Professional Documents

Culture Documents

FAF Assignment A

FAF Assignment A

Uploaded by

Srinu RaoCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chccom003 Answer Doc 2018Document4 pagesChccom003 Answer Doc 2018Tupy Tupas0% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Case Analysis Volunteerism RectoDocument2 pagesCase Analysis Volunteerism RectoSue Recto100% (1)

- Debono 6 Thinking Hats CourseDocument289 pagesDebono 6 Thinking Hats CourseVisesh100% (9)

- Shel SilversteinDocument11 pagesShel Silversteinapi-238286589No ratings yet

- CSS FormDocument2 pagesCSS FormhamzaNo ratings yet

- Sushil Kumar Patel: ObjectiveDocument3 pagesSushil Kumar Patel: Objectivesushil kumarNo ratings yet

- Modules Assessment Tool G7Document3 pagesModules Assessment Tool G7Hezl Valerie ArzadonNo ratings yet

- Financial Market QuestionDocument7 pagesFinancial Market QuestionPhạm Tân ĐứcNo ratings yet

- (Research and Practice in Applied Linguistics) Helen Silva de Joyce, Susan Feez (Auth.) - Exploring Literacies - Theory, Research and Practice-Palgrave Macmillan UK (2016)Document442 pages(Research and Practice in Applied Linguistics) Helen Silva de Joyce, Susan Feez (Auth.) - Exploring Literacies - Theory, Research and Practice-Palgrave Macmillan UK (2016)MayaAndrianiNo ratings yet

- Input Data Sheet For SHS E-Class Record: Learners' NamesDocument11 pagesInput Data Sheet For SHS E-Class Record: Learners' NamesAvery Jan Magabanua SilosNo ratings yet

- Lesson Plan El Arte de La BlogosferaDocument7 pagesLesson Plan El Arte de La Blogosferaapi-323597478100% (1)

- Newsletter 169Document3 pagesNewsletter 169St Bede's Catholic CollegeNo ratings yet

- Class Debate 2Document2 pagesClass Debate 2Raouf BoukouchaNo ratings yet

- RPH Week 5Document5 pagesRPH Week 5Afiq AissamuddinNo ratings yet

- Prosp e Cuts 2023 Versio in 1Document339 pagesProsp e Cuts 2023 Versio in 1ahsanshahjee34No ratings yet

- Post Practicum ReportDocument8 pagesPost Practicum ReportNaqiuddin HashimNo ratings yet

- Bhu Call LetterDocument7 pagesBhu Call LetterDeepanshuNo ratings yet

- Reggio Emilia SlideDocument3 pagesReggio Emilia SlidehuwainaNo ratings yet

- A Test For Moroccan Bac StudentsDocument2 pagesA Test For Moroccan Bac StudentsMoha Zahmonino67% (3)

- Kindergarten Weekly Home Learning Plan: R. Malanyaon Elementary SchoolDocument8 pagesKindergarten Weekly Home Learning Plan: R. Malanyaon Elementary SchoolWinston Yuta100% (1)

- THE CLUP.2016 2026. ApprovedDocument46 pagesTHE CLUP.2016 2026. ApprovedBRYLLE KYLLE OIDEMNo ratings yet

- EXERCISE 54 - Sentences - Word ChoiceDocument4 pagesEXERCISE 54 - Sentences - Word ChoiceLéoKostasNo ratings yet

- Supervisor'S Report Folder (SRF) : Igcse Information and Communication Technology (Ict)Document4 pagesSupervisor'S Report Folder (SRF) : Igcse Information and Communication Technology (Ict)Drako 2001No ratings yet

- Assessment Criteria SheetDocument1 pageAssessment Criteria Sheetapi-237976105No ratings yet

- Cellphone PresentationDocument14 pagesCellphone PresentationRobbie Krishen VirwaniNo ratings yet

- Mock Exam Literary StreamDocument3 pagesMock Exam Literary Streammahmoud ababsaNo ratings yet

- Curriculum Vitae: Michael AmanDocument6 pagesCurriculum Vitae: Michael Amanlameck paulNo ratings yet

- Performance Appraisal Private Sectors Banks Roll No 11Document40 pagesPerformance Appraisal Private Sectors Banks Roll No 11pareshgholapNo ratings yet

- Developmental Lesson Plan: BookletDocument8 pagesDevelopmental Lesson Plan: Bookletapi-547208974No ratings yet

- Annex 5 1 Planning Worksheet Access QualityDocument2 pagesAnnex 5 1 Planning Worksheet Access QualityALMA AGOYLONo ratings yet

FAF Assignment A

FAF Assignment A

Uploaded by

Srinu RaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAF Assignment A

FAF Assignment A

Uploaded by

Srinu RaoCopyright:

Available Formats

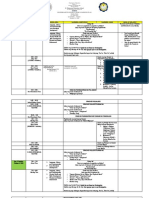

Assignment Assessment Report

Campus: Level: Module Name: Students Name: e-mail id & Mob No Stream Year/semester Assignment Type Assessors Name Reqd Submission Date Actual Submission Date Submitted to : A

FAF

Certificate by the Student: Plagiarism is a serious College offence. I certify that this is my own work. I have referenced all relevant materials. (Students Name/Signatures) Expected Outcomes Assessment Criteria Grade based on D,M,P,R system Feedback

General Parameters

Clarity Analytical ThinkingResearch DoneFormatting & Presentation1. Accuracy 2. Comprehension 3.Understanding the concept Grades P M D Clear understanding of the concept Ability to analyze the problem realistically Research carried out to solve the problem Concise& clear thinking along with presentation

Subject Specific Parameters

Accuracy of passing Journal Entries Ability to understand the importance of recording transactions Ability to pass all opening Journal Entries and all other transactions Achieved Yes/No (Y / N)

Grade Descriptors A Pass grade is achieved by meeting all the requirements defined. Identify & apply strategies/techniques to find appropriate solutions Demonstrate convergent, lateral and creative thinking.

Assignment Grading Summary (To be filled by the Assessor)

OVERALL ASSESSMENT GRADE: TUTORS COMMENTS ON ASSIGNMENT: SUGGESTED MAKE UP PLAN (applicable in case the student is asked to re-do the assignment) REVISED ASSESSMENT GRADE TUTORS COMMENT ON REVISED WORK (IF ANY) Date: Assessors Name / Signatures:

Assignment on Journal , ledger and Trail Balance Q1. Show the journal entry for the following opening balance as on 1 st January, 2006 cash Rs.500; Bank Rs 3,700; stock Rs 25,000; furniture Rs 6,000; debtors Rs; 2,100; investment Rs 20,000; machinery Rs 12,000; creditors Rs. 2,300; bank loan Rs. 10,000. The position of Resham as on 1st April, 2006 was as follows: Cash in hand Cash at bank Stock Raheja &Co.(Dr.) Juneja & Co.(Dr.) Plant & machinery Furniture and fixtures Investment Bills receivable Bills payable Show the journal entry for the above. Q3. Journalise the following transaction: April 1 April 5 April 7 April 12 April 15 April 18 April 26 April 30 April 30 April 30 Rajesh started business with cash purchased machinery from Mohan paid into bank sold goods to Riya purchased goods from Megha paid to Mohan a cheque cash sales salaries paid rent paid electricity charges paid 1, 00, 000 74,000 85,000 8,000 6,500 74,000 10,000 7,500 5,000 1,600 3,800 25,000 1,200 3,000 5,000 40,000 18,000 10,000 4,000 6,500

Q2.

Q4. Read the following transaction in the journal. Jan1 Jan5 Jan 7 Jan8 Jan 16 Jan20 Jan 23 Jan27 Jan31 Jan31 Vivek commenced business with cash Deposited into bank sold goods for cash sold goods to Aryan purchased goods from Mahadev paid to Mahadev Withdrew from bank for personal use electricity charges paid rent paid salaries due 2, 80,000 2, 00,000 3,850 18,000 7,500 7,000 3,000 2,000 4,500 7,000

Q5. Journalise the following transaction in the books of keshav : Oct1 Oct3 Oct5 Oct8 started business with cash Deposited into bank purchased goods from Sonu Machinery purchased from Sumit 1, 75,000 1, 00,000 15,000 60,000 8,000 14,850 150 12,000 11,550 450 5,000

Oct11 Cash sales to Mehta Oct13 payment made to Sonu Discount allowed by him Oct15 goods sold to Sandhya Oct18 Received from Sandhya Discount allowed to her Oct21 Drew from bank for domestic use

Oct26 Advertisement charges paid Oct31 office salaries paid Oct31 rent paid

2,000 8,200 6,800

Q6. Journalise the following transaction: Jan1 Jan3 Jan5 Jan7 Shyam commenced business with cash purchased furniture for cash paid into bank Bought goods from Kanna 1, 40,000 23,000 80,000 15,000 10,000 7,000 4,500 300 7,500 12,000

Jan 12 paid to Khanna on account Jan15 drew cash from bank for office use Jan17 paid Rent Jan22 carriage paid Jan30 paid salaries Jan31 cash sales for the month

Q7. . Journalise the following transaction in the books of Kirti March1 started business with Cash Stock Plant & machinery March2 March3 March5 March8 March13 paid wages for installation of machinery paid into bank purchased goods from Sachin for cash sold goods to Ashish purchased a motor bike for personal use 1, 10,000 20,000 30,000 2,500 80,000 6,000 10,000 15,000

March16 March21 March24 March27 March29 March 31

Ashish returned goods Received from Ashish in full settlement cash sales Rent paid Telephone charges paid wages paid

2,000 7,850 3,800 4,000 1,300 6,000

Q8. Record the following transaction in the books of Jatin: Dec1 commenced business with cash Dec3 deposited into bank Dec4 purchased machinery from Uday Dec6 bought goods from Rajan Dec8 lent money to vivek Dec11 sold goods to sneha Dec14 paid insurance premium Dec16 paid life insurance policy premium 2, 50,000 1, 00,000 50,000 20,000 80,000 16,000 6,000 3,500

Dec20 purchased goods from Karan, list price Rs. 12,000, less 10% Trade Discount Dec22 received from neha in full settlement a cheque of Dec24 paid to Karan Discount allowed by him Dec28 withdrew from bank for personal use Dec31 purchased computer Dec31 paid rent Dec31 paid salaries by cheque 15,500 10,500 300 4,000 45,000 6,500 10,000

Q9. Journalise the following transaction:

Sept1 Rohit started business with cash And stock worth And computer worth Sept3 Deposit into bank Sept4 purchased goods for cash from Sharma Sept7 purchased goods from Hari

1, 20,000 40,000 60,000 80,000 9,000 16,000

Sep15 sold goods to Ravi of list price, Rs 15,000, less 20%, Trade discount Sept17 Ravi returns goods of list price Rs. 2,000

Sept19 paid to Harish by cheque Sept22 discount received Sept25 paid for stationery Sep 26 bought printer for office use Sep30 paid salaries Sep30 paid rent by cheque Sep30 rent due

15,600 400 650 2,400 9,000 3,600 1,400

Q10. Mr Gupta commenced business as on 1st jan, 2005. Following transaction for the month of jan, 2005 are to be journalized in his books: 2005 Jan1 Jan2 Jan2 Jan4 Jan5 Jan6 Jan8 invested cash for commencement of the business 3,00,000 purchased machinery wages paid for installation of machinery purchased furniture bought computer from Raman bought goods from Mongia & Co. paid Raman by cheque in full settlement 1,10,000 10,000 15,000 28,600 7,000 28,000 12,000 11,500 800 150 800 3,000 500 2,000 18,000

Jan10 sold goods to Pawan Jan12 Pawan cleared his account by paying cash Jan19 paid for stationery Jan22 old newspaper sold Jan25 paid electricity charges Jan27 salaries paid by cheque Wages due but not paid Jan31 cash withdrawn for personal purpose Jan31 cash sales for the month

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Chccom003 Answer Doc 2018Document4 pagesChccom003 Answer Doc 2018Tupy Tupas0% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Case Analysis Volunteerism RectoDocument2 pagesCase Analysis Volunteerism RectoSue Recto100% (1)

- Debono 6 Thinking Hats CourseDocument289 pagesDebono 6 Thinking Hats CourseVisesh100% (9)

- Shel SilversteinDocument11 pagesShel Silversteinapi-238286589No ratings yet

- CSS FormDocument2 pagesCSS FormhamzaNo ratings yet

- Sushil Kumar Patel: ObjectiveDocument3 pagesSushil Kumar Patel: Objectivesushil kumarNo ratings yet

- Modules Assessment Tool G7Document3 pagesModules Assessment Tool G7Hezl Valerie ArzadonNo ratings yet

- Financial Market QuestionDocument7 pagesFinancial Market QuestionPhạm Tân ĐứcNo ratings yet

- (Research and Practice in Applied Linguistics) Helen Silva de Joyce, Susan Feez (Auth.) - Exploring Literacies - Theory, Research and Practice-Palgrave Macmillan UK (2016)Document442 pages(Research and Practice in Applied Linguistics) Helen Silva de Joyce, Susan Feez (Auth.) - Exploring Literacies - Theory, Research and Practice-Palgrave Macmillan UK (2016)MayaAndrianiNo ratings yet

- Input Data Sheet For SHS E-Class Record: Learners' NamesDocument11 pagesInput Data Sheet For SHS E-Class Record: Learners' NamesAvery Jan Magabanua SilosNo ratings yet

- Lesson Plan El Arte de La BlogosferaDocument7 pagesLesson Plan El Arte de La Blogosferaapi-323597478100% (1)

- Newsletter 169Document3 pagesNewsletter 169St Bede's Catholic CollegeNo ratings yet

- Class Debate 2Document2 pagesClass Debate 2Raouf BoukouchaNo ratings yet

- RPH Week 5Document5 pagesRPH Week 5Afiq AissamuddinNo ratings yet

- Prosp e Cuts 2023 Versio in 1Document339 pagesProsp e Cuts 2023 Versio in 1ahsanshahjee34No ratings yet

- Post Practicum ReportDocument8 pagesPost Practicum ReportNaqiuddin HashimNo ratings yet

- Bhu Call LetterDocument7 pagesBhu Call LetterDeepanshuNo ratings yet

- Reggio Emilia SlideDocument3 pagesReggio Emilia SlidehuwainaNo ratings yet

- A Test For Moroccan Bac StudentsDocument2 pagesA Test For Moroccan Bac StudentsMoha Zahmonino67% (3)

- Kindergarten Weekly Home Learning Plan: R. Malanyaon Elementary SchoolDocument8 pagesKindergarten Weekly Home Learning Plan: R. Malanyaon Elementary SchoolWinston Yuta100% (1)

- THE CLUP.2016 2026. ApprovedDocument46 pagesTHE CLUP.2016 2026. ApprovedBRYLLE KYLLE OIDEMNo ratings yet

- EXERCISE 54 - Sentences - Word ChoiceDocument4 pagesEXERCISE 54 - Sentences - Word ChoiceLéoKostasNo ratings yet

- Supervisor'S Report Folder (SRF) : Igcse Information and Communication Technology (Ict)Document4 pagesSupervisor'S Report Folder (SRF) : Igcse Information and Communication Technology (Ict)Drako 2001No ratings yet

- Assessment Criteria SheetDocument1 pageAssessment Criteria Sheetapi-237976105No ratings yet

- Cellphone PresentationDocument14 pagesCellphone PresentationRobbie Krishen VirwaniNo ratings yet

- Mock Exam Literary StreamDocument3 pagesMock Exam Literary Streammahmoud ababsaNo ratings yet

- Curriculum Vitae: Michael AmanDocument6 pagesCurriculum Vitae: Michael Amanlameck paulNo ratings yet

- Performance Appraisal Private Sectors Banks Roll No 11Document40 pagesPerformance Appraisal Private Sectors Banks Roll No 11pareshgholapNo ratings yet

- Developmental Lesson Plan: BookletDocument8 pagesDevelopmental Lesson Plan: Bookletapi-547208974No ratings yet

- Annex 5 1 Planning Worksheet Access QualityDocument2 pagesAnnex 5 1 Planning Worksheet Access QualityALMA AGOYLONo ratings yet