Professional Documents

Culture Documents

05 SpecialPurposeCompany SPE 12052012

05 SpecialPurposeCompany SPE 12052012

Uploaded by

tucano8997jOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05 SpecialPurposeCompany SPE 12052012

05 SpecialPurposeCompany SPE 12052012

Uploaded by

tucano8997jCopyright:

Available Formats

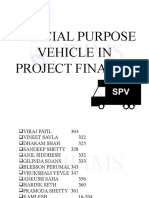

SPECIALPURPOSEENTITY

Page1of3

SPECIALPURPOSEENTITY Aspecialpurposeentity(SPE;or,especiallyinEurope,specialpurposevehicle/SPV,inIrelandFVCfinancial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited partnership)createdtofulfilnarrow,specificortemporaryobjectives. SPEsaretypicallyusedbycompaniestoisolatethefirmfromfinancialrisk. AcompanywilltransferassetstotheSPEformanagementorusetheSPEtofinancealargeprojectthereby achievinganarrowsetofgoalswithoutputtingtheentirefirmatrisk. SPEs are also commonly used in complex financings to separate different layers of equity infusion. In addition,theyarecommonlyusedtoownasingleassetandassociatedpermitsandcontractrights(suchas anapartmentbuildingorapowerplant),toallowforeasiertransferofthatasset. Moreover,theyareanintegralpartofpublicprivatepartnershipscommonthroughoutEuropewhichrelyon aprojectfinancetypestructure. Aspecialpurposeentitymaybeownedbyoneormoreotherentitiesandcertainjurisdictionsmayrequire ownershipbycertainpartiesinspecificpercentages. OftenitisimportantthattheSPEnotbeownedbytheentityonwhosebehalftheSPEisbeingsetup(the sponsor). For example, in the context of a loan securitization, if the SPE securitisation vehicle were owned or controlledbythebankwhoseloansweretobesecured,theSPEwouldbeconsolidatedwiththerestofthe bank's group for regulatory, accounting, and bankruptcy purposes, which would defeat the point of the securitisation. ThereforemanySPEsaresetupas'orphan'companieswiththeirsharessettledoncharitabletrustandwith professional directors provided by an administration company to ensure that there is no connection with thesponsor.

SOMEOFTHEREASONSFORCREATINGSPECIALPURPOSEENTITIES SPEsarecommonlyusedtosecuritiseloans(orotherreceivables).Forexample,abankmaywishtoissuea mortgagebackedsecuritywhosepaymentscomefromapoolofloans.However,toensurethattheholders ofthemortgagebacksecuritieshavethefirstpriorityrighttoreceivepaymentsontheloans,theseloans needtobelegallyseparatedfromtheotherobligationsofthebank.ThisisdonebycreatinganSPE,and thentransferringtheloansfromthebanktotheSPE. Risksharing:CorporatesmayuseSPEstolegallyisolateahighriskproject/assetfromtheparentcompany andtoallowotherinvestorstotakeashareoftherisk. Finance:MultitieredSPEsallowmultipletiersofinvestmentanddebt. Asset transfer: Many permits required to operate certain assets (such as power plants) are either non transferableordifficulttotransfer.ByhavinganSPEowntheassetandallthepermits,theSPEcanbesold asaselfcontainedpackage,ratherthanattemptingtoassignovernumerouspermits. Forcompetitivereasons:Forexample,whenIntelandHewlettPackardstarteddevelopingIA64(Itanium) processor architecture, they created a special purpose entity which owned the intellectual technology behind the processor. This was done to prevent competitors like AMD accessing the technology through preexistinglicensingdeals. Financialengineering:SPEsareoftenusedinfinancialengineeringschemeswhichhave,astheirmaingoal, theavoidanceoftaxorthemanipulationoffinancialstatements. Regulatory reasons: A special purpose entity can sometimes be set up within an orphan structure to circumventregulatoryrestrictions,suchasregulationsrelatingtonationalityofownershipofspecificassets.

Page2of3

Propertyinvesting:Somecountrieshavedifferenttaxratesforcapitalgainsandgainsfrompropertysales. For tax reasons, letting each property be owned by a separate company can be a good thing. These companies can then be sold and bought instead of the actual properties, effectively converting property salegainsintocapitalgainsfortaxpurposes.

ESTABLISHMENTOFASPE Likeacompany,anSPEmusthavepromoter(s)orsponsor(s). Usually,asponsoringcorporationhivesoffassetsoractivitiesfromtherestofthecompanyintoanSPE. Thisisolationofassetsisimportantforprovidingcomforttoinvestors. Theassetsoractivitiesaredistancedfromtheparentcompany;hencetheperformanceofthenewentity willnotbeaffectedbytheupsanddownsoftheoriginatingentity. TheSPEwillbesubjecttofewerrisksandthusprovidegreatercomforttothelenders. WhatisimportanthereisthedistancebetweenthesponsoringcompanyandtheSPE. Intheabsenceofadequatedistancebetweenthesponsorandthenewentity,thelatterwillnotbeanSPE butonlyasubsidiarycompany.

ACCOUNTINGGUIDANCE Under US GAAP, a number of accounting standards apply to SPEs, most notably FIN46R that sets out the consolidationtreatmentoftheseentities. ThereareanumberofotherstandardsthatapplytodifferenttransactionswithSPEs. UnderInternationalFinancialReportingStandards(IFRS),therelevantstandardisIAS27inconnectionwith theinterpretationofSIC12(ConsolidationSpecialPurposeEntities). TheIASBpublishedanexposuredraft(ED10)tomergebothregulations.

Page3of3

You might also like

- NPT-Pathfinder Course Chart - v2Document19 pagesNPT-Pathfinder Course Chart - v2divaamy4No ratings yet

- Mergers & AquisitionsDocument36 pagesMergers & AquisitionsJay KishanNo ratings yet

- Intellectual Property Securitization: Intellectual Property SecuritiesFrom EverandIntellectual Property Securitization: Intellectual Property SecuritiesRating: 5 out of 5 stars5/5 (1)

- Special Purpose Vehicle in Project Finance - Group 1-Batch 2Document10 pagesSpecial Purpose Vehicle in Project Finance - Group 1-Batch 2Blesson PerumalNo ratings yet

- OLI ParadigmDocument3 pagesOLI Paradigmsanjeev_kumar_133No ratings yet

- Questions CH 8Document5 pagesQuestions CH 8Anonymous Jf9PYY2E8No ratings yet

- C C C C: C C C CDocument3 pagesC C C C: C C C CSatish GoenkaNo ratings yet

- A Special Purpose EntityDocument3 pagesA Special Purpose Entitynayem_85No ratings yet

- Special Purpose EntityDocument4 pagesSpecial Purpose EntityRebel XNo ratings yet

- Special Purpose VehicleDocument3 pagesSpecial Purpose VehicleAkarsh GuptaNo ratings yet

- Special Purpose Vehicle in Project Finance - Group 1-Batch 2Document11 pagesSpecial Purpose Vehicle in Project Finance - Group 1-Batch 2Blesson PerumalNo ratings yet

- MULTINATIONAL FINANCE chp1Document22 pagesMULTINATIONAL FINANCE chp1Soninder KaurNo ratings yet

- Topic 2 Modes of International BusinessDocument5 pagesTopic 2 Modes of International BusinessBadhon KhanNo ratings yet

- Special Purpose VehiclesDocument2 pagesSpecial Purpose VehiclesSanthoshNo ratings yet

- Financial Analysis RevisionDocument5 pagesFinancial Analysis RevisionTosin YusufNo ratings yet

- FDIDocument24 pagesFDIAutumn FlowNo ratings yet

- Tutor Marked AssignmentDocument10 pagesTutor Marked Assignmentfarozeahmad100% (2)

- Modes of EntryDocument6 pagesModes of EntryHarini SugumarNo ratings yet

- Priva Te EqDocument34 pagesPriva Te EqRaksha KamatNo ratings yet

- Adv 1Document26 pagesAdv 1liyneh mebrahituNo ratings yet

- Fdi Without& With AllianceDocument10 pagesFdi Without& With AlliancemiarahmadinaNo ratings yet

- Legal EntityDocument3 pagesLegal EntityLemuel Angelo M. EleccionNo ratings yet

- Investment Entry Modes: Wholly Owned Subsidiaries, Joint Ventures, and Strategic AlliancesDocument8 pagesInvestment Entry Modes: Wholly Owned Subsidiaries, Joint Ventures, and Strategic AlliancesSang Ayu JuniariNo ratings yet

- Benedetta L. Romani Francesco Fiocchetti Gennaro Pengue Flavia Guagliardo Adriano PisculliDocument34 pagesBenedetta L. Romani Francesco Fiocchetti Gennaro Pengue Flavia Guagliardo Adriano PiscullivenvaniNo ratings yet

- PCC Assignment 5 P2270410.Document4 pagesPCC Assignment 5 P2270410.p2270304No ratings yet

- Chapter 12,13 & 14Document2 pagesChapter 12,13 & 14Javier CuadraNo ratings yet

- Private Equity NotesDocument5 pagesPrivate Equity NotesSaad KundiNo ratings yet

- Mergers and AcquisitionDocument12 pagesMergers and AcquisitionJeswel RebatoNo ratings yet

- KK RiskyDocument5 pagesKK RiskyRiandika SusilaNo ratings yet

- (Cayman) Guide To Hedge Funds in The Cayman IslandsDocument29 pages(Cayman) Guide To Hedge Funds in The Cayman IslandsAlinRoscaNo ratings yet

- Tema 3. Collaborative StrategiesDocument7 pagesTema 3. Collaborative Strategiesot2023juantinNo ratings yet

- R R R R : Purposes For Establishing A Joint VentureDocument4 pagesR R R R : Purposes For Establishing A Joint VentureSaloni KediaNo ratings yet

- Foreign Direct InvestmentDocument14 pagesForeign Direct Investmentzenithflame.786No ratings yet

- M&a 1Document34 pagesM&a 1shirkeoviNo ratings yet

- Chapter 9 - Alternatives To M&ADocument29 pagesChapter 9 - Alternatives To M&AkiranaishaNo ratings yet

- Stocks and Bonds: Professionals Are Any Better Than You atDocument2 pagesStocks and Bonds: Professionals Are Any Better Than You atElaine MateoNo ratings yet

- Seven Strategies in GlobalisationDocument5 pagesSeven Strategies in Globalisationchetan.chavan2025mbaeNo ratings yet

- ICWIM - 004 Collective InvestmentsDocument28 pagesICWIM - 004 Collective InvestmentsMaher G. BazakliNo ratings yet

- Final - Welingkar - Private Equity CompaniesDocument60 pagesFinal - Welingkar - Private Equity Companiessam coolNo ratings yet

- International InvestmentDocument15 pagesInternational InvestmentVincent Bryan PazNo ratings yet

- Special Purpose Vehicle (SPV)Document10 pagesSpecial Purpose Vehicle (SPV)Daksh TayalNo ratings yet

- Project Finance Question Bank: 1) What Is Financial Appraisal? What Are The Factors To Be Considered For Preparing It?Document47 pagesProject Finance Question Bank: 1) What Is Financial Appraisal? What Are The Factors To Be Considered For Preparing It?Anvesha TyagiNo ratings yet

- Long Term Financing1 - MainDocument35 pagesLong Term Financing1 - MainnwahidaNo ratings yet

- M N ADocument66 pagesM N Amoshins3365No ratings yet

- Stock Market: Over-The-Counter (OTC) or Off-Exchange Trading Is Done Directly Between TwoDocument4 pagesStock Market: Over-The-Counter (OTC) or Off-Exchange Trading Is Done Directly Between TwoAli JumaniNo ratings yet

- Joint Venture: Formation of A Separate EntityDocument24 pagesJoint Venture: Formation of A Separate EntityRakib HossainNo ratings yet

- ECONOMIC Jargon: Moody's Corporation (Document5 pagesECONOMIC Jargon: Moody's Corporation (Raush PrashantNo ratings yet

- Assets Equity Enterprise: NorampacDocument15 pagesAssets Equity Enterprise: NorampacKanwar DeepNo ratings yet

- Chapter 5 DivestitureDocument12 pagesChapter 5 Divestituremansisharma8301No ratings yet

- Buổi 6 - Bài Tập Unit 2 NewDocument9 pagesBuổi 6 - Bài Tập Unit 2 Newdieulinhle2820030No ratings yet

- Private Company Mergers & AcquisitionDocument13 pagesPrivate Company Mergers & AcquisitionAsimNo ratings yet

- 2.8 External SourcesDocument21 pages2.8 External SourcesRosy GuptaNo ratings yet

- Introduction To Raising FinanceDocument22 pagesIntroduction To Raising FinanceAshok KumarNo ratings yet

- Topic 6 - Foreign Direct InvestmentDocument21 pagesTopic 6 - Foreign Direct Investmentahmadnurhanifs2No ratings yet

- Mergers and Acquisitions: Close (X)Document6 pagesMergers and Acquisitions: Close (X)Sunil PatelNo ratings yet

- International Business - Chapter 1Document35 pagesInternational Business - Chapter 1Rishi SinghNo ratings yet

- Note Subject Note Type Note Text Date: (Txlw/FdslwdowkdwlvqrwtxrwhgrqdsxeolfDocument1 pageNote Subject Note Type Note Text Date: (Txlw/FdslwdowkdwlvqrwtxrwhgrqdsxeolfObi LiNo ratings yet

- Basic: Joint Venture With Foreign Company (International Joint Venture)Document3 pagesBasic: Joint Venture With Foreign Company (International Joint Venture)Sachin ChawlaNo ratings yet

- B LawDocument3 pagesB LawJill WongNo ratings yet

- Investing Made Easy: Finding the Right Opportunities for YouFrom EverandInvesting Made Easy: Finding the Right Opportunities for YouNo ratings yet

- Tactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionFrom EverandTactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionNo ratings yet

- Allergan Case Question and AnswersDocument16 pagesAllergan Case Question and AnswersMallikharjuna Rao ChNo ratings yet

- Managing Interest Rate RiskDocument32 pagesManaging Interest Rate RiskHenry So E Diarko100% (1)

- GR 11 Accounting P1 (English) November 2022 Answer BookDocument9 pagesGR 11 Accounting P1 (English) November 2022 Answer BookDoryson CzzleNo ratings yet

- SS 3 CF CostOfCapitalDocument22 pagesSS 3 CF CostOfCapitalmanish guptaNo ratings yet

- Final PPT On Dow TheoryDocument21 pagesFinal PPT On Dow Theorypari0000100% (2)

- Chapter 06 Test BankDocument46 pagesChapter 06 Test BankShaochong WangNo ratings yet

- ch14 InvestmentsDocument45 pagesch14 InvestmentsKaren TacadenaNo ratings yet

- CAS 11 Midterm QuizDocument7 pagesCAS 11 Midterm QuizShariine BestreNo ratings yet

- Analysis of Financial StatementsDocument36 pagesAnalysis of Financial StatementsvasuuumNo ratings yet

- Quiz 12 (Bonds)Document1 pageQuiz 12 (Bonds)Panda ErarNo ratings yet

- Reillych08 10th Edition SMDocument14 pagesReillych08 10th Edition SMUYEN NGUYEN LE THUNo ratings yet

- Jinko Solar Equity ReportDocument12 pagesJinko Solar Equity ReportShayne RebelloNo ratings yet

- Assignment Sw#1 Mod3 Return & Risk Multiple Choice ADocument6 pagesAssignment Sw#1 Mod3 Return & Risk Multiple Choice AAra FloresNo ratings yet

- Banking and InsuranceDocument13 pagesBanking and InsuranceKiran Kumar50% (2)

- Chapter 9Document21 pagesChapter 9kumikooomakiNo ratings yet

- Financial MGMTDocument507 pagesFinancial MGMTRamasubramanian Venkateswaran100% (2)

- Financial Analysis of Britannia and DaburDocument8 pagesFinancial Analysis of Britannia and DaburBiplab MondalNo ratings yet

- BEML - Visit Update - Oct 14Document5 pagesBEML - Visit Update - Oct 14Pradeep RaghunathanNo ratings yet

- Latest Finance Project TopicsDocument42 pagesLatest Finance Project Topicsamjad khan0% (1)

- Introduction To Business CombinationDocument15 pagesIntroduction To Business CombinationDELFIN, LORENA D.No ratings yet

- Soal Special Edition Akuntansi Keuangan Menengah IIDocument2 pagesSoal Special Edition Akuntansi Keuangan Menengah IIZephyra ViolettaNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- Hongren - Chap 17 - Cost Allocation Joint Products ByProductsDocument29 pagesHongren - Chap 17 - Cost Allocation Joint Products ByProductsreynaatheoNo ratings yet

- Solutions - Conso For SMEsDocument6 pagesSolutions - Conso For SMEsJack HererNo ratings yet

- Currency PeggingDocument15 pagesCurrency PegginghimanilapasiaNo ratings yet

- ADM 401 (K) and ESOP For Salaried Employees: Required Disclosure InformationDocument13 pagesADM 401 (K) and ESOP For Salaried Employees: Required Disclosure InformationAnonymous pKu7M7bBpS0% (1)

- PBID Annual Report 2019Document166 pagesPBID Annual Report 2019rosida ibrahimNo ratings yet

- CDSC FAQ EnglishDocument44 pagesCDSC FAQ EnglishSanjeev Bikram KarkiNo ratings yet