Professional Documents

Culture Documents

For Individual and Other Taxpayers (Other Than Company) : IT-11GA

For Individual and Other Taxpayers (Other Than Company) : IT-11GA

Uploaded by

sojol747412Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

For Individual and Other Taxpayers (Other Than Company) : IT-11GA

For Individual and Other Taxpayers (Other Than Company) : IT-11GA

Uploaded by

sojol747412Copyright:

Available Formats

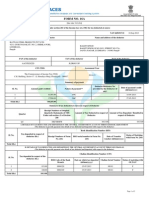

FOR INDIVIDUAL AND OTHER TAXPAYERS (OTHER THAN COMPANY)

FORM OF RETURN OF INCOME UNDER THE INCOME TAX ORDINANCE, 1984 (XXXVI OF 1984)

Be a Respectable Taxpayer submit return in due time avoid penalty

IT-11GA

Photograph of the Assessee (to be attested on the photograph)

Put the tick ( Self 1 2 3 4 5 6 8 9

) mark wherever applicable Universal Self Normal Faijus Salehin Ferdous 2 6 9 7 5 5 6 3 7 2 5 4 1

Name of the Assessee: National ID No (if any) : UTIN (if any) : TIN: (a) Circle:

129

(b) Taxes Zone:

6

/Non-resident Hindu Undivided family

Assessment Year: 2012-2013 Status: Individual Firm

7. Residential Status: Resident Association of persons

Name of the employer/business(where applicable) : Shahjalal Islami Bank Limited

10. Wife/Husband's Name (if assessee, please mention TIN) : 11. Father's Name : 12. Mother's Name :

13 Date of Birth

Shahabuddin Ahmed Ferdousi Ahmed Leena 0

Day

9

Year

Month

14. Address

(a) Present Shahjalal Islami Bank Limited Head Office, Gulshan, Dhaka

(b) Permanent 119, Ulon, Rampura, Dhaka

15 Telephone: Office/Business: 16 VAT Registration Number (if any)

02-8825457

Residential :

Statement of Income of the Assessee

Statement of income during the income year ended on 30.06.2012 SL 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Heads of Income Salaries: U/S 21 (as per schedule-1) Interest on Securities: u/s 22 Income from house property: u/s 24 (as per schedule - 2) Agricultural Income: u/s 26 Income from business or profession: u/s 28 Share of profit in a firm: Income of the spouse or minor child as applicable: u/s 43 (4) Capital Gains: u/s 31 Income from other source: u/s 33 (Bank Interest) Total (Serial 1 to 9) Foreign Income: Total Income (Serial 10 and 11) Tax leviable on total income Tax rebate : u/s 44(2)(b) (as per schedule 3) Tax payable (difference between serial 13 and 14) Amount in Taka 322,093 210 322,303 322,303 12,230 6,446 5,784

16 Tax Payments: (a) Tax deducted/collected at source Tk. (Please attach supporting documents/statement) (b) Advance tax u/s 64/68 [attach challan (s)] Tk. (c) Tax paid on the basis of this return (u/s 74) Tk. [Please attach challan/pay order/bank draft/cheque] (d) Adjustment of Tax Refund (if any) Tk. Total of (a), (b), (c) and (d) 17 Difference between serial 15 and 16 (if any) 18 Tax exempted & Tax free income 19 Income tax paid in the last assessment year * If needed, please use separate sheet.

1,520 4,264

5,784 168,067 -

Verification

Ifaijus Salehin Ferdous, Father Shahabuddin Ahmed TIN: NEW solemnly declare that to the best of my knowledge and belief the information given in this return and statements and documents annexed herewith is correct and complete.

Place: Dhaka Date: -

Signature FAIJUS SALEHIN FERDOUS Senior Officer

(Name in block letters)

SCHEDULE SHOWING DETAILS OF INCOME Name of the Assessee: TIN : N E W SCHEDULE -1 (Salaries) Pay and Allowances Basic Pay Special pay Dearness allowances Conveyance allowances House Rent allowances Medical Allowances Servent allowances Leave allowances Honorarium / Reward / Fee Overtime allowance Bonus / Ex-gratia Other allowances Employer's Contribution to Recognized Provident Fund Interest accrued on Recognized Provident Fund Deemed income for transport facility Deemed income for free furnished/unfurnished accommodation Others (House Maintenance & Utility) Net taxable income from salary 17,480 108,000 28,333 104,880 56,667 24,000 87,400 56,667 Amount of income (Tk.) 174,800 Amount of exempted income Net taxable income (Tk.) 174,800 4,333 17,480 108,000 17,480 490,160 SCHEDULE -2 (House Property Income) Location and description of property Particulars 1. Annual Rental Income 2. Claimed Expenses: Repair, Collection, etc. Municipal or Local Tax Land Revenue. Interest on Loan / Mortgage / Capital Charge Insurance Premium Vacancy Allowance Other, if any Total 3. Net Income (difference between item 1 and 2) Tk. Tk. 168,067 322,093 Ziaul Haque Assessment Year: 2012-2013

N/A

SCHEDULE -3 (Investment Tax Credit)

(Section 44(2)(b) read with part 'B' of Sixth Schedule) 1. Life insurance premium 2. Contribution to deferred annuity 3. Contribution to Provident Fund to which Provident Fund Act, 1925 applies 4. Self contribution and employer's conrtribution to Recgonized Provident Fund 5. Contribution to Super Annuation Fund 6. Investment in approved debenture or debenture stock, stock of Shares 7. Contribution to deposit pension scheme 8. Contribution to Benevolent Fund and Group Insurance Premium 9. Contribution to Zakat Fund 10. Others. Total * Please attach certificates / documents of investment. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. 34,960 34,960

List of Documents Furnished

1. Salary Certificate

2.

Tax payment certificate

3.

Challan No Dated :

Tk.

Statement of Profit on MSD Account & Tax thereon

* Incomplete return is not acceptable

IT-10B

Statement of Assets and Liabilities as on 30.06.2012

Name of the Assessee: Faijus Salehin Ferdous TIN: NEW 1 (a) Business Capital (Closing Balance) (b) Directors Shareholding in Limited Companies (at cost) Name of Companies Number of Share Tk. Tk. -

Non-Agriculture Property (at cost with legal expenses) : Land/House Property (Description & Location of property)

Tk. Tk.

Agriculture Property (at cost with legal expenses) :

Tk.

Investments: a) Shares / Debentures b) Saving Certificate/Unit Certificate/Bond c) Prize Bond/Savings Scheme d) Loans Given e) Other Investment

Tk. Tk. Tk. Tk. Tk. TOTAL (a+b+c+d+e) Tk. Tk. 20 Vori Tk.

5 6

Motor Vehicles ( at cost) Type of Motor Vehicle and Registration Number: Jewellery (Quantity and Cost) As marriage gift (Not Valued) Furniture (At Cost) :

Tk.

50,000 -

Electronic Equipment (at Cost)

Tk.

65,000

Cash Asset outside Business a) Cash in Hand b) Cash at Bank c) Other Deposits

Tk. Tk. Tk.

1,088 TOTAL(a+b+c) Tk. Total (1 to 9)

1,088 116,088

B/F = 10 Any other Assets (with details) a) Provident Fund Opening Add: This year b) Deposit Pension Scheme (DPS)

Tk.

116,088

52,786 34,960 Tk. Tk. TOTAL

87,746 Tk. 87,746 203,834

TOTAL ASSETS (1 to 10) Tk. 11 LESS: LIABILITIES a) Mortgages secured on property or land b) Unsecured Loans c) Bank Loan d) Other Loan Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Child Tk. Tk. Tk. 322,303 168,067

TOTAL LIABILITIES 12 13 14 15 Net Wealth as on last date of this income year (Difference between total assets and total liabilities) Net wealth as on last date of previous income year Accretion in wealth (Difference between serial no. 12 and 13) (a) Family Expenditure (Total Expenditure as per IT 10BB) (b) Number of dependant Children of the family: Adult 16 17 Total Accretion of wealth (Total of serial 14 and 15) Sources of Fund: (i) Shown Return Income (ii) Tax Exempted / Tax Free Income (iii) Other Receipts

203,834 203,834 108,000

311,834

Tk. Total Source of Fund : Tk. 18 Difference (Between Serial 16 and 17)

Tk.

490,370 178,536

I solemnly declare that to the best of my knowledge and belief the information given in the IT-10B is correct and complete. Signature of the Assessee: Name : Faijus Salehin Ferdous Md. Rana Pervez Date . * Assets and liabilities of self, spouse (if she/he is not an assessee), minor children and dependant(s) to .be shown in the above statements * If needed, please use separte sheet. 6

Form No. IT-10BB

FORM

Statement under section 75(2)(d)(i) and section 80 of the Income Tax Ordinance, 1984 (XXXVI of 1984) regarding particulars of life style

Name of the Assessee: Faijus Salehin Ferdous

TIN

Serial No. Particulars of Expenditure 1 2 3 4 5 6 7 8 9 10 11 Personal and fooding expenditure Tax paid including deduction at source of the last financial year Accommodation Expenses Transport Expenses Electricity Bill for Residence Wasa Bill for Residence Gas Bill for Residence Telephone/Mobile Bill for Residence Education Expenses for Children Personal Expenses for Foreign Travel Festival and Other special Expense, if any Total Expenditure

Amount of Tk. 60,000 12,000 6,000 30,000 108,000

Comments

Living with joint family

I solemnly declare that to the best of my knowledge and belief the information given in the IT-10BB is correct and complete.

Signature of the Assessee: Name : Faijus Salehin Ferdous Date : * If needed, please use separate sheet.

Acknowledgement Receipt of Income Statement

Name of the Assessee: Faijus Salehin Ferdous UTIN/TIN : N E W Assessment Year: 2012-2013 (a) Circle: (b) Taxes Zone: 7

129 6

Instructions to fill up the Return Form

Instructions: (1) (2) This return of income shall be signed and verified by the individual assessee or person as prescribed u/s 75 of the Income Tax Ordinance 1984. Enclose where applicable: (a) Salary statement for salary income; Bank statement for interest; certificate for interest on savings instruments; Rent agreement; receipts of municipal tax and land revenue, statement of house property loan interest, insurance premium for house property income; statement of professional income as per IT Rule-8; Copy of assessment/income statement and balance sheet for partnership income; Documents of capital gain; Dividend warrant for dividend income; statement of other income; Documents in support of investments in savings certificates, LIP, DPS, Zakat, Stock/Share etc. (b) Statement of income and expenditure; Manufacturing A/C, Trading and Profit & Loss A/C and Balance sheet. (c) Depreciation chart claiming depreciation as per THIRD SCHEDULE of the Income Tax Ordinance, 1984; (d) Computation of income according to Income tax Law; Enclose separate statement for: (a) Any income of the spouse of the assessee (if she/he is not an assessee), minor children and dependant; (b) Tax exempted / tax free income. Fulfillment of the conditions laid down in rule-38 is mandatory for submission of a return under "Self Assessment". Documents furnished to support the declaration should be signed by the assessee or his/her authorized representative. The assessee shall submit his/her photograph with return after every five year. Furnish the following information: (a) Name, address and TIN of the partners if the assessee is a firm (b) Name of firm, address and TIN if the assessee is a partner; (c) Name of the company, address and TIN if the assessee is a director. Assets and liabilities of self, spouse (if she/he is not an assessee), minor children and dependant(s) to be shown in the IT-10B. Signature is mandatory for all the assessee or his/her authorized represefntative. For individual, signature is also mandatory in I.T-10B and I.T-10BB. If needed, please use separate sheet.

(3)

(4) (5) (6) (7)

(8) (9) (10)

Total Income shown in Return: Net Wealth of Assessee : Tk. Tk. 203,834 Serial No. in return register Universal Self Normal 322,303 Tax paid: Tk. 5,784

Date of receipt of Return: Nature of Return: Self

Signature of Receiving Officer with seal

Computation of Salary Income

Name : Ziaul Haque Designation: Senior Officer TIN : NEW ON THE INCOME FOR THE PERIOD FROM

1ST JULY, 2011 TO 30TH JUNE, 2012 A. Salaries: u/s: 21 1 Basic Salary 2 House Rent Allowance Less: Exempted up to 3 Conveyance Allowance Less: Exempted up to 4 Medical Allowance Less: Exempted up to actual expenses 5 Bonus / Ex-gratia 6 PF Bank's Contribution Tk. Tk. Tk. Tk. Tk. Tk. Tk. 104,880 87,400 28,333 24,000 56,667 56,667 Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. 174,800 17,480 4,333 108,000 17,480 322,093 210 322,303 12,230 12,230

SUB-TOTAL : B Income from others 1 Interest from SB Account TOTAL TAXABLE INCOME: C CALCULATION OF TAX LIABILITIES: a) The First Tk. 200,000/b) On the Next Tk. 300,000/c) On the Next Tk. 400,000/d) On the Next Tk. 300,000/e) On the Balance of the Income at 0% 10% 15% 20% 25% 200,000 122,303 322,303 -

TOTAL TAX: 64,461 10,000,000 Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk. Tk.

Tk. Tk. Tk. Tk. Tk.

D INVESTMENT TAX CREDIT a) INVESTMENT @ 20% ON TOTAL INCOME b) BUT NOT EXCEEDING TK. 1 Crore c) Actual Investment 1. Life insurance premium 2. Contribution to deferred annuity 3. Contribution to PF (Own & Employers) 4. Contribution to Super Annuation Fund 5. Investment in Approved Debenture, Stock of share 6. Contribution to deposit pension scheme 7. Contribution to Benevolent Fund 8. Contribution to Zakat Fund 9. Others c. TOTAL ACTUAL INVESTMENT:

34,960

34,960 64,461 Tk. 6,446 5,784

a. TAX REBATE @ 10% ON ADMISSIBLE INVESTMENT OF WHICH EVER IS LOWER OF a, b & c Tax Deducted at Source From Salary Tk. From SB A/c Tk.

Total Tax Payable: 1,500 20 Tk. Tk.

Balance Tax Payable :

1,520 4,264

Signature of the Assessee

You might also like

- Pledge ReceiptDocument2 pagesPledge ReceiptAneesh CR50% (6)

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- Ir8a (M) 2010Document1 pageIr8a (M) 2010gk9f5e6ho1owcldxNo ratings yet

- Personal Budget SpreadsheetDocument7 pagesPersonal Budget SpreadsheetHimanshu MandawatNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SaleAlma SueNo ratings yet

- Valuation of Landlocked Properties in IndiaDocument8 pagesValuation of Landlocked Properties in IndiaJigesh Mehta50% (2)

- Sample Income Tax FormDocument8 pagesSample Income Tax FormSadav ImtiazNo ratings yet

- Kh. Shafiqur RahmanDocument48 pagesKh. Shafiqur RahmanAnonymous UqGvTrNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Form of Retun of Income Under The Income - Tax Ordinance, 1984 (XXXVI OF 1984) Universal Self/Normal Only For The Salaried IndividualDocument11 pagesForm of Retun of Income Under The Income - Tax Ordinance, 1984 (XXXVI OF 1984) Universal Self/Normal Only For The Salaried IndividualTrinathBanikNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNo ratings yet

- 2011 - ITR2 - r6Document33 pages2011 - ITR2 - r6Bathina Srinivasa RaoNo ratings yet

- Borang BE 2013 (Cukai)Document2 pagesBorang BE 2013 (Cukai)nabilah hussinNo ratings yet

- Universal Self: Be A Respectable Taxpayer Submit Return in Due Time Avoid PenaltyDocument20 pagesUniversal Self: Be A Respectable Taxpayer Submit Return in Due Time Avoid PenaltyShuvro PaulNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument8 pagesITR-3 Indian Income Tax Return: Part A-GENRahul SharmaNo ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument79 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- 3657 Atmpa0825cDocument5 pages3657 Atmpa0825cnithinmamidala999No ratings yet

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- Ani Instruments Private Limited: Declaration of Investment Made For The Financial Year 2015 - 16Document7 pagesAni Instruments Private Limited: Declaration of Investment Made For The Financial Year 2015 - 16dileepsiddiNo ratings yet

- IT Declaration Form 2012-13Document1 pageIT Declaration Form 2012-13Suresh SharmaNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- Case Study Bdjobs1Document20 pagesCase Study Bdjobs1Khaleda BithiNo ratings yet

- Annual Return - 2008Document9 pagesAnnual Return - 2008Yashwant KakadeNo ratings yet

- Ipr MPR of Self-R.mehtaDocument7 pagesIpr MPR of Self-R.mehtasharmarachana066658No ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Tanbirul Alam Shadin 2022-2023Document9 pagesTanbirul Alam Shadin 2022-2023Print DiboNo ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- 2016 Itr4 PR3Document165 pages2016 Itr4 PR3TejasNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Runwell Pre-Cured Private Limited: Schedule V - Part IiDocument19 pagesRunwell Pre-Cured Private Limited: Schedule V - Part IiLokesh DaveNo ratings yet

- Indian Numbering SystemDocument8 pagesIndian Numbering SystemelangomduNo ratings yet

- BE2015 Guidebook 2Document84 pagesBE2015 Guidebook 2ContenderCNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- Assessment Year: 2016-2017: Statement of Income During The Income Year Ended On 30 /06 /2015Document4 pagesAssessment Year: 2016-2017: Statement of Income During The Income Year Ended On 30 /06 /2015Mohammad MilonNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- SCHEDULE V - PART II - Annual Return: Form of Annual Return of A Company Having A Share CapitalDocument6 pagesSCHEDULE V - PART II - Annual Return: Form of Annual Return of A Company Having A Share CapitalaaptamilnaduNo ratings yet

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishNo ratings yet

- SCHEDULE V - PART II - Annual Return: Form of Annual Return of A Company Having A Share CapitalDocument6 pagesSCHEDULE V - PART II - Annual Return: Form of Annual Return of A Company Having A Share CapitalaaptamilnaduNo ratings yet

- Annual Return 2014 - 2Document13 pagesAnnual Return 2014 - 2sanNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Tax AmendmentDocument10 pagesTax AmendmentVinay BoradNo ratings yet

- Instructions For Filling Out FORM ITR-2Document8 pagesInstructions For Filling Out FORM ITR-2Ganesh KumarNo ratings yet

- Bir Form 2306 PDFDocument3 pagesBir Form 2306 PDFErwin Bucasas100% (1)

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996No ratings yet

- Tax ReturnDocument16 pagesTax ReturnHasan MahmoodNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- 2011 Itr4 SpecificeDocument54 pages2011 Itr4 SpecificeAnand ThackerNo ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- Form 990-P F: Return of Private FoundationDocument26 pagesForm 990-P F: Return of Private FoundationFund for Democratic CommunitiesNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- IT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Document7 pagesIT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Amanat AhmedNo ratings yet

- 1 Section 80CDocument2 pages1 Section 80CcssumanNo ratings yet

- Tax Calcuations 1Document2 pagesTax Calcuations 1G Uday KiranNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- RecoverdDocument55 pagesRecoverdcmtssikarNo ratings yet

- Trinidad and Tobago Emolument Income Tax 2012Document5 pagesTrinidad and Tobago Emolument Income Tax 2012Anand RockerNo ratings yet

- PDF Document 50fdc8ce3d82 1Document20 pagesPDF Document 50fdc8ce3d82 120BRM051 Sukant SNo ratings yet

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- BIR FormDocument4 pagesBIR FormfyeahNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- Flora Vs PradoDocument6 pagesFlora Vs Pradobloome9ceeNo ratings yet

- DSGDFHFDocument17 pagesDSGDFHFCy PanganibanNo ratings yet

- PNB V SanaoDocument15 pagesPNB V SanaoJahzel Dela Pena CarpioNo ratings yet

- Resume Ed TechDocument2 pagesResume Ed Techapi-369827779No ratings yet

- Mollah and Zaman 2015Document18 pagesMollah and Zaman 2015Ali Mehmood100% (1)

- Torrens TitleDocument5 pagesTorrens TitleBLP Cooperative100% (2)

- G.R. No. 159709Document6 pagesG.R. No. 159709Delsie FalculanNo ratings yet

- Toidel 2020 01 17Document40 pagesToidel 2020 01 17Harsh OhriNo ratings yet

- Laws and Executive Issuances: Implementing Rules and Regulations of R.A. No. 7279 (Summary Eviction)Document3 pagesLaws and Executive Issuances: Implementing Rules and Regulations of R.A. No. 7279 (Summary Eviction)Cel C. CaintaNo ratings yet

- Date: Name: Course & Year: SubjectDocument6 pagesDate: Name: Course & Year: SubjectDianne ToriñaNo ratings yet

- Feasibility Study: in The Business of Real EstateDocument9 pagesFeasibility Study: in The Business of Real EstateJhang Gheung Dee Sarip100% (4)

- Tutorial 2.solutionsDocument3 pagesTutorial 2.solutionsabcsingNo ratings yet

- Kenya Monetary PolicyDocument67 pagesKenya Monetary PolicyGkou DojkuNo ratings yet

- SodapdfDocument22 pagesSodapdfYossantos SoloNo ratings yet

- Instructions For Foreclosure Bond 5-7-03 Page 1secondDocument6 pagesInstructions For Foreclosure Bond 5-7-03 Page 1secondChuck East100% (1)

- Know All Men by These Presents:: Deed of Sale of Motor VehicleDocument2 pagesKnow All Men by These Presents:: Deed of Sale of Motor VehicleJanine FabeNo ratings yet

- Prudential Bank Vs Hon. PanisDocument2 pagesPrudential Bank Vs Hon. PanisErwin Dacanay100% (1)

- Loan Agreement: This Agreement Is Made and Entered Into BetweenDocument5 pagesLoan Agreement: This Agreement Is Made and Entered Into BetweenWasif Mehmood100% (5)

- Shriram Transport Finance Company LTD, MeghanDocument26 pagesShriram Transport Finance Company LTD, MeghanAnil Bambule100% (1)

- Case 3 Kota Fibres123Document2 pagesCase 3 Kota Fibres123timbulmanaluNo ratings yet

- BBADocument9 pagesBBAAsad MsaNo ratings yet

- Torres Case and Goldenway Merchandising CaseDocument6 pagesTorres Case and Goldenway Merchandising CaseMaria LucesNo ratings yet

- Valarao Vs CADocument2 pagesValarao Vs CABanana100% (1)

- DT Hot TipsDocument12 pagesDT Hot TipsChaNo ratings yet

- De Jesus V Atty. Sanchez-MalitDocument6 pagesDe Jesus V Atty. Sanchez-MalitJimcris Posadas HermosadoNo ratings yet

- Prudential Regulations For Small and Medium Enterprises FinancingDocument30 pagesPrudential Regulations For Small and Medium Enterprises FinancingMuskan94No ratings yet