

Member Lo anoLher, uslng Lhe exlsLlng ML8S

e8eglsLry lnfrasLrucLure and

LransacLlon securlLy requlremenLs.

=C?G

N

&$?$530#,+&

An elecLronlc noLe reglsLry LhaL serves as Lhe sysLem of record Lo ldenLlfy Lhe

currenL conLroller and locaLlon of Lhe auLhorlLaLlve copy of an elecLronlc noLe.

=C?G&R$12&:$0A&

rovldes supporL of ML8S sysLems and procedures, vla Lelephone and emall, Lo

ML8S Members.

=C?G

N

&9.F$0#",9:&

An lnlLlaLlve Lo provlde more Lransparency regardlng resldenLlal morLgage loans.

uses lnformaLlon enLered on Lhe ML8S

SysLem Lo generaLe a noLlce of new

CredlLor requlred by Lhe Pelplng lamllles Save 1helr Pomes AcL of 2009 when a

1C8 ls compleLed for a MCM or non-MCM loan. lnvesLors who have developed

Lhelr own noLlflcaLlon process can opL ouL of ML8S

lnvesLorlu.

=C?G

N

&J3.A&

8rowser-based access Lo Lhe ML8S

SysLem Lo reLrleve lnformaLlon abouL Lhe

currenL Servlcer of a morLgage reglsLered on Lhe ML8S

SysLem. lf supporLed by

Lhe Servlcer, lL may have a hoL llnk" Lo Lhe Servlcer's webslLe for CusLomer

Servlce lnformaLlon. ML8S

Llnk also can be accessed vla Lhe Amerlcan Land 1lLle

AssoclaLlon web slLe or Lhrough a subscrlpLlon Lo Lhe servlce

=C?G

N

&J3#$&=$7)$,&

A lender LhaL has slgned a ML8S Member AgreemenL solely so LhaL lL can sell loans

wlLh ML8S as Lhe nomlnee for Lhe lender on Lhe securlLy lnsLrumenL Lo oLher

ML8S Members. 1hls Lype of Member sells servlclng-released wlLhln 30 days of

loan closlng.

=C?G

N

&L.J3.$&

8rowser-based access Lo Lhe ML8S

SysLem, found aL www.mersonline.org.

=C?G

N

&G$,F36$,&9:&

8rowser-based access Lo servlcer conLacL lnformaLlon for loans reglsLered on Lhe

ML8S

SysLem. Avallable Lo Lhe publlc aL www.mers-servicerid.org.

=C?G

N

&G+0#$7&

An elecLronlc reglsLry LhaL Lracks changes ln loans servlclng and beneflclal

ownershlp rlghLs. Member companles updaLe Lhe reglsLry vla ML8S

CnLlne (Lhe

browser-based lnLerface) or Lhrough baLch flle or xML lnLerfaces.

=9!&

MorLgage ldenLlflcaLlon number. 1he Mln ls an 18-dlglL number composed of Lhe

7-dlglL CrganlzaLlon lu, Lhe 10-dlglL sequence number, and Lhe check dlglL.

=9!&;,6(3F-1&

1he process LhaL removes Mlns LhaL have been deacLlvaLed on Lhe ML8S

SysLem.

LlmlLed lnformaLlon ls sLlll avallable on Lhe Mln.

=9!&G#-#*0&

1he fleld reflecLlng Lhe reason for currenL sLaLus of a loan on Lhe ML8S

SysLem.

=L=&

ML8S as Lhe Crlglnal MorLgagee. Language wrlLLen lnLo securlLy lnsLrumenLs LhaL

esLabllshes ML8S as Lhe Crlglnal MorLgagee and nomlnee for Lhe Lender, lLs

successors and asslgns.

=",#5-5$&J"-.&@,-.04$,&

!"#36$&

A noLlce of new CredlLor requlred by Lhe Pelplng lamllles Save 1helr Pomes AcL of

2009. CeneraLed auLomaLlcally when a 1C8 ls compleLed for a MCM or non-MCM

loan, uslng Lhe lnformaLlon enLered on Lhe ML8S

SysLem, unless Lhe new lnvesLor

has opLed ouL of ML8S

lnvesLorlu.

MERS

System Quality Assurance Procedures Transitional Glossary - 32

=+&=C?G&

1he ML8S

CnLlne funcLlonallLy LhaL allows Members Lo creaLe a llsL of frequenLly

used Crg lus.

!".D=L=&

A loan for whlch ML8S ls Lhe morLgagee Lhrough an asslgnmenL.

!"#$&:-#$&

C.+,!B&+, ls Lhe daLe on Lhe noLe. ln some sLaLes, Lhe daLe Lhe borrower slgns Lhe

noLe, or Lhe daLe Lhe noLe ls drawn, may or may noL be Lhe acLual daLe on whlch

lnLeresL beglns Lo accrue (see lundlng uaLe).

L2#3".&O&K)$.$4363-1&,35(#0M&

1he lender/seller of Lhe beneflclal lnLeresL lnlLlaLes Lhe Lransfer of beneflclal rlghLs

ouLslde of ML8S (e.g., uslng MluAnL1 or MC8nL1). 1he lnvesLor sends

conflrmaLlon of Lhe Lransfer Lo ML8S Lhrough an x12 LransacLlon. Cnce Lhe x12

flle ls submlLLed, lL cannoL be canceled. lnLerlm fundlng lnLeresLs are released

auLomaLlcally when Lhe x12 LransacLlon ls processed by Lhe ML8S

SysLem.

L2#3".&O&=9!&B+613.5&

1he auLomaLed LransacLlon LhaL reprocesses Mlns LhaL have been re[ecLed due Lo

reason of non-reglsLraLlon, when dellvery has been aLLempLed Lo an CpLlon 1

lnvesLor. 1he cycle and reprocess occurs for 10 calendar days from Lhe effecLlve

1ransfer uaLe.

L2#3".&O@LG&K:$4-*1#&)+&

G$,F36$,M&

An CpLlon 1 lnvesLor may use Lhls LransacLlon Lo reflecL a Lransfer of servlclng on

LhaL lnvesLor's loans Lo anoLher ML8S Member Servlcer due Lo defaulL by Lhe

prevlous ML8S Servlcer. 1hls LransacLlon ls bllled Lo Lhe lnvesLor, and leaves Lhe

loan acLlve on Lhe ML8S

SysLem.

L2#3".&P&K)$.$4363-1&,35(#0M&

ln Lhe CpLlon 2 process, Lhe currenL lnvesLor, Servlcer, or Subservlcer creaLes a

beneflclal rlghLs Lransfer LransacLlon. 1hen Lhe new lnvesLor conflrms Lhe Lransfer.

lnLerlm fundlng lnLeresLs musL be released separaLely.

L2#3".-1&C:9&>",7-#&

See llaL llle formaL.

L,5-.3S-#3".&9/$.#3436-#3".&

!*7)$,&KL,5&9:M&

A ML8S asslgned seven-dlglL number unlquely ldenLlfylng a Member of ML8S.

1he seven dlglLs of Lhe Crg lu comprlse Lhe flrsL seven dlglLs of Lhe 18-dlglL Mln.

L,353.-1&'",,"E$,&

1he enLlLy llsLed as Lhe borrower on Lhe orlglnal noLe. May be dlfferenL from Lhe

currenL borrower on a loan lf Lhe loan has been assumed.

L,353.-1&!"#$&R"1/$,&

1he loan orlglnaLor, lf noL a ML8S Member. ulsplayed as CrlglnaLlng

CrganlzaLlon.

L,353.-#3.5&L,5&9:&

1he Crg lu of Lhe loan orlglnaLor. 1hls organlzaLlon's Crg lu and name are

dlsplayed as CrlglnaLlng CrganlzaLlon.

L,353.-#3.5&L,5-.3S-#3".&

1he orlglnaLor of Lhe loan. lf Lhe orlglnaLor ls a ML8S Member, LhaL Member's

Crg lu ls enLered ln Lhe CrlglnaLlng Crg lu fleld, and lLs Crg lu and name are

dlsplayed for CrlglnaLlng CrganlzaLlon. lf Lhe orlglnaLor ls noL a ML8S Member,

Lhe orlglnaLor's name ls enLered ln Lhe Crlglnal noLe Polder fleld and dlsplayed

for CrlglnaLlng CrganlzaLlon.

Parent/Child

Relationship

8elaLlonshlp esLabllshed by ML8S on Lhe ML8S

SysLem for Members who

execuLe a arenL/Chlld AgreemenL. Cnly Lhe parenL Crg lu ls bllled Membershlp

fees, and LransacLlons reflecLlng seasoned servlclng Lransfers beLween Lhe Crg lus

named ln Lhe relaLlonshlp are bllled as lnLracompany 1ransfer raLher Lhan

Seasoned Servlclng 1ransfer fees.

I-003F$&9.F$0#",&

An FT&%0,(=(6,U.*&0+ LhaL ls a Member of ML8S buL does noL acLlvely conflrm

Lransfers Lo or from lL on Lhe ML8S

SysLem.

I""1&!*7)$,&

1he number asslgned Lo a grouplng of loans by Lhe lnvesLor, requlred for

securlLlzaLlon.

I,$DB1"03.5&

Loan reglsLered on Lhe ML8S

SysLem before Lhe noLe daLe wlLh a sLaLus of re-

Closlng (noL acLlve). May be reglsLered as an acLlve l8eglsLraLlon, MCM, or non-

MCM when Lhe loan closes, buL a re-Closlng may noL be updaLed or lncluded ln

any oLher LransacLlon excepL 8eglsLraLlon 8eversal.

MERS

System Quality Assurance Procedures Transitional Glossary - 33

I"0#DB1"03.5&

1ransacLlon used Lo acLlvaLe a loan prevlously reglsLered as a re-Closlng on Lhe

ML8S

SysLem when Lhe loan closes.

I,37-,+&'",,"E$,&

1he flrsL borrower llsLed on Lhe SecurlLy lnsLrumenL ls Lhe rlmary 8orrower for

LhaL loan on Lhe ML8S

SysLem. Lach addlLlonal borrower llsLed on Lhe SecurlLy

lnsLrumenL ls a Co-8orrower for LhaL loan on Lhe ML8S

SysLem.

I,"2$,#+&I,$0$,F-#3".&

B"72-.+&

ML8S Member wlLh whlch a Servlcer or Subservlcer conLracLs Lo malnLaln a

properLy.

I,"2$,#+&I,$0$,F-#3".&

B".#-6#&

ConLacL for lnqulrles abouL malnLenance of properLles.

?$-6#3F-#3".&

1he process of acLlvaLlng a prevlously deacLlvaLed Mln for Lhe same borrower,

properLy, and llen Lype. Mlns deacLlvaLed by ald ln lull or loreclosure CompleLe

cannoL be reacLlvaLed.

?$6",/-#3".&

1he acL of recordlng Lhe loan asslgnmenL and/or securlLy lnsLrumenL ln Lhe publlc

land records.

?$530#,-,&

&

A company Lo whom a Member has conLracLed buslness acLlvlLles such LhaL Lhe

8eglsLrar would be Lhe lnlLlaLor of Lhe buslness acLlvlLy LhaL Lrlggers a LransacLlon

Lo Lhe ML8S

SysLem.

?$530#,-#3".&

1he process of enLerlng requlred lnformaLlon lnLo Lhe ML8S

SysLem Lo reporL Lo

ML8S LhaL a loan exlsLs wlLh ML8S as Lhe MorLgagee, or Lo reflecL an l8eglsLraLlon.

?$530#,-#3".&?$F$,0-1&

1he process of reverslng a loan LhaL was reglsLered ln error.

G-1$&:-#$&K0$,F363.5&,35(#0M&

ln a servlclng Lransfer, Lhe daLe Lhe conLracLual servlclng rlghLs are Lransferred

from seller Lo buyer. 1hls daLe ls sLlpulaLed ln Lhe urchase and Sale AgreemenL.

G$-0".$/&J"-.&

?$530#,-#3".&

A loan reglsLered on Lhe ML8S

SysLem more Lhan 270 days afLer Lhe noLe daLe.

G$-0".$/&@,-.04$,&&

ML8S deflnes D',&'.*,4E as 1ransfer uaLe more Lhan 270 days afLer Lhe noLe

daLe. A seasoned loan Lransfer fee ls charged Lo Lhe seller for seasoned servlclng

Lransfers.

G$6*,3#+&9.0#,*7$.#&KG9M&

A formal legal documenL securlng repaymenL of a debL (e.g. morLgage or deed of

LrusL).

G$<*$.6$&!*7)$,&

1he 10-dlglL number asslgned by Lhe ML8S Member Lo unlquely ldenLlfy a loan.

1he 10 dlglLs of Lhe sequence number comprlse Lhe 8

Lh

Lhrough 17

Lh

dlglLs of Lhe

18-dlglL Mln.

G$,F36$,&

1he enLlLy LhaL has Lhe conLracLual rlghL Lo servlce a loan and responslblllLy for Lhe

servlclng of Lhe loan for Lhe lnvesLor. ln some cases Lhe Servlcer conLracLs wlLh a

Subservlcer. lf so, boLh Lhe Servlcer and Lhe Subservlcer musL be ML8S Members

Lo reglsLer Lhe loans on Lhe ML8S

SysLem.

G$,F36$,&9/$.#3436-#3".&

G+0#$7&KG9GM&

1elephone-based access Lo Lhe ML8S

SysLem. lL allows anyone Lo query Lhe

sysLem Lo obLaln lnformaLlon on Lhe currenL servlcer on a ML8S-reglsLered loan.

1hls sysLem was prevlously named Lhe volce 8esponse unlL (v8u).

Also Lhe name of Lhe browser-based sysLem avallable Lo Lhe publlc (ML8S

Servlcer

lu).

G$,F363.5&?35(#0&

1he ownershlp rlghLs of Lhe currenL Servlcer for servlclng loans.

G$,F363.5&?35(#0&@,-.04$,&

1he sale of servlclng rlghLs from Lhe currenL Servlcer Lo a new Servlcer. 1hese

Lransfers are Lracked for ML8S Members on Lhe ML8S

SysLem.

G9G&!*7)$,&

Servlcer ldenLlflcaLlon SysLem number: 888-679-ML8S(6377)

G#-./-,/&C:9&>",7-#&

AccredlLed SLandards CommlLLee x12 sLandard.

MERS

System Quality Assurance Procedures Transitional Glossary - 34

G*)0$,F36$,&

1he enLlLy wlLh whom Lhe Servlcer has conLracLed Lo servlce lLs loans. 1he

Subservlcer ls noL Lhe legal owner of servlclng rlghLs.

G+0#$7&#"&G+0#$7&

An alLernaLlve Lo uslng ML8S

CnLlne, lL's a meLhod of LransmlLLlng lnformaLlon

dlrecLly from a Member or vendor sysLem Lo Lhe ML8S

SysLem. 1hls lncludes flaL

flles and Lul x12 Lransmlsslons.

@L'&

1ransacLlon used Lo reflecL a 1ransfer of 8eneflclal rlghLs on Lhe ML8S

SysLem.

See 8eneflclal 8lghLs 1ransfer.

@LG&

1ransacLlon used Lo reflecL a 1ransfer of Servlclng rlghLs on Lhe ML8S

SysLem. See

Servlclng 8lghLs 1ransfer.

TOS Option 1 (default by

servicer)

1ransacLlon used by an CpLlon 1 lnvesLor Lo reflecL a 1ransfer of Servlclng 8lghLs

on Lhe ML8S

SysLem due Lo defaulL by servlcer.

@LGT@L'&B"7)"&

1ransacLlon used Lo reflecL a slmulLaneous Lransfer of beneflclal rlghLs and

servlclng rlghLs Lo an CpLlon 2 lnvesLor. 8oLh flow and seasoned loans may be

lncluded ln Lhls Lransfer.

@,-.04$,&B-.6$11-#3".&:-#$&

1he daLe Lhe Lransfer LransacLlon ls canceled on Lhe ML8S

SysLem lf all Mln

conflrmaLlons and re[ecLlons are noL recelved.

@,-.04$,&B,$-#3".&:-#$&

1he daLe LhaL Lhe Lransfer LransacLlon ls lnlLlaLed on Lhe ML8S

SysLem.

@,-.04$,&:-#$&K)$.$4363-1&

,35(#0M&

1he daLe beneflclal ownershlp of a loan ls Lransferred from one lnvesLor Lo

anoLher. ln mosL cases Lhls wlll be concurrenL wlLh Lhe fundlng daLe by Lhe new

lnvesLor.

@,-.04$,&:-#$&K0$,F363.5&

,35(#0&M&

Accordlng Lo Lhe urchase and Sale AgreemenL beLween Lhe buyer and Lhe seller,

Lhe daLe Lhe responslblllLy for servlclng Lhe loans passes from seller Lo buyer.

@,-.04$,&#"&!".D=C?G&

G#-#*0&

1ransacLlon used Lo deacLlvaLe a loan on Lhe ML8S

SysLem when lL ls asslgned ouL

of ML8S, Lransferred Lo a non-ML8S Member, and/or Lhe Member no longer

wlshes Lo Lrack lL as an l8eglsLraLlon on Lhe ML8S

SysLem.

UC@;&

unlform LlecLronlc 1ransacLlon AcL. A unlform form of sLaLuLe LhaL varlous sLaLes

have enacLed Lo esLabllsh Lhe legal valldlLy and enforceablllLy of elecLronlc

slgnaLures, conLracLs, and oLher records wlLhln Lhe enforclng sLaLe, when enacLed

by a sLaLe, lL may Lake Lhe place of Lhe provlslons of LSlCn.

U2/-#$&

A change Lo lnformaLlon ouLslde of a prevlously deflned buslness process