Professional Documents

Culture Documents

Vesuvius India: Performance Highlights

Vesuvius India: Performance Highlights

Uploaded by

Angel BrokingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vesuvius India: Performance Highlights

Vesuvius India: Performance Highlights

Uploaded by

Angel BrokingCopyright:

Available Formats

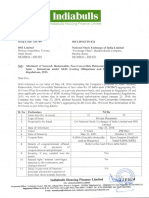

3QCY2012 Result Update | Capital Goods

November 5, 2012

Vesuvius India

Performance Highlights

Y/E December (` cr) Net sales EBITDA EBITDA margin (%) Adjusted PAT

Source: Company, Angel Research

NEUTRAL

CMP Target Price

% chg (yoy) (4.5) (2.1) 45bp (4.0) 2QCY12 139 22 16.1 13 % chg (qoq) (5.2) 9.1 243bp 11.3

`341 -

3QCY12 132 25 18.6 14

3QCY11 138 25 18.1 15

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others Abs. (%) Sensex VESUVIUS 3m 7.8 1yr 6.8

Cap Goods 693 (22) 0.7 464/305 3,363 10 18,763 5,704 VESU.BO VI@IN

For 3QCY2012, Vesuvius India Ltd (VIL) reported a 4.5% yoy decline in its revenue to `132cr. The EBITDA margin expanded marginally by 45bp yoy to 18.6% on account of decline in raw material expense, while on a sequential basis, the EBITDA margin expanded by 243bp from 16.1% in 2QCY2012 owing to a 16% decline in other expenses. The net profit declined a tad by 4.0% yoy to `14cr from `15cr in 3QCY2011. Demand outlook bleak, operating performance improves: We expect the company to face short-term pressures on the volume front due to weak demand. Raw material cost continues to show some relief, which coupled with decreased other expenses lead to a sequential improvement in operating performance. We expect raw material prices to remain stable at these levels; however employee expense (as percentage of net sales) is expected to increase. The net profit is expected to see a dip in CY2012E and then recover in CY2013E. Outlook and valuation: We expect VIL to post a 4.3% CAGR revenue growth over CY2011-13E due to weak demand while the EBITDA margin is expected to contract marginally by 41bp over CY2011-13E from 17.4% in CY2011 to 17.0% in CY2013E, owing to relatively higher operating expenses. The net profit is expected to decline in CY2012E to `51cr from `55cr in CY2011 and recover to `56cr by CY2013E. At the current market price, the stock is trading at a PE of 12.4x its CY2013E earnings and P/BV of 1.8x for CY2013E. Considering higher valuations, we recommend a Neutral view on the stock.

55.6 15.7 10.8 17.9 3yr 16.8

(6.8) (13.1) 118.8

Key financials

Y/E December (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoIC (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

CY2010 440 21.7 49 29.3 18.7 23.9 14.3 2.7 20.8 43.9 1.4 7.8

CY2011 540 22.8 55 13.7 17.4 27.2 12.5 2.3 20.1 40.6 1.2 6.8

CY2012E 549 1.6 51 (7.2) 16.6 25.2 13.5 2.1 16.1 32.6 1.1 6.8

CY2013E 587 6.9 56 9.0 17.0 27.5 12.4 1.8 15.5 31.4 1.0 6.1

Shareen Batatawala

+91- 22- 3935 7800 Ext: 6849 shareen.batatawala@angelbroking.com

Please refer to important disclosures at the end of this report

Vesuvius India | 3QCY2012 Result Update

Exhibit 1: 3QCY2012 performance

Y/E December (` cr) Net Sales Net raw material (% of Sales) Staff Costs (% of Sales) Other Expenses (% of Sales) Total Expenditure EBITDA EBITDA margin (%) Interest Depreciation Other Income PBT (% of Sales) Tax (% of PBT) Reported PAT PATM (%) Equity capital (cr) EPS (`)

Source: Company, Angel Research

3QCY12 132 73 54.9 9 6.7 26 19.9 108 25 18.6 0 4 0.3 21 15.7 7 32.5 14 10.6 20 6.9

3QCY11 138 76 55.3 8 5.8 29 20.8 113 25 18.1 (0) 4 0.0 21 15.4 7 31.8 15 10.5 20 7.2

yoy chg (%) (4.5) (5.2) 10.0 (8.9) (5.0) (2.1) 45bp 3.3 (3.0) (0.9) (4.0)

2QCY12 139 77 55.1 9 6.3 31 22.5 117 22 16.1 0 4 0.3 19 13.4 6 32.5 13 9.0 20

qoq chg (%) (5.2) (5.5) 0.3 (16.1) (7.9) 9.1 243bp (2.6) 11.3 11.3 11.3

9MCY12 410 229 55.8 26 6.4 88 21.4 343 67 16.4 0 12 1 56 13.8 18 32.5 38 9.3 20

9MCY11 395 217 54.8 23 5.9 80 20.2 320 75 19.1 (1) 11 0 66 16.6 21 31.6 45 11.4 20 22.1

% chg 3.8 5.7 13.0 9.6 7.2 (10.7) (266)bp 14.6 12.6 (11.7) (15.1)

(4.0)

6.2

11.3

18.8

(15.1)

Exhibit 2: Actual vs. Angel estimates (3QCY2012)

Actual (` cr) Total Income EBITDA EBITDA margin (%) Adjusted PAT

Source: Company, Angel Research

Estimate (` cr) 140 24 17.4 14

Var (%) (5.8) 0.7 120bp 2.3

132 25 18.6 14

Top-line below estimate, EBITDA margin surprises positively

For 3QCY2012, VIL reported a top-line of `132cr, 5.8% below our estimate of `140cr owing to a weak demand scenario. However, lower-than-expected other expenses led to expansion of EBITDA margin by 243bp qoq vis--vis our expectation of 17.4%. As a result, the net profit for the quarter stood at `14cr marginally higher than our expectation.

November 5, 2012

Vesuvius India | 3QCY2012 Result Update

Investment rationale

WSA further reduces steel consumption estimates- concerns persist

About 75% of the total refractories are consumed in the iron and steel industry. Indias steel consumption reported a sluggish growth of 5.5% in CY2011 vs an estimate of 13.3% by the World Steel Association (WSA). Following this, WSA revised its consumption estimates for CY2012 to 6.9% in April 2012, which were further reduced to 5.5% in October 2012. However, WSAs steel consumption growth estimate for India still stands higher than most other developed as well as developing countries. Thus, refractory consumption is expected to grow, but at a relatively slower pace on account of reduced steel demand.

Exhibit 3: Country-wise steel consumption estimates (WSA)

5.5 5.2

NAFTA 8 4 2 0

Growth (%)

2.2

2.5

(0.6)

(4) (6) (8)

(1.2)

(2)

Japan

EU

(5.6)

China

CIS

0.8

Central & South America

3.8

4.0

4.1

6.8

CY2012E (April 2012)

Source: WSA, Angel Research

CY2012E (Oct 2012)

New capacity to replace imports, but with a lag

Imports constitute 25-30% of the refractory industry wherein a majority of the imports are from China. Stagnation in domestic consumption due to increased refractory life cycle in the critical areas of steel making process has led to low capacity utilization at ~60%, thus leading to a substantial unutilized capacity. Also, ~15% additional capacities are expected to be operational by CY2012E. Besides, VIL has also acquired 15acres of land in Visakhapatnam for setting up its proposed fifth plant.

Exhibit 4: Capacity expansion for major players (MT)

Expansion

VIL IFGL Tata Refractories Total capacity

Source: Company

2010

622,500 800,000 250,760

New capacity

155,900 84,000 36,000

6.9

India

2012E

778,400 884,000 286,760 1,949,160

1,673,260

November 5, 2012

7.5

10

Vesuvius India | 3QCY2012 Result Update

We expect new capacities to contribute to the industry post improvement in capacity utilization to higher levels. This would lead to a decrease in the imports market share for refractories.

Exhibit 5: Refractory import market share to reduce (India)

45 40 35

(%)

42.2

30 25 20 15

29.3 24.0

28.2

27.3

26.5

CY08

CY09

CY10

CY11

CY12E

CY13E

Refractory imports marketshare

Source: Company, Angel Research

Strong balance sheet favors return ratios

VIL being a debt free company had a RoIC of 40.6% for CY2011. Since the company has completed its expansion, no major capex is required in the short term. Hence, we expect the cash reserves to increase to `87cr by CY2013E from `54cr in CY2011. VIL is expected to have a RoIC of 31.4% in CY2013E.

November 5, 2012

Vesuvius India | 3QCY2012 Result Update

Financials

Exhibit 6: Key assumptions

CY2012E Change in refractory volume sales Change in MRP of refractories

Source: Angel Research

CY2013E 6.2 1.0

(4.1) 3.0

Exhibit 7: Change in estimates

Y/E March Net sales (` cr) OPM (%) EPS (`)

Source: Angel Research

Earlier estimates CY2012E 560 16.1 24.7 CY2013E 611 17.0 28.8

Revised estimates CY2012E 549 16.6 25.2 CY2013E 587 17.0 27.5

% chg CY2012E (2.0) 49bp 2.3 CY2013E (3.9) (5)bp (4.3)

Slowdown in steel industry to restrain revenue growth

WSAs continuous downward revision for steel demand is an indication of slowdown in the industry. Hence, we expect a decline in demand for refractories, thus leading to a mere 4.3% CAGR revenue growth over CY2011-13E. Revenue for 9MCY2012 has witnessed the impact of demand slowdown with marginal sales growth. We expect the sluggishness to continue going forward with gradual recovery from CY2013E.

Exhibit 8: Slowdown in revenue growth in 9MCY2012

160 24.1 120 21.7 23.2 30 25 20

Exhibit 9: Revenue growth to improve gradually

700 600 500 21.7 22.8 30 25 20

(` cr)

10 0.7 139 2QCY12 132 3QCY12 5 1.8 0 (5) 2QCY11 3QCY11 4QCY11 1QCY12 Revenue (LHS) yoy growth (RHS)

300 200 100 0 CY2008 CY2009 CY2010 CY2011 CY2012E CY2013E Revenue (LHS) Revenue growth (RHS) 353 10.4 6.9 362 2.5 440 540 549 1.6 587

40 137 0 138 148 139

10 5 0

1.8

Source: Company, Angel Research

Source: Company, Angel Research

November 5, 2012

(%)

80

(` cr)

15

(%)

400

15

Vesuvius India | 3QCY2012 Result Update

Higher operational cost to impact EBITDA margin

Raw material cost which constitutes ~55% of the total cost was a major contributor in impacting EBITDA margin to sub 15% levels in 4QCY2011 and 1QCY2012 in comparison to more than 18% levels historically. However, recent fall in raw material prices along with decrease in other expenses led to a recovery in the EBITDA margin during the quarter. We expect raw material prices to stabilize at these levels, but the commencement of the expanded facility has led to an increase in employee cost. Hence, we expect the EBITDA margin to contract in CY2012E to 16.6% and recover to 17.0% in CY2013E.

Exhibit 10: Margin recovery on lower operational cost

30 25 20 18.3 18.1 18.6 19 18 17

Exhibit 11: EBITDA margin to recover in CY2013E

120 100 80 18.7 17.7 17.4 16.6 19 18 17.0 17

(` cr)

(` cr)

16.1 14.8 14.6 25 0 2QCY11 3QCY11 4QCY11 1QCY12 2QCY12 3QCY12 EBITDA (LHS) EBITDA margin (RHS) 25 22 20 22 25 13

(%)

15 10 5

16 15 14

40 20 53 0

15.0

15 14 64 CY2009 82 CY2010 94 CY2011 91 CY2012E 100 13 CY2013E

CY2008

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Net profit to rebound in CY2013E

Considering the impact of demand slowdown and margin pressure, we expect the net profit to decline to `51cr in CY2012E and recover in CY2013E to `56cr.

Exhibit 12: Profit to recover at CY2011 level

60 50 40

(` cr)

40 29.3 18.8 30 20 13.7 9.0 10 0 32 (3.9) 38 CY2009 49 CY2010 PAT (LHS) 55 CY2011 51 (7.2) CY2012E 56 CY2013E (10)

(%)

30 20 10 0

CY2008

PAT growth (RHS)

Source: Company, Angel Research

November 5, 2012

(%)

60

16

Vesuvius India | 3QCY2012 Result Update

Outlook and valuation

We have revised our revenue and earnings estimates for CY2012E and CY2013E marginally downwards on the back of slowdown in steel demand which is impacting refractory demand. At current levels, the stock is trading at a PE of 12.4x its CY2013E earnings and P/BV of 1.8x for CY2013E. Given the higher valuations and weak demand in steel industry, we recommend a Neutral view on the stock.

Exhibit 13: One year forward P/E band

500 400 300

Exhibit 14: One year forward P/E chart

20 16 12

(`)

(x)

200 100 0 Nov-07 8 4 0 Nov-07 Nov-08 Price Nov-09 5x Nov-10 8x 11x Nov-11 14x Nov-12

Nov-08

Nov-09

Nov-10 PE

Nov-11

Nov-12

Median PE (5 yr)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 15: Relative valuation

Year end IFGL Refractor Vesuvius India

Source: Company

TTM ended June12 TTM ended Sept12

Sales (` cr) 651 559

OPM (%) 12.1 16.4

PAT (` cr) 41 51

EPS (`) 12 25

ROE (%) 32.3 16.0

P/E (x) 4.0 13.5

P/BV (x) 1.3 2.1

EV/ Sales (x) 0.2 1.2

EV/ EBITDA (x) 1.8 7.3

Risks

Slowdown in steel industry: VIL is a manufacturer of refractories, which has major application (~75% of total production) in the iron and steel industry. Slowdown in steel demand has a direct impact on refractory demand. Underperformance in the steel industry may be a cause for declining demand of refractories, thus affecting the company.

November 5, 2012

Vesuvius India | 3QCY2012 Result Update

Profit & Loss Statement

Y/E December (` cr) Gross sales Less: Excise duty Net Sales Other operating income Total operating income % chg Net Raw Materials Other Mfg costs Personnel Other Total Expenditure EBITDA % chg (% of Net Sales) Depreciation EBIT % chg (% of Net Sales) Interest & other charges Other Income (% of Net Sales) PBT % chg Tax (% of PBT) PAT (reported) Extraordinary (Exp)/Inc. ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg CY2009

384 22 362 362 2.5 198 46 21 32 298 64 20.9 17.7 13 51 15.9 14.2 1 6 1.5 56 17.4 19 33 37 (0) 38 18.8 10.4 18.5 18.5 18.8

CY2010

473 33 440 440 21.7 242 59 25 32 358 82 28.5 18.7 13 69 35.1 15.7 1 6 1.5 75 33.6 26 35 49 0 49 29.3 11.0 23.9 23.9 29.3

CY2011

581 40 540 540 22.8 307 73 30 37 446 94 14.4 17.4 15 79 14.6 14.7 1 5 0.9 83 10.6 27 33 55 55 13.7 10.2 27.2 27.2 13.7

CY2012E

587 38 549 549 1.6 308 77 35 38 458 91 (2.9) 16.6 16 75 (5.6) 13.6 2 0.3 76 (7.5) 25 33 51 51 (7.2) 9.3 25.2 25.2 (7.2)

CY2013E

628 41 587 587 6.9 331 80 36 41 487 100 9.2 17.0 18 82 9.0 13.9 2 0.3 83 9.0 28 33 56 56 9.0 9.5 27.5 27.5 9.0

November 5, 2012

Vesuvius India | 3QCY2012 Result Update

Balance Sheet

Y/E December (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Deferred Tax Liability (Net) Other Long Term Liabilities Long Term Provisions Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Long Term loans and adv. Other long term assets Current Assets Cash Loans & Advances Inventory Debtors Other current assets Current liabilities Net Current Assets Misc. Exp. not written off Total Assets 161 79 82 21 193 55 11 29 98 77 115 218 181 90 92 20 373 56 164 38 116 226 147 259 207 99 109 30 181 1 270 54 15 48 149 3 109 161 482 239 115 123 20 184 1 299 72 16 56 151 3 105 193 521 262 133 129 20 197 1 331 87 17 63 162 4 113 219 565 20 193 213 5 218 20 233 253 6 259 20 278 298 6 177 482 20 317 337 6 177 521 20 361 381 6 177 565 CY2009 CY2010 CY2011 CY2012E CY2013E

November 5, 2012

Vesuvius India | 3QCY2012 Result Update

Cash Flow Statement

Y/E December (` cr) Profit before tax Depreciation Change in Working Capital Direct taxes paid Other income Others Cash Flow from Operations (Inc.)/Dec. in Fixed Assets (Inc.)/Dec. in Investments (Incr)/Decr. in L.T loans & adv Other income Others Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances CY2009 56 13 32 (19) (6) (4) 73 (37) 6 8 (23) (9) 5 (4) 45 9 55 CY2010 75 13 (31) (26) (6) 6 31 (19) 6 (8) (21) (9) 1 (9) 1 55 56 CY2011 83 15 (16) (27) (5) (4) 45 (37) (182) 5 174 (40) (10) 2 (8) (2) 56 54 CY2012E 76 16 (14) (25) (2) 52 (21) (3) 2 (22) (12) (12) 18 54 72 CY2013E 83 18 (11) (28) (2) 61 (24) (13) 2 (35) (12) (12) 15 72 87

November 5, 2012

10

Vesuvius India | 3QCY2012 Result Update

Key Ratios

Y/E December Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover Inventory / Sales (days) Receivables (days) Payables (days) WC (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (0.3) (0.9) 61.0 (0.2) (0.7) 80.5 (0.2) (0.6) 62.4 (0.2) (0.8) (0.2) (0.9) 2.2 11 99 95 61 2.4 8 96 231 75 2.6 8 101 89 72 2.3 10 101 70 81 2.2 10 101 70 82 25.1 33.8 18.9 29.0 43.9 20.8 21.4 40.6 20.1 14.9 32.6 16.1 15.0 31.4 15.5 14.2 0.7 2.5 24.0 (0.3) 15.7 0.7 2.4 24.7 (0.2) 14.7 0.7 1.4 13.3 (0.2) 13.6 0.7 1.3 11.7 (0.2) 13.9 0.7 1.3 11.9 (0.2) 18.5 18.5 24.8 3.7 105.1 23.9 23.9 30.3 4.0 124.6 27.2 27.2 34.4 4.3 146.9 25.2 25.2 33.4 5.0 166.2 27.5 27.5 36.4 5.0 187.9 18.4 6.8 3.2 1.1 1.8 10.0 2.9 14.3 5.5 2.7 1.2 1.4 7.8 2.5 12.5 4.9 2.3 1.2 1.2 6.8 1.3 13.5 10.2 2.1 1.5 1.1 6.8 1.2 12.4 9.4 1.8 1.5 1.0 6.1 1.1 CY2009 CY2010 CY2011 CY2012E CY2013E

November 5, 2012

11

Vesuvius India | 3QCY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Vesuvius India Ltd. No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

November 5, 2012

12

You might also like

- Cooperative Banking ProjectDocument53 pagesCooperative Banking ProjectselvamNo ratings yet

- Valuing Financial Services FirmsDocument20 pagesValuing Financial Services Firmsgargrahul20004612No ratings yet

- 0000 AA - 2 Certified Coupon Bond For The WebDocument1 page0000 AA - 2 Certified Coupon Bond For The WebComeBack100% (4)

- Cooperatives Republic Act No. 9520 Philippine Cooperative Code of 2008Document60 pagesCooperatives Republic Act No. 9520 Philippine Cooperative Code of 2008xinfamousxNo ratings yet

- Ceat Result UpdatedDocument11 pagesCeat Result UpdatedAngel BrokingNo ratings yet

- Kalyani Steel LimitedDocument26 pagesKalyani Steel LimitedSHREEYA BHATNo ratings yet

- Optimization of Tap Hole Concept in JSPL BFDocument9 pagesOptimization of Tap Hole Concept in JSPL BFSaumit PalNo ratings yet

- CEAT Annual Report 2019Document5 pagesCEAT Annual Report 2019Roberto GrilliNo ratings yet

- TQU 7th AprilDocument12 pagesTQU 7th AprilnarnoliaNo ratings yet

- Tata Steel Sustainability Repor 2015Document98 pagesTata Steel Sustainability Repor 2015AkanshaNo ratings yet

- Chapter 6 PDFDocument102 pagesChapter 6 PDFOscar Espinosa BonillaNo ratings yet

- GGSPL Corporate PresentationDocument10 pagesGGSPL Corporate PresentationpduvvuriNo ratings yet

- Accenture Gas Grows UpDocument32 pagesAccenture Gas Grows Upadibella77No ratings yet

- 26 Eu BCG ReportDocument49 pages26 Eu BCG ReportSiddharth ModiNo ratings yet

- M.rigaud Aluminaandmagnesia BasedcastablescontaininggraphiteDocument15 pagesM.rigaud Aluminaandmagnesia BasedcastablescontaininggraphiteBagas Prasetyawan Adi NugrohoNo ratings yet

- PT. Mirae Asset Sekuritas Indonesia - Initiation Report PDFDocument75 pagesPT. Mirae Asset Sekuritas Indonesia - Initiation Report PDFLia HafizaNo ratings yet

- Aidan Singh ReportDocument25 pagesAidan Singh ReportGolyanShubhamNo ratings yet

- Nomura Hong Kong Property 120213Document16 pagesNomura Hong Kong Property 120213dickersonwtsNo ratings yet

- AltaCorp PDFDocument4 pagesAltaCorp PDFzNo ratings yet

- R&D Roadmap Blast FurnaceDocument37 pagesR&D Roadmap Blast FurnaceVishal JainNo ratings yet

- Presented by Mohammed Fajis Mahesh M Narmatha Devi V.PDocument20 pagesPresented by Mohammed Fajis Mahesh M Narmatha Devi V.Pmahy_1986No ratings yet

- Mahindra and Mahindra Q1FY13Document4 pagesMahindra and Mahindra Q1FY13Kiran Maruti ShindeNo ratings yet

- Jordan Telecom 04jan11Document26 pagesJordan Telecom 04jan11papuNo ratings yet

- Effect of Reclaimed Bauxite On Andalusite-Based Refractory Castable For Tundish ApplicationsDocument12 pagesEffect of Reclaimed Bauxite On Andalusite-Based Refractory Castable For Tundish ApplicationssajjadNo ratings yet

- Goodpack LTDDocument3 pagesGoodpack LTDventriaNo ratings yet

- Initiation - Comment Seadrill Limited: Initiating Coverage of SeadrillDocument25 pagesInitiation - Comment Seadrill Limited: Initiating Coverage of SeadrillocrandallNo ratings yet

- BARCLAYS Global Energy OutlookDocument154 pagesBARCLAYS Global Energy OutlookMiguelNo ratings yet

- Anchoring Effect in Making DecisionDocument11 pagesAnchoring Effect in Making DecisionSembilan Puluh DuaNo ratings yet

- Ame Research Thesis 11-13-2014Document890 pagesAme Research Thesis 11-13-2014ValueWalkNo ratings yet

- Atmosphere FurnacesDocument4 pagesAtmosphere Furnacesumairgul841100% (1)

- 2 5391242927911474276Document38 pages2 5391242927911474276مرتضى حامد كاظم رحيمNo ratings yet

- Carbon Negative: A Primer On Vertical Integration of CCUS / DAC With Oil & GasDocument47 pagesCarbon Negative: A Primer On Vertical Integration of CCUS / DAC With Oil & GasDanielNo ratings yet

- High Capacity Ship Unloading: Nordströms SiwertellDocument42 pagesHigh Capacity Ship Unloading: Nordströms SiwertelllehuylapNo ratings yet

- WALMART Visit Us at Management - UmakantDocument54 pagesWALMART Visit Us at Management - Umakantwelcome2jungleNo ratings yet

- MSFL - Inflation Aug'11Document4 pagesMSFL - Inflation Aug'11Himanshu KuriyalNo ratings yet

- Fresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Document10 pagesFresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Vidhi MehtaNo ratings yet

- Cannacord - RKHDocument17 pagesCannacord - RKHShane ChambersNo ratings yet

- Oil & Gas Valuation Case Study: Ultra Petroleum (UPL) and Its Acquisition of The Uinta Basin Acreage - SHORT Recommendation Notes and DisclaimersDocument21 pagesOil & Gas Valuation Case Study: Ultra Petroleum (UPL) and Its Acquisition of The Uinta Basin Acreage - SHORT Recommendation Notes and DisclaimersihopethisworksNo ratings yet

- Lunch With Dave: David A. RosenbergDocument18 pagesLunch With Dave: David A. Rosenbergwinstonchen5No ratings yet

- ERP and Steel IndustryDocument11 pagesERP and Steel IndustrySumar LoombaNo ratings yet

- Barclays-Infosys Ltd. - The Next Three Years PDFDocument17 pagesBarclays-Infosys Ltd. - The Next Three Years PDFProfitbytesNo ratings yet

- Oilsands EmergerDocument200 pagesOilsands EmergerTed RennerNo ratings yet

- Euro Themes - SpainDocument22 pagesEuro Themes - SpainGuy DviriNo ratings yet

- VT-SAIL Abhishek ShrivastavaDocument105 pagesVT-SAIL Abhishek ShrivastavaCHINMAYA BHURE0% (1)

- European Metals and Mining ... 280513Document47 pagesEuropean Metals and Mining ... 280513Guy DviriNo ratings yet

- Feasibility of Expanding The Use of Steel Slag As A Concrete Pavement AggregateDocument204 pagesFeasibility of Expanding The Use of Steel Slag As A Concrete Pavement Aggregatepma1motorsport motorsportNo ratings yet

- Wildcat 9 CHENDocument18 pagesWildcat 9 CHENitccpvfzkNo ratings yet

- Anchor Report Indonesia Outlook 2013 - Coming Out From TheDocument130 pagesAnchor Report Indonesia Outlook 2013 - Coming Out From Thesathiaseelans5356No ratings yet

- Positioning For A Liquidity Drain: U.S. Interest Rates Outlook 2010Document108 pagesPositioning For A Liquidity Drain: U.S. Interest Rates Outlook 2010zacchariahNo ratings yet

- Basic Oxygen Steelmaking Converter LivesDocument16 pagesBasic Oxygen Steelmaking Converter LivesBagas Prasetyawan Adi NugrohoNo ratings yet

- Study On Supply Chain Management at Visakhapatnam Steelplant (Rinl), VizagDocument76 pagesStudy On Supply Chain Management at Visakhapatnam Steelplant (Rinl), VizagSahil GouthamNo ratings yet

- BP Stats Review 2020 All DataDocument204 pagesBP Stats Review 2020 All DataAdriana FrancoNo ratings yet

- Sty MatDocument7 pagesSty Matsonalisabir100% (1)

- ACB - JP MorganDocument23 pagesACB - JP MorganNam Phuong DangNo ratings yet

- Pershing Square 1Q17 Shareholder Letter May 11 2017 PSHDocument11 pagesPershing Square 1Q17 Shareholder Letter May 11 2017 PSHmarketfolly.comNo ratings yet

- Bonding of mgOC Brick by Catalytically Activated ResinDocument4 pagesBonding of mgOC Brick by Catalytically Activated ResinBagas Prasetyawan Adi NugrohoNo ratings yet

- ArcelorMittal - Fact Book 2011Document110 pagesArcelorMittal - Fact Book 2011Ayam Zeboss100% (1)

- LF MgoDocument9 pagesLF Mgoneetika tiwariNo ratings yet

- In For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Document31 pagesIn For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Doshi VaibhavNo ratings yet

- Coal India: Performance HighlightsDocument10 pagesCoal India: Performance HighlightsAngel BrokingNo ratings yet

- Abbott India: Performance HighlightsDocument11 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- Abbott India: Performance HighlightsDocument13 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- Jyoti Structures: Performance HighlightsDocument12 pagesJyoti Structures: Performance HighlightsAngel BrokingNo ratings yet

- IVRCL Infrastructure: Performance HighlightsDocument12 pagesIVRCL Infrastructure: Performance HighlightsAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- Allotment of NCD's (Company Update)Document2 pagesAllotment of NCD's (Company Update)Shyam SunderNo ratings yet

- Unit III-Leasing and Hire PurchaseDocument50 pagesUnit III-Leasing and Hire PurchaseAkashik GgNo ratings yet

- Law On Sales Practice SetDocument32 pagesLaw On Sales Practice SetChester CariitNo ratings yet

- A Study On Financial Performance of Oil and Natural Gas Corporation ( (1) - OriginalDocument105 pagesA Study On Financial Performance of Oil and Natural Gas Corporation ( (1) - OriginalGupta AbhishekNo ratings yet

- Housing PoliciesDocument456 pagesHousing PoliciesDarci BestNo ratings yet

- Metrobank Vs BA Finance CorpDocument11 pagesMetrobank Vs BA Finance CorpWalter FernandezNo ratings yet

- SAP FICO QuestionnaireDocument7 pagesSAP FICO QuestionnaireSambhaji50% (2)

- Apllied Auditing Q&ADocument10 pagesApllied Auditing Q&APeterJorgeVillarante100% (2)

- AccaDocument3 pagesAccaVinitha VenuNo ratings yet

- EPWnovDocument81 pagesEPWnovRahul SharmaNo ratings yet

- Jaguar Land Rover Acquisition Part 1Document12 pagesJaguar Land Rover Acquisition Part 1Ankur Dinesh PandeyNo ratings yet

- Central Bank of Sri Lanka - Direction For Non Bank Financial InstitutionsDocument272 pagesCentral Bank of Sri Lanka - Direction For Non Bank Financial InstitutionsajsihsanNo ratings yet

- Margin TradingDocument11 pagesMargin TradingAvi RajNo ratings yet

- On Credit CardDocument31 pagesOn Credit Cardoureducation.in100% (1)

- Bar Qs NegoDocument3 pagesBar Qs NegoAra Princess OlamitNo ratings yet

- Q&A - 300+ Finance Interview Questions Leverage Academy ForumDocument21 pagesQ&A - 300+ Finance Interview Questions Leverage Academy Forumsaw4321No ratings yet

- Core Bank in Axis BankDocument24 pagesCore Bank in Axis BankNatasha MistryNo ratings yet

- Agriland Funding: Made By:-Pinki Gaur Sapna YadavDocument9 pagesAgriland Funding: Made By:-Pinki Gaur Sapna YadavPuja GaurNo ratings yet

- Sakala Janula Samme GODocument5 pagesSakala Janula Samme GOvenudreamerNo ratings yet

- SVIXDocument65 pagesSVIXLeoEuler12No ratings yet

- Balance SheetDocument1 pageBalance SheetMCOM 2050 MAMGAIN RAHUL PRASADNo ratings yet

- Part 1-3Document15 pagesPart 1-3Christina AureNo ratings yet

- Study of Equipment Prices in The Power SectorDocument121 pagesStudy of Equipment Prices in The Power Sector이주성100% (1)

- Filing From Bondurant's Landlord, The Sun Marina Valley Development CorporationDocument8 pagesFiling From Bondurant's Landlord, The Sun Marina Valley Development CorporationStefNo ratings yet

- 15-10458 - Solid Foundation Rev Memo PDFDocument2 pages15-10458 - Solid Foundation Rev Memo PDFRecordTrac - City of OaklandNo ratings yet

- Difference Between Withholding Taxes and Extended TaxesDocument2 pagesDifference Between Withholding Taxes and Extended Taxesrohit12345aNo ratings yet