Professional Documents

Culture Documents

Feasability Study Falesti - English

Feasability Study Falesti - English

Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Feasability Study Falesti - English

Feasability Study Falesti - English

Copyright:

Available Formats

1

Feasibility Study regarding Creation of the

Industrial Park on the Territory of

Falesti Plant of Street Cleaning Machines JSC,

Falesti

Beneficiaries:

Ministry of Economy of the Republic of Moldova

United Nations Development Program in RM

Executor:

ProConsulting LLC

MD-2004, Chisinau Municipality, Republic of Moldova

23/9 Mitropolit Petru Movila St.

tel./fax: 21-00-89

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

2

C ONTE NT

ABBREVIATIONS .............................................................................................................................................................. 6

EXECUTIVE SUMMARY .................................................................................................................................................... 7

1. INTRODUCTION....................................................................................................................................................... 8

1.1. DESCRIPTION OF THE PROJECT IDEA AND THE CONCEPT OF THE INDUSTRIAL PARK ...................................................... 8

1.2. GOAL AND OBJECTIVES OF THE STUDY. .................................................................................................................... 9

1.3. BRIEF PRESENTATION OF THE ECONOMIC ENTITY ..................................................................................................... 9

1.4. PRESENTATION OF THE ELABORATING COMPANY. .................................................................................................. 10

1.5. METHODOLOGY. ................................................................................................................................................. 10

2. ANALYSIS OF THE REGION .................................................................................................................................. 12

2.1. ANALYSIS OF BUSINESS ENVIRONMENT. .................................................................................................... 12

2.1.1. Sectorial analysis. ....................................................................................................................................... 12

2.1.2. Analysis of the regional activity of enterprises. ......................................................................................... 17

2.1.3. Analysis of employed labor force................................................................................................................ 22

2.2. ANALYSIS OF INVESTMENT CLIMATE. ........................................................................................................ 23

2.3. ADMINISTRATIVE-TERRITORIAL ORGANIZATION. ................................................................................................... 26

2.4. ANALYSIS OF THE SOCIO-ECONOMIC ENVIRONMENT. ............................................................................................... 27

2.4.1. Analysis of the demographic situation. ...................................................................................................... 27

2.4.2. Analysis of labor force. ............................................................................................................................... 30

2.4.3. Analysis of populations well-being and labor productivity. ..................................................................... 33

2.5. ANALYSIS OF PHYSICAL INFRASTRUCTURE. .............................................................................................. 34

2.5.1. Analysis of natural resources. .................................................................................................................... 34

2.5.2. Analysis of transport infrastructure. ......................................................................................................... 35

2.5.3. Analysis of utilities infrastructure. ............................................................................................................. 36

2.5.4. Analysis of educational infrastructure. ...................................................................................................... 39

2.5.5. SWOT analysis of the region / Falesti locality. .......................................................................................... 40

3. LEGAL FRAMEWORK ............................................................................................................................................ 41

3.1. ANALYSIS OF LEGAL FRAMEWORK OF RM. ............................................................................................................. 41

3.2. ANALYSIS OF LEGAL CONFORMITY OF THE MANAGING ENTERPRISE .......................................................................... 43

4. ECONOMIC ENTITY PRESENTATION ................................................................................................................. 45

4.1. PROFILE OF THE ENTERPRISE. .............................................................................................................................. 45

4.1.1. General presentation. ................................................................................................................................. 45

4.1.2. Brief historical review ................................................................................................................................ 45

4.1.3. Field of activity. Products and services of the enterprise. ......................................................................... 46

4.1.4. Dimension of the company. ........................................................................................................................ 47

4.2. POTENTIAL OF THE ENTERPRISE. .......................................................................................................................... 50

4.2.1. Diagnosis and infrastructure of location. .................................................................................................. 50

4.2.2. Technical diagnosis. ................................................................................................................................... 50

4.2.2.1. Description of real estate. .................................................................................................................................. 50

4.2.2.2. Description of equipment and facilities. ........................................................................................................... 55

4.2.3. Technological and operational diagnosis. ................................................................................................. 57

4.2.4. Human resources and organizational structure. ...................................................................................... 59

4.3. COMMERCIAL AND MARKETING DIAGNOSIS. ........................................................................................................... 62

4.4. ECONOMIC AND FINANCIAL DIAGNOSIS. ................................................................................................................. 63

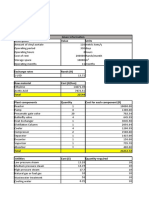

4.4.1. Analysis of Balance Sheet ........................................................................................................................... 64

4.4.2. Analysis of financial results. ....................................................................................................................... 66

4.4.3. Analysis on the basis of financial indicators. ............................................................................................. 67

4.4.3.1. Indicators of liquidity: ....................................................................................................................................... 67

4.4.3.2. Indicators of profitability. ................................................................................................................................. 68

4.4.3.3. Indicators of financial stability.......................................................................................................................... 69

4.5. SWOT ANALYSIS OF THE ENTERPRISE. ................................................................................................................. 70

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

3

5. SCENARIOS OF THE INDUSTRIAL PARK DEVELOPMENT............................................................................... 72

5.1. DETERMINATION OF THE SCENARIO FOR THE INDUSTRIAL PARK DEVELOPMENT. ....................................................... 72

5.2. SELECTION, ANALYSIS AND SUBSTANTIATION OF THE OPTIMUM SCENARIO. ............................................................... 74

5.3. IDENTIFICATION OF POTENTIAL RESIDENT ENTERPRISES ........................................................................................ 80

5.4. IDENTIFICATION OF THE SOURCES OF FINANCE. ...................................................................................................... 81

5.5. ORGANIZATION OF THE INDUSTRIAL PARKS ACTIVITY ............................................................................................ 84

6. ACTION PLAN ......................................................................................................................................................... 89

6.1. LEGAL ACTION PLAN . .......................................................................................................................................... 89

6.2. OPERATIONAL ACTION PLAN. ............................................................................................................................... 93

7. INVESTMENT AND FINANCIAL DIAGNOSIS ...................................................................................................... 94

7.1. ESTIMATION OF THE NECESSARY VOLUME OF INVESTMENTS. ................................................................................... 94

7.2. FINANCIAL PLAN. ................................................................................................................................................ 98

7.2.1. Forecast of incomes of the Managing enterprise ...................................................................................... 98

7.2.2. Forecast of expenses of the Managing enterprise. ................................................................................... 100

7.2.3. Forecast of financial results. .................................................................................................................... 100

7.2.4. Forecast of cash flow. ............................................................................................................................... 103

7.2.5. Forecast of the balance sheet. .................................................................................................................. 106

7.2.6. Forecast of financial indicators ............................................................................................................... 111

7.2.6.1. Indicators of profitability. ............................................................................................................................... 111

7.2.6.2. Liquidity indicators. ......................................................................................................................................... 112

7.2.6.3. Indicators of financial stability........................................................................................................................ 113

7.2.6.4. Turnover indicators. ........................................................................................................................................ 114

7.3. ESTIMATION OF INVESTMENT EFFICIENCY ........................................................................................................... 116

8. SOCIAL AND ECONOMIC AND ENVIRONMENTAL IMPACT OF THE INDUSTRIAL PARK ON THE REGION

117

9. CONCLUSIONS ...................................................................................................................................................... 119

Lists of tables

Table 1. Indicators of the industrial production by the types of ownership, 2008-2009. ........................................................ 15

Table 2. Industrial production by the types of activity, 2009. ............................................................................................... 15

Table 3. Main sectoral indicators of Falesti district, 2006-2009. ........................................................................................... 16

Table 4. Number of economic entities by mediums and size of the enterprise, 2008-2009..................................................... 17

Table 5. Activity of economic entities by the volume of sales, millions MDL, 2008-2009. ....................................................... 18

Table 6. Volume of sales referred to the number of enterprises, millions MDL 2008-2009. ................................................... 19

Table 7. Distribution of enterprises by fields of activity, Falesti district. ............................................................................... 20

Table 8. Average number of employees................................................................................................................................ 22

Table 9. Structure of investments in fixed capital by the types of ownership. ........................................................................ 24

Table 10. Structure of investments in fixed capital by the sources of finance, 2009. .............................................................. 24

Table 11. Population density, 2010. ..................................................................................................................................... 28

Table 12. Natural movement of population from Falesti, 2008-2009. ................................................................................... 29

Table 13. Natural movement of population from Falesti, 2008. ............................................................................................ 32

Table 14. Total availability of population in area of 30 km around Falesti locality, 2007........................................................ 32

Table 15. Distribution of land resources by land categories, Falesti district, 2008-2009. ....................................................... 34

Table 16. SWOT analysis of the region. ................................................................................................................................ 40

Table 17. Evolution of sales by groups of products or services.............................................................................................. 47

Table 18. Real estate of Falesti plant of street cleaning machines JSC. ................................................................................ 50

Table 19. Balance value of real estate of Falesti PSCM JSC. ................................................................................................. 52

Table 20. Interpretation of equipment and facilities of Falesti PSCM JSC. ........................................................................... 55

Table 21. List of fixed assets, whose wear is calculated for tax and financial purpose for 2008-2010. .................................... 56

Table 22. Structure of staff in terms of education. ............................................................................................................... 60

Table 23. Structure of staff in terms of age. .......................................................................................................................... 60

Table 24. Structure of staff in terms of professional specialization. ...................................................................................... 60

Table 25. Express analysis of Falesti PSCM JSC within 2006-01.10.2010. ........................................................................... 63

Table 26. Situation regarding commercial receivables of Falesti PSCM JSC, 1.10.2010, MDL. ............................................... 65

Table 27. Financial results of Falesti PSCM JSC , 2006-01.10.2010. ..................................................................................... 66

Tabelul 28. Liquidity indicators for the period 2006-2009. .................................................................................................. 67

Table 29. Profitability indicators for the period 2006-2009. ................................................................................................. 68

Table 30. Financial stability indicators................................................................................................................................. 69

Table 31. SWOT analysis of Falesti PSCM JSC. .................................................................................................................... 70

Table 32. Determination of scenarios of the industrial parks activity. .................................................................................. 72

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

4

Table 33. Analysis of scenarios of the industrial parks activity. ............................................................................................ 74

Table 34. Risks of choice of the scenario 1 and elimination methods..................................................................................... 78

Table 35. Benefits of the scenario 1 by the categories of beneficiaries .................................................................................. 79

Table 36. Methods of financing of the Industrial Park in the light of the investor State and/or Local public administration. 81

Table 37. Methods of financing of the Industrial Park in the light of the private investor. ...................................................... 82

Table 38. Comparison of options of identification of funding sources for the industrial park. ................................................ 83

Table 39. Identification of services, provided by the Managing Enterprise. ........................................................................... 84

Table 40. Legal action plant with the view to creating and organizing the industrial parks activity. ...................................... 89

Table 41. Schematic presentation of the legal action plan. .................................................................................................... 92

Table 42. Action plan for rehabilitation of the Managing Enterprise's constructions and infrastructure ................................ 94

Table 43. Assessed value of general construction works and internal and external networks to be executed for rehabilitation

of the production process of the enterprise Falesti PSCM JSC. .................................................................................. 95

Table 44. Investment structure. ........................................................................................................................................... 96

Table 45. Incomes, forecasted for the Managing Enterprise, thousand MDL (VAT including). ................................................ 99

Table 46. Forecast of financial results for the forecast period, thousand MDL. .................................................................... 101

Table 47. Cash flow dynamics, thousand MDL. ................................................................................................................... 104

Table 48. Balance sheet dynamics, thousand MDL. ............................................................................................................. 107

Table 49. Structure of assets for the forecast period. .......................................................................................................... 109

Table 50. Main indicators of profitability ........................................................................................................................... 111

Table 51. Main liquidity indicators. ................................................................................................................................... 112

Table 52. Main indicators of financial stability. .................................................................................................................. 113

Table 53. Main indicators of turnover. ............................................................................................................................... 114

Table 54.Determination of investment efficiency. .............................................................................................................. 116

Table 55. Determining investment efficiency. .................................................................................................................... 117

List of figures

Figure 1. Branch structure of GDP, 2008. ............................................................................................................................. 12

Figure 2. Indices of industrial specialization by the number of staff, 2007............................................................................. 12

Figure 3. Scheme of location of NDR economic sectors, 2010. ............................................................................................... 13

Figure 4. Potential of the NDR agro-industrial sector, 2010. ................................................................................................. 14

Figure 5. Evolution of the share of types of enterprises from Falesti as compared to the total NDR, 2008-2009. .................... 18

Figure 6. Structure of sales by enterprises from Falesti according to the form of organization of the enterprise, 2009. .......... 19

Figure 7. Private investments per capita, Falesti district. MDL. ............................................................................................. 23

Figure 8. Structure of private investments by the types of economic activities, %, Falesti district. ......................................... 25

Figure 9. Geographical location of Falesti district within NDR and closeness to CDR and Romania......................................... 26

Figure 10. Resident population, 2008-2010. ........................................................................................................................ 27

Figure 11. Dynamics of sex structure of the population of Falesti district.............................................................................. 28

Figure 12. Structure and share by age groups of population of Falesti district, 2010. ............................................................ 29

Figure 13. Population working in the main fields of activity, Falesti, 2009. ........................................................................... 30

Figure 14. Level of education of the population, Falesti, 2009. .............................................................................................. 30

Figure 15. Road, railroad and water passageways of NDR. ................................................................................................... 35

Figure 16. Density of water-supply networks, km/100 km2 in districts, 2008 ...................................................................... 36

Figure17. Density of water-supply, sewage and purification networks. ................................................................................ 37

Figure 18. Scheme of gas networks. ..................................................................................................................................... 38

Figure 19. Level of deprivation in development regions, NDR, CDR, SDR. .............................................................................. 40

Figure 20. Structure of authorized capital of Falesti plant of street cleaning machines. ....................................................... 48

Figure 21. Evolution of staff of Falesti PSCM, 2007-2010. .................................................................................................. 48

Figure 22. Dynamics of wages fund, 2007-2009. .................................................................................................................. 49

Figure 23. Evolution of sales revenues, 2006 III quarter of 2010. ....................................................................................... 49

Figure 24. Organizational chart of Falesti plant of street cleaning machines. ......................................................................... 59

Figure 25. Average salary for the employee of Falesti PSCM JSC, 2007-2009. ..................................................................... 61

Figure 26. Integrated organizational chart of the Managing enterprise. ................................................................................ 86

Figure 27. Elementary organization of the Managing enterprise. .......................................................................................... 86

Figure 28. Relations, created within the Park, in the light of activity organization. ............................................................... 87

Figure 29. Model of organization of the industrial parks activity. ......................................................................................... 88

Figure 30. Dynamics of the Managing enterprise's financial results. ................................................................................... 101

List of schemes

Scheme 1. Geographical location of Falesti Plant of Street Cleaning Machines JSC within the district. ................................. 27

Scheme 2. Area of demographic situation research. ............................................................................................................. 31

Scheme 3. Geographical location of Falesti plant of street cleaning machines JSC. .............................................................. 50

Scheme 4. Structure of location of real estate items on the area of Falesti PSCM. ................................................................... 51

Scheme 5. Organization of technical and production infrastructure of the industrial park. .................................................... 89

List of photos

Photo 1. General view of the enterprises territory. .............................................................................................................. 45

Photo 2. Main production shop (Block II, Unfinished)........................................................................................................... 53

Photo 3. Floor. .................................................................................................................................................................... 53

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

5

List of Annexes

Annex 1. Estimate for complete repairs and infrastructure renovation, Falesti PSCM JSC. ................................................. 120

Annex 2. Investment structure. ......................................................................................................................................... 122

Annex 3. Provision of rental services. ................................................................................................................................ 122

Annex 4. Forecast of operating income (VAT including). .................................................................................................... 122

Annex 5. Forecast of forecast consumption and operating expenses (VAT including). ......................................................... 122

Annex 6. Forecast cash flow. ............................................................................................................................................. 122

Annex 7. Forecast financial results..................................................................................................................................... 122

Annex 8. Forecast balance sheet. ....................................................................................................................................... 122

Annex 9. Calculation of investment efficiency with a discount of up to 30% on rental price. ................................................ 122

Annex 10.Financial indicators. .......................................................................................................................................... 122

Annex 11. Calculation of wear. .......................................................................................................................................... 122

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

6

ABBREVIATIONS

RDA Regional Development Agency;

GMS General Meeting of Shareholders;

CPA Central Public Authority;

LPA Local Public Authority;

NBS National Bureau of Statistics;

APC Agricultural Production Cooperative;

FC Fiduciary Company;

COOP Consumer Cooperative;

DC District Council;

TPC Town Planning Certificate;

DAESI Documentation on assessment of the environmental and social impact;

IE Individual Enterprise;

JV Joint Venture;

SME Small and Medium Enterprise;

FDI Foreign Direct Investments;

IT Information Technologies;

EFC Enterprise with Foreign Capital;

SE State Enterprise;

MDL Moldovan lei (national currency);

MCN Moldovan construction norms;

PIB Gross Domestic Product;

DN Distribution Network;

TER Technical Expertise Report;

DSR Debt Service Ratio;

CDR Central Development Region;

NDR Northern Development Region;

SDR Southern Development Region;

RM Republic of Moldova;

JSC Joint-Stock Company;

CA Commercial Association;

NI Natural Increase;

LLC Limited Liability Company;

VAT Value-Added Tax;

PSCM Plant of Street Cleaning Machines;

UNIDO United Nations Industrial Development Organization;

USD United States Dollar (American Dollar);

ATU Administrative Territorial Unit;

ha hectare

km kilometer

inh. inhabitants

abt. about

dist. district

vil. village

w/n without number

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

7

EXECUTIVE SUMMARY

The present feasibility study has been developed in order to determine viability of the creation of the

industrial park on the territory of Falesti Plant of Street Cleaning Machines JSC of Falesti with

orientation to industrial production, the activity carried out on the area of 13.2 ha.

The analysis of the regions potential to create the industrial park is focused on: existence of resources

available for the development of industrial activity from the point of view of sectoral development of

economy in the region as well as of the directions of specialization of the Plant; business sector of the

district is mostly consisted of SMEs dynamic part of economy representing an identification area of

potential residents of the park correlated with availability of labor force; represents an impressive

factor for delimitation of resources necessary to create the industrial park; geographic proximity to

the European Union through Romania creates an effect of acceleration of the investment process;

transport infrastructure in the northern region is developed, resulting in good prospects and higher

attractiveness for investors willing to invest in the industrial park, while utilities infrastructure

requires additional resources for renovation or construction, which can be implicitly implemented by

creating optimum working conditions of the industrial park.

The region of Falesti district and of the district centre particularly corresponds to the concept of

creation of the industrial park from simple considerations that an industrial park is welcomed in the

regions, where nothing appears on its own, and Falesti corresponds to the peculiarities of these

regions.

The results of the factorial analysis of the current situation of Falesti PSCM JSC identify the lack of

optimum conditions for the creation of the Industrial Park on the basis of the resources available at the

moment of the study, the situation which can be improved by implementing certain strategic

development directions.

As a result of the analysis of the situation in the region and of the company, two directions of the

industrial park development have been identified. On the basis of a number of indicators resulting in

the substantiation of the optimum scenario of activity, the following points have been identified:

orientation of the parks activity to industrial production with provision of additional services and

inclusion of a Business Incubators activity; choice of the source of finance having as synergetic

components Falesti PSCM JSC, private investor in cooperation with the Local Public Authority;

creation of a new enterprise as Managing Enterprise in order to manage the activity of the industrial

park, as well as with reference to the need for it to become a resident enterprise of the industrial park;

potential residents can be represented by local enterprises, as well as by foreign economic entities

among which G.P.I JSC, represented by Mr. Mauro Giovetti from Italy, has been identified.

Investments in the development of the technical and production infrastructure for the creation of the

Industrial Park were estimated at 321 272 000 MDL which are to be invested in 5 stages within 24

months.

Creation of the industrial park according to the identified model will have a positive social-economic

impact on the region by means of efficient use of its resource potential, by obtaining the associated

benefits, at the same it will also contribute to the economic development in the country. Construction

of the modern utilities infrastructure within the project of the industrial park will also reduce the

environmental pollution existing under current conditions.

Finally, it is emphasized that the project of creation of the industrial park on the territory of Falesti

PSCM JSC in Falesti will be EFFICIENT provided that the following conditions are observed: the

optimum scenario, proposed action plan and the amount of the estimated investment. Meanwhile, it is

necessary that the Managing Enterprise analyses the option to become a resident of the industrial

park. In this way, the enterprise's operating income would increase significantly, which positively

affects the term of recovery of the expected investment.

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

8

1. INTRODUCTION

1.1. Description of the project idea and the concept of the industrial park

The idea of the project consists in the creation of the industrial park on the territory of Falesti PSCM

JSC of Falesti, which at the moment operates with a minimum production capacity, having fixed assets

and unused real estate.

Falesti district is characterized as an industrial region. Falesti locality is the resident city of Falesti

district, its economic attractiveness is also conditioned by its closeness to Balti municipality the

northern capital of the Republic of Moldova, as well as by geographic closeness with the European

Union through territorial bordering with Iasi county, Romania. In this context, the concept of creation

of the industrial park on the territory of the enterprise Falesti PSCM JSC of Falesti is focused on

acceleration of the social-economic development of the mentioned region by means of: attraction of

local and foreign investments; implementation of modern and innovative technologies; development

of the sector of small and medium enterprises; application of advanced management practices; a more

efficient use of the public patrimony and creation of jobs.

The importance of the creation of industrial parks in the Republic of Moldova comes from the need of

industrial development of economy able to lead to the optimization of the production costs, obtaining

qualitative and competitive products on outlets, etc., and as an associated effect, acceleration of

investment processes in the country is required. Thus, the industrial park is an efficient instrument of

the economic growth at the national and regional levels due to its impact on the development of

production intended for export and development of home consumption in the country.

According to the Law No.182 of 15.07.2010 on industrial parks, industrial park is a delimited area

having technical and production infrastructure where economic activities are carried out,

predominantly of industrial production, service rendering, implementation of scientific researches

and/or technological development within a specific facilities framework with a view to maximizing the

human and material potential of a region.

The above mentioned premises, as well as availability of the associated land with the area of abt. 13,2

ha, situated next to the national highway R14 and railroad, existing infrastructure conditions and

economic potential of the region have determined the emergence of the idea to create the industrial

park on the territory of Falesti PSCM JSC according to the results of the feasibility study and on the

basis of Law No. 182 of 15.07.2010 on industrial parks.

Creation of the industrial park on the mentioned territory has several major characteristics

- Creation of the park on a territory, the area of which (13,2 ha) allows carrying out carrying out

various industrial activities corresponding to the legislation in force

1

;

- Existence of spaces of production purpose and industrial production equipment facilitate the

carrying out of activities within the industrial park;

- Interest on the part of potential foreign investors for the purpose of industrial use of existing

assets, the majority of which are not introduced in the commercial circulation.

The developed feasibility study provides for the opportunities to create the industrial park and

optimum scenario of its development based on recommendations of economic, technical and legal

organization of activity of the industrial park and the expected effects upon the region.

1

Law No. 182 of 5.07.2010 on Industrial Parks, art. (5), i.(e).

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

9

1.2. Goal and objectives of the study.

The goal of the feasibility study on creation of the industrial park on the territory of Falesti PSCM

JSC consists in substantiation of technical-economic and legal viability of the present project.

Objectives of the feasibility study consist in confirmation of opportunities to create the park based

on the positive social, economic and environmental impact on the region development; opportunity to

develop economic activities in the region and attract residents in the park; existence of the human

potential of the region necessary for the parks activity and existence of regional infrastructure

necessary for the parks activity.

They derive from the main goal and refer to:

- establishment of the concept of the industrial park and indication of the planned types of

activity;

- assessment of the social, economic and environmental impact of industrial park on the region

development;

- description of economic activities of the region and possibility to involve the residents in the

park as well as human potential of the region necessary for the park activity;

- diagnosis of the regional infrastructure necessary for the park activity as well as the condition

of technical and production infrastructure which is to be connected to the industrial park;

- delimitation of the site and industrial park configuration;

- determination of the action plan for the creation of the industrial park;

- estimation of the investment necessary for creation of the park and funding sources; as well as

financial forecasting for activity of the Managing Enterprise.

Objectives for the creation of the industrial park refer to:

- attraction of local and foreign investments;

- creation of competitive industrial sectors on the basis of modern and innovative technologies;

- carrying out of economic activities according to the opportunities of development specific to

the corresponding zone, including more efficient use of public property;

- development of small and medium enterprises;

- creation of jobs within the industrial park and ensuring of equal access of all citizens to the

activity within the park;

- development of human resources by improving the quality of professional training within the

park.

- adoption of operational practices of foreign companies in activities of production of pieces

from machinery and equipment construction industry.

1.3. Brief presentation of the economic entity

Joint-stock company Falesti plant of street cleaning machines is located in the industrial zone of

Falesti.

Legal address: 61 Eminescu St., Falesti, Republic of Moldova. The headquarters of the executive

authority is situated at the same address

Falesti PSCM JSC is established according to the Law on Joint-Stock Companies, Law on

Entrepreneurship and Enterprises, Law on Securities and other legislative acts of the Republic of

Moldova which operate on the basis of the statute, approved in new edition in 2009.

The Company is founded by reorganization of the state enterprise Falesti plant of street cleaning

machines, registered on September 15, 1992, being the legal successor in its property rights and

obligations, related to the corresponding land and refers to open joint-stock companies. The

registration number of the enterprise is 151052150. The company is given unique identification code

(IDNO) 1005600014663.

The construction of the Plant started in 1987 but has not been finished even until now. Within 1987-

1988 Metallurgical section was put into operation and within 1991-1993 the activity in the

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

10

Production shop I as well as a number of related constructions started. Constructions planned

according to the project and remained at the initial stage of construction have been preserved.

According to the companys articles of association, it has the right to carry out the following types of

activity:

- Construction of street cleaning machine plant;

- Production of consumer goods;

- Rendering of transport services to individuals and legal entities within the country and abroad;

- Commercial activity;

- External economic activity;

- Other activities which do not contradict the legislation in force.

The enterprise is situated on a territory of 13,2 ha. In the past it was one of the enterprises of national

importance, destined for processing and production of street cleaning equipment and component

parts for the whole Soviet Union.

Executive management is performed by the Managing Team, headed by the General Director

(Manager). 29 persons work in the company, however, there is no well-structured organizational

scheme. The problem of staff has become a chronic one, characterized by aging of the existing labor

force and, at the same time, by the lack of specialists in the priority fields, such as: production,

marketing, planning, etc.

At present, the enterprise Falesti PSCM JSC is in a decrease period, being dependent on periodical

production orders and operating under poor conditions of technical infrastructure and without

utilities infrastructures necessary for good functioning of the operating activity.

1.4. Presentation of the elaborating company.

The feasibility study has been developed by ProConsulting LLC which has operated on the consulting

market of the Republic of Moldova since 2003. The companys products portfolio refers to:

- Consulting in financial management.

- Consulting in strategic management.

- Consulting in investments and fund-rising.

- Business planning.

- Trainings and workshops. Insurance and real estate assessment.

Contact information. MD -2004, 23/9 Mitropolit Petru Movila St., Chisinau, Republic of Moldova.

Tel./fax: +(373 22) 21-00-89. office@proconsulting.md

Web: www.proconsulting.md

Team of consultants involved in the development of the present study:

- Palade Anatol Project Manager.

- Negru Mihaela Financial Consultant.

- Vascan Grigore - Consultant in technical issues and restructuring.

- Utica Oleg - Consultant in legal issues.

1.5. Methodology.

The feasibility study for the creation of the industrial park was developed taking into account the

practices of neighboring countries, in particular Romania, Russia, Hungary, Czech Republic. Also, the

feasibility study was developed according to the UNIDO Methodology, subsequently adjusted to the

specific nature of the given project.

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

11

For the development of the present feasibility study a number of tools and techniques, depending on

stages of the project lifecycle, have been used.

- Data collection. For this purpose, the team of consultants developed the diagnostic analysis of

the region and Falesti PSCM JSC using the following methods:

Questionnaire method;

Interview method;

Observation;

Analysis of internal and external reports;

Study of the statistical sources: empirical methods; science-based methods.

- Project development. Fundamental methods are numerous, among which the following ones

were the most frequently used:

Methods of forecasting: extrapolation of trends with the help of certain statistical and

analytical methods;

Methods of market research; methods of strategic and operational diagnosis;

Methods of financial modeling.

Methods of strategic modeling;

Methods of scenario building.

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

12

2. ANALYSIS OF THE REGION

2.1. ANALYSIS OF BUSINESS ENVIRONMENT.

The Joint-Stock Company Falesti Plant of Street Cleaning Machines is situated in Falesti, Falesti

district a component part of the Northern Development Region. As a result, the regional analysis of

Falesti, as the core of the study with the view to determining the viability of the creation of the

Industrial Park on the basis of Falesti PSCM is performed also from perspective of locality belonging

to the Northern Development Region, hereinafter NDR.

2.1.1. Sectorial analysis.

NDR study in the light of sectorial specialization is relevant from the beginning, by relating the share

of sectors in the Gross Domestic Product of the Region (GDP).

The latest available data regarding Gross Domestic Product (GDP) of the NDR are as of 2008 and are

amounted to 7,22 milliards MDL or 21% of the allocable national GVA

2

.

Economic sectors contribute differently to the formation of the regional GDP. Within recent years, the

trend of changing the branch structure of the regional economy is observed. Thus, in 2008, the share of

agriculture in GDP made up 25%, having reduced as compared to the previous years by 6-11%. At the

same time, the share of services increased in the same proportion reaching 47% (see Figure 1 and

Figure 2).

Figure 1. Branch structure of GDP, 2008.

Figure 2. Indices of industrial specialization by the number of staff, 2007.

Source: Powell 2009 (Regional statistical report).

At the level of NDR the relatively developed potential is the industrial one. Main industrial

agglomerations are (see Figure 3. ):

a) extractive industry;

b) production of garments, furs fabrication and dyeing;

c) production and distribution of electric and thermal energy, gas and hot water;

d) food and beverage industry;

e) production of equipment and medical, precision, optical instruments.

On the basis of the analysis of the Figure 3, in the zone of Falesti district, the main directions of the

sectorial economy are represented by:

- sugar production;

2

Data regarding GDP in the region are taken from the Matthew Powell with reference to the Study, implemented

by Expert Grup.

Agricu

lture

Indust

ry

Constructio

n

Services

Pharmaceutical industry

Food and beverages

industry

Electric power distribution

and production

Footwear manufacturing

Mining industry

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

13

- machinery production;

- production of wines, champagnes and spirits;

- production of construction materials;

- electric and thermal power plants;

- oil storage, etc.

At the same time, sectorial organization of economy of the Falesti district has determined the need to

create in prospects in this region a Free Economic Zone which by activity, advantages and

opportunities, involved as concept, will have a decisive role in the change of business culture as well as

of qualitative and quantitative indices of the district in whole.

Figure 3. Scheme of location of NDR economic sectors, 2010.

Source: North Regional Development Agency.

Out of total NDR area, 70% are agricultural lands, the region contributes about 40% to the total

agricultural production in the country.

Agriculture agro-industrial sector.

The regions agro-industrial potential consists of 51 production cooperatives, 25 joint-stock

companies, over 530 limited liability companies and over 90 farm households and individually

registered enterprises.

Meat processing

Main branches

Oil production

Tobacco processing

Sugar production

Oil storage

Chemical industry

Machinery production

Manufacture of asphalt

Production of dairy products

Production of garments

Cereals processing and storage

Manufacture of construction materials

Manufacture of ceramic products

wine, champagne, alcoholic beverages

Production of canned food, juices and non-alcoholic

beverages

Manufacture of carpets

Free economic zone existing situation

Free economic zone forecasting

Industrial parks forecasting

Woodworking and furniture manufacture

Electrical engineering

Production of poultry meat and eggs

Glass production

Petrol processing

Waste treatment

Oil extraction

Metallurgical industry

Manufacture of leather

Electric and thermal

power plants

Footwear production

Printing industry

pharmaceutical products

Storage of radioactive wastes

Aeromarine services

Shipbuilding

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

14

Figure 4. Potential of the NDR agro-industrial sector, 2010.

Source: North RDA.

In this sense, Falesti district is characterized by a decreased agricultural mechanization index and

namely by 3,06-3,67 units per 1 ha of arable land. At the same time, the district is not strongly

dependent on the agricultural sector despite the fact that it is one of the districts with the largest share

of rural population from the North RD of the country.

The share of the agricultural sector in global production of the district in 2008 made up abt. 12%.

With an area of 81 thousand ha of agricultural lands (arable land 46 thousand ha), but with soil

productivity of only 65 (as compared to regional medium of 70), the harvest in the district is lower

than the regional medium.

The area of eroded lands is one of the largest in the region 31,9 thousand ha.

Falesti district is the leader as regards the total quantity of harvested sugar beet (158 751 tonnes in

2008), but not as regards harvest per ha. Falesti district is one of the fewest from NDR, where vines are

still cultivated (near Singerei). Animal husbandry does not represent an important part of the

agricultural sector, with the exception of ovines and caprines, where Falesti is the leader in the region,

as well as among leaders of the livestock in the country.

The number of agricultural enterprises per 100 inhabitants makes up 8,19 (including farm

households) slightly over the regional medium, but the majority of them are small enterprises. Only

100 of 7 644 agricultural enterprises cultivate areas with over 10 ha.

Industry.

According to data of NBS, the volume of the industrial production of Falesti district makes up 393,1

millions MDL for 2008.

In the district there are 98 industrial enterprises, the volume of the industrial production per

enterprise being relatively high 4 millions MDL. Most enterprises are from agro-industrial sector

(mills, oil mills, bakeries). There are only 7 enterprises from light industry (enterprises with foreign

Fertility ground level

Wine

Type of

enterprises

Beverages

Meat

Milk

Pharmaceutical

Greenhouse

Ceramics

Lees

Sweets

Bread

Tobacco

Glass

Sugar

Paperboard

concentrated

food

Mill houses

Level of mechanization

Units per 1 ha

Quality

level

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

15

capital, specialized in garment fabrication), but also 6 large enterprises in heavy industry (production

of pipes, metal fabrication).

Proximity to the border with Romania and existence of railroads with branching in the district allows

establishing external relations and creates opportunities for export, these advantages contribute in

their turn to the development of certain industrial branches. Also, there are industrial areas which can

be used due to the fact that Falesti by tradition was the industrial zone. These advantages contributed

to the development of the industrial sector in the district as well as to the creation of relatively large

enterprises (there are some enterprises with over 100 employees). But namely industrial enterprises

were mostly affected by the crisis and in 2009 some of them even reduced the number of employees.

These aspects represent major premises for the creation of the industrial park, which by concentrating

economic activities to the industrial production, will be able to redress the current situation.

The volume of the industrial production by the types of ownership is presented in the table below.

Table 1. Indicators of the industrial production by the types of ownership, 2008-2009.

January December, 2008 January December, 2009

At current prices,

thousand MDL

In % as

compared I

XII, 2007

At current prices,

thousand MDL

In % as

compared to I

XII, 2008

Total 393 139 246,1 179 259 45,6

Private ownership 49 137 108,4 35 528 72.3

Mixed ownership without foreign

participation

2003 98,2 123 137 + 61,4 times

Foreign ownership 23 611 137,5 20 594 87,2

Source: Falesti DC.

The situation regarding the industrial production depending on the types of activity is represented in

the following table.

Table 2. Industrial production by the types of activity, 2009.

December, 2009 January December, 2009

At current prices,

thousand MDL

In % as

compared to

XII. 2008

At current prices,

thousand MDL

In % as

compared to I

XII 2008

Industry Total 120 994 2215,2 179 259 +48,2

Processing industry 120 994 2215,2 179 529 +48,2

Out of them:

Food and beverage industry 115 495 9269,3 147 673 +2,9

Panification and production of confectionery 369 109,5 3 773 +10,22

times

Beverage production 1 636 244,5 20 763 +12,69

times

Production of garments 2 487 177,5 20 594 +8,2 times

Production of work clothes 2 487 177,5 20 594 +8,2 times

Production of finished metal products 2 638 109,3 10 150 +3,8 times

Production of metal products for

constructions

2 402 113,9 10 150 +4,2 times

Metal working and coating 154 64,7 0 0

Production of other metal articles 82 124,2 0 0

Production of machinery and equipment 374 93 842 +2,2 times

Production of agricultural machinery 32 168,4 0 0

Production of other special purpose

machinery

342 140,8 842 +2,2 times

Source: Falesti DC.

The situation in the industrial sector of Falesti district economy during recent years has been dictated

by enterprises from light industry, which, for example, in the first six months, 2010 made up 65,8% of

the total volume of the industrial production (32 043 thousand MDL).

Services.

Despite a sufficiently developed industrial sector, service sector is less diversified in Falesti district.

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

16

Also, communications enterprises have a significant share in the volume of provided services, which

registered a modest increase of 0,3% in 2008 as compared to the previous year.

Transport enterprises, registered on the territory of the district, are specialized only in passenger

transport. For the period of first 6 months of 2010, abt. 297 thousand passengers were transported,

having increased by 3,4% as compared to 2009. At the same time, during the first six months of 2010,

the emergence of the segment of goods transportation by means of motor transport enterprises was

also registered. Thus, abt. 1000 tonnes of goods, having registered an indicator of 697 thousand

tonnes/km, were transported.

In the district there is no enterprise with foreign capital rendering services. In general, the number of

enterprises rendering services is one of the lowest in the region. For servicing the agricultural sector

alone, the number of technological servicing plants is lower than the medium in the region, making up

31 units. In general, for the first six months, 2010 the value of paid services, provided for the

population, registered a decrease by 5.4% as compared to 2009, having reached a value of 54 millions

MDL.

Trade.

Retail trade represents the main activity in the sector, both by officially registered and unregistered

units. The total value of sales of retail trade goods in the first six months of 2010 made up 105

millions MDL, having increased by 13,6% as compared to 2009. However, unauthorized sector has

a higher share.

Main dynamic indicators regarding the sectorial analysis of Falesti district are presented in the table

below.

Table 3. Main sectoral indicators of Falesti district, 2006-2009.

Source:http://statistica.expert-grup.org/index.php/fleti/306-falesti-principalii-indicatori-economici-i-

ociali.html

Potential of resources for the industrial park.

Aspects of sectoral development of Falesti district economy with reference to the administrative

center as well, defines a premise for identification of the industrial parks profile. They refer to:

Activities of industrial production of machinery, equipment, pieces, household goods, etc;

Provision of services on maintenance of agricultural and industrial complex;

Activities of processing primary agricultural production;

Additional production activities (packaging materials, etc.)

These possible fields of activity result from resources available in the region, from sectoral

distribution of the regions economy, as well as from the technical potential of the Plant, and are based

on the following arguments:

1. Existence of industrial areas, which can be used due to the fact that Falesti traditionally was

the industrial zone;

2. Material and technical base for the agricultural sector is relatively developed 31

technological stations of machines with over 700 aggregates. Their condition is not

satisfactory, therefore, there are constant repair costs referred to: costs for spare parts,

additional costs for labor force, etc. If on the territory of the industrial park an economic entity,

oriented to the provision of maintenance services, is created, costs for technological stations

would decrease, both because parts would be produced on the spot and labor force would be

qualified while the repair time would be reduced.

As for processing of the agricultural production of cereals, the direction of activity for the industrial park

would not be appropriate, since on the territory of the district there are sufficient number of oil mills,

Industrial production as compared to the previous year

Retail trade as compared to the previous year

as compared to the previous year

Services, provided to

population

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

17

mills, bakeries, specialized in this segment. The same is the situation with processing of sugar beet (the

district being the leader in terms of volume) and processing of technical grape varieties. In this sense, in

the existing district there is Sugar Factory of Joint-Stock Company Sudzucker Moldova and Winery.

3. However, the district is the leader in the country as regards the production of ovine and

caprine livestock undeveloped segment in the country, but which, at the same time, has a

high potential. In this way, processing of livestock production has important resources to carry

out an activity within the industrial park.

4. Trends of development of sectors of processing agricultural products of vegetable or animal

origin need the potential of package production so that the region launches a final product on

the market, but not only raw material, which is all concentrated in the central zone. In this

regard, production of materials for packing (milk products, for dried vegetable products)

would determine depolarization of economic activities between the economic center of the

country and the region according to the formula: territory of the country produces raw

materials while the center packs and sells the final product, whose final value is comparatively

higher as compared to the price of raw materials.

Expected benefits for the district.

The development of this branch within the industrial park will condition:

- Increase in the number of local economic entities with production economic orientation;

- Creation of jobs, reduction in unemployment rate, increase of purchasing power of population,

improvement of the populations well-being, increase of allocations to the local budget by

allocating taxes;

- Growth of industrial production with value added to the local, regional Domestic product;

- Diversification of outlet, satisfaction of populations demand with local production;

- Development of the export potential through the proximity to the European Union, etc.

2.1.2. Analysis of the regional activity of enterprises.

The development of entrepreneurship is the main goal of the regional development. According to the

data of the State Chamber of Registration, in particular, of the Balti Territorial Office, as of October 01,

2010 in Falesti district 2 148 enterprises are registered, making up abt. 15% of the total number of

economic entities, registered in districts Singerei, Glodeni, Riscani and Balti municipality.

According to the NBS for 2009, out of 2 148 enterprises, abt. 227 enterprises are registered in Falesti.

The number of enterprises of Falesti denotes an increase by 2,2% of the entrepreneurial sector (see

Table 4. Number of economic entities by mediums and size of the enterprise, 2008-2009).

Table 4. Number of economic entities by mediums and size of the enterprise, 2008-2009.

Total number

of enterprises

Large

enterprises

Medium

enterprises

Small

enterprises

Micro

enterprises

2008 2009 2008 2009 2008 2009 2008 2009 2008 2009

Total number in RM 42 121 44 633 1 012 975 1 686 1 589 8 329 8 264 31 095 33 805

Northern Region 5 385 5 492 138 131 327 305 1 252 1 228 3 668 3 828

Falesti 271 277 8 7 34 27 81 79 148 164

Source: NBS.

Analyzed at the national level, the Northern Region covers abt. 12% of the number of economic

entities which activate on the territory of the country.

Within the region, Falesti has a 6% average share of local economic entities as compared to the total

NDR (see Figure 5).

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

18

Figure 5. Evolution of the share of types of enterprises from Falesti as compared to the total

NDR, 2008-2009.

Source: NBS. Authors calculation.

Both at level of the country and of the region, but at the same time, at the level of locality, the first

place, by the number of enterprises, is taken by Micro enterprises, which for Falesti have a share of

59% for 2009, when a 0.25% increase in number was also registered. However, it can be observed

from the Figure 5 that Medium enterprises predominate as the NDR component demonstrating a

positive quality of entrepreneurship in the locality.

As for the quality of entrepreneurship in terms of obtained results, the situation is changing from the

perspective of two analyzed indicators:

1. Volume of sales, registered per total types of enterprises;

2. Average volume of sales per enterprise per each type.

The largest volume of sales of enterprises by the form of organization is registered for Large

Enterprises. At the level of country, the total share of their sales makes up 61% which is by 4% more

than the share at the level of Northern Region and respectively by 38% more than the level, registered

by large enterprises of Falesti.

The value of sales, registered by enterprises from Falesti for 2009 is 580 millions MDL (see table 5)

making up 3,3% of the value of sales by enterprises from Northern Region and respectively 0,4% at

the national level.

Table 5. Activity of economic entities by the volume of sales, millions MDL, 2008-2009.

Total RM Northern Region Falesti

Total number of

enterprises

2008 175 058 23 473 931

2009 146 447 17 561 580

Large enterprises 2008 110 074 14 498 326

2009 88 966 9 945 132

Medium enterprises 2008 23 306 3 352 226

2009 20 318 2 810 163

Small enterprises 2008 33 598 4 480 324

2009 29 104 3 729 232

Micro enterprises 2008 8 079 1 142 54

2009 8 057 1 076 52

Source: NBS

Out of the value of sales by enterprises, operating on the territory of Falesti, the largest share belongs

to Small Enterprises having 40%, followed by Medium Enterprises with a 12% difference (see Figure

6).

Small

Medium

Large

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

19

Figure 6. Structure of sales by enterprises from Falesti according to the form of organization of

the enterprise, 2009.

Source: NBS. Authors calculations.

Referring to the number of enterprises for each form of their organization, it is determined that the

largest average volume of sales, made by an enterprise belongs eventually to Large Enterprises. Each

of 7 Large Enterprises, operating in Falesti, registered in 2009 an average of abt. 19 millions MDL of

sales (see Table 6 below).

Table 6. Volume of sales referred to the number of enterprises, millions MDL 2008-2009.

Total number

of enterprises

Large

enterprises

Medium

enterprises

Small

enterprises

Micro

enterprises

2008 2009 2008 2009 2008 2009 2008 2009 2008 2009

Total in RM 4,16 3,28 108,77 91,25 13,82 12,79 4,03 3,52 0,26 0,24

Northern

Region

4,36 3,20 105,06 75,92 10,25 9,21 3,58 3,04 0,31 0,28

Falesti 3,44 2,10 40,81 18,87 6,66 6,05 4,00 2,95 0,37 0,32

Source: NBS. Authors calculations.

According to accumulated obtained data, as regarding entrepreneurial activity of Falesti, each

registered and acting enterprise, has an average of annual sales making up 2,10 millions MDL

according to data of 2009.

According to the dynamic analysis of the situation of entrepreneurship in the light of the registered

business figure, a decrease of indicators in 2009 as compared to 2009 is observed. If for those three

analyzed average values (National, Northern Regional and Falesti locality) an increase in the number

of established enterprises (with 5% for Falesti) was registered, then the volume of their sales

determined a 38% decrease, for example, for Falesti. This trend was also observed at the national

level, where the value of sales of enterprises decreased by 16%, as well as in the Northern Region this

indicator having also decreased by 25% as compared to 2008.

For all three analyzed values, the biggest decrease in value of sales was registered for Large

Enterprises:

- 60% for Falesti;

- 31% for Northern Region;

- 19% at the national level.

The main reason consists in the conditions, created by the world economic-financial crisis, which

reduced the purchasing power of consumers, transformed in the decline in demand and,

correspondingly, operational and financial stability of enterprises decreased, sometimes dramatically.

Out of the total number of enterprises, operating on the territory of Falesti district, abt. 430 of them

are the most important both in terms of volume of activity and stability of activity.

Depending on the type of ownership, there exist 5 enterprises, in which the state has either shares or

is the founder and among these: 3 Joint-stock companies, where the state has majority stake of over

90% and an enterprise, in which the state has abt. 8% of the block of shares.

Small

Medium

Large

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

20

Also, there is a consumer cooperative in the district, the Co-op belonging 100% to the state.

Particularly, 9 enterprises with foreign capital and a joint venture are operating in the industrial field.

As for the rest, enterprises are with local private capital.

Main fields of activity belong to the domains of industry, agriculture, trade (food products,

pharmaceutical products, construction materials, etc.), provision of transport services, mostly for

passengers, etc. (see table below).

Table 7. Distribution of enterprises by fields of activity, Falesti district.

No. Field of activity

Number

of

enterpr

ises

Name of the enterprise Location

1

(Processing

industry)

Heavy industry

6

1. JSC Protos Plant of pipelines from

Moldova;

2. Falesti PSCM JSC

3. Prit - 80 JSC

4. Fag LLC

5. JSC ISRT repair of agricultural equipment

6. Agas Ros LLC

Falestii Noi vil.

Falesti

Falesti

Falesti

Falesti

Falesti

2

(Processing

industry)

Light industry

7

1. EFC Marthatex LLC

2. EFC Antile Moldova

3. EFC Textre LLC

4. Belig Service LLC

5. Plastic Manufacturing EFC

6. EFC Romina Cablaggi LLC

7. EFC Gabriedil LLC

Falesti

Falesti

Glingeni vil.

Falesti

Falesti

Albinetul Vechi vil.

Albinetul Vechi vil.

3

Processing

industry

14

1. Winery Mold Nord" JSC

2. Avicola Nord" JSC

3. JV Sudzucker Moldova"

4. Corn seeds calibration plant" JSC

5. Falesti panification enterprise JSC

6. Heuveland" LLC

7. Tobacco fermentation plant" JSC

8. Cereal collection enterprise JSC

9. Miledi LLC

10. Trimobil Design LLC

Etc.

Falesti

Falesti

Falesti

Rautel vil.

Falesti

Logofteni vil.

Falesti

Falesti

Falesti

Falesti

4

Constructions 16

1. Adirem Con" LLC

2. Agas Ros" LLC

3. ICM2 JSC

4. Metal" JSC

5. JV Falesti construction"

6. Chirservix" LLC

7. IE Savciuc Anatolie"

8. Amicrist" LLC

9. Polimer Gaz Conducte" LLC

10. Frizas-Group" LLC

11. Prodianit" LLC

12. . EFC Gabriedil LLC

13. Megacom Construct LLC

Etc.

Falesti

Falesti

Falesti

Falesti

Falesti

Calinesti vil.

Calugar vil.

Falestii Noi vil.

Falestii Noi vil.

Pirlita vil.

Rautel vil.

Albinetul Vechi vil.

Falesti

5

Service provision 36

1. Drumuri Falesti" JSC

2. JV Asociatia pietelor

3. CCPC JSC

4. Falesti bus stop

5. Uniteh service" JSC

6. Machinery and equipment station No. 294

7. EFC Moldromsat Group LLC TV

Etc.

Falesti

Falesti

Falesti

Falesti

Falesti

Rautel vil.

Falesti

6

Pharmacy 4

1. Agromed" LLC

2. Primafarm" LLC

Falesti

Falesti

Feasibility study regarding creation of the Industrial Park on the territory of Falesti SEP JSC, Falesti

Study was developed by ProConsulting LLC, tel./fax: 21-00-89

21

3. Solid Farm" LLC

4. Sinteza Farm" LLC

Falesti

Falesti

7

Transport 41

1. Falesti motor transport enterprise JSC

2. LLC Plai CA

3. Rotmix Trans" LLC

4. Autotrans Nord" LLC

5. Lia-MC" LLC

6. Osoianu Transport LLC

7. IE Bologan Ion-Trans"

8. Trans Special" LLC

Etc.

Falesti

Falestii Noi vil.

Falesti

Falesti

Falesti

Calugar vil.

Falesti

Falesti

8

Trade 209

1. EFC Moldromsat-Group"

2. Nomad si Co" LLC

3. Hanuco" LLC

4. Nichifor" IE

5. Energia" LLC

6. Serveton Magazin Rapid LLC

7. Pizza Best

8. Agroprivat Servicii LLC

9. ,,ELITA-5 Altepi LLC

Etc.

Falesti

Falesti

Falesti

Falesti