Professional Documents

Culture Documents

Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS Zurich

Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS Zurich

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS Zurich

Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS Zurich

Uploaded by

Impulsive collectorCopyright:

Available Formats

16 theSun | MONDAY JANUARY 19 2009

business

Forest’Secret

set to

penetrate

BCorp sets up joint-venture KL market summary

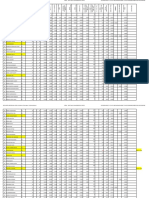

INDICES

FBMEMAS

COMPOSITE

JANUARY 16, 2009

5869.54

896.47

CHANGE

-12.52

-0.98

overseas

stockbroking firm in Vietnam

INDUSTRIAL 2106.92 -6.99

CONSUMER PROD 286.37 +0.39

INDUSTRIAL PROD 67.73 -0.12

market CONSTRUCTION

TRADING/SERVICES

167.75

118.58

+0.51

-0.10

FINANCE 7040.69 -88.33

PROPERTIES 544.44 +1.80

KUALA LUMPUR: Forest’ PLANTATION 4347.81 +10.52

Secret, a wellness and beauty KUALA LUMPUR: Berjaya Ky Hoa Tourism and Trading tality industry and is owned by MINING 249.25 UNCH

brand that specialises in in- Corporation Berhad (BCorp) Company Limited (Ky Hoa the Ho Chi Minh City’s Com- FBM2BRD 4001.89 +40.91

novative herbal solutions, on Friday announced its Co) has 13%, the Saigon Bank munist Party Committee. FBMSHA 6094.67 +16.81

is set to penetrate overseas inroads into the Vietnamese for Industry and Trade 11% Saigon Bank for Industry Chow TECHNOLOGY 13.27 +0.01

markets particularly in financial market by launching and about 90 Vietnamese in- and Trade was established wins a

a joint-venture stockbroking dividual shareholders owning in 1987 and is one of the first TURNOVER VALUE

Europe, the Middle East and

firm known as SaigonBank the remaining 27%. joint stock commercial banks

Porsche 546.612mil 549.655mil

North Africa.

Forest’Secret Sdn Bhd is Berjaya Securities Joint Stock SBBS has a Charter Capital in Vietnam. It has a network of pg 18

the owner and brandbuilder Company (SBBS), a newly li- of VND300 billion (US$18 mil- 62 branches and sub-branches

of the Forest’Secret - a pre-

mium herbal-based products

censed stockbroking company

in Vietnam.

lion) and is fully licensed in all

areas of securities trading and

and a staff force of 1,227.

Inter-Pacific Securities Sdn

Prices expected to

brand.

It is a wholly-owned

BCorp’s subsidiary, Inter-

Pacific Securities Sdn Bhd,

securities-related businesses.

Ky Hoa Co has over 25

Bhd has over 500 dealers, re-

misiers and staff operating in rebound this week

subsidiary of Malaysia Inter- owns a 49% stake in SBBS and years experience in the hospi- six locations across Malaysia. SHARE prices on Bursa Malaysia are expected

national Franchise Sdn Bhd to see a rebound this week on improved con-

(MyFranchise), the franchise sumer sentiment along with a potential upside

investment holding company

and brandbuilder of Per-

badanan Nasional Bhd (PNS),

EON Bank set for talks to to commodity prices, analysts said.

The stock exchange’s Composite Index

ended below the 900 mark on Friday.

which in turn is an agency While prices are expected to see a rebound,

under the wings of the En-

trepreneur and Cooperative

Development Ministry.

acquire MCIS Zurich the general sentiment will continue to be dic-

tated by external factors such as Wall Street’s

performance.

MyFranchise invests PETALING JAYA: EON Bank Berhad total assets exceeding RM40 billion, MCIS Zurich employs more than The outcome of the Kuala Terengganu

in brands and builds new will begin talks to acquire a substantial with a major presence in the retail 500 staff and sells through 3,000 by-election on Saturday could also influence

brands as well as develop the stake in MCIS Zurich Insurance Bhd. and small and medium enterprises agents operating through a network direction, said the head of research at a local

brands and products for the Both companies were given ap- segment. It has a nationwide net- of 26 branches nationwide. brokerage company.

international market. proval by Bank Negara Malaysia to work of 140 branches serving one MCIS had its roots in the Malay- “The KLCI is expected to rebound to the 920-

Its chief executive officer, begin talks on the acquisition that million customers. sian Cooperative Insurance Society 930 range with the main market drivers likely

Shahrul Azlan Zulkifli, said will see EON Bank taking up at least MCIS Zurich is one of the leading which was incepted in 1954, and to be the banking counters and to some extent,

the company expected to 30% equity stake in MCIS Zurich. life and general insurance companies later incorporated in 1998 to become plantation,” he said, adding that the support

open up outlets in London EON has filed an announcement in the country with total assets in ex- MCIS Insurance Bhd. The company level will likely be at 870-880 range.

and Jeddah this year. with Bursa Malaysia on the matter. cess of RM3.1 billion and an annual later merged with Zurich Insurance He said the market might be also volatile

“London will be a good EON Bank is the seventh largest gross premium income surpassing Malaysia Bhd in July 2002 to form amid the fluctuation in crude palm oil and crude

launchpad for entry into banking group in the country with RM590 million. MCIS Zurich. oil prices, and the US financial crisis which is

Europe and Jeddah will be far from over although the US government has

our gateway into the halal shown willingness to pour billions of dollars to

Middle East and North Africa bail out its banks.

market. Investment opportunities still there in emerging markets “The volatility in the crude palm oil prices

“We are intensifying ef- remain a concern for plantation stocks and it is

forts to get all the necessary KUALA LUMPUR: Investment oppor- steady growth as the government is He said the main sectors that will likely to affect the major counters such as Sime

approvals and certification tunities are still there in the emerging expected to deliver policies for the be most attractive for investment are Darby and IOI,” he said.

for market entry as well as markets in line with the expected benefit of the country. consumer products and commodi- He said the local bourse however was still

concluding our market study recovery in the economy and markets “Among the key reasons that make ties. resilient as many foreign investors were still

of both markets,” he told next year. emerging markets an attractive invest- “In the commodities market, in- having positions in the market.

Bernama recently. Executive chairman of Templeton ment options are higher economic vestment that is related to the mining “They see the volatility in the market as an

Shahrul Azlan said Egypt Asset Management Ltd, Dr Mark growth, sizeable foreign exchange re- sector such as gold will be the most opportunity.”

would be the next target des- Mobius, said China, India, Turkey and serves and lower debt levels,” Mobius lucrative,” he said. The research analyst also said that he

tination as it was a market of South Africa were among the countries said during a media briefing here on Steep declines in global equity wished for more foreign interest presence in

more than 60 million people which would gain the most in terms of Saturday. markets, he emphasised have brought the market who would look at the country as an

with large cities and modern higher economic growth and invest- Mobius was in Kuala Lumpur to valuations down to even more attrac- alternative to other markets which have been

lifestyle suitable for a pre- ment opportunities. present a talk to Citibank’s Wealth Man- tive levels and investors should start hit rather badly by the global financial crisis.

mium halal brand in beauty As for the Malaysian market, agement affluent clients with a mini- looking at lucrative sectors of the – Bernama

and wellness. Mobius said it will continue to see a mum portfolio value of RM200,000. market. – Bernama

You might also like

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Commercial Aerospace Coatings: Revised February 2020Document9 pagesCommercial Aerospace Coatings: Revised February 2020Jose Miguel Atehortua ArenasNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector78% (9)

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- KL City Plan 2020Document10 pagesKL City Plan 2020Impulsive collector0% (2)

- Rubenstein Chapter 3Document2 pagesRubenstein Chapter 3Khanh NguyenNo ratings yet

- 101 Villa Riviera q2Document5 pages101 Villa Riviera q2Tu Vo67% (3)

- Thesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidDocument1 pageThesun 2009-04-14 Page16 Tech Mahindra Wins Satyam BidImpulsive collectorNo ratings yet

- TheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekDocument1 pageTheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekImpulsive collectorNo ratings yet

- TheSun 2008-11-03 Page20: Bargain Hunting Likely To Lift MarketDocument1 pageTheSun 2008-11-03 Page20: Bargain Hunting Likely To Lift MarketImpulsive collectorNo ratings yet

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDocument1 pageTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNo ratings yet

- Thesun 2009-06-15 Page13 PTP Bucks The TrendDocument1 pageThesun 2009-06-15 Page13 PTP Bucks The TrendImpulsive collectorNo ratings yet

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefDocument1 pageTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorNo ratings yet

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDocument1 pageTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNo ratings yet

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDocument1 pageTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNo ratings yet

- TheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownDocument1 pageTheSun 2008-11-27 Page21 Pensonic Posts 6.5pct Growth Despite SlowdownImpulsive collectorNo ratings yet

- TheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyDocument1 pageTheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyImpulsive collectorNo ratings yet

- Drainage Layout-Layout1Document1 pageDrainage Layout-Layout1pamkasNo ratings yet

- Thesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearDocument1 pageThesun 2009-04-17 Page15 Nestle Allocates rm320m For Capex This YearImpulsive collectorNo ratings yet

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Document1 pageTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNo ratings yet

- Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentDocument1 pageThesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentImpulsive collectorNo ratings yet

- TheSun 2009-01-29 Page11 PTP Remains Malaysias Number One PortDocument1 pageTheSun 2009-01-29 Page11 PTP Remains Malaysias Number One PortImpulsive collectorNo ratings yet

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDocument1 pageTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNo ratings yet

- The Sun 2008-10-30 Page22Document1 pageThe Sun 2008-10-30 Page22Impulsive collectorNo ratings yet

- TheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bDocument1 pageTheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bImpulsive collectorNo ratings yet

- TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyDocument1 pageTheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local EconomyImpulsive collectorNo ratings yet

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDocument1 pageThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNo ratings yet

- Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownDocument1 pageThesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownImpulsive collectorNo ratings yet

- Daily Newspaper - 2015 - 10 - 03 - 000000Document44 pagesDaily Newspaper - 2015 - 10 - 03 - 000000Rachid MeftahNo ratings yet

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDocument1 pageThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNo ratings yet

- Tampak Depan-EtiketDocument1 pageTampak Depan-EtiketAtras AtsiruddinNo ratings yet

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDocument1 pageThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNo ratings yet

- TheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangDocument1 pageTheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangImpulsive collectorNo ratings yet

- BG Industries 2020 Map - 01 - Automotive IndustryDocument3 pagesBG Industries 2020 Map - 01 - Automotive IndustryGebarfly BNo ratings yet

- HOUSING SITE PLAN-Layout1Document1 pageHOUSING SITE PLAN-Layout1Manvi SharmaNo ratings yet

- A3 FLOOR PLAN - Layout - 2105Document8 pagesA3 FLOOR PLAN - Layout - 2105Peter WestNo ratings yet

- Mkts Dip 2% As Omicron Variant Spooks Investors: BusinessDocument1 pageMkts Dip 2% As Omicron Variant Spooks Investors: BusinessAvi SaiNo ratings yet

- SUS2 CorrectedDocument11 pagesSUS2 Correctedapi-3716917No ratings yet

- Schematic Key Plan: D/S U/SDocument1 pageSchematic Key Plan: D/S U/SRambabau KadaliNo ratings yet

- Vermi PlanDocument1 pageVermi Planmanilesnarf5No ratings yet

- PIAM AvlLand Sale Layouts 211011 v01Document5 pagesPIAM AvlLand Sale Layouts 211011 v01Edgar MackNo ratings yet

- Walkers Midas OPENING 27 OCT!Document2 pagesWalkers Midas OPENING 27 OCT!Erin WalkerNo ratings yet

- DWG No. Drawing Project Owner ArchitectDocument1 pageDWG No. Drawing Project Owner ArchitectMAYURESH DNo ratings yet

- Detail Interior Part-01Document1 pageDetail Interior Part-01prima latuajiNo ratings yet

- BGW-11 Standby ReportDocument1 pageBGW-11 Standby ReportPronami BoraNo ratings yet

- Salary Sheet 22 23Document65 pagesSalary Sheet 22 23Manojit GamingNo ratings yet

- 20 - Priti Kulkarni - Abcs I - MultibasementDocument5 pages20 - Priti Kulkarni - Abcs I - Multibasement11Shraddha Ramraje GhorpadeNo ratings yet

- TheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresDocument1 pageTheSun 2009-02-27 Page15 MAS To Continue With Cost-Saving MeasuresImpulsive collectorNo ratings yet

- Hadiyol SR No - 398 - Pareshbhail DT - 30-05-2019-ModelDocument1 pageHadiyol SR No - 398 - Pareshbhail DT - 30-05-2019-ModelharshNo ratings yet

- Hadiyol SR No - 398 - Pareshbhail DT - 30-05-2019-ModelDocument1 pageHadiyol SR No - 398 - Pareshbhail DT - 30-05-2019-ModelharshNo ratings yet

- Rupesh Shah - Sanction Drawing - 05.01.19-Aa-01Document1 pageRupesh Shah - Sanction Drawing - 05.01.19-Aa-01Hareesh GangolliNo ratings yet

- V2 Working DrawingsDocument8 pagesV2 Working DrawingsHarshil ThakarNo ratings yet

- Normalisasi - River Bridge Surah Sta. 12+195Document2 pagesNormalisasi - River Bridge Surah Sta. 12+195Pih KNINo ratings yet

- Data Schedule (30-TMSS-01, Revision 0) Air Break Disconnect Switches & Grounding Switches-69Kv Substation No. 001Document3 pagesData Schedule (30-TMSS-01, Revision 0) Air Break Disconnect Switches & Grounding Switches-69Kv Substation No. 001John BuntalesNo ratings yet

- Parshottambhai Corporation Drawing-4Document1 pageParshottambhai Corporation Drawing-4Manoj Bhatt MJNo ratings yet

- Orkide - Excavation Method - PDFDocument40 pagesOrkide - Excavation Method - PDFSokvisal MaoNo ratings yet

- Dimension Drawing, GA800, W4, TYPE 12Document2 pagesDimension Drawing, GA800, W4, TYPE 12Mário NetoNo ratings yet

- Minor 2 Assignment 2: Working Drawing Natural History MuseumDocument3 pagesMinor 2 Assignment 2: Working Drawing Natural History MuseumAditiNo ratings yet

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDocument1 pageTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNo ratings yet

- Bartolome, Rohan Siegfried B. Arc 007 Plate No. 2 Shopping Mall ComplexDocument5 pagesBartolome, Rohan Siegfried B. Arc 007 Plate No. 2 Shopping Mall ComplexRohan Siegfried BartolomeNo ratings yet

- Sd-Ec-Cgc-St-232 Rev-0Document1 pageSd-Ec-Cgc-St-232 Rev-0Ahmed Salah El DinNo ratings yet

- X Museum Site Analysis1 PDFDocument1 pageX Museum Site Analysis1 PDFHimanshu SainiNo ratings yet

- CENTRO ComercialDocument1 pageCENTRO ComercialRAQUEL XILOJNo ratings yet

- LDP 221100329 C Ga SLR LM 01 - R0Document1 pageLDP 221100329 C Ga SLR LM 01 - R0syaifullintechNo ratings yet

- Floor PlanDocument1 pageFloor PlanJane BullecerNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsDocument1 pageTheSun 2009-11-04 Page15 Huge Shake-Up For Rbs and LloydsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMDocument1 pageTheSun 2009-11-04 Page14 Significant Success in Islamic Finance Says PMImpulsive collectorNo ratings yet

- TheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyDocument1 pageTheSun 2009-11-04 Page11 We Await Answers To Dipang TragedyImpulsive collectorNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Business and Investment Guide in VietnamDocument94 pagesBusiness and Investment Guide in VietnamDo KhoiNo ratings yet

- Nghiên Cứu Đặc Tính Kháng Khuẩn Của Tinh Dầu Tràm Trà Và Khả Năng Ứng Dụng Trong Mỹ Phẩm - 1149008Document8 pagesNghiên Cứu Đặc Tính Kháng Khuẩn Của Tinh Dầu Tràm Trà Và Khả Năng Ứng Dụng Trong Mỹ Phẩm - 1149008Đường Thị Đoan TrangNo ratings yet

- The Transportation ProblemDocument3 pagesThe Transportation ProblemLiễu VyNo ratings yet

- Scaling The 50th Percentile Hybrid III Dummy Model To The Height and The Weight of A Typical VietnameseDocument7 pagesScaling The 50th Percentile Hybrid III Dummy Model To The Height and The Weight of A Typical VietnameseOlivier GouveiaNo ratings yet

- Bai Tap HPDocument3 pagesBai Tap HPĐỗ Tấn QuốcNo ratings yet

- Sika Poxitar F PDFDocument7 pagesSika Poxitar F PDFHung TrieuNo ratings yet

- Vfresh Aloe Vera: Marketing PlanDocument34 pagesVfresh Aloe Vera: Marketing PlanHuynhGiangNo ratings yet

- Food Tech CompanyDocument1 pageFood Tech CompanyLêQuangKhangNo ratings yet

- 00. (Trước minh họa) Nhóm giáo viên ĐHNN Hà Nội - Đề 2Document23 pages00. (Trước minh họa) Nhóm giáo viên ĐHNN Hà Nội - Đề 2queluahtNo ratings yet

- Textile and Garment Industry in VietnamDocument64 pagesTextile and Garment Industry in Vietnamsai742gon100% (1)

- Bản Vẽ Triển Khai Gia Công Cốt Thép Sàn Tum, Cầu Thang Nhà Văn Phòng Shop Drawing Rebar Fabrication For Office'S Attic &StairDocument13 pagesBản Vẽ Triển Khai Gia Công Cốt Thép Sàn Tum, Cầu Thang Nhà Văn Phòng Shop Drawing Rebar Fabrication For Office'S Attic &StairTải Trọng SóngNo ratings yet

- CVenglishDocument4 pagesCVenglishTri NhanNo ratings yet

- Word Form: Làm bài sáng chủ nhật cô chữa nhéDocument3 pagesWord Form: Làm bài sáng chủ nhật cô chữa nhéHồng NgọcNo ratings yet

- 4Q21 Investor PresentationDocument17 pages4Q21 Investor Presentationhaitex48No ratings yet

- Listening AnswerDocument52 pagesListening AnswerThanhNo ratings yet

- Bản Sao ĐẮC-ĐÁ-ĐÌDocument20 pagesBản Sao ĐẮC-ĐÁ-ĐÌVu VictorNo ratings yet

- Unit 8 ReadingDocument5 pagesUnit 8 Readingngocanhbt1112No ratings yet

- Vietnam Airlines - Bringing Vietnamese Culture To The WorldDocument7 pagesVietnam Airlines - Bringing Vietnamese Culture To The WorldUyen DoanNo ratings yet

- Ha Noi Essay-Writing Contest Tests History Buffs: Essay Comparision and ContrastDocument2 pagesHa Noi Essay-Writing Contest Tests History Buffs: Essay Comparision and ContrastJerry LeeNo ratings yet

- KIDO Annual Report 2016Document57 pagesKIDO Annual Report 2016Ashley Huyen VanNo ratings yet

- Itinerary Ho Chi MinhDocument4 pagesItinerary Ho Chi MinhHaanatharao GunnasagaranNo ratings yet

- s3915023 NguyenVuong A1 MKTG1421Document12 pagess3915023 NguyenVuong A1 MKTG1421Anh NguyenNo ratings yet

- NhiDocument3 pagesNhiDuy PhạmNo ratings yet

- OrderForm Pipeline-Forecaster VNDocument1 pageOrderForm Pipeline-Forecaster VNshengchanNo ratings yet

- Overview of Paper IndustryDocument27 pagesOverview of Paper IndustryDương NguyễnNo ratings yet

- Đề Thi Học Kì 2 Tiếng Anh Lớp 8Document16 pagesĐề Thi Học Kì 2 Tiếng Anh Lớp 8Uyên VũNo ratings yet

- Danh Sach Khach Hang Hoi ChoDocument14 pagesDanh Sach Khach Hang Hoi ChoPhạm Minh Toàn100% (1)

- Nguyen Khuong Duy (9958142) - Offer Letter (BP217 - S2 2022)Document7 pagesNguyen Khuong Duy (9958142) - Offer Letter (BP217 - S2 2022)duyNo ratings yet