Professional Documents

Culture Documents

At Eli.y: I 'Foio A Aebd

At Eli.y: I 'Foio A Aebd

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

At Eli.y: I 'Foio A Aebd

At Eli.y: I 'Foio A Aebd

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

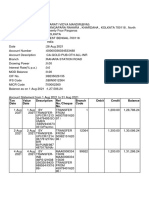

UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE

In re: Cameros Acquisition Corp. Debtor MONTHLY OPERATING REPORT

Case No. 09-10788 Reporting Period- December 2010

b at Mt i Schedule of Cash Receipts and Disbursements Bank Reconciliation (or copies of debtors bank reconciliations) Schedule of Professional Fees Paid Copies of bank statements Cash disbursements journals Statement of Operations Balance Sheet Status of Postpetition Taxes Copies of IRS Form 6123 or payment receipt Copies of tax returns filed during reporting period Summary of Unpaid Posipetition Debts Listing ofaged accounts payable Accounts Receivable Reconciliation and Aging Debtor Questionnaire

Foio

MOR-1 MOR-la MOR-lb P

-

eli.Y

N/A N/A N/A N/A N/A

aebd

N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

N/A N/A

I

MOR-2 MOR-3 MOR-4

-

I N/A N/A I I

N/A

a4

MOR-4 MOR-4 MOR-5 MOR-5

N/A N/A N/A N/A N/A N/A N/A I N/A

I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief.

Signature of Debtor

Date

Signature of mt Debtor

Date

Signature of Auttiori

ii d Individual

Gerry Tjworsiuk Printed Name of Authorized Individual

January 21. 2011 Date

Plan Representative Title of Authorized Individual

*Authorized individual must be an officer, director or shareholder ifdeblor is a corporation; a partner ifdebtor is a partnership; a manager or member ifdeblor is a limited liability company.

MOX

(cons)

In re: Cameros Acqitisilion Con. Debtor

Case No. 09-10788 ReoopinPeijocj: December 2010_

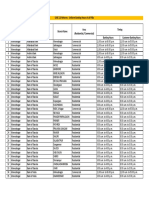

SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS

(IDt75

L

TOTAL RECEIPTS

Cameros Acquisition Corp. doss not maintain any cash accounts. jk

TOTAL DISBURSEMENTS

I

snn are roIrerPP nrs.&Divth v wwC

Ifl

THE FOLLOWING SECTION MUST BE COMPLETED

t-r ini r-rfl .

I

-

I

$0.00 $000 $0.00 $0.00

TOTAL DISDUNSEMENTS

LESS; TRANSFERS TO DEBTOR IN POSSESSION ACCOUNTS PLUS: ESTATE DISBURSEMENTSMADEBYOUTSIDESOURCES (i.e. fromescxowccounIs) TOTAL DISBURSEMENTS FOR CALCULATING U.S. TRUSTEE QUARTERLY FEES

FOSMMOR.I (04e7)

In re: Cameros Acquisition Corp. Debtor BANK RECONCILIATIONS Continuation Sheet For MOB-I Optratung ayroI(

CaseNo. 09-10788 Reporting Period: December2010

Ta

Other

IBALANCE PER BOOKS

BANKBALA1iCE DEPOSITS IN TRANSIT (ATTACH LIST) (-) OUTSTANDING CHECKS (ATTACH LIST) ADJUSTED BANK BALANCE * Adjusted bank balance must equal baIaoicaperbools

(-I-)

I

Cameros AcquIsItIon Corp. does not maintain any cash accounts.

FORM MOO-h (01)01)

In re: Cameros Acquisition Corp. Debtor

Case No. 09-10788 Reporting Period: December 2010 SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID

No profesional fees were paid post-petition.

FORM MOR.lb (04/07)

In re: Cameros Acquisition Corp. Debtor

Case No. 09-10788 Reporting Period: December 2010

STATEMENT OF OPERATIONS

(Income Statement)

RFVINOE.S Oil and gas production revenue

Royalty payments Net Revenue

- .:

;.. ::,

.:- .!:.:

Month

-..Fikneto flate

-

FORM MOR-2 (04107)

In re: Cameras Acquisition Corp. Debtor

Case No. 09-10788 Reporting Peiiod December 2010

BALANCE SHEET

OOXVAEATThOI

AF1 (I1RtlA,IrTS

Unrestricted Cash and Equivalents Restricted Cash and Cash Equivalents Accounts Receivable (Net) Inventories Prepaid Expenses Professional Retainers OlherCw-rent AssetsLSeeAttuched Schedule) TOTAL CURRENT ASSETS

is

S

-

1,840,096 1,840,096

-

kOPBRT1bB1PMNT

Proved Properties Including Lease and Well Equipment Asset Retirement Costs In Process Development Unproved Propea1im Office Equipment and Software Vehicles Other Equipment and Leasehold Improvements Pipeline Equipment ess Accumulated Depreciation TOTAL PROPERTY & EQUIPMENT OTHRASTSrOlher Assets (Sen Macbed Schedule) LTOTALAIS

is

I tAffil lTIKSADOWlPftPQUIFY

NX

..

-

flgbEN4I.uEA1,NDoF cURRtIWPOltNtMO\11l

Accounts Payable and Accrued Liabilities Taxes Payable Wages Payable Notes Payable - Debtor-in-possession financing Rent I Leases - Building/Equipment Secured Debt I Adequate Protection Payments Professional Fees ntercompany Payalmles Asset Retirement Obligations Accrued Interest Other Liabilities TOTAL POSTPETITION LIABILITIES B1LIT1 SUBThYFTO CO1IPRoMTSE rethjon Secured Debt LPiionty Debt Unsecured Debt [etercOsapany Paynbles [TOTAL PRE-PETITION LIABILITIES TOTAL LIABILITIES

s

-

A ""

Js

$

Xhs,

\!

5,099434 5,099,434

5,099,431

Share Capital capital 100 S Contmibuted Surplus Warrants Additional Paid In Capital 6,124,900 Accumulated Other Comprehensive Loss Nrtners Capital Account OwssemsEquilyAccount Retained Earnings - Pre-Pelifton (9,384,338) Retained Earnings -Posipetition djiIstment to owner Equity (attach schedule) Postpeition Contributions (Distiibsstioss (Draws) (attach schedule) NET SHAREHOLDERS EQUITY Is (3,259,338) ._.r,r.-.-.-r-- .-,-:-.--- ---..-.......---,_. --------------.r--,-:----s.-.--,-;-.v-.z..---rm,,!:--.---:,--rrs...1 TOTAL LIABILITfES AND OW)EUS EQbJTY I 840 091 $ , -

FORM MOe-i

In re: Cameros Acquisition Corp. Debtor

Case No. 09-10788 Reporting Period: December 2010

BALANCE SHEET - continuation sheet

- OtherCrentAssets Intercompany Receivables Derivative Assets Advances Other Receivables Total Other Current Assets

-

ASS,ETS ; t

"

A

1,240,096

-

1,840,096

FORM MOR-3 COTD (O41O)

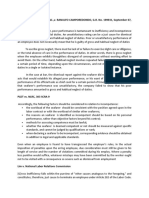

Case No. 09-10788 Reporting Period: December 2010 STATUS OF POSTPETITION TAXES

Withholding PICA-Employee FICA-Employer Unemployment Income Total Federal Taxes

-----..-----,------.--.--.----

I

Not Applicable

S(ate ad Local Withholding

Sales Excise Unemployment Real Property Personal Property Total State and Local Total Taxes

I I I

I I

Not Applicable

SUMMARY OF UNPAID POSTPETITION DEBTS - -: - ----- I rr,.nt

-: -

Accounts Payable Wages Payable Taxes Payable Rent/Leases-Building Rent/Leases-Equipment Secured Debt/Adequate Protection Payments Professional Fees Total Postpetition Debts

n Qfl -----.--

--:.

., -. ------

un*erofflaspst.flitc--- A At.

-;-.

w--. -- - - -----.-,

-v--- ---

I

Not Applicable

FORM MOR4

(04(07)

In re: Cameros Acquisition Con). Debtor

Case No. 09-10788 Reporting Period: December20 10_

ACCOUNTS RECEIVABLE RECONCILIATION AND AGING

Xin

Total Accounts Receivable at the beginning of the reporting period + Amounts billed during the period - Amounts collected during the period Total Accounts Receivable at the end of the reporting period

Not Applicable

____________________

0-30 days old 31 -6o days old 61- 90 days old 91+ days old Total Accounts Receivable Accounts Receivable (Net)

Not Applicable

I

DEBTOR QUESTIONNAIRE

iMiSt cothp1ited reach month

.

No No Yes Yes

1. Have any assets been sold or transferred outside the normal course of business this reporting period? If yes, provide an explanation below. 2. Have any funds been disbursed from any account other than a debtor in possession account this reporting period? If yes, provide an explanation below. 3. Have all posipetition tax returns been timely filed? If no, provide an explanation below. 4. Are workers compensation, general liability and other necessary insurance coverages in effect? If no, provide an explanation below. Note: We carry only fiduciary liability insurance. Company has no employees. Workers comp not requred. 5. Has any bank account been opened during the reporting period? If yes, provide documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3.

No

FORM Molt-S (04/07)

You might also like

- Parts Emporium CaseDocument3 pagesParts Emporium CaseCylver Rose100% (3)

- Preamble To BoQDocument4 pagesPreamble To BoQGerard GovinNo ratings yet

- P87 Tax Relief For Expenses of EmploymentDocument4 pagesP87 Tax Relief For Expenses of EmploymentKen Smith0% (1)

- In Re: Petrocal Acquisition Corp.: If Is Is CompanyDocument9 pagesIn Re: Petrocal Acquisition Corp.: If Is Is CompanyChapter 11 DocketsNo ratings yet

- Debtor: Unjted States Bankruptcy Court District of DelawareDocument9 pagesDebtor: Unjted States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- Doeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsDocument9 pagesDoeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Delaware: MOR (041W)Document9 pagesUnited States Bankruptcy Court District of Delaware: MOR (041W)Chapter 11 DocketsNo ratings yet

- Debtor: I I I IDocument9 pagesDebtor: I I I IChapter 11 DocketsNo ratings yet

- R!Iet Qrocumnts.. Sinq: 1Hcd N/ADocument9 pagesR!Iet Qrocumnts.. Sinq: 1Hcd N/AChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of DelawareDocument9 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- Reouired Do (Ijmfn Is Form No T1iachclDocument9 pagesReouired Do (Ijmfn Is Form No T1iachclChapter 11 DocketsNo ratings yet

- Monthly Operating ReportDocument9 pagesMonthly Operating ReportChapter 11 DocketsNo ratings yet

- N/A N/A: T'DwonluisDocument9 pagesN/A N/A: T'DwonluisChapter 11 DocketsNo ratings yet

- Documentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedDocument9 pagesDocumentexplanation Affida%Itjsuppiexuviii Rf:U1Red Docume Is Form No. Att Ichcd Attached CiiedChapter 11 DocketsNo ratings yet

- United States Bankrupt (:Y Court District of Delaware: An Is A orDocument9 pagesUnited States Bankrupt (:Y Court District of Delaware: An Is A orChapter 11 DocketsNo ratings yet

- Reqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Document9 pagesReqi'Ireh Docl..Men Is Form Attached Ktraehc, 1: 1N1'FEI)Chapter 11 DocketsNo ratings yet

- .7 Imor 4: Ui - CH Irfd I1 ('IDocument9 pages.7 Imor 4: Ui - CH Irfd I1 ('IChapter 11 DocketsNo ratings yet

- N, Il ¡ /-Y¡: Requid DocumntsDocument9 pagesN, Il ¡ /-Y¡: Requid DocumntsChapter 11 DocketsNo ratings yet

- L R L¡ V-C (Ó: Attchd Attch DDocument9 pagesL R L¡ V-C (Ó: Attchd Attch DChapter 11 DocketsNo ratings yet

- Status: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/ADocument9 pagesStatus: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Document9 pagesUnited States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Chapter 11 DocketsNo ratings yet

- Required) Ocuments: I Na EhDocument11 pagesRequired) Ocuments: I Na EhChapter 11 DocketsNo ratings yet

- Debtor: ReturnsDocument9 pagesDebtor: ReturnsChapter 11 DocketsNo ratings yet

- Mor-3 VDocument9 pagesMor-3 VChapter 11 DocketsNo ratings yet

- 10000016855Document9 pages10000016855Chapter 11 DocketsNo ratings yet

- Monthly Operating ReportDocument12 pagesMonthly Operating ReportChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaDocument9 pagesUnited States Bankruptcy Court District of Delaware: or Isa A If Isa A IsaChapter 11 DocketsNo ratings yet

- Date (L I: 5 (Vi R-C (ÓDocument9 pagesDate (L I: 5 (Vi R-C (ÓChapter 11 DocketsNo ratings yet

- R'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntDocument9 pagesR'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntChapter 11 DocketsNo ratings yet

- Qocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqDocument11 pagesQocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqChapter 11 DocketsNo ratings yet

- Monthly Operating ReportDocument12 pagesMonthly Operating ReportChapter 11 DocketsNo ratings yet

- VT ¡Cfõ: Requidí) OcusDocument9 pagesVT ¡Cfõ: Requidí) OcusChapter 11 DocketsNo ratings yet

- Ggiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyDocument14 pagesGgiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyChapter 11 DocketsNo ratings yet

- Si ,,LL: I/l HfoDocument9 pagesSi ,,LL: I/l HfoChapter 11 DocketsNo ratings yet

- Monthly Operating Report: MOR (O4fl)Document12 pagesMonthly Operating Report: MOR (O4fl)Chapter 11 DocketsNo ratings yet

- Exp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Document12 pagesExp!Nn (In MF - Daviusuppicrnent Required Documents:: Oeqt.Chapter 11 DocketsNo ratings yet

- Petters Bankruptcy Monthly Operating ReportDocument24 pagesPetters Bankruptcy Monthly Operating ReportCamdenCanaryNo ratings yet

- ..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormDocument11 pages..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormChapter 11 DocketsNo ratings yet

- 10000003278Document16 pages10000003278Chapter 11 DocketsNo ratings yet

- Doeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedDocument11 pagesDoeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedChapter 11 DocketsNo ratings yet

- Requid Documnts Attched Attched: DocentDocument9 pagesRequid Documnts Attched Attched: DocentChapter 11 DocketsNo ratings yet

- Monthly Operating Report: N/A N/ADocument12 pagesMonthly Operating Report: N/A N/AChapter 11 DocketsNo ratings yet

- 'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Document12 pages'Dtcunu Avppiencn .Orni No... T (Accd Atlached. Attached Mor-1Chapter 11 DocketsNo ratings yet

- $"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtDocument9 pages$"'y-B/?' Sa /Ð-, Y: United States SSankruptcy CourtChapter 11 DocketsNo ratings yet

- Miscellaneous Transaction QuizDocument2 pagesMiscellaneous Transaction QuizJodie SagdullasNo ratings yet

- Eq'Ujr1'Bocljments Yjo":: CH ofDocument12 pagesEq'Ujr1'Bocljments Yjo":: CH ofChapter 11 DocketsNo ratings yet

- Steven Meldahl Operating Report 10-31-13Document11 pagesSteven Meldahl Operating Report 10-31-13CamdenCanaryNo ratings yet

- Cash and Cash EquivalentDocument54 pagesCash and Cash EquivalentHello Kitty100% (1)

- Monthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiDocument11 pagesMonthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiChapter 11 DocketsNo ratings yet

- Monthly Operating Report: MOR (O47)Document11 pagesMonthly Operating Report: MOR (O47)Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument11 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 Dockets100% (1)

- I) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedDocument12 pagesI) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedChapter 11 DocketsNo ratings yet

- Office of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportDocument2 pagesOffice of The United States Trustee - Region 3 Post-Confirmation Quarterly Summary ReportChapter 11 DocketsNo ratings yet

- This Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboDocument2 pagesThis Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboChapter 11 DocketsNo ratings yet

- Reporting: DebtorDocument15 pagesReporting: DebtorChapter 11 DocketsNo ratings yet

- Closing Guidelines 2023-24Document68 pagesClosing Guidelines 2023-24Nikhil Kharat NiCkNo ratings yet

- Audit Report On Collection and Reporting of Revenues by The Board of Standards and AppealsDocument14 pagesAudit Report On Collection and Reporting of Revenues by The Board of Standards and AppealslanderNo ratings yet

- Barangay - Acctg. System - Edited.emrDocument104 pagesBarangay - Acctg. System - Edited.emrAnnamaAnnama100% (2)

- ANC 4C Quarter 4 July Thru September 2010Document4 pagesANC 4C Quarter 4 July Thru September 2010Advisory Neighborhood Commission 4CNo ratings yet

- Solution Manual For Financial Accounting Fundamentals 5Th Edition by Wild Isbn 0078025753 9780078025754 Full Chapter PDFDocument36 pagesSolution Manual For Financial Accounting Fundamentals 5Th Edition by Wild Isbn 0078025753 9780078025754 Full Chapter PDFcarmen.hall969100% (11)

- 518 Assignment FinalDocument12 pages518 Assignment FinalCarmel ThereseNo ratings yet

- T10 Managing Finance Notes by SeahDocument43 pagesT10 Managing Finance Notes by SeahSeah Chooi KhengNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Local Corp Chapter 11 Bankruptcy PetitionDocument18 pagesLocal Corp Chapter 11 Bankruptcy PetitionChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- My Views On Whether Customers Are Treated Fairly in Retailer BankruptciesDocument3 pagesMy Views On Whether Customers Are Treated Fairly in Retailer BankruptciesChapter 11 DocketsNo ratings yet

- Kabirjon Abdumajidov: Education and QualificationsDocument1 pageKabirjon Abdumajidov: Education and QualificationsKabirjon AbdumajidovNo ratings yet

- Stratified Random SamplingDocument19 pagesStratified Random SamplingMelodina AcainNo ratings yet

- A Synopsis ON: Inventory ManagementDocument9 pagesA Synopsis ON: Inventory ManagementDEEPAKNo ratings yet

- Government of Andhra Pradesh Municipal Administration DepartmentDocument6 pagesGovernment of Andhra Pradesh Municipal Administration Departmentuttamreddy8244266No ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangNo ratings yet

- Chapter 3 ConsiderationDocument14 pagesChapter 3 Considerationwasewsadab262000No ratings yet

- Gideon Hatsu Cv...Document4 pagesGideon Hatsu Cv...Gideon HatsuNo ratings yet

- Industry Analysis Is A Tool That Facilitates A CompanyDocument3 pagesIndustry Analysis Is A Tool That Facilitates A CompanyAri NugrahaNo ratings yet

- Chapter 2: Statement of Comprehensive IncomeDocument9 pagesChapter 2: Statement of Comprehensive IncomeLushelle JiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument5 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceasdNo ratings yet

- Anti-Money Laundering and Combating The Financing of TerrorismDocument124 pagesAnti-Money Laundering and Combating The Financing of TerrorismLaurette M. BackerNo ratings yet

- Bank Timings Wef 01.11.19 PDFDocument213 pagesBank Timings Wef 01.11.19 PDFNilesh BhavsarNo ratings yet

- CUET MA Economics 2020 QPDocument11 pagesCUET MA Economics 2020 QP2549 VarshithaNo ratings yet

- October 24, 2013 Class Cert OrderDocument86 pagesOctober 24, 2013 Class Cert OrderPando DailyNo ratings yet

- RGDGHDocument7 pagesRGDGHjassi nishadNo ratings yet

- Chris Jerome Federal LawsuitDocument93 pagesChris Jerome Federal LawsuitLansingStateJournalNo ratings yet

- F&F ATS - SellerDocument1 pageF&F ATS - SellerAdarsh PandeyNo ratings yet

- On WCTDocument28 pagesOn WCTumaambekar123No ratings yet

- Who Are Entitled To Practice Law?: Problem Areas in Legal Ethics (Pale)Document10 pagesWho Are Entitled To Practice Law?: Problem Areas in Legal Ethics (Pale)Chris Dianne Miniano SanchezNo ratings yet

- Gross InefficiencyDocument2 pagesGross InefficiencyNowell SimNo ratings yet

- 1Document100 pages1Niomi GolraiNo ratings yet

- Nature and CharacteristicsDocument6 pagesNature and CharacteristicsrajendrakumarNo ratings yet

- ISM Company Report Aug 2013Document13 pagesISM Company Report Aug 2013Nowhere Man100% (1)

- Metropolitan Waterworks Vs Court of Appeals 143 SCRA 623Document11 pagesMetropolitan Waterworks Vs Court of Appeals 143 SCRA 623Janella Montemayor-RomeroNo ratings yet

- CV of Sahadat SM NewDocument5 pagesCV of Sahadat SM Newabu naymNo ratings yet

- Spearheading End of Year AppealsDocument4 pagesSpearheading End of Year AppealsbikewalkallianceNo ratings yet

- Bibaran PatraDocument40 pagesBibaran PatraAmar PandeyNo ratings yet