Professional Documents

Culture Documents

Hurricane Sandy P814 Farm - 11!02!12 - 1103am

Hurricane Sandy P814 Farm - 11!02!12 - 1103am

Uploaded by

NYSLaborOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hurricane Sandy P814 Farm - 11!02!12 - 1103am

Hurricane Sandy P814 Farm - 11!02!12 - 1103am

Uploaded by

NYSLaborCopyright:

Available Formats

Fact

SHEET

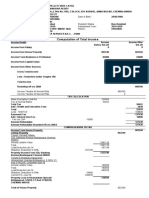

Farmers and the Self-Employed Directly Affected by Hurricane Sandy You May Qualify for Disaster Unemployment Assistance (DUA)

business or farm income has been impacted as a direct result of the disaster.

Have you lost your income due to the effects of Hurricane Sandy? If so, you may be eligible for Disaster Unemployment Assistance (DUA).

What is DUA?

DUA is a Federal program that provides payments to people in a Federally declared disaster area who have lost work or income due to the disaster. The NYS Department of Labor determines if claims filed under the program are valid, and makes payments to those who qualify. The Federal government funds the DUA program. President Obama declared several counties in New York major disaster areas, at Governor Cuomos request.

Can I still run my business or farm and collect DUA?

You may be able to earn an income and still collect DUA in some situations. Examples include, but are not limited to, the following: - Businesses may qualify for DUA if the level of income is significantly diminished as a direct result of the disaster. For example, a manufacturer of goods that has a major part of their inventory destroyed may be eligible. - Farmers who are involved in more than one aspect of farming (i.e. dairy and crops) may still be eligible for partial DUA payments.

Who is eligible?

If you live or work in Bronx, Kings, Nassau, New York, Queens, Richmond or Suffolk Counties and you lost your income due to the effects of Hurricane Sandy, you may qualify for DUA. Eligibility requirements for DUA differ from regular unemployment insurance and you may qualify if you are self-employed, even if you own and operate a farm. DUA eligibility and benefit amounts are decided on an individual, case-by-case basis. The primary factor is whether the self-employed person or farmer is performing less than their normal, full-time services and earning wages less than $405 a week. Some situations that qualify for DUA include: - You were injured in the disaster and are unable to work. - Your business or farm was damaged or destroyed in the disaster. - You are now the breadwinner or provide the majority of support for a household because the former head of household died in the disaster. - Most of your income comes from areas affected by the disaster, even if you worked for yourself, and your

Will collecting DUA prevent me from either cleaning or salvaging my business/farm?

- Restorative or clean-up work, which is necessary because of the disaster, will not disqualify an individual for DUA. - Salvaging or other limited self-employment activity alone will not necessarily make someone ineligible for DUA as long as they work less than full time and their earnings do not exceed their maximum weekly benefit rate. - If salvaging results in a brief period of earnings of more than $405 a week, then DUA would stop during that period, but resume after salvaging operations end. For example, a farmer who was substantially impacted by the disaster may be able to harvest the residual crops that were not impacted by the disaster. During the period where salvaging occurred, the farmer may not be eligible for DUA, but could be eligible later on.

How do I apply for DUA?

Call our toll-free number at 1-888-209-8124 and you will be connected with a DUA specialist who will walk you through the application process. If you are currently out of state, but lived or worked in affected counties, call 1-877-358-5306. Deadline: File your application with the NYS Department of Labor as soon as possible. The application deadline is December 3, 2012. When you file for unemployment insurance benefits, you should have the following information ready and available: - Your social security number - Your NYS driver license or Motor Vehicle ID card number (if you have one) - Your mailing address and zip code - A phone number where you can be reached for additional information - Your alien registration card number (if you have one) - Your 2011 income tax return: Self-employed workers: Schedule C (line 31) net profit or loss Farmers: Schedule F (line 36) net farm profit or loss

Is there anything else I should know?

If you are eligible for DUA, you will be required to certify that you lost total or partial income with the NYS Department of Labor on a weekly basis, either online or by mailing your certification to the Department. You must specify that you are unemployed and remain directly impacted by the disaster. For those impacted by Hurricane Sandy, if you qualify, the maximum payable period is 27 weeks, beginning October 29, 2012 through May 5, 2013. Even if you salvage a crop or have some income coming in, you may still qualify for DUA, so it is important that you file as soon as possible. Your employees could also qualify for DUA. Because DUA is Federally funded, your unemployment insurance taxes will not be impacted if you have employees who qualify for DUA.

Where can I go for more information?

For questions about your claim, call 1-888-209-8124. For general employment and training services, including layoff aversion strategies, job listings, and help with finding workers, please visit your local Department of Labor One-Stop Career Center. For information on DOL services for job seekers, please call 1-888-4-NYSDOL or (518) 457-9000. Or visit our web site at: www.labor.ny.gov/workforcenypartners/osview.asp

If you lost these records in the disaster, you should apply anyway and inform the DUA specialist when you apply.

PROTECT all Workers ASSIST the Unemployed CONNECT Employers and Workers

www.labor.ny.gov

1-888-4-NYSDOL

P814 F/SE (11/12) The New York State Department of Labor is an Equal Opportunity Employer/Program. Auxiliary aids and services are available upon request to individuals with disabilities.

You might also like

- Notes and Loans Receivable c8 ValixDocument6 pagesNotes and Loans Receivable c8 ValixJames Patrick Antonio75% (12)

- Glencore Australia Letter of Employment (Offer Letter) Oluwasegun Odunitan BakareDocument3 pagesGlencore Australia Letter of Employment (Offer Letter) Oluwasegun Odunitan BakareLucy Bakare67% (3)

- SBI Staff BenefitsDocument31 pagesSBI Staff Benefitssandeeprvss34160% (1)

- 1453104607550Document10 pages1453104607550JGNo ratings yet

- A Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealFrom EverandA Beginner's Guide to Disability Insurance Claims in Canada: How to Apply for and Win Payment of Disability Insurance Benefits, Even After a Denial or Unsuccessful AppealNo ratings yet

- SIPL-Total Rewards System EvaluationDocument2 pagesSIPL-Total Rewards System EvaluationShriniwas Nehete0% (1)

- Hurricane Sandy P814 Farm - 11!02!12 - 1231pmDocument2 pagesHurricane Sandy P814 Farm - 11!02!12 - 1231pmNYSLaborNo ratings yet

- Hurricane Sandy P814 - 11-02-12 - 1102amDocument2 pagesHurricane Sandy P814 - 11-02-12 - 1102amNYSLaborNo ratings yet

- Frequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ WorkersDocument2 pagesFrequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ Workersdavid rockNo ratings yet

- US Internal Revenue Service: p907 - 2005Document13 pagesUS Internal Revenue Service: p907 - 2005IRSNo ratings yet

- US Internal Revenue Service: p907 - 2002Document12 pagesUS Internal Revenue Service: p907 - 2002IRSNo ratings yet

- F 1040 EsDocument12 pagesF 1040 EsEndu EnduroNo ratings yet

- Unemployment and Other Assistance ProgramDocument10 pagesUnemployment and Other Assistance ProgramMaimai Durano100% (1)

- US Internal Revenue Service: p907 - 2001Document12 pagesUS Internal Revenue Service: p907 - 2001IRSNo ratings yet

- Delaware Unemployment Guide For Claimants 2014Document38 pagesDelaware Unemployment Guide For Claimants 2014ResumeBearNo ratings yet

- US Internal Revenue Service: p907 - 2003Document13 pagesUS Internal Revenue Service: p907 - 2003IRSNo ratings yet

- Household Employer's Tax Guide: Future DevelopmentsDocument16 pagesHousehold Employer's Tax Guide: Future DevelopmentsTezadeLicentaNo ratings yet

- Homeworkers Tax AllowanceDocument6 pagesHomeworkers Tax Allowanceh47hphdb100% (1)

- EDRF - Apply FAQs - E4E VERSION FINALDocument4 pagesEDRF - Apply FAQs - E4E VERSION FINALGuntur AgungNo ratings yet

- EDD HandbookDocument40 pagesEDD HandbookJoshua Laferriere0% (1)

- The Worker's Guide - Your Rights During Coronavirus (COVID-19) - October 2, 2020Document35 pagesThe Worker's Guide - Your Rights During Coronavirus (COVID-19) - October 2, 2020msegarra88No ratings yet

- Presentation On Unemployment BenefitsDocument59 pagesPresentation On Unemployment BenefitsState Senator Liz KruegerNo ratings yet

- Reference Id: Entitledto-10957291 Your Income: Entitlement Yearly Weekly Notes and GuidanceDocument12 pagesReference Id: Entitledto-10957291 Your Income: Entitlement Yearly Weekly Notes and GuidanceJohnny AlfaNo ratings yet

- Your 2019 Social Security Cost of Living IncreaseDocument4 pagesYour 2019 Social Security Cost of Living IncreasetugwareNo ratings yet

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- Top Tips For Successfully Claiming The Self-Employed Tax Credit 188127Document3 pagesTop Tips For Successfully Claiming The Self-Employed Tax Credit 188127galenajmdtNo ratings yet

- US Internal Revenue Service: p907 - 2004Document13 pagesUS Internal Revenue Service: p907 - 2004IRSNo ratings yet

- UnemploymentCARES ActDocument5 pagesUnemploymentCARES ActOlga CiesielskiNo ratings yet

- Who Should File A 2012 Tax Return?Document2 pagesWho Should File A 2012 Tax Return?Landmark Tax Group™No ratings yet

- Self-Employed PersonDocument3 pagesSelf-Employed PersonqwertyNo ratings yet

- Understanding The Eligibility Criteria For The Self-Employed Tax Credit 197265Document2 pagesUnderstanding The Eligibility Criteria For The Self-Employed Tax Credit 197265galenajmdtNo ratings yet

- US Internal Revenue Service: p907 - 1998Document8 pagesUS Internal Revenue Service: p907 - 1998IRSNo ratings yet

- Beacon O - S A: Frequently Asked QuestionsDocument8 pagesBeacon O - S A: Frequently Asked QuestionsRowell JaoNo ratings yet

- Frequently Asked Questions About UI Benefits - The Basics: This PostDocument1 pageFrequently Asked Questions About UI Benefits - The Basics: This Postcezeh701No ratings yet

- May 2013 EbriefDocument2 pagesMay 2013 EbriefkyliemkaNo ratings yet

- Nyserda Covid 19 ResourcesDocument1 pageNyserda Covid 19 ResourcesOANo ratings yet

- Applying For: Pandemic Unemployment Assistance (PUA)Document2 pagesApplying For: Pandemic Unemployment Assistance (PUA)Peggy PattenNo ratings yet

- Form 1040-ES 2013Document11 pagesForm 1040-ES 2013Zeeshan AliNo ratings yet

- Indiana Unemployment FAQDocument22 pagesIndiana Unemployment FAQDemmy KayNo ratings yet

- Your 2024 Social Security Cost of Living IncreaseDocument4 pagesYour 2024 Social Security Cost of Living IncreaseABUDUAOA KOOA9WNo ratings yet

- 2020 Employer Toolkit V12 1Document22 pages2020 Employer Toolkit V12 1sachinitsmeNo ratings yet

- US Internal Revenue Service: p907 - 1996Document8 pagesUS Internal Revenue Service: p907 - 1996IRSNo ratings yet

- Your 2024 Social Security Cost of Living IncreaseDocument4 pagesYour 2024 Social Security Cost of Living IncreasenazoyaqNo ratings yet

- The Self-Employed Tax Credit: A Valuable Resource For Freelancers and Gig Workers 177313Document2 pagesThe Self-Employed Tax Credit: A Valuable Resource For Freelancers and Gig Workers 177313galenajmdtNo ratings yet

- More Information About Tax Credits: R T - L 8 - HDocument1 pageMore Information About Tax Credits: R T - L 8 - HKevin MangumNo ratings yet

- Common Deductions Taxpayers OverlookDocument4 pagesCommon Deductions Taxpayers OverlookDoug PotashNo ratings yet

- Unemployment Insurance Faqs Regarding Covid-19:: UpdateDocument11 pagesUnemployment Insurance Faqs Regarding Covid-19:: UpdatenwytgNo ratings yet

- Supports and Information For The Self-EmployedDocument32 pagesSupports and Information For The Self-EmployedAhmedTagAlserNo ratings yet

- EDD UI BenefitsDocument9 pagesEDD UI Benefitsalex kapelNo ratings yet

- Indiana Unemployment Insurance: How Do I File? Am I Eligible? What Happens After I File? Other Questions?Document12 pagesIndiana Unemployment Insurance: How Do I File? Am I Eligible? What Happens After I File? Other Questions?MusicDramaMama100% (1)

- Form - 1040 - ES PDFDocument12 pagesForm - 1040 - ES PDFAnonymous JqimV1ENo ratings yet

- Eligibility Results NoticeDocument14 pagesEligibility Results NoticekistllcNo ratings yet

- The Universal Savings CreditDocument25 pagesThe Universal Savings CreditCenter for American ProgressNo ratings yet

- US Internal Revenue Service: p907 - 1997Document8 pagesUS Internal Revenue Service: p907 - 1997IRSNo ratings yet

- I 1040 ScaDocument15 pagesI 1040 Scaapi-173610472No ratings yet

- JobPlanDocument2 pagesJobPlanwigginjimmyNo ratings yet

- Fact Sheet For Workers Ages 18-48: Retirement Is Different For EveryoneDocument2 pagesFact Sheet For Workers Ages 18-48: Retirement Is Different For EveryoneBrandon BachNo ratings yet

- 1040es Estimated Tax 2014 For IndividualsDocument12 pages1040es Estimated Tax 2014 For IndividualsClaudia MaldonadoNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- US Internal Revenue Service: p533 - 2000Document20 pagesUS Internal Revenue Service: p533 - 2000IRSNo ratings yet

- Full Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All ChapterDocument40 pagesFull Payroll Accounting 2019 5Th Edition Landin Solutions Manual Online PDF All Chapterkadinkaspadial538100% (6)

- J.K. Lasser's Guide to Self-Employment: Taxes, Tips, and Money-Saving Strategies for Schedule C FilersFrom EverandJ.K. Lasser's Guide to Self-Employment: Taxes, Tips, and Money-Saving Strategies for Schedule C FilersNo ratings yet

- Social Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceFrom EverandSocial Security: The New Rules, Essentials & Maximizing Your Social Security, Retirement, Medicare, Pensions & Benefits Explained In One PlaceNo ratings yet

- Keller & Co. Ltd. v. COB Group MKTGDocument2 pagesKeller & Co. Ltd. v. COB Group MKTGMaria AnalynNo ratings yet

- Fernwood Gardens Venue Rental Quotation 2019Document3 pagesFernwood Gardens Venue Rental Quotation 2019Alicia ServinoNo ratings yet

- Functions of Asset Management CompanyDocument4 pagesFunctions of Asset Management CompanyRishabh DubeyNo ratings yet

- Task-1 Master Budget With Profit ProjectionsDocument5 pagesTask-1 Master Budget With Profit ProjectionsbabluanandNo ratings yet

- AA Accounts Part ADocument4 pagesAA Accounts Part Arajan shukla100% (2)

- Icici Shg-Bank Linkage Program: Presented By: Ishita KhadijaDocument6 pagesIcici Shg-Bank Linkage Program: Presented By: Ishita KhadijaishitaNo ratings yet

- Zillow Inc: Form 8-KDocument15 pagesZillow Inc: Form 8-KJohn CookNo ratings yet

- Organisation Structure of Tata MotorsDocument16 pagesOrganisation Structure of Tata MotorsNirmal29% (7)

- Chapter - 3 - Departmental AccountsDocument22 pagesChapter - 3 - Departmental Accountsshubham yadavNo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- CCGGOO Letter To Hon'ble PM On DA FreezeDocument3 pagesCCGGOO Letter To Hon'ble PM On DA Freezedev kumarNo ratings yet

- FABM 2 NotesDocument4 pagesFABM 2 NotesShiny Natividad100% (1)

- Yogesh Kannan PDFDocument9 pagesYogesh Kannan PDFAnonymous KTnqDVhdgNo ratings yet

- (Free Download) Personal Budgeting by ItsfebbiDocument13 pages(Free Download) Personal Budgeting by ItsfebbiCitra AndreaNo ratings yet

- Riba Definition Characteristics Social ImpactDocument5 pagesRiba Definition Characteristics Social ImpactMD. ANWAR UL HAQUE100% (3)

- Group 4 ReportDocument16 pagesGroup 4 Reportnguyễnthùy dươngNo ratings yet

- Bond Market - How It WorksDocument18 pagesBond Market - How It WorksZain GuruNo ratings yet

- Ifrs For SmesDocument52 pagesIfrs For Smesfaisalislambutt3021No ratings yet

- First Round Capital Original Pitch DeckDocument10 pagesFirst Round Capital Original Pitch DeckJessi Craige ShikmanNo ratings yet

- Unaudited Audited: (Amounts in Philippine Peso)Document40 pagesUnaudited Audited: (Amounts in Philippine Peso)Louie SalazarNo ratings yet

- CBA Business Taxation UpdatedDocument3 pagesCBA Business Taxation UpdatedJL BaternaNo ratings yet

- ESI & PF Brief InformationDocument8 pagesESI & PF Brief InformationPrashant Dhangar0% (1)

- Australian Rental Market Discussion PaperDocument7 pagesAustralian Rental Market Discussion PaperBob odenkirkNo ratings yet

- Credit Digest Alcantara v. AlineaDocument2 pagesCredit Digest Alcantara v. Alineacclacsina100% (1)

- Problems Identified by The Narasimham CommitteeDocument3 pagesProblems Identified by The Narasimham Committeeshaikhaamir21No ratings yet

- National Insurance Policy 2015Document37 pagesNational Insurance Policy 2015FrancisNo ratings yet